Finance

Where Is PPE On The Balance Sheet?

Modified: December 30, 2023

Find out where Personal Protective Equipment (PPE) is accounted for in the balance sheet. Understand its financial implications and ensure compliance with proper finance management practices.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of PPE on the Balance Sheet

- Classification of PPE on the Balance Sheet

- Tangible Fixed Assets

- Intangible Fixed Assets

- Financial Reporting of PPE on the Balance Sheet

- Methods of Valuing PPE on the Balance Sheet

- Depreciation of PPE on the Balance Sheet

- Impairment of PPE on the Balance Sheet

- Presentation and Disclosure of PPE on the Balance Sheet

- Conclusion

Introduction

When it comes to understanding the financial health of a company, the balance sheet is a crucial document. It provides a snapshot of the company’s assets, liabilities, and equity at a given point in time. One key component of the balance sheet is Property, Plant, and Equipment (PPE), which represents the tangible and intangible assets that a company owns and uses to generate revenue.

PPE encompasses a wide range of items, ranging from land and buildings to machinery, vehicles, and even intellectual property. These assets play a vital role in the daily operations and long-term success of a business. However, figuring out where exactly PPE fits on the balance sheet can be a bit perplexing.

The purpose of this article is to shed light on the importance of PPE on the balance sheet and provide insights into its classification, financial reporting, valuation, and presentation. Whether you are a business owner, investor, or financial professional, understanding the role of PPE in financial statements is essential for making informed decisions.

So, let’s delve into the world of PPE and explore its significance on the balance sheet.

Importance of PPE on the Balance Sheet

PPE holds significant importance on the balance sheet as it represents a substantial investment made by a company to support its operations and achieve its strategic objectives. Here are a few reasons why PPE is crucial:

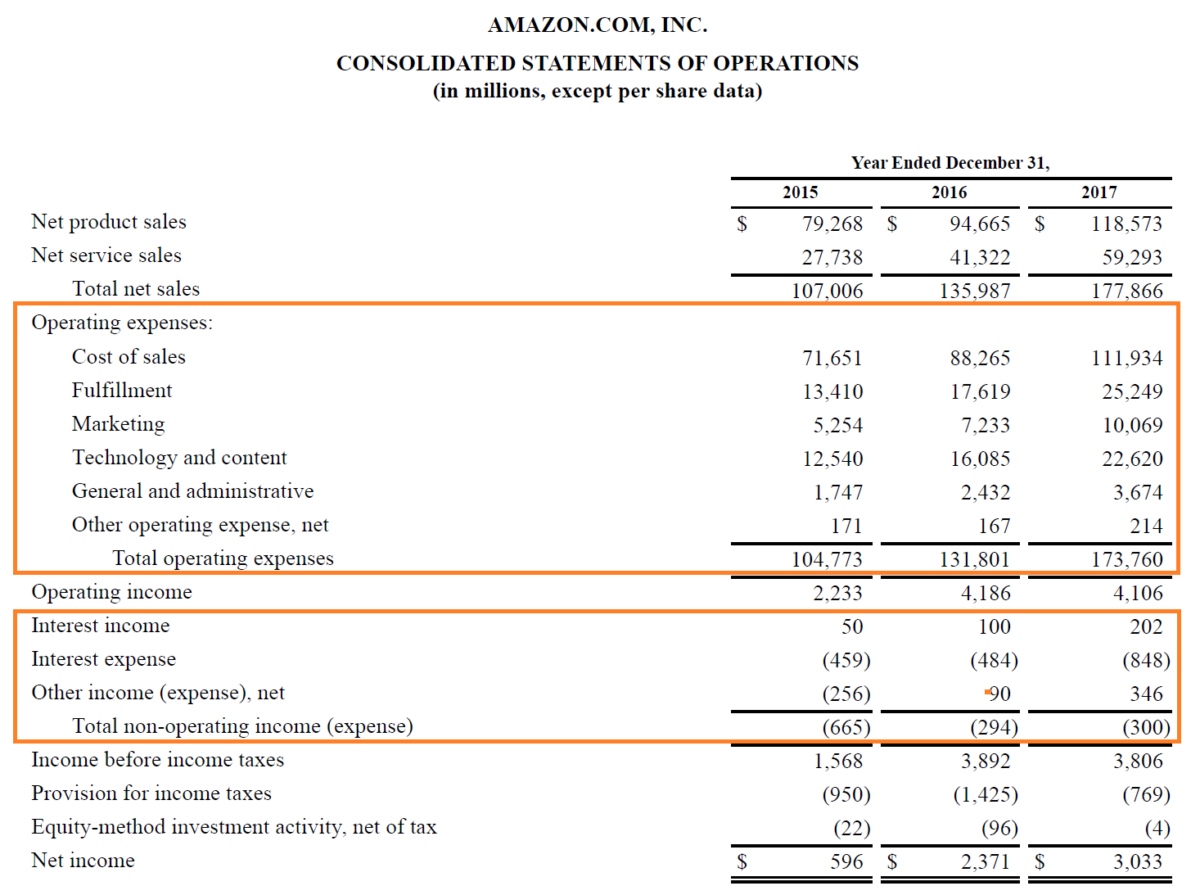

- Asset Value: PPE constitutes a substantial portion of a company’s total assets. Its value on the balance sheet reflects the capital invested in acquiring and maintaining these assets. Investors and stakeholders use this information to assess the financial health and stability of a company.

- Revenue Generation: PPE plays a fundamental role in a company’s revenue generation. Machinery, equipment, and other tangible assets enable businesses to produce goods and provide services. The value generated through the use of these assets contributes to the company’s overall financial performance.

- Long-term Investment: PPE represents a long-term investment for a company. Unlike current assets that are expected to be consumed or sold within a year, PPE assets have a useful life of more than one year. Proper maintenance and efficient utilization of these assets are crucial for their long-term viability and profitability.

- Business Expansion: As a company grows, it may need to invest in additional PPE to expand its operations. The value of PPE on the balance sheet provides insights into a company’s growth strategy and its ability to scale operations. Investors and lenders evaluate this information to assess a company’s prospects for future expansion and profitability.

- Depreciation and Impairment: PPE assets, particularly tangible assets, are subject to depreciation and impairment. Depreciation represents the systematic allocation of the cost of an asset over its useful life, while impairment reflects a decrease in an asset’s value due to obsolescence or market conditions. Tracking the depreciation and impairment of PPE assets on the balance sheet is vital for accurate financial reporting.

