Finance

When Is It Ok Not To Have Health Insurance?

Published: November 16, 2023

Discover when it's acceptable to go without health insurance and find alternative financial options to protect your finances with this comprehensive finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Health Insurance

- When It May Be Acceptable to Not Have Health Insurance

- Low-Income Individuals Eligible for Government Programs

- Individuals with Employer-Sponsored Coverage

- Those Who Qualify for Exemptions under the Affordable Care Act

- Individuals with Access to Alternative Healthcare Options

- Young and Healthy Individuals

- People with Religious Beliefs Regarding Medical Treatment

- Risks of Not Having Health Insurance

- Conclusion

Introduction

Health insurance is an essential component of modern life, offering financial protection against medical expenses and ensuring access to quality healthcare. However, there are certain circumstances where not having health insurance may be acceptable. While it is generally advisable to have health coverage, there are scenarios where individuals may be exempted from this requirement or have access to alternative healthcare options.

In this article, we will explore situations where it may be deemed acceptable to not have health insurance, while highlighting the potential risks and consequences of being uninsured. It’s important to note that the decision to forego health insurance should be carefully considered and based on individual circumstances, as having coverage is typically recommended to protect against unexpected medical costs.

It is critical to have a basic understanding of health insurance in order to assess when it may be acceptable to go without coverage. Health insurance works by pooling resources from individuals to provide financial support for medical expenses. Policyholders pay premiums, and in return, the insurance company covers a portion of their medical costs. This coverage can include doctor visits, hospital stays, prescription medications, and more, depending on the specific plan.

Typically, health insurance can be obtained through government programs, such as Medicaid or Medicare, employer-sponsored coverage, or individual plans purchased on the healthcare marketplace. However, there are instances where individuals may qualify for exemptions or have access to alternative healthcare options that make it permissible to forgo traditional health insurance.

Understanding Health Insurance

To make informed decisions about health insurance, it’s crucial to have a clear understanding of how it works. Health insurance operates on the principle of risk-sharing, where individuals pay premiums into a pool that is used to cover the medical expenses of policyholders who require healthcare services.

When you have health insurance, you typically have access to a network of healthcare providers who have contracted with your insurance company. These providers are considered in-network, meaning they have agreed to provide healthcare services at negotiated rates. If you seek medical treatment from an out-of-network provider, your insurance coverage may be limited, and you may be responsible for a higher percentage of the cost.

Health insurance plans often come with a deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. Once you meet the deductible, the insurance company will typically cover a percentage of your medical expenses, known as co-insurance, while you are responsible for the remaining portion.

In addition to the deductible and co-insurance, health insurance plans may also require copayments for specific services, such as doctor visits or prescription medications. Copayments are fixed amounts that you pay at the time of service.

It’s important to carefully review the benefits and coverage details of any health insurance plan you are considering. Compare the costs and benefits of different plans to find the one that best fits your needs and budget. Keep in mind that while premiums may vary, it’s essential to consider the overall value of a plan, including the deductible, co-insurance, copayments, and coverage limits.

Understanding the basics of health insurance will help you navigate the decision-making process when determining if it is acceptable for you to go without coverage. While it is generally recommended to have health insurance for financial protection and access to necessary healthcare services, there are certain circumstances where it may be acceptable and reasonable to forgo traditional insurance coverage.

When It May Be Acceptable to Not Have Health Insurance

While having health insurance is typically advisable, there are situations where it may be deemed acceptable to not have coverage. It’s important to note that these circumstances vary depending on individual factors, such as income, employment, and personal beliefs. Here are some scenarios where not having health insurance may be acceptable:

- Low-Income Individuals Eligible for Government Programs: Low-income individuals and families may qualify for government programs like Medicaid or the Children’s Health Insurance Program (CHIP). These programs provide comprehensive healthcare coverage to those who meet income requirements, making it acceptable to not have additional health insurance.

- Individuals with Employer-Sponsored Coverage: If you have access to affordable and comprehensive health insurance through your employer, it may be acceptable to rely solely on this coverage. Employer-sponsored plans often offer comprehensive benefits and are subsidized by the employer, making it a viable option for individuals.

