Home>Finance>How To Record An Investment In Another Company On The Balance Sheet

Finance

How To Record An Investment In Another Company On The Balance Sheet

Published: October 17, 2023

Learn how to properly record an investment in another company on the balance sheet with our comprehensive finance guide. Master investment accounting now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Investments in Another Company

- Types of Investments in Another Company

- Methods for Recording Investments in Another Company on the Balance Sheet

- Method 1: Cost Method

- Method 2: Equity Method

- Method 3: Consolidation Method

- Disclosure Requirements for Investments in Another Company

- Conclusion

Introduction

Investments play a crucial role in the world of finance, allowing individuals and businesses to allocate capital and generate returns. One common form of investment involves owning shares or equity in another company. This can be a strategic move to gain a stake in a potential competitor, diversify portfolios, or simply generate income through dividends and capital appreciation.

When an entity invests in another company, it is important to accurately record this transaction on the balance sheet. Properly accounting for investments allows stakeholders to gauge the financial health and performance of the investing entity.

In this article, we will delve into the intricacies of recording investments in another company on the balance sheet. We will explore the different types of investments, as well as the various methods for recording these investments. Additionally, we will discuss the disclosure requirements to provide a comprehensive understanding of this financial aspect.

Whether you are an investor, business owner, or a financial professional, understanding how to record investments in another company is essential for accurate financial reporting.

Let’s dive in and explore the world of investment accounting!

Understanding Investments in Another Company

Investments in another company involve purchasing shares or equity in that company. This gives the investing entity a stake in the ownership and potential profits of the invested company. It is important to understand the nature of these investments and their implications before recording them on the balance sheet.

Investments in another company can be categorized into two main types: passive investments and strategic investments.

Passive investments are made primarily for the purpose of generating returns on invested capital. These investments typically involve purchasing shares of publicly traded companies through stock markets. The investing entity, in this case, does not exert significant influence over the operations or management of the invested company.

On the other hand, strategic investments are made for the purpose of gaining a significant stake in another company, often with the intention of exerting influence over its operations and strategies. This type of investment is commonly seen in mergers and acquisitions, joint ventures, or when a company wishes to gain exposure to a specific market or industry.

Understanding the purpose and motives behind the investment is crucial for determining the accounting treatment and recording of the investment on the balance sheet.

