Finance

What Is A Balance Sheet Loan

Published: December 27, 2023

Learn about balance sheet loans and how they can help you with your financing needs. Discover the benefits of balance sheet loans in the field of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Balance Sheet Loan

- Purpose of a Balance Sheet Loan

- How Balance Sheet Loans Work

- Advantages of Balance Sheet Loans

- Disadvantages of Balance Sheet Loans

- Key Components of a Balance Sheet Loan

- Examples of Balance Sheet Loans

- Differences Between Balance Sheet Loans and Other Types of Loans

- Conclusion

Introduction

Welcome to the world of finance, where complexities abound and choices are aplenty. One such financial instrument that plays a vital role in lending and borrowing is the balance sheet loan. This article will delve into the intricacies of balance sheet loans, exploring their definition, purpose, workings, advantages, and disadvantages.

A balance sheet loan is a type of loan that is secured by using a company’s assets, liabilities, and equity as collateral. Unlike other types of loans that focus primarily on the borrower’s creditworthiness and income, a balance sheet loan takes into account the borrower’s overall financial health, as indicated by their balance sheet.

Balance sheet loans can be instrumental for businesses seeking to raise capital for various purposes, such as expansion, working capital needs, acquisition of assets, or debt refinancing. These loans provide businesses with the necessary funds while using their existing assets as a guarantee for repayment.

Understanding balance sheet loans is crucial not only for business owners but also for investors and lenders. By comprehending the key components and mechanics of balance sheet loans, they can make informed decisions regarding investments and lending opportunities, assessing the risk and potential returns associated with such transactions.

Join us on this finance journey as we dissect balance sheet loans and unravel the mysteries behind this essential financial instrument. Discover how balance sheet loans work, their advantages and disadvantages, and gain insight into real-life examples of balance sheet loans. Finally, we will compare balance sheet loans to other types of loans to highlight their unique features and benefits.

Definition of a Balance Sheet Loan

A balance sheet loan, also known as a secured loan or asset-based loan, is a type of financing that uses a borrower’s balance sheet as collateral for the loan. It is a financial arrangement where a lender provides funds to a borrower based on the value of the borrower’s assets and the strength of their overall financial position.

Unlike traditional loans that solely rely on the borrower’s creditworthiness and income, balance sheet loans take into account the borrower’s entire financial picture, including assets, liabilities, and equity. The lender evaluates the borrower’s balance sheet to assess the worthiness of providing the loan and to determine the amount and terms of the loan.

