Home>Finance>How To Calculate Non-Refundable Portion Of Employee Retention Credit

Finance

How To Calculate Non-Refundable Portion Of Employee Retention Credit

Published: January 10, 2024

Calculate the non-refundable portion of the Employee Retention Credit with this comprehensive finance guide. Master the intricate calculations and optimize your tax strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Employee Retention Credit

- Qualifications for the Employee Retention Credit

- Calculating the Non-Refundable Portion

- Method 1: Using the Modified Calculation Method

- Method 2: Using the Prior Year Gross Receipts

- Method 3: Using the 2020 Calendar Quarters

- Example Calculation: Non-Refundable Portion of Employee Retention Credit

- Conclusion

Introduction

Welcome to this comprehensive guide on how to calculate the non-refundable portion of the Employee Retention Credit. In the wake of the COVID-19 pandemic, many businesses have faced unprecedented challenges, including financial strain and workforce disruptions. To mitigate the impact on businesses, the U.S. government introduced the Employee Retention Credit as part of the CARES Act.

The Employee Retention Credit is a tax credit designed to help businesses retain their employees during challenging times. It allows eligible employers to claim a refundable credit against their payroll tax liabilities. However, it’s important to note that not all credits claimed are refundable. Some credits can only be used to offset tax liabilities but cannot be refunded to the business.

Understanding how to calculate the non-refundable portion of the Employee Retention Credit is crucial for businesses to determine the actual benefit they can obtain from this program. By accurately calculating the non-refundable portion, businesses can effectively manage their tax obligations while leveraging the available credits to support their workforce.

In this guide, we will walk you through the qualifications for the Employee Retention Credit and provide three methods for calculating the non-refundable portion. We will also provide an example calculation to help clarify the process. By the end of this guide, you will have a clear understanding of how to calculate the non-refundable portion of the Employee Retention Credit and make informed decisions for your business.

Understanding the Employee Retention Credit

The Employee Retention Credit (ERC) is a tax credit introduced by the U.S. government to provide financial relief to businesses during the COVID-19 pandemic. It aims to incentivize employers to keep their employees on payroll, even if the business is experiencing financial hardship.

The ERC is available to eligible employers, including businesses that experienced either a full or partial suspension of operations due to a government order or a significant decline in gross receipts. This credit is designed to offset a portion of the employer’s share of Social Security taxes, reducing their tax burden and providing financial assistance during challenging times.

To be eligible for the ERC, businesses must meet specific criteria. Firstly, the business must have been in operation during the 2020 or 2021 calendar year. Additionally, the employer should not have received a Paycheck Protection Program (PPP) loan, and in case they did, they cannot claim the credit on wages paid with forgiven PPP loan proceeds.

The ERC is generally calculated based on qualified wages paid to eligible employees. Qualified wages are the wages and compensation paid to employees working during the eligible period. The credit is equal to a percentage of qualified wages, with a maximum credit amount per employee.

It’s important to note that the ERC can be claimed for qualified wages paid between specific dates, depending on when the business became eligible. For businesses that experienced a full or partial suspension of operations, the eligible period starts on the date the suspension began. In cases of significant decline in gross receipts, the eligible period begins with the quarter that gross receipts dropped below 50% compared to the same quarter in the previous year and continues until gross receipts exceed 80% of the same quarter in the prior year.

By understanding the basics of the Employee Retention Credit, businesses can determine their eligibility and ascertain if they meet the requirements to claim this valuable tax credit. The ERC provides vital financial relief to businesses and helps them retain their workforce during difficult times. In the next section, we will delve deeper into the qualifications for the Employee Retention Credit.

Qualifications for the Employee Retention Credit

To be eligible for the Employee Retention Credit (ERC), businesses must meet certain criteria outlined by the U.S. government. Understanding these qualifications is crucial to determine whether a business is eligible to claim the credit and take advantage of the financial relief provided.

