Finance

How To Sell Stocks On Fidelity

Published: January 18, 2024

Learn how to sell stocks on Fidelity and manage your finances effectively. Gain insights on stock selling strategies and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of stock trading! If you’re looking to sell stocks on Fidelity, one of the leading brokerage firms in the industry, you’ve come to the right place. Whether you’re a seasoned trader or just starting out, this guide will walk you through the process of selling stocks on Fidelity, step by step.

Before we dive into the details, it’s important to understand the basics. Selling stocks essentially means that you’re parting ways with a portion or all of your ownership in a particular company. This can be done for a variety of reasons, such as taking profits, cutting losses, or adjusting your investment portfolio.

Fidelity is a well-established brokerage firm that provides a comprehensive platform for trading stocks, bonds, mutual funds, and other investment vehicles. With its user-friendly interface, robust research tools, and competitive pricing, Fidelity is a popular choice among investors.

Now, let’s get started on how to sell stocks on Fidelity. It’s important to note that before you can sell stocks, you will need to have an active Fidelity brokerage account. If you haven’t set up an account yet, don’t worry – we’ll cover that in the first step.

Step 1: Set up a Fidelity brokerage account

The first step in selling stocks on Fidelity is to set up a brokerage account. If you already have one, you can skip this step and proceed to the next section.

To set up a Fidelity brokerage account, follow these simple steps:

- Visit the Fidelity website: Go to the Fidelity Investments website and click on the “Open an Account” button.

- Select the type of account: Fidelity offers a variety of account types, including individual brokerage accounts, joint accounts, retirement accounts, and more. Choose the account type that best suits your needs.

- Provide personal information: Fill out the required personal information, such as your name, address, social security number, and employment information.

- Choose account features: Select any additional features you may want for your brokerage account, such as margin trading or options trading.

- Review and submit your application: Take a moment to review your application for accuracy, then submit it online.

After submitting your application, Fidelity will verify your information and open your brokerage account. You may be required to provide additional documentation or complete a phone interview for verification purposes.

Once your account is approved and set up, you’ll receive a confirmation email with your account details and login information. Keep this information in a safe place, as you’ll need it to access your account and sell stocks on Fidelity.

Now that you have your Fidelity brokerage account set up, you’re ready to move on to the next step: accessing your portfolio.