In summary, the importance of PPE on the balance sheet cannot be overstated. It represents a significant investment, revenue generation potential, long-term value, expansion opportunity, and the need for accurate financial reporting. As we proceed, we will explore how PPE is classified and reported on the balance sheet to better understand its impact on a company’s financial position.

Classification of PPE on the Balance Sheet

PPE assets can be categorized into two main groups: tangible fixed assets and intangible fixed assets. Let’s explore each classification in detail:

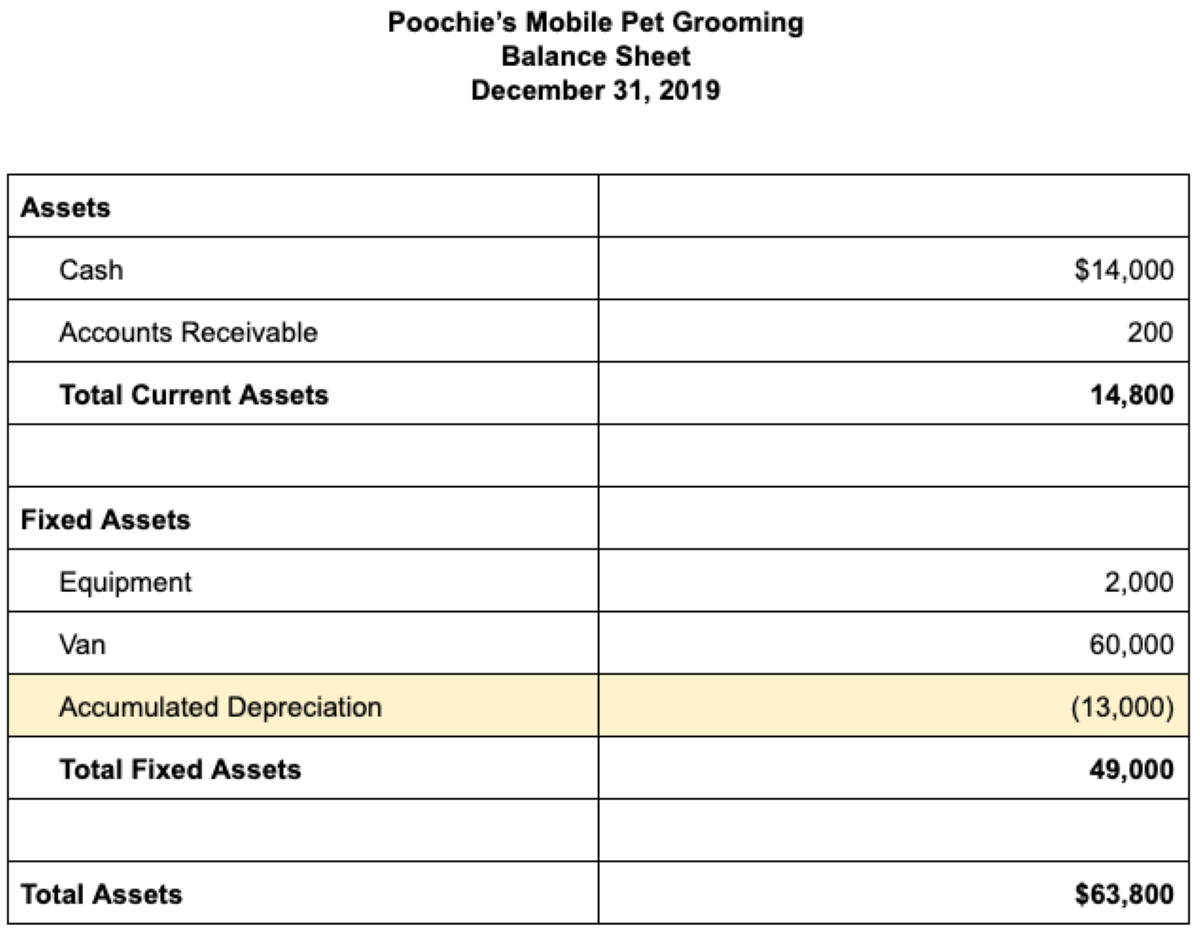

Tangible Fixed Assets

Tangible fixed assets are physical assets that have a physical existence and can be touched or seen. These assets include land, buildings, machinery, vehicles, furniture, and equipment. Tangible fixed assets are typically long-term assets with a useful life of more than one year.

