Home>Finance>If My Vantage Score Is 700, What Is My FICO Score

Finance

If My Vantage Score Is 700, What Is My FICO Score

Published: March 7, 2024

Discover the relationship between your Vantage Score and FICO Score in finance. Learn how a Vantage Score of 700 compares to your FICO Score and its impact. Gain insights now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Differences Between Vantage Score and FICO Score

When it comes to understanding your creditworthiness, two significant players often come into the spotlight: the Vantage Score and the FICO Score. These scores play a pivotal role in determining your financial health and can influence your ability to secure loans, mortgages, and favorable interest rates. Understanding the nuances between the Vantage Score and the FICO Score is crucial for anyone seeking to navigate the complex landscape of personal finance.

While both scores serve the same fundamental purpose of assessing an individual's credit risk, they are calculated using different algorithms and have varying ranges, which can lead to disparities in the scores assigned to the same individual. This article aims to shed light on the intricacies of these credit scoring models, unraveling the key disparities between them and providing insights into the factors that can impact your Vantage Score and FICO Score. Additionally, we will explore actionable steps to enhance and maintain healthy credit scores, empowering you to take control of your financial well-being.

Understanding the differences between the Vantage Score and the FICO Score is not only valuable but also essential for making informed financial decisions. By delving into the intricacies of these scoring models, you can gain a deeper understanding of how your creditworthiness is evaluated and uncover strategies to bolster your credit standing. Let's embark on a journey to unravel the mysteries of credit scoring and equip ourselves with the knowledge to achieve financial success.

Understanding Vantage Score and FICO Score

To comprehend the significance of the Vantage Score and FICO Score, it’s essential to grasp their individual roles in evaluating an individual’s creditworthiness. The Vantage Score was developed in 2006 by the three major credit bureaus—Equifax, Experian, and TransUnion—as a collaborative effort to provide a standardized scoring model. In contrast, the FICO Score, created by the Fair Isaac Corporation, has been a prominent player in the credit scoring landscape for decades, wielding substantial influence in the lending industry.

