Finance

Where Are Expenses On The Balance Sheet

Published: December 27, 2023

Learn where expenses are listed on the balance sheet and understand their impact on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The balance sheet is a key financial statement that provides a snapshot of a company’s financial health at a given point in time. It presents a detailed summary of a company’s assets, liabilities, and equity. While the balance sheet primarily focuses on the financial position of a company, it also includes information about the expenses incurred by the business.

Expenses play a crucial role in determining a company’s profitability and overall financial performance. Understanding the classification and treatment of expenses on the balance sheet is essential for both investors and stakeholders.

This article aims to provide a comprehensive overview of the role of expenses on the balance sheet. We will explore the different classifications of expenses, their importance, and how they are treated on the balance sheet. Additionally, we will examine examples of expenses to provide a practical understanding of their representation in financial statements.

By delving into the world of expenses on the balance sheet, readers will gain insights into how these costs impact a company’s financial standing and profitability, and how to interpret and analyze them effectively.

Understanding the Balance Sheet

The balance sheet is one of the primary financial statements used by businesses to provide a snapshot of their financial position. It is a statement of the company’s assets, liabilities, and equity at a specific point in time. By analyzing the balance sheet, investors, creditors, and other stakeholders can gain valuable insights into the financial health and stability of a company.

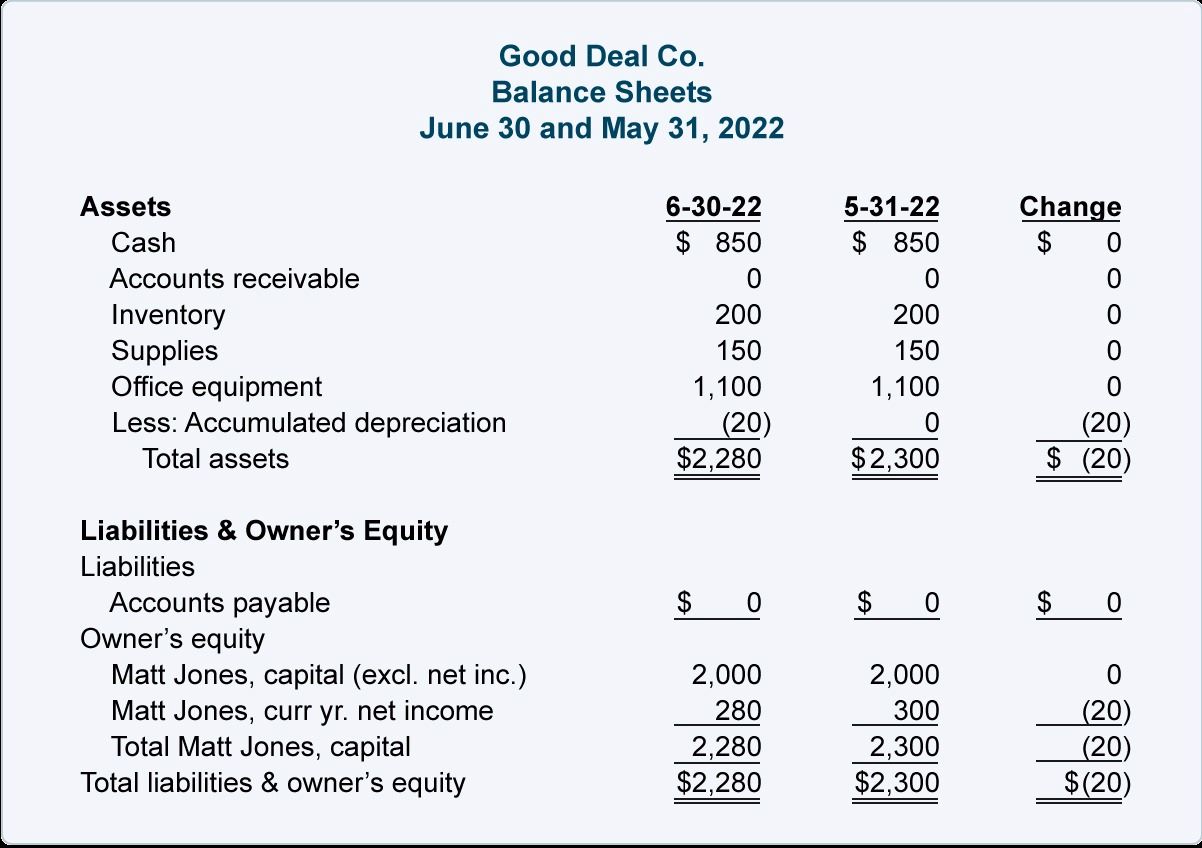

The balance sheet follows a basic accounting equation: Assets = Liabilities + Equity. This equation ensures that the balance sheet remains in balance, as the total value of a company’s assets is equal to the sum of its liabilities and equity.

The balance sheet is divided into three main sections: assets, liabilities, and equity. Assets represent what a company owns, liabilities represent what it owes to others, and equity represents the owner’s share of the company.

