Home>Finance>On How Many Financial Statements Does Retained Earnings Appear?

Finance

On How Many Financial Statements Does Retained Earnings Appear?

Modified: December 30, 2023

Retained earnings, a crucial element in finance, can be found on multiple financial statements. Learn where to locate this valuable information.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Retained earnings play a crucial role in the financial performance and stability of a company. They represent the accumulated net profit or loss that has been retained in the business after dividends are paid out to shareholders. Understanding retained earnings and where they appear on financial statements is essential for investors, analysts, and stakeholders to assess a company’s financial health and future prospects.

In this article, we will explore the concept of retained earnings and shed light on the financial statements where they are reported. By the end, you will have a clear understanding of how retained earnings are reflected in a company’s financial information.

Retained earnings represent the cumulative profit or loss generated by a company since its inception. If the company is profitable, the retained earnings increase over time. Conversely, if the company experiences losses, retained earnings decrease. These earnings are reinvested in the business to fund growth opportunities, repay debt, or distribute dividends to shareholders.

Retained earnings are an integral part of a company’s financial statements as they indicate the long-term profitability and financial stability of the business. They are reported on the Statement of Retained Earnings, which provides a detailed summary of the changes in the retained earnings balance over a specific period. Additionally, the impact of retained earnings is indirectly reflected in other financial statements such as the income statement, balance sheet, and cash flow statement.

Throughout this article, we will delve into each of these financial statements to examine how retained earnings are presented and understood within the context of a company’s overall financial performance. By gaining a comprehensive understanding of the role of retained earnings in the financial statements, you will be equipped to make informed investment decisions and evaluate a company’s financial health.

Explanation of Retained Earnings

Retained earnings are a crucial component of a company’s financial health and provide valuable insights into its profitability and sustainability. They represent the cumulative earnings generated by the business that have not been distributed as dividends to shareholders. In simple terms, retained earnings are the portion of profits that the company chooses to keep and reinvest in its operations.

When a company generates a profit, it has two options: distribute the earnings to shareholders in the form of dividends or reinvest the earnings back into the business. If the company decides to retain the earnings, they are added to the retained earnings account on the balance sheet. This account will reflect the cumulative amount of the retained earnings over time.

On the other hand, if the company incurs a loss, the negative earnings reduce the retained earnings balance. This indicates that the company has accumulated losses and can impact its financial stability and ability to pay dividends in the future.

Retained earnings are an important financial metric as they indicate a company’s ability to generate profits and sustain its operations. Positive retained earnings demonstrate that the company has been profitable and has chosen to reinvest its earnings for future growth.

It’s important to note that retained earnings are not the same as cash reserves. While retained earnings may be used to fund future investments, they don’t necessarily indicate immediately available cash. A company may have substantial retained earnings but could face liquidity challenges if its cash flow position is weak.

Retained earnings also play a role in determining a company’s book value or shareholder’s equity. The retained earnings account is part of the equity section on the balance sheet and represents the accumulated earnings reinvested in the business. As a result, retained earnings contribute to increasing the overall value of the company and shareholders’ stake in it.

In summary, retained earnings represent the accumulated profit or loss that a company has retained after distributing dividends to its shareholders. They indicate the company’s profitability, financial stability, and long-term growth prospects. By analyzing the changes in retained earnings over time, investors and stakeholders can gain valuable insights into a company’s financial performance and decision-making strategies.

Financial Statements

Financial statements are a crucial tool for investors, analysts, and stakeholders to assess the financial performance and health of a company. These statements provide a comprehensive overview of the company’s financial activities over a specific period and include important information about its revenues, expenses, assets, liabilities, and equity. There are three main financial statements: the Statement of Retained Earnings, the Income Statement, and the Balance Sheet.

