Finance

Circular Flow Model Definition And Calculation

Published: October 27, 2023

Learn what the circular flow model is in finance and how to calculate it. Understand the concept and its importance for economic analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Circular Flow Model: Understanding the Flow of Money in an Economy

Have you ever wondered how money flows in an economy? How businesses make sales and individuals earn income? The circular flow model provides a visual representation of how money circulates within an economy. In this blog post, we will delve into the definition and calculation of the circular flow model, shedding light on its significance in understanding the complex mechanisms of the financial world.

Key Takeaways

- The circular flow model illustrates the flow of money, goods, and services between households, businesses, and the government.

- Understanding the circular flow model helps us comprehend the interactions and interdependencies that shape an economy.

What is the Circular Flow Model?

The circular flow model is a simplified representation of how money and resources circulate within an economy. At its core, the model illustrates the relationships between households, businesses, and the government, highlighting how they interact and contribute to the overall economic activity.

In this model, there are two main components:

- Households: These are the individual consumers who make up the economy. They provide labor, earn income, and consume goods and services.

- Businesses: These are the producers in the economy. They employ labor, produce goods and services, and earn revenue through sales.

The circular flow of money occurs in two distinct phases:

- The Resource Market: In this market, businesses purchase the resources they need to produce goods and services from households. These resources include labor, land, capital, and entrepreneurship. In return, households receive income in the form of wages, rent, interest, and profits.

- The Product Market: In this market, businesses sell the goods and services they have produced to households, government entities, and other businesses. The revenue generated from these sales goes back to businesses, allowing them to cover costs, pay wages, and invest in further production.

The circular flow model also takes into account the role of the government. Taxes are collected from households and businesses, and the government uses this revenue to provide public goods and services, such as infrastructure and defense.

