Finance

What Is An Interest Bearing Checking Account

Modified: February 21, 2024

Learn about interest bearing checking accounts in finance and discover how they can help you earn money on your daily balances. Find the best options for maximizing your financial growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of an Interest Bearing Checking Account

- How Interest is Earned

- Pros and Cons of Interest Bearing Checking Accounts

- Factors to Consider before Opening an Interest Bearing Checking Account

- Comparison with Regular Checking Accounts

- How to Open an Interest Bearing Checking Account

- Tips for Managing an Interest Bearing Checking Account

- Conclusion

Introduction

Welcome to the world of finance, where the decisions you make can have a significant impact on your financial well-being. One such decision is choosing the right checking account for your needs. While most people are familiar with regular checking accounts, there is another type of checking account that offers an additional benefit: an interest bearing checking account.

An interest bearing checking account is a type of bank account that not only allows you to manage your day-to-day banking needs, but also earns you interest on the funds deposited in the account. This means that as you use your checking account for transactions, your money continues to work for you by growing through interest.

In this article, we will explore the ins and outs of interest bearing checking accounts, including how interest is earned, the pros and cons of such accounts, factors to consider before opening one, and tips for managing them effectively. By the end, you’ll have a comprehensive understanding of interest bearing checking accounts and be able to make an informed decision about whether it’s the right choice for you.

Definition of an Interest Bearing Checking Account

An interest bearing checking account, also known as an interest checking account, is a type of bank account that combines the benefits of both a traditional checking account and a savings account. With an interest bearing checking account, you can manage your day-to-day financial transactions, such as writing checks, making electronic payments, and using a debit card, while also earning interest on the balance of the account.

Unlike a regular checking account that typically does not earn any interest, an interest bearing checking account allows you to earn a certain percentage of interest on the funds you have deposited. This interest is calculated and added to your account on a periodic basis, such as monthly or quarterly. The amount of interest you earn is usually based on the average daily balance in your account.

Interest rates on interest bearing checking accounts can vary widely depending on the bank and the current economic conditions. The interest rate may be fixed or variable, meaning it can fluctuate over time. It’s important to compare the interest rates offered by different banks to ensure you are getting the best return on your money.

Additionally, some interest bearing checking accounts may have certain requirements or restrictions. For example, there may be a minimum balance requirement to earn interest or to avoid monthly maintenance fees. Some banks may also limit the number of transactions or withdrawals you can make per month. It’s crucial to review the terms and conditions of the account before opening one to fully understand the requirements and any associated fees.

Overall, an interest bearing checking account provides a convenient way to manage your daily financial transactions while earning a return on your deposited funds. It combines the flexibility of a checking account with the potential for growth through interest.

How Interest is Earned

Interest in an interest bearing checking account is typically calculated on the average daily balance of the account. This means that the interest is based on the sum of the balances in the account at the end of each day, divided by the number of days in the statement period.

For example, let’s say you have an interest bearing checking account with an average daily balance of $10,000. The bank offers an annual interest rate of 1%. At the end of each day during a 30-day statement period, the bank will calculate the interest earned based on the daily balance. If we assume simple interest calculation, the daily interest rate would be 1% divided by 365 days, which is approximately 0.0027%. Multiply this daily rate by the average daily balance of $10,000, and you would earn around $0.27 in interest each day.

It’s important to note that the actual interest calculation method may vary between banks and account types. Some banks may use a different compounding method, such as compound interest, which involves adding the accrued interest to the account periodically, allowing the interest to grow over time.

The interest earned on an interest bearing checking account is typically added to the account on a regular basis, such as monthly or quarterly. The interest can be viewed as a bonus for keeping your money in the account and can help your balance grow over time.

Furthermore, the interest earned on an interest bearing checking account is usually subject to federal and state taxes. This means that you will need to report the interest income on your tax return and pay any applicable taxes. It’s important to keep track of the interest earned and any necessary tax documentation provided by the bank.

Overall, the way interest is earned in an interest bearing checking account can vary between banks, but it is typically calculated based on the average daily balance. By understanding the interest calculation method used by your bank, you can better estimate the interest you will earn and make informed decisions about your finances.

Pros and Cons of Interest Bearing Checking Accounts

Interest bearing checking accounts offer several advantages and disadvantages compared to regular checking accounts. Let’s explore some of the pros and cons to consider when deciding whether an interest bearing checking account is right for you.

Pros:

- Earn Interest: The primary benefit of an interest bearing checking account is the ability to earn interest on your deposited funds. This allows your money to work for you, potentially growing your balance over time.

- Liquidity: Unlike traditional savings accounts, interest bearing checking accounts provide easy access to your funds. You can still write checks, make electronic payments, and use a debit card for your everyday transactions, while still earning interest on your balance.

