Home>Finance>What Is The Limit For Earned Income Credit 2016

Finance

What Is The Limit For Earned Income Credit 2016

Modified: February 21, 2024

Learn about the maximum limit for the Earned Income Credit in 2016 and how it can impact your finances. Ensure you take advantage of this tax credit opportunity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Earned Income Credit

- Changes to Earned Income Credit for 2016

- Qualifying Criteria for Earned Income Credit in 2016

- Income Limits for Earned Income Credit in 2016

- Calculating the Earned Income Credit in 2016

- Additional Factors Affecting the Earned Income Credit in 2016

- Common Questions about the Earned Income Credit in 2016

- Conclusion

Introduction

The Earned Income Credit (EIC) is a tax benefit designed to assist lower-income individuals and families in the United States. It is a refundable credit, meaning that even if you don’t owe any taxes, you may still receive a refund if you qualify. The EIC was established in 1975 to help alleviate the financial burden of low-wage workers and encourage workforce participation.

The EIC has undergone some changes in recent years, including updates to the income limits and qualifying criteria. It’s important to stay informed about these changes to ensure you receive the maximum benefit available to you. In this article, we will discuss the limit for Earned Income Credit in 2016 and provide an overview of the qualification criteria and calculation methods.

Whether you’re an individual looking to claim the EIC or a tax professional assisting clients, understanding the rules and regulations surrounding the credit is essential. So, let’s dive in and explore what you need to know about the Earned Income Credit for the year 2016.

Overview of Earned Income Credit

The Earned Income Credit (EIC) is a tax credit designed to assist low to moderate-income individuals and families. It is intended to provide financial relief by reducing the amount of taxes owed or, in some cases, providing a refund even if there is no tax liability. This credit can make a significant difference in the financial well-being of eligible taxpayers.

The amount of the credit depends on various factors, including income, filing status, and the number of qualifying children. The EIC is calculated based on earned income, which includes wages, tips, and self-employment income. It is important to note that investment income does not count towards the earned income calculation for the EIC.

The EIC is a refundable credit, meaning that if the credit exceeds the amount of taxes owed, the excess is refunded to the taxpayer. This can provide a much-needed financial boost for families and individuals with low incomes.

One of the major advantages of the Earned Income Credit is that it is progressive, meaning that the credit amount increases as earned income increases, up to a certain limit. This helps ensure that those with lower incomes receive a larger credit. On the other hand, as income increases beyond the threshold, the credit gradually phases out.

The EIC is a valuable tax benefit that can help lift individuals and families out of poverty and improve their overall financial situation. It is important to understand the eligibility requirements and how to calculate the credit accurately to maximize its benefits.

Changes to Earned Income Credit for 2016

Like any tax credit, the Earned Income Credit undergoes changes and updates over time. It’s crucial to stay informed about these changes to ensure you are eligible for the maximum credit amount. Here are some notable changes to the Earned Income Credit for the year 2016:

- Income Limits: The income limits for the Earned Income Credit in 2016 were slightly adjusted compared to previous years. These limits determine if an individual or family is eligible to claim the credit. It’s important to note that the income limits vary based on filing status and the number of qualifying children.

- Phase-out Range: The phase-out range for the Earned Income Credit in 2016 was also adjusted. This range determines at what income level the credit begins to phase out. Once an individual’s or family’s income exceeds the upper limit of the phase-out range, the credit gradually reduces until it is completely phased out.

- Qualifying Child Rules: The rules for determining if a child qualifies for the Earned Income Credit remained relatively unchanged in 2016. However, it’s always important to familiarize yourself with these rules to ensure you meet the criteria for claiming the credit.

- Expanded Eligibility for Childless Workers: One significant change to the Earned Income Credit in 2016 was the expansion of eligibility for childless workers. Previously, the credit amount for individuals without qualifying children was quite limited. However, the changes made in 2016 allowed more individuals without children to qualify for a higher credit amount.

It’s crucial to consult the official guidelines and tax resources to fully understand the changes made to the Earned Income Credit for a specific year. Staying up to date with these changes ensures that you can make proper use of the credit and receive all the benefits you are eligible for.

Qualifying Criteria for Earned Income Credit in 2016

To claim the Earned Income Credit (EIC) for the year 2016, taxpayers must meet specific qualifying criteria. These criteria are designed to ensure that the credit reaches those who need it most. Here are the key requirements for qualifying for the EIC in 2016:

- Earned Income: You must have earned income from employment, self-employment, or certain other sources. Investment income does not count towards earned income for the purposes of the EIC.

- Filing Status: You must file your taxes using one of the following statuses: Single, Married Filing Jointly, Head of Household, or Qualifying Widow(er) with Dependent Child.

