Finance

What Does Buy Hold Sell Mean In Stocks

Published: January 19, 2024

Learn the meaning of "buy hold sell" in stocks and how it impacts your financial decisions. Explore the world of finance and make informed choices for your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing in stocks, the decision to buy, hold, or sell can play a critical role in determining your financial success. These three actions, commonly referred to as “buy-hold-sell,” are the pillars of stock market investing strategies.

Buy: The decision to buy a stock is the initial step in acquiring ownership in a company. Investors typically analyze various factors, including the company’s financials, growth potential, market trends, and future prospects, to determine if the stock is worth purchasing.

Hold: After buying a stock, investors may choose to hold onto their investment for an extended period. The hold strategy is based on the belief that the stock will increase in value over time, allowing the investor to profit from capital appreciation.

Sell: The decision to sell a stock involves selling the shares of a company and realizing the gains or losses from the investment. Selling is often driven by factors such as changes in the company’s performance, market conditions, or the need to rebalance one’s investment portfolio.

Understanding the implications and intricacies of buy-hold-sell is crucial for investors to make informed decisions and maximize their returns. In this article, we will explore the concept of buy-hold-sell in stocks, the advantages and disadvantages of each action, and the factors to consider when making investment decisions.

Understanding Buy Hold Sell in Stocks

Buy, hold, and sell are actions that investors take when dealing with stocks. Let’s delve deeper into understanding each of these actions:

Buy: Buying a stock means acquiring ownership in a particular company. Investors typically purchase stocks in companies they believe have the potential for future growth and profitability. This decision is often based on thorough research and analysis of the company’s financials, industry trends, competitive landscape, and management team.

Hold: Holding refers to the act of retaining ownership of a stock for an extended period. Investors may choose to hold onto their investments for various reasons. One reason is the belief that the stock’s value will increase over time, leading to capital appreciation. Additionally, holding allows investors to benefit from dividends, which are periodic payments made by companies to shareholders.

Sell: Selling a stock involves disposing of the shares of a company. Investors may decide to sell their holdings for several reasons, including profit-taking, risk management, or the need to rebalance their investment portfolio. Selling is typically driven by changes in the company’s performance, market conditions, or the achievement of certain investment objectives.

Buy-hold-sell strategies are not mutually exclusive. In fact, successful investors often employ a combination of these actions based on their investment goals, risk tolerance, and market conditions. Some investors take a more active approach, frequently buying and selling stocks to capitalize on short-term price movements. Others adopt a long-term buy-and-hold strategy, aiming to reap the benefits of compounding growth over time.

It’s important to note that the decision to buy, hold, or sell stocks should be rooted in a comprehensive understanding of the company, the industry it operates in, and the broader market trends. Thorough research, analysis, and staying informed about market events are essential for making informed investment decisions.

In the next sections, we will explore the pros and cons of buying stocks, the advantages of holding onto investments, and the risks associated with selling stocks.

Pros and Cons of Buying Stocks

Buying stocks can offer numerous benefits to investors, but it is essential to be aware of the potential drawbacks. Let’s examine the pros and cons of buying stocks:

Pros:

- Investment Potential: Buying stocks provides an opportunity for investors to participate in the growth and success of a company. If the company performs well, stockholders can benefit from capital appreciation, allowing them to potentially earn significant returns on their investment.

- Ownership and Voting Rights: By purchasing stocks, investors become owners of a portion of the company. This ownership entitles them to voting rights in the company’s decision-making processes, such as electing the board of directors or approving corporate actions.

- Dividend Income: Some companies distribute a portion of their profits to shareholders in the form of dividends. By buying dividend-paying stocks, investors can earn a regular stream of income in addition to potential capital gains.

