Finance

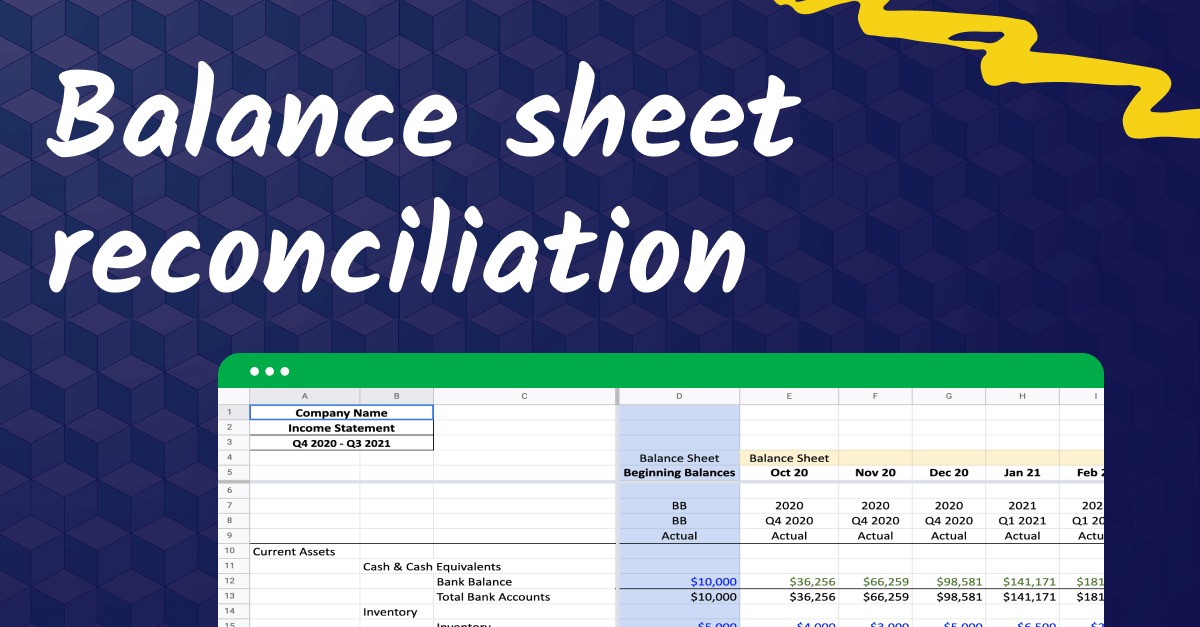

What Is A Consolidated Balance Sheet?

Published: December 27, 2023

Learn about consolidated balance sheets in finance and how they provide a comprehensive overview of a company's financial position.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Consolidated Balance Sheet

- Purpose of a Consolidated Balance Sheet

- Components of a Consolidated Balance Sheet

- How to Prepare a Consolidated Balance Sheet

- Benefits of Using a Consolidated Balance Sheet

- Limitations of a Consolidated Balance Sheet

- Importance of Reviewing a Consolidated Balance Sheet

- Example of a Consolidated Balance Sheet

- Conclusion

Introduction

When it comes to understanding the financial health of a company, the consolidated balance sheet plays a crucial role. This financial statement provides a comprehensive snapshot of a company’s assets, liabilities, and equity, taking into account not only the parent company but also its subsidiaries. It allows stakeholders, investors, and creditors to gauge the overall financial position of the entire corporate group rather than just one entity.

In simple terms, a consolidated balance sheet combines the financial information of a parent company and its subsidiaries into a single document. It provides a holistic view of the assets the company owns, the debts it owes, and the equity it holds. This is especially important for companies with multiple subsidiaries or a complex organizational structure.

Consolidation is necessary because each subsidiary is considered a separate legal entity, even if it is wholly owned by the parent company. Without consolidation, the financial information of each subsidiary would be presented as individual statements, making it difficult to assess the true financial standing of the entire corporate group.