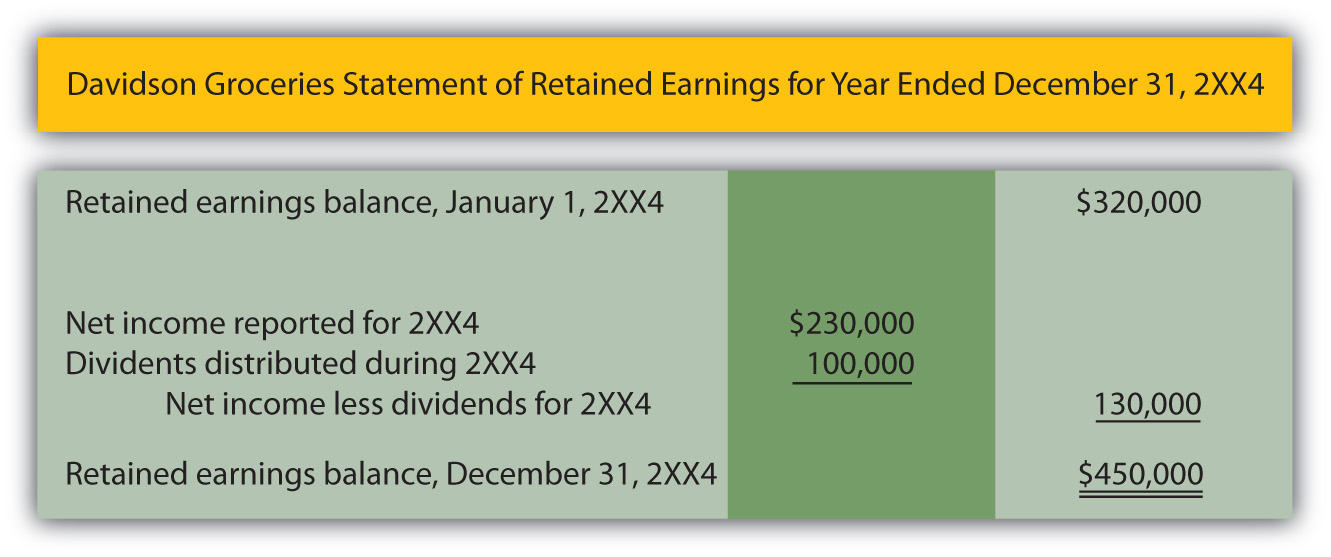

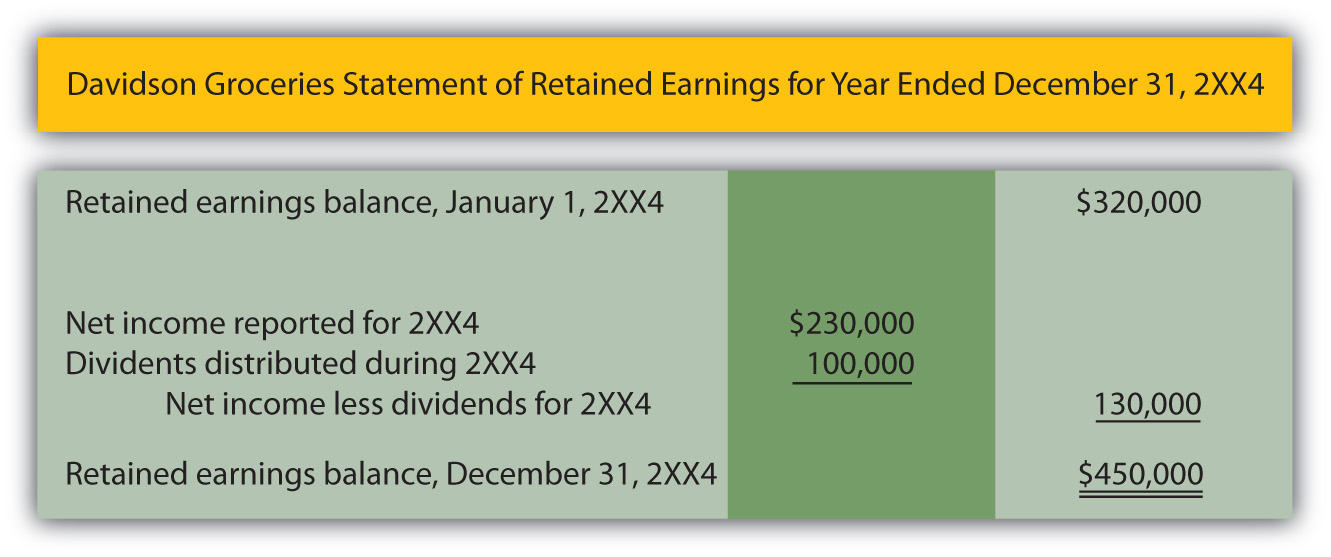

The Statement of Retained Earnings provides a detailed summary of the changes in the retained earnings balance over a specific period, typically a fiscal year. This statement outlines the net income or loss generated by the company during the period, dividends paid to shareholders, and any other adjustments that affect the retained earnings balance. The Statement of Retained Earnings is an essential document as it shows how the company has utilized its earnings and whether it has chosen to retain them for future growth or distribute them as dividends.