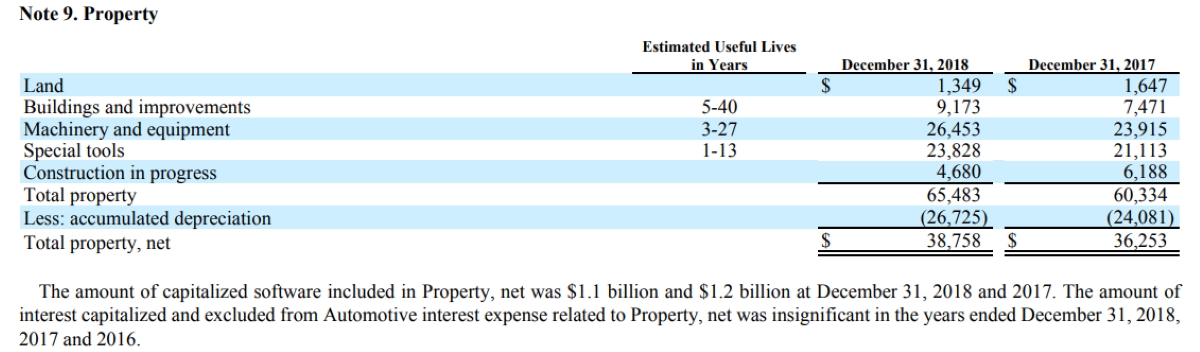

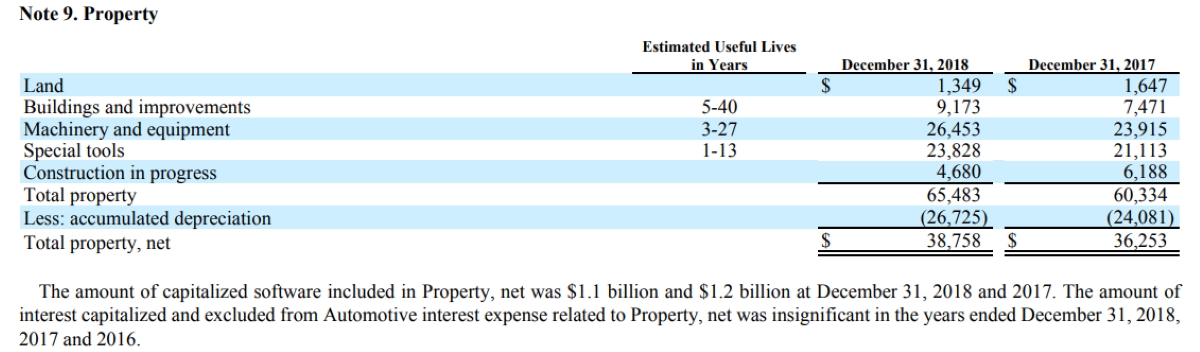

On the balance sheet, tangible fixed assets are presented at their historical cost, which includes the purchase price, transportation costs, installation costs, and any necessary improvements or renovations to bring the asset into its usable condition. The historical cost is then reduced by accumulated depreciation to reflect the net book value of the asset.

Depreciation is the systematic allocation of the cost of the asset over its useful life. It is recorded as an expense on the income statement and reduces the value of the asset on the balance sheet. Depreciation methods can vary, such as straight-line depreciation, accelerated depreciation, or units-of-production depreciation, depending on the nature of the asset and its expected pattern of use.

Intangible Fixed Assets

Intangible fixed assets, on the other hand, are assets that do not have a physical existence but still hold value for the company. These assets include intellectual property, patents, copyrights, trademarks, trade secrets, software, customer lists, and brand recognition. Intangible assets are also long-term assets with a useful life of more than one year.

Intangible fixed assets are typically reported on the balance sheet at their cost of acquisition or development. However, unlike tangible fixed assets, which are depreciated, intangible assets are subject to amortization. Amortization is similar to depreciation but is used to allocate the cost of intangible assets over their useful life.

It’s important to note that not all intangible assets are considered fixed assets. Some intangible assets, such as goodwill, are not classified as fixed assets but have their own separate category on the balance sheet.

By classifying PPE into tangible fixed assets and intangible fixed assets, companies can provide a clearer picture of their asset composition on the balance sheet. This classification enables investors, stakeholders, and financial analysts to assess the value, depreciation, and amortization of these assets, aiding in better decision making and understanding a company’s financial position.

Tangible Fixed Assets

Tangible fixed assets are physical assets that have a physical existence and can be touched or seen. These assets play a vital role in the operations of a company and include land, buildings, machinery, vehicles, furniture, and equipment.

Land is an essential tangible fixed asset that represents the surface area and natural resources of a property. It includes undeveloped land, land with buildings or structures, and land leased by the company for its operations. The value of land on the balance sheet is typically its original purchase cost or fair market value.

Buildings are another significant component of tangible fixed assets. They include structures used for manufacturing, offices, warehouses, retail spaces, and other operational needs. The value of buildings on the balance sheet is the original cost of construction or acquisition, including related expenses such as legal fees and renovation costs.

Machinery and equipment are tangible fixed assets used in the production process. These assets include manufacturing machinery, vehicles, computer hardware, and tools. The value of machinery and equipment is recorded on the balance sheet at their original purchase cost, which includes transportation and installation costs.

Furniture and fixtures are tangible fixed assets used in office settings, retail spaces, or other operational areas. These can include desks, chairs, shelves, display cases, and lighting fixtures. The value of furniture and fixtures is typically the original cost of acquisition.

Tangible fixed assets are reported on the balance sheet at their historical cost, which includes the initial purchase price and any additional costs incurred to make the asset ready for use, such as transportation or installation expenses. The historical cost is then reduced by accumulated depreciation to reflect the net book value of the asset.

Depreciation is the process of allocating the cost of tangible fixed assets over their useful life. It recognizes that assets deteriorate over time due to wear and tear, obsolescence, or technological advancements. Various depreciation methods can be used, such as straight-line depreciation, which evenly spreads the cost of the asset over its useful life, or accelerated depreciation, which allows for a higher depreciation expense in the early years.

It is important for companies to accurately track the depreciation of tangible fixed assets to provide a realistic representation of the asset’s value on the balance sheet. This information provides insights into the age and condition of the assets, their impact on the company’s profitability, and any potential need for replacement or upgrades.

In summary, tangible fixed assets are physical assets that are vital for a company’s operations. They include land, buildings, machinery, vehicles, furniture, and equipment. These assets are reported at their historical cost on the balance sheet, and their value is reduced by accumulated depreciation to determine the net book value. Proper management and accurate reporting of tangible fixed assets are crucial for assessing a company’s financial health and its ability to generate revenue.

Intangible Fixed Assets

Intangible fixed assets are assets that do not have a physical existence but still hold value for a company. These assets play a critical role in contributing to a company’s success and include intellectual property, patents, copyrights, trademarks, trade secrets, software, customer lists, and brand recognition.

Intellectual property (IP) is one of the most valuable types of intangible fixed assets. It includes creations of the mind, such as inventions, designs, processes, and artistic works. Patents, which provide exclusive rights to an invention, are a common form of intellectual property. The value of intellectual property assets is generally determined by the cost of acquisition or development, including legal fees and research and development expenses.

Copyrights protect original works of authorship, such as books, music, and software code, from being copied or used without permission. These intangible fixed assets hold value for companies in industries such as publishing, entertainment, and technology.

Trademarks are distinctive signs, symbols, or words that identify and distinguish a company’s products or services. Trademarks play a crucial role in brand recognition and customer loyalty. The value of trademarks is determined by their recognition and reputation in the market and can be a significant asset for companies in industries such as consumer goods, retail, and hospitality.

Trade secrets are confidential information that provides a competitive advantage to a company. It can include customer lists, manufacturing processes, formulas, and proprietary technologies. While trade secrets may not have a specific cost associated with them, they hold a significant value for companies in maintaining a competitive edge.

Software is another valuable intangible fixed asset for technology companies. This includes computer programs, applications, and databases that are either developed internally or acquired from third-party vendors. The value of software assets is typically the cost of acquisition or development.

Intangible fixed assets are reported on the balance sheet at their cost of acquisition or development. However, unlike tangible fixed assets that are depreciated, intangible assets are typically amortized. Amortization is the process of allocating the cost of intangible assets over their useful life. The useful life of intangible assets can be either a specific number of years or an indefinite period, depending on the nature of the asset.

