Finance

How To Price A Credit Default Swap

Published: March 4, 2024

Learn how to price a credit default swap in the finance industry. Understand the key factors and calculations involved in determining the value of a CDS. Gain insights into the pricing process and its significance in financial markets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the intricate world of credit default swaps (CDS), where the financial landscape intertwines with risk management strategies. As an essential component of the derivatives market, CDS plays a pivotal role in hedging against credit risk. Understanding the pricing dynamics of CDS empowers market participants to make informed decisions, mitigating potential vulnerabilities within their portfolios.

In the realm of finance, the pricing of CDS holds significant importance, influencing investment strategies, risk assessment, and overall market stability. This article delves into the fundamental aspects of pricing a credit default swap, providing a comprehensive guide for both novice enthusiasts and seasoned professionals in the finance industry.

Join us on this enlightening journey as we unravel the complexities of credit default swaps, exploring the factors that underpin their pricing and the steps involved in determining their value. Whether you are a financial analyst, investor, or simply intrigued by the dynamics of financial instruments, this exploration will equip you with valuable insights into the world of credit default swaps. Let's embark on this enlightening odyssey, delving into the intricate mechanisms that govern the pricing of credit default swaps.

Understanding Credit Default Swaps

Before delving into the pricing intricacies of credit default swaps (CDS), it is essential to grasp the fundamental concept of this financial instrument. A credit default swap serves as a form of insurance against the default or non-payment of a debt obligation, typically a bond. In essence, it allows investors to hedge against the risk of a borrower failing to meet their financial obligations.

Imagine a scenario where an investor holds a portfolio of corporate bonds, and there is a concern regarding the creditworthiness of a particular issuer. To mitigate the risk associated with potential default, the investor can enter into a credit default swap agreement with a counterparty, commonly a financial institution. In this agreement, the investor makes regular payments, known as premiums, to the counterparty in exchange for protection against the potential default of the underlying bond.

One of the defining features of a credit default swap is its flexibility, as it enables investors to customize their exposure to credit risk without necessitating the actual ownership of the underlying asset. This aspect has contributed to the widespread use of CDS as a risk management tool within the financial industry.

Furthermore, credit default swaps are traded over-the-counter (OTC), allowing for tailored agreements between parties based on their specific risk management needs. This flexibility in structuring CDS contracts has contributed to their versatility in addressing a diverse range of credit risk scenarios.

It is important to note that while credit default swaps offer risk mitigation benefits, they also introduce counterparty risk. In the event of a default by the protection seller (the counterparty providing the protection), the buyer of the CDS may face challenges in realizing the protection they were promised. Understanding the interplay of these risks is crucial in comprehending the dynamics of credit default swaps.

As we navigate the realm of credit default swaps, it becomes evident that these financial instruments serve as a crucial mechanism for managing credit risk, providing investors with a means to safeguard their portfolios against potential defaults. With this foundational understanding in place, we are poised to delve into the intricate process of pricing a credit default swap, unraveling the multifaceted considerations that underpin this essential financial practice.

Factors to Consider When Pricing a Credit Default Swap

When pricing a credit default swap (CDS), several critical factors come into play, shaping the valuation of this essential financial instrument. Understanding these factors is paramount for market participants seeking to ascertain the fair price of a CDS contract and effectively manage their exposure to credit risk.

Creditworthiness of the Reference Entity: The credit quality of the entity underlying the CDS, often referred to as the reference entity, is a primary determinant of the swap’s pricing. A higher likelihood of default by the reference entity translates to a greater risk for the protection seller, leading to higher premium payments and, consequently, a higher CDS price.