The Income Statement, also known as the Profit and Loss Statement, provides a snapshot of a company’s revenues, expenses, and net profit or loss over a specific period. It shows the company’s ability to generate revenue, manage costs, and ultimately, its profitability. The retained earnings are indirectly impacted by the net income (or loss) reported on the Income Statement.

The Balance Sheet is a crucial financial statement that presents the company’s financial position at a specific point in time. It provides an overview of the company’s assets, liabilities, and equity. The retained earnings account is an integral part of the equity section on the Balance Sheet, representing the cumulative earnings reinvested in the business.

While the Statement of Retained Earnings highlights the changes in the retained earnings balance, the Income Statement and Balance Sheet indirectly affect the retained earnings by influencing the profitability and net assets of the company. The income statement indicates the profitability of the company, which impacts the amount of earnings available for retention. Meanwhile, the balance sheet provides a broader context by presenting the company’s overall financial position and the impact of its assets and liabilities on the retained earnings balance.

These financial statements work together to provide a comprehensive view of a company’s financial performance and the factors affecting its retained earnings. By analyzing these statements collectively, investors and stakeholders gain insights into the company’s ability to generate profits, manage expenses, and reinvest earnings for future growth.

In the following sections, we will explore how retained earnings appear on each of these financial statements, providing a deeper understanding of their role in accurately assessing a company’s financial standing and outlook.

Statement of Retained Earnings

The Statement of Retained Earnings is a financial statement that summarizes the changes in the retained earnings balance over a specific period, typically a fiscal year. It provides valuable insights into how a company has allocated its earnings, whether for reinvestment in the business or distribution to shareholders as dividends.

The statement begins with the opening balance of retained earnings from the previous period. It then incorporates the net income or loss generated during the current period. If the company earns a profit, the net income is added to the opening balance of retained earnings, increasing the overall balance. Conversely, if the company incurs a loss, the net loss is subtracted from the opening balance, reducing the retained earnings balance.

In addition to the net income or loss, the Statement of Retained Earnings accounts for other adjustments that impact the retained earnings balance. This includes dividends paid to shareholders, which decrease the retained earnings balance as they represent a distribution of profits to owners or investors.

The Statement of Retained Earnings is typically split into several sections to provide a clear breakdown of the changes in the retained earnings balance. These sections may include the net income or loss for the period, dividends paid to shareholders, and any other adjustments such as changes in accounting policies or the correction of errors.

At the end of the statement, the closing balance of retained earnings is calculated. This closing balance represents the accumulated profits or losses that have been retained in the business since its inception. It serves as an important indicator of a company’s financial stability and the extent to which earnings have been reinvested back into the business.

The information presented in the Statement of Retained Earnings is essential for both internal and external stakeholders. Internal stakeholders, such as management and board members, can use the statement to evaluate the company’s financial performance and make informed decisions regarding dividend distributions, reinvestment strategies, or debt repayment.

External stakeholders, including investors and creditors, rely on this statement to assess the company’s financial health and profitability. They can analyze the trend of retained earnings over time, which provides insights into the company’s ability to generate consistent profits and allocate them effectively.

Overall, the Statement of Retained Earnings provides a comprehensive overview of the changes in a company’s retained earnings balance. By examining this statement, stakeholders can gain valuable insights into a company’s financial performance, its dividend policies, and the reinvestment of earnings, ultimately informing their investment and business decisions.

Income Statement

The Income Statement, also known as the Profit and Loss Statement, is a financial statement that summarizes a company’s revenues, expenses, and net profit or loss over a specific period. It provides a snapshot of the company’s ability to generate revenue, manage costs, and ultimately, its profitability.

The Income Statement indirectly impacts the retained earnings by influencing the amount of earnings available for retention. The net income (or loss) reported on the Income Statement plays a significant role in determining how much of the earnings will contribute to the retained earnings balance.

The Income Statement begins with the revenues section, which includes the revenue generated by the company’s primary business activities. This can include sales of goods or services, interest income, or any other sources of revenue unique to the business.

Next, the statement deducts various expenses incurred by the company, such as cost of goods sold, operating expenses, depreciation, and interest expenses. These expenses are subtracted from the revenues to determine the company’s gross profit.

After calculating the gross profit, the Income Statement further deducts non-operating expenses or losses, such as taxes, interest on loans, or one-time charges. At this point, the statement arrives at the company’s net profit or loss before taxes.

