Finance

What Are Audited Financial Statements

Published: December 22, 2023

Learn the importance of audited financial statements in finance. Discover how these statements provide transparency and credibility for businesses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Audited Financial Statements

- Purpose of Audited Financial Statements

- Key Components of Audited Financial Statements

- Importance of Audited Financial Statements

- Process of Auditing Financial Statements

- Benefits of Audited Financial Statements

- Limitations of Audited Financial Statements

- Conclusion

Introduction

Audited financial statements are a crucial part of the financial reporting process for businesses. These statements provide a comprehensive view of a company’s financial performance and position, offering transparency and accountability to stakeholders, including investors, creditors, and regulatory bodies. A thorough audit ensures that the financial statements accurately reflect the company’s financial health and compliance with accounting standards.

In this article, we will delve deeper into the concept of audited financial statements, understand their purpose, explore their key components, discuss the importance of auditing, and highlight the benefits and limitations of this process.

Financial statements play a significant role in decision-making, risk assessment, and evaluating the financial health of a company. However, stakeholders need assurance that the information presented is reliable and unbiased. This is where auditing comes into play. Audited financial statements provide assurance to stakeholders that the information presented is accurate, complete, and conforms to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

An audit is an independent examination conducted by a certified public accountant (CPA) or a registered auditing firm to assess the fairness and integrity of a company’s financial reports. Through this examination, auditors provide an opinion on the reliability and accuracy of the financial statements.

Definition of Audited Financial Statements

Audited financial statements refer to the financial reports of a company that have undergone a thorough examination and verification by an independent auditor. The audit process involves analyzing the company’s financial records, transactions, and supporting documents to ensure accuracy and compliance with accounting standards.

When a company’s financial statements are audited, it means that an external party, such as a certified public accountant (CPA) or a registered auditing firm, has reviewed the financial records and statements to provide an independent and unbiased opinion on their reliability. The auditor assesses the fairness and integrity of the financial statements by examining the company’s financial data, internal controls, and accounting policies.

The scope of an audit often includes the balance sheet, income statement, cash flow statement, and notes to the financial statements. The auditor ensures that the financial statements are presented in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) and that they provide a true and fair view of the company’s financial position and performance.

The purpose of auditing financial statements is to enhance the credibility and reliability of the financial information presented to stakeholders. Audited financial statements provide assurance to shareholders, investors, lenders, and other interested parties that the company’s financial statements are free from material errors or misstatements.

It is important to note that auditing financial statements does not involve guaranteeing that the company is financially successful or that there are no frauds or illegal activities taking place. The auditor’s role is to provide an opinion on the accuracy and compliance of the financial statements based on the evidence gathered during the audit process.

Overall, audited financial statements serve as a vital tool for stakeholders to make informed decisions, evaluate the financial health of a company, and assess its ability to meet its financial obligations. They provide transparency, credibility, and accountability, helping to build trust between the company and its stakeholders.

Purpose of Audited Financial Statements

Audited financial statements serve multiple purposes and provide various benefits to stakeholders within and outside of a company. The primary purposes of audited financial statements are as follows:

1. Enhancing Credibility and Reliability: The main purpose of auditing financial statements is to enhance the credibility and reliability of the financial information provided by a company. By subjecting the financial statements to an independent and objective examination, the auditor provides assurance that the information is accurate, complete, and in compliance with accounting standards.

2. Building Stakeholder Confidence: Audited financial statements build trust and confidence among stakeholders, such as investors, shareholders, lenders, and creditors. When these external parties review audited financial statements, they have a higher level of confidence in the company’s financial position and performance, making them more likely to invest in or provide credit to the business.

3. Meeting Regulatory Requirements: In many jurisdictions, companies are legally required to have their financial statements audited. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, may mandate audit requirements to ensure fair and transparent financial reporting.

4. Detecting and Preventing Fraud: Auditing plays a significant role in detecting and preventing fraud or financial irregularities. By examining the company’s financial transactions and internal controls, auditors can identify potential fraudulent activities and recommend improved controls to mitigate the risk of fraud.

5. Assessing Financial Health: Audited financial statements provide stakeholders with a comprehensive view of a company’s financial health. Investors and shareholders can evaluate the company’s profitability, liquidity, and solvency by analyzing the audited financial statements. This information helps stakeholders make informed decisions regarding their investments or involvement with the company.

6. Facilitating Capital Raising: Audited financial statements play a crucial role in attracting investors or lenders for capital raising purposes. Potential investors or lenders are more likely to provide capital to a company that has audited financial statements, as they offer a higher level of transparency and reliability in the financial information provided.