It is crucial for companies to accurately track the amortization of intangible fixed assets to reflect their decreasing value over time. This information provides insights into the ongoing value of these assets and any potential need for reinvestment or the development of new intellectual property.

In summary, intangible fixed assets are assets that do not have a physical presence but still hold significant value for a company. They include intellectual property, patents, copyrights, trademarks, trade secrets, software, and brand recognition. These assets are reported at their cost of acquisition or development and are subject to amortization. Proper management and reporting of intangible fixed assets are essential for assessing a company’s competitive advantage and potential for long-term success.

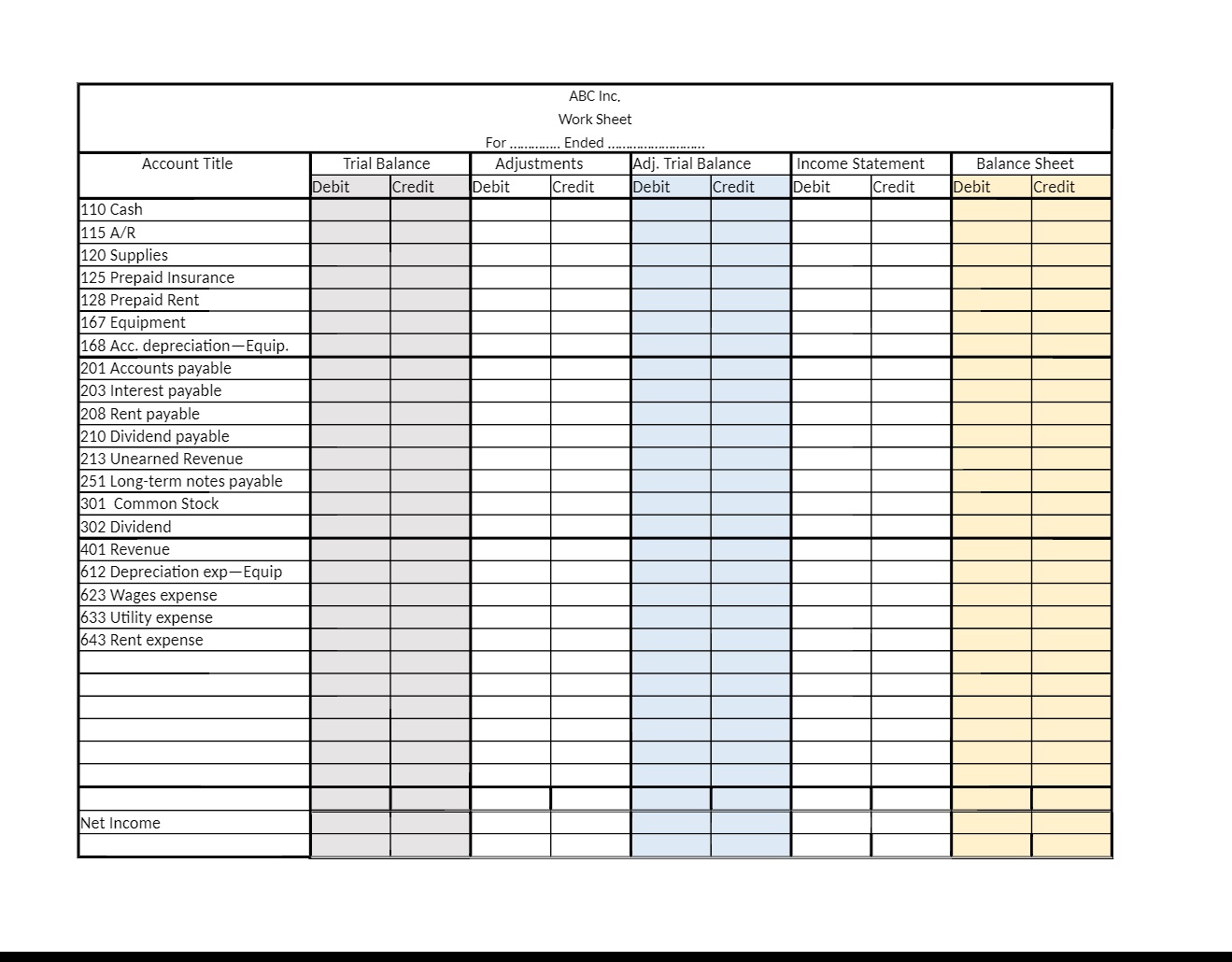

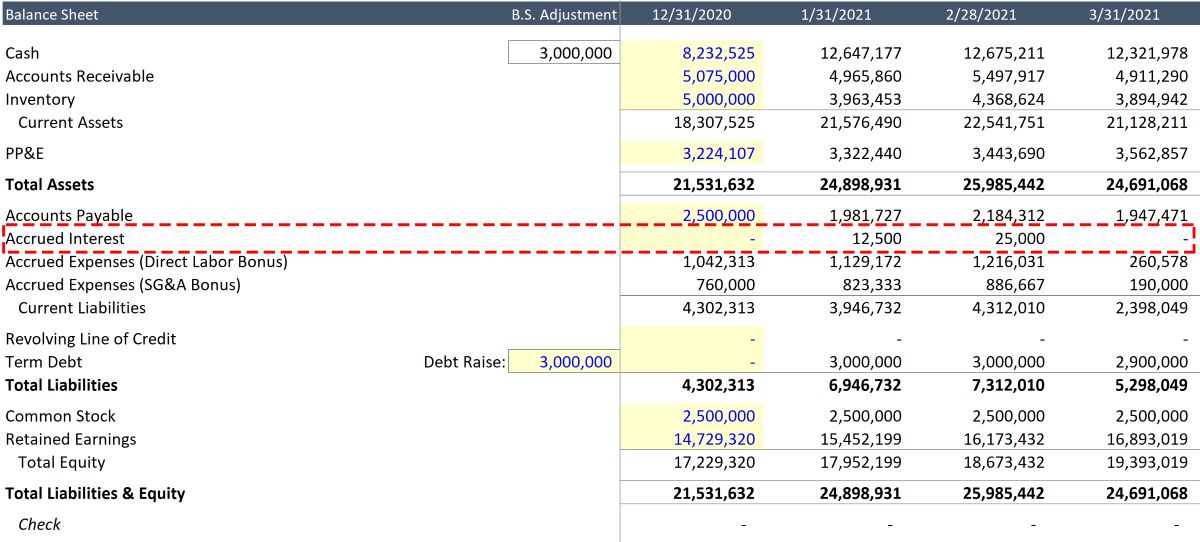

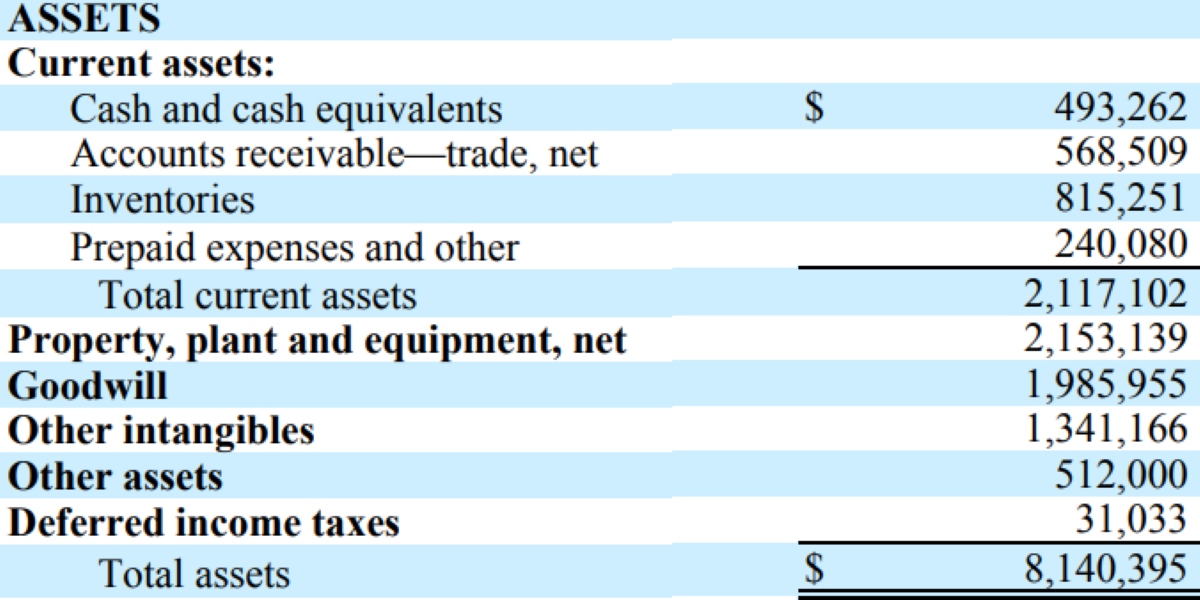

Financial Reporting of PPE on the Balance Sheet

The financial reporting of Property, Plant, and Equipment (PPE) on the balance sheet involves several key aspects that provide insights into the value and condition of these assets. Let’s explore the main elements of financial reporting for PPE:

Cost Recognition

When a company acquires or constructs an item of PPE, it is initially recognized on the balance sheet at its historical cost. The historical cost includes all expenditures directly attributable to acquiring, constructing, and preparing the asset for its intended use, such as purchase price, transportation costs, and installation fees. Indirect costs, such as financing costs, are generally not included in the cost of PPE.

Subsequent Measurement

After recognizing PPE on the balance sheet, companies need to determine how to measure and present these assets in subsequent periods. PPE is typically reported at cost less accumulated depreciation or amortization, and any impairment losses that may have occurred. The accumulated depreciation or amortization represents the cumulative amount of the asset’s value that has been allocated as an expense over its useful life.

Revaluation

In some cases, companies may choose to report PPE at revalued amounts instead of historical cost. Revaluation involves assessing the fair value of the asset at a particular point in time and adjusting the carrying amount accordingly. Revaluations can occur periodically or when there is a significant change in the asset’s fair value. Revaluations are typically undertaken for land and buildings, and the revalued amounts are disclosed in the financial statements.

Disclosure

Financial reporting of PPE also requires disclosure of significant information related to these assets. This includes providing details about the nature and location of PPE, useful lives or depreciation methods used, any restrictions on PPE, and any material contractual obligations related to PPE. Companies are also required to disclose any impairment losses, revaluations, and changes in accounting policies or estimates regarding PPE.

Notes to the Financial Statements