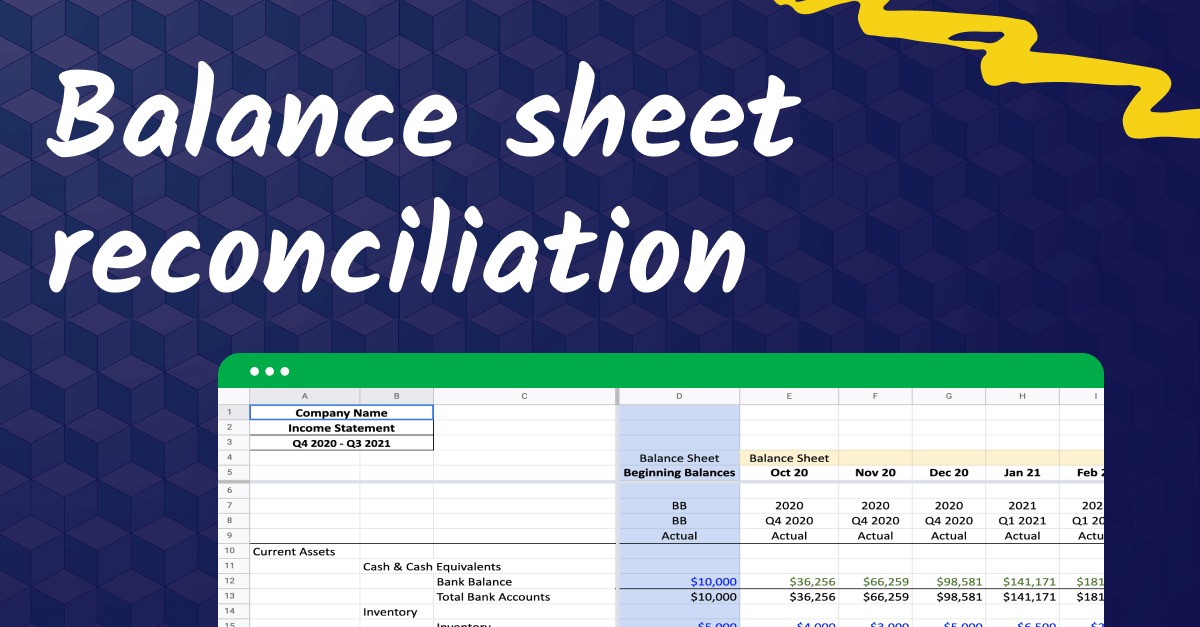

The balance sheet is a financial statement that provides a snapshot of a company’s financial standing at a given point in time. It includes assets, liabilities, and equity. Assets represent what the company owns, such as cash, inventory, equipment, or real estate. Liabilities are the company’s debts and obligations, including loans, accounts payable, and accrued expenses. Equity represents the ownership interest of the company’s shareholders.

When a business applies for a balance sheet loan, the lender will assess the value of the assets pledged as collateral. These assets can include tangible assets like equipment, real estate, or inventory, as well as intangible assets like intellectual property, patents, or future cash flows. The lender may also evaluate the company’s liabilities to gauge its overall debt and repayment capacity.

The lender will typically assign a loan-to-value ratio (LTV) to determine the maximum loan amount. The LTV ratio reflects the percentage of the asset value that the lender is willing to lend. For example, if a company’s assets are appraised at $1 million and the lender’s LTV ratio is 80%, the maximum loan amount would be $800,000.

Overall, the purpose of a balance sheet loan is to provide businesses with access to capital by leveraging their existing assets. By using the balance sheet as collateral, lenders are able to secure the loan and mitigate their risk. This type of lending allows businesses to unlock the value of their assets and address their financing needs without resorting to unsecured loans or diluting their ownership through equity financing.

Purpose of a Balance Sheet Loan

Balance sheet loans serve a variety of purposes for businesses. Whether it’s to support growth initiatives, manage cash flow, acquire assets, or refinance existing debt, these loans offer flexibility and an alternative source of financing. Let’s explore some of the common purposes for which businesses utilize balance sheet loans:

- Business Expansion: One of the primary reasons businesses seek balance sheet loans is to finance expansion plans. Whether it’s opening new locations, launching new product lines, or entering new markets, businesses often require capital to fund these strategic endeavors. Balance sheet loans provide the necessary funds to support expansion while leveraging the value of existing assets.

- Working Capital Management: Maintaining sufficient working capital is essential for the day-to-day operations of any business. However, businesses may face seasonal fluctuations, delayed customer payments, or unexpected expenses that affect their cash flow. Balance sheet loans can be used to cover short-term working capital needs, ensuring smooth operations and continuity.

- Asset Acquisition: Businesses may need to acquire new assets, such as equipment, machinery, or real estate, to support their operations or enhance productivity. Balance sheet loans can help businesses finance these asset purchases while using the asset itself as collateral. This allows businesses to spread the cost of the asset over time, preserving cash flow for other needs.

- Debt Refinancing: If a business has existing high-interest debt or unfavorable repayment terms, they may opt to refinance it with a balance sheet loan. By securing a new loan with more favorable terms, such as lower interest rates or longer repayment periods, businesses can reduce their overall borrowing costs and improve their financial position.

- Restructuring or Turnaround Situations: In challenging financial times, businesses may need to undergo restructuring or turnaround efforts to improve their financial health. Balance sheet loans can play a crucial role in providing the necessary capital infusion to support these initiatives, such as paying off creditors, implementing operational changes, or funding marketing and sales efforts.