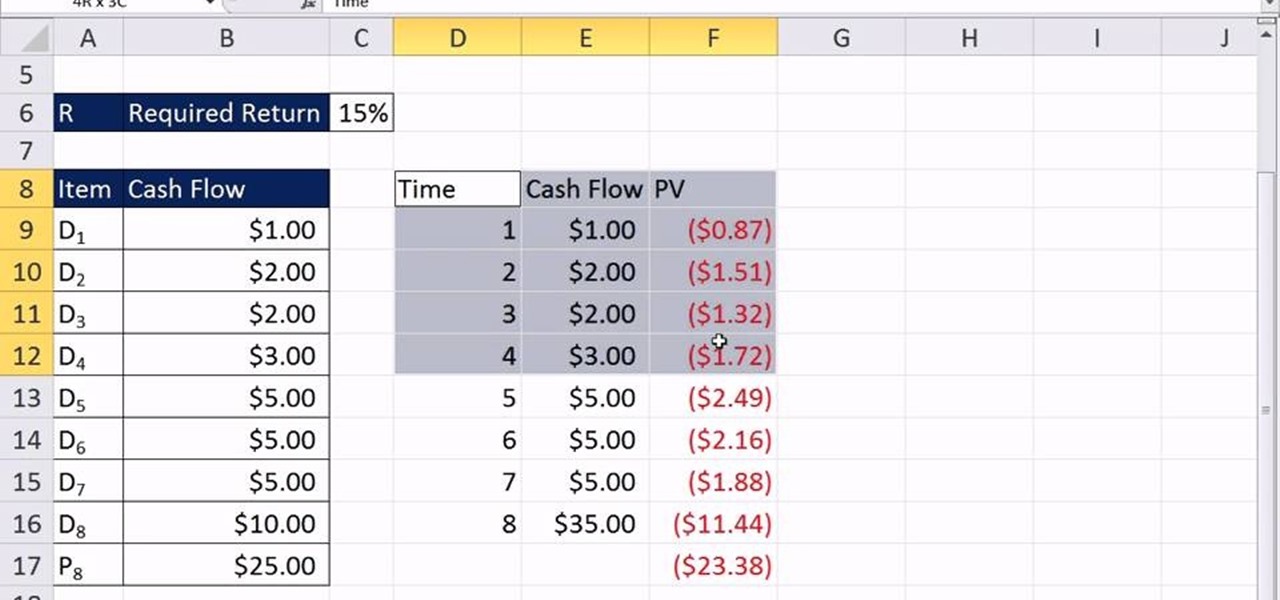

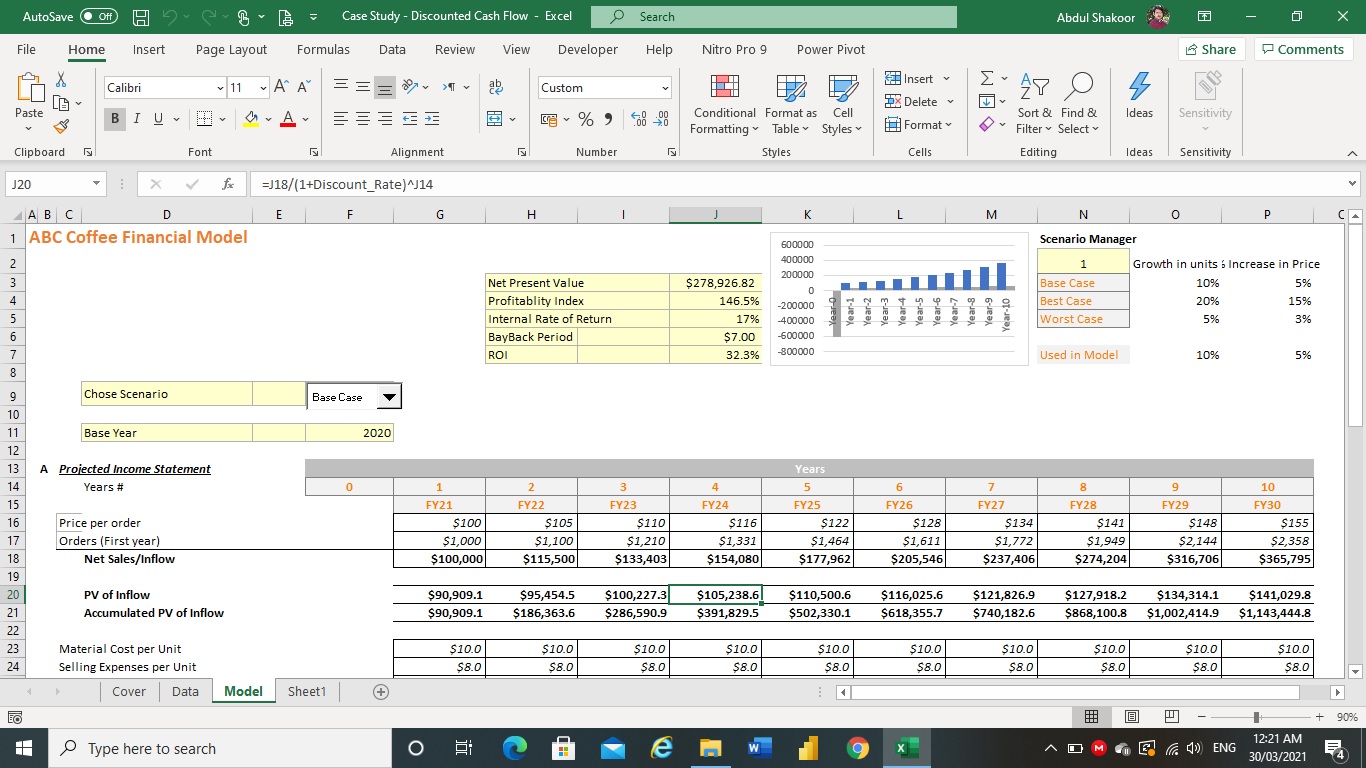

Calculating the Circular Flow Model

Calculating the circular flow model involves quantifying the flows of money between households, businesses, and the government. To do this, several key components must be considered:

- Personal Income: This includes wages, salaries, rent, interest, and profits earned by individuals in households.

- Disposable Income: This is the money available to households after deducting taxes from their personal income.

- Consumption Expenditure: This represents the portion of disposable income that households spend on goods and services.

- Saving: The portion of disposable income that households choose to save rather than spend.

- Investment: The amount of money that businesses spend on capital goods, such as machinery, equipment, and infrastructure, to increase future production capacity.

- Government Spending: The total expenditure by the government on goods, services, and public welfare, financed by taxes and other sources of revenue.

- Exports and Imports: The value of goods and services exported and imported by the country, representing the international flow of money.

By calculating these components, it is possible to better understand how money flows within an economy and how different factors, such as changes in consumption or investment, can impact economic growth and stability.

In Conclusion

The circular flow model provides a valuable framework for comprehending the intricate financial interactions that shape an economy. By visualizing the flow of money, goods, and services between households, businesses, and the government, we gain insight into the fundamental drivers of economic activity. Whether you are an aspiring economist or simply curious about the dynamics of finance, understanding the circular flow model is a great step towards financial literacy.