The process of consolidation involves combining the financial statements of the parent company and its subsidiaries, eliminating any intercompany transactions and balances, and adjusting for minority interest. The resulting consolidated balance sheet provides a clearer picture of the company’s overall financial position.

Overall, the consolidated balance sheet serves as a valuable tool for decision-making, risk assessment, and financial analysis. It allows investors and creditors to gain insights into the company’s overall leverage, liquidity, and solvency. Additionally, it helps stakeholders evaluate the company’s ability to generate cash flows, measure its profitability, and assess its financial stability.

In the following sections, we will delve deeper into the definition, purpose, components, preparation, benefits, and limitations of a consolidated balance sheet. We will also provide an example to help you better understand how this financial statement is constructed. Let’s explore this important financial document and its significance in assessing the financial health of a company.

Definition of a Consolidated Balance Sheet

A consolidated balance sheet is a financial statement that combines the financial information of a parent company and its subsidiaries into a single document. It provides a comprehensive overview of the financial position and performance of the entire corporate group, rather than just one entity. The consolidated balance sheet reflects the combined assets, liabilities, and equity of the parent company and its subsidiaries.

Consolidation is necessary because each subsidiary is considered a separate legal entity, even if it is wholly owned by the parent company. Without consolidation, it would be challenging to assess the true financial standing of the entire corporate group. By consolidating the financial statements, the company can present a unified view of its financial health and provide stakeholders, investors, and creditors with a more accurate representation of its overall financial position.

When preparing a consolidated balance sheet, the financial information of the subsidiaries is adjusted and combined with that of the parent company. Any intercompany transactions and balances are eliminated to prevent double counting and ensure accuracy. Additionally, minority interest, which represents the portion of subsidiary ownership that is not owned by the parent company, is accounted for in the consolidated balance sheet.

By preparing a consolidated balance sheet, the company can present a consolidated view of its assets, including cash, investments, property, plant, and equipment. It also provides an overview of the liabilities, such as loans, accounts payable, and accrued expenses. The equity section of the consolidated balance sheet reflects the parent company’s ownership interest and the minority interest in the subsidiaries.

Overall, the consolidated balance sheet is a crucial financial statement that allows stakeholders to evaluate the financial performance and position of the entire corporate group. It provides a comprehensive and accurate representation of the company’s assets, liabilities, and equity, giving stakeholders an understanding of the company’s overall financial health. Additionally, it serves as a basis for financial analysis, decision-making, and risk assessment, providing valuable insights into the company’s financial stability and potential for growth.

Purpose of a Consolidated Balance Sheet

The consolidated balance sheet serves several important purposes in assessing the financial health and performance of a company and its subsidiaries. It provides stakeholders, investors, and creditors with valuable insights into the overall financial position of the entire corporate group. Here are the main purposes of a consolidated balance sheet:

- Presenting a unified view: One of the primary goals of a consolidated balance sheet is to provide a unified view of the financial position and performance of the entire corporate group. By combining the financial information of the parent company and its subsidiaries, stakeholders can assess the collective assets, liabilities, and equity, gaining a comprehensive understanding of the company’s overall financial health.

- Evaluating financial position: The consolidated balance sheet allows stakeholders to evaluate the company’s financial position from a broader perspective. It provides a consolidated snapshot of the company’s total assets, including cash, investments, properties, and equipment, as well as its total liabilities, such as loans and accounts payable. By analyzing the consolidated balance sheet, stakeholders can assess the company’s liquidity, leverage, and solvency, giving them a better understanding of its financial stability and risk exposure.

- Assessing performance: The consolidated balance sheet provides insights into the financial performance of the entire corporate group. By comparing the consolidated balance sheets of different periods, stakeholders can evaluate changes in assets, liabilities, and equity, indicating the company’s growth, profitability, and efficiency over time. This information helps stakeholders assess the company’s ability to generate profits and manage its resources effectively.