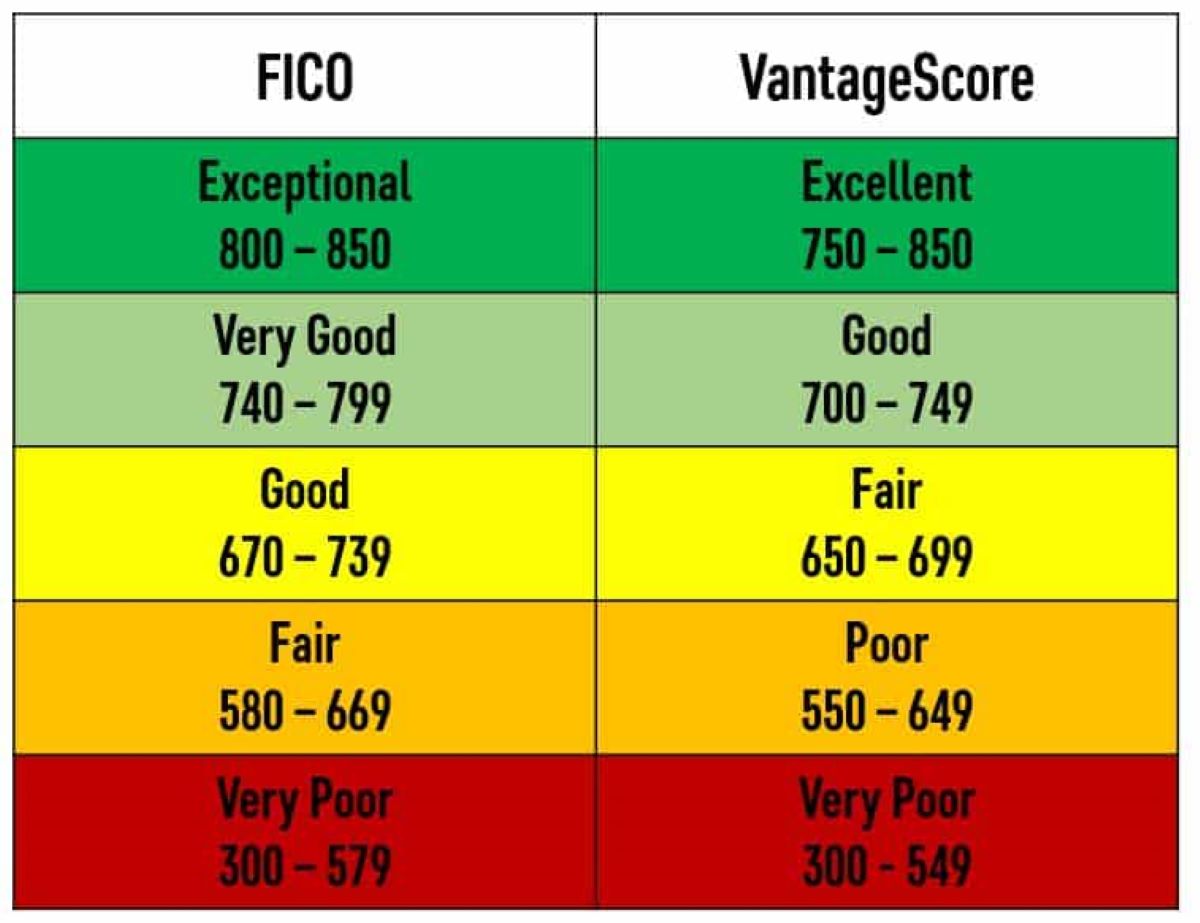

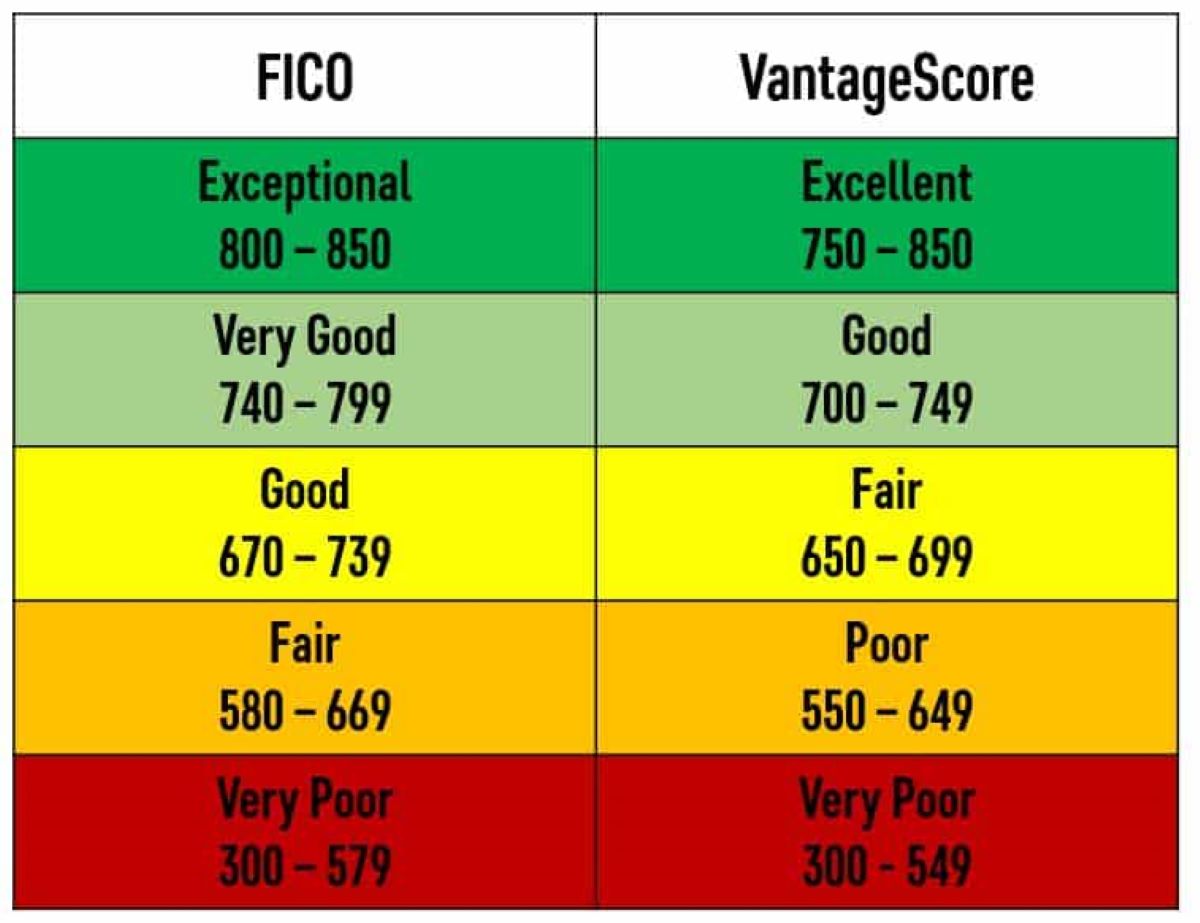

While both scores serve the same fundamental purpose of assessing an individual’s credit risk, they are calculated using distinct algorithms and have different scoring ranges. The Vantage Score ranges from 300 to 850, similar to the FICO Score, which also operates within this range. However, the criteria and weightings used to calculate these scores differ, leading to potential variations in the scores assigned to the same individual.

The Vantage Score employs a different methodology, utilizing a single model for all three credit bureaus and providing lenders with a consistent assessment of an individual’s creditworthiness. Conversely, the FICO Score offers multiple versions tailored to each credit bureau, resulting in potential disparities across the scores generated by Equifax, Experian, and TransUnion.

Both scoring models consider various factors, including payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. However, the emphasis placed on these factors may differ between the Vantage Score and the FICO Score, contributing to the potential disparities in the scores provided by each model.

By gaining a comprehensive understanding of the Vantage Score and FICO Score, individuals can navigate the intricacies of credit scoring with confidence. Armed with this knowledge, you can make informed decisions to optimize your credit standing and pursue your financial goals with clarity and purpose.

Key Differences Between Vantage Score and FICO Score

While the Vantage Score and FICO Score serve the same fundamental purpose of assessing credit risk, several key differences distinguish these two scoring models. Understanding these disparities is crucial for individuals seeking to comprehend the intricacies of their credit scores and the potential variations that may arise when lenders utilize different scoring models.

One of the primary distinctions between the Vantage Score and the FICO Score lies in their calculation methodologies. The Vantage Score utilizes a single model for all three major credit bureaus—Equifax, Experian, and TransUnion—resulting in a consistent assessment of an individual’s creditworthiness across the board. In contrast, the FICO Score offers tailored versions for each credit bureau, potentially leading to variations in the scores provided by Equifax, Experian, and TransUnion.