Here are the key qualifications for the Employee Retention Credit:

- The business must have experienced either a full or partial suspension of operations due to a government order related to COVID-19. This could include mandated closures, lockdowns, or restrictions that directly impacted the business’s ability to operate.

- Alternatively, businesses that did not face a government-mandated shutdown but experienced a significant decline in gross receipts may also be eligible. A significant decline is defined as a decline of 50% or more in gross receipts for a calendar quarter when compared to the same quarter in the previous year.

- The ERC is available to businesses of all sizes. However, there are specific criteria for businesses with different employee counts:

- For businesses with 100 or fewer full-time employees, all wages paid during the eligible period are eligible for the credit, regardless of whether the employees are providing services or not.

- For businesses with more than 100 employees, only wages paid to employees who are not providing services due to a full or partial suspension or a significant decline in gross receipts are eligible for the credit.

- Wages used to calculate the Employee Retention Credit cannot be used for other tax credits, such as the Work Opportunity Credit or the Paid Family and Medical Leave Credit.

- If the business received a Paycheck Protection Program (PPP) loan, there are restrictions on claiming the ERC. Businesses cannot claim the credit on wages paid with forgiven PPP loan proceeds.

It’s important to note that the ERC is available for wages paid between specific dates, depending on when the business became eligible. The eligible period starts on the date the suspension of operations began due to a government order or the quarter when the significant decline in gross receipts occurred.

By meeting the qualifications for the Employee Retention Credit, businesses can take advantage of this valuable tax credit and alleviate some of the financial burdens caused by the COVID-19 pandemic. In the next section, we will explore the methods for calculating the non-refundable portion of the Employee Retention Credit.

Calculating the Non-Refundable Portion

When determining the benefit of the Employee Retention Credit (ERC), it’s essential to understand the non-refundable portion. The non-refundable portion represents the portion of the credit that can only be used to offset tax liabilities and cannot be refunded to the business. Calculating the non-refundable portion accurately is crucial for businesses to manage their tax obligations effectively. Here, we will discuss three methods for calculating the non-refundable portion of the ERC.

Method 1: Using the Modified Calculation Method

Under the modified calculation method, the non-refundable portion of the ERC is equal to the total qualified wages multiplied by the applicable percentage. The applicable percentage varies depending on the eligibility period:

- For wages paid between March 13, 2020, and December 31, 2020, the applicable percentage is 50%.

- For wages paid between January 1, 2021, and June 30, 2021, the applicable percentage is 70%.

This method allows businesses to calculate the non-refundable portion based on the applicable percentage for the specific time period in which the wages were paid.

Method 2: Using the Prior Year Gross Receipts

Another method to calculate the non-refundable portion is by comparing the gross receipts of the current quarter to the same quarter in the prior year. If the current quarter’s gross receipts exceed 80% of the gross receipts from the same quarter in the prior year, the non-refundable portion is equal to the total qualified wages multiplied by the applicable percentage (50% or 70%). If the current quarter’s gross receipts are below 80% of the prior year’s gross receipts, the non-refundable portion is equal to the qualified wages paid during that quarter.

Method 3: Using the 2020 Calendar Quarters

For businesses that were not in operation in 2019, the non-refundable portion can be calculated by comparing the gross receipts of the current quarter to the first or second calendar quarter of 2020. If the current quarter’s gross receipts exceed 80% of either of the 2020 quarters, the non-refundable portion is equal to the total qualified wages multiplied by the applicable percentage. If the current quarter’s gross receipts are below 80% of the referenced 2020 quarters, the non-refundable portion is equal to the qualified wages paid during that quarter.

It’s important for businesses to carefully choose the most suitable method for calculating the non-refundable portion based on their specific circumstances. By accurately calculating the non-refundable portion, businesses can better manage their tax obligations and make informed decisions regarding the utilization of the ERC. In the next section, we will provide an example calculation to illustrate the process.