- Aiding decision-making: The consolidated balance sheet plays a crucial role in decision-making for stakeholders, investors, and creditors. It provides vital information for assessing investment opportunities, making strategic decisions, and evaluating the financial viability of the corporate group. By analyzing the consolidated balance sheet, stakeholders can identify potential risks, gauge the company’s financial capacity for expansion or acquisition, and make informed decisions based on the company’s financial health.

- Facilitating financial analysis: The consolidated balance sheet serves as a fundamental tool for financial analysis. By examining the ratios and trends derived from the consolidated balance sheet, stakeholders can perform in-depth financial analysis to gain insights into liquidity, profitability, and overall financial performance. This analysis helps stakeholders understand the company’s strengths, weaknesses, and areas for improvement, assisting them in making informed decisions and implementing effective financial strategies.

Overall, the consolidated balance sheet serves as a powerful financial statement that enables stakeholders to evaluate the financial position, performance, and potential risks of a company and its subsidiaries as a cohesive unit. It provides a comprehensive and accurate representation of the entire corporate group’s financial health, aiding decision-making, risk assessment, and financial analysis.

Components of a Consolidated Balance Sheet

A consolidated balance sheet consists of several key components that provide a detailed overview of the financial position of the parent company and its subsidiaries. Understanding these components is essential for stakeholders to gain insights into the assets, liabilities, and equity of the entire corporate group. Here are the main components of a consolidated balance sheet:

- Assets: The assets section of a consolidated balance sheet includes all the resources owned by the parent company and its subsidiaries. This can include cash, accounts receivable, investments, property, plant, and equipment, as well as any intangible assets like patents or trademarks. The consolidated balance sheet presents the total value of these assets, reflecting the combined resources of the entire corporate group.

- Liabilities: The liabilities section of a consolidated balance sheet represents the debts and obligations of the parent company and its subsidiaries. It includes items such as accounts payable, loans, accrued expenses, and any other financial obligations. The consolidated balance sheet presents the total amount of the liabilities owed by the corporate group as a whole.

- Equity: The equity section of a consolidated balance sheet represents the ownership interest in the parent company and its subsidiaries. It includes the equity held by the parent company and any minority interest in the subsidiaries. Minority interest refers to the portion of subsidiary ownership that is not owned by the parent company. The consolidated balance sheet shows the combined equity of the corporate group.

- Intercompany Eliminations: Intercompany transactions and balances refer to financial transactions and amounts owed between the parent company and its subsidiaries. In the consolidation process, these intercompany transactions and balances are eliminated to avoid double counting and to provide an accurate depiction of the entire corporate group’s financial position. The consolidated balance sheet presents only the consolidated balances after eliminating the intercompany amounts.

- Minority Interest: Minority interest refers to the portion of subsidiary ownership that is not owned by the parent company. It represents the external ownership stake in the subsidiary. The consolidated balance sheet accounts for minority interest as a separate component, representing the ownership interests held by external investors in the subsidiaries.

By combining these components, the consolidated balance sheet provides a comprehensive view of the assets, liabilities, and equity of the parent company and its subsidiaries. It enables stakeholders to understand the overall financial position of the entire corporate group and assess its financial health, strength, and potential for growth. This information is vital for making informed decisions, evaluating investment opportunities, and managing risks associated with the corporate group.

How to Prepare a Consolidated Balance Sheet

Preparing a consolidated balance sheet involves a systematic process to combine the financial information of the parent company and its subsidiaries. The following steps outline the process of preparing a consolidated balance sheet:

- Gather financial statements: Collect the financial statements of the parent company and all its subsidiaries. These statements include the balance sheets, income statements, and cash flow statements of each entity.

- Adjust for minority interest: Determine the ownership percentages of the parent company in its subsidiaries, as well as the ownership percentages held by external investors (minority interest). Adjust the balance sheets of the subsidiaries to include the minority interest portion based on their ownership percentages.

- Eliminate intercompany transactions: Identify and eliminate any intercompany transactions or balances between the parent company and its subsidiaries. Examples of intercompany transactions include sales of goods or services between entities within the corporate group. These amounts are removed to avoid double counting in the consolidated balance sheet.