- Those Who Qualify for Exemptions under the Affordable Care Act: The Affordable Care Act (ACA) mandates that individuals have health insurance or pay a penalty. However, there are certain exemptions available for individuals who meet specific criteria. If you qualify for an exemption, it may be deemed acceptable to not have health insurance.

- Individuals with Access to Alternative Healthcare Options: Some individuals may have access to alternative healthcare options, such as direct primary care or healthcare sharing ministries. These alternatives can provide affordable and accessible healthcare outside of traditional health insurance models, making it acceptable not to have conventional coverage.

- Young and Healthy Individuals: Young individuals who are generally healthy may choose to forgo health insurance, especially if they are unlikely to require frequent medical attention. However, it’s important to consider the potential risks and unforeseen circumstances that may arise.

- People with Religious Beliefs Regarding Medical Treatment: There are individuals who hold strong religious beliefs that might discourage or prevent them from seeking conventional medical treatment. In such cases, not having health insurance may align with their beliefs and be considered acceptable.

Each situation is unique, and it’s crucial to evaluate your specific circumstances before deciding to go without health insurance. It’s important to understand the potential risks and consequences associated with being uninsured, as well as the availability of other healthcare options.

Although it may be acceptable in certain situations to not have health insurance, it’s important to remember that unforeseen medical emergencies or unexpected health issues can arise. Being uninsured can leave you vulnerable to significant financial burden and limited access to necessary healthcare services. It is recommended that individuals without health insurance explore alternative options, such as short-term health plans or healthcare sharing ministries, to mitigate these risks.

Low-Income Individuals Eligible for Government Programs

One situation where it may be acceptable to not have health insurance is when individuals fall into the low-income bracket and are eligible for government programs such as Medicaid or the Children’s Health Insurance Program (CHIP).

Medicaid is a joint federal and state program that provides health coverage to low-income individuals, including children, pregnant women, adults with disabilities, and the elderly. Eligibility for Medicaid varies by state, but generally, it is based on income and household size. If you meet the requirements, you can enroll in Medicaid and receive comprehensive healthcare coverage at little to no cost.

Similarly, the Children’s Health Insurance Program (CHIP) provides health coverage to children from low-income families. CHIP programs are administered by the states, and eligibility guidelines may vary. However, they generally cover children whose families have incomes too high to qualify for Medicaid but still within the low-income range.

For individuals who qualify for Medicaid or CHIP, not having additional health insurance coverage may be acceptable because these government programs provide comprehensive medical coverage, including doctor visits, hospital stays, preventive care, prescription medications, and more.

It’s important to note that eligibility for these government programs may be based on income limits and household size. As financial situations change, individuals may transition in and out of these programs, necessitating a re-evaluation of their health insurance status.

If you find yourself in a low-income situation and qualify for Medicaid or CHIP, it’s essential to fully understand the benefits and limitations of these programs. Familiarize yourself with the healthcare providers who accept Medicaid or CHIP in your area and ensure that the coverage meets your healthcare needs.

While Medicaid and CHIP provide valuable coverage for low-income individuals, it’s worth considering the potential risks of not having additional health insurance. Unforeseen medical emergencies or health issues that fall outside of the coverage provided by Medicaid or CHIP could result in significant financial burden. Therefore, it’s vital to assess your individual healthcare needs and weigh the benefits and potential drawbacks of relying solely on these government programs.

Individuals with Employer-Sponsored Coverage

Another scenario where it may be acceptable to not have health insurance is when individuals have access to affordable and comprehensive coverage through their employer. Employer-sponsored health insurance plans are a common benefit offered by many companies to their employees.

Employer-sponsored coverage often provides a range of benefits, including medical, dental, and vision care. These plans may have negotiated discounts with healthcare providers, making them a cost-effective option for employees. Additionally, employers often subsidize a portion of the premium, reducing the financial burden on employees.

If you have access to employer-sponsored health insurance, it may be acceptable to rely solely on this coverage. These plans typically offer comprehensive benefits, including preventive care, doctor visits, hospitalization, and prescription medications. Being enrolled in an employer-sponsored plan ensures that you have access to necessary healthcare services and financial protection in case of a medical emergency.