7. Complying with Stakeholder Demands: Stakeholders, such as suppliers, customers, or business partners, often require audited financial statements before engaging in significant transactions with a company. Audited financial statements help establish the credibility and financial stability of the company, fostering trust and facilitating business relationships.

In summary, the purpose of audited financial statements is to provide credibility, transparency, and accountability to stakeholders. By having their financial statements audited, companies ensure that their financial information meets the expectations of investors, creditors, regulatory bodies, and other interested parties.

Key Components of Audited Financial Statements

Audited financial statements consist of several key components that provide a comprehensive view of a company’s financial position and performance. These components, which are examined and assessed during the audit process, include:

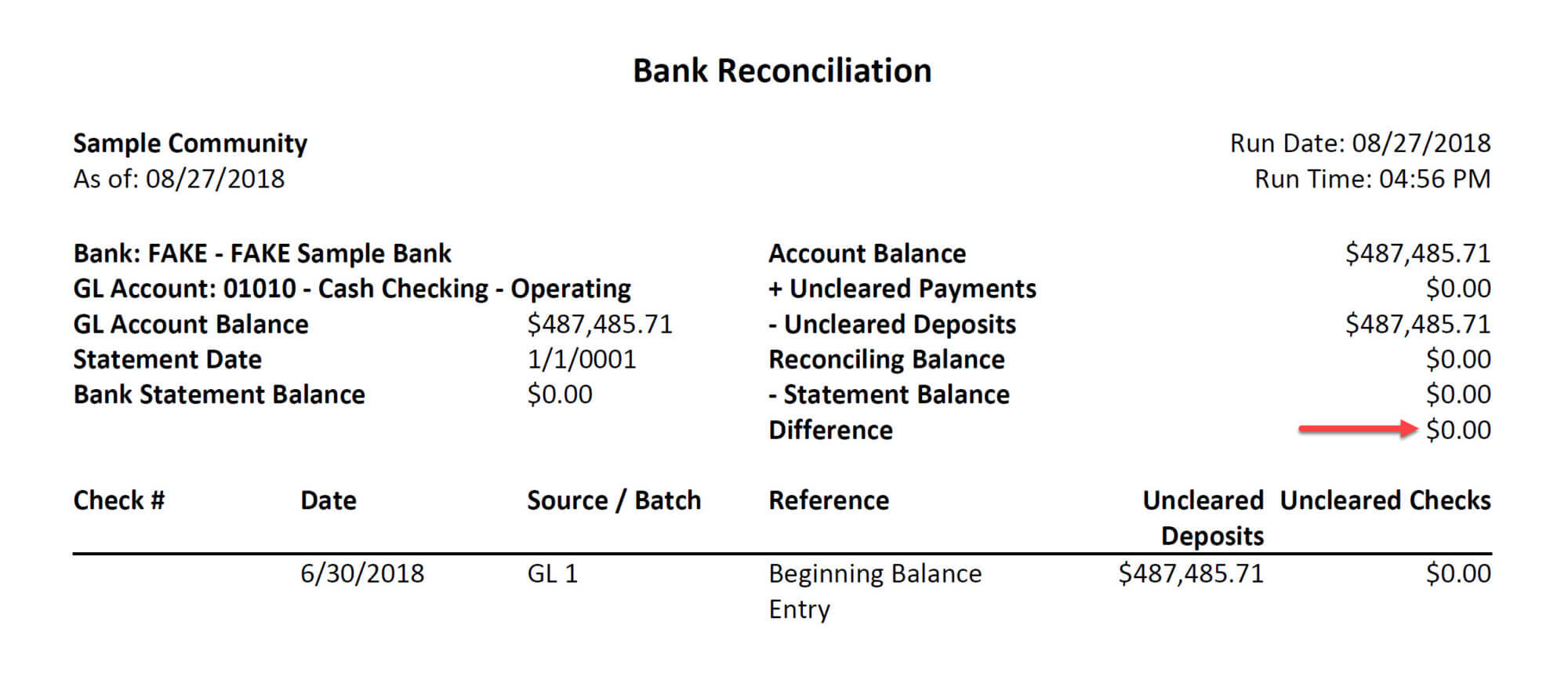

1. Balance Sheet: The balance sheet is a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and shareholders’ equity. Auditors review the balance sheet to ensure that the values reported are accurate, properly classified, and in compliance with accounting standards.

