Home>Finance>How Is Inventory Shrinkage Reported In The Financial Statements

Finance

How Is Inventory Shrinkage Reported In The Financial Statements

Published: December 22, 2023

Discover how inventory shrinkage is reported in the financial statements and its impact on finance. Learn the importance of accurate tracking and controlling shrinkage to maintain financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Inventory Shrinkage

- Causes of Inventory Shrinkage

- Impact of Inventory Shrinkage on Financial Statements

- Reporting Inventory Shrinkage in the Balance Sheet

- Reporting Inventory Shrinkage in the Income Statement

- Reporting Inventory Shrinkage in the Statement of Cash Flows

- Disclosures and Footnotes Related to Inventory Shrinkage

- Conclusion

Introduction

Inventory shrinkage is a common challenge faced by businesses in the retail and manufacturing industries. It refers to the loss or disappearance of inventory items, either due to theft, damage, obsolescence, or errors in recording. Inventory shrinkage can have a significant impact on a company’s financial performance, as it directly affects the accuracy of the financial statements.

In this article, we will explore how inventory shrinkage is reported in the financial statements and its implications for business owners and investors. Understanding how to properly account for inventory shrinkage is crucial for maintaining transparency and ensuring that financial statements accurately reflect the company’s financial position.

Inventory shrinkage can occur for various reasons. Theft by employees or shoplifters, misplaced or damaged goods, spoilage, and inaccurate record-keeping are some of the common causes of inventory shrinkage. Regardless of the cause, it is essential for businesses to appropriately address and report shrinkage to ensure the integrity of their financial statements.

The reporting of inventory shrinkage in financial statements involves considerations in the balance sheet, income statement, and statement of cash flows. Additionally, companies are required to provide disclosures and footnotes that detail the extent and impact of inventory shrinkage on their financials.

Now, let’s delve into the details of how inventory shrinkage is reported in the financial statements, starting with its definition and causes.

Definition of Inventory Shrinkage

Inventory shrinkage refers to the loss of inventory items within a business due to various factors such as theft, damage, obsolescence, or errors in recording. It is the discrepancy between the inventory levels recorded in the books and the actual physical count.

Inventory shrinkage can occur at any stage of the supply chain, from the point of production to the point of sale. It is a significant concern for businesses, as it directly affects their profitability and financial performance.

The causes of inventory shrinkage can vary, but some common factors include:

- Theft: This can involve both internal theft by employees and external theft by shoplifters or burglars. Internal theft can occur through various means, such as theft of inventory items, fraudulent sales transactions, or collusion among employees.

- Damaged Goods: Inventory items may get damaged during transportation, handling, or storage. This can result in shrinkage if the damaged items cannot be sold or used.

- Obsolescence: Some inventory items may become obsolete due to changes in technology, market preferences, or expiration dates. When these items are not sold or used before becoming obsolete, they contribute to inventory shrinkage.

- Recording Errors: Mistakes in recording inventory levels, such as missing or duplicate entries, can lead to discrepancies between the recorded inventory count and the actual physical count.

Inventory shrinkage is a pervasive issue in the retail industry, where theft and damage are more common. However, it can also occur in the manufacturing industry, especially if there are flaws in the production or storage processes.

Understanding the causes of inventory shrinkage is essential for businesses to implement effective control measures and address the problem proactively. By identifying the root causes, businesses can take steps to minimize shrinkage and protect their bottom line.

Causes of Inventory Shrinkage

Inventory shrinkage occurs as a result of various factors that can impact businesses in different industries. Identifying the causes of inventory shrinkage is crucial for developing strategies to mitigate these losses and maintain accurate inventory records. Here are some common causes of inventory shrinkage:

- Theft: Internal theft by employees and external theft by shoplifters or burglars is one of the primary causes of inventory shrinkage. It can lead to significant losses if not properly addressed. Implementing robust security measures, conducting regular audits, and providing employee training on inventory handling and security can help prevent theft-related shrinkage.

