Finance

How Often Does Fingerhut Increase Credit Limit

Published: March 5, 2024

Learn how often Fingerhut increases credit limits and manage your finances more effectively with these expert tips and strategies. Gain insights on improving your credit limit and financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Fingerhut is a popular online retailer that provides a wide range of products, from electronics to home goods, to consumers with varying credit profiles. One of the key attractions of shopping with Fingerhut is the opportunity to build or rebuild credit through responsible use of their credit accounts. Understanding how Fingerhut credit limits work and how often they may increase is essential for maximizing the benefits of this credit-building tool.

In this article, we will delve into the dynamics of Fingerhut credit limits, exploring the factors that influence credit limit increases and shedding light on how frequently these increases may occur. Additionally, we will provide valuable tips for those looking to boost their Fingerhut credit limits effectively. By the end of this article, you will have a comprehensive understanding of Fingerhut credit limits and be well-equipped to navigate the process of credit limit increases with confidence. Let's embark on this enlightening journey to unravel the intricacies of Fingerhut credit limits and empower your financial decision-making.

Understanding Fingerhut Credit Limits

When you open a Fingerhut credit account, you are assigned a credit limit, which represents the maximum amount you can spend on the platform. This limit is determined by various factors, including your credit history, income, and the information provided on your application. Fingerhut, like other creditors, assesses the level of risk associated with extending credit to an individual when setting credit limits.

It’s important to note that Fingerhut may initially assign a relatively conservative credit limit to new account holders, especially those with limited or poor credit history. This cautious approach serves to mitigate risk while allowing customers to demonstrate responsible credit management over time.

Over time, as you use your Fingerhut credit account responsibly and exhibit positive credit behavior, you may become eligible for a credit limit increase. This increase can provide you with greater purchasing power and contribute to an improvement in your credit utilization ratio, a key factor in credit scoring models. Understanding the dynamics of Fingerhut credit limits is crucial for leveraging this financial tool to your advantage and maximizing its potential to bolster your credit profile.

Factors That Influence Fingerhut Credit Limit Increases

Several key factors play a significant role in determining whether you are eligible for a credit limit increase with Fingerhut. Understanding these factors can provide valuable insights into how you can position yourself favorably to secure a higher credit limit.

- Credit History: Your credit history is a pivotal determinant in the decision to increase your Fingerhut credit limit. Consistently making on-time payments, managing your existing credit accounts responsibly, and avoiding derogatory marks on your credit report can enhance your eligibility for a credit limit boost.

- Income Stability: Fingerhut may consider your income stability when evaluating your suitability for a credit limit increase. A steady and reliable income stream can signal financial stability, which is a positive indicator for credit limit adjustments.

- Account Management: How you manage your Fingerhut credit account is crucial. Responsible utilization of your existing credit limit, staying within your credit utilization ratio, and avoiding excessive debt can demonstrate prudent financial behavior, potentially increasing your chances of a credit limit raise.

- Credit Utilization Ratio: This ratio, which reflects the percentage of your available credit that you are currently using, is a critical factor in credit limit decisions. Maintaining a low credit utilization ratio, ideally below 30%, showcases disciplined credit management and can pave the way for a higher credit limit.

- Payment History: Consistently making at least the minimum payment on time reflects positively on your creditworthiness. Timely payments contribute to a positive payment history, which is a fundamental aspect of credit limit increase evaluations.

By comprehending the factors that influence Fingerhut credit limit increases, you can proactively work towards strengthening these aspects of your financial profile, enhancing your prospects for securing a higher credit limit and optimizing the benefits of your Fingerhut credit account.

How Often Fingerhut Increases Credit Limits

Fingerhut typically reviews accounts periodically to assess eligibility for credit limit increases. However, the specific frequency of credit limit reviews and potential increases can vary based on individual circumstances and the discretion of Fingerhut’s credit management policies.

For many customers, Fingerhut may initiate automatic reviews of credit accounts to evaluate eligibility for credit limit increases. These reviews often consider factors such as payment history, account management, credit utilization, and overall creditworthiness. Positive developments in these areas, such as consistent on-time payments and responsible credit utilization, can enhance the likelihood of qualifying for a credit limit increase.