2. Income Statement: The income statement, also known as the profit and loss statement, reports a company’s financial performance over a specific period. It shows the revenues, expenses, gains, and losses incurred by the company. Auditors verify the accuracy and completeness of the income statement, ensuring that all revenues and expenses are properly recorded and match supporting documentation.

3. Cash Flow Statement: The cash flow statement provides information about a company’s cash inflows and outflows during a particular period. It classifies cash flows into operating, investing, and financing activities. Auditors review the cash flow statement to ensure that the information presented is reliable, consistent, and accurately reflects the company’s cash flow activities.

4. Notes to the Financial Statements: The notes to the financial statements provide additional disclosures and explanations about specific items within the financial statements. They provide important details about accounting policies, significant transactions, contingencies, and other relevant information. Auditors carefully review the notes to ensure that they are complete, accurate, and in compliance with accounting standards.

5. Management’s Discussion and Analysis (MD&A): The MD&A is a section where management provides an analysis of the company’s financial performance, results of operations, and future prospects. While the MD&A is not audited, auditors review it to ensure consistency with the audited financial statements and assess whether it provides a fair and balanced representation of the company’s financial condition and results.

6. Auditor’s Report: The auditor’s report is a written statement that expresses the auditor’s opinion on the fairness and reliability of the audited financial statements. It outlines the scope of the audit, the auditor’s findings, and any potential limitations or concerns. The auditor’s report provides stakeholders with an independent assessment of the financial statements.

Throughout the audit process, auditors examine these components to ensure their accuracy, adherence to accounting principles, and consistency within the financial statements. They review supporting documents, perform tests on accounting transactions, assess internal controls, and gather sufficient evidence to support their opinion on the financial statements.

It is important to note that audited financial statements may also include supplementary schedules, such as segment reporting, significant accounting policies, or a statement of changes in shareholders’ equity, depending on the company’s specific reporting requirements and industry norms.

By examining these key components, auditors provide stakeholders with assurance that the financial statements present a true and fair view of the company’s financial position and performance, promoting transparency and credibility in the financial reporting process.

Importance of Audited Financial Statements

Audited financial statements are of significant importance to various stakeholders involved in the decision-making process and assessing the financial health of a company. The following are key reasons why audited financial statements hold importance:

1. Enhanced Credibility: Audited financial statements provide credibility to the financial information presented by a company. The involvement of an independent auditor adds an extra layer of assurance that the financial statements have undergone a thorough examination, promoting trust and confidence among stakeholders.

2. Improved Transparency: Audited financial statements enhance transparency by providing a clear and accurate representation of a company’s financial position and performance. Stakeholders can rely on the audited information to make informed decisions and assess the company’s ability to meet its financial commitments.

3. Decision Making: For investors and shareholders, audited financial statements serve as a vital tool for making informed investment decisions. The independence and expertise of auditors ensure that the financial statements provide reliable insights into a company’s profitability, solvency, and future prospects.

4. Access to Credit: Lenders and creditors heavily rely on audited financial statements when assessing a company’s creditworthiness. The presence of audited financial statements reassures lenders that the financial information is accurate and allows companies to access credit with favorable terms and conditions.

5. Compliance with Regulations: Audited financial statements are often required by regulatory bodies to ensure compliance with accounting standards and legal requirements. Companies that do not comply with these regulations may face penalties or legal consequences, making audits essential for maintaining compliance.

6. Fraud Detection and Prevention: Audits play a crucial role in detecting and preventing fraudulent activities. Through detailed examinations, auditors can identify potential instances of fraud, misrepresentation, or errors in financial statements, helping companies take corrective actions and implement stronger internal controls.

7. Stakeholder Confidence: Audited financial statements build confidence and trust among stakeholders, including shareholders, investors, employees, suppliers, and customers. The reassurance provided by audited financial statements strengthens the relationships between companies and their stakeholders, facilitating business partnerships and growth opportunities.

8. Widened Market Opportunities: Companies with audited financial statements may have an advantage in the market. Investors, shareholders, and potential business partners often prefer companies that have undergone audits, as audited financial statements demonstrate a commitment to transparency, accountability, and good corporate governance.

In summary, audited financial statements are of paramount importance for businesses and their stakeholders. They provide credibility, transparency, and accuracy in financial reporting, which in turn enables investors to make informed decisions, lenders to assess creditworthiness, and regulatory bodies to ensure compliance. Audited financial statements promote trust and confidence, benefiting companies in terms of credibility, reputation, and access to financial resources.