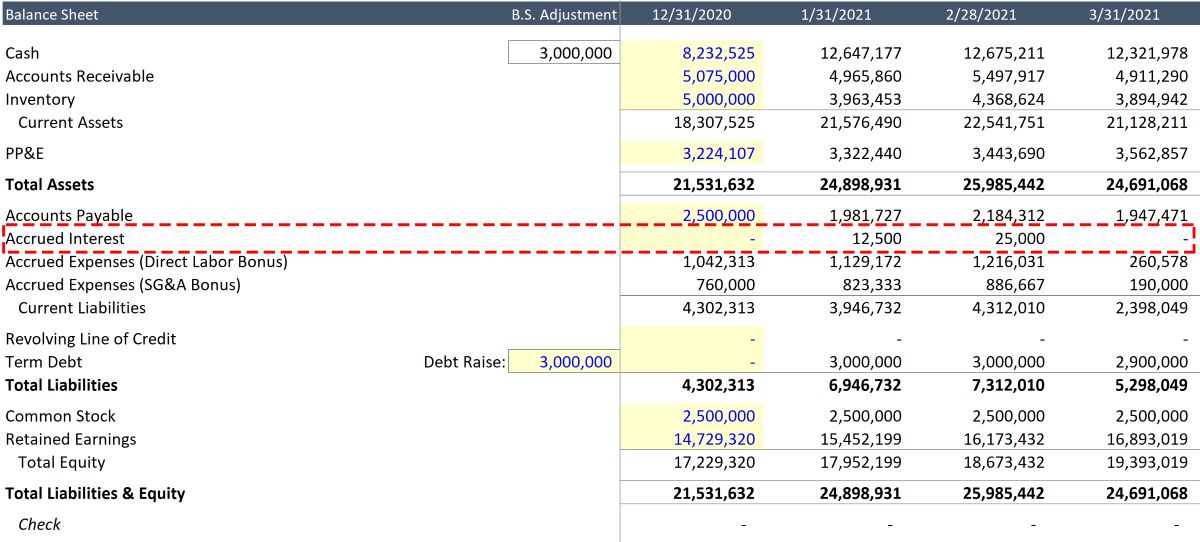

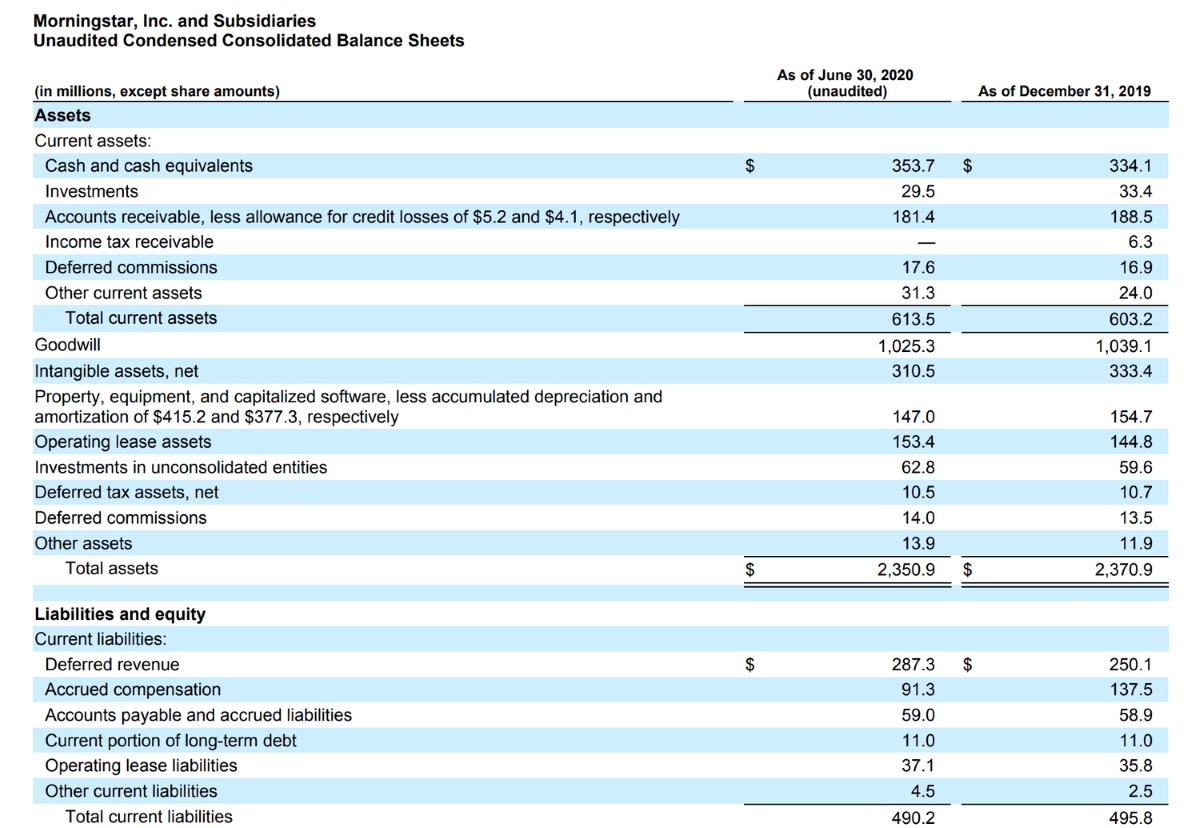

Assets are further categorized into current assets and non-current assets. Current assets include cash, accounts receivable, inventory, and other assets that are expected to be converted into cash within a year. Non-current assets, on the other hand, include property, plant, and equipment, investments, and intangible assets like patents or trademarks.