Before deciding to forgo individual health insurance, it’s important to carefully review your employer-sponsored plan. Understand the coverage limits, out-of-pocket costs, and network of healthcare providers. Consider if it meets your specific healthcare needs and if the plan covers your dependents if applicable.

Keep in mind that changes in employment or job status may affect your eligibility for employer-sponsored coverage. If you switch jobs or become self-employed, you may lose access to this type of health insurance. It’s important to consider alternative coverage options during these transitions to ensure continuous protection.

While employer-sponsored coverage offers many advantages, it’s worth noting that the cost of premiums for these plans can still be a significant expense. Some employers may require employees to contribute a portion of the premium, and these contributions can increase over time. It’s important to assess the affordability of the premiums and compare the benefits and costs of the employer-sponsored plan to individual health insurance options available to you.

Overall, if you have access to affordable and comprehensive health insurance through your employer, it may be acceptable to rely on this coverage. However, it’s essential to carefully review the details of the plan and consider the potential risks and limitations, as well as the impact of any career changes on your health insurance status.

Those Who Qualify for Exemptions under the Affordable Care Act

The Affordable Care Act (ACA) requires individuals to have health insurance coverage or face a penalty, known as the individual mandate. However, there are certain exemptions available for individuals who meet specific criteria. If you qualify for one of these exemptions, it may be deemed acceptable to not have health insurance.

Exemptions under the ACA can be granted for various reasons, including financial hardship, religious beliefs, tribal membership, and certain hardships related to healthcare access. Some common exemptions include:

- Income-related Exemptions: If the cost of health insurance is deemed unaffordable based on your household income, you may qualify for an exemption. Affordability is determined based on a percentage of your income that exceeds a certain threshold.

- Short Coverage Gap: If you had a gap in health coverage for less than three consecutive months during the year, you may be exempt from the individual mandate penalty for that period.

- Religious Beliefs: Individuals who have religious beliefs that are contrary to accepting health insurance coverage may qualify for an exemption.

- Hardship Exemptions: There are specific hardship exemptions for individuals facing circumstances such as bankruptcy, eviction, domestic violence, or the death of a close family member. These exemptions allow individuals to be exempt from the penalty for not having health insurance.

If you qualify for one of these exemptions, it is acceptable under the ACA to not have health insurance coverage without incurring a penalty. However, it’s important to review and understand the specific requirements and qualifications for each exemption to ensure compliance with the law.

It’s worth noting that even if you qualify for an exemption, unforeseen medical emergencies or unexpected health issues can still occur. Being uninsured in such situations can leave you vulnerable to significant financial burden and limited access to necessary healthcare services. Exploring alternative healthcare options, such as short-term health plans or healthcare sharing ministries, can help mitigate these risks.

Before making a decision to forgo health insurance based on an exemption, it’s advisable to consult with a qualified professional or seek guidance from the healthcare marketplace to fully understand your options and ensure compliance with the ACA regulations.

Individuals with Access to Alternative Healthcare Options

In certain situations, individuals may have access to alternative healthcare options that provide affordable and accessible healthcare outside of traditional health insurance models. If you have access to such alternative healthcare options, it may be acceptable to not have conventional health insurance coverage.

One alternative option is direct primary care (DPC), which involves a direct relationship between the patient and the primary care physician. Through DPC, patients pay a monthly or annual fee to their primary care physician in exchange for a broad range of primary care services. This model often eliminates the need for traditional health insurance for routine and preventive care, as these services are covered under the DPC agreement.

Another alternative option is healthcare sharing ministries. These are nonprofit organizations formed by individuals who share similar religious beliefs and contribute towards each other’s medical expenses. Members of healthcare sharing ministries agree to share the cost of medical expenses among the community, often through monthly contributions, providing a form of pooled healthcare funding.

These alternative healthcare options can offer cost-effective and accessible healthcare services. However, it is important to understand that they may have limitations. For example, healthcare sharing ministries often have specific guidelines and restrictions, such as restrictions based on pre-existing conditions or a required adherence to certain religious beliefs.