Process of Auditing Financial Statements

The process of auditing financial statements involves a systematic examination and verification of a company’s financial records, transactions, and internal controls. This process is conducted by an independent auditor to assess the accuracy, reliability, and compliance of the financial statements with accounting standards. The following steps outline the typical process of auditing financial statements:

1. Planning: The audit engagement begins with thorough planning. The auditor assesses the nature and complexity of the business, identifies key risks, and determines the scope of the audit. The audit plan includes establishing objectives, timelines, and resource allocation to ensure an efficient and effective audit process.

2. Risk Assessment: The auditor performs a risk assessment to identify significant areas of the financial statements that may be prone to errors or fraud. This involves understanding the company’s internal control systems, assessing the risk of material misstatements, and developing strategies to address those risks.

3. Evidence Collection: Auditors gather evidence to support their assessment of the financial statements. This involves inspecting relevant documents, such as invoices, bank statements, contracts, and journal entries. They may also perform analytical procedures and tests of details to verify the accuracy and completeness of the financial information.

4. Internal Control Evaluation: Auditors evaluate the company’s internal control systems to assess their design and effectiveness in preventing and detecting errors or fraud. They review the company’s policies, procedures, and control mechanisms, identifying any weaknesses or deficiencies that may impact the reliability of the financial statements.

5. Substantive Procedures: Auditors perform substantive procedures, which involve detailed testing of the financial statement balances and transactions. This includes verifying the existence, valuation, and ownership of assets, testing the accuracy of recorded transactions, and confirming liabilities and related party transactions. Substantive procedures provide auditors with more specific evidence to support their opinion on the financial statements.

6. Opinion Formulation: Based on the evidence collected and the results of their assessments, auditors form an opinion on the fairness and reliability of the financial statements. This opinion is provided in the form of the auditor’s report, which outlines the findings, any concerns or limitations, and whether the financial statements comply with accounting standards.

7. Follow-up Procedures: After issuing the audit report, auditors may perform follow-up procedures to ensure that any identified issues or recommendations have been addressed by the company. This may involve retesting specific areas, reviewing management’s responses, or providing additional guidance if necessary.

Throughout the auditing process, auditors maintain independence, objectivity, and professional skepticism. They adhere to auditing standards and ethical guidelines to ensure the integrity and credibility of the audit process. The specific procedures and documentation requirements may vary depending on the industry, regulatory requirements, and the size and complexity of the company being audited.

The goal of auditing financial statements is to provide assurance to stakeholders that the financial information presented is reliable, accurate, and in compliance with accounting standards. The process helps detect and prevent errors, fraud, and non-compliance, ultimately enhancing the credibility and transparency of the financial reporting process.

Benefits of Audited Financial Statements

Audited financial statements provide numerous benefits to both companies and stakeholders. These statements, which have undergone a thorough examination and verification process by independent auditors, offer the following advantages:

1. Enhanced Credibility: Audited financial statements enhance the credibility of a company’s financial information. The involvement of independent auditors adds assurance that the financial statements are reliable, accurate, and comply with accounting standards. This enhances the trust and confidence of stakeholders, including investors, lenders, and business partners.

2. Improved Decision Making: For investors and shareholders, audited financial statements serve as a crucial tool for making informed investment decisions. The independent opinion of the auditor helps stakeholders assess the financial health, stability, and performance of the company, enabling better decision making regarding investments or divestments.

3. Access to Credit: Lenders and creditors heavily rely on audited financial statements when evaluating a company’s creditworthiness. The presence of audited financial statements provides reassurance and validation of the company’s financial position, making it easier to obtain credit at favorable terms and conditions.

4. Compliance with Regulatory Requirements: In many jurisdictions, companies are required by law to have their financial statements audited. Audited financial statements ensure compliance with regulatory requirements, such as those imposed by government agencies or stock exchanges. Compliance with these regulations prevents penalties and legal consequences for non-compliance.

5. Fraud Detection and Prevention: Auditing plays a vital role in detecting and preventing fraud or financial irregularities. Auditors examine the company’s financial transactions, internal controls, and documentation, helping uncover any potential instances of fraud. Furthermore, the presence of audited financial statements acts as a deterrent to fraudulent activity.

6. Building Stakeholder Trust: Audited financial statements build trust and confidence among stakeholders. The transparency, reliability, and accuracy provided by audited financial statements foster trust between the company and its shareholders, investors, employees, suppliers, and customers. Trustworthy financial information strengthens relationships and supports long-term business sustainability.

7. Market Opportunities: Audited financial statements provide companies with a competitive advantage and access to market opportunities. Potential investors, partners, and customers often prioritize companies with audited financial statements, as they provide a higher level of transparency, credibility, and accountability. This opens doors to new business relationships and growth opportunities.