These are just a few examples of the purposes a balance sheet loan can serve. The versatile nature of these loans allows businesses to meet their unique financing needs in a strategic and cost-effective manner. However, it’s important for businesses to carefully evaluate their financial situation and projected cash flow to ensure they can meet the repayment obligations associated with balance sheet loans.

How Balance Sheet Loans Work

Balance sheet loans function by leveraging a borrower’s assets and overall financial position to secure financing. Let’s explore the step-by-step process of how balance sheet loans work:

- Borrower Evaluation: The first step in obtaining a balance sheet loan is for the borrower (typically a business) to approach a lender and provide their financial statements, including the balance sheet. The lender will carefully evaluate the borrower’s financial health, including their assets, liabilities, and equity, to assess their creditworthiness and determine the loan amount for which they qualify.

- Asset Assessment: Once the lender has evaluated the borrower’s financial statements, they will assess the value of the assets pledged as collateral. This involves determining the market value of tangible assets, such as real estate, equipment, or inventory, and considering the worth of intangible assets, such as intellectual property or future cash flows.

- Loan-to-Value Ratio (LTV): The lender will assign a loan-to-value ratio (LTV) to determine the maximum loan amount. The LTV ratio reflects the percentage of the asset value that the lender is willing to lend. For example, if a company’s assets are appraised at $1 million and the lender’s LTV ratio is 80%, the maximum loan amount would be $800,000.

- Loan Terms and Conditions: Based on the borrower’s financial position and the assessed value of the assets, the lender will propose the loan terms and conditions, including the interest rate, repayment period, and any additional fees. The terms of balance sheet loans can vary depending on factors such as the borrower’s creditworthiness, the nature of the assets, and prevailing market conditions.

- Loan Disbursement: Once the borrower and the lender agree on the loan terms, the loan amount will be disbursed to the borrower. The borrower can then utilize the funds for the intended purpose, such as expanding operations, managing working capital, acquiring assets, or refinancing debt.

- Repayment and Collateral: Balance sheet loans are typically repaid through regular installments over the agreed-upon loan term. The borrower must make timely payments to fulfill the loan obligations. In the event of default, the lender can seize the collateral (the pledged assets) to recover their funds. Collateral acts as a form of security for the lender and mitigates the risk associated with the loan.

A crucial aspect of balance sheet loans is the continuous monitoring by the lender of the borrower’s financial health throughout the loan term. This is to ensure that the borrower maintains the necessary financial standing to fulfill the repayment obligations. Additionally, lenders may perform periodic asset appraisals to keep track of the collateral’s value.

By leveraging the value of their assets, businesses can access capital through balance sheet loans and address their financial needs, all while utilizing their existing resources as collateral. This type of financing provides businesses with an efficient and practical option for raising funds and supporting their growth and financial stability.

Advantages of Balance Sheet Loans

Balance sheet loans offer several advantages for businesses compared to other forms of financing. Let’s explore some of the key benefits of utilizing balance sheet loans:

- Access to Capital: Balance sheet loans provide businesses with access to much-needed capital by leveraging their existing assets. This allows businesses to obtain funds without the need for additional equity financing or surrendering ownership shares.

- Flexible Use of Funds: With balance sheet loans, businesses have the flexibility to use the funds for a variety of purposes, such as expansion, acquisition of assets, debt consolidation, or managing working capital. This versatility enables businesses to adapt the loan to their specific financial needs.

- Lower Interest Rates: Compared to unsecured loans or credit lines, balance sheet loans often come with lower interest rates since they are secured by collateral. Lenders are more likely to offer competitive rates when there is reduced risk associated with the loan.

- Longer Repayment Period: Balance sheet loans typically offer longer repayment periods compared to short-term loans or lines of credit. This extended repayment timeline allows businesses to spread out payments over time, reducing the strain on their cash flow.

- Preserves Ownership: Balance sheet loans allow businesses to maintain ownership and control over their company. Unlike equity financing, where ownership shares are relinquished, balance sheet loans provide an avenue for capital infusion without diluting ownership stakes.

- Improved Cash Flow Management: By utilizing balance sheet loans for working capital needs or debt refinancing, businesses can improve their cash flow management. They can free up cash from their balance sheet to cover short-term expenses or allocate funds towards growth initiatives.