Additional information about PPE is typically disclosed in the notes to the financial statements. This can include details about significant PPE transactions during the reporting period, commitments for acquiring PPE in the future, and any major repairs or maintenance activities undertaken on existing PPE assets. These notes provide readers with further insights into the composition, condition, and future plans pertaining to PPE.

Proper financial reporting of PPE on the balance sheet is essential for providing transparent and accurate information to investors, creditors, and other stakeholders. It allows them to assess the value, depreciation, and impairment of these assets, aiding in decision-making, performance evaluation, and risk assessment.

Methods of Valuing PPE on the Balance Sheet

Valuing Property, Plant, and Equipment (PPE) on the balance sheet involves determining the monetary worth of these assets. There are several methods used to value PPE, each with its own considerations and benefits. Let’s explore some of the common methods:

Historical Cost

The historical cost method is the most widely used approach for valuing PPE. Under this method, PPE is initially recorded on the balance sheet at its historical cost, which represents the amount paid to acquire or construct the asset. Historical cost includes all direct expenditures related to the acquisition, as well as indirect costs directly attributable to bringing the asset into its usable condition. The advantage of this method is that it provides a reliable and verifiable value that reflects the original investment made by the company.

Revaluation Model

The revaluation model is an alternative method for valuing PPE, whereby the carrying amount of the asset is adjusted to its fair value. Fair value represents the estimated market value of the asset at a specific point in time. Revaluations are typically undertaken for land and buildings, as their values can fluctuate significantly over time. The advantage of the revaluation model is that it provides a more up-to-date and realistic value for assets that have experienced substantial appreciation or depreciation since their acquisition.

Depreciated Replacement Cost

Depreciated replacement cost is a method that estimates the current value of an asset by considering the cost of acquiring a similar replacement asset after deducting the accumulated depreciation. This method takes into account the asset’s age, condition, and remaining useful life. By calculating the depreciated replacement cost, companies can determine a reasonable estimate of the current value of their PPE assets. This method is particularly useful when determining the insurance coverage needed for these assets.

Market Value

Market value is an approach that values PPE based on the prices at which similar assets are currently being bought and sold in the market. This method is particularly relevant when there is an active market for the specific type of asset in question. However, determining market value can be challenging, especially for unique or specialized assets where comparable transactions may be limited. Market value is typically used when determining the fair value of assets during revaluation.