- Citizenship Status: You, your spouse if filing jointly, and any children claimed for the credit must have a valid social security number and be a U.S. citizen, resident alien, or non-resident alien married to a U.S. citizen or a resident alien.

- Family Status: The EIC eligibility also depends on your family status. To qualify, you must be either married and filing jointly, or your child must meet all the qualifying child rules.

- Income Limits: The Earned Income Credit is income-limited. The total earned income and adjusted gross income (AGI) must be below specific thresholds which are determined by the number of qualifying children. The income limits for 2016 vary based on filing status and the number of qualifying children.

- Age Requirements: There are certain age requirements for claiming the EIC. You must be between the ages of 25 and 65 at the end of the tax year unless you have a qualifying child.

- Investment Income Limit: Your investment income must not exceed $3,400 for the year. If your investment income exceeds this limit, you will not be eligible for the EIC.

- Not a Qualifying Child Dependent: You cannot claim the EIC if you are claimed as a dependent on someone else’s tax return.

It’s crucial to carefully review the specific requirements for the year you are claiming the EIC. To ensure accuracy and maximize your credit eligibility, consult a tax professional or refer to the official IRS guidelines and publications.

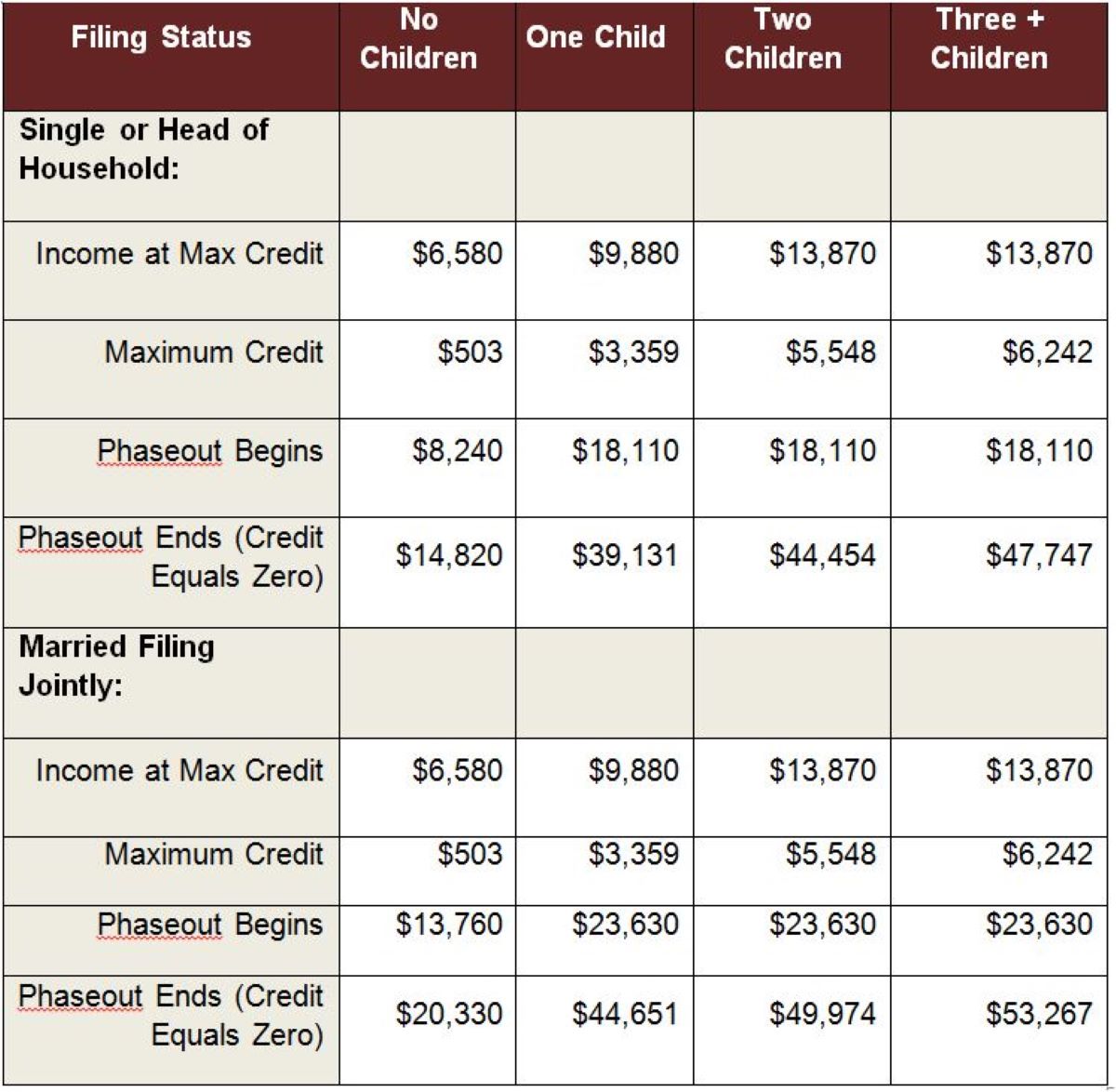

Income Limits for Earned Income Credit in 2016

The Earned Income Credit (EIC) is subject to income limits, which determine if an individual or family is eligible to claim the credit and the amount they can receive. The income limits for the EIC in 2016 vary based on filing status and the number of qualifying children. Here are the income limits for 2016:

- Filing Status: Single or Married Filing Separately

– Zero qualifying children: The income limit is $14,880.

– One qualifying child: The income limit is $39,296.

– Two qualifying children: The income limit is $44,648.

– Three or more qualifying children: The income limit is $47,955. - Filing Status: Head of Household

– Zero qualifying children: The income limit is $20,430.

– One qualifying child: The income limit is $44,846.

– Two qualifying children: The income limit is $50,198.

– Three or more qualifying children: The income limit is $53,505. - Filing Status: Married Filing Jointly

– Zero qualifying children: The income limit is $20,430.

– One qualifying child: The income limit is $44,846.

– Two qualifying children: The income limit is $50,198.

– Three or more qualifying children: The income limit is $53,505. - Filing Status: Qualifying Widow(er) with Dependent Child

– Zero qualifying children: The income limit is $20,430.

– One qualifying child: The income limit is $44,846.

– Two qualifying children: The income limit is $50,198.

– Three or more qualifying children: The income limit is $53,505.

It’s important to note that these income limits are subject to change each year. Additionally, the income limits may be adjusted for inflation and other factors. It’s recommended to consult the official IRS guidelines or seek assistance from a tax professional to verify the most up-to-date income limits for the Earned Income Credit. Meeting the income limits is crucial to determining your eligibility for the credit and the amount you can claim.