- Helps Build Credit History: Successfully repaying balance sheet loans can help businesses establish and improve their credit history. This can be beneficial in the long term for accessing future financing opportunities at more favorable terms.

- Flexibility in Asset Types: Balance sheet loans can be secured by a variety of assets, from tangible assets like real estate or equipment to intangible assets like intellectual property or future cash flows. This allows businesses with diverse asset types to leverage their specific strengths for financing.

Overall, balance sheet loans offer businesses a practical and flexible financing solution, allowing them to leverage their existing assets for capital while maintaining ownership and control. It is crucial for businesses to carefully evaluate their financial situation, compare loan offers, and consider the potential advantages before deciding to pursue a balance sheet loan.

Disadvantages of Balance Sheet Loans

While balance sheet loans offer numerous advantages, it is important to consider the potential disadvantages before deciding to pursue this form of financing. Let’s explore some of the key challenges and drawbacks associated with balance sheet loans:

- Asset Collateral Requirement: One of the primary disadvantages of balance sheet loans is the requirement to provide collateral in the form of assets. This means that businesses must have valuable assets that can be pledged as collateral. This may pose a challenge for startups or businesses with limited tangible assets.

- Potential Loss of Assets: In the event of default on a balance sheet loan, lenders have the right to seize the collateral (assets) pledged by the borrower. This can result in the loss of valuable assets for the borrower, which can have significant implications for the business’s operations and future growth.

- Asset Valuation Limitations: The value of assets used as collateral for balance sheet loans may fluctuate over time. Lenders typically appraise assets periodically to assess their worth. If the appraised value of the assets decreases, it can impact the borrowing capacity, loan terms, or even trigger loan covenant violations.

- Restricts Asset Use: When assets are pledged as collateral, their use may be restricted or affected. This can limit a business’s ability to leverage those assets for other purposes, such as selling or using them for other financing options. The assets become tied to the loan arrangement until the loan is fully repaid.

- Cost of Appraisals and Due Diligence: Before granting a balance sheet loan, lenders typically require extensive due diligence, including asset appraisals and assessments of the borrower’s financial position. These processes involve fees and additional costs that businesses must bear, which can increase the overall cost of accessing the loan.

- Greater Risk for Lenders: Balance sheet loans can be riskier for lenders compared to other types of loans, such as unsecured loans or lines of credit. However, to mitigate the risk, lenders may impose higher interest rates, stricter borrowing conditions, or request personal guarantees from business owners.

- Required Financial Transparency: When applying for a balance sheet loan, businesses must provide extensive financial documentation, including their balance sheet, income statement, and cash flow statement. This level of financial transparency may be uncomfortable for some businesses, as it reveals sensitive financial information to the lender.

- Restrictions on Future Financing: Taking on a balance sheet loan may limit a business’s ability to obtain additional financing in the future. The assets used as collateral may be tied up with the existing loan, making it more challenging to secure further funding, especially if the business needs to pledge additional assets as collateral.

It is important for businesses to carefully weigh the disadvantages of balance sheet loans against the potential benefits. Considerations such as the availability of assets for collateral, the impact on future financing needs, and the potential risks involved in defaulting on the loan should be taken into account before pursuing this type of financing.

Key Components of a Balance Sheet Loan

Understanding the key components of a balance sheet loan is crucial for both borrowers and lenders. These components provide insight into the structure, terms, and conditions of the loan. Let’s explore the key elements that make up a balance sheet loan:

- Borrower’s Balance Sheet: The borrower’s balance sheet is a fundamental component of a balance sheet loan. It provides a snapshot of the borrower’s financial position, including their assets, liabilities, and equity. Lenders evaluate the balance sheet to assess the borrower’s creditworthiness and determine the loan amount and terms.

- Collateral: Collateral is a crucial element of a balance sheet loan and acts as security for the lender. It refers to the assets that the borrower pledges as collateral to secure the loan. These assets can include tangible assets like real estate, equipment, or inventory, as well as intangible assets like intellectual property or future cash flows.