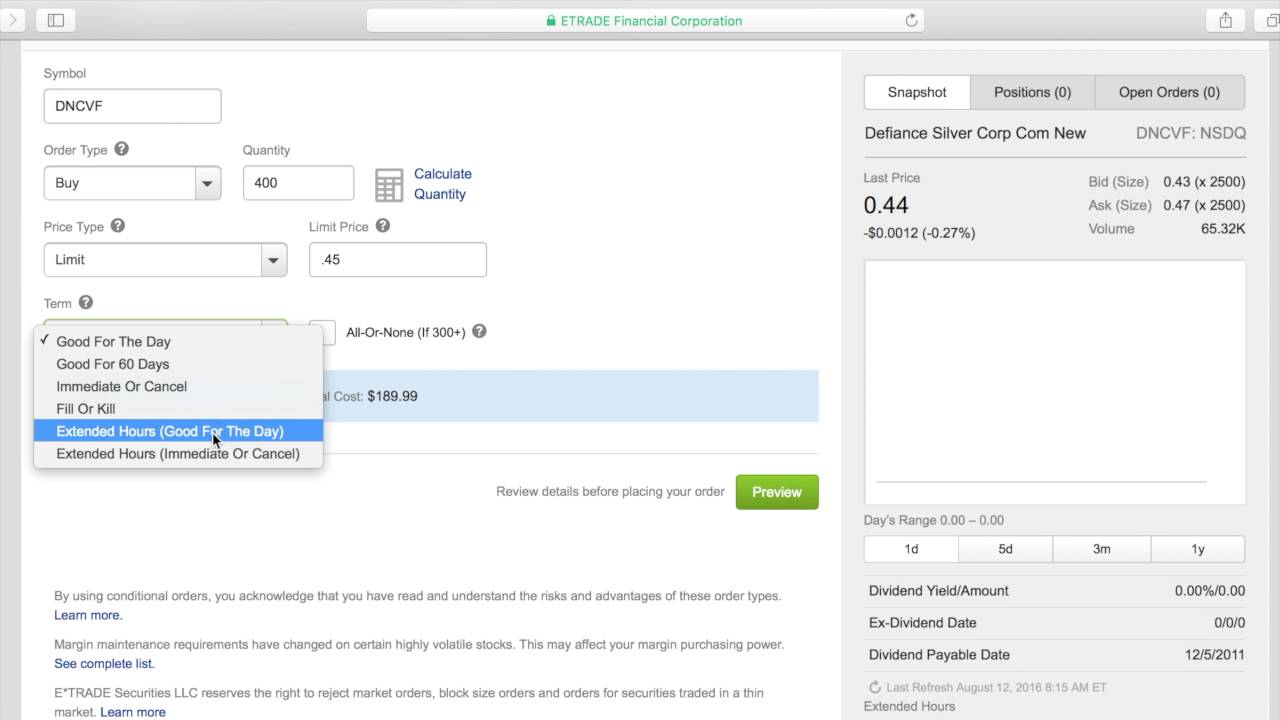

- Liquidity: The stock market offers high liquidity, meaning that investors can easily buy or sell stocks at market prices. This allows for flexibility in managing investment portfolios and taking advantage of market opportunities.

Cons:

- Market Volatility: The stock market is prone to fluctuations and can be affected by various factors, including economic conditions, geopolitical events, or company-specific news. As a result, stock prices can be volatile and may experience significant short-term fluctuations.

- Risk of Capital Loss: Investing in stocks carries the risk of capital loss. Some stocks may underperform, and investors can potentially lose a portion or even the entire value of their investment.

- Time and Research: Buying stocks requires time and effort to research and analyze companies. Investors need to assess a company’s financial health, competitive advantages, growth prospects, and industry trends to make informed decisions.

- Emotional Decision-Making: Emotions can often cloud judgment when buying stocks. Fear or greed may lead investors to make irrational decisions, such as buying at the peak of a market bubble or selling during a market downturn.

It’s crucial for investors to carefully consider the pros and cons before buying stocks. Diversification, risk management strategies, and a long-term perspective can help mitigate the potential drawbacks and enhance the chances of successful investing.

Advantages of Holding Stocks

Holding stocks for the long term has several advantages that can contribute to a successful investment strategy. Let’s explore the benefits of holding onto stocks:

1. Potential for Long-Term Growth:

By holding stocks, investors have the potential to benefit from the long-term growth of the underlying companies. Over time, well-managed companies can increase their earnings, expand into new markets, and innovate, which can lead to higher stock prices and capital appreciation.