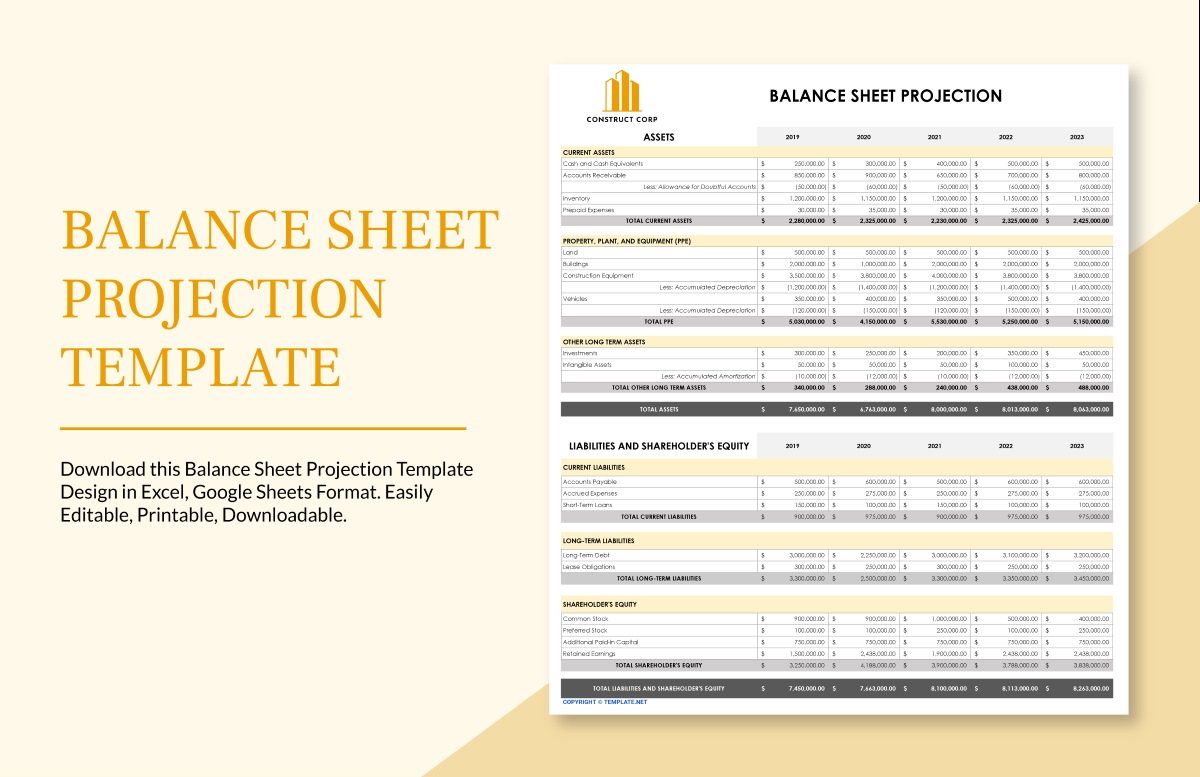

Investments in another company are typically recorded as long-term assets on the balance sheet. The exact classification of the investment depends on the level of influence or control the investing entity has over the invested company.

In the following sections, we will explore the different methods for recording investments in another company on the balance sheet, including the cost method, equity method, and consolidation method.

Types of Investments in Another Company

When it comes to investments in another company, there are several types that you should be familiar with. Each type represents a different level of ownership or influence over the invested company, and understanding these distinctions is essential for accurately recording the investment on the balance sheet.

Here, we will discuss three main types of investments: equity investments, debt investments, and derivative investments.

1. Equity Investments: This type of investment involves purchasing shares or equity in another company. By acquiring equity, the investing entity becomes a shareholder and gains ownership rights in the company. The extent of ownership depends on the percentage of shares held. Equity investments can be further categorized into two types:

- Minority Investments: When the investing entity holds less than 50% of the shares, it is considered a minority investment. In this case, the influence or control over the invested company is limited.

- Majority Investments: When the investing entity holds more than 50% of the shares, it is considered a majority investment. This gives the investing entity significant control over the operations and decision-making of the invested company.

2. Debt Investments: This type of investment involves lending money to another company in exchange for regular interest payments and the return of the principal amount. Debt investments can take various forms, such as corporate bonds, government bonds, or loans. Unlike equity investments, debt investments do not grant ownership rights. Instead, the investing entity acts as a creditor to the borrowing company.

3. Derivative Investments: Derivatives are financial instruments that derive their value from an underlying asset. In the context of investments in another company, derivative investments can include options, futures, or swaps. These investments allow the investor to speculate on the future price movement of the underlying asset without actually owning it.

Each type of investment has its own characteristics and accounting treatment. It is important to correctly identify the type of investment made in order to accurately record it on the balance sheet.

Now that we have a broad understanding of the types of investments in another company, let’s explore the methods for recording these investments on the balance sheet.

