Home>Finance>Cash Flow After Taxes: Definition, How To Calculate, And Example

Finance

Cash Flow After Taxes: Definition, How To Calculate, And Example

Published: October 24, 2023

Learn how to calculate cash flow after taxes in finance with a clear definition and real-life example. Maximize your financial understanding now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Cash Flow After Taxes: Definition, How to Calculate, and Example

When it comes to managing your personal finances, understanding cash flow after taxes is crucial. It allows you to have a clear picture of how much money you have available to cover your expenses, savings, and investments after accounting for taxes. But what exactly is cash flow after taxes? How do you calculate it, and why is it important? In this blog post, we will explore the answers to these questions and provide you with a practical example to help you grasp the concept easily.

Key Takeaways:

- Cash flow after taxes represents the amount of money you have available for expenses, savings, and investments after accounting for taxes.

- To calculate cash flow after taxes, subtract your total tax liability from your net income (after deducting any pre-tax deductions).

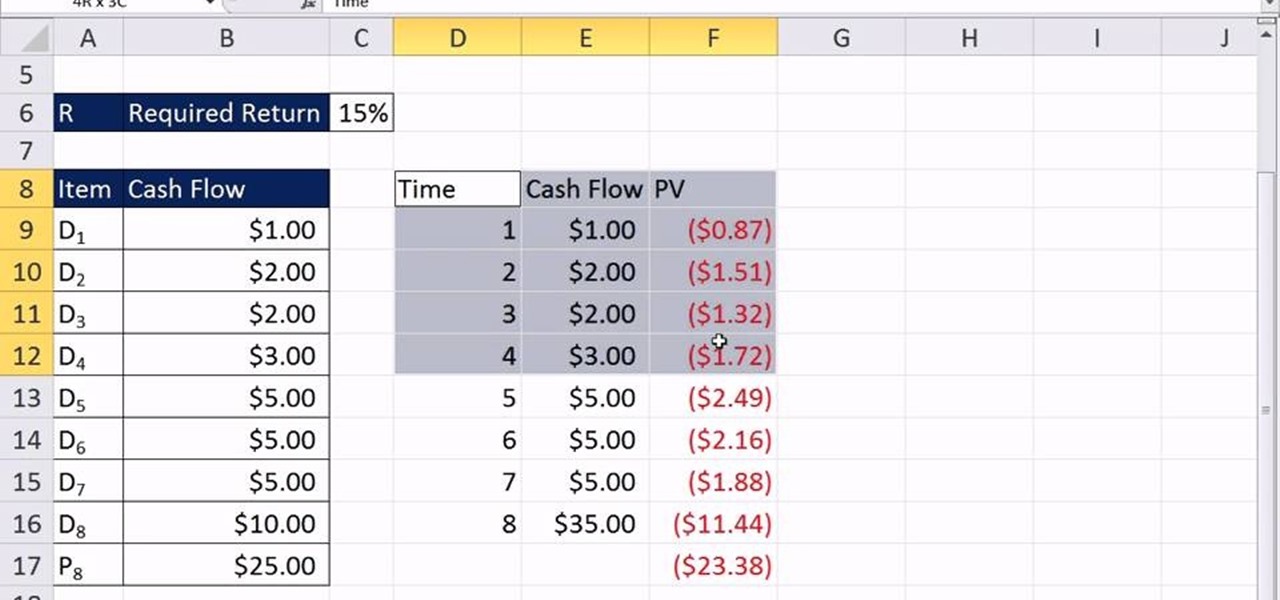

Calculating your cash flow after taxes is relatively straightforward. Here’s a step-by-step guide on how to do it:

- Start by determining your net income. This is the amount of money you earn after subtracting any pre-tax deductions, such as retirement contributions or health insurance premiums. Make sure to include all sources of income, such as salary, bonuses, dividends, and rental income.

- Next, calculate your total tax liability. This includes all income taxes, payroll taxes, and any other taxes you may be responsible for paying.

- Subtract your total tax liability from your net income. The resulting amount is your cash flow after taxes.

For example, let’s say your net income is $5,000 per month, and your total tax liability is $1,000. By subtracting your tax liability from your net income, you would have a cash flow after taxes of $4,000 per month. This is the amount of money you have available to cover your monthly expenses, save for the future, and invest in opportunities that may arise.

Understanding your cash flow after taxes is essential for several reasons:

- Budgeting: By knowing your cash flow after taxes, you can create a realistic budget that aligns with your financial goals. It allows you to allocate your money efficiently, ensuring you have sufficient funds for essential expenses, while also considering savings and investments.

- Debt Management: Knowing your cash flow after taxes helps you determine how much money you can allocate towards debt repayment. It enables you to make strategic decisions on how to effectively reduce your debt burden and avoid financial stress.

- Financial Planning: Your cash flow after taxes serves as a foundation for your long-term financial planning. It provides clarity on how much you can afford to save and invest, allowing you to work towards your financial goals, such as retirement, buying a home, or starting a business.

In conclusion, understanding your cash flow after taxes is crucial for effective financial management. By calculating this number, you can make informed decisions about budgeting, debt management, and long-term financial planning. Take control of your finances by incorporating cash flow after taxes into your financial management strategy, and watch your financial goals become a reality.