Another notable difference is the weight assigned to certain credit factors within each scoring model. While both the Vantage Score and FICO Score consider factors such as payment history, credit utilization, length of credit history, credit mix, and new credit inquiries, the emphasis placed on these factors may vary. For instance, the Vantage Score places a significant emphasis on the trend of an individual’s credit utilization, aiming to capture recent behavior, while the FICO Score considers the utilization of different types of credit, such as credit cards and installment loans, to assess creditworthiness.

Furthermore, the scoring ranges of the Vantage Score and FICO Score, although both operating within a range of 300 to 850, may lead to disparities in the scores assigned to the same individual. These differences can be attributed to the distinct algorithms and criteria used by each scoring model, highlighting the importance of comprehending the specific scoring model utilized by lenders when assessing creditworthiness.

By recognizing the key differences between the Vantage Score and FICO Score, individuals can navigate the complexities of credit scoring with clarity. This understanding empowers individuals to interpret their credit scores effectively and take proactive steps to optimize their credit standing, ultimately fostering financial well-being and resilience.

Factors Affecting Vantage Score and FICO Score

Both the Vantage Score and FICO Score are influenced by a range of factors that collectively shape an individual’s creditworthiness. Understanding these factors is essential for individuals seeking to proactively manage and improve their credit scores.

Payment History: One of the most influential factors impacting both the Vantage Score and FICO Score is an individual’s payment history. Timely payments on credit accounts demonstrate responsible financial behavior and contribute positively to credit scores. Conversely, late payments or delinquencies can significantly lower credit scores.

Credit Utilization: The proportion of available credit that an individual utilizes, known as credit utilization, plays a pivotal role in determining credit scores. Both the Vantage Score and FICO Score consider credit utilization, with lower utilization ratios positively impacting credit scores. Maintaining a low credit utilization ratio demonstrates responsible credit management and can enhance credit scores.

Length of Credit History: The length of an individual’s credit history is a crucial factor influencing credit scores. Both the Vantage Score and FICO Score consider the age of credit accounts, with longer credit histories generally contributing positively to credit scores. Individuals with established credit histories demonstrate a track record of managing credit responsibly, which can bolster their credit scores.