- Convenience: With an interest bearing checking account, you can conveniently manage your day-to-day financial transactions while earning interest. You don’t have to maintain multiple accounts for different purposes, thus simplifying your financial life.

- Protection: Like regular checking accounts, interest bearing checking accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, giving you peace of mind that your funds are protected.

Cons:

- Higher Balance Requirements: Some interest bearing checking accounts may require a higher minimum balance to earn interest or avoid monthly maintenance fees. It’s important to review the account requirements and associated fees to ensure you can meet them.

- Lower Interest Rates: While earning interest is a benefit, the interest rates on interest bearing checking accounts may be lower compared to other savings or investment options. It’s important to compare the rates offered by different banks to ensure you are getting the best return on your money.

- Transaction Limitations: Depending on the account terms, interest bearing checking accounts may have limitations on the number of transactions or withdrawals you can make per month. Exceeding these limits may result in additional fees or a loss of interest earning potential.

- Opportunity Cost: By keeping your funds in an interest bearing checking account, you may miss out on potentially higher returns by investing in other financial instruments such as stocks, bonds, or certificates of deposit (CDs).

It’s important to carefully weigh the pros and cons of an interest bearing checking account based on your individual financial goals and circumstances. Determine how much you value earning interest, compared to the potential limitations and opportunity cost. This will help you make an informed decision about the type of checking account that best suits your needs.

Factors to Consider before Opening an Interest Bearing Checking Account

While an interest bearing checking account can offer several benefits, it’s essential to consider a few factors before opening one. Taking the time to evaluate these factors will help ensure that the account aligns with your financial needs and goals. Here are some key considerations:

1. Interest Rates:

Compare the interest rates offered by different banks for their interest bearing checking accounts. Look for competitive rates that will maximize your earnings. Keep in mind that interest rates may fluctuate over time, so consider both current rates and long-term trends.

2. Minimum Balance Requirements:

Determine if there is a minimum balance required to open an account and whether you need to maintain a specific balance to avoid maintenance fees or qualify for interest. Make sure the minimum balance requirement is within your financial means and aligns with your banking habits.

3. Fees and Charges:

Review the account fees associated with an interest bearing checking account. These can include monthly maintenance fees, overdraft fees, and transaction fees. Consider how these fees may impact your account balance and overall banking costs.

4. Transaction Limitations:

Check if there are any limitations on the number of transactions or withdrawals you can make per month. Some interest bearing checking accounts may have restrictions to maintain the account’s interest earning capabilities. Ensure that the transaction limitations align with your banking needs.

5. Bank Reputation and Services:

Research the reputation and reliability of the bank offering the interest bearing checking account. Look for a bank with good customer service, convenient branch locations, and robust online and mobile banking services. Consider the bank’s track record in providing secure and reliable financial services.

6. Additional Account Features:

Explore any additional features or perks that come with the interest bearing checking account. These may include online bill payment services, ATM fee reimbursements, and access to discounts or rewards programs. Assess whether these features align with your banking preferences and lifestyle.

7. Tax Implications:

Consider the tax implications of earning interest on an interest bearing checking account. Interest earned is typically subject to federal and state income taxes. Consult with a tax professional to understand the tax responsibilities associated with your account.

By carefully considering these factors, you can make an informed decision about opening an interest bearing checking account that suits your financial needs and goals. Remember to prioritize aspects such as the interest rate, fees, transaction limitations, and the overall reliability and convenience of the bank. This evaluation process will help ensure that you choose the right account for your financial well-being.

Comparison with Regular Checking Accounts

When considering whether to open an interest bearing checking account, it’s important to understand how it compares to a regular checking account. Here’s a comparison of the key differences between the two:

1. Earning Potential:

The most significant difference between the two types of accounts is the earning potential. With a regular checking account, your funds typically do not earn any interest. On the other hand, an interest bearing checking account allows you to earn interest on the balance of the account.

2. Balance Requirements:

Regular checking accounts usually have lower or no minimum balance requirements. They are designed to meet basic transactional needs without the pressure of maintaining a certain balance. In contrast, interest bearing checking accounts may have higher minimum balance requirements to earn interest or avoid monthly maintenance fees.

3. Transaction Limitations:

Regular checking accounts generally have no or minimal transaction limitations. You can make unlimited withdrawals, transfers, and transactions without incurring additional fees. Interest bearing checking accounts, however, may have restrictions on the number of transactions or withdrawals allowed per month to maintain their interest earning ability.