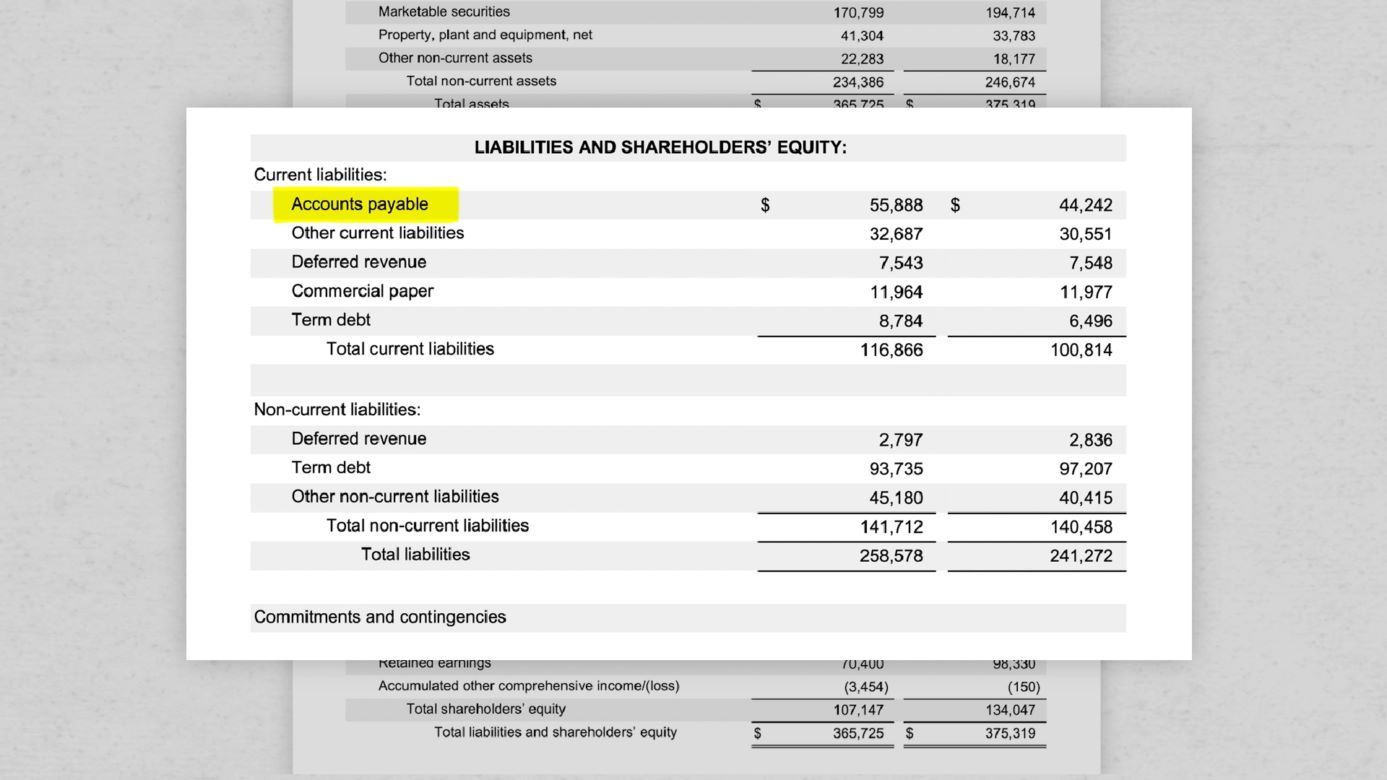

Liabilities are also divided into current liabilities and non-current liabilities. Current liabilities are obligations that are due within a year, such as accounts payable and short-term debts. Non-current liabilities include long-term debts, such as loans or bonds that are not due within a year.

Equity represents the owner’s investment in the company and is calculated by subtracting total liabilities from total assets. It includes retained earnings, contributed capital, and other equity accounts.

By understanding the structure and components of the balance sheet, stakeholders can assess a company’s liquidity, solvency, and overall financial stability.

Classifications on the Balance Sheet

The balance sheet classifies items into different categories to provide a clear representation of a company’s financial position. These classifications enable stakeholders to easily identify and analyze the various components of the balance sheet. The main classifications on the balance sheet include assets, liabilities, and equity.

Assets: Assets are resources owned by the company that have economic value. They are further categorized into current assets and non-current assets. Current assets include cash, cash equivalents, accounts receivable, inventory, and short-term investments. Non-current assets include property, plant, and equipment, long-term investments, intangible assets, and other long-term assets. By classifying assets in this way, the balance sheet provides insights into the company’s liquidity and its ability to generate future returns.

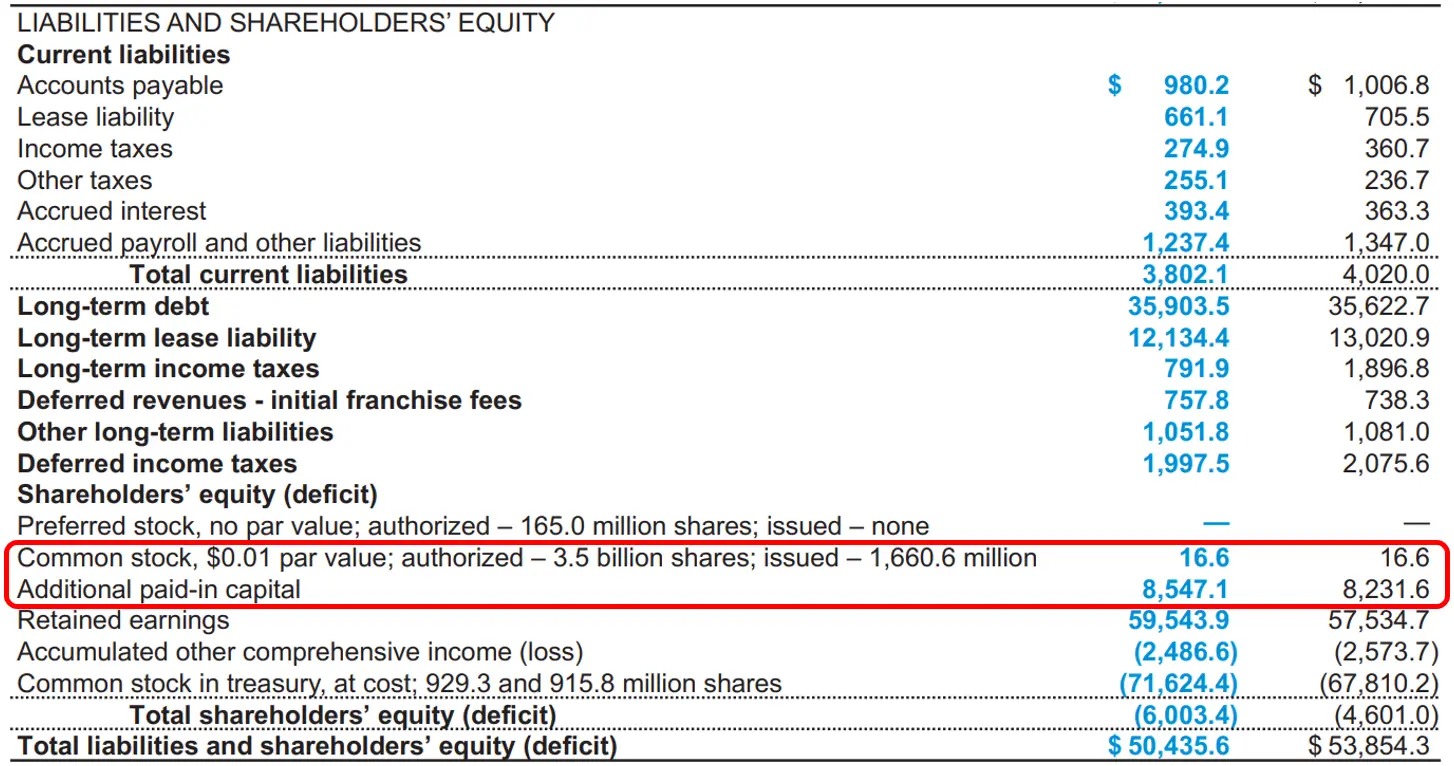

Liabilities: Liabilities represent the company’s obligations to other parties. Like assets, liabilities are divided into current liabilities and non-current liabilities. Current liabilities include accounts payable, short-term debts, accrued expenses, and other obligations that are due within a year. Non-current liabilities include long-term debts, such as bank loans, bonds, and lease obligations that are not due within a year. Classifying liabilities on the balance sheet enables stakeholders to evaluate the company’s financial obligations and its ability to meet these obligations in the short and long term.

