Home>Finance>Where Is Contributed Capital On The Balance Sheet

Finance

Where Is Contributed Capital On The Balance Sheet

Modified: December 30, 2023

Learn where contributed capital is located on the balance sheet and understand its role in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Contributed Capital

- Importance of Contributed Capital on the Balance Sheet

- Classification of Contributed Capital

- Contributed Capital from Shareholders

- Contributed Capital from Business Owners

- Contributed Capital from Investors

- Contributed Capital from Lenders

- Presentation of Contributed Capital on the Balance Sheet

- Examples of Contributed Capital Disclosures

- Conclusion

Introduction

In the world of finance, understanding the various components of a balance sheet is crucial for analyzing a company’s financial health. One key element that plays a significant role in a company’s capital structure is contributed capital. But what exactly is contributed capital and where does it show up on the balance sheet?

Contributed capital, also known as paid-in capital, refers to the funds that a company receives from its owners and investors in exchange for ownership shares or ownership interests in the business. It represents the initial investment made by shareholders or business owners to finance the operations and growth of the company.

The inclusion of contributed capital on the balance sheet is essential as it represents the tangible value contributed by stakeholders to support the company’s operations. It reflects the financial resources available to the business and provides important insights for investors, creditors, and other stakeholders in evaluating the company’s financial standing.

Understanding the classification and presentation of contributed capital on the balance sheet is crucial for financial analysis and decision-making. In this article, we will explore the different sources of contributed capital and how they are disclosed on the balance sheet.

Definition of Contributed Capital

Contributed capital, also known as paid-in capital, is a term used in finance to describe the funds that a business receives from its owners and investors in exchange for ownership shares or ownership interests in the company. It represents the initial investment made by shareholders or business owners to finance the operations and growth of the business.

Contributed capital is an essential component of a company’s capital structure. It is different from retained earnings, which represent the cumulative profits that have been retained and reinvested in the company’s operations over time. Contributed capital, on the other hand, reflects the direct contributions made by shareholders or business owners to acquire ownership in the company.

The main purpose of contributed capital is to provide the company with the necessary financial resources to support its operations, invest in new projects, or fund expansion initiatives. Contributed capital is typically raised through the issuance of common or preferred stock, where shareholders or investors contribute cash or other assets in exchange for ownership shares or ownership interests in the company.

Contributed capital is a permanent source of financing for a business. Unlike debt, which needs to be repaid over time with interest, contributed capital does not impose any repayment obligations on the company. Instead, shareholders or investors become partial owners of the business and participate in its future profits and growth potential.

Contributed capital plays a vital role in determining a company’s financial strength, as it represents the tangible contribution of stakeholders to the business. It provides a sense of security to creditors, as it reflects the owners’ commitment and willingness to invest their own resources in the company. Higher levels of contributed capital often indicate a strong financial foundation and can enhance a company’s creditworthiness and access to additional funding.

In summary, contributed capital represents the funds contributed by shareholders or business owners in exchange for ownership shares or ownership interests in a company. It serves as a permanent source of financing and reflects the tangible commitment of stakeholders to support the business’s operations and growth.

Importance of Contributed Capital on the Balance Sheet

Contributed capital plays a crucial role in determining the financial health and stability of a company. It provides valuable insights into the company’s ability to raise funds from its owners and investors and reflects the tangible commitment of stakeholders to the business. Here are some key reasons why contributed capital is important on the balance sheet:

- Financial Stability: The amount of contributed capital on the balance sheet indicates the level of financial resources that the company has received from its owners and investors. A higher amount of contributed capital suggests a stronger financial foundation, which can enhance the company’s ability to weather financial challenges and pursue growth opportunities.

- Ownership Structure: Contributed capital also reveals the ownership structure of the company. By analyzing the balance sheet, investors and stakeholders can determine the percentage of ownership held by individual shareholders, providing a snapshot of how the company is structured in terms of ownership concentration.

- Investor Confidence: The presence of significant contributed capital signals investor confidence in the business. When investors contribute their own funds to the company, it demonstrates their belief in the company’s potential for success. This can be a positive signal to other potential investors, creditors, and business partners, enhancing the company’s reputation and attractiveness as an investment opportunity.