- Damage: Physical damage to inventory can occur during transportation, storage, or handling. This includes breakage, leakage, spoilage, or deterioration of goods. Proper packaging, handling procedures, and regular quality inspections can minimize damages that contribute to inventory shrinkage.

- Obsolescence: Inventory that becomes obsolete due to changes in technology, market trends, or expiration dates can contribute to shrinkage. Businesses should actively monitor their inventory to identify items that are at risk of becoming obsolete and implement strategies such as discounted sales or product redesign to prevent or minimize obsolescence-related shrinkage.

- Inaccurate Record-Keeping: Errors in recording inventory levels can lead to discrepancies between the physical count and the recorded count. This can occur due to data entry mistakes, missed entries, or duplicate entries. Implementing robust inventory management systems, conducting regular reconciliations, and training staff on accurate recording practices can help reduce shrinkage caused by inaccurate record-keeping.

- Poor Communication: Inadequate communication between various departments involved in the inventory management process can lead to discrepancies and shrinkage. For example, if there is a lack of coordination between the purchasing and sales departments, it can result in overstocking or understocking of inventory, leading to shrinkage. Establishing clear communication channels and adopting integrated inventory management systems can help minimize such communication-related shrinkage.

It’s important for businesses to regularly assess the causes of inventory shrinkage and take proactive measures to address them. Implementing rigorous inventory control procedures, investing in security measures, training employees, maintaining accurate records, and monitoring market trends can all contribute to reducing inventory shrinkage and improving overall profitability.

Impact of Inventory Shrinkage on Financial Statements

Inventory shrinkage can have a significant impact on a company’s financial statements. The inaccuracies caused by shrinkage can distort the financial performance, profitability, and asset valuation of a business. Understanding the impact of inventory shrinkage on financial statements is crucial for stakeholders to make informed decisions. Here are some of the key impacts:

- Balance Sheet: The balance sheet reflects a company’s financial position at a specific point in time. Inventory is a significant asset for many businesses, and shrinkage directly affects its value. As a result, the shrinkage reduces the inventory value on the balance sheet, which, in turn, lowers the total assets and the total equity of the company. This can negatively impact important financial ratios, such as current ratio and return on assets, potentially affecting the company’s creditworthiness and valuation.

- Income Statement: The income statement shows a company’s revenues, expenses, and net income over a given period. Inventory shrinkage can indirectly impact the income statement by affecting the cost of goods sold (COGS). If not properly accounted for, the shrinkage can inflate the COGS, reducing gross profit and net income. This can give an inaccurate representation of the company’s profitability and erode investor confidence.

- Statement of Cash Flows: Inventory shrinkage also affects the statement of cash flows. When inventory is lost or stolen, the company incurs a direct expense. This expense reduces the cash flow from operations, thereby impacting the operating activities section of the statement. Additionally, if the shrinkage is not recovered through insurance or other means, it can impact the cash flow from financing activities.

It is worth noting that inventory shrinkage can have both short-term and long-term effects on a company’s financial position. In the short term, the immediate impact is a reduction in assets, equity, and profitability. In the long term, excessive shrinkage can erode trust among stakeholders, damage the company’s reputation, and lead to financial instability.

To mitigate the impact of inventory shrinkage on financial statements, companies should prioritize implementing robust inventory control measures. This includes implementing security measures, training employees on inventory management best practices, conducting regular audits, and leveraging technology solutions for accurate record-keeping and inventory tracking. By minimizing shrinkage, businesses can maintain the reliability and integrity of their financial statements.