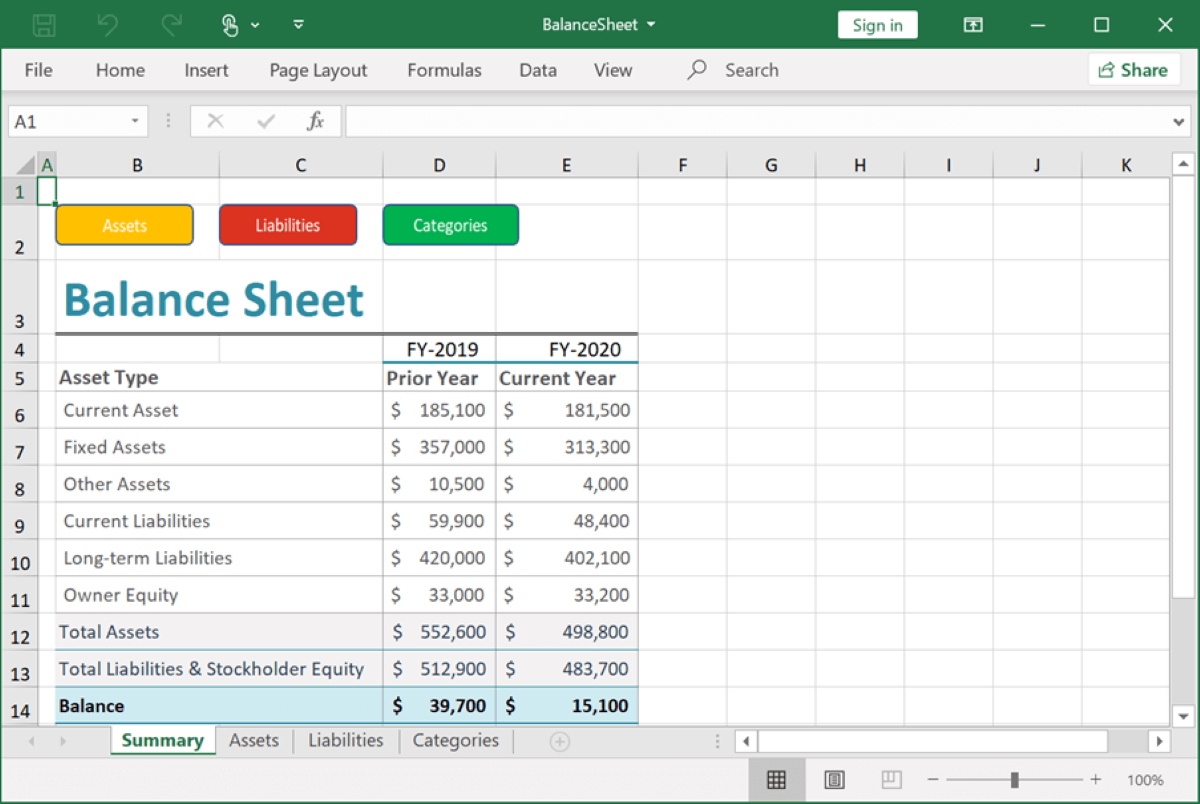

Methods for Recording Investments in Another Company on the Balance Sheet

Recording investments in another company on the balance sheet involves determining the appropriate method based on the level of influence or control the investing entity has over the invested company. There are three main methods for recording these investments: the cost method, the equity method, and the consolidation method. Each method has its own criteria and implications.

