Finance

Where Does Sales Revenue Go On A Balance Sheet

Published: December 27, 2023

Learn where sales revenue is recorded on a balance sheet and gain insights into the financial aspect of your business with our comprehensive finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

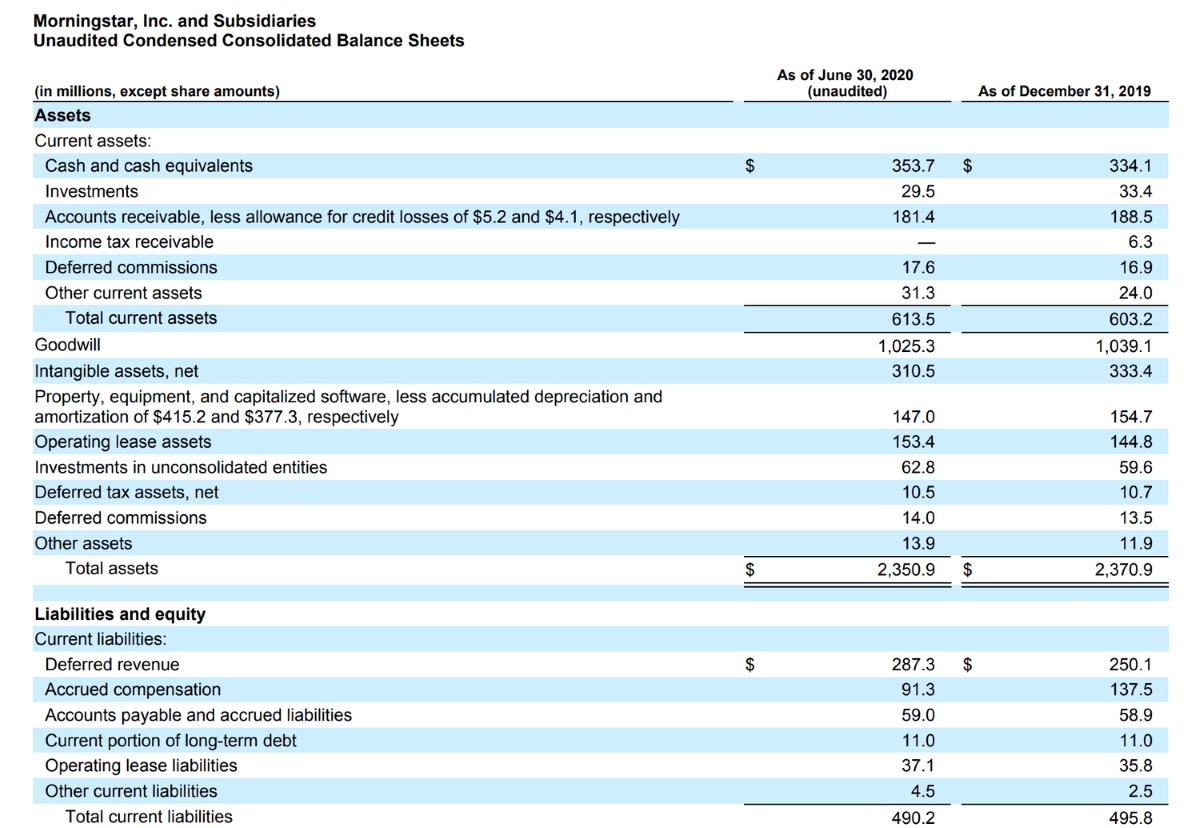

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of the organization’s assets, liabilities, and shareholders’ equity. One crucial aspect of the balance sheet is the reporting of sales revenue, which represents the income generated from the sale of goods or services. Understanding how sales revenue is recorded on a balance sheet is essential for evaluating a company’s financial performance and stability.

Sales revenue, often referred to as the top line or gross sales, is a vital indicator of a company’s ability to generate income from its primary operations. It represents the total amount of revenue or income earned by a business from sales activities within a specific reporting period.