- Combine individual financial statements: Aggregate the financial information from the parent company and its subsidiaries. Add together the assets, liabilities, and equity from each entity to create a consolidated balance sheet.

- Adjustments: Make any necessary adjustments to ensure consistency and accuracy in the consolidated balance sheet. This may involve reconciling any discrepancies between the financial statements or accounting for any non-controlling interests.

- Present consolidated financials: Present the final consolidated balance sheet, including all assets, liabilities, equity, and minority interest. Ensure that the consolidated balance sheet complies with applicable accounting standards and provides a clear and comprehensive view of the financial position of the entire corporate group.

- Periodic review and updates: Review and update the consolidated balance sheet on a regular basis to reflect changes in the financial position of the parent company and its subsidiaries. This allows stakeholders to stay informed about the latest financial information and make well-informed decisions.

It is important to note that preparing a consolidated balance sheet requires expertise in accounting principles and a deep understanding of the intercompany relationships within the corporate group. Professional accountants or financial experts often handle the consolidation process to ensure accuracy and adherence to accounting standards.

By following these steps and ensuring the accuracy and integrity of the financial information, companies can create a consolidated balance sheet that provides a comprehensive and reliable view of the financial position and performance of the entire corporate group.

Benefits of Using a Consolidated Balance Sheet

A consolidated balance sheet offers numerous advantages to stakeholders, investors, and creditors in evaluating the financial health and performance of a corporate group. Here are some key benefits of using a consolidated balance sheet:

- Comprehensive financial view: The consolidated balance sheet provides a comprehensive view of the financial position of the entire corporate group. By combining the financial information of the parent company and its subsidiaries, stakeholders can assess the collective assets, liabilities, and equity, gaining a holistic understanding of the company’s overall financial health.

- Accurate assessment of risks and liabilities: The consolidated balance sheet helps stakeholders accurately assess the risks and liabilities of the corporate group. By consolidating the financial information, it captures the full extent of the company’s debts and obligations. This enables stakeholders to evaluate the company’s leverage, solvency, and risk exposure, assisting in making informed decisions and managing potential risks.

- Identification of synergies and cross-collateralization: The consolidated balance sheet highlights any synergies and cross-collateralization that exist within the corporate group. It exposes the intercompany transactions, shared assets, and liabilities between entities. This information can be useful in optimizing resource allocation, identifying potential cost savings, and improving operational efficiency.

- Better understanding of performance: By analyzing the consolidated balance sheet, stakeholders can gain insights into the overall financial performance of the corporate group. They can track trends, assess changes in assets, liabilities, and equity, and evaluate the company’s growth, profitability, and efficiency over time. This information helps stakeholders understand the company’s financial performance and make data-driven decisions based on its historical and current financial position.

- Enhanced transparency: The consolidated balance sheet enhances transparency and accountability in financial reporting. It provides stakeholders with a clear and accurate overview of the company’s financial position, reducing the potential for misleading information or misinterpretation. Transparency is crucial for building trust, attracting investors, and demonstrating the company’s commitment to sound financial practices.

- Improved investment decision-making: Investors can make more informed investment decisions by analyzing the consolidated balance sheet. It provides them with a comprehensive understanding of the company’s financial stability, performance, and growth potential. By assessing the company’s financial position and evaluating the associated risks, investors can make sound investment choices aligned with their investment objectives and risk tolerance.

- Facilitation of financial analysis: The consolidated balance sheet serves as a fundamental tool for financial analysis. It allows stakeholders to calculate various financial ratios and metrics, such as liquidity ratios, leverage ratios, and profitability indicators. These analyses provide valuable insights into the company’s financial performance, efficiency, and long-term sustainability, aiding in decision-making and strategic planning.

Overall, the use of a consolidated balance sheet improves transparency, enhances decision-making, and provides a comprehensive understanding of the financial position and performance of a corporate group. It is a valuable resource for stakeholders, investors, and creditors in assessing the company’s financial health and making well-informed decisions.