Equity: Equity represents the residual interest in the company’s assets after deducting its liabilities. It is also known as shareholders’ equity or net worth. Equity includes retained earnings, which are the accumulated profits or losses of the company, as well as additional paid-in capital from shareholders. By categorizing equity on the balance sheet, stakeholders can assess the company’s financial health and the owners’ claims on the company’s assets.

In addition to these main classifications, the balance sheet may also include subcategories and other line items that provide further detail about specific types of assets, liabilities, or equity. These subcategories can vary depending on the industry and the specific accounting conventions followed by the company.

By understanding the classifications on the balance sheet, stakeholders can analyze the company’s financial position, assess its liquidity, solvency, and overall financial health, and make informed decisions based on these insights.

Assets

Assets are an essential component of the balance sheet as they represent the resources owned by a company that have economic value. They are classified into two main categories: current assets and non-current assets. Understanding the different types of assets and their significance is crucial for evaluating a company’s financial position.

Current Assets: Current assets are those that are expected to be converted into cash or used up within one year or the operating cycle of the business, whichever is longer. These assets are easily liquidated and provide short-term benefits. Common examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments. Cash and cash equivalents include physical currency, bank balances, and highly liquid investments with original maturities of three months or less. Accounts receivable represent amounts owed by customers for goods or services provided. Inventory consists of goods held for sale, while short-term investments include marketable securities that can be easily converted into cash.

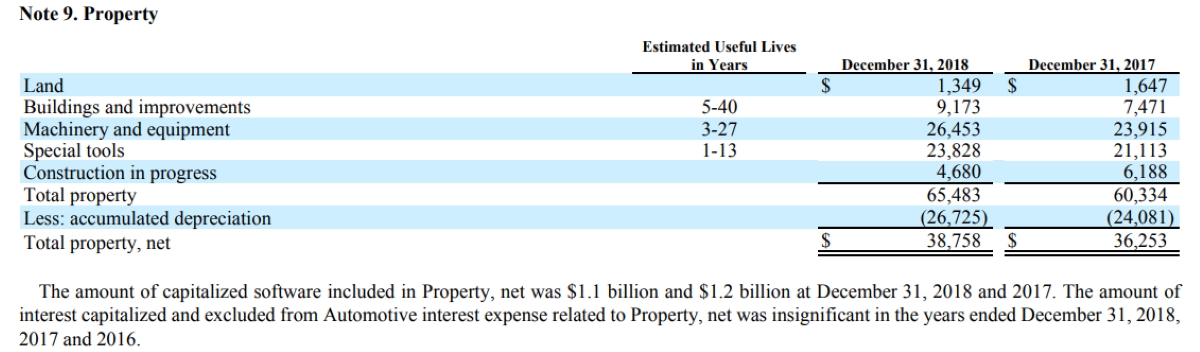

Non-Current Assets: Non-current assets, also known as long-term assets, have a useful life of more than one year and are not intended to be sold or converted into cash in the near term. These assets provide long-term benefits and support the ongoing operations of the business. Non-current assets include property, plant, and equipment, investments, intangible assets, and long-term investments. Property, plant, and equipment (PP&E) consist of tangible assets, such as buildings, machinery, and vehicles, used in the production or delivery of goods and services. Investments can include the company’s ownership stakes in other businesses or financial instruments held for long-term gains. Intangible assets, such as patents, trademarks, and copyrights, represent non-physical assets with value derived from legal or contractual rights. Long-term investments encompass investments in bonds, stocks, or other securities that the company intends to hold for more than one year.

Assets are a crucial indicator of a company’s financial health, liquidity, and ability to generate future returns. The composition and value of the assets can provide insights into the company’s operational efficiency, growth prospects, and risk exposure. By analyzing the assets on the balance sheet, stakeholders can assess a company’s ability to meet its financial obligations, invest in future growth, and generate profits.

Liabilities

Liabilities are obligations or debts that a company owes to other parties. They represent the company’s financial responsibilities and are classified into two main categories: current liabilities and non-current liabilities. Understanding the different types of liabilities is crucial for assessing a company’s financial obligations and its ability to meet them.

Current Liabilities: Current liabilities are debts or obligations that are expected to be settled within one year or the operating cycle of the business, whichever is longer. These liabilities typically arise from day-to-day operations and ongoing business activities. Common examples of current liabilities include accounts payable, short-term loans, accrued expenses, and income taxes payable. Accounts payable represent amounts owed to suppliers for goods or services received but not yet paid for. Short-term loans are debts that are due within one year. Accrued expenses include accrued salaries, rent, utilities, and other expenses that have been incurred but not yet paid. Income taxes payable refer to the taxes that the company owes to tax authorities.

Non-Current Liabilities: Non-current liabilities, also known as long-term liabilities, are debt obligations that are not due within one year or the normal operating cycle of the business. These liabilities represent long-term financing arrangements and obligations that extend beyond the short term. Common examples of non-current liabilities include long-term loans, bonds, lease obligations, and pension obligations. Long-term loans refer to the debts that are due after one year. Bonds represent long-term debt instruments issued by the company to raise capital from investors. Lease obligations include the obligations arising from operating leases or finance leases. Pension obligations represent the company’s obligations to provide pension benefits to its employees.

Liabilities play a vital role in assessing a company’s financial health and risk profile. They provide insights into the company’s level of debt, its ability to meet its financial obligations, and its overall financial stability. By analyzing the liabilities on the balance sheet, stakeholders can assess the company’s solvency, evaluate its ability to repay debts, and understand the potential impact of debt on the company’s profitability and cash flow.

