Home>Finance>Reinvestment Risk Definition And How To Manage It

Finance

Reinvestment Risk Definition And How To Manage It

Published: January 18, 2024

Learn about the definition of reinvestment risk in finance and discover effective strategies to manage this potential investment challenge.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Reinvestment Risk and Its Impact on Your Finances

When it comes to making financial decisions, understanding the different types of risks is crucial. One risk that investors often overlook is reinvestment risk. But what exactly is reinvestment risk, and how can you manage it effectively? In this article, we will explore the definition of reinvestment risk and provide you with valuable insights on how to mitigate its impact on your investments.

Key Takeaways:

- Reinvestment risk refers to the potential danger of earning a lower return on reinvested funds compared to the original investment.

- Managing reinvestment risk involves diversifying your investments, keeping track of interest rates, and carefully assessing investment opportunities.

Reinvestment risk is an inherent part of investing, especially when it comes to fixed-income securities such as bonds and certificates of deposit (CDs). It arises when you receive periodic payments, like interest or dividends, from your investments, and you need to reinvest them at a different interest rate.

The key concern with reinvestment risk is that when interest rates decline, the return on your reinvested funds may be lower than what you were earning before. This can impact the overall performance of your investment portfolio and potentially reduce your income.

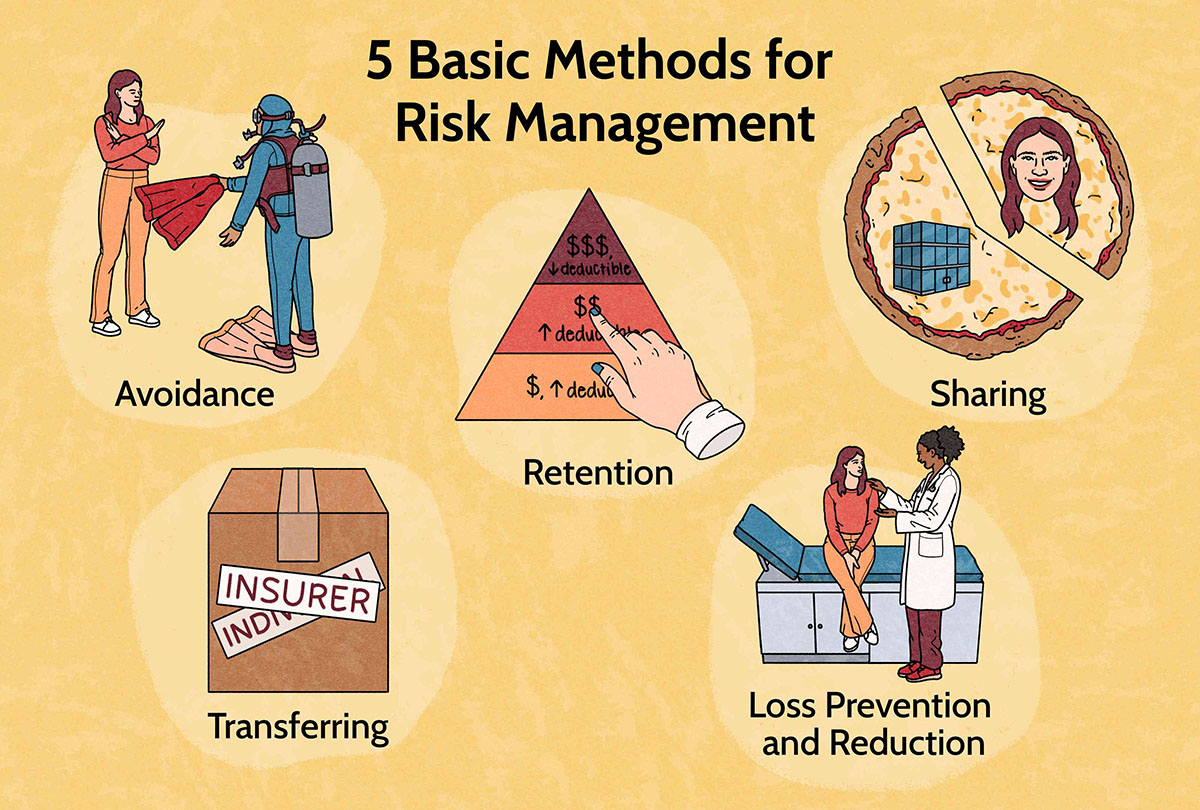

To manage reinvestment risk effectively, consider implementing the following strategies:

- Diversify your investments: By spreading your investments across a range of different assets and sectors, you can minimize the impact of poor reinvestment choices.

- Monitor interest rates: Stay informed about changes in interest rates, as fluctuations can significantly affect your reinvestment options. Keep an eye on market trends and consult with financial experts to make informed decisions.

- Assess investment opportunities carefully: Before reinvesting your funds, evaluate the potential returns and risks associated with each opportunity. Consider seeking professional advice if needed to ensure you choose the most suitable investment option.

Additionally, it is vital to remember that time plays a crucial role in managing reinvestment risk. The longer your investment horizon, the more opportunities you have to adapt to changing market conditions and make better reinvestment decisions.

By being proactive and staying vigilant, you can mitigate reinvestment risk and protect the value of your investments. Regularly review and assess your investment strategy to ensure it aligns with your financial goals and risk tolerance.

Conclusion:

Reinvestment risk is an important aspect of investing that you should not ignore. Understanding its definition and impact is crucial for making informed financial decisions. By diversifying your investments, monitoring interest rates, and carefully assessing investment opportunities, you can effectively manage the reinvestment risk associated with your portfolio. Remember, time and staying proactive are the keys to successfully navigating through this risk.