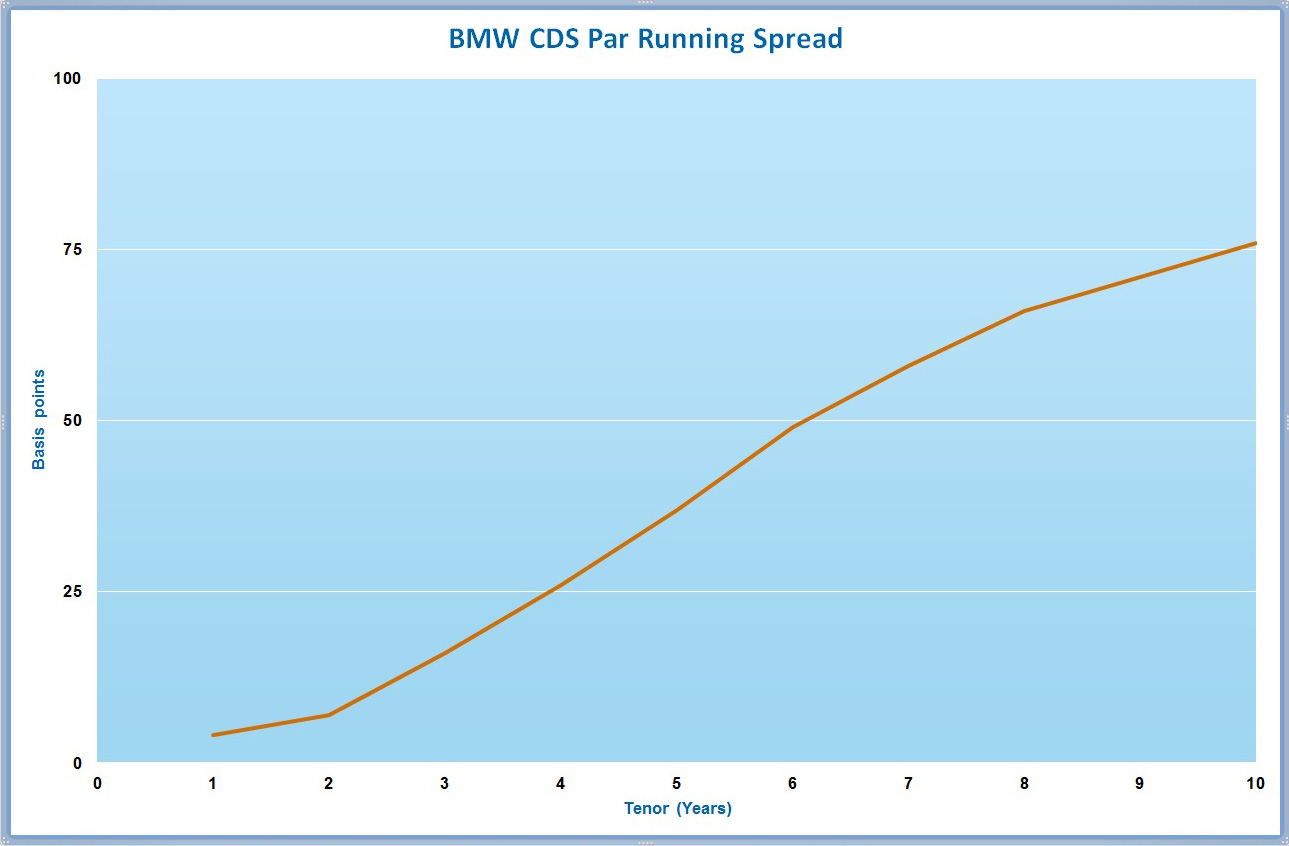

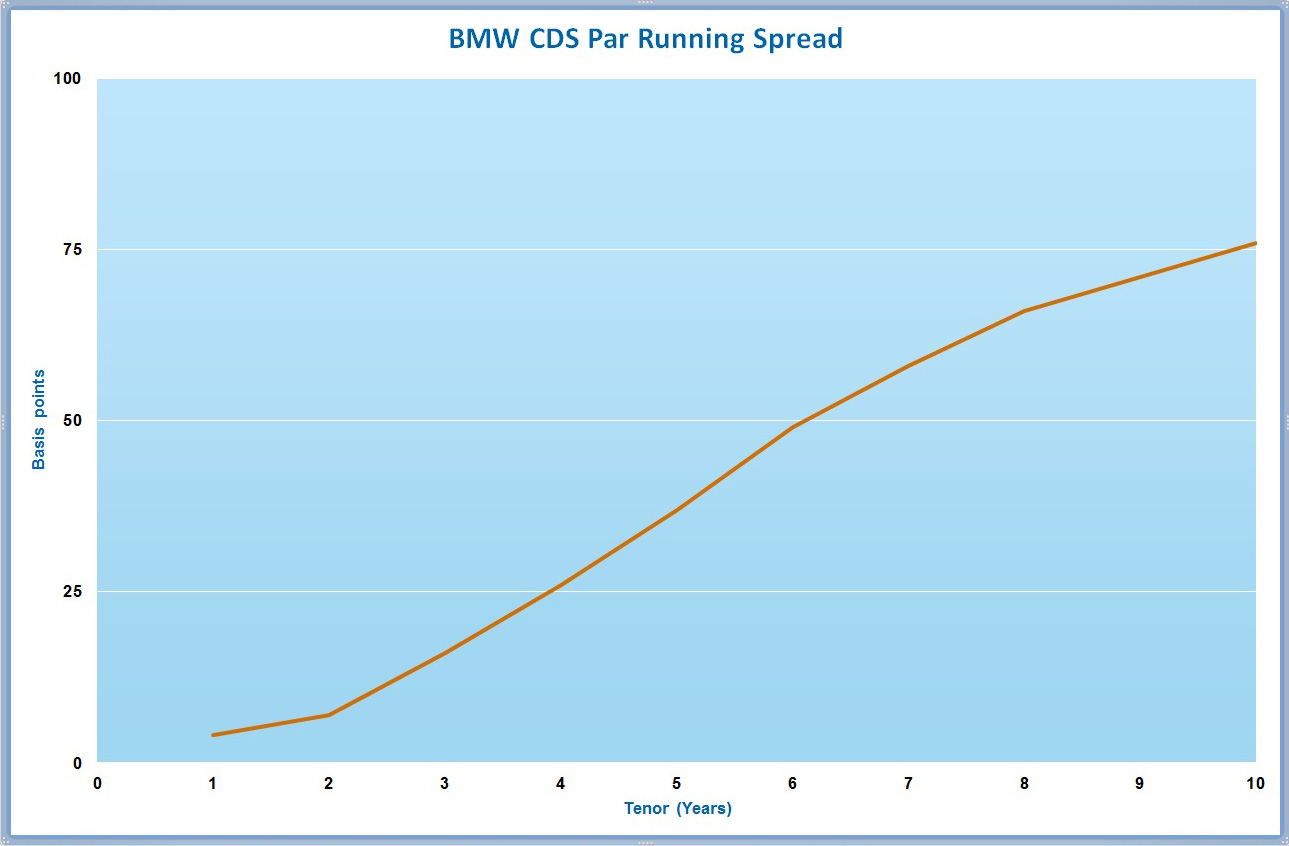

Tenor of the CDS: The maturity or tenor of the credit default swap plays a crucial role in its pricing. Longer tenors generally entail a higher degree of uncertainty and, therefore, command higher premiums, impacting the overall pricing of the CDS contract.

Market Conditions and Sentiment: The prevailing market environment and investor sentiment can significantly influence the pricing of credit default swaps. During periods of economic instability or heightened credit concerns, CDS prices may rise as market participants seek to protect themselves against potential defaults, reflecting the impact of market sentiment on pricing dynamics.

Interest Rates and Yield Curve: The prevailing interest rate environment and yield curve dynamics can impact the pricing of CDS contracts. Changes in interest rates and yield curve movements influence the present value of future cash flows associated with the CDS, thereby affecting its overall price.

Liquidity and Trading Activity: The liquidity of the CDS market and the trading activity surrounding specific reference entities can influence pricing. More liquid CDS markets may exhibit tighter bid-ask spreads, contributing to more efficient pricing, while illiquid markets can introduce pricing uncertainties.

Volatility and Market Risk: The volatility of financial markets and broader market risk factors can impact CDS pricing. Heightened market volatility may lead to increased uncertainty and risk premiums, influencing the pricing of credit default swaps.

By comprehensively evaluating these factors, market participants can gain valuable insights into the pricing dynamics of credit default swaps, enabling informed decision-making and effective risk management strategies. The interplay of these elements underscores the multifaceted nature of pricing CDS contracts, reflecting the intricate relationship between credit risk, market dynamics, and financial valuation.