In this article, we will explore the placement of sales revenue on a balance sheet and understand its significance in assessing a company’s financial health. We will also delve into other sources of revenue and the overall structure of a balance sheet.

What is a Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is one of the key financial statements used by investors, creditors, and stakeholders to assess the financial health and performance of a business.

The balance sheet follows a fundamental accounting equation, which states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity. This equation reflects the basic principle of double-entry bookkeeping, where every transaction has an equal and opposite effect on both sides of the equation.

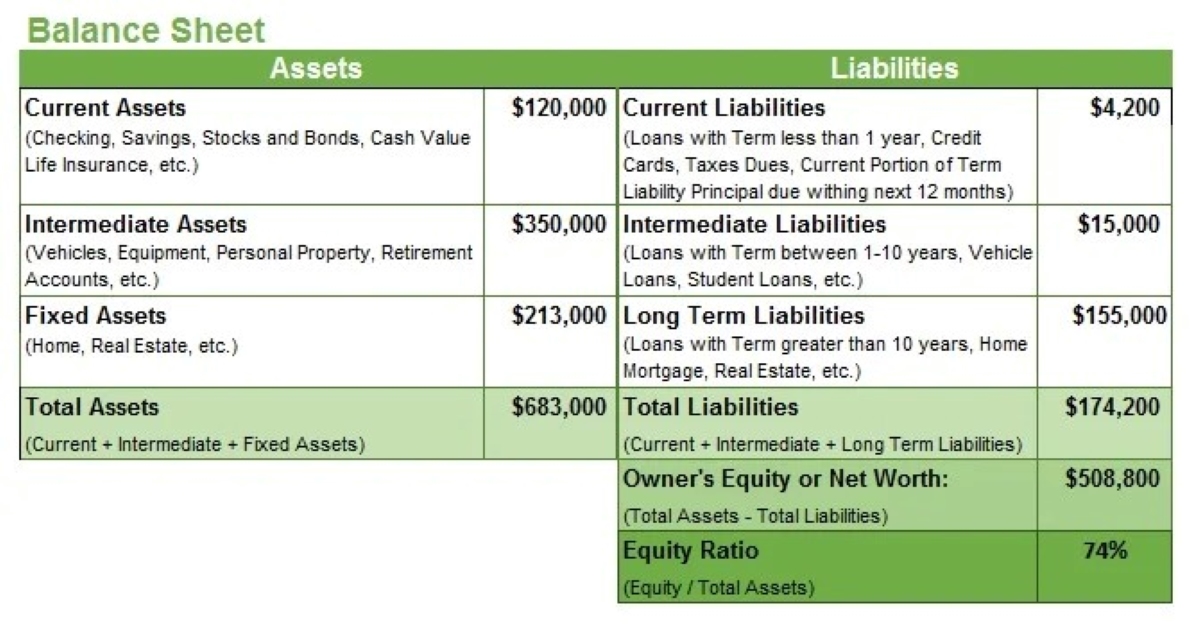

The balance sheet is divided into two main sections: assets and liabilities. Assets represent the resources owned by the company, such as cash, accounts receivable, inventory, property, and equipment. On the other hand, liabilities are the obligations and debts owed by the company, including accounts payable, loans, and accrued expenses.

The third component of the balance sheet is shareholders’ equity, also known as net worth or owner’s equity. It represents the residual interest in the company’s assets after deducting liabilities. Shareholders’ equity includes capital contributed by the owners and retained earnings, which are the accumulated profits or losses generated by the business.

Balance sheets are typically prepared at the end of an accounting period, such as a quarter or a fiscal year. By reviewing multiple balance sheets over time, investors and stakeholders can analyze the changes in a company’s financial position and make informed decisions about its stability and profitability.