2. Compounding Returns:

The power of compounding is a significant advantage of holding stocks. As companies generate profits, they may reinvest those earnings back into the business for further growth. This can result in an increase in the company’s value, which ultimately benefits shareholders. By holding stocks for the long term, investors can take advantage of the compounding effect to potentially build significant wealth over time.

3. Dividend Income:

Many established companies distribute a portion of their profits to shareholders in the form of dividends. By holding dividend-paying stocks, investors can receive regular income streams, which can be particularly beneficial for those seeking a steady source of income during retirement or other financial goals.

4. Tax Benefits:

Holding stocks for the long term may offer tax advantages. In some countries, long-term capital gains from stocks held for a certain period may be subject to lower tax rates compared to short-term capital gains. Additionally, qualified dividends can be taxed at a lower rate than regular income.

5. Opportunity to Ride Out Market Fluctuations:

Stock markets can be subject to short-term volatility and fluctuations. However, holding onto stocks allows investors to ride out this volatility and potentially benefit from market recoveries. Over the long term, the stock market has historically shown resilience and the ability to rebound from downturns.

6. Diversification:

Holding a diversified portfolio of stocks can help spread risk and reduce potential losses. By holding stocks from various sectors, industries, and geographic locations, investors can balance out the performance of individual stocks and create a more stable and resilient investment portfolio.

Overall, the advantages of holding stocks for the long term include the potential for growth, compounding returns, dividend income, tax benefits, the ability to weather market fluctuations, and the advantages of diversification. This approach requires patience, discipline, and a long-term investment mindset, but it can be a rewarding strategy for investors seeking to build wealth over time.

The Risks Involved in Selling Stocks

Selling stocks is an integral part of investment strategies, but it comes with its own set of risks. Understanding these risks is essential for investors to make informed decisions. Let’s examine some of the risks involved in selling stocks:

1. Capital Loss:

One of the primary risks of selling stocks is the potential for capital loss. The value of a stock can decline, leading to a decrease in the investor’s initial investment. Selling stocks at a loss can result in a financial loss, which can be emotionally challenging for investors.

2. Timing Risk:

The decision to sell stocks involves timing the market. Market timing is notoriously difficult, and attempting to sell stocks at the peak of their value or buy them at the bottom can be a challenging task. The risk of mistiming the market can result in missed opportunities for profit or selling at a suboptimal price.

3. Missed Growth Potential:

When selling stocks, investors risk missing out on potential future growth of the company. If a sold stock continues to perform well and its value increases, investors may experience regret for not holding onto their investment.

4. Tax Consequences:

Selling stocks can have tax implications. Depending on the tax regulations in a particular country, capital gains from the sale of stocks held for a short period may be subject to higher tax rates compared to long-term capital gains. Investors should carefully consider the tax consequences of selling stocks to optimize their overall financial position.

5. Emotional Bias:

Emotions can cloud judgment when it comes to selling stocks. Fear, greed, or herd mentality may drive investors to make irrational decisions and sell stocks prematurely or hold onto underperforming stocks for too long. Emotionally driven decisions can negatively impact investment returns.

6. Rebalancing Challenges:

Selling stocks may be necessary when rebalancing an investment portfolio. However, determining when and which stocks to sell can be challenging. Selling the wrong stocks or selling too many stocks in one sector can result in an imbalanced portfolio and increased risk.

It’s essential for investors to carefully assess the risks involved in selling stocks. A well-informed approach, based on thorough research, risk management strategies, and a long-term investment perspective, can help mitigate these risks and enhance the likelihood of successful investing.

Factors to Consider When Deciding to Buy, Hold, or Sell

When it comes to making decisions on whether to buy, hold, or sell stocks, investors should consider a variety of factors to navigate the complex world of financial markets. Here are some key factors to consider when making these decisions:

1. Company Fundamentals:

Evaluating the fundamental factors related to a company is crucial before deciding to buy, hold, or sell its stock. This includes analyzing the company’s financial health, competitive position, management team, and growth prospects. Understanding the company’s potential for future profitability and its ability to navigate market challenges is essential for making informed investment decisions.

2. Market Conditions:

It’s important to consider the broader market conditions when deciding to buy, hold, or sell stocks. Factors such as economic indicators, interest rates, inflation, and geopolitical events can significantly impact market performance. Assessing whether the overall market is bullish or bearish can help investors determine the appropriate actions to take.