Steps to Price a Credit Default Swap

Effectively pricing a credit default swap (CDS) involves a structured approach that integrates financial modeling, risk assessment, and market insights. Market participants, including financial institutions, investors, and risk managers, rely on a series of steps to ascertain the fair value of a CDS contract, enabling informed decision-making and risk mitigation strategies.

Step 1: Identify the Reference Entity and Obligation

The first step in pricing a CDS involves identifying the reference entity, which is the entity or obligation against which the CDS provides protection. This entails conducting thorough due diligence on the creditworthiness of the reference entity and the specific debt obligation, laying the foundation for the subsequent pricing analysis.

Step 2: Gather Market Data and Risk Parameters

Market participants gather pertinent market data and risk parameters, including credit spreads, yield curves, and relevant market indicators. These inputs serve as critical components in the pricing model, offering insights into market sentiment, credit risk dynamics, and prevailing economic conditions.

Step 3: Utilize Pricing Models and Valuation Techniques

Financial modeling and valuation techniques are employed to calculate the fair value of the credit default swap. This often involves utilizing probability of default (PD) models, credit spread curves, and discounted cash flow analysis to estimate the appropriate premium payments and overall pricing of the CDS contract.

Step 4: Assess Counterparty Risk and Funding Costs

Market participants evaluate counterparty risk associated with the CDS transaction, considering the creditworthiness of the protection seller and the impact of funding costs on the overall pricing. This step involves factoring in the credit risk of the counterparty and the funding expenses associated with the CDS arrangement.

Step 5: Consider Market Liquidity and Trading Dynamics

Liquidity and trading dynamics within the CDS market are taken into account when pricing the credit default swap. Assessing market liquidity, bid-ask spreads, and trading volumes provides valuable context for determining the fair price of the CDS contract, reflecting the impact of market conditions on pricing.

Step 6: Validate Pricing Against Market Quotes

Validation of the calculated CDS price against prevailing market quotes and observable transactions is a crucial step in the pricing process. This validation ensures that the derived price aligns with market realities and facilitates adjustments based on actual market conditions and pricing benchmarks.

By diligently following these steps, market participants can effectively price credit default swaps, leveraging a comprehensive approach that integrates market insights, risk assessment, and financial modeling. The structured nature of these steps underscores the importance of a methodical and informed approach to pricing CDS contracts, empowering market participants to navigate the complexities of credit risk management and derivatives valuation.

Conclusion

As we conclude our exploration of pricing credit default swaps (CDS), it becomes evident that these financial instruments represent a critical component of risk management and financial markets. The intricate process of pricing a CDS encompasses a multifaceted analysis, integrating market dynamics, credit risk considerations, and financial valuation techniques.

Understanding the factors that influence CDS pricing, including the creditworthiness of the reference entity, market conditions, and liquidity dynamics, is essential for market participants seeking to navigate the complexities of derivatives pricing. By comprehensively evaluating these factors, investors, financial institutions, and risk managers can make informed decisions, effectively managing their exposure to credit risk and optimizing their investment portfolios.

The steps involved in pricing a credit default swap underscore the structured approach required to ascertain the fair value of these essential financial instruments. From identifying the reference entity to utilizing pricing models and validating against market quotes, each step contributes to a holistic pricing process that integrates market data, risk assessment, and financial modeling.

Market participants are tasked with the ongoing challenge of effectively pricing credit default swaps in a dynamic and evolving financial landscape. The ability to accurately price CDS contracts is instrumental in fostering market transparency, facilitating risk transfer, and enhancing overall market efficiency.

As we reflect on the complexities of CDS pricing, it is evident that market participants must remain vigilant and adaptive, continuously refining their pricing methodologies to align with evolving market conditions and regulatory developments. By embracing a comprehensive understanding of credit default swap pricing, market participants can navigate the intricacies of derivatives valuation, ultimately contributing to the resilience and stability of the broader financial ecosystem.

In essence, the pricing of credit default swaps transcends mere financial valuation; it embodies the convergence of risk management, market dynamics, and financial acumen, shaping the landscape of modern finance. As market participants embark on the ongoing journey of pricing CDS contracts, they are tasked with upholding the principles of transparency, diligence, and informed decision-making, fostering a robust and resilient derivatives market.