Finally, any income taxes owed by the company are subtracted to arrive at the net profit or loss after taxes. This final figure represents the company’s bottom line and reflects its profitability for the given period.

The net income reported on the Income Statement indirectly affects the retained earnings. If a company generates a net income, a portion or all of it can be retained in the business as retained earnings. On the other hand, if the company incurs a net loss, it will reduce the retained earnings balance.

Understanding the components of the Income Statement is crucial for stakeholders to assess a company’s financial health and profitability. By analyzing the revenues, expenses, and net income, investors can gain insights into the company’s ability to generate profits, control costs, and sustain its operations.

The information provided by the Income Statement is particularly useful for investors looking to evaluate the company’s performance and make informed investment decisions. It allows them to compare the company’s revenue growth, profit margins, and efficiency against industry peers.

Furthermore, creditors and lenders rely on the Income Statement to assess a company’s ability to generate cash flow and repay any outstanding debts. A positive net income indicates the company’s capacity to meet its financial obligations and may improve its access to credit and financing options.

In summary, the Income Statement provides a comprehensive overview of a company’s revenues, expenses, and net profit or loss. It indirectly influences the retained earnings by determining the amount of earnings available for retention. By analyzing the Income Statement, stakeholders can gain valuable insights into a company’s profitability, financial performance, and ability to generate cash flow.

Balance Sheet

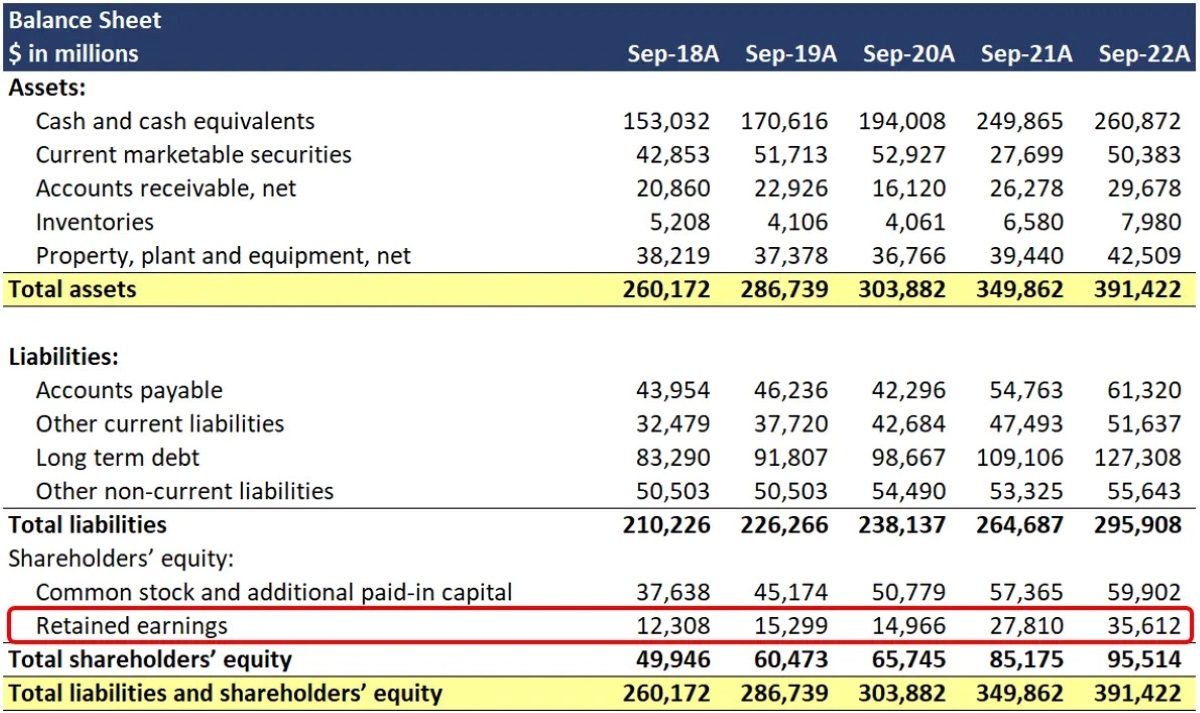

The Balance Sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of the company’s assets, liabilities, and equity, allowing stakeholders to understand the company’s overall financial health and the value of its resources.

The Balance Sheet indirectly impacts the retained earnings by reflecting the cumulative earnings reinvested in the business. The retained earnings account is part of the equity section on the Balance Sheet and represents the accumulated earnings that have not been distributed as dividends to shareholders.