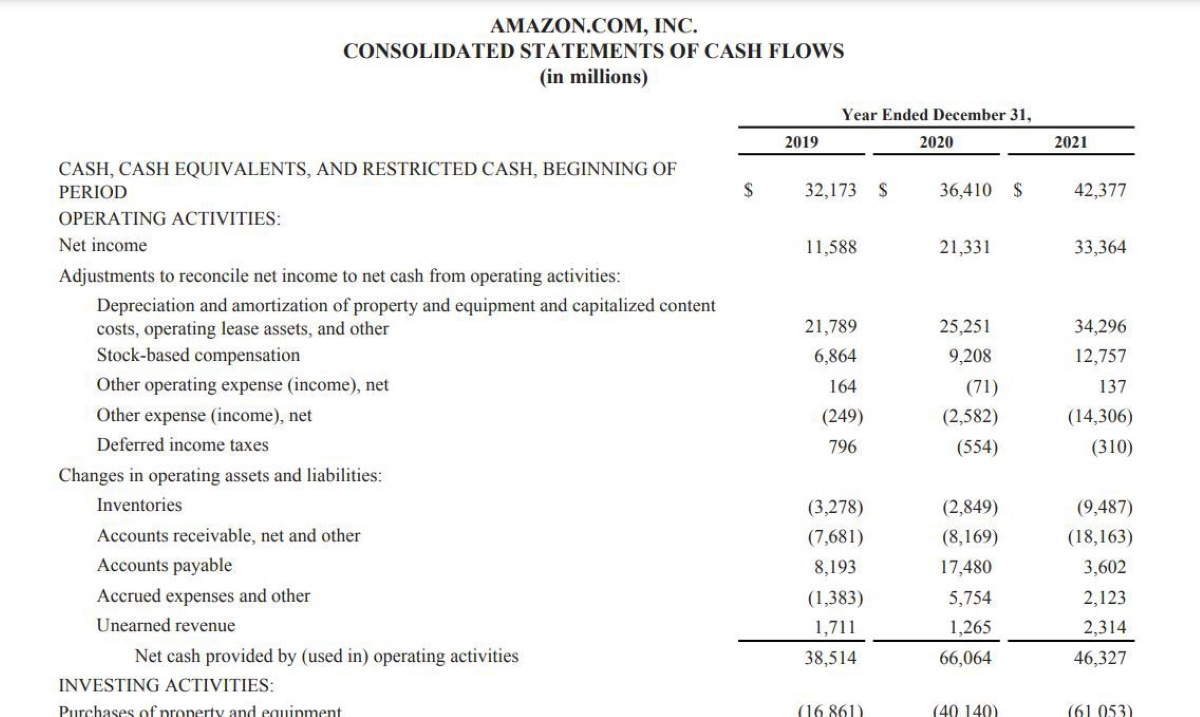

Furthermore, balance sheets can be compared across companies to assess their relative financial strength. It is important to note that balance sheets should be analyzed in conjunction with other financial statements, such as the income statement and cash flow statement, to gain a comprehensive understanding of a company’s financial performance.

What is Sales Revenue?

Sales revenue, also known as sales or revenue from sales, is the income generated by a company from the sale of goods or services to its customers. It is a crucial component of a company’s financial performance, as it directly contributes to its top line and reflects the effectiveness of its sales efforts.