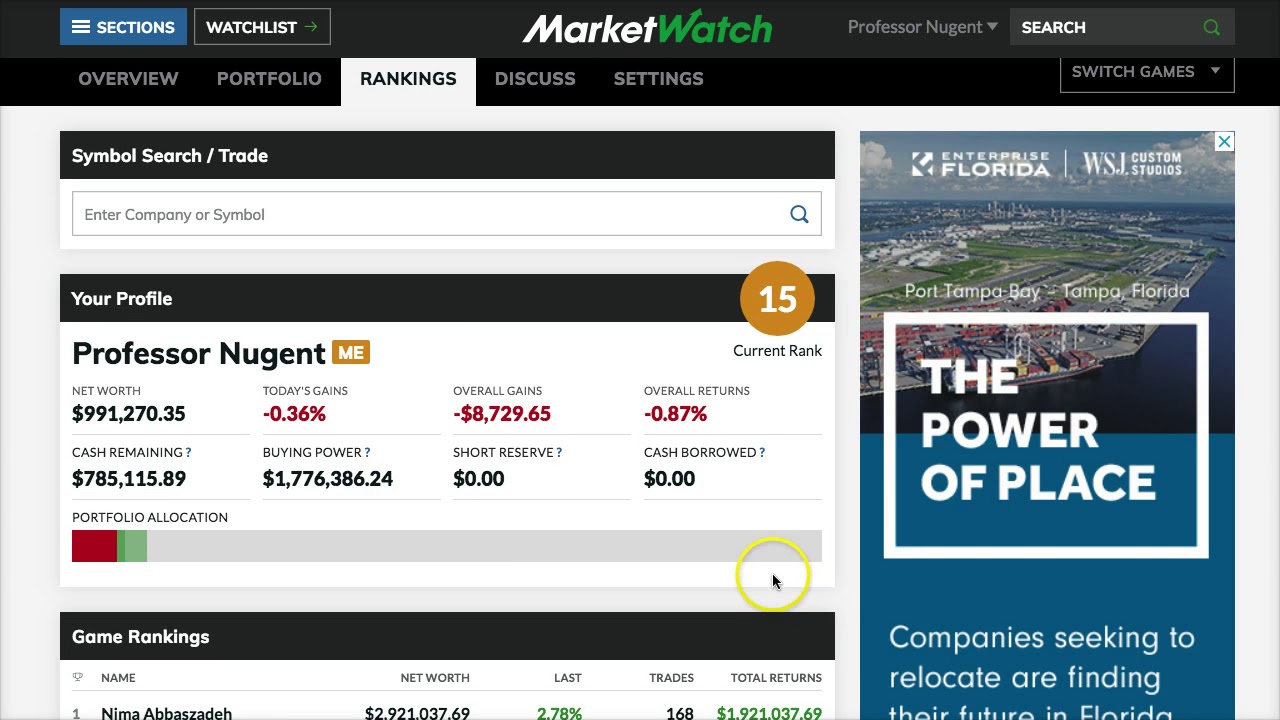

Step 2: Access your portfolio

Once you have your Fidelity brokerage account set up, the next step is to access your portfolio. Your portfolio is where you can view all the stocks and other securities that you currently own.

To access your portfolio on Fidelity, follow these steps:

- Log in to your Fidelity account: Go to the Fidelity website and enter your login credentials (username and password) to log in to your account.

- Navigate to your account summary: Once logged in, you’ll be directed to your account summary page. Here, you can see an overview of your account balances and holdings.

- Select the “Portfolio” tab: Look for the “Portfolio” tab on the main navigation bar, usually located at the top of the page. Click on this tab to access your portfolio.

After following these steps, you should be able to view your portfolio, including all the stocks you currently own, their respective quantities, and their current market values.

Having access to your portfolio is crucial when it comes to selling stocks on Fidelity. It allows you to assess your current holdings and make informed decisions about which stocks to sell and when.

Now that you know how to access your portfolio on Fidelity, let’s move on to the next step: selecting the stock to sell.

Step 3: Select the stock to sell

After accessing your portfolio on Fidelity, it’s time to select the stock you want to sell. You may have multiple stocks in your portfolio, so it’s important to identify the specific one you wish to sell.

To select the stock to sell on Fidelity, follow these steps:

- Review your portfolio: Take a moment to review your portfolio and identify the stock you want to sell. Look for the stock’s symbol, which is usually a combination of letters, to easily locate it.

- Click on the stock’s name or symbol: Once you have identified the stock, click on its name or symbol to view its detailed information.

- Verify the stock details: When viewing the stock’s details, verify that it is indeed the correct stock. Double-check the company name, symbol, and any other relevant information.

By following these steps, you can ensure that you have selected the right stock for selling. It’s essential to be accurate and double-check all the details before proceeding.

When selecting the stock to sell, you may also consider factors such as the stock’s performance, market conditions, and your investment goals. It’s important to make an informed decision based on your individual circumstances and financial objectives.

Now that you have selected the stock you want to sell, let’s move on to the next step: choosing the type of order.