Credit Mix: The diversity of credit accounts, including credit cards, installment loans, and mortgages, contributes to an individual’s credit mix. Both the Vantage Score and FICO Score consider credit mix when assessing creditworthiness. A well-managed mix of credit accounts can positively influence credit scores, reflecting a balanced approach to credit management.

New Credit Inquiries: When individuals apply for new credit, inquiries are generated on their credit reports. Both the Vantage Score and FICO Score take into account new credit inquiries, with multiple recent inquiries potentially indicating a higher credit risk. Managing new credit inquiries responsibly can help maintain healthy credit scores.

Understanding the factors that affect the Vantage Score and FICO Score empowers individuals to take proactive steps to enhance their creditworthiness. By managing these factors effectively, individuals can optimize their credit scores, paving the way for improved financial opportunities and stability.

How to Improve Your Vantage Score and FICO Score

Improving your Vantage Score and FICO Score requires a strategic approach to managing your credit and financial behavior. By implementing proactive measures, individuals can work towards enhancing their creditworthiness and securing better financial opportunities.

1. Maintain Timely Payments: Consistently making on-time payments on credit accounts is crucial for improving both your Vantage Score and FICO Score. Setting up payment reminders or automatic payments can help ensure that payments are made punctually, positively impacting credit scores over time.

2. Manage Credit Utilization: Keeping credit card balances low in relation to credit limits can positively influence credit scores. Aim to maintain a low credit utilization ratio, as this demonstrates responsible credit management and can contribute to score improvements.

3. Monitor Credit Reports: Regularly reviewing your credit reports from all three major credit bureaus allows you to identify and address any inaccuracies or discrepancies that could impact your credit scores. Addressing errors promptly can help maintain the accuracy of your credit reports and, subsequently, your credit scores.

4. Diversify Your Credit Mix: Building a diverse credit portfolio that includes a mix of credit cards and installment loans can positively impact credit scores. However, it is essential to manage these accounts responsibly and avoid taking on more credit than necessary.

5. Limit New Credit Inquiries: When applying for new credit, be mindful of the potential impact of inquiries on your credit scores. Limiting the number of new credit applications and inquiries can help safeguard your credit scores from unnecessary fluctuations.

6. Utilize Credit-Building Tools: For individuals with limited credit history or those aiming to rebuild their credit, utilizing credit-building tools such as secured credit cards or becoming an authorized user on a responsible family member’s credit account can aid in improving credit scores over time.

By implementing these strategies and maintaining responsible financial habits, individuals can work towards improving their Vantage Score and FICO Score. While credit score improvements may not occur overnight, consistent and proactive credit management can lead to tangible enhancements in creditworthiness, opening doors to better financial opportunities and stability.

Conclusion

In conclusion, the Vantage Score and FICO Score stand as pivotal instruments in evaluating an individual’s creditworthiness, wielding substantial influence over financial opportunities and lending decisions. While both scores serve the fundamental purpose of assessing credit risk, they operate on distinct algorithms and consider varying factors, leading to potential disparities in the scores assigned to the same individual.

Understanding the nuances of the Vantage Score and FICO Score empowers individuals to navigate the complexities of credit scoring with clarity and purpose. By comprehending the specific factors that influence these scores, individuals can take proactive steps to optimize their credit standing and pursue their financial goals with confidence.

Improving credit scores requires a strategic and disciplined approach to credit management, encompassing timely payments, responsible credit utilization, and prudent financial decision-making. By implementing these measures and monitoring their credit reports diligently, individuals can work towards enhancing their Vantage Score and FICO Score, paving the way for improved financial opportunities and stability.

Ultimately, the journey to improving credit scores is a marathon, not a sprint. Consistent and responsible credit management, coupled with a thorough understanding of credit scoring models, can lead to tangible enhancements in creditworthiness over time. By embracing this journey with determination and perseverance, individuals can position themselves for greater financial resilience and empowerment.

Armed with the knowledge and strategies outlined in this article, individuals can embark on a path towards achieving and maintaining healthy credit scores, unlocking a world of financial possibilities and security. By taking control of their creditworthiness, individuals can shape a brighter financial future and navigate the terrain of personal finance with confidence and resilience.