If you have access to alternative healthcare options like direct primary care or healthcare sharing ministries, it is essential to thoroughly research and understand the terms, limitations, and coverage provided by these options. You should also consider how they align with your individual healthcare needs and preferences.

While alternative healthcare options may provide affordable access to certain healthcare services, they may not offer the same level of comprehensive coverage and protection against high-cost medical procedures or hospitalization. It is important to weigh the potential risks and consider supplemental coverage options if necessary.

Additionally, it is crucial to assess your personal circumstances and healthcare needs before making the decision to forego traditional health insurance. Unforeseen medical emergencies or unexpected health issues can arise, and not having adequate coverage may leave you vulnerable to financial hardship and limited access to necessary care. Evaluating the potential risks and exploring all available healthcare options will help you make an informed decision regarding your insurance coverage.

Young and Healthy Individuals

One group of individuals for whom it may be acceptable to not have health insurance is young and healthy individuals. Young adults, especially those in their 20s and 30s, often believe they are in good health and less likely to require frequent medical attention. In these situations, going without health insurance may seem like a viable option.

Young and healthy individuals often have fewer medical needs and may not have chronic health conditions that require regular medical care. They may also have fewer financial responsibilities and may prioritize spending their money on other needs or goals.

However, it’s important for young individuals to carefully consider the potential risks of not having health insurance. Even if you are healthy now, unforeseen accidents or illnesses can occur. In such cases, having health insurance can provide financial protection and access to necessary medical care without incurring significant out-of-pocket expenses.

Additionally, health insurance not only covers unexpected medical events but also offers preventive care and screenings, which are important for early detection and addressing potential health issues before they become more severe and costly.

Another factor to consider is compliance with the Affordable Care Act (ACA). While the ACA has exemptions for certain age groups and income thresholds, it’s crucial to ensure that you meet the requirements for exemption if you choose to forego health insurance.

Lastly, it’s important to note that health insurance premiums may be lower for young and healthy individuals compared to older individuals or those with pre-existing conditions. Taking advantage of these lower premiums early in life can provide long-term benefits in terms of continuous coverage and opportunities for comprehensive healthcare services.

Ultimately, the decision to not have health insurance as a young and healthy individual should be made after careful consideration of the potential risks, financial implications, and personal circumstances. It’s advisable to evaluate alternative healthcare options, such as catastrophic coverage plans or short-term health insurance, which can offer some level of protection and cost-effective solutions for unexpected medical events.

However, it’s crucial to remember that life is unpredictable, and having health insurance can provide peace of mind and essential support in the face of unforeseen health issues or emergencies.

People with Religious Beliefs Regarding Medical Treatment

For individuals with strong religious beliefs that prohibit or discourage conventional medical treatment, it may be acceptable to not have health insurance. Religion plays a significant role in shaping personal beliefs and practices, including attitudes towards medical interventions. In these cases, individuals may rely on faith-based healing practices and alternative healthcare options aligned with their religious beliefs.

Some religious groups, such as certain Christian denominations or faiths that follow holistic or natural healing principles, believe in relying solely on prayer, meditation, or alternative treatments for healing. These individuals may choose to forego traditional health insurance and rely on their faith or alternative healthcare options as a means of addressing their health needs.

It’s important to respect and understand the religious beliefs of these individuals. For them, not having health insurance aligns with their religious ideologies and acts as an expression of their faith.

However, it’s important to acknowledge that not having health insurance may present potential risks for individuals with religious beliefs regarding medical treatment. Unforeseen medical emergencies or serious health conditions could arise, requiring specialized medical interventions or surgical procedures. In these situations, the absence of health insurance could lead to financial burden and limited access to necessary care.

For individuals who choose not to have health insurance based on their religious beliefs, it’s recommended to explore faith-based healthcare sharing ministries or other alternative healthcare options. Healthcare sharing ministries are often organized by religious groups and provide a means for members to share medical expenses. These programs may provide a certain level of financial protection and access to healthcare services while aligning with religious beliefs.