Method 1: Using the Modified Calculation Method

One of the methods for calculating the non-refundable portion of the Employee Retention Credit (ERC) is by using the modified calculation method. This method considers the applicable percentage based on the time period in which qualified wages were paid. Let’s dive deeper into how this method works.

Under the modified calculation method, the non-refundable portion of the ERC is determined by multiplying the total qualified wages by the applicable percentage. The applicable percentage varies depending on the time period in which the wages were paid:

- For wages paid between March 13, 2020, and December 31, 2020, the applicable percentage is 50%.

- For wages paid between January 1, 2021, and June 30, 2021, the applicable percentage is 70%.

Let’s consider an example to better understand this calculation method:

ABC Company qualified for the Employee Retention Credit and paid a total of $100,000 in qualified wages during the eligible period. The eligible period for this example is between March 13, 2020, and December 31, 2020.

To calculate the non-refundable portion using the modified calculation method:

- Step 1: Determine the applicable percentage based on the time period. In this case, it is 50%.

- Step 2: Multiply the total qualified wages ($100,000) by the applicable percentage (50%): $100,000 * 0.50 = $50,000.

In this example, the non-refundable portion of the Employee Retention Credit for ABC Company using the modified calculation method is $50,000.

It’s important for businesses to take note of the specific time period and the applicable percentage when using the modified calculation method. This method allows businesses to calculate the non-refundable portion accurately based on the wage payments made during the respective time period. By understanding and applying this method correctly, businesses can effectively manage their tax obligations and maximize the benefits of the Employee Retention Credit.

In the next section, we will explore another method for calculating the non-refundable portion, which involves using the prior year’s gross receipts.

Method 2: Using the Prior Year Gross Receipts

Another method for calculating the non-refundable portion of the Employee Retention Credit (ERC) is by using the prior year gross receipts. This method compares the gross receipts of the current quarter to the same quarter in the prior year to determine the non-refundable portion. Let’s explore this calculation method in more detail.

Under the method of using the prior year gross receipts, the non-refundable portion is calculated based on the following criteria:

- If the gross receipts for the current quarter exceed 80% of the gross receipts for the same quarter in the prior year, the non-refundable portion is equal to the total qualified wages multiplied by the applicable percentage (50% or 70%).

- If the gross receipts for the current quarter are below 80% of the gross receipts for the same quarter in the prior year, then the non-refundable portion is equal to the qualified wages paid during that quarter.

Let’s illustrate this calculation method with an example:

XYZ Corporation paid a total of $150,000 in qualified wages during the eligible quarter, which is the third quarter of 2021 (July 1, 2021, to September 30, 2021). To calculate the non-refundable portion using the prior year gross receipts method, we need to compare the gross receipts for the third quarter of 2021 to the same quarter in the prior year (third quarter of 2020).

Suppose that the gross receipts for the third quarter of 2021 were $200,000, and the gross receipts for the third quarter of 2020 were $250,000.

To calculate the non-refundable portion using the prior year gross receipts method:

- Step 1: Calculate 80% of the gross receipts for the same quarter in the prior year: $250,000 * 0.80 = $200,000.

- Step 2: Compare the gross receipts for the current quarter ($200,000) to 80% of the prior year’s gross receipts ($200,000). Since they are equal, the non-refundable portion is the total qualified wages ($150,000) multiplied by the applicable percentage (70%): $150,000 * 0.70 = $105,000.

In this example, the non-refundable portion of the Employee Retention Credit for XYZ Corporation using the prior year gross receipts method is $105,000.

Businesses should carefully analyze their gross receipts and compare them to the prior year’s figures to determine the non-refundable portion accurately. By applying this calculation method correctly, businesses can effectively utilize the Employee Retention Credit and manage their tax obligations.

In the next section, we will explore another method for calculating the non-refundable portion of the ERC, which involves using the 2020 calendar quarters.

Method 3: Using the 2020 Calendar Quarters

The third method for calculating the non-refundable portion of the Employee Retention Credit (ERC) involves using the 2020 calendar quarters as a reference point. This method is particularly useful for businesses that were not in operation in 2019. Let’s delve deeper into this calculation method.