8. Internal Control Improvement: Through the auditing process, auditors assess the company’s internal control systems. They provide recommendations for improving controls, minimizing risks, and ensuring the accuracy and integrity of financial statements. These recommendations help companies strengthen their internal control environment and mitigate possible risks.

Audited financial statements play a vital role in promoting transparency, accountability, and trust in the financial reporting process. They provide stakeholders with reliable and credible information, setting the foundation for sound decision making, attracting investment, accessing credit, and building strong business relationships.

Limitations of Audited Financial Statements

While audited financial statements provide valuable insights and assurance, it is important to recognize their limitations. These limitations are inherent to the nature of auditing and the complexity of financial reporting. Understanding these limitations is crucial for stakeholders to have a comprehensive view of a company’s financial health and performance. The following are key limitations of audited financial statements:

1. No Absolute Guarantee: Audited financial statements do not provide an absolute guarantee of accuracy or future performance. Auditors perform their work based on sampling and testing procedures, which means that there is a possibility of undetected errors, fraud, or misstatements in the financial statements.

2. Reliance on Management Representations: Auditors rely on the information and representations provided by the company’s management as the basis for their audit. If management intentionally provides false or misleading information, auditors may not be able to identify or uncover the deception, which can undermine the reliability of the audited financial statements.

3. Limited Scope: Auditors conduct their examinations within a limited scope dictated by time, cost, and materiality considerations. This means that they cannot review every single transaction or record within a company. Instead, they rely on sampling and analytical procedures to make inferences about the overall financial position and performance of the company. As a result, there may be limited coverage of potential errors or irregularities.

4. Estimates and Judgments: Financial statements often contain estimates and judgments made by management, such as the valuation of assets, determination of allowances, or recognition of contingent liabilities. These estimates are subject to inherent uncertainties and may require significant judgment, which can introduce a degree of subjectivity into the financial statements.

5. Focus on Historical Information: Audited financial statements mainly focus on historical financial information, providing a snapshot of the company’s financial position and performance at a specific point in time. They may not fully reflect the current or future financial position, economic conditions, or industry trends that can impact the company’s prospects and performance.

6. Complexity and Technicality: Financial reporting standards and accounting principles can be complex and subject to interpretation. Auditors may face challenges in applying these standards consistently across different industries and companies. Differences in accounting policies or interpretations can impact the comparability of financial statements between companies.

7. Time Lag: Audited financial statements are prepared after the end of the financial reporting period and undergo the auditing process, which can take several weeks or months. As a result, the information presented in audited financial statements may not be up-to-date or timely for certain stakeholders, especially those requiring real-time or more current financial information.

Despite these limitations, audited financial statements still provide valuable assurance and insights to stakeholders. It is important for stakeholders to consider these limitations and supplement their analysis with other sources of information, such as industry trends, market analysis, and qualitative factors, to have a more comprehensive understanding of a company’s financial performance and prospects.

Conclusion

Audited financial statements play a critical role in financial reporting, providing stakeholders with reliable and credible information about a company’s financial health and performance. The audit process, conducted by independent auditors, enhances the credibility and transparency of the financial statements, offering assurance to investors, lenders, regulators, and other stakeholders.

Throughout the auditing process, auditors examine key components of the financial statements, such as the balance sheet, income statement, cash flow statement, and notes to the financial statements. They assess the accuracy, compliance, and reliability of the financial information, while also evaluating internal controls and risk management systems. The auditors then provide an opinion on the fairness and integrity of the financial statements, offering valuable insights to stakeholders.

Audited financial statements bring numerous benefits to companies and stakeholders. They improve credibility, enhance transparency, and foster stakeholder confidence. These statements assist in informed decision making, attract investors and lenders, and facilitate compliance with regulatory requirements. Moreover, audits help detect and prevent fraudulent activities, build trust among stakeholders, and open up market opportunities.

However, it is important to recognize the limitations of audited financial statements. They do not provide an absolute guarantee of accuracy, and the audit process has inherent constraints, such as reliance on management representations, limited scope, and the focus on historical information. Stakeholders should consider these limitations and supplement their analysis with additional information to gain a comprehensive understanding of a company’s financial position and performance.

In conclusion, audited financial statements serve as a crucial tool for stakeholders to assess the financial health, stability, and performance of a company. They provide valuable insights, foster transparency, and enhance confidence in the financial reporting process. By obtaining audited financial statements, stakeholders can make informed decisions, evaluate investment opportunities, and navigate the complex financial landscape with greater assurance.