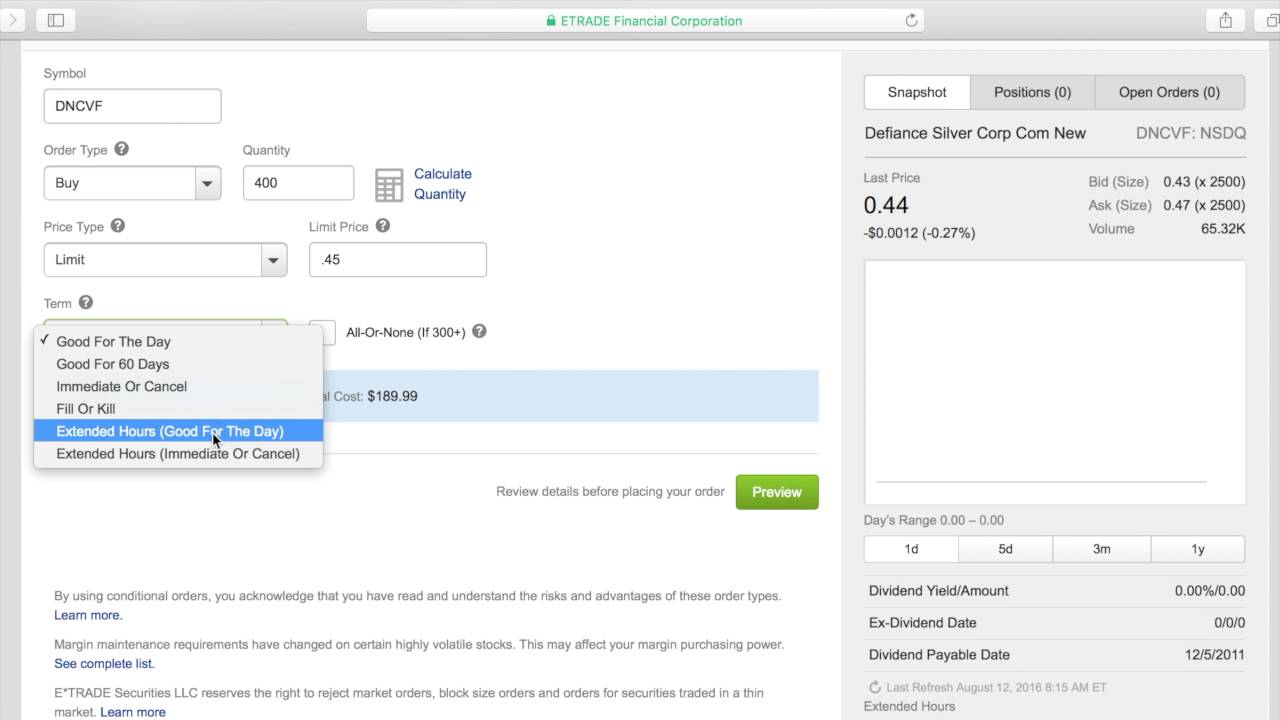

Step 4: Choose the type of order

Once you have selected the stock you want to sell on Fidelity, the next step is to choose the type of order you want to place. Fidelity offers different order types to accommodate various trading preferences and strategies.

To choose the type of order on Fidelity, consider the following options:

- Market Order: A market order is the simplest and most straightforward type of order. When you place a market order, you are instructing Fidelity to sell the stock at the best available price in the market. Keep in mind that the execution price may not be exactly what you see at the time of placing the order, especially if there is high volatility or low liquidity.

- Limit Order: A limit order allows you to set a specific price at which you are willing to sell the stock. When the market price reaches your specified limit, Fidelity will execute the sell order. This type of order gives you more control over the selling price, but there is a possibility that the order may not be filled if the market does not reach your specified price.

- Stop Order: A stop order, also known as a stop-loss order, is designed to protect you from excessive losses. With a stop order, you set a trigger price below the current market price. If the stock price reaches or falls below the trigger price, Fidelity will automatically execute a market order to sell the stock. This type of order is useful for limiting downside risk but does not guarantee a specific price of execution.

- Stop Limit Order: Similar to a stop order, a stop limit order also has a trigger price. However, with a stop limit order, you also set a limit price. If the stock price reaches or falls below the trigger price, Fidelity will place a limit order to sell the stock at or above your specified limit price. This type of order provides more control over the execution price but may not be filled if the limit price is not reached.

Consider your trading objectives and risk tolerance when choosing the type of order. If you want to sell the stock quickly and are not concerned about the exact execution price, a market order may be suitable. If you have a specific price in mind and are willing to wait for it to be reached, a limit or stop limit order may be more appropriate.

Now that you have chosen the type of order, let’s move on to the next step: setting the order details.

Step 5: Set the order details

Once you have selected the type of order you want to place on Fidelity, it’s time to set the order details. This step involves specifying the quantity of shares you want to sell, any additional order instructions, and the duration of the order.

To set the order details on Fidelity, follow these steps:

- Enter the quantity: Specify the number of shares you want to sell. Make sure to double-check the quantity to ensure accuracy.

- Add any additional instructions: If you have any specific instructions or preferences regarding the order, such as selling in lots or selling only during certain market conditions, you can include them in the additional instructions section.

- Choose the order duration: Select the duration for which the order will remain active. Fidelity offers different options, including day orders, good ’til canceled (GTC) orders, and immediate or cancel (IOC) orders. Consider your trading strategy and preferences when choosing the order duration.

Setting the order details is crucial as it determines the specific parameters of your sell order. Ensure that you enter the correct quantity and review any additional instructions or order duration options before proceeding.

It’s important to note that Fidelity also provides advanced order options, such as trailing stop orders and conditional orders. These options allow you to incorporate more sophisticated trading strategies into your sell order. If you are familiar with these types of orders and want to explore them, Fidelity offers resources and guidance to help you understand and utilize them effectively.