Under the method of using the 2020 calendar quarters, the non-refundable portion is determined by comparing the gross receipts of the current quarter to the gross receipts in either the first or second calendar quarter of 2020. The steps for calculating the non-refundable portion using this method are as follows:

- If the gross receipts for the current quarter exceed 80% of the gross receipts for either the first or second quarter of 2020, the non-refundable portion is equal to the total qualified wages multiplied by the applicable percentage (50% or 70%).

- If the gross receipts for the current quarter are below 80% of the gross receipts for the referenced 2020 quarter, then the non-refundable portion is equal to the qualified wages paid during that quarter.

Let’s illustrate this calculation method with an example:

ABC Company, which started its operations in 2020, paid a total of $80,000 in qualified wages during the eligible quarter, which is the fourth quarter of 2021 (October 1, 2021, to December 31, 2021). To calculate the non-refundable portion using the 2020 calendar quarters method, we need to compare the gross receipts for the fourth quarter of 2021 to either the first or second quarter of 2020.

If the gross receipts for the fourth quarter of 2021 were $100,000, and the gross receipts for the first quarter of 2020 were $120,000, we can proceed with the calculation:

- Step 1: Calculate 80% of the gross receipts for the referenced 2020 quarter: $120,000 * 0.80 = $96,000.

- Step 2: Compare the gross receipts for the current quarter ($100,000) to 80% of the referenced 2020 quarter ($96,000). Since the current quarter’s gross receipts exceed 80% of the referenced 2020 quarter, the non-refundable portion is the total qualified wages ($80,000) multiplied by the applicable percentage (70%): $80,000 * 0.70 = $56,000.

In this example, the non-refundable portion of the Employee Retention Credit for ABC Company using the 2020 calendar quarters method is $56,000.

Businesses that were not in operation in 2019 can utilize this calculation method to determine the non-refundable portion accurately. By analyzing their gross receipts in comparison to the referenced 2020 quarters, businesses can effectively leverage the Employee Retention Credit and manage their tax obligations.

In the next section, we will present an example calculation to further illustrate the process of calculating the non-refundable portion of the ERC.