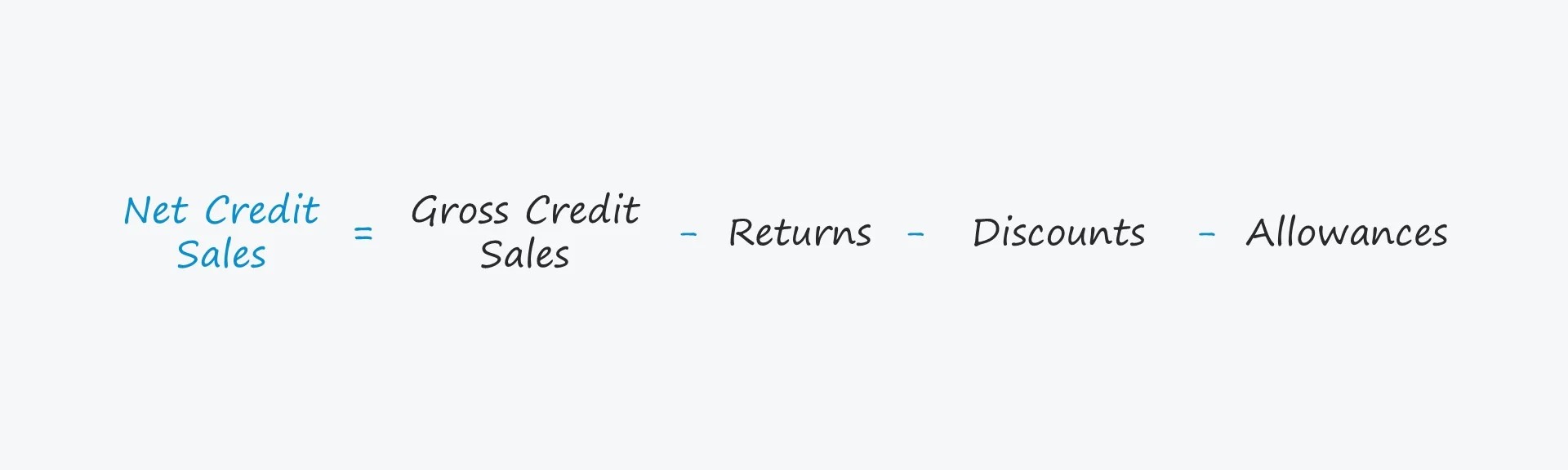

Sales revenue can be generated through various channels, such as direct sales to customers, online sales, or sales through intermediaries or distributors. It is important to note that sales revenue represents the total amount earned from sales before any deductions for expenses, returns, or discounts.

For retail businesses, sales revenue is primarily derived from the sale of merchandise or products. This includes both tangible goods, such as clothing, electronics, or groceries, and intangible goods, such as software licenses or subscription services. In the case of service-based companies, sales revenue is generated from providing professional services, such as consulting, healthcare, or legal services.

Sales revenue is a key performance metric for businesses, as it indicates the demand for their products or services and their ability to generate income. By analyzing sales revenue over time, companies can identify trends and patterns in their sales performance, evaluate the effectiveness of their marketing and sales strategies, and make informed decisions to drive future growth.

It is important to note that sales revenue is distinct from other types of revenue that a company may generate. For instance, a company may also generate revenue from non-operating activities, such as interest income from investments, rental income from properties, or gains from the sale of assets. These sources of revenue are typically reported separately on a company’s financial statements.

In summary, sales revenue represents the income generated by a company from the sale of goods or services and is a vital indicator of its sales performance and financial health. It is an essential component of a company’s income statement and plays a significant role in evaluating its profitability and growth prospects.

How is Sales Revenue Reported on a Balance Sheet?

While the balance sheet is a snapshot of a company’s financial position at a specific point in time, sales revenue is an income statement item that reflects the company’s performance over a specific period. As a result, sales revenue is not directly reported on the balance sheet. Instead, it is reported on the income statement, also known as the profit and loss statement or statement of earnings.

The income statement provides a summary of a company’s revenues, expenses, gains, and losses for a specific period, such as a quarter or a fiscal year. The top line of the income statement is typically reserved for reporting sales revenue. Sales revenue is presented as the total amount earned from the sale of goods or services, before any deductions for expenses or discounts.

However, the impact of sales revenue does indirectly affect the balance sheet. When a company generates sales revenue, it is often accompanied by an increase in assets, such as accounts receivable or cash. Accounts receivable represents the amount that customers owe the company for products or services not yet paid for. This increase in accounts receivable is reflected as an asset on the balance sheet.