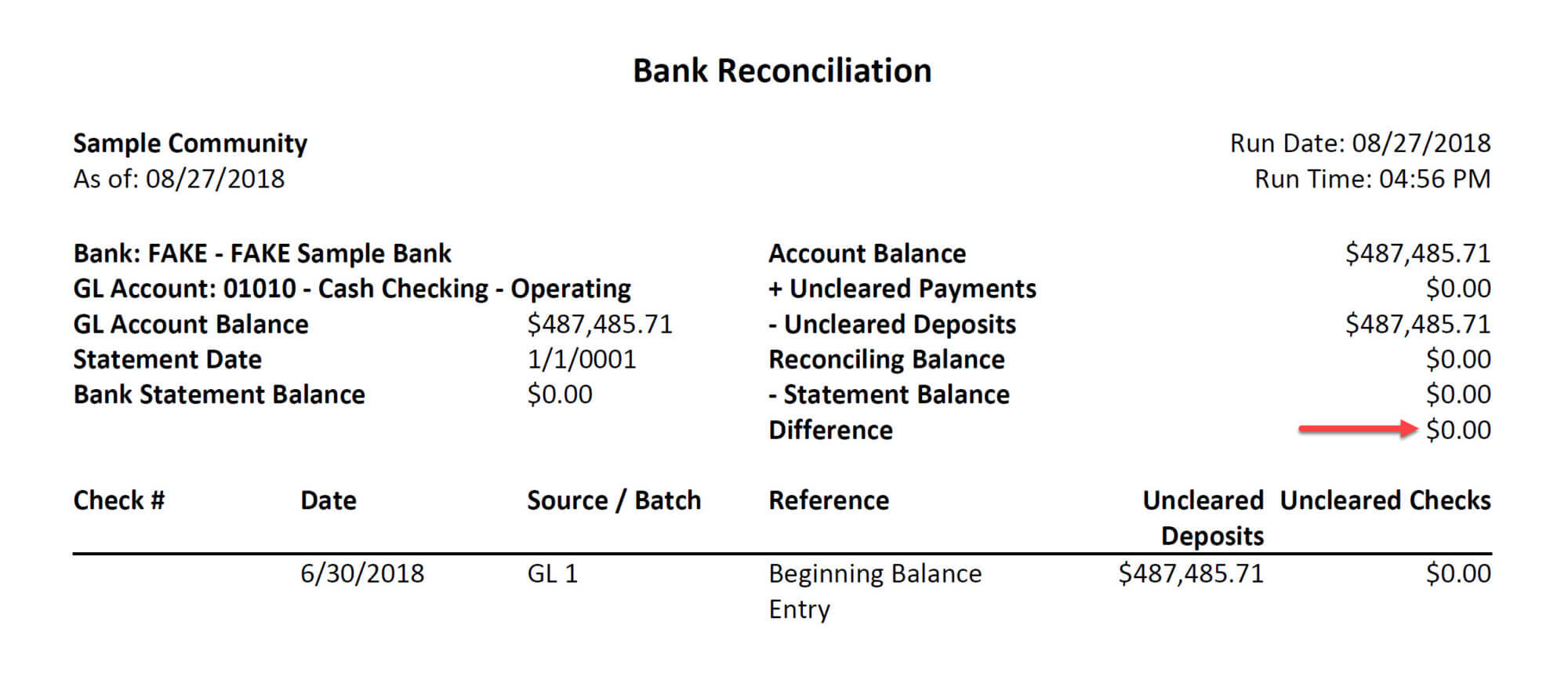

Reporting Inventory Shrinkage in the Balance Sheet

Inventory shrinkage affects the value of a company’s inventory, which in turn impacts the balance sheet. The balance sheet provides a snapshot of a company’s financial position, showing its assets, liabilities, and shareholders’ equity. Properly reporting inventory shrinkage is essential for maintaining accurate financial statements. Here’s how inventory shrinkage is reported in the balance sheet:

- Inventory Valuation: The first step in reporting inventory shrinkage in the balance sheet is to adjust the inventory valuation. The shrinkage amount is deducted from the original recorded value, thus reducing the amount of inventory reported. This adjustment is typically made using a separate contra account called “Inventory Shrinkage” or “Inventory Reserve”.