The key components of a Balance Sheet include:

- Assets: These represent the resources owned by the company, including cash, accounts receivable, inventory, property, and equipment. Assets are categorized as current assets (such as cash and inventory) or non-current assets (such as long-term investments or property).

- Liabilities: These are the company’s financial obligations, including loans, accounts payable, and accrued expenses. Similar to assets, liabilities are divided into current liabilities (such as short-term loans or unpaid bills) and non-current liabilities (such as long-term debt).

- Equity: Equity represents the ownership interest in the company. It includes the initial investment by shareholders and any additional contributions made, as well as retained earnings and accumulated other comprehensive income.

The retained earnings account is a crucial part of the equity section on the Balance Sheet. It represents the cumulative net income generated by the company that has not been distributed as dividends. The retained earnings balance increases when a company earns a profit and chooses to retain the earnings for reinvestment. Conversely, it decreases when dividends are paid out to shareholders or when the company incurs losses.

The Balance Sheet provides stakeholders with important information about a company’s financial position and its ability to meet its financial obligations. By analyzing the assets, liabilities, and equity, investors can assess the company’s liquidity, leverage, and overall financial stability.

Additionally, the information presented on the Balance Sheet enables stakeholders to calculate various financial ratios and metrics that aid in evaluating the company’s performance. For example, the debt-to-equity ratio compares a company’s debt to its equity level, indicating its leverage and ability to manage financial risks.

The Balance Sheet is also crucial for creditors and suppliers who need to assess a company’s creditworthiness and ability to repay debts. By examining the company’s assets and liabilities, creditors can determine if the company possesses sufficient resources to cover its obligations.

In summary, the Balance Sheet provides a snapshot of a company’s financial position, including its assets, liabilities, and equity. The retained earnings account, part of the equity section, reflects the cumulative earnings retained in the business. By analyzing the Balance Sheet, stakeholders can gain valuable insights into a company’s financial health, liquidity, and ability to meet its financial obligations.

Cash Flow Statement

The Cash Flow Statement is a financial statement that provides information about the cash generated and used by a company during a specific period. It illustrates the inflows and outflows of cash from operating activities, investing activities, and financing activities. It plays a vital role in understanding the company’s cash position, its ability to generate cash flow, and the impact on the retained earnings.

The Cash Flow Statement indirectly affects the retained earnings by providing insights into how a company has used its cash flow. It shows whether the company has generated enough cash to support its operations, make investments, repay debts, or distribute dividends.

The Cash Flow Statement is divided into three main sections:

- Operating Activities: This section reports the cash inflows and outflows generated from the company’s core business operations. It includes cash received from customers, cash paid to suppliers and employees, and other operating expenses. Operating activities play a significant role in determining the company’s ability to generate profitable cash flow, which can be used to retain earnings.

- Investing Activities: This section accounts for the cash flow resulting from the company’s investments in assets or divestment of assets. It includes cash flow from the purchase or sale of property, plant, and equipment, as well as investments in other companies or financial instruments. Investing activities can impact the retained earnings indirectly by affecting the company’s ability to generate future profits.

- Financing Activities: This section reflects the cash flow resulting from the company’s financing activities, such as raising capital through debt or equity, issuing dividends, or repaying loans. Financing activities can directly impact the retained earnings as distributions (dividends) to shareholders are made from this section.

By analyzing the Cash Flow Statement, stakeholders can evaluate the company’s cash-generating capabilities, identify any potential cash flow issues, and understand how it allocates its cash resources.

For investors, the Cash Flow Statement provides valuable insight into a company’s financial stability and its capacity to generate cash. It helps investors assess the company’s ability to fund its operations, repay debts, and distribute dividends. A positive cash flow from operating activities indicates that the company’s core business is generating profit, contributing to retained earnings.

Creditors and lenders also rely on the Cash Flow Statement to assess a company’s creditworthiness and its ability to repay debts. A positive cash flow from operations and financing activities suggests that the company has sufficient cash to meet its financial obligations and repay its debts.

Furthermore, the Cash Flow Statement aids stakeholders in evaluating the company’s reinvestment strategies. By analyzing the cash flow from investing activities, investors can determine if the company is strategically allocating its resources into investments that can potentially generate future returns and contribute to the retained earnings.

In summary, the Cash Flow Statement provides insights into a company’s cash position, cash flow from operating, investing, and financing activities. It indirectly affects the retained earnings by illustrating how a company generates and uses its cash flow. By analyzing the Cash Flow Statement, stakeholders can make informed decisions about the company’s financial health, investment potential, and the utilization of cash resources to impact the retained earnings.