It’s important to note that the chosen method of valuing PPE should be consistently applied to ensure comparability and accuracy in financial reporting. Additionally, the valuation method used should be disclosed in the financial statements along with any significant assumptions or estimates made during the valuation process.

By utilizing appropriate methods of valuing PPE, companies can provide stakeholders with a clearer understanding of the value of their tangible assets and ensure more accurate financial reporting.

Depreciation of PPE on the Balance Sheet

Depreciation is a critical aspect of financial reporting for Property, Plant, and Equipment (PPE) on the balance sheet. It is the systematic allocation of the cost of an asset over its useful life, reflecting the decrease in value that occurs due to wear and tear, obsolescence, or technological advancements. Let’s delve into the importance and methods of depreciation for PPE:

Importance of Depreciation

Depreciation serves two main purposes in financial reporting. Firstly, it aligns the recognition of the cost of the asset with the revenue the asset generates over its useful life, providing a more accurate representation of the asset’s earning capacity. Secondly, depreciation helps to distribute the cost of the asset over its useful life, allowing for a fair assessment of the company’s profitability and performance.

Depreciation Methods

There are several methods used to calculate the depreciation of PPE assets. The most common methods include:

Straight-Line Method:

The straight-line method evenly allocates the cost of the asset over its useful life. This is achieved by dividing the difference between the asset’s initial cost and its estimated residual value by the expected number of years of useful life. The advantage of the straight-line method is its simplicity and equal distribution of depreciation expense over time.

Declining Balance Method:

The declining balance method, also known as the accelerated depreciation method, allocates a higher depreciation expense in the early years of the asset’s life and lower amounts in subsequent years. This method recognizes that assets often experience greater wear and tear and technological obsolescence in the earlier years. The declining balance method allows for a faster recovery of the asset’s cost and better matches the depreciation expense with the asset’s revenue-generating capacity.

Units-of-Production Method:

The units-of-production method calculates depreciation based on the actual usage or production output of the asset. This method takes into account the asset’s expected total units of production or service hours and allocates depreciation based on the proportion of units produced or service hours utilized during a particular period. The advantage of this method is that it links the depreciation expense directly to the asset’s usage, providing a more accurate reflection of the asset’s contribution to the company’s operations.

Impact of Depreciation on the Balance Sheet

Depreciation has a direct impact on the carrying value of PPE assets reported on the balance sheet. The accumulation of depreciation over time reduces the asset’s net book value, which is the historical cost minus the accumulated depreciation. The net book value represents the remaining value of the asset that has not yet been allocated as an expense.

Depreciation is also reflected in the income statement as an expense, reducing the company’s net income. This depreciation expense helps adjust the reported revenue for the cost of using the PPE assets during a given period. As a non-cash expense, depreciation shows a company’s ability to generate profit from its investments in PPE, while also accounting for the ongoing reduction in value of these assets.

Accurate depreciation accounting ensures that the carrying value of PPE assets on the balance sheet reflects their current value and helps stakeholders assess a company’s financial position, profitability, and ability to reinvest in its operations.

Impairment of PPE on the Balance Sheet

Impairment of Property, Plant, and Equipment (PPE) is an essential consideration in financial reporting, as it reflects a significant decline in the value of these assets. An impairment occurs when the carrying amount of an asset exceeds its recoverable amount, which is the higher of its fair value less costs to sell or its value in use. Let’s explore the implications and process of impairment for PPE on the balance sheet:

Signs of Impairment

There are several indicators that may signal the need for impairment testing of PPE assets:

- Physical damage, technological obsolescence, or significant changes in market conditions that could affect the asset’s value

- Unforeseen events or changes in regulations impacting the asset’s usefulness or restrict its usage

- Significant decline in the asset’s market value or the entity’s financial performance

- Loss of a major customer or contract associated with the asset

Impairment Testing

Impairment testing involves comparing the carrying amount of the asset with its recoverable amount. If the carrying amount exceeds the recoverable amount, the asset is impaired, and an impairment loss needs to be recognized on the balance sheet.

When conducting impairment testing, companies typically follow a two-step process:

- Step 1: Determining Impairment: In this step, the recoverable amount of the asset is calculated by determining the higher of its fair value less costs to sell or its value in use. Fair value represents the price at which the asset could be sold in the market, while the value in use is the present value of expected future cash flows generated by the asset. If the carrying amount exceeds the recoverable amount, the asset is considered impaired.

- Step 2: Measuring Impairment Loss: If impairment is identified, the impairment loss is calculated as the difference between the carrying amount of the asset and its recoverable amount. The impairment loss is recognized as an expense on the income statement and reduces the carrying value of the asset on the balance sheet.

Financial Reporting of Impairment

When an impairment loss is recognized, companies need to disclose this information in the financial statements. The impairment loss is typically reported as a separate line item on the income statement, reflecting the impact on the company’s net income. Additionally, the carrying amount of the impaired asset is adjusted on the balance sheet to reflect the reduced value.

Companies are also required to provide detailed disclosures about the impairment loss, including the nature of the impairment, the carrying amounts before and after impairment, the events or circumstances leading to the impairment, and the method of impairment testing used.

Impairment of PPE on the balance sheet is crucial for providing accurate and transparent financial information to investors, creditors, and other stakeholders. It ensures that the carrying value of assets reflects their current value and helps assess a company’s financial performance and ability to generate future cash flows.