On the other hand, when a company completes a sale, there may also be accompanying expenses, such as the cost of goods sold (COGS) or operating expenses. The cost of goods sold is the cost incurred to produce or acquire the goods sold, while operating expenses represent the costs associated with running the business. These expenses are deducted from sales revenue on the income statement, resulting in the company’s net income or profit.

The net income from the income statement is then transferred to the balance sheet as an increase in shareholders’ equity. This occurs through the retained earnings component of shareholders’ equity, which represents the accumulated profits that the company has retained over time.

Overall, although sales revenue is not directly reported on the balance sheet, it affects various components of the balance sheet, such as accounts receivable and retained earnings. Understanding the relationship between the income statement and the balance sheet is essential for analyzing a company’s financial performance and assessing its financial stability.

Components of a Balance Sheet

A balance sheet is divided into three main components: assets, liabilities, and shareholders’ equity. Each component provides valuable information about a company’s financial position and helps stakeholders assess its solvency, liquidity, and overall financial health.

1. Assets

Assets represent the resources owned by a company that have economic value and can be used to generate future benefits. They are categorized into two types: current assets and non-current assets.

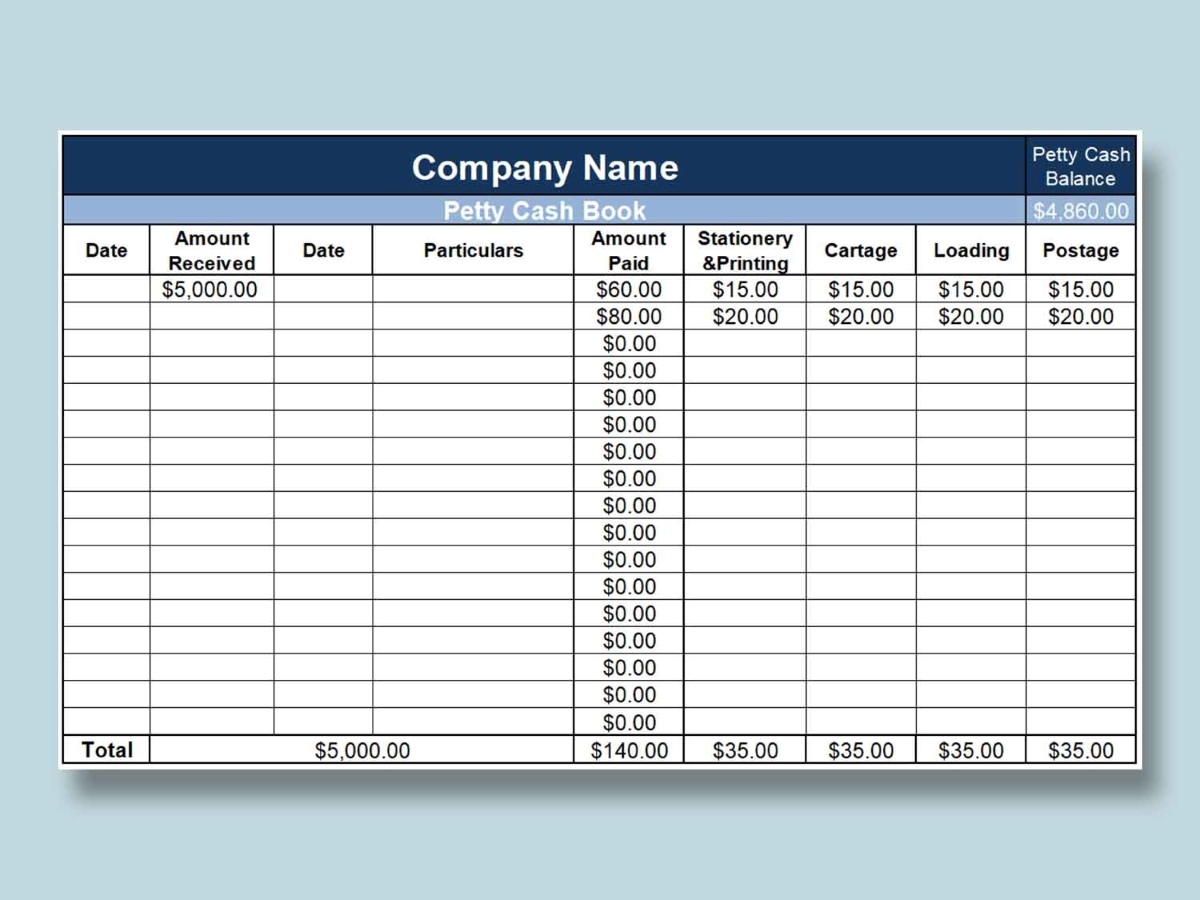

- Current assets: These are assets that are expected to be converted into cash or used up within one year or the operating cycle of the business. Examples include cash and cash equivalents, accounts receivable, inventory, and prepaid expenses.

- Non-current assets: Also known as long-term assets, these are assets that are not expected to be converted into cash or used up within one year. Examples include property, plant, and equipment, investments, intangible assets, and long-term investments.

2. Liabilities

Liabilities represent the amounts owed by a company to its creditors, suppliers, and other stakeholders. Like assets, liabilities are categorized into current liabilities and non-current liabilities.

- Current liabilities: These are obligations that are due within one year or the operating cycle of the business. Examples include accounts payable, short-term loans, accrued expenses, and customer deposits.