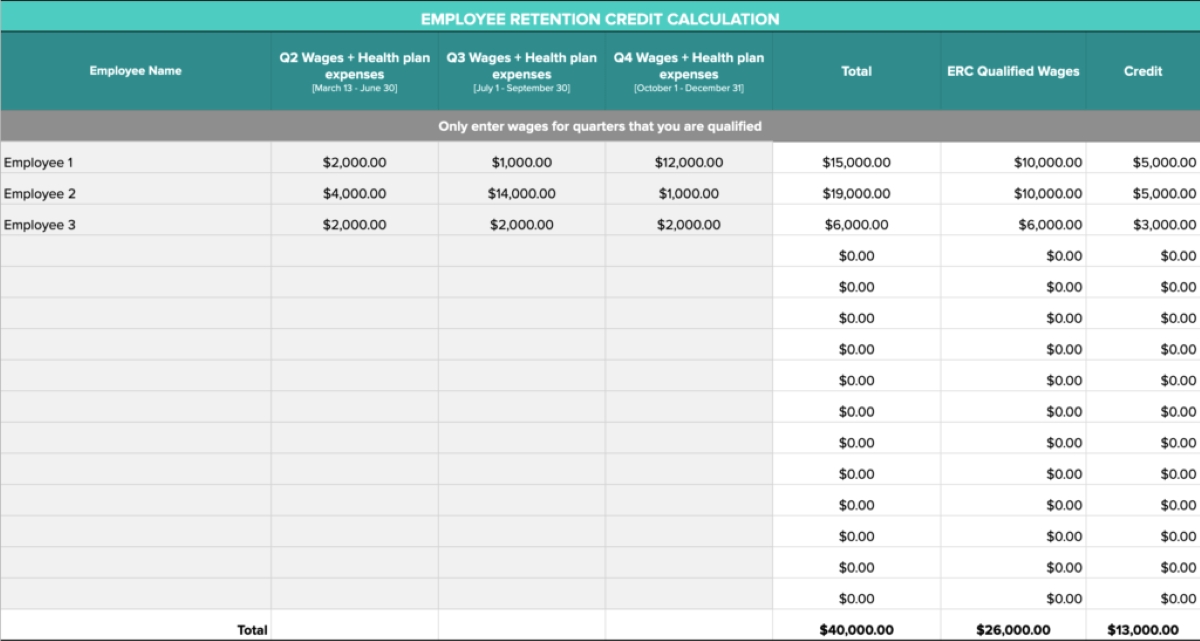

Example Calculation: Non-Refundable Portion of Employee Retention Credit

Let’s walk through an example calculation to further illustrate how to determine the non-refundable portion of the Employee Retention Credit (ERC). This example will demonstrate the process using one of the calculation methods discussed earlier.

Suppose XYZ Corporation, a manufacturing company, experienced a full suspension of operations due to a government order related to COVID-19. During the eligible period, which is from March 13, 2020, to December 31, 2020, they paid a total of $200,000 in qualified wages.

Using the modified calculation method, we know that the applicable percentage is 50% for wages paid during this time period. Let’s calculate the non-refundable portion:

- Step 1: Multiply the total qualified wages ($200,000) by the applicable percentage (50%): $200,000 * 0.50 = $100,000.

In this example, the non-refundable portion of the Employee Retention Credit for XYZ Corporation using the modified calculation method is $100,000.

This means that XYZ Corporation can use $100,000 of the ERC to offset their tax liabilities but cannot receive a refund for this amount. The non-refundable portion represents the credit that cannot be refunded and serves as a reduction to the company’s tax liability.

It’s important to note that this example showcases one calculation method, and businesses should choose the most appropriate method based on their specific circumstances and eligibility requirements. The non-refundable portion can vary depending on the selected calculation method and the applicable percentages or thresholds used.

By performing the necessary calculations, businesses can accurately determine the non-refundable portion of the Employee Retention Credit and make informed decisions regarding their tax planning and financial management.

In the next section, we will conclude our guide on calculating the non-refundable portion of the ERC and summarize the key points discussed.

Conclusion

Calculating the non-refundable portion of the Employee Retention Credit (ERC) is crucial for businesses to effectively manage their tax obligations and maximize the benefits of this valuable tax credit. Throughout this guide, we have discussed the qualifications for the ERC and explored three methods for calculating the non-refundable portion.

We started by understanding the basics of the Employee Retention Credit and the qualifications businesses must meet to be eligible for the credit. Businesses need to consider factors such as operational suspensions, significant declines in gross receipts, and the number of employees to determine their eligibility for the ERC.

We then explored three methods for calculating the non-refundable portion of the ERC:

- The modified calculation method, which considers the applicable percentage based on the time period.

- Using the prior year gross receipts to determine if the current quarter exceeds 80% of the gross receipts for the same quarter in the prior year.

- Using the 2020 calendar quarters as a reference point, comparing the current quarter’s gross receipts to either the first or second quarter of 2020.

Each method has its own considerations and is applicable in different scenarios. It’s important for businesses to carefully analyze their specific circumstances and choose the most appropriate method for their calculations.

In conclusion, understanding how to calculate the non-refundable portion of the Employee Retention Credit allows businesses to make informed decisions regarding their tax planning and financial management. By accurately determining the non-refundable portion, businesses can take full advantage of the relief provided by the ERC.

Remember, the examples and methods discussed in this guide are for illustrative purposes only. It’s essential to consult with a tax professional or financial advisor for personalized advice and guidance based on your specific business situation.

By leveraging the Employee Retention Credit and managing tax obligations effectively, businesses can navigate the challenges posed by the COVID-19 pandemic and emerge stronger in the post-pandemic era.