- Creditworthiness: Contributed capital can also impact a company’s creditworthiness. Lenders and creditors often consider the amount of contributed capital when assessing a company’s ability to repay debts. Higher levels of contributed capital provide a sense of security to lenders, indicating that there is a significant equity cushion to absorb potential losses and enhance the company’s ability to honor its financial obligations.

- Growth Potential: In addition to providing financial stability, contributed capital can support a company’s growth initiatives. The funds raised through contributed capital can be used to invest in research and development, expand operations, acquire new assets, or explore new markets. This capital infusion can fuel the company’s growth trajectory and increase its competitiveness in the market.

Overall, contributed capital is a critical element on the balance sheet as it reflects the financial resources contributed by owners and investors to support the company’s operations and growth. It provides insights into the company’s financial stability, ownership structure, investor confidence, creditworthiness, and growth potential, making it an essential indicator for stakeholders in assessing the company’s financial standing and prospects for success.

Classification of Contributed Capital

Contributed capital can be classified into different categories based on the source from which it is received. Understanding these classifications is crucial for analyzing a company’s financing structure and assessing the nature of the contributions made by stakeholders. Here are the common classifications of contributed capital:

- Contributed Capital from Shareholders: This category includes the funds contributed by the owners of the company, typically in the form of common stock or equity shares. Shareholders invest their own money or assets in exchange for ownership interests, entitling them to participate in the company’s profits and decision-making processes. Contributed capital from shareholders represents the primary source of financing for many companies and is often a significant component of the balance sheet.

- Contributed Capital from Business Owners: In the case of privately-owned businesses, the owners’ contributions may be classified separately from the contributions made by shareholders. This category represents the funds directly provided by the business owners, who may also be the majority shareholders. The contributions of the owners are typically in the form of cash injections or assets transferred to the business to support its operations.

- Contributed Capital from Investors: Companies may also raise capital from external investors, such as venture capitalists or angel investors. These investors provide funding in exchange for ownership stakes or preferred shares. Contributed capital from investors represents the financial resources contributed by these external parties and is often directed towards specific objectives, such as funding research and development or driving growth strategies.

- Contributed Capital from Lenders: While not traditional shareholders in the company, lenders may also contribute capital in some cases. For instance, convertible debt allows lenders to convert their loans into equity shares at a predetermined price or based on certain trigger events. The capital received from lenders in such cases is classified as contributed capital.

It is important to note that the classification of contributed capital may vary depending on the specific accounting standards and reporting requirements applicable to the company. Different jurisdictions and accounting frameworks may have specific guidelines for how contributed capital should be classified and presented on the balance sheet.

By classifying contributed capital based on its source, stakeholders can gain a better understanding of the various inflows of funds into the company and the nature of the contributions made by different parties. This classification helps provide insights into the financing structure of the company and its relationships with shareholders, business owners, investors, and lenders.

Contributed Capital from Shareholders

Contributed capital from shareholders is a vital source of financing for a company. It represents the funds that shareholders invest in exchange for ownership interests in the business. This category of contributed capital is typically in the form of common stock or equity shares.

When a company is established, it issues shares of stock that represent ownership in the company. Shareholders purchase these shares either through cash investments or by contributing assets such as property or equipment. The funds received from shareholders in these transactions are recorded as contributed capital.

Shareholders who contribute capital to the company become partial owners, with their ownership percentage determined by the number of shares they hold relative to the total number of shares outstanding. They also gain certain rights, such as voting rights in important corporate decisions and the right to share in the company’s profits.

Contributed capital from shareholders plays a crucial role in providing long-term financing and supporting the company’s operations and growth. It reflects the commitment and belief of shareholders in the company’s potential for success. The higher the contributed capital from shareholders, the stronger the financial foundation of the company.

In addition to the initial contributions, shareholders may also make additional investments in the company over time through the purchase of additional shares or through rights offerings. These subsequent contributions are also considered as part of the contributed capital from shareholders and further strengthen the financial resources available to the company.

On the balance sheet, contributed capital from shareholders is typically presented as a separate line item, often under the equity section. It is important to note that contributed capital is a permanent source of financing for the company, which means that it does not have to be repaid like debt.

Investors and stakeholders closely analyze the contributed capital from shareholders on the balance sheet to assess the financial strength and stability of the company. Higher levels of contributed capital can enhance the company’s creditworthiness and provide a sense of security to potential creditors and lenders.