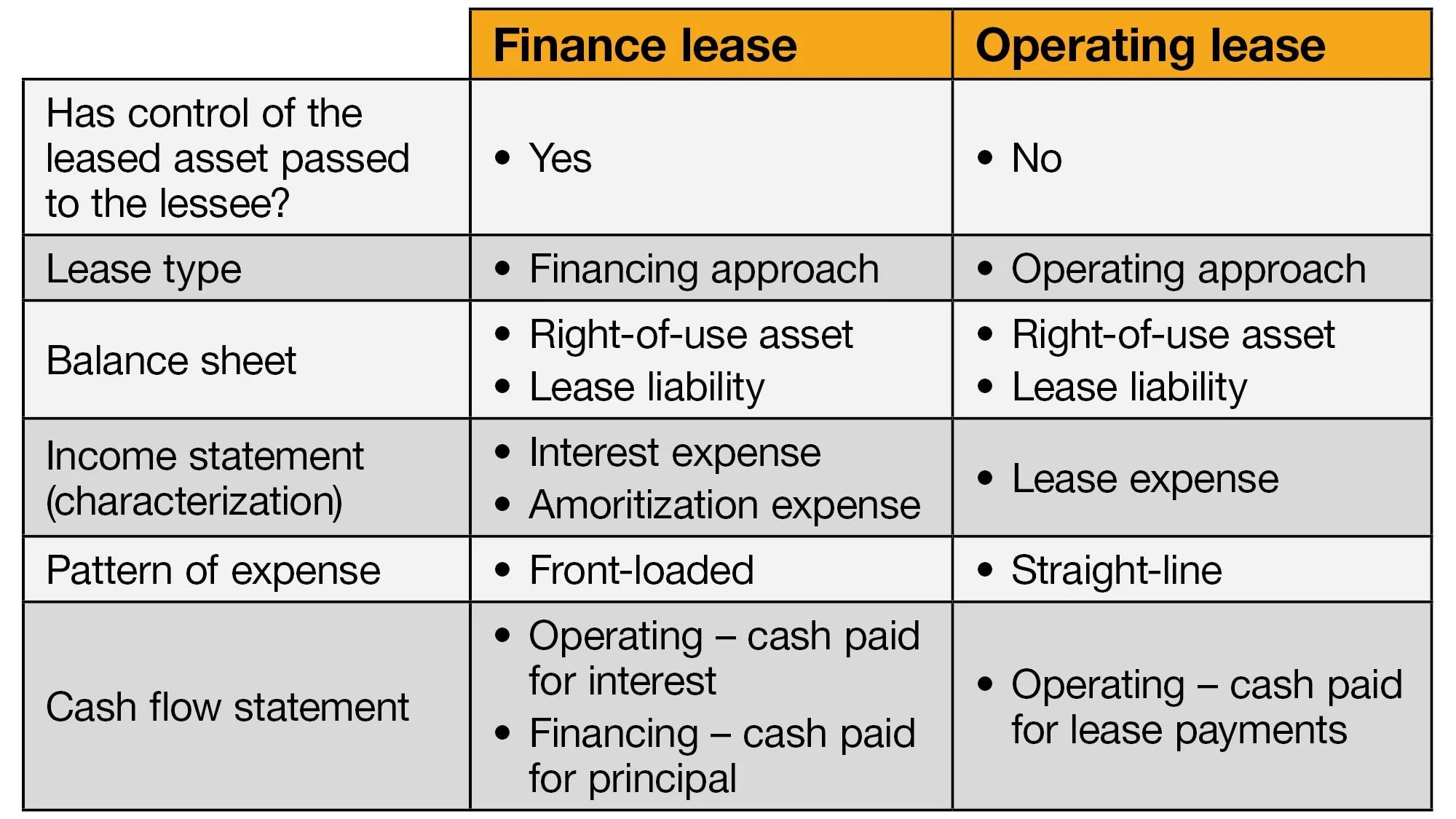

- Non-current liabilities: Also known as long-term liabilities, these are obligations that are not due within one year. Examples include long-term loans, leases, pension liabilities, and deferred tax liabilities.

3. Shareholders’ Equity

Shareholders’ equity, also referred to as owners’ equity or net worth, represents the residual interest in a company’s assets after deducting its liabilities. It represents the shareholders’ claim on the company’s assets and encompasses two main components: contributed capital and retained earnings.

- Contributed capital: This includes the initial investments made by shareholders, such as common stock or preferred stock.

- Retained earnings: Retained earnings represent the accumulated net income or profit of the company that has been retained and reinvested in the business over time.

The balance sheet equation, Assets = Liabilities + Shareholders’ Equity, illustrates the fundamental relationship between these components. The balance sheet provides a comprehensive picture of a company’s financial position by showing the value of its assets, the claims against those assets (liabilities), and the residual claim of the shareholders (equity).

By analyzing the components of a balance sheet, investors, creditors, and stakeholders can assess a company’s liquidity, solvency, and financial performance, helping them make informed decisions and evaluate its potential for growth and profitability.

The Placement of Sales Revenue on a Balance Sheet

Sales revenue, as we discussed earlier, is not directly reported on a balance sheet. Instead, it is recorded on the income statement, which focuses on the company’s revenues, expenses, gains, and losses for a specific period. However, the impact of sales revenue does indirectly affect certain components of the balance sheet.

When a company generates sales revenue, it often leads to an increase in certain assets on the balance sheet. One significant asset affected is accounts receivable. Accounts receivable represents the outstanding payments that customers owe the company for goods or services sold on credit. An increase in sales revenue typically results in a corresponding increase in accounts receivable.

On the balance sheet, accounts receivable is listed under the current assets section. It represents the amount that is expected to be collected within one year or the normal operating cycle of the business. This indicates the company’s expectation of future cash inflow resulting from the sales made in the current period.

In addition to accounts receivable, sales revenue also impacts other assets on the balance sheet. For example, if a company generates cash sales, the cash account on the balance sheet will increase. Cash from sales is considered a current asset and is a crucial indicator of a company’s liquidity.

It is important to note that while sales revenue affects certain assets, it does not have a direct impact on liabilities or shareholders’ equity on the balance sheet. However, sales revenue indirectly contributes to shareholders’ equity through its impact on net income.