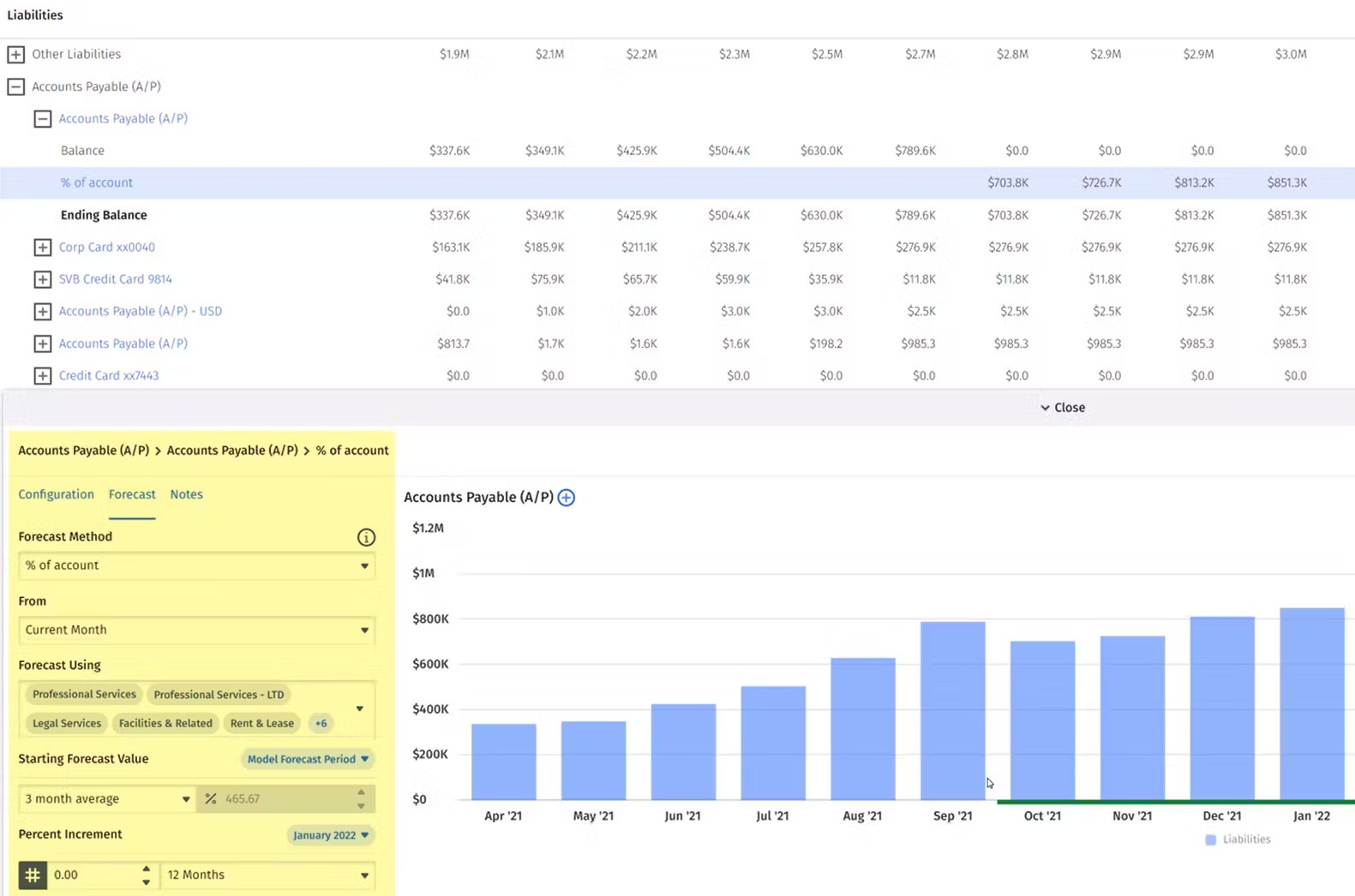

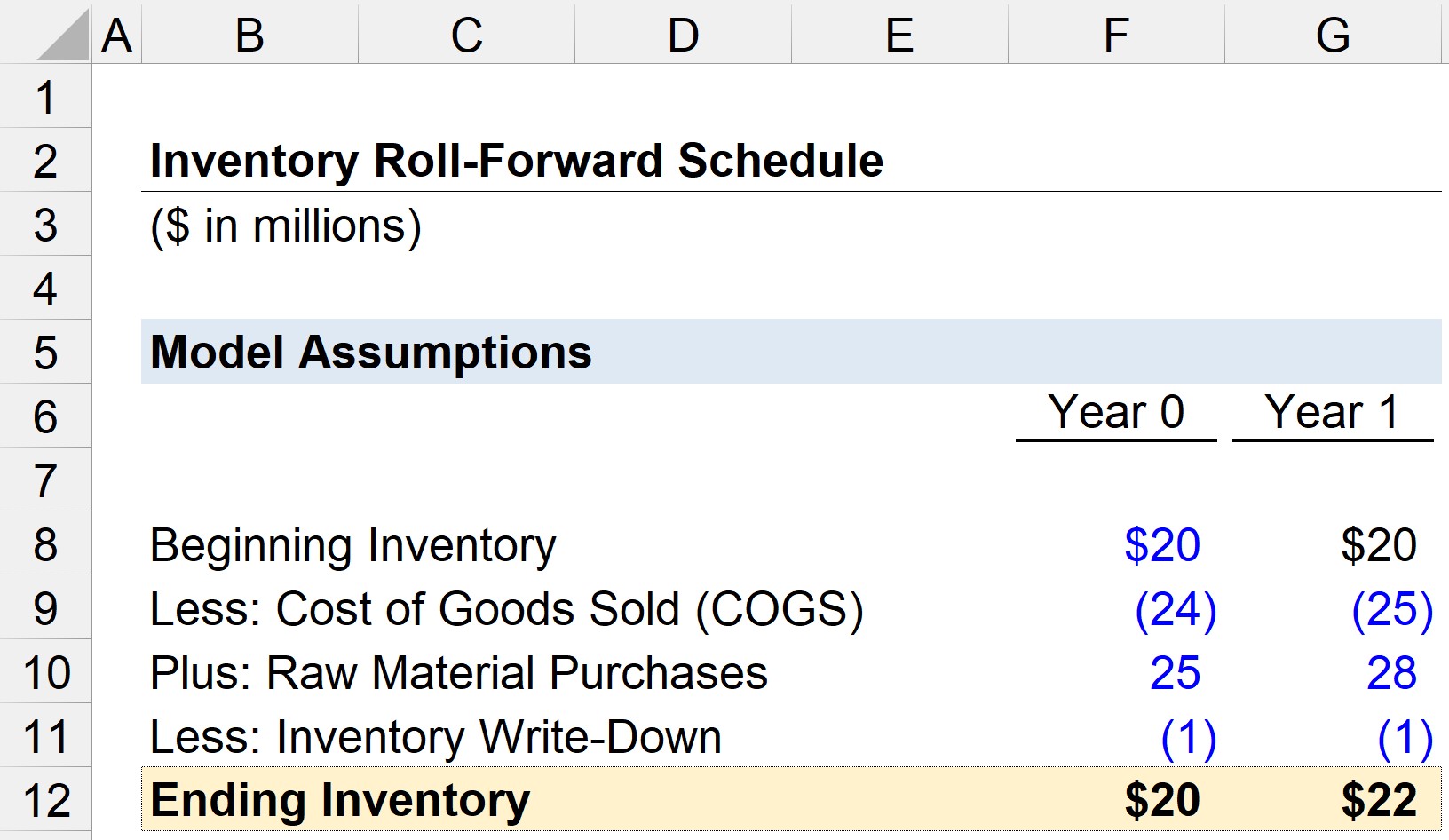

1. Cost Method: The cost method is used when the investing entity has a passive investment with no significant influence over the invested company. Under this method, the investment is initially recorded at its cost, which includes the purchase price and any transaction costs. The investment is subsequently carried at cost, adjusted for any impairments or write-downs. Dividends received from the invested company are recognized as income.

2. Equity Method: The equity method is applied when the investing entity has significant influence over the invested company but does not exert control. Significant influence is generally presumed when the investing entity owns between 20% and 50% of the voting shares of the invested company. Under this method, the investment is initially recorded at cost and subsequently adjusted for the investor’s share of the invested company’s profits or losses. The investor recognizes its share of the invested company’s net income as income on the income statement.

3. Consolidation Method: The consolidation method is used when the investing entity has control over the invested company. Control is generally deemed to exist when the investing entity owns more than 50% of the voting shares of the invested company. Under this method, the financial statements of the investing entity and the invested company are combined, as if they were one entity. The investment is eliminated, and the investing entity recognizes the assets, liabilities, and results of operations of the invested company on its own balance sheet.

It’s important to carefully assess the level of influence or control that the investing entity has when choosing the appropriate method for recording investments on the balance sheet. Applying the correct method ensures accurate financial reporting and transparency.

In the next section, we will delve into the specific details of each method and discuss their implications in more depth.

Method 1: Cost Method

The cost method is a straightforward approach used to record investments in another company on the balance sheet when the investing entity has a passive investment with no significant influence over the invested company. Under this method, the investment is initially recorded at its cost, which includes the purchase price and any transaction costs.

Once the investment is recorded at cost, it is subsequently carried at cost on the balance sheet unless there are impairment or write-downs needed. This means that any fluctuations in the value of the investment over time are not reflected in the financial statements unless there is a change in ownership or a specific impairment is identified.