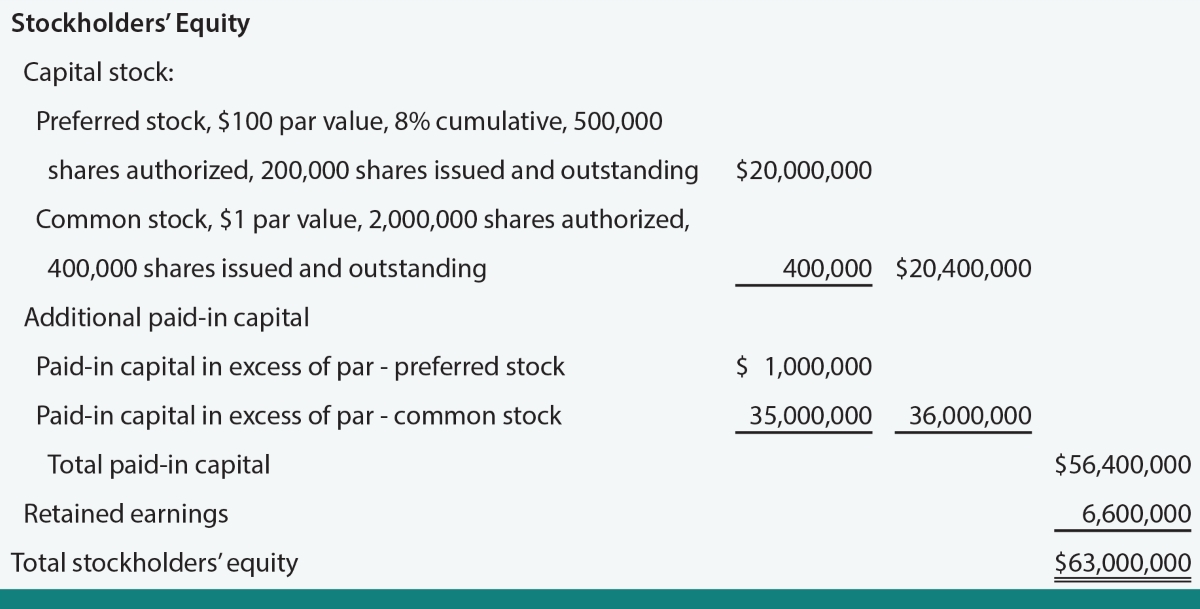

Equity

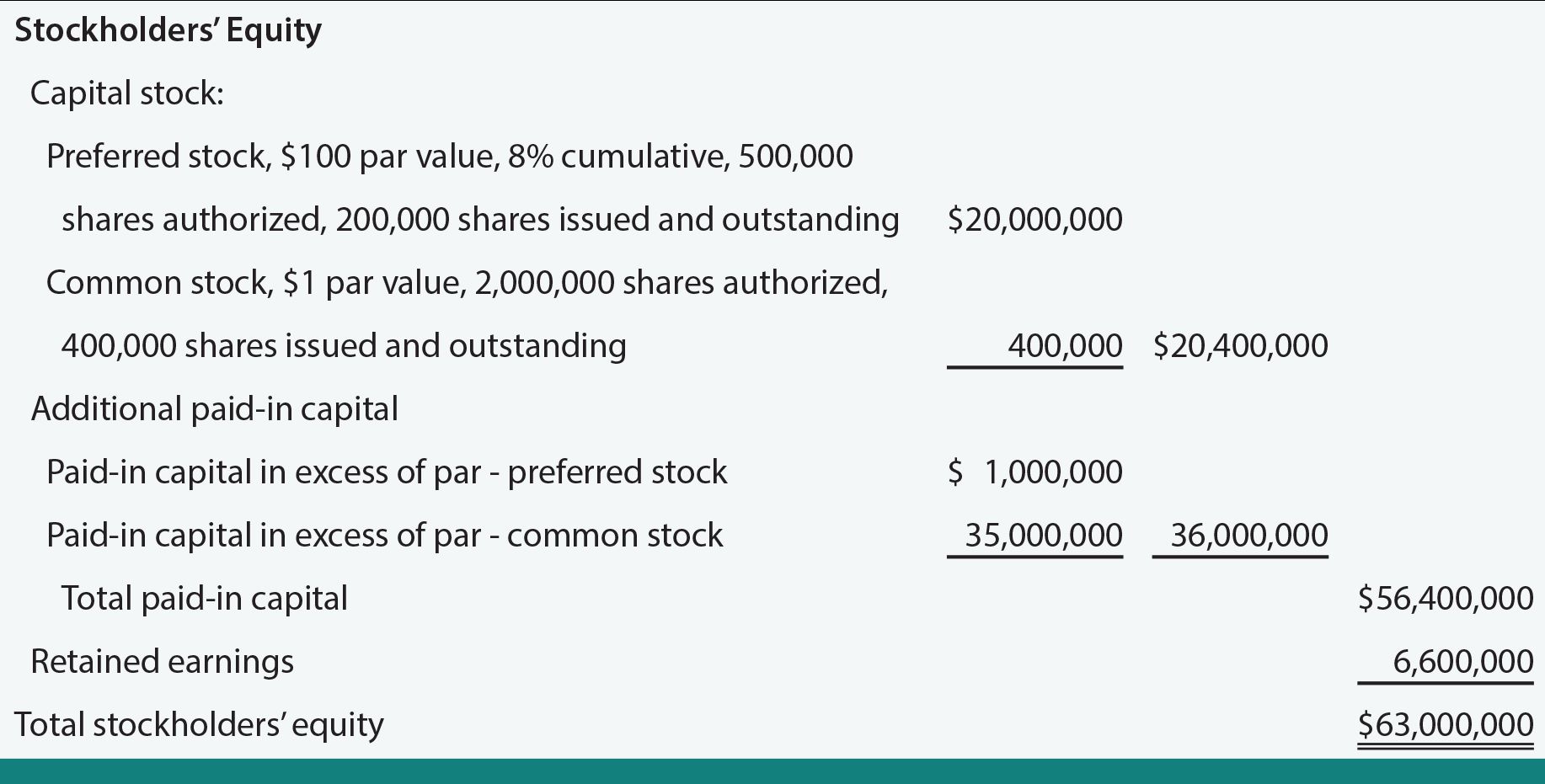

Equity, also known as shareholders’ equity or net worth, represents the ownership interest in a company. It is an important element of the balance sheet and reflects the residual value of a company’s assets after deducting its liabilities. Equity represents the shareholders’ claim on the company’s assets and is a key indicator of the company’s financial health and value.