Limitations of a Consolidated Balance Sheet

While a consolidated balance sheet provides valuable insights into the financial position of a corporate group, it is important to recognize its limitations. Understanding these limitations allows stakeholders to interpret the information with caution and consider additional factors. Here are some key limitations of a consolidated balance sheet:

- Only a snapshot in time: A consolidated balance sheet represents the financial position of the corporate group at a specific point in time. It does not capture the dynamic nature of the business and its operations. As a result, the consolidated balance sheet may not reflect significant changes that have occurred after the balance sheet date.

- Estimates and judgments: The preparation of a consolidated balance sheet involves the use of estimates and judgments, particularly in areas such as asset valuation, provision for doubtful debts, and contingent liabilities. These estimates can impact the accuracy of the consolidated balance sheet and may be subject to change as more information becomes available.

- Excludes non-consolidated entities: A consolidated balance sheet only includes the financial information of entities that are consolidated. Non-consolidated entities, such as joint ventures, associates, or entities under significant influence, are not included in the consolidated balance sheet. As a result, stakeholders may not have a complete view of the company’s financial relationships and investments.

- Varies based on accounting standards: The preparation and presentation of a consolidated balance sheet can vary depending on the applicable accounting standards. Different accounting standards may have different rules and requirements for consolidation, leading to variations in the presentation and content of the consolidated balance sheet. This can make it challenging to compare the consolidated balance sheets of companies across different jurisdictions or industries.

- Complexity of intercompany transactions: Intercompany transactions, especially those involving complex financial instruments or related party transactions, can add complexity to the consolidation process. It may be challenging to accurately identify and eliminate intercompany transactions, potentially affecting the accuracy and reliability of the consolidated balance sheet.

- Difficulty in assessing individual entity performance: While a consolidated balance sheet provides an overall picture of the financial position of the corporate group, it does not provide detailed information on the performance of individual entities within the group. Stakeholders seeking to evaluate the performance of specific subsidiaries or business units may need to refer to separate entity-level financial statements.

- Not a comprehensive measure of value: The consolidated balance sheet primarily focuses on the book value of assets, which may not reflect their fair market value or the company’s true economic value. Market conditions, changes in asset valuations, and other external factors may affect the company’s overall value, which may not be fully captured in the consolidated balance sheet.

Given these limitations, it is important for stakeholders to complement their analysis with other financial statements, such as income statements and cash flow statements, and consider additional factors like market trends, industry dynamics, and qualitative information to gain a more comprehensive understanding of a company’s financial position and performance.

Importance of Reviewing a Consolidated Balance Sheet

Regularly reviewing a consolidated balance sheet is crucial for stakeholders, investors, and creditors in assessing the financial health and performance of a corporate group. Here are some key reasons why reviewing a consolidated balance sheet is important:

- Financial position evaluation: Reviewing a consolidated balance sheet allows stakeholders to evaluate the financial position of the entire corporate group. It provides a comprehensive overview of the assets, liabilities, and equity, enabling stakeholders to assess the company’s solvency, liquidity, and leverage. Understanding the financial position is essential for making informed decisions, assessing risk exposure, and determining the company’s capacity for growth.

- Risk assessment: The consolidated balance sheet helps stakeholders identify and assess the risks associated with the corporate group. By analyzing the liabilities and contingent liabilities, stakeholders can evaluate the company’s debt levels, potential obligations, and potential risks that may impact its financial stability. This information is vital for risk assessment, allowing stakeholders to mitigate potential risks and make informed decisions.

- Investment decision-making: Reviewing a consolidated balance sheet is crucial for investors in assessing the financial viability and attractiveness of a corporate group. It provides them with insights into the company’s overall financial health, risk profile, and potential for growth. Investors can evaluate the company’s assets, liabilities, and equity, and compare these to industry benchmarks to make informed investment decisions.

