Finance

Form 8282: Donee Information Return Definition

Published: November 27, 2023

Learn the definition of Form 8282: Donee Information Return in finance, and how it impacts various financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Form 8282: Donee Information Return Definition – Everything You Need to Know

Welcome to our Finance category, where we provide valuable insights into various aspects of personal finance, investment options, and taxation. In this article, we will delve deep into Form 8282: Donee Information Return, a crucial document that both organizations and individuals should be familiar with. If you want to ensure compliance with tax regulations and understand how to accurately report charitable donations, keep reading to learn about the significance of Form 8282 and the information it includes.

Key Takeaways:

- Form 8282, also known as the Donee Information Return, is used by charitable organizations to report certain dispositions of charitable deduction property.

- When a donee organization sells, exchanges, or otherwise disposes of a donation within three years after receiving it, they must file Form 8282 to notify the IRS.

3 minutes read

Understanding Form 8282

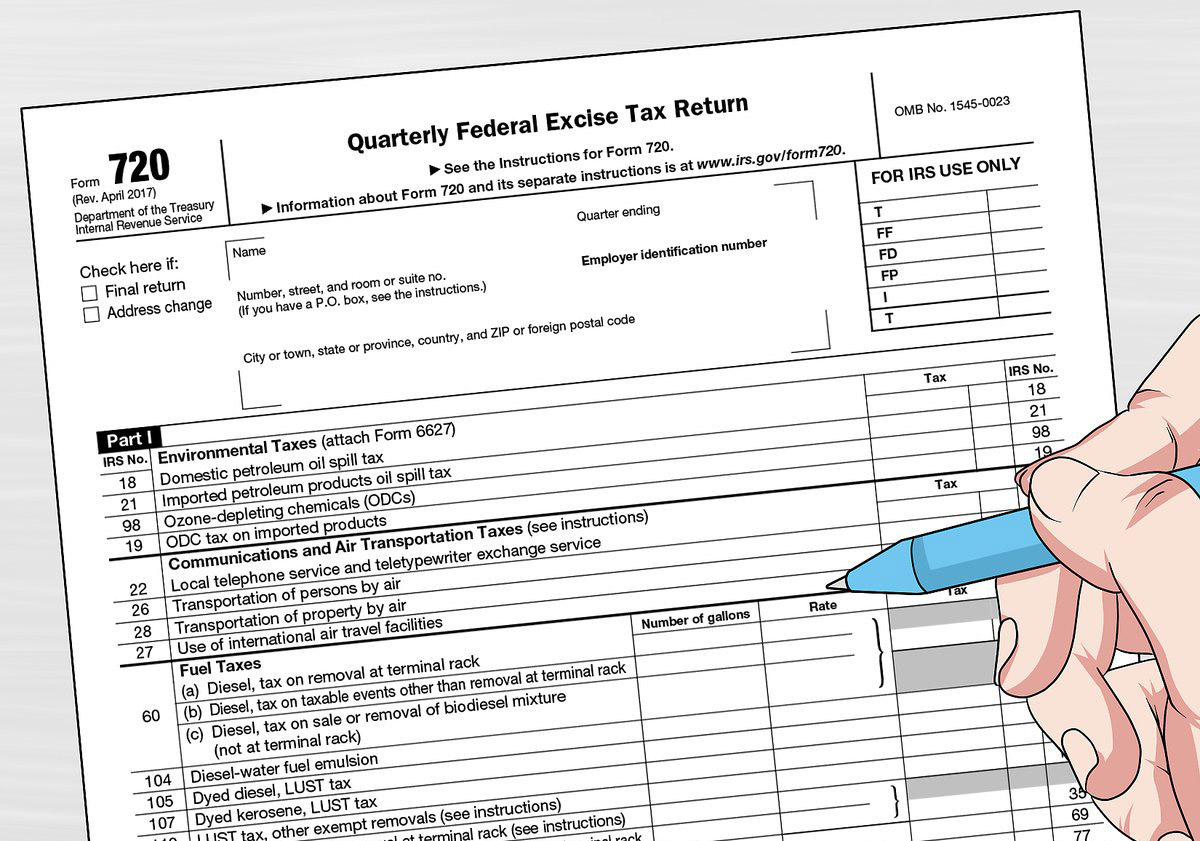

Form 8282, also referred to as the Donee Information Return, helps the Internal Revenue Service (IRS) track and ensure proper reporting of charitable donations. This form is used to report dispositions of certain property when a charitable organization decides to sell, exchange, or otherwise dispose of a donated item within three years after its receipt.

Donors who claim a charitable deduction of over $5,000 for an item, such as artwork, jewelry, securities, or real estate, must obtain a completed copy of Form 8282 from the charitable organization. The donor needs this document to support their deduction claim on their own tax return.

Here are two key takeaways to keep in mind when it comes to Form 8282:

- Form 8282 is filed by charitable organizations to notify the IRS of the disposition of donated property.

- Donee organizations must submit Form 8282 within 125 days after the disposition takes place to ensure timely reporting.

Reporting Requirements for Charitable Organizations

Once a charitable organization takes a disposition action, such as selling, exchanging, or transferring a donated item, they are required to complete and submit Form 8282. The form includes essential information about the item and its disposition, ensuring proper tax reporting.

The following information should be included in Form 8282:

- Name and contact information of the charitable organization.

- Description of the donated item, including its fair market value at the time of the contribution.

- Date of the contribution and the date of the disposition.

- Sale or other disposition information, including the name and contact details of the transferee.

By filing Form 8282, charitable organizations provide transparency to the IRS, allowing them to monitor the dispositions of donated property. This ensures that the charitable deduction claimed by the donor aligns with the organization’s disposition of the donated item.

Penalties for Non-Compliance

It is crucial for charitable organizations to comply with the reporting requirements outlined by the IRS when it comes to Form 8282. Failure to file the Donee Information Return can result in penalties for both the organization and the donor.

Charitable organizations that neglect to file Form 8282 within the required time frame may face a penalty of $50 for each day of non-compliance, with a maximum penalty of $10,000 per return.

Donors who claim deductions for items without the required Form 8282 may receive a penalty equal to 10% of the fair market value of the donated item, up to $5,000, unless reasonable cause is shown.

In Conclusion

Understanding Form 8282: Donee Information Return is essential for both charitable organizations and donors. By accurately reporting dispositions of donated property, this form allows the IRS to ensure proper tax compliance and transparency within the charitable sector.

Remember, if you plan to make significant charitable contributions or claim deductions for donated items, familiarize yourself with Form 8282 and the reporting requirements it entails. Consulting with a qualified tax professional can help ensure that your donations are properly documented and adhere to the IRS regulations.