In summary, contributed capital from shareholders represents the funds that shareholders invest in a company in exchange for ownership interests. It provides long-term financing to support the company’s operations and growth. By analyzing this component on the balance sheet, investors and stakeholders can gain insights into the financial strength and commitment of the company’s shareholders.

Contributed Capital from Business Owners

In addition to contributions from shareholders, businesses may also receive contributed capital directly from their owners. This category of contributed capital represents the funds that the business owners invest in the company to support its operations and growth.

Unlike contributed capital from shareholders, which typically involves multiple owners and the issuance of stock, contributions from business owners often occur in privately-owned businesses where the owners are actively involved in the day-to-day operations.

Contributed capital from business owners can take various forms. It may involve injecting cash into the business, transferring personal assets to the company, or even providing services or expertise without immediate compensation. These contributions from the owners help provide the necessary resources to meet operating expenses, invest in new initiatives, or seize growth opportunities.

It is important to note that in some cases, the business owners might also be the majority shareholders. However, contributions from business owners are often distinguished from those made by other shareholders because they reflect the personal investments and commitments of the owners, rather than the typical issuance of stock.

When recording contributions from business owners, the company typically credits the contributed capital account while debiting the owner’s equity or capital account. This helps ensure proper tracking and transparency of the contributions made by the owners.

Contributed capital from business owners is an essential component of the company’s financing structure. It demonstrates the owners’ dedication and belief in the success of the business. These contributions help create a solid financial foundation and can supplement the funds received from external sources such as shareholders or investors.

On the balance sheet, contributed capital from business owners is generally presented as a separate line item within the equity section. This allows investors, creditors, and other stakeholders to distinguish between contributions made by shareholders and those made by the business owners themselves.

The inclusion of contributed capital from business owners on the balance sheet provides valuable information about the financial commitment and level of involvement of the owners. It indicates their willingness to invest their own personal resources to support the business and reflects their dedication to its long-term success.

In summary, contributed capital from business owners represents the funds that owners invest in the company to support its operations and growth. These contributions play a crucial role in providing the necessary financial resources and demonstrate the owners’ commitment to the success of the business. Analyzing contributed capital from business owners on the balance sheet provides insights into the personal investments made by the owners and their level of involvement in the company.

Contributed Capital from Investors

In addition to contributed capital from shareholders and business owners, companies may also receive contributed capital from external investors. These investors provide funds in exchange for ownership stakes or preferred shares, contributing to the company’s capital structure and financial resources.

Contributed capital from investors often occurs in situations where a company seeks additional financing beyond what can be obtained from existing shareholders or business owners. These external investors can include venture capitalists, angel investors, private equity firms, or institutional investors.

Investors contribute capital to a company with the expectation of earning a return on their investment. They assess the company’s growth potential, market opportunities, and management team before deciding to commit their funds. Contributed capital from investors is typically structured through equity investments, where investors purchase shares of stock or receive ownership interests in the company.

In addition to providing capital, investors may also bring valuable expertise, industry connections, or strategic guidance to the company. Their involvement can help accelerate growth, improve operational efficiencies, or open doors to new opportunities. The decision to accept contributed capital from investors is often a strategic one aimed at fueling expansion or supporting specific initiatives.

The contributed capital from investors contributes to the long-term financing of the company. It is recorded as a liability on the balance sheet until certain conditions are met, such as achieving profitability or reaching a liquidity event like an initial public offering or acquisition. At that point, the contributed capital is converted into equity and recorded in the shareholders’ equity section of the balance sheet.

The classification and presentation of contributed capital from investors on the balance sheet may vary depending on the specific terms of the investment and the accounting standards implemented by the company. It is generally disclosed separately from other types of contributed capital to differentiate the contributions made by investors.

Contributed capital from investors is an important source of financing, especially for startups and companies in high-growth industries. The funds received from investors can provide a significant boost to the company’s operations, allowing it to invest in research and development, expand market reach, or scale production capabilities.

Overall, contributed capital from investors represents the funds provided by external investors in exchange for ownership stakes or preferred shares in a company. It plays a critical role in supporting the long-term growth and development of the business. Analyzing the contributed capital from investors on the balance sheet provides insights into the external financial support received by the company and the level of confidence that investors have in its potential for success.