- Net Realizable Value: In some cases, when the shrinkage amount is significant, the reduced inventory value may be below its original cost. In such situations, the inventory is reported at the lower of cost or net realizable value (NRV). NRV is the estimated selling price of the inventory minus any estimated selling costs.

- Impact on Assets and Equity: The reduction in inventory value due to shrinkage directly affects the total assets reported in the balance sheet. This decrease in assets, in turn, affects the shareholders’ equity. It is important to note that inventory shrinkage can impact financial ratios, such as current ratio and inventory turnover, which may affect the assessment of a company’s financial health and liquidity.

It is crucial for businesses to clearly disclose the presence of inventory shrinkage and the amount of the adjustment made in the notes to the financial statements. This provides transparency to stakeholders and ensures that they have a comprehensive understanding of the company’s financial position.

Effective inventory management practices, regular physical inventory counts, and the use of technology-based systems can help minimize inventory shrinkage. By implementing robust control measures and accurately reporting shrinkage in the balance sheet, businesses can maintain the integrity of their financial statements and provide stakeholders with reliable information.

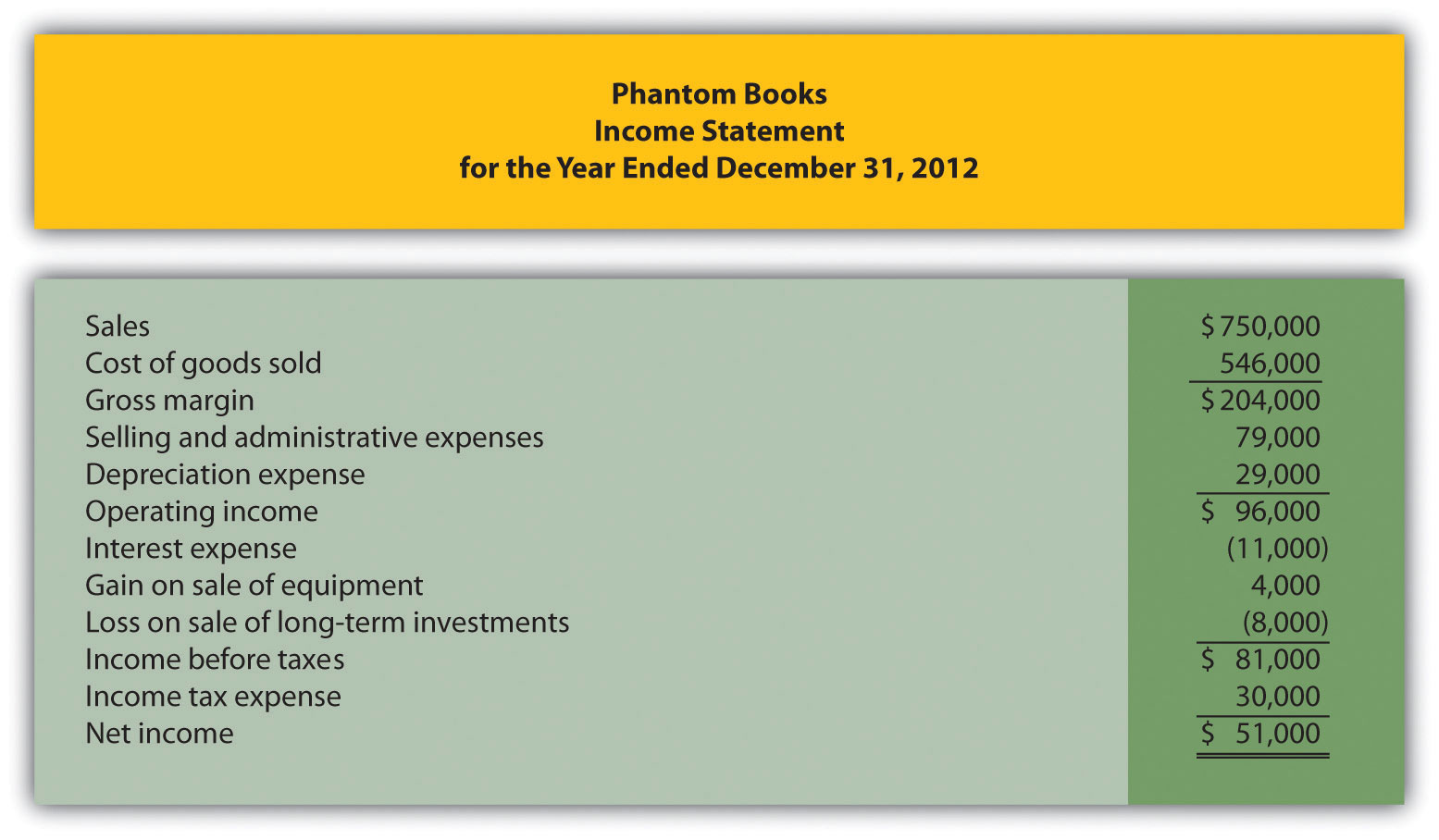

Reporting Inventory Shrinkage in the Income Statement

Inventory shrinkage can significantly impact a company’s income statement, as it directly affects the calculation of the cost of goods sold (COGS). Accurate reporting of inventory shrinkage in the income statement is crucial for providing a true reflection of a company’s profitability. Here’s how inventory shrinkage is reported in the income statement:

- Adjusting COGS: The first step in reporting inventory shrinkage in the income statement is to adjust the COGS. The shrinkage amount is added to the original recorded COGS to reflect the actual cost of goods sold. This adjustment is typically recorded as an expense line item under a separate heading such as “Inventory Shrinkage Expense” or “Inventory Write-Off.”

- Impact on Gross Profit and Net Income: Since the COGS is a direct component of the gross profit calculation, the adjustment for inventory shrinkage directly impacts the gross profit. By increasing the COGS, the gross profit decreases, which in turn affects the net income. The reduction in net income can have a significant impact on the overall profitability of the company.