- Loan-to-Value Ratio (LTV): The loan-to-value ratio (LTV) is a key factor in determining the loan amount that a borrower can receive. The LTV ratio represents the percentage of the appraised value of the collateral that the lender is willing to lend. For example, if the lender’s LTV ratio is 80% and the appraised value of the collateral is $1 million, the maximum loan amount would be $800,000.

- Loan Amount and Terms: The loan amount is the principal sum that the lender agrees to provide to the borrower. It is determined based on factors such as the appraised value of the collateral, the borrower’s financial position, and the lender’s risk appetite. The loan terms include the repayment period, interest rate, and any additional fees or conditions associated with the loan.

- Interest Rate: The interest rate is the cost of borrowing the funds and is typically expressed as a percentage. It is a key factor in determining the total cost of the loan. The interest rate on a balance sheet loan is influenced by factors such as the borrower’s creditworthiness, the market interest rates, and the overall risk associated with the loan.

- Repayment Schedule: The repayment schedule outlines the timeline and structure of loan repayments. It includes the frequency of payments (monthly, quarterly, etc.), the duration of the loan, and the installment amounts. The repayment schedule ensures that both the principal amount and the interest are repaid over the agreed-upon term.

- Covenants: Covenants are conditions or restrictions imposed by the lender to ensure that the borrower maintains certain financial and operational standards throughout the loan term. These covenants may include financial ratios, limitations on additional borrowings, or requirements for maintaining certain levels of insurance or compliance with legal and regulatory requirements.

- Default and Remedies: The balance sheet loan agreement will outline the consequences of defaulting on the loan, including the actions that the lender can take to recover their funds. This may include the right to seize the collateral, impose penalties or fees, or initiate legal proceedings to enforce the loan agreement.

These key components form the foundation of a balance sheet loan and provide the structure, terms, and conditions for both the borrower and the lender. Understanding these components is crucial to ensure transparency, manage expectations, and navigate the loan process successfully.

Examples of Balance Sheet Loans

Balance sheet loans are utilized by businesses across various industries for a range of financing needs. Let’s explore a few examples of how businesses can benefit from balance sheet loans:

- Real Estate Development: A real estate developer may seek a balance sheet loan to finance the acquisition of land and construction costs for a new commercial building. The developer can use existing properties as collateral to secure the loan, leveraging their balance sheet to access the funds required for the project.

- Manufacturing Equipment Purchase: A manufacturing company may require new equipment to improve production efficiency. They can obtain a balance sheet loan by pledging their existing machinery or inventory as collateral. This loan allows the company to acquire the necessary equipment without disrupting their cash flow and operations.

- Working Capital Injection: A retail business experiencing seasonal fluctuations in cash flow may need working capital to manage inventory, pay suppliers, and cover operational costs during slower periods. By leveraging their balance sheet, the business can secure a loan to bridge the cash flow gap and ensure smooth operations throughout the year.

- Business Acquisition: When acquiring another company, a business may require significant capital. By utilizing a balance sheet loan, the acquiring company can use their existing assets and financial health to secure funds for the acquisition. This form of financing allows the business to expand its operations and leverage the synergies of the acquired company.

- Debt Refinancing: A business with multiple high-interest loans may opt to consolidate its debt by taking out a balance sheet loan. This allows the business to pay off the existing loans and reduce its borrowing costs. By using its balance sheet as collateral, the business can access financing at more favorable terms, potentially improving cash flow and financial stability.

It is important to note that each balance sheet loan is unique and tailored to the specific needs and financial position of the borrower. The loan terms, interest rates, and maximum loan amounts will vary based on factors such as the borrower’s creditworthiness, the value and type of collateral, and prevailing market conditions.

These examples highlight the versatility of balance sheet loans and their applicability across different industries and business scenarios. By utilizing their balance sheet assets, businesses can tap into funds for growth, acquisitions, debt management, or working capital, allowing them to strengthen their financial position and achieve their strategic objectives.