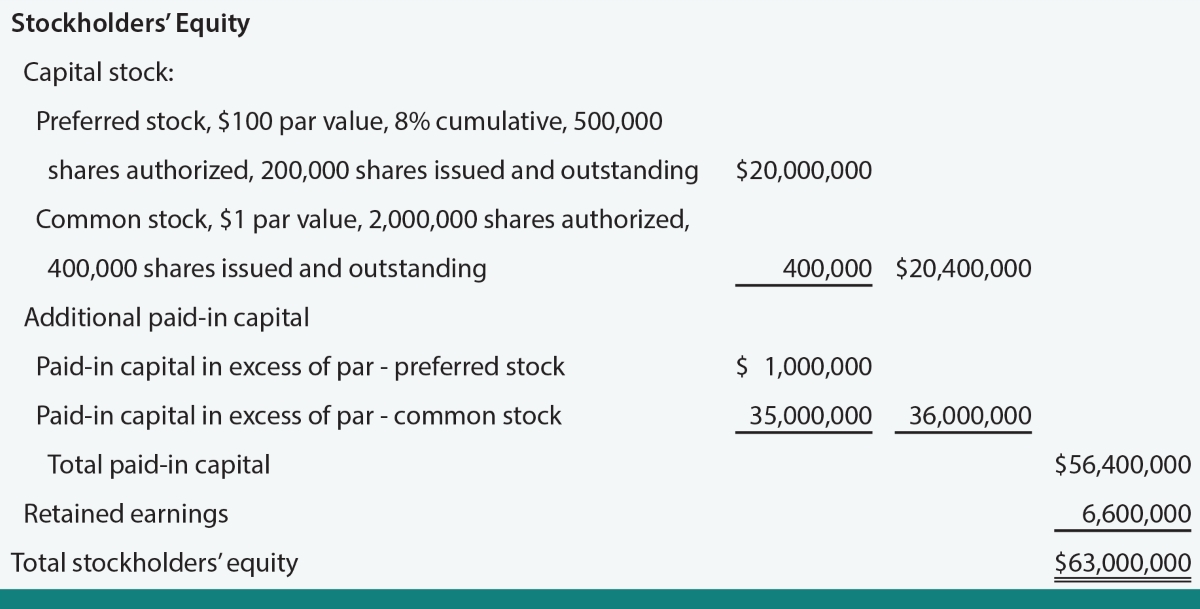

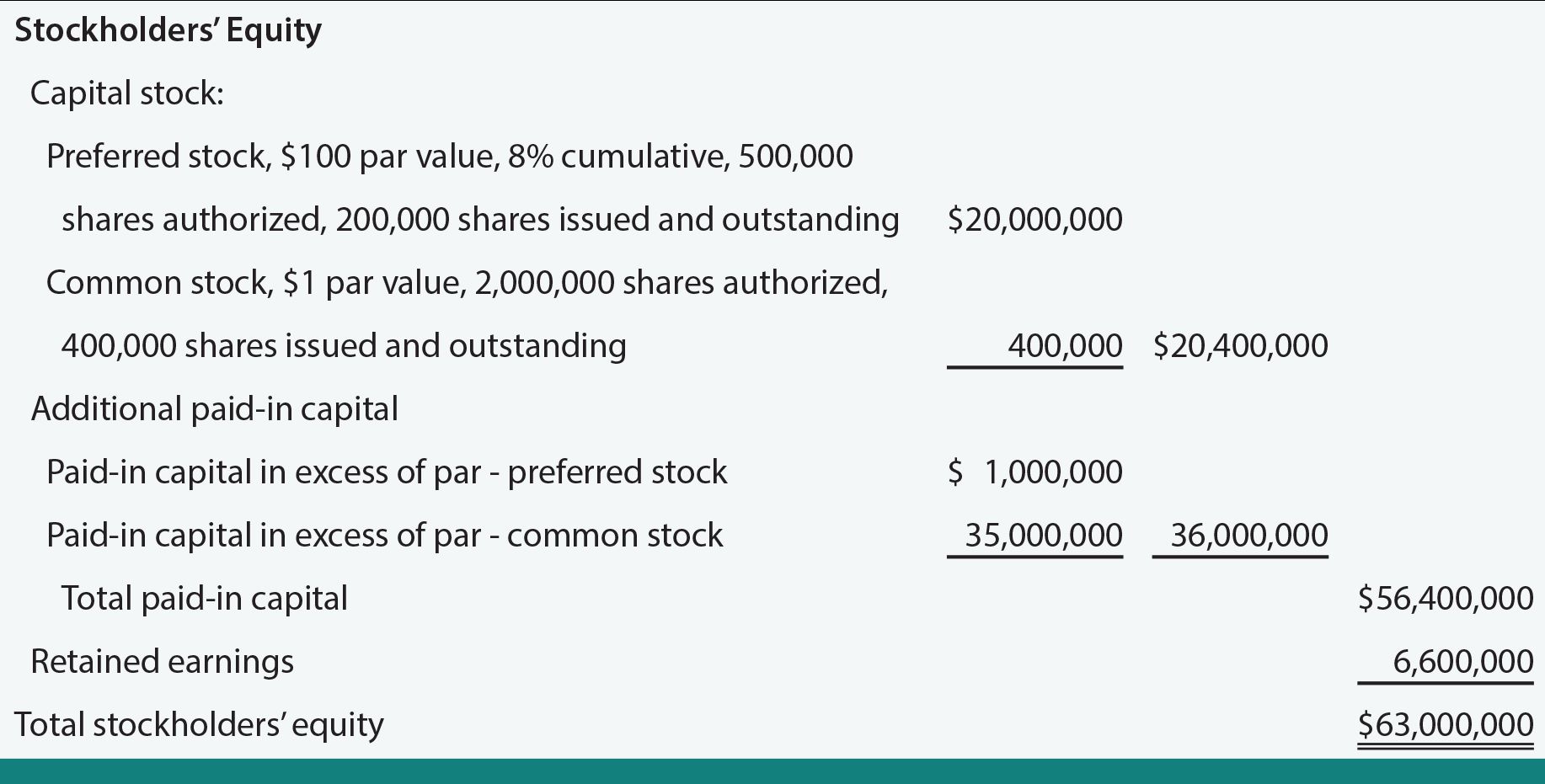

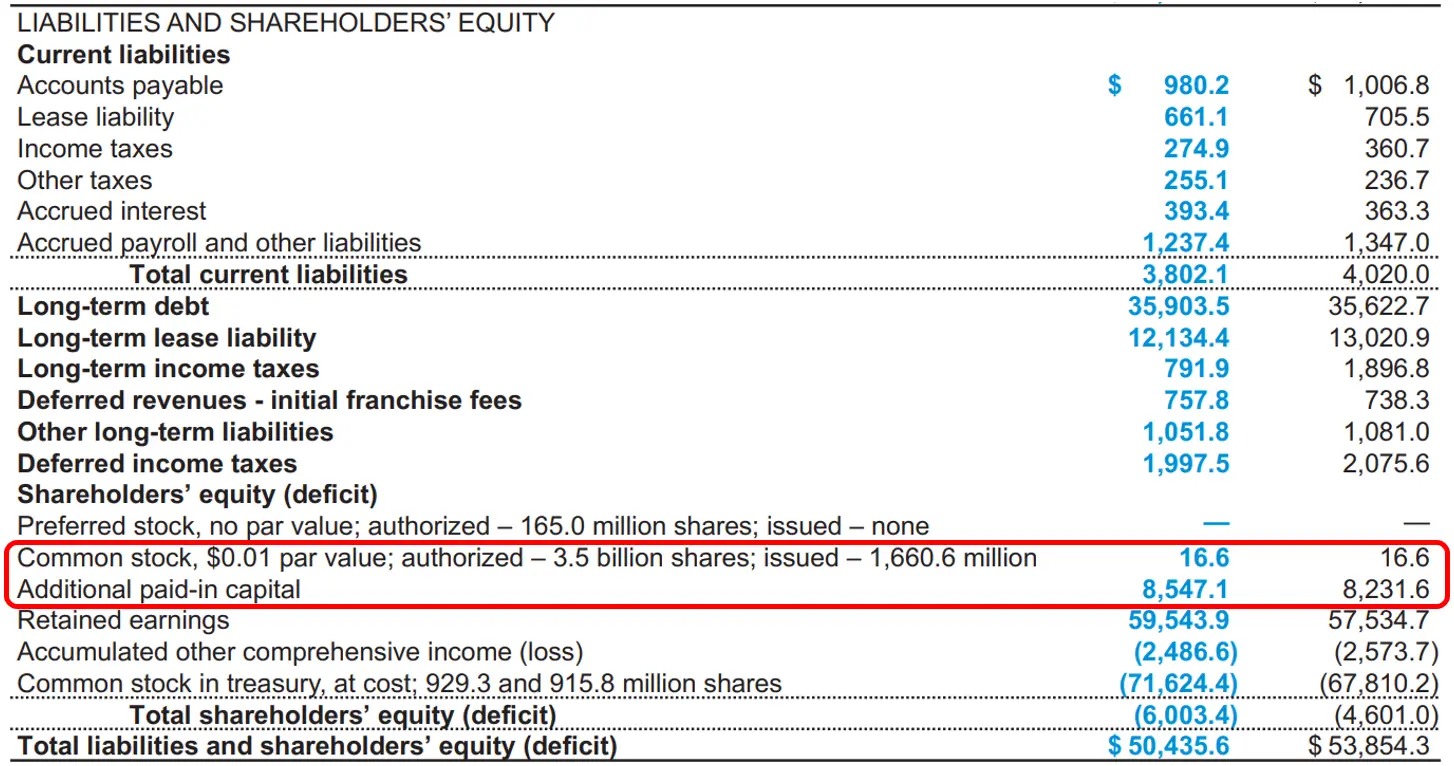

Presentation and Disclosure of PPE on the Balance Sheet

The presentation and disclosure of Property, Plant, and Equipment (PPE) on the balance sheet is essential for providing transparent and accurate information about these assets to investors, creditors, and other stakeholders. Let’s explore the key aspects of how PPE is presented and disclosed:

Separate Category

PPE is typically presented as a separate category on the balance sheet. This allows readers to easily identify and analyze the value and composition of these assets. The total value of PPE is often reported as a single line item, with additional disclosures provided in the notes to the financial statements.

Carrying Amount

The carrying amount of PPE represents the value of these assets after deducting accumulated depreciation and any impairment losses. This net book value provides insights into the remaining value of the assets on the balance sheet.

Classification and Breakdown

Companies are required to provide a breakdown of PPE assets within the separate category on the balance sheet. This breakdown usually includes major asset classes, such as land, buildings, machinery, vehicles, and equipment. This granularity allows stakeholders to understand the composition of PPE and assess the significance of each asset class to the company’s operations.

Accumulated Depreciation

The accumulated depreciation of PPE is typically disclosed alongside the carrying amount of each asset class. This information shows the total depreciation recognized on these assets over their useful lives. It helps stakeholders understand the extent to which the assets have been depreciated and how much value remains on the balance sheet.

Revaluations and Impairments

If any revaluations or impairments have occurred during the reporting period, companies are required to disclose these events and their impact on the carrying amount of PPE. This information helps stakeholders understand any significant changes in the value of the assets and the reasons behind those changes.

Notes to the Financial Statements

Additional disclosure about PPE is typically provided in the notes to the financial statements. These notes provide further details about the assets, including the methods used to calculate depreciation, the useful lives assigned to each asset class, any restrictions on the assets, and commitments for acquiring additional PPE in the future.

The notes may also disclose any lease arrangements related to PPE, obligations for deferred maintenance or repairs, and significant transactions involving the purchase or disposal of PPE during the reporting period. This information helps stakeholders gain a comprehensive understanding of the PPE assets and their impact on the company’s financial position.