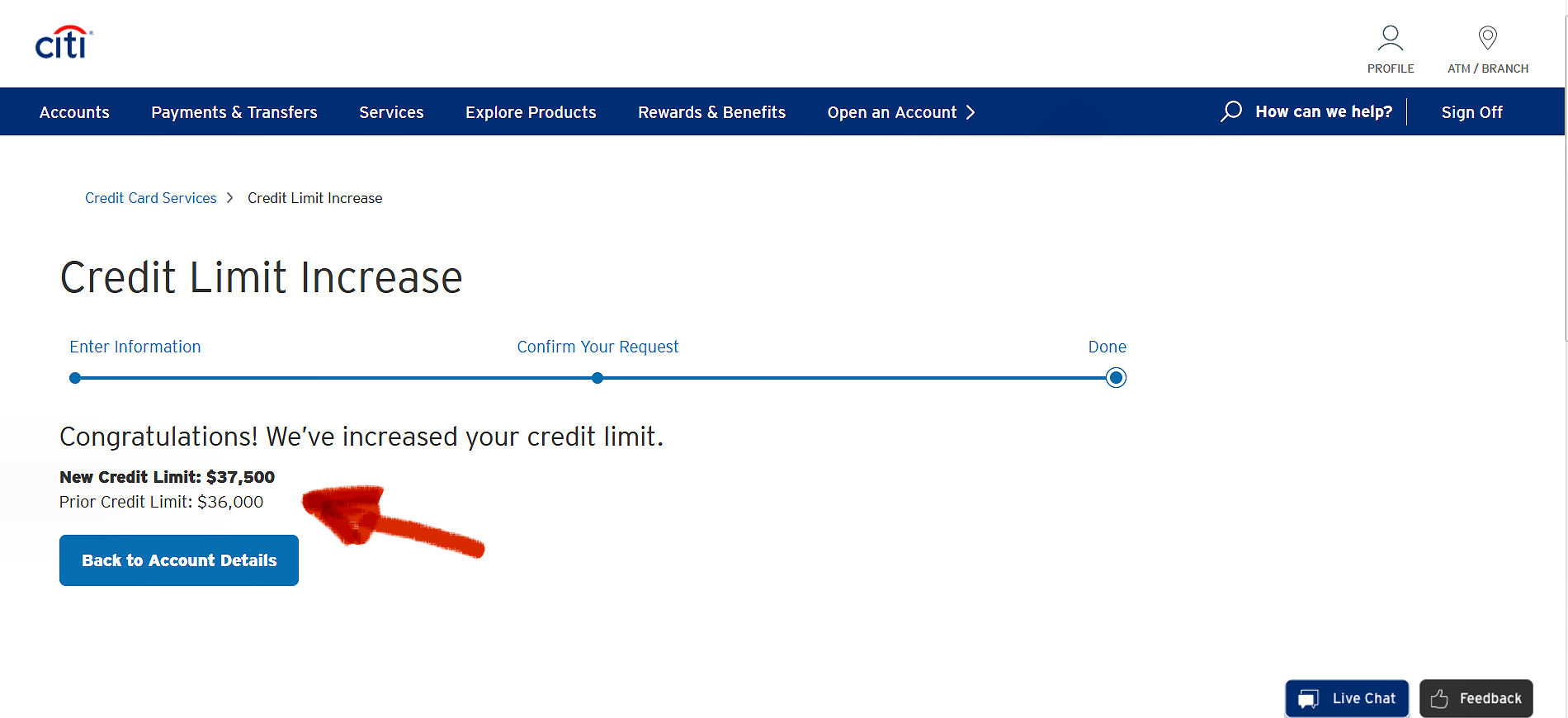

It’s important to note that while Fingerhut conducts periodic reviews, there is no guaranteed timeline for credit limit adjustments. Some customers may experience credit limit increases after several months of responsible account management, while others may see adjustments over a longer duration. Additionally, proactive requests for credit limit increases can be considered, providing an avenue for customers to advocate for adjustments based on their improved financial circumstances.

Understanding the dynamics of credit limit reviews and increases at Fingerhut empowers customers to engage in prudent financial practices and position themselves favorably for potential credit limit adjustments. By demonstrating responsible credit management and maintaining a positive credit profile, customers can increase their chances of securing higher credit limits and maximizing the benefits of their Fingerhut credit accounts.

Tips for Increasing Your Fingerhut Credit Limit

Boosting your Fingerhut credit limit can provide greater financial flexibility and contribute to an improved credit profile. By implementing strategic approaches and demonstrating responsible credit management, you can enhance your prospects for securing a higher credit limit with Fingerhut.

- Manage Your Account Responsibly: Consistently making on-time payments and effectively managing your Fingerhut credit account can strengthen your creditworthiness and position you favorably for a credit limit increase.

- Monitor Your Credit Utilization: Keeping your credit utilization ratio low, ideally below 30% of your available credit, showcases prudent credit management and can bolster your eligibility for a credit limit boost.

- Regularly Check for Prequalified Offers: Fingerhut may extend prequalified offers for credit limit increases to eligible customers. Checking for these offers and responding promptly can facilitate potential credit limit adjustments.

- Request a Credit Limit Increase: Proactively reaching out to Fingerhut to request a credit limit increase, especially after demonstrating responsible account management and positive credit behavior, can be a proactive step towards securing a higher credit limit.

- Review and Update Your Income Information: Ensuring that your income information is accurate and up to date with Fingerhut can provide a clearer picture of your financial stability, potentially influencing credit limit increase evaluations.

By adhering to these tips and maintaining a proactive approach to credit management, you can position yourself for potential credit limit increases with Fingerhut. It’s important to exercise patience and continue exhibiting responsible financial behavior while leveraging these strategies to optimize your chances of securing a higher credit limit.

Conclusion

Understanding the intricacies of Fingerhut credit limits is pivotal for leveraging this financial tool to its fullest potential. By comprehending the factors that influence credit limit increases and the frequency of such adjustments, you can navigate the process with informed decision-making and strategic credit management.

Fingerhut provides a platform for individuals to build or rebuild their credit while accessing a diverse array of products. The opportunity for credit limit increases further enhances the appeal of Fingerhut credit accounts, offering a pathway to greater purchasing power and improved credit utilization ratios.

As you engage with your Fingerhut credit account, it’s essential to prioritize responsible credit management, including making timely payments, monitoring your credit utilization, and maintaining a positive credit history. These practices not only contribute to potential credit limit increases but also bolster your overall creditworthiness, opening doors to broader financial opportunities beyond the Fingerhut platform.

By implementing the tips outlined in this article and maintaining a proactive approach to credit management, you can position yourself favorably for potential credit limit increases with Fingerhut. Patience, diligence, and financial prudence are key elements in this journey, and by adhering to these principles, you can optimize the benefits of your Fingerhut credit account and pave the way for a stronger credit profile.

Ultimately, the dynamics of Fingerhut credit limits underscore the significance of responsible credit utilization and strategic financial planning. By staying attuned to these principles and leveraging the insights provided in this article, you can navigate the landscape of credit limit increases with confidence, driving positive outcomes for your financial well-being.