Differences Between Balance Sheet Loans and Other Types of Loans

Balance sheet loans differ from other types of loans in several key aspects. Understanding these differences can help borrowers and lenders identify the most suitable financing option for their specific needs. Let’s explore the distinctions between balance sheet loans and other common types of loans:

- Collateral Requirement: Balance sheet loans are secured loans that require collateral, usually in the form of assets listed on the borrower’s balance sheet. In contrast, unsecured loans, such as personal loans or credit card loans, do not require collateral. Instead, unsecured loans are based on the borrower’s creditworthiness and income.

- Credit Focus: Balance sheet loans consider the overall financial health of the borrower as reflected in their balance sheet. This includes assessing the borrower’s assets, liabilities, and equity. In contrast, traditional loans like personal loans or credit card loans place greater emphasis on an individual’s credit history, income, and ability to make timely payments.

- Loan Amount and Terms: Balances sheet loans typically offer higher loan amounts and longer repayment periods compared to short-term and unsecured loans. Balance sheet loans are designed to accommodate the borrower’s specific needs and provide flexibility in terms of loan duration and installment payments.

- Interest Rates: Balance sheet loans often come with lower interest rates compared to unsecured loans, as the collateral reduces the lender’s risk. Unsecured loans generally have higher interest rates to compensate for the absence of collateral and the associated risk to the lender.

- Flexibility in Use of Funds: Balance sheet loans provide businesses with more flexibility in how they utilize the loan proceeds. These funds can be used for various purposes, such as working capital management, business expansion, asset acquisition, or debt refinancing. In contrast, some types of loans may have limitations on how the funds can be used (e.g., home loans must be used for housing-related purposes).

- Approval Process: Balance sheet loans typically involve a more rigorous approval process compared to unsecured loans. Lenders require a thorough evaluation of the borrower’s financial statements, asset appraisals, and financial health. Unsecured loans, on the other hand, often have a quicker approval process and require less extensive documentation.

- Risk and Default Consequences: Balance sheet loans carry a higher risk to the borrower, as defaulting on the loan can result in the loss of the collateral assets. Unsecured loans do not involve the risk of asset seizure but may result in legal action or damage to the borrower’s credit score if they default on the loan.

- Availability and Accessibility: Unsecured loans like personal loans and credit card loans are more readily available to individuals, requiring minimal documentation and collateral. Balance sheet loans, on the other hand, are typically accessed by businesses and may have more specific eligibility requirements, such as a certain asset value or revenue threshold.

Understanding these differences helps businesses and individuals evaluate the various loan options available to them. By considering factors such as their financial health, collateral availability, loan amounts, repayment terms, and risk tolerance, borrowers can make informed decisions and select the loan type that best aligns with their specific financial needs.

Conclusion

Balance sheet loans are powerful financial tools that allow businesses to leverage their assets to access capital. By utilizing their balance sheet as collateral, businesses can secure loans for a variety of purposes, including expansion, working capital management, asset acquisition, and debt refinancing. These loans offer advantages such as lower interest rates, longer repayment periods, and preservation of business ownership. However, they also come with potential disadvantages, including the requirement of collateral, the risk of asset seizure, and the need for extensive financial transparency.

Understanding the key components and mechanics of balance sheet loans is essential for both borrowers and lenders. By comprehending the borrower’s financial position, the value of collateral, loan-to-value ratios, and other terms and conditions, lenders can assess risk and make informed lending decisions. Similarly, borrowers can navigate the loan process more effectively, ensuring they maintain the necessary financial health and understand the consequences of default.

It is crucial for businesses to carefully evaluate their specific financial needs and consider alternative financing options before pursuing balance sheet loans. Factors such as collateral availability, long-term financial sustainability, and the impact of asset pledge on future financing should be taken into account. Moreover, borrowers should compare loan offers, seek professional advice when necessary, and ensure they have a sound repayment plan in place.

In conclusion, balance sheet loans provide businesses with a viable option for accessing capital, allowing them to leverage their existing assets while maintaining ownership and control. By understanding the nuances of balance sheet loans and their impact on both financial statements and operations, businesses can make well-informed decisions that support their growth, stability, and success in the dynamic world of finance.