Contributed Capital from Lenders

In some cases, companies may receive contributed capital from lenders, which is a unique source of financing. While lenders are typically associated with debt financing, certain arrangements allow lenders to contribute capital to a company, further strengthening its financial resources.

Contributed capital from lenders often arises through convertible debt instruments or convertible loans. These financial instruments provide lenders with the option to convert their loans into equity shares of the company under specific conditions.

Convertible debt allows companies to obtain funding from lenders while providing the potential for lenders to become partial owners of the business in the future. The decision to contribute capital as a lender is based on the lender’s assessment of the company’s growth prospects, financial stability, and potential for delivering a return on investment.

When lenders contribute capital, it represents their interest in not only being repaid the loan but also participating in the company’s long-term success. By converting their debt into equity, lenders align their interests with the company’s shareholders, as they gain the potential for capital appreciation and a share of future profits.

The contributed capital from lenders is generally recorded as a separate line item on the balance sheet under the equity section. This classification distinguishes it from other sources of contributed capital, such as funds provided by shareholders, business owners, or external investors.

It is important to note that contributed capital from lenders is typically contingent upon specific events, as outlined in the convertible debt agreements. For example, lenders may specify a predetermined period or a trigger event, such as the company achieving a certain level of financial performance or securing additional funding, before their loans can be converted into equity shares.

The inclusion of contributed capital from lenders on the balance sheet provides valuable information to stakeholders regarding the financing structure of the company. It signals the company’s ability to attract lenders who have confidence in its financial prospects and are willing to contribute not only through debt but also through potential equity participation.

Contributed capital from lenders can enhance a company’s financial standing by providing a non-dilutive source of funding and strengthening the equity component of the balance sheet. It can also be seen as a vote of confidence from lenders in the company’s ability to generate future earnings and return on investment.

In summary, contributed capital from lenders represents the funds contributed by lenders who have the option to convert their loans into equity shares of the company. This unique source of financing strengthens the company’s financial resources and aligns the lenders’ interests with the company’s long-term success. Analyzing the contributed capital from lenders on the balance sheet provides insights into the financial support obtained from lenders and the potential for equity participation in the future.

Presentation of Contributed Capital on the Balance Sheet

The presentation of contributed capital on the balance sheet provides valuable information about the financing structure of a company and the sources of capital utilized to support its operations and growth. Contributed capital is typically recorded in the equity section of the balance sheet, highlighting the investments made by stakeholders to acquire ownership interests in the business.

The specific presentation of contributed capital may vary depending on the company’s jurisdiction and the accounting standards followed. However, there are common elements in how contributed capital is typically disclosed on the balance sheet:

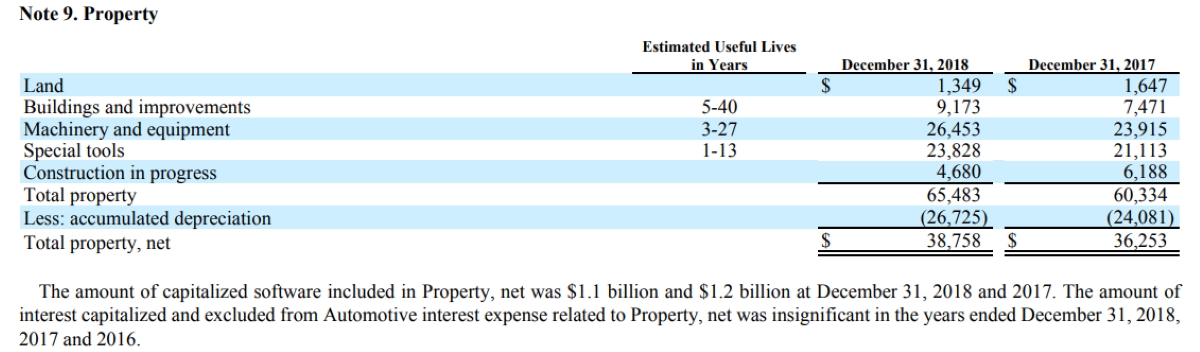

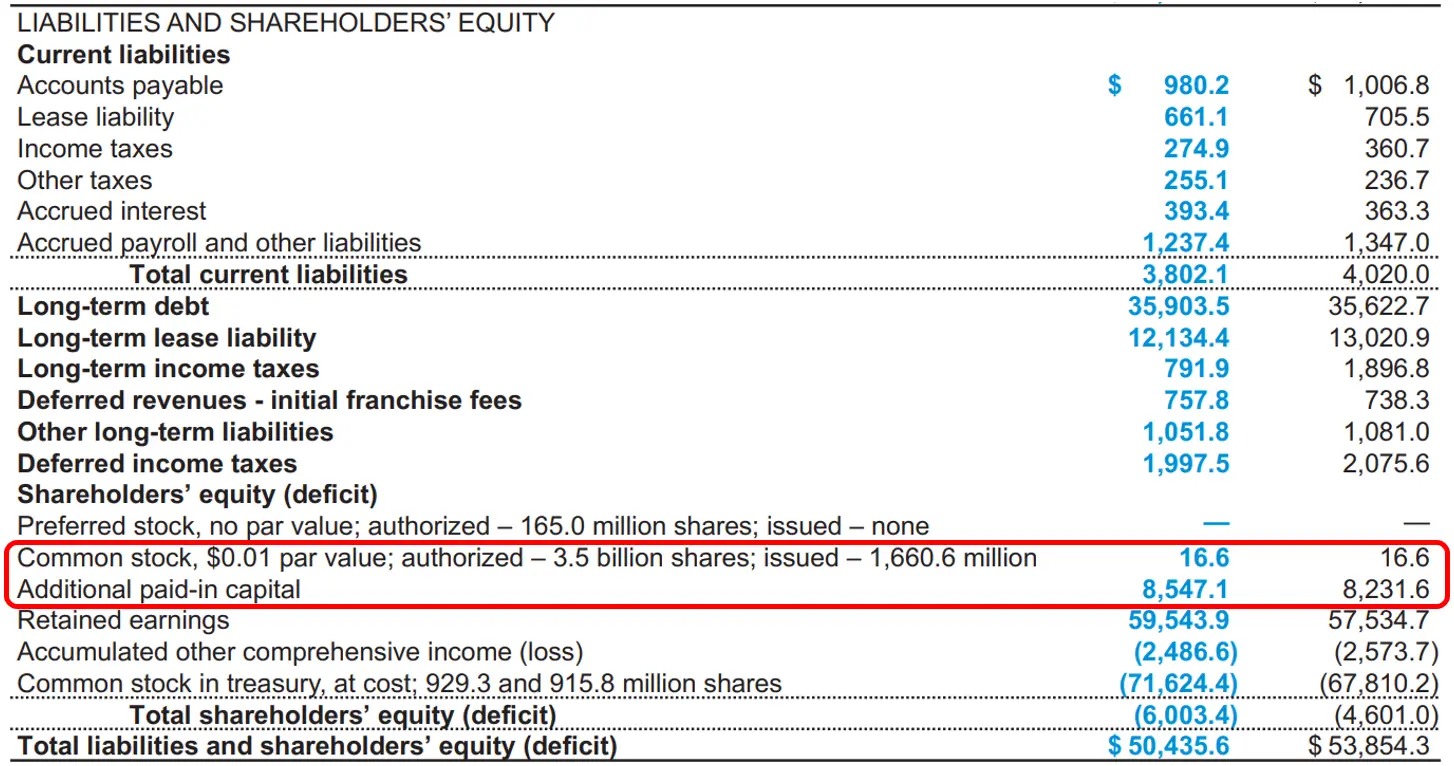

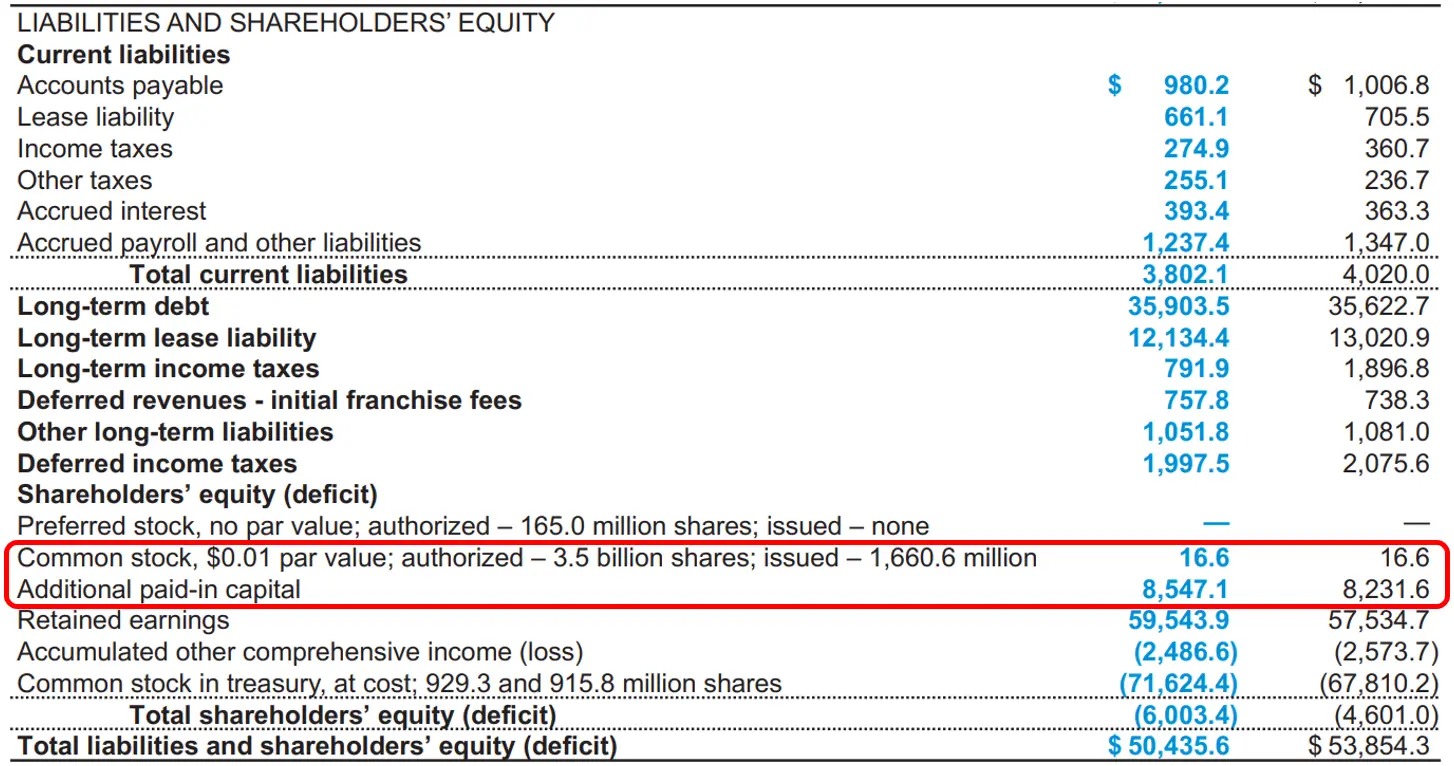

- Common Stock or Equity: The balance sheet often includes a line item for common stock or equity, which represents the amount of capital contributed by shareholders in exchange for ownership shares. This includes the initial contributions made by shareholders at the time of the company’s formation, as well as subsequent investments in the form of additional shares or rights offerings.

- Preferred Stock: If the company has issued preferred stock, it may be presented as a separate line item. Preferred stock represents ownership with specific preferences and rights, such as priority in dividend payments or liquidation preferences. The value of preferred stock reflects the contributed capital from investors who hold these shares.

- Additional Paid-in Capital: Contributed capital that exceeds the par value or stated value of the shares issued is recorded as additional paid-in capital. This account captures the excess amount that investors have paid for their shares, which represents additional contributed capital beyond the nominal value of the shares.

- Treasury Stock: In some cases, companies may repurchase their own shares on the open market, resulting in a reduction of outstanding shares. The cost of repurchased shares is recorded as treasury stock, which is subtracted from the total contributed capital to reflect the reduction in equity ownership.

The presentation of contributed capital on the balance sheet provides essential information to stakeholders, including investors, creditors, and regulatory authorities. It allows them to assess the level of capital invested in the company and the ownership structure. It also helps measure the financial resources available to the company and its ability to support future initiatives or weather financial challenges.

It is important to note that contributed capital is a permanent source of financing, unlike debt that needs to be repaid. Therefore, it is presented in the equity section rather than the liabilities section of the balance sheet. The inclusion of contributed capital in the equity section provides a clear distinction between the funds contributed by stakeholders and the company’s obligations to creditors or lenders.