4. Fees and Charges:

Regular checking accounts often have lower fees compared to interest bearing checking accounts. While regular checking accounts may have fees for certain services like overdrafts or returned checks, interest bearing checking accounts may have monthly maintenance fees and higher transaction fees to offset the cost of providing interest on the account.

5. Purpose:

Regular checking accounts are primarily used for everyday banking transactions and managing day-to-day expenses. They offer convenience and accessibility. Interest bearing checking accounts serve the same purpose but also provide the added benefit of earning interest on the account balance. They are ideal for individuals who maintain a higher account balance and want their money to work for them.

6. Flexibility:

Regular checking accounts are more flexible when it comes to accessing and using funds. You have no or few limitations on withdrawals and transfers. In contrast, interest bearing checking accounts may have limitations on transactions to maintain the account’s interest earning ability. This can be significant if you need frequent access to your funds.

Ultimately, the choice between a regular checking account and an interest bearing checking account depends on your financial goals, account balance, and banking habits. If you prioritize earning interest and can meet the minimum balance requirements, an interest bearing checking account may be a suitable option. However, if flexibility and lower fees are more important to you, a regular checking account may be the better choice. Consider your financial needs and preferences to make the decision that aligns with your objectives.

How to Open an Interest Bearing Checking Account

Opening an interest bearing checking account is a straightforward process. Here are the steps to follow:

1. Research Different Banks:

Start by researching different banks that offer interest bearing checking accounts. Look for reputable banks with favorable interest rates, low fees, and convenient account features.

2. Compare Account Options:

Compare the account options offered by different banks. Consider factors such as minimum balance requirements, interest rates, fees, transaction limitations, and additional account features. Choose the account that best suits your needs and preferences.

3. Gather Required Documentation:

Gather the necessary documentation to open an account. This typically includes a valid government-issued photo ID (such as a driver’s license or passport), proof of address (such as a utility bill), and your Social Security number or Tax Identification Number (TIN).

4. Visit the Bank:

Visit the chosen bank’s branch location or their website to initiate the account-opening process. If visiting the branch, bring the required documentation with you. If applying online, follow the instructions provided on the bank’s website.

5. Complete the Application:

Complete the account application form provided by the bank. Provide accurate and up-to-date personal information, and ensure that all required sections are filled out properly. Review the terms and conditions of the account before submitting the application.

6. Fund Your Account:

Once your application is approved, the bank will provide instructions on how to fund your account. This typically involves making an initial deposit either by transferring funds from another account, writing a check, or using an online payment service.

7. Activate Your Account:

Once you have funded your account, the bank will activate your interest bearing checking account. You will receive account details, such as an account number and any associated debit card, which you can use to access your funds.

8. Begin Using Your Account:

Once your account is activated, you can start using your interest bearing checking account for your financial transactions. Write checks, make electronic payments, use your debit card, and manage your finances conveniently while earning interest on your balance.

Remember to keep track of your transactions, review your statements regularly, and review any notifications or updates from the bank about your account. This will help you effectively manage your interest bearing checking account and maximize its benefits.

Tips for Managing an Interest Bearing Checking Account

Managing an interest bearing checking account effectively can help you make the most of its benefits. Here are some valuable tips to consider:

1. Maintain the Required Minimum Balance:

Ensure that you meet the minimum balance requirement to earn interest and avoid monthly maintenance fees. Falling below the required balance can result in a loss of interest and potentially additional charges.

2. Track Your Transactions:

Keep a close eye on your account activity and regularly review your statements. Track your deposits, withdrawals, and any fees incurred. This will help you stay on top of your finances and identify any discrepancies or unauthorized transactions.

3. Set up Account Alerts:

Take advantage of account alerts provided by your bank. These alerts can notify you of low balances, large transactions, or any suspicious activity on your account. By staying informed, you can quickly address any issues and maintain control over your account.