Calculating the Earned Income Credit in 2016

Calculating the Earned Income Credit (EIC) can be complex, especially with the various factors that come into play. The EIC amount is based on a formula that considers the individual’s or family’s earned income, filing status, and the number of qualifying children. Here’s a general overview of how the EIC is calculated for the year 2016:

- Determine Earned Income: Start by calculating your earned income for the year. This includes wages, salaries, tips, and self-employment income. Investment income, pensions, and other unearned income do not count towards the earned income calculation for the EIC.

- Review Filing Status: Identify your filing status, which can be Single, Married Filing Jointly, Head of Household, or Qualifying Widow(er) with Dependent Child.

- Number of Qualifying Children: Determine the number of qualifying children you have. A qualifying child is a dependent who meets specific criteria, including age, relationship, and residency.

- Consult EIC Table: Use the Earned Income Credit table provided by the IRS to find the credit amount that corresponds to your earned income, filing status, and the number of qualifying children you have. This table provides a range of credit amounts based on income.

- Calculate Percentage: Once you determine the credit amount from the EIC table, calculate the percentage of your earned income that corresponds to the credit. The percentage varies based on income and the number of qualifying children.

- Apply Phase-out Rules: If your income exceeds the upper limit of the phase-out range, the credit begins to phase out. The credit is gradually reduced until it is completely phased out. Consult the IRS guidelines or a tax professional to understand the phase-out rules and limitations.

- Claiming the Credit: When you file your tax return, you will need to complete the appropriate forms, such as Form 1040 or Form 1040A, and include the necessary information to claim the Earned Income Credit.

It’s important to note that the calculations and guidelines for the EIC can be complex, and there may be additional rules and exceptions that apply. It’s recommended to consult the official IRS guidelines or seek assistance from a tax professional to ensure accurate calculation and maximize your Earned Income Credit in 2016.

Additional Factors Affecting the Earned Income Credit in 2016

While the Earned Income Credit (EIC) primarily depends on earned income, filing status, and the number of qualifying children, there are additional factors that can affect the credit amount or eligibility. It’s important to consider these factors when calculating and claiming the EIC for the year 2016. Here are some additional factors to keep in mind:

- Marriage and Divorce: If you got married or divorced during the tax year, it can impact your eligibility and the amount of the EIC. Changes in filing status and the number of qualifying children may occur, affecting the credit calculation.

- Other Dependents: While the EIC primarily takes into account qualifying children, certain other dependents, such as disabled dependents, may also impact the credit. Ensure you understand the rules regarding other dependents and consult the IRS guidelines for further information.