Dividends received from the invested company are recognized as income when they are received. They are typically reported separately on the income statement as dividend income.

The cost method is commonly used for minority investments where the investing entity does not exert significant influence over the invested company’s operations or decision-making. It is a straightforward and conservative method of accounting for investments, as it does not assume any influence or control over the invested company.

However, it is important to periodically assess the carrying value of the investment for any indications of impairment. If there is a significant and permanent decline in the value of the investment, the investing entity will need to recognize an impairment loss on the income statement and reduce the carrying value of the investment on the balance sheet.

It is worth noting that the cost method may not provide a true reflection of the economic value of the investment. As a passive investor, the investing entity does not have the ability to contribute or influence the invested company’s operations or decision-making, which may limit the returns or potential benefits of the investment.

In summary, the cost method is a simple and conservative approach used to record passive investments in another company on the balance sheet. It focuses on the initial cost of the investment, with subsequent adjustments made for impairments or write-downs. Dividends received from the invested company are recognized as income when received. While it may not reflect the true economic value of the investment, the cost method is a reliable way to account for passive investments.

Method 2: Equity Method

The equity method is a widely used approach for recording investments in another company on the balance sheet when the investing entity has a significant influence over the invested company, typically through owning between 20% and 50% of the voting shares.

Under the equity method, the investment is initially recorded at cost, similar to the cost method. However, unlike the cost method, the equity method requires the investing entity to adjust the carrying value of the investment over time to reflect its share of the invested company’s profits or losses.

The investing entity recognizes its share of the invested company’s net income as income on the income statement. This is typically reported as equity income or investment income, depending on the specific accounting standards followed.

Similarly, if the invested company incurs any losses, the investing entity needs to recognize its share of those losses as a reduction in the investment value on the balance sheet and as an expense on the income statement.

The equity method allows the investing entity to reflect its proportionate ownership interest in the invested company’s financial results. It acknowledges the investing entity’s significant influence over the operations and decision-making of the invested company.

It’s important to note that dividends received from the invested company are not recognized as income. Instead, they are treated as a return of the investing entity’s investment and are used to adjust the carrying value of the investment on the balance sheet.

The equity method is commonly used when the investing entity has a significant interest in the invested company but does not exercise full control. It provides a more accurate reflection of the economic value of the investment compared to the cost method.

However, it’s crucial to regularly assess the investment for any impairment indicators. If there is a significant and permanent decline in the value of the investment, the investing entity needs to recognize an impairment loss and adjust the carrying value of the investment accordingly.

In summary, the equity method is a widely utilized approach for recording investments in another company when the investing entity has a significant influence over the invested company. It involves adjusting the carrying value of the investment based on the investing entity’s share of the invested company’s profits or losses. Dividends received are treated as a return of the investment, and impairments are recognized if necessary.

Method 3: Consolidation Method

The consolidation method is used for recording investments in another company on the balance sheet when the investing entity has control over the invested company, typically by owning more than 50% of the voting shares. This method involves combining the financial statements of the investing entity and the invested company as if they were one entity.

Under the consolidation method, the investment is not recorded on the balance sheet as a separate line item. Instead, the investing entity recognizes the assets, liabilities, and results of operations of the invested company on its own balance sheet.

The consolidation process involves eliminating any intercompany transactions or balances between the investing entity and the invested company. This ensures that only external transactions and third-party balances are reflected in the consolidated financial statements.

The consolidated financial statements provide a comprehensive picture of the financial position, performance, and cash flows of the combined entities. They allow stakeholders to assess the overall financial health and results of operations of the combined entity as a whole.

It’s worth noting that under the consolidation method, a minority interest account is created on the balance sheet to represent the portion of the invested company’s equity that is not owned by the investing entity. This minority interest reflects the ownership rights of external shareholders in the invested company.

The consolidation method is used when the investing entity has control over the invested company and aims to present a complete picture of the financial position and operations of the combined entities. It provides the most comprehensive and accurate representation of the invested company’s financials within the investing entity’s financial statements.