It is important to note that the reported inventory shrinkage expense in the income statement should be clearly disclosed in the footnotes or management discussion and analysis section. This provides transparency to stakeholders and helps them understand the reasons behind the decrease in profitability.

Reporting inventory shrinkage accurately in the income statement is essential for assessing the company’s performance and making informed business decisions. It allows stakeholders to have a clear understanding of the true cost of goods sold and the impact of shrinkage on profitability.

Implementing effective inventory control measures, conducting regular physical inventory counts, and using advanced inventory management systems can help minimize inventory shrinkage and reduce its impact on the income statement. By accurately reporting shrinkage in the income statement, businesses can provide stakeholders with reliable financial information and maintain transparency in their financial reporting.

Reporting Inventory Shrinkage in the Statement of Cash Flows

Reporting inventory shrinkage in the statement of cash flows is a crucial step in accurately presenting a company’s cash flow from operations. Inventory shrinkage can impact the cash flow statement by affecting the operating activities section. Here’s how inventory shrinkage is reported in the statement of cash flows:

- Operating Activities: Inventory shrinkage is typically reported as an operating expense in the statement of cash flows. The shrinkage amount is included in the calculation of net income and is added back to reconcile the net income to the cash flows from operating activities. This adjustment ensures that the cash flow reflects the actual cash generated from the company’s core operations.

- Impact on Cash Flow from Operations: The inventory shrinkage expense reduces the net income and, therefore, the cash flow from operations. It is important to highlight this impact in the statement of cash flows to provide transparency to stakeholders. The shrinkage expense should be clearly disclosed, ensuring that users of the financial statements are aware of the reduction in cash flow resulting from inventory shrinkage.

It’s worth noting that if the shrinkage is recovered through insurance claims or other means, the cash inflow from these recoveries should be separately reported in the statement of cash flows. This ensures that the cash flow from operating activities reflects the true impact of inventory shrinkage on the company’s cash position.