Now that you have set the order details, let’s move on to the next step: reviewing and confirming the sale.

Step 6: Review and confirm the sale

After setting the order details for your sell order on Fidelity, it’s crucial to review and confirm the sale before finalizing the transaction. Taking this step ensures that all the information is accurate and that you are comfortable proceeding with the sale.

To review and confirm the sale on Fidelity, follow these steps:

- Review the order details: Carefully go through all the order details, including the stock symbol, order type, quantity, additional instructions, and order duration. Make sure everything is as intended and accurate.

- Check the total proceeds: Take a look at the estimated total proceeds you will receive from the sale. This amount is calculated based on the current market price and the quantity of shares you are selling.

- Confirm the sale: Once you have reviewed and verified all the information, click the “Confirm” or “Place Order” button to finalize the sale. At this point, the order will be submitted to Fidelity for execution.

It’s essential to review the order details to avoid any errors or unintended outcomes. Double-checking the information helps ensure a smooth and accurate transaction process.

Once you confirm the sale, Fidelity will execute the order based on the specified parameters. You may receive an order confirmation email or notification to confirm the execution of the sale. It’s a good practice to keep a record of this confirmation for future reference.

Now that you have reviewed and confirmed the sale, let’s move on to the final step: monitoring the status of your order.

Step 7: Monitor the status of your order

After placing your sell order on Fidelity, it’s important to regularly monitor the status of your order. Monitoring allows you to stay informed about the progress of the sale and make any necessary adjustments if needed.

To monitor the status of your order on Fidelity, follow these steps:

- Access your order status: Log in to your Fidelity account and navigate to the “Orders” or “Order Status” section.

- View order details: Locate the specific sell order you placed and click on it to view the order details. Here, you can see information such as the order type, quantity, execution price, and any other relevant details.

- Check for updates: Keep an eye on any updates or status changes for your order. Fidelity provides real-time updates on the status of your order, such as whether it has been executed, partially executed, or still pending.

- Adjust or cancel the order if necessary: If you need to make any changes or cancel the order, follow the provided options within the Fidelity platform. Keep in mind that there may be limitations or restrictions based on the current status of the order.

Monitoring the status of your order is crucial as it allows you to respond promptly to any changes or updates. For example, if the market conditions shift significantly, you may choose to adjust or cancel the order to align with your investment strategy.

It’s important to note that the execution of your sell order is subject to market conditions, trading volume, and other factors that may impact the timing and price of the execution. Fidelity strives to provide efficient execution and transparency, but there may be instances where the order is executed differently than anticipated.

By regularly monitoring the status of your order, you can stay informed and make informed decisions regarding your investment portfolio.

Congratulations! You have successfully learned how to sell stocks on Fidelity. Remember to conduct thorough research and consider your investment objectives before making any investment decisions. Happy trading!

If you have any further questions or need assistance, Fidelity provides customer support to help you navigate the process and address any concerns you may have.

Now that you know how to monitor the status of your order, you can feel confident in managing your stock sales effectively on Fidelity.

Conclusion

Congratulations! You have reached the end of this comprehensive guide on how to sell stocks on Fidelity. By following the steps outlined in this article, you have gained the knowledge and confidence to navigate the process with ease.

We started by setting up a Fidelity brokerage account, ensuring you have the necessary platform to conduct your stock trading activities. Then, we learned how to access your portfolio, allowing you to review your current holdings and make informed selling decisions.

Next, we explored the crucial step of selecting the stock to sell, taking into consideration factors such as performance, market conditions, and personal investment goals. We then delved into choosing the type of order, from market orders to stop limit orders, allowing you to tailor your sell order to your preferences and trading strategy.

Setting the order details and carefully reviewing all the information before confirming the sale were highlighted as crucial steps in the process. By double-checking the details, you reduce the possibility of errors and ensure the accuracy of your trade.

Lastly, we emphasized the importance of monitoring the status of your order. By regularly checking for updates and staying informed about the progress of your sale, you can make timely adjustments or decisions if necessary.

Remember, investing in stocks carries risks, and it’s important to conduct thorough research and consider your individual financial circumstances before making any investment decisions. Consult with a financial advisor if needed to ensure you have a well-rounded understanding of the market and your personal investment goals.

With the knowledge and guidance provided in this guide, you are well-equipped to navigate the process of selling stocks on Fidelity. Enjoy your trading journey and may your investments be prosperous!