3. Risk Tolerance:

Each investor has a unique risk tolerance. Understanding your risk tolerance is crucial when deciding whether to buy, hold, or sell stocks. Investors with a higher risk tolerance may be more comfortable taking on volatile stocks or holding onto investments during market downturns. Conversely, investors with a lower risk tolerance may prefer more stable stocks or be inclined to sell stocks quickly at the first sign of market turbulence.

4. Investment Horizon:

The time horizon for your investment goals should also be factored into buy, hold, or sell decisions. Short-term traders may focus more on timing market movements and may be more prone to selling stocks quickly for short-term gains. Long-term investors, on the other hand, may have a buy-and-hold approach, considering the potential growth and compounding effects over an extended period.

5. Portfolio Diversification:

Considering the diversity of your investment portfolio is vital when deciding whether to buy, hold, or sell stocks. Diversification helps spread risk across various asset classes, sectors, and geographic regions. Striking the right balance between risk and reward by having a diversified portfolio can provide stability and potentially reduce the impact of a poorly performing stock.

6. Valuation:

Assessing the valuation of a stock is crucial when considering whether to buy, hold, or sell. Evaluating key financial ratios such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-book value (P/B) can provide insights into the stock’s value relative to its financial performance. Understanding if a stock is overvalued or undervalued can guide your decision-making process.

It’s important to note that these factors are not exhaustive, and individual circumstances may require additional considerations. Consulting with financial advisors or professionals who can provide personalized advice based on your specific goals and risk tolerance is highly recommended.

By carefully considering these factors and conducting comprehensive research, investors can make more informed decisions on whether to buy, hold, or sell stocks and increase their chances of achieving their investment objectives.

Strategies for Successful Investing

Successful investing requires a well-thought-out strategy that aligns with your financial goals and risk tolerance. Here are some strategies that can help you navigate the intricacies of the stock market:

1. Determine your Investment Goals:

Before investing in stocks, define your investment goals. Are you aiming for long-term growth, generating income, or a combination of both? Understanding your objectives will help shape your investment strategy and guide your decision-making process.

2. Conduct Thorough Research:

Take the time to research companies, industries, and market trends. Analyze financial statements, assess a company’s competitive advantage, and stay informed about industry news. Informed decisions based on comprehensive research are more likely to yield successful outcomes.

3. Practice Diversification:

Diversify your investments across different sectors, industries, and asset classes. This helps spread risk and reduces the impact of a single investment’s poor performance. Diversification should be carefully planned and regularly reviewed to ensure it aligns with your investment goals.

4. Avoid Emotional Decision-Making:

Emotional decisions can lead to poor investment outcomes. Avoid making impulsive decisions based on short-term market fluctuations or succumbing to fear or greed. Stick to your investment strategy and make decisions based on research and analysis rather than emotional impulses.

5. Keep a Long-Term Perspective:

Successful investing is often a long-term endeavor. Stocks can be volatile in the short term, but historical data shows that the market tends to trend upward over time. Avoid getting swayed by daily price movements and focus on the long-term prospects of your investments.

6. Regularly Review and Rebalance:

Monitor your investments regularly and adjust your portfolio as needed. Periodically review your holdings to ensure they still meet your investment goals and risk tolerance. Rebalance your portfolio by selling overperforming assets and reinvesting in underperforming areas to maintain the desired asset allocation.

7. Stay Informed:

Stay up-to-date with market news, trends, and economic indicators. This knowledge will help you make informed decisions and adapt your strategy as market conditions change. Continuous learning and staying informed are crucial for long-term investment success.

8. Consider Dollar-Cost Averaging:

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy can help mitigate the impact of market fluctuations and reduce the risk of making poor timing decisions.

Remember, each investor’s strategy should be tailored to their unique circumstances and goals. It’s advisable to seek professional advice or consult with a financial advisor who can provide personalized guidance based on your specific needs.

By employing these strategies, you can improve your chances of achieving successful investment outcomes and reaching your financial objectives over time.