- Business performance analysis: By reviewing a consolidated balance sheet over time, stakeholders can analyze the financial performance of the corporate group. They can assess changes in assets, liabilities, and equity, and track key financial ratios and metrics to gauge the company’s performance. This analysis helps in identifying trends, strengths, and weaknesses, allowing stakeholders to make strategic decisions and take appropriate actions to improve financial performance.

- Compliance: Regular review of the consolidated balance sheet helps ensure compliance with regulatory requirements and accounting standards. Stakeholders can identify any discrepancies, inconsistencies, or material errors that may impact the accuracy and reliability of the financial statements. Addressing these issues promptly helps maintain transparency, integrity, and compliance with accounting principles.

- Communication and transparency: The consolidated balance sheet serves as a communication tool to convey the company’s financial performance and position to stakeholders. Reviewing the consolidated balance sheet helps ensure that the information presented is accurate, clear, and transparent. This fosters trust and confidence in the company’s financial reporting, enhancing relationships with stakeholders, investors, and creditors.

Overall, reviewing a consolidated balance sheet is essential for stakeholders to assess the financial health, performance, and risks associated with a corporate group. It enables stakeholders to make informed decisions, evaluate investments, monitor financial performance, and ensure compliance with regulatory requirements. By regularly reviewing the consolidated balance sheet, stakeholders can stay informed about the company’s financial position and make sound strategic and financial decisions based on reliable information.