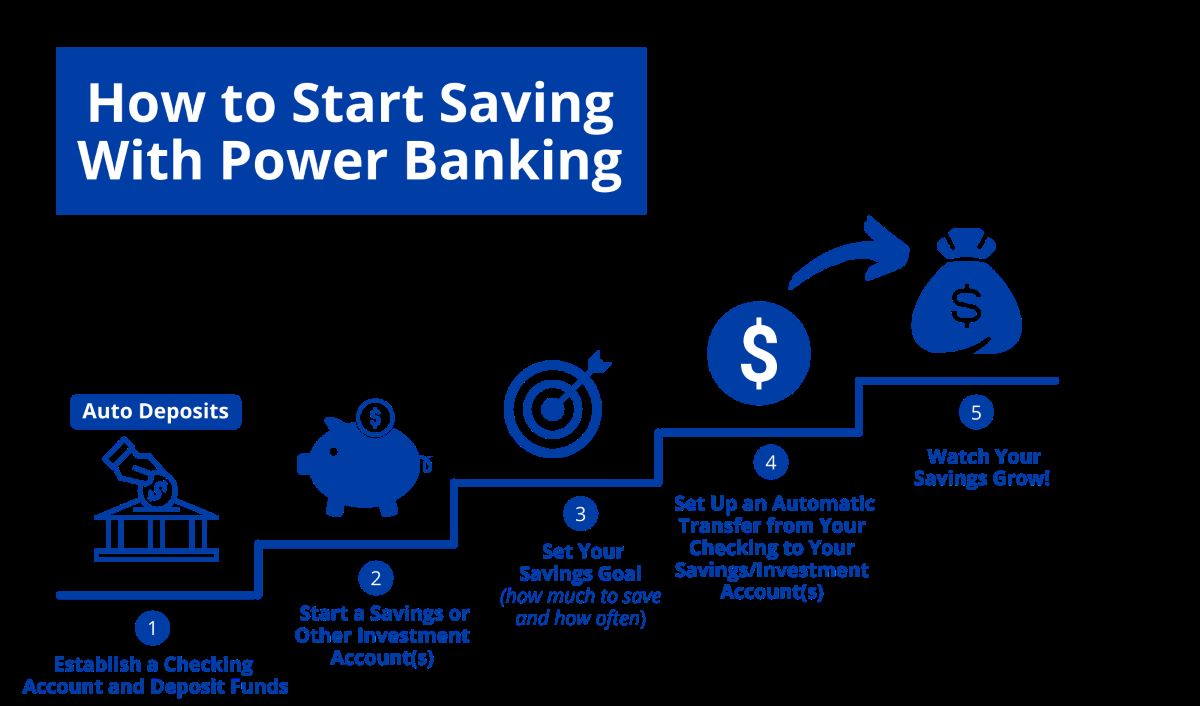

4. Automate Your Finances:

Consider setting up automatic deposits or transfers to your interest bearing checking account. Automating regular deposits can help you consistently build your balance and maximize the interest earned.

5. Use Online and Mobile Banking:

Utilize the online and mobile banking features provided by your bank. This will allow you to conveniently monitor your account, track transactions, and make transfers or payments from anywhere at any time. The ability to bank on the go can help you stay organized and in control of your finances.

6. Review Your Banking Needs Regularly:

Regularly assess your financial habits and needs to ensure that your interest bearing checking account is still the best option for you. If your banking requirements change, consider discussing with your bank if another account type or product may better align with your needs.

7. Maximize Your Interest Earnings:

If there are opportunities to earn higher interest rates on your account, such as through promotional offers or tiered interest rates, explore those options. Be proactive in researching and comparing different banks and their offerings to find the most competitive interest rates available.

8. Monitor Interest Rate Changes:

Interest rates can fluctuate over time. Stay informed about any changes in interest rates offered by your bank. If you notice a significant drop in rates, you may want to consider exploring other banks or account options that provide better opportunities for growth.

By implementing these tips, you can effectively manage your interest bearing checking account, optimize your earnings, and maintain control over your finances. Regular monitoring, automation, and leveraging digital banking tools will help you make the most of your account’s features and benefits.

Conclusion

Choosing the right checking account is an important financial decision, and an interest bearing checking account can provide you with additional benefits that a regular checking account may not offer. By earning interest on your deposited funds, an interest bearing checking account allows your money to grow while providing the convenience and accessibility of a traditional checking account.

Throughout this article, we have explored the definition of an interest bearing checking account, how interest is earned, the pros and cons of these accounts, factors to consider before opening one, a comparison with regular checking accounts, and tips for managing them effectively.

Before opening an interest bearing checking account, it’s essential to consider factors such as interest rates, minimum balance requirements, fees, transaction limitations, and the reputation of the bank. These factors will ensure that the account aligns with your financial needs and goals.

Once you have opened an interest bearing checking account, it’s important to manage it effectively. This includes maintaining the required minimum balance, tracking your transactions, leveraging online and mobile banking tools, and staying informed about any changes in interest rates or account features. By following these tips, you can make the most of your account and maximize your earnings.

Remember that opening an interest bearing checking account is just one piece of your overall financial strategy. It’s important to consider your broader financial goals, such as saving for emergencies, investing for retirement, or paying down debt. Evaluating your entire financial picture and seeking guidance from a trusted financial advisor can help you make well-informed decisions and achieve financial success.

In conclusion, an interest bearing checking account provides the opportunity to earn interest while managing your day-to-day financial transactions. By understanding the features, benefits, and considerations associated with these accounts, you can make an informed decision and take control of your financial journey.