Home>Finance>Money Flow: Definition, Calculation, Uses In Trading

Finance

Money Flow: Definition, Calculation, Uses In Trading

Published: December 26, 2023

Learn the definition and calculation of money flow in finance, and discover the various uses of this concept in trading. Enhance your financial knowledge today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Money Flow: Definition, Calculation, Uses in Trading

When it comes to finance, understanding the concept of money flow is crucial. Whether you are an investor, trader, or simply interested in the financial markets, having a grasp of how money flows in and out of different assets can greatly enhance your decision-making process. In this blog post, we will explore the definition of money flow, how it is calculated, and its uses in trading.

Key Takeaways:

- Money flow refers to the movement of funds in and out of different assets, such as stocks, bonds, or commodities.

- Money flow can be calculated using various technical indicators, such as the Money Flow Index (MFI), which takes into account price and volume data.

The Definition of Money Flow

Money flow, in a general sense, refers to the movement of funds in and out of different assets. It represents the buying and selling pressure in the market, as well as the overall sentiment of investors towards a particular asset. The flow of money is influenced by a multitude of factors, including economic indicators, company news, and market trends.

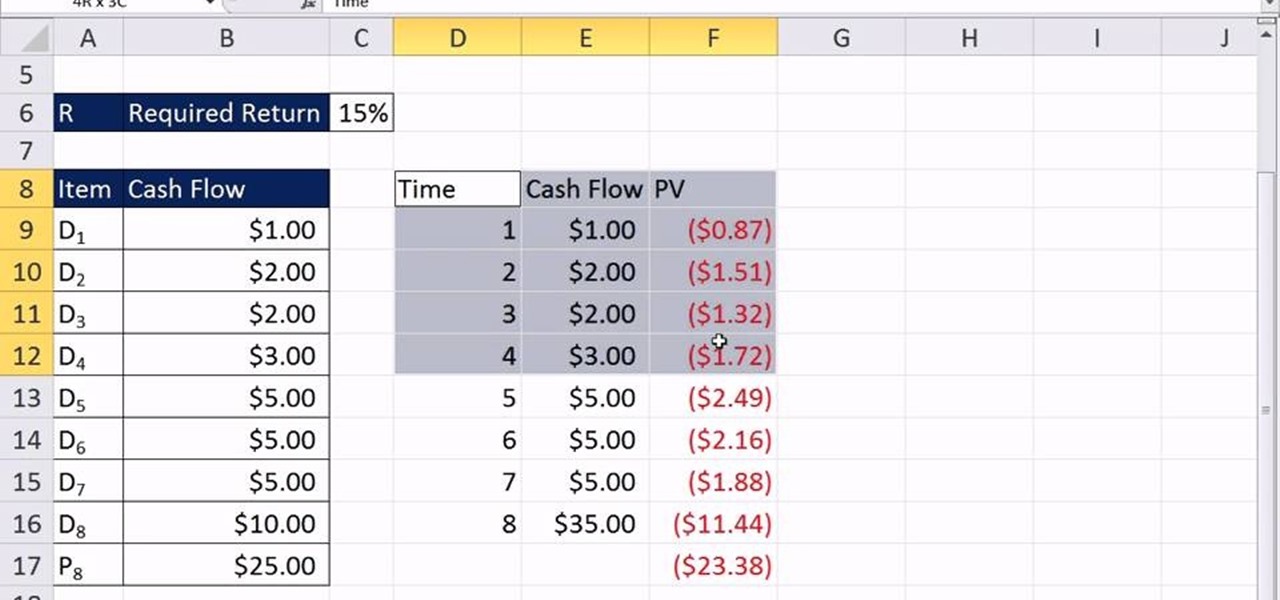

Calculating Money Flow

One way to calculate money flow is by using technical indicators, such as the Money Flow Index (MFI). MFI takes into account both price and volume data to determine the strength of money flow in a particular asset. It is calculated by multiplying the typical price (average of high, low, and close) by the volume traded and then dividing it by a ratio of positive and negative money flow values.

The formula for calculating the Money Flow Index is as follows:

MFI = 100 – (100 / (1 + positive money flow / negative money flow))

By analyzing the MFI, traders can identify periods of overbought or oversold conditions, as well as potential price reversals.

Uses of Money Flow in Trading

Money flow analysis has several uses in trading. Here are some ways it can be applied:

- Identifying Trends: By analyzing the flow of money in and out of an asset, traders can identify the underlying trend. Positive money flow indicates buying pressure and suggests an upward trend, while negative money flow indicates selling pressure and suggests a downward trend.

- Confirming Price Movements: Money flow can be used to confirm price movements. When the price of an asset is rising along with positive money flow, it indicates strong buying pressure and confirms the upward momentum. Conversely, when the price falls along with negative money flow, it confirms the downward trend.

- Divergence Analysis: Money flow analysis can help identify divergences between the price of an asset and the money flow. Divergence occurs when the price is moving in one direction while the money flow is moving in the opposite direction. This can be an early warning sign of a potential trend reversal.

By incorporating money flow analysis into their trading strategies, traders can gain valuable insights into the market dynamics and make more informed investment decisions.

In conclusion, money flow plays a vital role in understanding the movement of funds within the financial markets. By calculating and analyzing money flow, traders can gain valuable insights into market trends, confirm price movements, and identify potential reversals. Incorporating money flow analysis into your trading strategy can significantly enhance your decision-making process and lead to more successful trades.