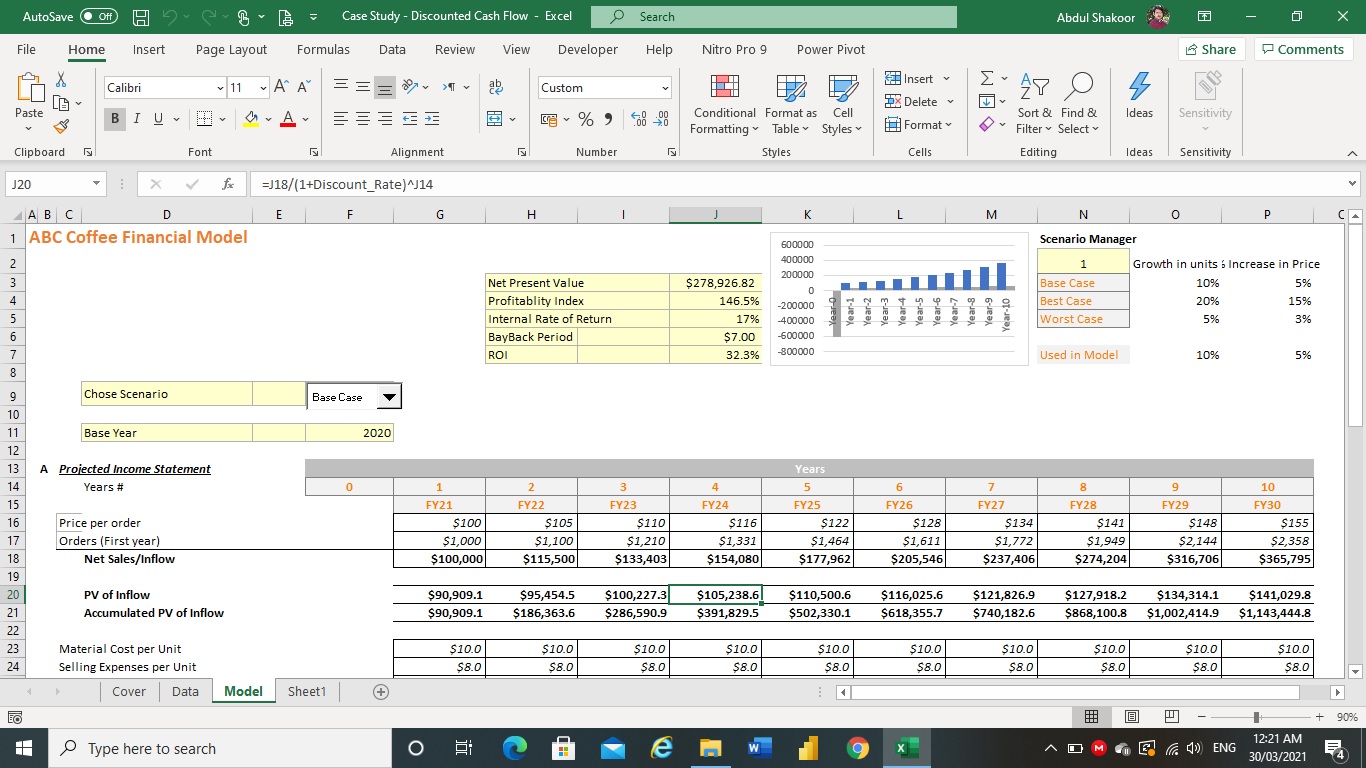

Example of a Consolidated Balance Sheet

To provide a better understanding of a consolidated balance sheet, let’s take a hypothetical example of a multinational corporation, ABC Group, and its consolidated balance sheet:

html

This consolidated balance sheet reflects the financial position of ABC Group, which includes its parent company and subsidiaries, as of the end of the fiscal year.

Within the consolidated balance sheet, you can find various components:

- Assets: This section lists the company’s total assets. It includes cash and cash equivalents, accounts receivable, inventory, investments, property, plant, and equipment, as well as intangible assets like patents or trademarks. These assets represent the resources owned by ABC Group and its subsidiaries.

- Liabilities: The liabilities section presents the company’s total debts and obligations. It includes accounts payable, accrued expenses, short-term and long-term loans, and any other outstanding liabilities. These liabilities reflect the amount owed by ABC Group and its subsidiaries to external parties.

- Equity: The equity section represents the ownership interests within ABC Group. It includes the equity held by the parent company and any minority interest in the subsidiaries. This portion reflects the shareholders’ or owners’ equity in the corporate group.

- Intercompany Eliminations: Intercompany transactions and balances between the parent company and its subsidiaries are eliminated in this section. This ensures that the consolidated balance sheet does not include any double counting of assets or liabilities resulting from internal transactions within the corporate group.

- Minority Interest: This component of the consolidated balance sheet represents the ownership interests held by external investors in the subsidiaries. It reflects the portion of subsidiary ownership that is not owned by the parent company.

The example of a consolidated balance sheet is a useful tool for stakeholders to gain insights into the financial position of ABC Group as a whole. By reviewing each component, stakeholders can assess the company’s liquidity, leverage, and equity structure. They can analyze trends, compare financial metrics, and make informed decisions based on the financial health and performance of the entire corporate group.

It is important to note that the example provided is purely hypothetical. The actual format and content of a consolidated balance sheet will vary depending on the company’s industry, accounting standards, and specific requirements.

Conclusion

A consolidated balance sheet is a vital financial statement that provides a comprehensive view of the financial position and performance of a corporate group. By combining the financial information of the parent company and its subsidiaries, stakeholders can assess the collective assets, liabilities, and equity, gaining valuable insights into the company’s overall financial health.

The consolidated balance sheet serves several important purposes, including presenting a unified view of the corporate group, evaluating the financial position, assessing performance, aiding decision-making, and facilitating financial analysis. It enhances transparency and accountability, allowing stakeholders to make informed decisions and manage potential risks associated with the company.

However, it is essential to recognize the limitations of a consolidated balance sheet. It provides a snapshot in time, involves estimates and judgments, excludes non-consolidated entities, and may not capture the true economic value of the company. Therefore, stakeholders should use the consolidated balance sheet in conjunction with other financial statements, consider additional factors, and conduct comprehensive analysis to form a complete understanding of the company’s financial position and performance.

In conclusion, the consolidated balance sheet is a powerful tool for stakeholders, investors, and creditors to assess the financial health and performance of a corporate group. Regular review of the consolidated balance sheet enables stakeholders to stay informed about the company’s financial position, make informed decisions, and manage potential risks. With this valuable financial statement, stakeholders can navigate the complex financial landscape and contribute to the sustainable growth and success of the corporate group.