Common Mistakes to Avoid in Buy Hold Sell Decisions

Buy, hold, and sell decisions are critical in the world of investing, and avoiding common mistakes can significantly impact the success of your investment journey. Here are some key mistakes to avoid when making buy, hold, and sell decisions:

1. Emotional Decision-Making:

Emotional decision-making can lead to detrimental outcomes. Making buy, hold, or sell decisions based on fear, greed, or panic can result in poor choices and missed opportunities. Avoid letting your emotions dictate your investment decisions and instead rely on research, analysis, and a long-term strategy.

2. Lack of Research and Due Diligence:

Insufficient research and due diligence can lead to poor investment decisions. Failing to thoroughly evaluate a company’s financials, industry dynamics, and competition increases the risk of investing in underperforming or unstable stocks. Take the time to conduct comprehensive research to make informed decisions.

3. Chasing Hot Stocks or Market Trends:

Chasing hot stocks or the latest market trends can be a dangerous investment strategy. Buying into stocks solely based on recent performance or market buzz rarely leads to sustainable gains. It’s essential to focus on long-term fundamentals rather than short-term hype.

4. Overlooking Risk Management:

Risk management is a crucial aspect of investment decisions. Failing to assess and manage risks effectively can result in substantial losses. Diversification, setting risk limits, and regularly reviewing and adjusting your portfolio are essential elements of a sound risk management strategy.

5. Failing to Reassess Investment Thesis:

Market conditions and company dynamics can change over time, and it’s vital to regularly reassess your investment thesis. Failing to adjust your buy, hold, or sell decisions to align with new information or circumstances can lead to missed opportunities or prolonged exposure to poorly performing investments.

6. Market Timing:

Attempting to time the market by predicting short-term price movements is notoriously challenging. Market timing often leads to missed opportunities or selling investments at the wrong time. Instead, focus on a long-term investment strategy and take a disciplined approach rather than trying to time the market.

7. Neglecting to Rebalance Portfolios:

Neglecting to rebalance your investment portfolio can result in an imbalanced allocation and increased risks. Over time, certain investments may outperform others, causing your portfolio to deviate from your original asset allocation. Regularly review and rebalance your portfolio to maintain a diversified and aligned allocation.

8. Lack of Patience and Discipline:

Successful investing requires patience and discipline. Avoid the temptation to make impulsive buy, hold, or sell decisions based on short-term fluctuations. Stick to your investment strategy and have the discipline to stay the course, even during periods of market volatility.

By recognizing and avoiding these common mistakes, you can enhance your decision-making process and increase the likelihood of achieving your investment goals. It’s essential to continuously learn, adapt, and seek professional advice when needed to fine-tune your buy, hold, and sell decisions.

Conclusion

The decision to buy, hold, or sell stocks is a fundamental aspect of investment strategies. Understanding the implications and considerations associated with these actions is essential for investors to navigate the dynamic world of finance successfully.

When making buy, hold, or sell decisions, it is crucial to evaluate various factors. Consider the company’s fundamentals, market conditions, and your risk tolerance. Thorough research and a long-term perspective can help investors make informed decisions and avoid common pitfalls.

Buying stocks offers the potential for capital appreciation, ownership, and dividend income. However, it also carries risks such as market volatility and the potential for capital loss. Holding stocks allows investors to benefit from long-term growth, compounding returns, and potential dividend income. Selling stocks involves the risk of mistiming the market and missing out on future growth potential.

Factors to consider when deciding to buy, hold, or sell include the company’s fundamentals, market conditions, risk tolerance, investment horizon, portfolio diversification, and valuation. By carefully assessing these factors and staying informed, investors can make more informed decisions aligning with their goals.

To succeed in investing, follow strategies such as determining your investment goals, conducting thorough research, practicing diversification, avoiding emotional decision-making, maintaining a long-term perspective, regularly reviewing and rebalancing, and staying informed.

Avoid common mistakes like emotional decision-making, lack of research, chasing trends, neglecting risk management, failing to reassess investment thesis, attempting to time the market, neglecting portfolio rebalancing, and lacking patience and discipline.

In conclusion, investing in stocks requires a comprehensive understanding of buy, hold, and sell decisions. By following sound strategies, considering crucial factors, and avoiding common mistakes, investors can be better equipped to navigate the stock market and increase their chances of achieving their financial objectives.