Equity is composed of several components, including:

- Retained Earnings: Retained earnings are the accumulated profits or losses of the company that have not been distributed to shareholders as dividends. They reflect the amount of earnings that the company has retained to reinvest in the business or to offset losses.

- Contributed Capital: Contributed capital represents the funds contributed by shareholders in exchange for ownership shares in the company. It includes the par value of common stock, additional paid-in capital, and any other forms of equity contributions made by shareholders.

- Treasury Stock: Treasury stock represents the company’s own shares that it has repurchased and is holding as a financial instrument. It is subtracted from total equity as it represents a reduction in the shareholders’ ownership interest.

- Accumulated Other Comprehensive Income: Accumulated other comprehensive income (AOCI) includes gains or losses from certain non-owner transactions that bypass the income statement initially but are eventually recognized in the comprehensive income. AOCI items may include foreign currency translation adjustments and unrealized gains or losses on available-for-sale securities.

Equity represents the company’s net worth and provides insights into the owners’ claims on the company’s assets. It is an important measure for investors and creditors to assess a company’s financial position, profitability, and overall value. A healthy level of equity demonstrates the company’s ability to generate profits and build shareholder value over time.

By analyzing the equity section of the balance sheet, stakeholders can evaluate the company’s financial stability, assess the owners’ investment in the business, and gauge the company’s ability to generate future returns for shareholders.

Expenses on the Balance Sheet

In addition to assets, liabilities, and equity, the balance sheet also includes information about the expenses incurred by a company. Expenses are the costs incurred by a business in its day-to-day operations to generate revenue. While the balance sheet primarily focuses on the financial position of a company, including expenses provides valuable insights into the company’s financial performance.

Expenses are an essential aspect of assessing a company’s profitability and overall financial health. They are classified as an income statement item but can also be reflected on the balance sheet under certain circumstances.

On the balance sheet, expenses are typically not reported individually but are instead reflected indirectly through their impact on the company’s assets, liabilities, and equity. Expenses can affect the reported figures of these categories in various ways.

For example:

- Expenses such as depreciation or amortization can reduce the value of non-current assets over time.

- Expenses related to inventory, such as cost of goods sold, can impact the reported value of inventory on the balance sheet.

- Operating expenses, such as salaries, rent, utilities, and marketing expenses, can affect the company’s cash flow and cash balances reported on the balance sheet.

While expenses are primarily recorded on the income statement, understanding their indirect impact on the balance sheet is crucial for a comprehensive analysis of a company’s financial position. By considering the interplay between expenses and the balance sheet, stakeholders can gain a deeper understanding of a company’s financial performance, efficiency, and cash flow management.

It is important to note that expenses do not directly affect the equity section of the balance sheet. However, they indirectly impact retained earnings, which is a component of equity. Retained earnings reflect the accumulated profits or losses of the company, including the impact of expenses over time.

Overall, including expenses on the balance sheet provides a more complete financial picture and enhances the transparency and accuracy of the company’s financial statements. It allows stakeholders to assess the financial performance, profitability, and efficiency of a company, and make informed decisions based on these insights.

Importance of Expenses

Expenses play a critical role in evaluating a company’s financial performance and overall financial health. They provide valuable insights into the costs incurred by a business to generate revenue and can indicate the efficiency and effectiveness of its operations. Understanding the importance of expenses is essential for investors, creditors, and stakeholders in assessing a company’s profitability and making informed decisions.

Here are some key reasons why expenses are important:

- Profitability Analysis: Expenses are a key component in calculating a company’s profitability. By comparing the revenue generated with the expenses incurred, stakeholders can evaluate the company’s ability to generate profit. Analyzing and tracking expenses over time enable stakeholders to assess trends and make informed decisions regarding resource allocation and cost management.

- Operational Efficiency: Examining expenses is crucial for evaluating a company’s operational efficiency. High or increasing expenses relative to revenue may indicate inefficiencies in cost management, production processes, or resource allocation. By identifying and addressing these inefficiencies, companies can enhance their operational performance and improve their overall profitability.

- Cost Control: Monitoring expenses helps companies identify areas where they can cut costs and improve their financial performance. Analyzing expense categories and comparing them with industry benchmarks allows organizations to identify cost-saving opportunities and implement strategies to optimize spending.

- Investment Decisions: Expenses are a crucial factor in evaluating the feasibility and potential return on investment for new projects or business ventures. Assessing the expected expenses and their impact on future cash flows allows stakeholders to make informed investment decisions and allocate resources effectively.

- Cash Flow Management: Understanding expenses is essential for effective cash flow management. By tracking and analyzing expenses, companies can better predict and manage their cash inflows and outflows, ensuring they have sufficient funds on hand to meet their financial obligations and invest in future growth.

It is important for stakeholders to consider expenses in conjunction with other financial metrics, such as revenue, profit margins, and cash flow, to gain a comprehensive understanding of a company’s financial performance and make informed decisions.

By recognizing the significance of expenses, stakeholders can navigate the complexities of financial statements, evaluate a company’s profitability and operational efficiency, and assess its ability to generate sustainable growth and shareholder value.

Types of Expenses

Expenses in a business can take various forms, representing the costs incurred in the day-to-day operations of the company. Understanding the different types of expenses is essential for analyzing a company’s financial performance and evaluating its cost structure. Here are some common types of expenses:

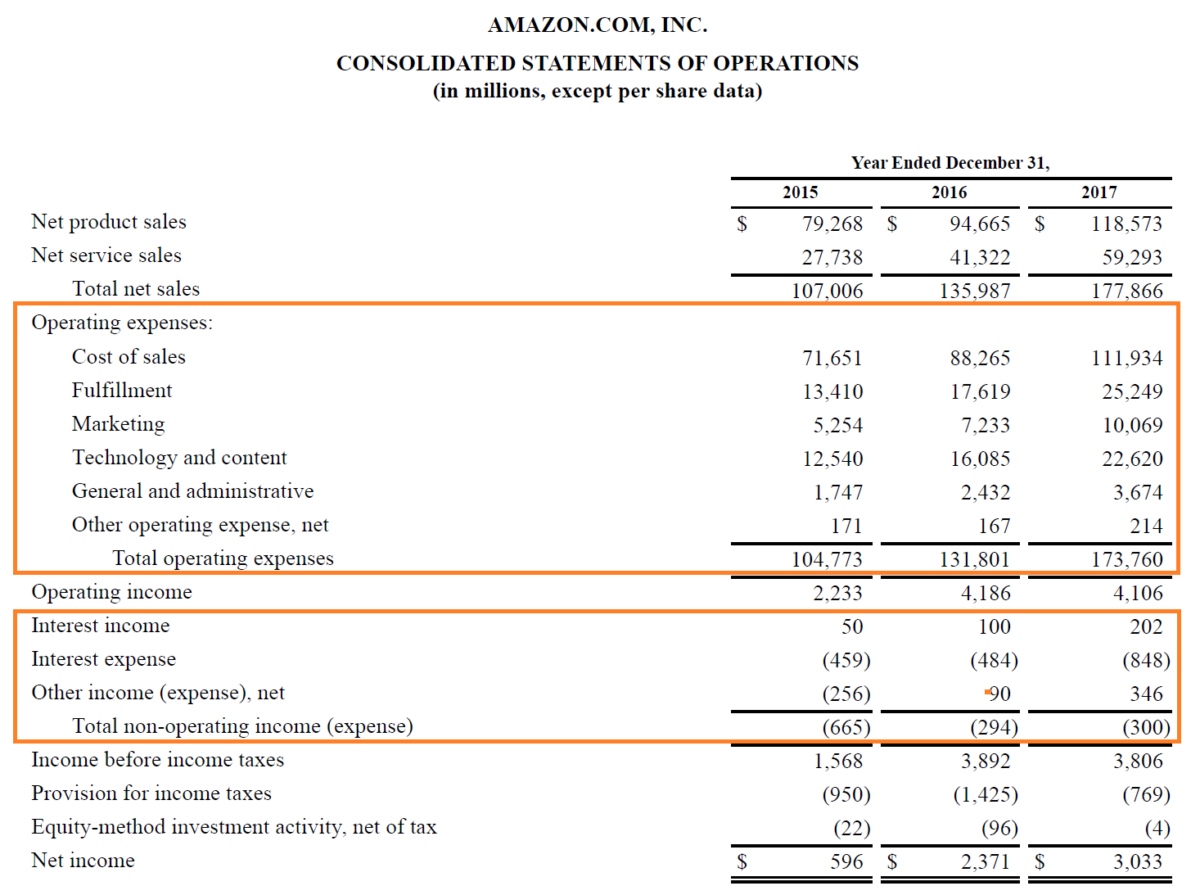

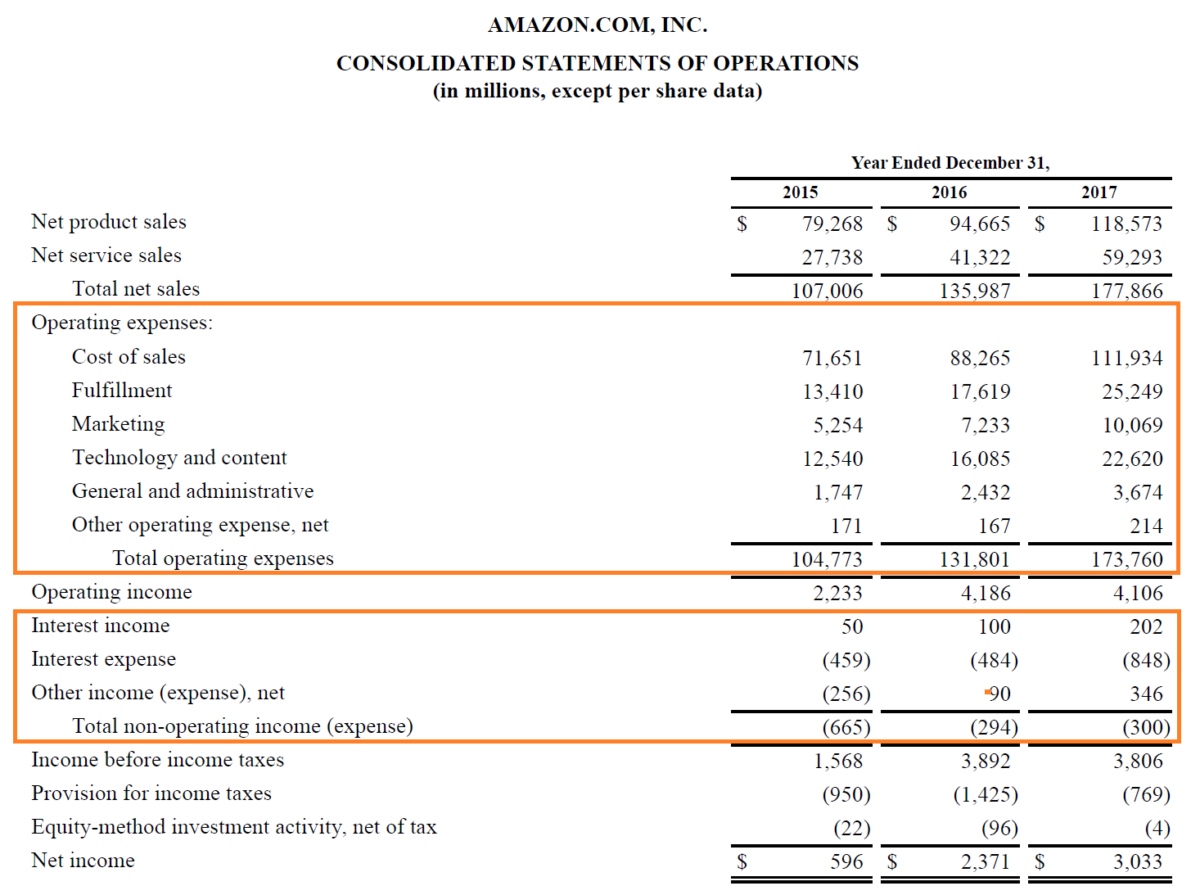

- Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or acquiring the goods or services that a company sells. It includes expenses such as raw materials, labor, and manufacturing overhead directly related to the production process.

- Operating Expenses: Operating expenses, also known as selling, general, and administrative expenses (SG&A), encompass various costs associated with running a business. This category includes expenses such as employee salaries, rent, utilities, marketing and advertising costs, office supplies, and professional fees.

- Interest Expenses: Interest expenses arise from the cost of borrowing funds or servicing debt. It includes interest payments on loans, bonds, and other financial liabilities.