Accurate reporting of inventory shrinkage in the statement of cash flows is vital for understanding the cash flow generation and usage of a company’s operating activities. It enables stakeholders to assess the sustainability of the company’s cash flow and its ability to fund ongoing operations and investments.

By accurately reporting inventory shrinkage in the statement of cash flows, businesses can provide stakeholders with a transparent view of the impact on cash generated from operating activities. Implementing effective inventory control measures and regularly monitoring shrinkage can help minimize its impact on the statement of cash flows and improve overall cash flow management.

Disclosures and Footnotes Related to Inventory Shrinkage

When reporting inventory shrinkage in financial statements, it is essential for businesses to provide disclosures and footnotes that provide additional information and context. These disclosures help stakeholders understand the extent and impact of inventory shrinkage on the company’s financial position. Here are some key disclosures and footnotes related to inventory shrinkage:

- Nature and Causes of Shrinkage: Companies should provide a detailed explanation of the nature and causes of inventory shrinkage. This includes disclosing the types of shrinkage (e.g., theft, damage, obsolescence), potential risk factors, and the efforts made by the company to mitigate shrinkage.

- Measurement and Estimation Methods: Disclose the methods and assumptions used to measure and estimate the amount of inventory shrinkage. This includes any industry-specific guidelines or standards followed, as well as the basis for determining the adjustment to be made in the financial statements.

- Impact on Financial Statements: Clearly communicate the impact of inventory shrinkage on the balance sheet, income statement, and statement of cash flows. This includes the reduction in inventory value, the adjustment to COGS and gross profit, and the impact on cash flow from operations.

- Insurance Coverage: If applicable, disclose any insurance coverage related to inventory shrinkage, including the amount covered and any significant insurance claims made or pending. This provides insight into the financial recovery potential and any potential impact on future financial statements.

- Remedial Actions Taken: If the company has taken any remedial actions to address inventory shrinkage, such as implementing improved security measures or inventory management systems, disclose these actions. This demonstrates proactiveness and a commitment to minimizing future shrinkage.

- Risk Management Strategies: Disclose the strategies in place to manage inventory shrinkage, such as regular inventory audits, employee training programs, or engagement of third-party security providers. This provides stakeholders with confidence in the company’s risk management practices.

By providing comprehensive disclosures and footnotes related to inventory shrinkage, businesses can enhance the transparency and clarity of their financial statements. This allows stakeholders to make informed decisions and have a deeper understanding of the company’s financial position and risks associated with inventory management.

It is crucial for businesses to comply with applicable accounting standards and regulations when making these disclosures. This ensures consistency and comparability across different companies and industries, facilitating accurate analysis and interpretation of financial statements.

Conclusion

Inventory shrinkage is a pervasive issue that businesses in the retail and manufacturing industries face. It refers to the loss or disappearance of inventory items, which can have a significant impact on financial statements. Properly reporting inventory shrinkage is crucial for maintaining transparency and providing accurate information to stakeholders.

In this article, we explored the definition of inventory shrinkage and its causes. We discussed how inventory shrinkage impacts the financial statements, including the balance sheet, income statement, and statement of cash flows. Additionally, we highlighted the importance of providing disclosures and footnotes related to inventory shrinkage to provide additional context and transparency.

To accurately report inventory shrinkage in the financial statements, businesses should implement effective inventory control measures, conduct regular physical inventory counts, and leverage technology solutions for accurate record-keeping. By minimizing shrinkage, companies can improve their financial performance and maintain the integrity of their financial statements.

Furthermore, transparently disclosing information about the nature, causes, measurement methods, and impact of inventory shrinkage allows stakeholders to assess the company’s risk management practices and make informed decisions. It demonstrates the company’s commitment to addressing inventory shrinkage and mitigating future risks.

In conclusion, successfully managing inventory shrinkage requires proactive measures, accurate reporting, and ongoing monitoring. By understanding the impact of inventory shrinkage on financial statements and following best practices for reporting and disclosure, businesses can enhance their financial transparency, build trust with stakeholders, and make informed decisions to improve their overall performance.