- IRS Identity Protection PIN: If you have an IRS Identity Protection PIN, make sure to include it when claiming the EIC. This unique six-digit PIN helps protect against tax-related identity theft and ensures the accurate processing of your tax return.

- Child Support: Child support received is not considered earned income and does not affect the calculation of the EIC. However, it’s important to accurately report any child support received on your tax return.

- Taxable and Nontaxable Income: Different types of income may have different implications for the EIC. For example, certain nontaxable income, such as certain military allowances or benefits, may be excluded from the calculation of the credit.

- Tax Withholdings and Payments: Adjustments to your tax withholdings and payments throughout the year can have an impact on the credit amount. Make sure to review your tax withholdings and consult a tax professional for optimal tax planning.

- Education Expenses: While education expenses do not directly impact the EIC calculation, they may qualify for other education-related tax benefits, such as the American Opportunity Credit or the Lifetime Learning Credit. Explore these options to maximize your tax savings.

- State and Local EIC: In addition to the federal EIC, some states and local jurisdictions offer their own versions of the credit. Review your state and local tax laws to see if you may qualify for additional EIC benefits.

These additional factors can have implications for the Earned Income Credit in 2016. It’s recommended to consult the official IRS guidelines or seek assistance from a tax professional to fully understand how these factors may affect your specific tax situation and the calculation of the EIC.

Common Questions about the Earned Income Credit in 2016

As the Earned Income Credit (EIC) can be complex and subject to various rules and provisions, it’s natural to have questions about how it works. Here are some common questions and answers about the EIC for the year 2016:

- Q: Can self-employed individuals claim the EIC?

A: Yes, self-employed individuals can claim the EIC if they meet the qualifying criteria. However, accurately calculating self-employment income and understanding the specific rules for self-employed taxpayers is essential. - Q: Can I still claim the EIC if I don’t owe any taxes?

A: Yes, the EIC is a refundable credit, which means that if the credit amount exceeds your tax liability, you may receive a refund for the remaining credit amount. - Q: Can I claim the EIC if I am a full-time student?

A: In general, full-time students who are under the age of 24 cannot claim the EIC unless they have a qualifying child. However, there are exceptions for certain individuals with disabilities or those who are married and filing jointly. - Q: Are there income limits for claiming the EIC?

A: Yes, there are income limits for the EIC. The income limits vary based on filing status, the number of qualifying children, and whether you are eligible for the expanded income limit options. - Q: Do I need a Social Security Number to claim the EIC?

A: Yes, you, your spouse (if filing jointly), and any qualifying children must have valid Social Security Numbers to claim the EIC. This helps verify eligibility and prevent fraudulent claims. - Q: What happens if I make a mistake on my EIC claim?

A: If you made a mistake on your EIC claim, it’s important to correct it as soon as possible. Incorrect or fraudulent claims can result in penalties and could affect future eligibility for the credit. You may need to file an amended return or contact the IRS for guidance. - Q: Can I claim the EIC if I am claimed as a dependent on someone else’s tax return?

A: No, you cannot claim the EIC if you are claimed as a dependent on someone else’s tax return. However, if you have a qualifying child and meet certain criteria, you may be eligible for the EIC even if you are claimed as a dependent.

It’s important to review the official IRS guidelines, consult a tax professional, or use reputable tax software to ensure accurate and compliant claims for the Earned Income Credit in 2016. Understanding the rules and requirements will help you make the most of this valuable tax credit.

Conclusion

The Earned Income Credit (EIC) is a significant tax benefit designed to provide financial relief to low to moderate-income individuals and families. Understanding the rules and guidelines surrounding the EIC for the year 2016 is crucial in order to maximize your eligibility and claim the appropriate credit amount.

Throughout this article, we have discussed the various aspects of the EIC, including its overview, changes in 2016, qualifying criteria, income limits, calculation methods, additional factors affecting eligibility, and answered common questions. By familiarizing yourself with these details, you can ensure accurate calculation and claim the EIC successfully.

Remember to stay informed about any changes to the EIC and consult official IRS guidelines or seek assistance from a tax professional to ensure compliance and optimize your EIC benefits. The EIC can serve as a valuable tool in improving your financial situation, relieving tax burdens, and even providing a refund, so take advantage of this tax credit if you are eligible.

By staying informed and understanding the intricacies of the EIC, you can make the most of this tax credit and potentially improve your overall financial well-being. Don’t hesitate to seek professional advice if you have any questions or need assistance with your EIC claim. Take the appropriate steps to optimize your tax return and make the most of the Earned Income Credit.