However, it is crucial to ensure compliance with applicable accounting standards and guidelines when applying the consolidation method. This includes assessing and adjusting for any effects of potential conflicts of interest, contingent liabilities, or non-controlling interests.

In summary, the consolidation method is used to record investments in another company on the balance sheet when the investing entity has control over the invested company. It involves combining the financial statements of the investing entity and the invested company, eliminating intercompany transactions, and recognizing the assets, liabilities, and results of operations of the invested company on the investing entity’s balance sheet. The consolidated financial statements provide a holistic view of the combined entities’ financials.

Disclosure Requirements for Investments in Another Company

Proper disclosure of investments in another company is crucial for providing transparency and enabling stakeholders to make informed decisions. Disclosure requirements ensure that relevant information about the investments is presented in the financial statements or accompanying notes. Here are some key disclosure requirements for investments in another company:

1. Reporting basis: The financial statements should clearly state the basis on which the investments are reported, whether it is the cost method, equity method, or consolidation method.

2. Investment details: Disclose the nature, type, and extent of the investments made in another company. This includes information such as the name of the company invested in, the percentage of ownership, and the voting rights associated with the investment.

3. Valuation methodology: Provide information on the valuation methodology used to determine the carrying value of the investment. This includes any valuation techniques or inputs utilized, such as market prices, earnings multiples, or discounted cash flow models.

4. Impairment assessment: If there are indicators of impairment for the investment, disclose the impairment assessment performed, including the assumptions, estimates, and calculations used to determine if a significant and permanent decline in value has occurred.

5. Equity method disclosures: If the equity method is applied, disclose the investor’s share of the invested company’s net income or loss, including the basis for determining the proportionate ownership and any adjustments made to the carrying value of the investment.

6. Consolidation disclosures: If the consolidation method is employed, provide details on the consolidation process, including the basis for determining control, any non-controlling interests, and any intercompany transactions that have been eliminated.

7. Commitments and contingencies: Disclose any significant commitments or contingencies related to the investments in another company. This may include guarantees, warranties, or legal disputes that could impact the value or future performance of the investment.

8. Related party transactions: If there are any related party transactions between the investing entity and the invested company, disclose the nature, terms, and amounts of those transactions to ensure transparency and prevent conflicts of interest.

9. Changes in ownership: Disclose any changes in ownership, including acquisitions or disposals of the investment, as well as any resulting gains or losses.

10. Significant risks and uncertainties: Provide information on any significant risks and uncertainties associated with the investments in another company. This may include industry-specific risks, market volatility, or regulatory changes that could impact the investment’s value.

By adhering to these disclosure requirements, companies can provide stakeholders with a comprehensive understanding of their investments in another company. This allows investors, creditors, and other financial statement users to assess the risks and potential impact on the company’s financial position and performance.

Conclusion

Recording and disclosing investments in another company on the balance sheet is a crucial aspect of financial reporting. The proper accounting and disclosure of these investments provide stakeholders with transparency and enhance their understanding of the investing entity’s financial position and performance.

Throughout this article, we have explored the different methods for recording investments in another company, including the cost method, equity method, and consolidation method. Each method has its own criteria and implications, depending on the level of influence or control the investing entity has over the invested company.

Understanding the types of investments, such as equity investments, debt investments, and derivative investments, is essential for determining the appropriate accounting treatment. Each type represents a different level of ownership or influence and requires specific considerations when recording the investment on the balance sheet.

Furthermore, we have discussed the importance of proper disclosure when it comes to investments in another company. Clear and comprehensive disclosure ensures that stakeholders have access to relevant information about the investments, including valuation methodologies, impairment assessment, equity method disclosures, consolidation information, and related party transactions.

By adhering to these disclosure requirements, companies demonstrate their commitment to transparency and provide stakeholders with the necessary information to make informed decisions.

In conclusion, accurately recording and disclosing investments in another company on the balance sheet is vital for financial reporting. It allows stakeholders to evaluate the financial health and performance of the investing entity and promotes trust in the company’s reporting practices. By understanding the methods for recording investments and meeting the disclosure requirements, companies can ensure that their financial statements provide a true and fair representation of their investment activities.