It’s worth noting that healthcare sharing ministries are not regulated in the same way as traditional health insurance, and each program may have its own guidelines, limitations, and eligibility requirements. Therefore, it’s important to thoroughly research and understand the details of any faith-based healthcare sharing program before relying on it as an alternative to health insurance.

In summary, individuals with religious beliefs regarding medical treatment may consider not having health insurance as acceptable and in alignment with their faith. However, careful consideration of potential risks and exploration of alternative healthcare options is necessary to ensure adequate financial protection and access to necessary medical care.

Risks of Not Having Health Insurance

While there are circumstances where not having health insurance may be considered acceptable, it’s crucial to understand the potential risks and consequences of being uninsured. Here are some of the risks associated with not having health insurance:

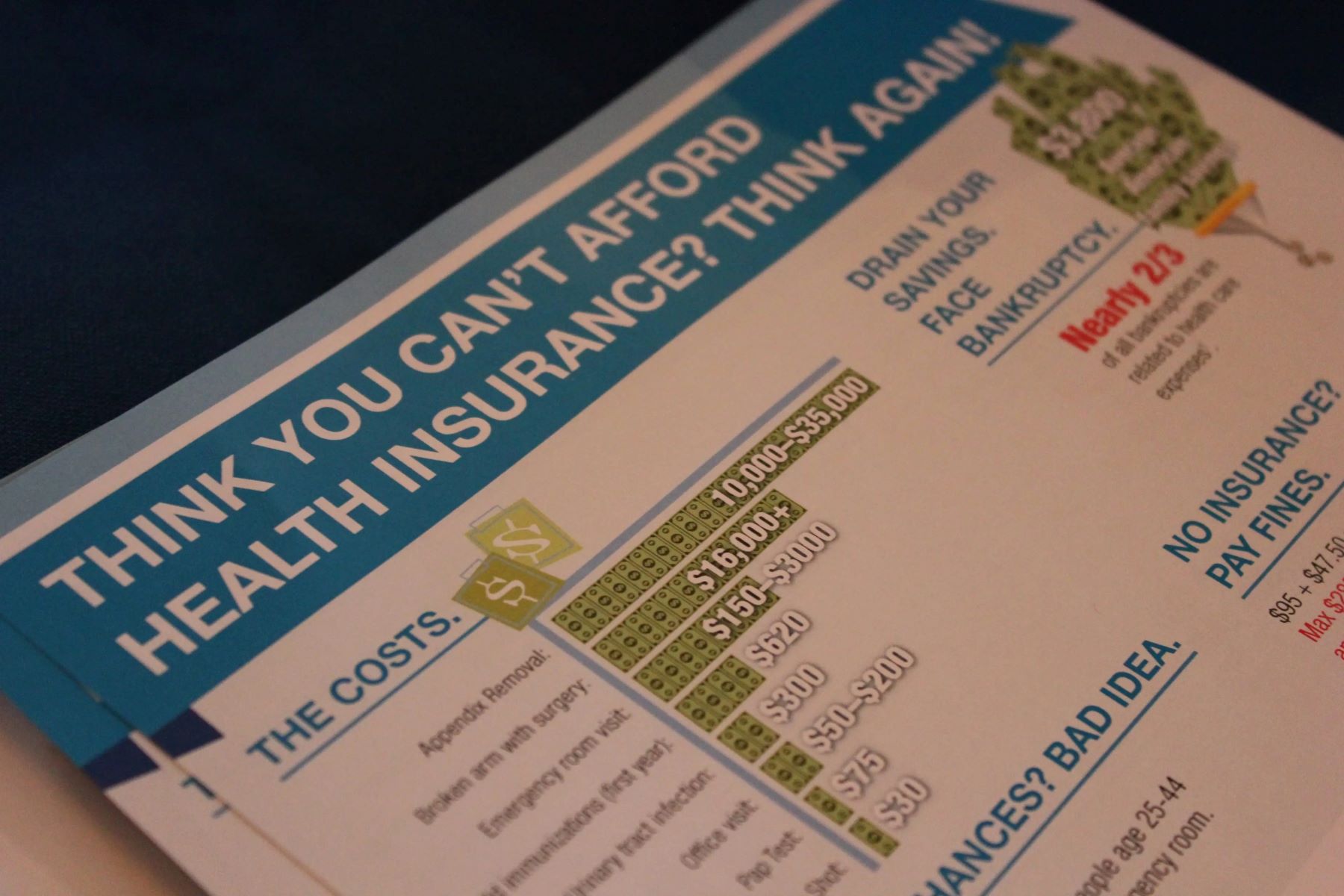

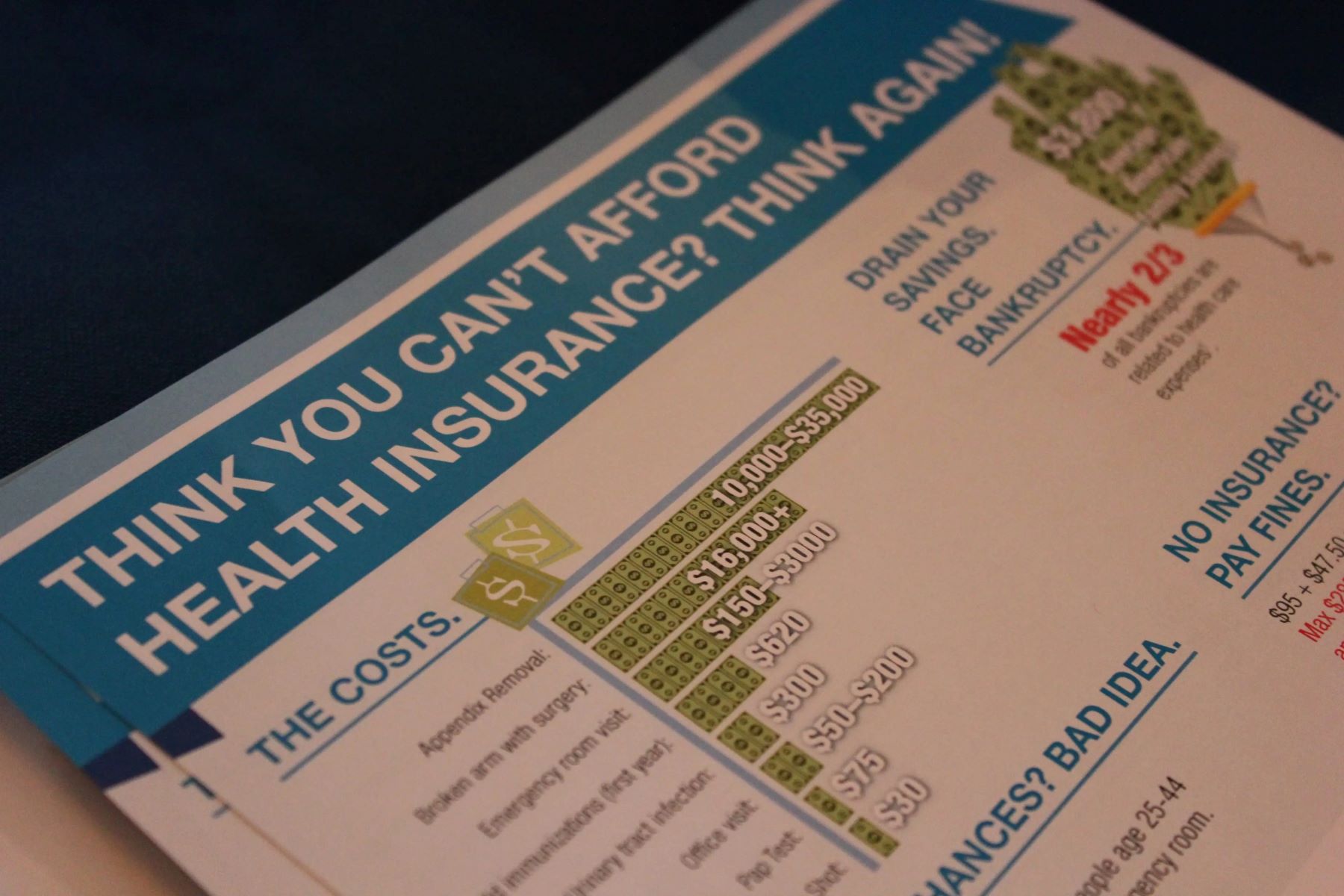

- Financial Burden: One of the most significant risks of being uninsured is the potential for high medical costs. Without insurance, you may be responsible for paying the full cost of medical services, including doctor visits, hospitalization, surgeries, and prescription medications. These expenses can quickly accumulate, potentially leading to financial strain or even personal bankruptcy.