Changes in Retained Earnings

Changes in retained earnings reflect the cumulative profit or loss generated by a company that has been retained and reinvested in the business. These changes are influenced by various factors, including net income, dividends paid to shareholders, and other adjustments affecting the retained earnings balance.

Net income plays a significant role in determining changes in retained earnings. If a company earns a profit, a portion or all of it can be retained in the business. This increases the retained earnings balance, reflecting that the company has chosen to reinvest its earnings for future growth opportunities.

On the other hand, when a company incurs a net loss, it reduces the retained earnings balance. Losses indicate that the company has accumulated negative earnings, and it may impact the company’s financial stability and ability to distribute dividends to shareholders.

Dividends paid to shareholders are another factor affecting changes in retained earnings. Dividends represent the distribution of profits to owners or investors. When dividends are paid, they decrease the retained earnings balance. Companies make dividend declarations based on their profitability, cash flow position, and dividend policies.

Other adjustments can also impact the retained earnings balance. For instance, changes in accounting policies, revisions to estimates, or corrections of errors can affect the reported earnings and subsequent retained earnings balance.

The Statement of Retained Earnings provides a detailed summary of the changes in the retained earnings balance over a specific period. It starts with the opening balance of retained earnings and incorporates the net income or loss, dividends paid to shareholders, and other adjustments. The statement concludes with the closing balance of retained earnings, representing the accumulated profits or losses reinvested in the business since its inception.

Changes in retained earnings are crucial for stakeholders to assess a company’s financial performance and decision-making strategies. Positive changes indicate that the company has been profitable and retains earnings for future growth. Negative changes, on the other hand, may indicate financial challenges or losses incurred by the company.

Investors analyze changes in retained earnings to evaluate a company’s profitability, dividend policies, and reinvestment strategies. It provides insights into how a company utilizes its earnings and its commitment to long-term growth. Companies that consistently demonstrate positive changes in retained earnings often attract investors seeking financial stability and potential returns on investment.

In summary, changes in retained earnings reflect the cumulative profit or loss that a company has retained and reinvested in the business. These changes are influenced by factors such as net income, dividends paid to shareholders, and other adjustments. Understanding and analyzing the changes in retained earnings provide valuable insights into a company’s financial performance, stability, and strategic decision-making.

Conclusion

Retained earnings are a vital aspect of a company’s financial health and performance. They represent the cumulative profit or loss that has been retained in the business after dividends are paid out to shareholders. By understanding where retained earnings appear on financial statements, investors, analysts, and stakeholders can gain valuable insights into a company’s financial stability, profitability, and growth potential.

In this article, we have explored the concept of retained earnings and their significance in evaluating a company’s financial standing. We have discussed the various financial statements, including the Statement of Retained Earnings, which provides a comprehensive summary of changes in retained earnings over a specific period. Additionally, we have examined how retained earnings are indirectly reflected in the Income Statement, Balance Sheet, and Cash Flow Statement.

The Statement of Retained Earnings presents a detailed breakdown of the changes in the retained earnings balance, incorporating net income, dividends paid, and other adjustments. It offers insights into how a company has utilized its earnings and the extent to which they have been reinvested for future growth.

The Income Statement demonstrates the company’s profitability and indirectly affects the retained earnings by determining the amount of earnings available for retention. The Balance Sheet provides a snapshot of the company’s financial position, reflecting the cumulative earnings that have been retained in the business. Lastly, the Cash Flow Statement outlines the company’s cash inflows and outflows, offering insights into how cash is generated and used.

By analyzing these financial statements collectively, stakeholders can make informed decisions regarding investment, creditworthiness, and strategic planning. Positive retained earnings indicate a company’s ability to generate profits, sustain operations, and potentially distribute dividends. It signifies financial stability and the commitment to long-term growth.

Understanding the role and impact of retained earnings on financial statements is crucial for assessing a company’s financial health and performance. By leveraging this knowledge, investors and stakeholders can make well-informed decisions, evaluate potential risks, and identify opportunities for growth and profitability.

In conclusion, retained earnings play a critical role in measuring a company’s financial strength and growth potential. Their appearance on financial statements provides valuable insights into a company’s financial performance, stability, and reinvestment strategies. By delving into the details of these financial statements, stakeholders can gain a comprehensive understanding of a company’s retained earnings dynamics, enhancing their ability to make informed business and investment decisions.