Overall, the presentation of contributed capital on the balance sheet is a critical component for understanding a company’s financing structure and analyzing its financial health. The disclosure of contributed capital highlights the investments made by stakeholders and provides insights into the ownership structure, financial resources, and long-term stability of the business.

Examples of Contributed Capital Disclosures

When reviewing financial statements, it is important to understand how contributed capital is disclosed on the balance sheet. Here are some examples of contributed capital disclosures that you may come across:

- Common Stock: A company may have a line item on the balance sheet titled “Common Stock” or “Capital Stock,” which represents the amount of capital contributed by shareholders in exchange for ownership shares. This disclosure provides insight into the initial investments made by shareholders at the time of the company’s formation.

- Additional Paid-in Capital: Alongside common stock, the balance sheet may include a separate line item for “Additional Paid-in Capital.” This account captures the excess amount that investors have paid for their shares above the nominal or par value. It represents the additional contributed capital beyond the stated value of the shares.

- Preferred Stock: If the company has issued preferred stock, it may disclose a separate line item for “Preferred Stock” on the balance sheet. This represents the contributed capital from investors who hold preferred shares, which have specific preferences and rights over common stock.

- Treasury Stock: In some cases, companies may disclose the repurchase of their own shares through a line item titled “Treasury Stock.” The cost of repurchased shares is subtracted from the total contributed capital to reflect the reduction in equity ownership. This disclosure provides transparency regarding the company’s treasury stock activities.

- Shareholders’ Equity Breakdown: Some companies provide a more detailed breakdown of contributed capital within the shareholders’ equity section of the balance sheet. This breakdown may include separate line items for common stock, preferred stock, and additional paid-in capital, enabling stakeholders to analyze the composition of the contributed capital more comprehensively.

It is important to note that the specific disclosures may vary depending on the accounting standards followed and the jurisdiction in which the company operates. Companies may also include additional disclosures to provide more detailed information about the nature and terms of the contributed capital received.

The examples provided above offer a general understanding of how contributed capital may be disclosed on the balance sheet. Nonetheless, it is advisable to refer to the company’s specific financial statements and accompanying notes for accurate and detailed information regarding the composition and presentation of contributed capital.

Studying the contributed capital disclosures on the balance sheet allows stakeholders to gain insights into the financial resources invested in the company by its stakeholders, the ownership structure, and the capital contributions made over time.

Remember, the purpose of these disclosures is to provide transparency and enable stakeholders to make informed decisions based on the financial health and stability of the company.

Conclusion

Contributed capital is a vital component of a company’s balance sheet, representing the funds contributed by shareholders, business owners, investors, and lenders to support the operations and growth of the business. The presentation and disclosure of contributed capital on the balance sheet provide valuable insights into the financing structure, financial resources, and ownership composition of a company.

Understanding the classification and presentation of contributed capital is crucial for investors, creditors, and other stakeholders in assessing a company’s financial health and stability. It allows them to evaluate the level of financial resources available to support the company’s operations, the commitment of stakeholders, the ownership structure, and the potential for future growth and profitability.

Contributed capital can originate from shareholders, business owners, investors, or lenders, each representing different sources of funding and varying degrees of ownership and control. By clearly differentiating the sources of contributed capital, stakeholders can better understand the capital structure and related risks associated with the company.

Whether it is the contributions made by shareholders at the company’s inception, the investments made by business owners to sustain operations, the capital provided by external investors with an interest in the company’s success, or even contributions made by lenders in the form of convertible debt, the various forms of contributed capital are crucial for the company’s financial stability and growth potential.

As stakeholders analyze the balance sheet and review the disclosed contributed capital, they can gain insights into the financial commitment, confidence, and alignment of interests among the contributors. This knowledge supports decision-making, enhances financial evaluation, and enables stakeholders to assess the risk-reward tradeoff associated with their involvement in the company.

In conclusion, contributed capital is an essential element on the balance sheet, reflecting the funds invested by stakeholders to support a company’s operations and growth. The proper classification, presentation, and disclosure of contributed capital provide transparency and enable stakeholders to make informed decisions about their involvement with the company. By understanding the significance of contributed capital on the balance sheet, stakeholders can gain valuable insights into the financial health, stability, and growth potential of the business.