When sales revenue is recognized on the income statement, it is accompanied by the recognition of cost of goods sold (COGS) and other expenses incurred in generating that revenue. These expenses are deducted from the sales revenue to calculate the net income or profit for the period.

The net income, which represents the company’s earnings after all expenses have been deducted from sales revenue, is then recorded on the balance sheet. It is added to the retained earnings component of shareholders’ equity. Retained earnings represent the cumulative profits or losses that the company has retained over time.

Overall, while sales revenue is not directly reported on a balance sheet, it does impact certain assets and indirectly contributes to the shareholders’ equity through its impact on net income. Understanding the relationship between sales revenue and the balance sheet is essential for evaluating a company’s financial performance and analyzing its overall financial health.

Other Sources of Revenue on a Balance Sheet

While sales revenue is a significant source of income for many businesses, there are other sources of revenue that can be reported on a balance sheet. These sources of revenue represent income generated from activities other than the primary sale of goods or services. Let’s explore some of these sources:

1. Interest and Dividend Income

One common source of revenue is interest income earned from investments, loans, or other interest-bearing assets. This includes interest earned on savings accounts, fixed deposits, bonds, or loans provided to other entities. Dividend income, on the other hand, represents the earnings received from owning shares of stock in other companies.

2. Rental Income

Companies that own and lease out properties generate revenue from rental income. This includes income generated from residential, commercial, or industrial properties that are leased or rented to tenants. Rental income is typically reported as part of the operating revenue on the income statement.

3. Licensing and Royalty Fees

Some companies generate revenue by licensing their intellectual property, such as patents, trademarks, copyrights, or technology, to other entities. These licenses allow other companies to use the intellectual property in exchange for royalty fees or licensing fees paid to the original owner.

4. Service Fees

In addition to the primary sale of goods or services, companies may also generate revenue from providing additional services to their customers. These service fees can include installation fees, maintenance fees, consulting fees, or subscription fees for value-added services.

5. Gain on Sale of Assets

When a company sells an asset, such as property, equipment, or investments, for a higher value than its original purchase cost, it realizes a gain on the sale. This gain is reported as revenue on the income statement and can contribute to the company’s overall financial performance.

All these sources of revenue, along with sales revenue, contribute to the company’s total revenue. On the balance sheet, these revenues are typically reflected in the retained earnings component of shareholders’ equity. Retained earnings represent the accumulated profits and losses from all sources of revenue and expenses throughout the company’s existence.

It is important to note that while sales revenue is often the primary source of income for businesses, these other sources of revenue can play a significant role in diversifying a company’s revenue streams and contributing to its financial stability and growth.

Conclusion

Understanding the placement of sales revenue on a balance sheet is essential for evaluating a company’s financial health and performance. While sales revenue itself is not directly reported on the balance sheet, its impact is reflected in various components of the balance sheet.

The income generated from sales revenue affects assets on the balance sheet, primarily through an increase in accounts receivable for credit sales and an increase in cash for cash sales. These assets represent the company’s expectation of future cash inflow resulting from sales activities.

Moreover, sales revenue indirectly contributes to shareholders’ equity through its impact on net income. Net income, calculated by deducting expenses such as cost of goods sold and operating expenses from sales revenue, is recorded on the income statement. This net income is then transferred to the balance sheet as an increase in retained earnings, representing the cumulative profits or losses that the company has retained over time.

Additionally, it’s important to recognize that there are other sources of revenue that can be reported on a balance sheet, such as interest and dividend income, rental income, licensing and royalty fees, service fees, and gains on the sale of assets. These sources contribute to the company’s overall revenue and may also impact the different components of the balance sheet.

In conclusion, understanding the relationship between sales revenue and the balance sheet helps stakeholders evaluate a company’s financial performance, liquidity, and solvency. By analyzing the placement of sales revenue and other sources of revenue, investors and creditors can make informed decisions about a company’s financial stability, growth potential, and overall value.