Home>Finance>Flood Insurance: Definition, How It Works, Coverage, And Example

Finance

Flood Insurance: Definition, How It Works, Coverage, And Example

Published: November 25, 2023

Looking for flood insurance? Discover the definition, coverage options, and how it works, with a practical finance example. Protect your assets today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Flood Insurance: Protecting Your Property from Nature’s Fury

Have you ever wondered what would happen if your home was hit by a flood? Would you be financially prepared to handle the damages? This is where flood insurance comes into play. In this article, we will explore the definition, how it works, coverage, and provide a real-life example of why having flood insurance is crucial.

Key Takeaways:

- Flood insurance is a specialized type of insurance that provides coverage for property damage caused by floods.

- It is important to understand the definition, functioning, and coverage of flood insurance to ensure adequate protection for your property.

What is Flood Insurance?

Flood insurance is a unique type of coverage that protects property owners from losses associated with flood damage. Flooding can occur due to heavy rain, melting snow, storm surge, or even overwhelmed drainage systems. Standard homeowners insurance policies typically exclude flood damage coverage, making it essential to obtain a separate flood insurance policy.

Flood insurance helps property owners recover financially when their homes or businesses suffer damage from flooding. Without flood insurance, these costs can be devastating, leaving individuals and families in financial ruin.

How Does Flood Insurance Work?

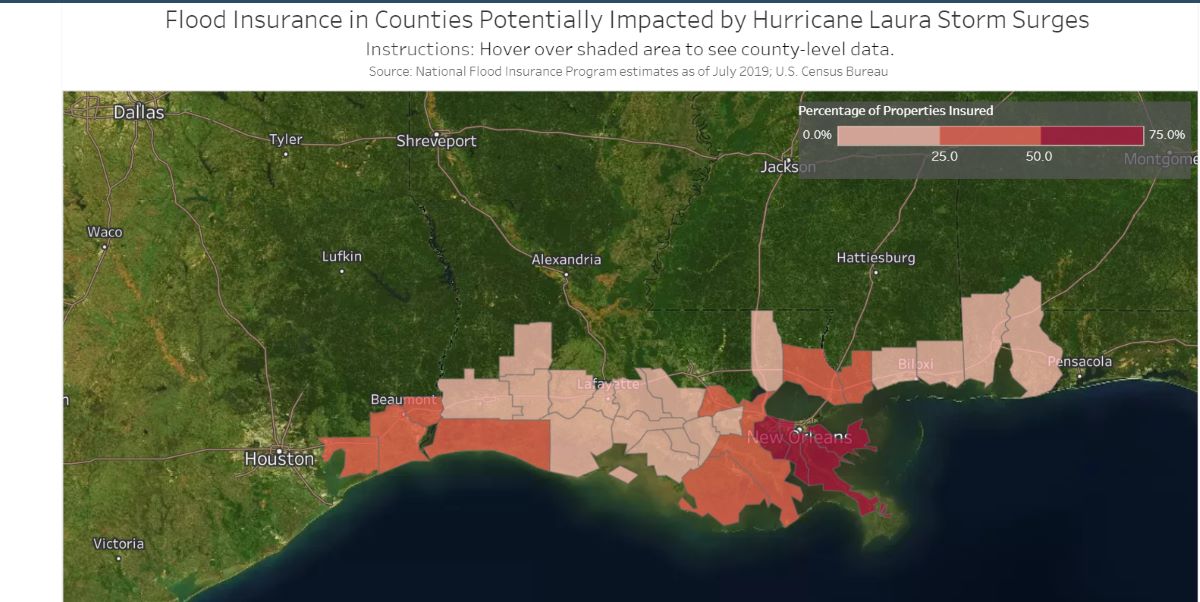

Flood insurance works similarly to other types of insurance policies. Property owners purchase a policy from a private insurance company or through the National Flood Insurance Program (NFIP). The NFIP is a federal program created to provide affordable flood insurance coverage to property owners in high-risk flood zones.

Once a policy is in place, the property owner pays premiums to maintain coverage. Should a flood occur and the property sustains damage, the policyholder can file a claim for reimbursement. The insurance company will then assess the damages and provide compensation according to the policy terms.

It’s crucial to note that there are specific waiting periods associated with flood insurance policies. This means that you cannot purchase coverage right before a storm is about to hit; there is a waiting period of 30 days before the policy becomes effective.

Coverage Offered by Flood Insurance

Flood insurance primarily covers the physical structures and contents within a property that have been damaged due to a flood. Here’s what flood insurance typically covers:

- Structure Coverage: This includes coverage for the building itself, including its foundation, walls, electrical systems, plumbing, and HVAC systems.

- Contents Coverage: This covers personal belongings such as furniture, appliances, clothing, and electronics damaged by flooding.

- Additional Living Expenses: If your home becomes uninhabitable due to a flood, flood insurance may provide coverage for temporary living expenses, including accommodations and meals.

It’s essential to review your policy carefully to understand the specific coverage limits and exclusions. Certain items, such as home offices or valuable artwork, may require additional policies or endorsements to ensure full protection.

An Example: The Importance of Flood Insurance

Let’s envision a scenario where Jane, a homeowner who lives in a coastal area, lacks flood insurance. A severe storm hits her neighborhood, resulting in a major flood. Unfortunately, Jane’s home sustains significant damage, including foundation issues, waterlogged electrical systems, and all of her furniture and appliances being destroyed. The cost of repairs and replacing her belongings quickly adds up, leaving Jane in a financial crisis.

Had Jane invested in flood insurance, she could have filed a claim and avoided the financial burden of repairs and replacements. The insurance company would have assessed the damages and provided her with compensation according to her policy. As a result, Jane would have been able to rebuild her life without enduring a significant financial setback.

Remember, disasters can strike unexpectedly, and being prepared is key to protecting your financial well-being.

By understanding the definition, how it works, coverage, and value of flood insurance, you can make an informed decision about protecting your property against nature’s fury. Don’t wait until it’s too late – explore flood insurance options today!