By presenting and disclosing PPE assets appropriately on the balance sheet and in the accompanying notes, companies can provide stakeholders with clear and detailed information about the value, composition, and conditions of these assets. This enhances transparency, facilitates informed decision-making, and promotes trust and confidence among investors and other interested parties.

Conclusion

Understanding the role of Property, Plant, and Equipment (PPE) on the balance sheet is essential for evaluating and comprehending a company’s financial position. PPE represents a significant investment by companies and plays a crucial role in their operations and revenue generation.

Throughout this article, we have explored the importance, classification, financial reporting, valuation, and presentation of PPE on the balance sheet. PPE assets are classified into tangible fixed assets, including land, buildings, machinery, vehicles, and equipment, and intangible fixed assets, such as intellectual property, patents, copyrights, trademarks, and software.

Financial reporting of PPE on the balance sheet involves recognizing the cost of acquisition or development, subsequent measurement at cost less accumulated depreciation or amortization, and disclosure of significant information about these assets.

Valuation methods for PPE include historical cost, revaluation, depreciated replacement cost, and market value. The chosen method should be consistently applied and disclosed in the financial statements.

Depreciation is a vital aspect of PPE accounting, involving the systematic allocation of the asset’s cost over its useful life. Depreciation methods, such as straight-line, declining balance, or units-of-production, help accurately match the cost of the asset with its revenue-generating capacity over time.

Impairment of PPE occurs when the carrying amount of an asset exceeds its recoverable amount, indicating a significant decline in value. Impairment testing and recognition are necessary to reflect the true value of assets on the balance sheet.

Presentation and disclosure of PPE on the balance sheet involve separate categorization, breakdown by asset classes, disclosure of accumulated depreciation and any revaluations or impairments, and additional information provided in the notes to the financial statements.

In conclusion, having a comprehensive understanding of PPE on the balance sheet is vital for analyzing a company’s financial health, asset composition, and future prospects. Accurate reporting and disclosure of PPE assets provide stakeholders with the information they need to make informed decisions and assess the value and condition of these critical assets.