- Depreciation and Amortization: These expenses represent the allocation of the cost of long-term assets over their useful lives. Depreciation applies to tangible assets like buildings and equipment, while amortization pertains to intangible assets such as patents or copyrights.

- Research and Development (R&D) Expenses: R&D expenses are costs incurred in the research, design, and development of new products, technologies, or processes. These expenses aim to enhance innovation and drive future growth.

- Non-operating Expenses: Non-operating expenses include costs that are outside of the company’s core business operations. Examples may include losses from the sale of assets, impairment charges, or expenses related to discontinued operations.

- Income Taxes: Income taxes are expenses incurred by a company based on its taxable income, subject to applicable tax rates and regulations.

These are just a few examples of the types of expenses that companies may incur. It is important to note that the specific types and categories of expenses can vary based on the industry, size of the company, and accounting standards followed.

Being able to classify and analyze different types of expenses grants stakeholders insights into how costs are allocated and provides a comprehensive picture of a company’s cost structure. By evaluating the composition of expenses, identifying trends, and benchmarking against industry peers, stakeholders can make informed decisions regarding cost optimization, resource allocation, and overall financial performance.

Treatment of Expenses on the Balance Sheet

Expenses are primarily recorded on the income statement as they represent costs incurred during a specific period to generate revenue. However, the impact of expenses on the balance sheet is indirect and reflected through their effect on assets, liabilities, and equity.

The treatment of expenses on the balance sheet depends on the nature of the expense and its impact on the financial position of the company. Here are some common treatments:

- Inventory Expenses: Expenses related to inventory, such as the cost of goods sold (COGS), are directly deducted from the revenue on the income statement. However, they indirectly impact the balance sheet by reducing the reported value of inventory, which is considered an asset.

- Depreciation and Amortization Expenses: Depreciation and amortization expenses reduce the value of non-current assets over time. They are recorded on the income statement as part of operating expenses and are deducted from the respective asset accounts on the balance sheet. Accumulated depreciation is reported as a contra-asset account, reducing the value of the corresponding asset.

- Operating Expenses: Operating expenses, such as salaries, rent, utilities, and marketing expenses, are deducted from the revenue on the income statement to calculate net income. While they are not directly reported on the balance sheet, their impact on cash flow can be reflected in changes to the cash and cash equivalents reported on the balance sheet.

- Non-operating Expenses: Non-operating expenses, such as losses from the sale of assets or impairment charges, are also recorded on the income statement. However, they do not directly impact the balance sheet. Instead, their impact may be seen in changes to specific asset accounts or equity accounts.

It is important to note that while expenses do not directly affect the equity section of the balance sheet, they indirectly impact retained earnings, which is a component of equity. Retained earnings reflect the accumulated profits or losses of the company, including the impact of expenses over time.

Overall, the treatment of expenses on the balance sheet involves their indirect impact on the reported values of assets, liabilities, equity, and cash flow. Understanding this treatment is essential for a comprehensive analysis of a company’s financial position, profitability, and cash flow management.

Examples of Expenses on the Balance Sheet

Expenses on the balance sheet are not typically reported individually but rather indirectly reflected through their impact on various financial statement categories. Here are some examples of common expenses and their effect on the balance sheet:

- Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or acquiring goods sold by a company. These expenses are deducted from the revenue on the income statement, reducing the company’s reported gross profit. The reduction in gross profit indirectly affects the retained earnings component of equity on the balance sheet.

- Depreciation and Amortization: Depreciation and amortization expenses reflect the allocation of the cost of long-term assets over their useful lives. While they are recorded on the income statement, their impact is indirect on the balance sheet. The corresponding asset accounts, such as property, plant, and equipment or intangible assets, are reduced on the balance sheet through accumulated depreciation or accumulated amortization. This reduction in asset value indirectly affects the equity section of the balance sheet.

- Salary and Wage Expenses: Salary and wage expenses represent the compensation paid to employees for their services. These expenses are recorded on the income statement as operating expenses. However, their impact on the balance sheet is indirect. The cash account may decrease as a result of salary payments, affecting the reported cash balance on the balance sheet. Additionally, any unpaid salary or wages may be reported as a liability, such as accrued expenses or accounts payable.

- Interest Expenses: Interest expenses arise from the cost of borrowing funds or servicing debt. While they are recorded on the income statement, their impact on the balance sheet is indirect. Interest expenses can lead to increases in liabilities, such as long-term debt or short-term loans, which are reported on the balance sheet. The payment of interest also affects the company’s cash flow and may result in changes to the cash and cash equivalents reported on the balance sheet.

These are just a few examples of how expenses indirectly affect the balance sheet. Other common expenses, such as rent, utilities, marketing expenses, and taxes, can also impact the financial position and cash flow of a company reported on the balance sheet.

Understanding these examples helps stakeholders analyze the financial health, profitability, and overall performance of a company. By examining and interpreting the indirect effects of expenses on the balance sheet, stakeholders can gain valuable insights into a company’s financial position and make informed decisions based on these insights.

Conclusion

The inclusion of expenses on the balance sheet is essential for a comprehensive understanding of a company’s financial position, profitability, and overall financial health. While expenses are primarily recorded on the income statement, their indirect impact on the balance sheet provides valuable insights into a company’s cost structure, operational efficiency, and cash flow management.

By accurately classifying and analyzing expenses, stakeholders such as investors, creditors, and decision-makers can make informed assessments of a company’s financial performance, profitability, and sustainability. By monitoring and evaluating different types of expenses, stakeholders can identify areas for cost optimization, resource allocation, and operational improvements.

The treatment of expenses on the balance sheet differs depending on the nature of the expense. Expenses can impact asset values, such as inventory or non-current assets, as well as liabilities and equity accounts. Understanding their indirect influence on the balance sheet allows for a more comprehensive analysis of a company’s financial position and performance.

Examples of expenses on the balance sheet, such as COGS, depreciation and amortization, salary and wage expenses, and interest expenses, demonstrate the diverse ways in which expenses can influence the financial statements. Interpreting these examples helps stakeholders gain insights into a company’s financial performance and profitability.

In conclusion, incorporating expenses on the balance sheet provides a more holistic view of a company’s financial landscape. By considering the impact of expenses on the balance sheet, stakeholders can better evaluate a company’s financial position and make informed decisions that drive growth, optimize costs, and enhance overall financial performance.