- Limited Access to Healthcare: Not having health insurance may limit your access to necessary healthcare services. Healthcare providers and facilities often prioritize patients with insurance coverage, which could result in delays in receiving medical care. Without insurance, you may also face challenges in finding doctors or specialists who are willing to treat uninsured patients.

- Lack of Preventive Care: Health insurance typically covers preventive services such as vaccinations, screenings, and routine check-ups. Without insurance, you may be less likely to receive essential preventive care, which can help detect and address health issues at an early stage before they become more serious and costly.

- Inability to Manage Chronic Conditions: For individuals with chronic health conditions, not having health insurance can pose significant challenges. Ongoing medical care, medication management, and regular check-ups are essential for effectively managing chronic conditions. Without insurance, it may be difficult to sustain the necessary treatment and monitoring, potentially leading to worsening health outcomes.

- Risk of Medical Debt: Being uninsured puts you at a higher risk of accumulating medical debt. Medical bills can be overwhelming, especially for unexpected emergencies or complex treatments. Medical debt can have long-term consequences, negatively impacting your credit score and financial stability.

- Limited Coverage for Catastrophic Events: While catastrophic health insurance plans exist, they offer limited coverage and typically require high deductibles. Without comprehensive health insurance, you may lack sufficient coverage in case of a major medical event, leaving you exposed to substantial financial burdens.

It’s important to remember that life is unpredictable, and unexpected medical emergencies or illnesses can occur. Having health insurance provides a safety net by mitigating the financial risks associated with healthcare and ensuring access to necessary medical services.

If you find yourself without health insurance, it’s advisable to explore alternative options such as short-term health plans, healthcare sharing ministries, or low-cost clinics. While these options may not provide the same level of comprehensive coverage as traditional health insurance, they can offer some level of financial protection and access to healthcare services.

Ultimately, the decision to not have health insurance should be carefully weighed, taking into account the potential risks, individual circumstances, available alternatives, and personal preferences. It’s always advisable to consult with a qualified professional or seek guidance from healthcare marketplaces to ensure adequate protection and access to necessary healthcare services.

Conclusion

While health insurance is generally recommended for financial protection and access to necessary healthcare services, there are circumstances where it may be deemed acceptable to not have coverage. These situations include qualifying for government programs like Medicaid or CHIP, having access to affordable and comprehensive employer-sponsored coverage, meeting exemptions under the Affordable Care Act, having access to alternative healthcare options, being a young and healthy individual, or holding religious beliefs regarding medical treatment.

However, it’s important to recognize the potential risks associated with being uninsured. These risks include financial burdens from high medical costs, limited access to healthcare services, lack of preventive care, challenges in managing chronic conditions, and the potential for medical debt. Unforeseen medical emergencies or unexpected health issues can happen to anyone, making health insurance a valuable safeguard against financial hardship and ensuring access to necessary care.

If you find yourself without health insurance, it’s important to explore alternative options that align with your needs and circumstances. These may include government programs, alternative healthcare options, or low-cost clinics. It’s also advisable to weigh the potential risks and consider supplemental coverage options such as catastrophic health insurance or short-term health plans.

The decision to go without health insurance should be informed and based on individual factors. It’s always recommended to carefully evaluate your healthcare needs, financial situation, and available alternatives before deciding to forego traditional health insurance.

Ultimately, while there are acceptable circumstances where not having health insurance may be deemed appropriate, it’s important to approach the decision with caution and understanding of the potential consequences. Prioritizing your health and well-being by securing adequate insurance coverage is a responsible choice that can provide peace of mind and financial protection in uncertain times.