Finance

What Is A Classified Balance Sheet

Modified: December 30, 2023

Learn about the importance of a classified balance sheet in finance and how it helps analyze a company's financial position accurately.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

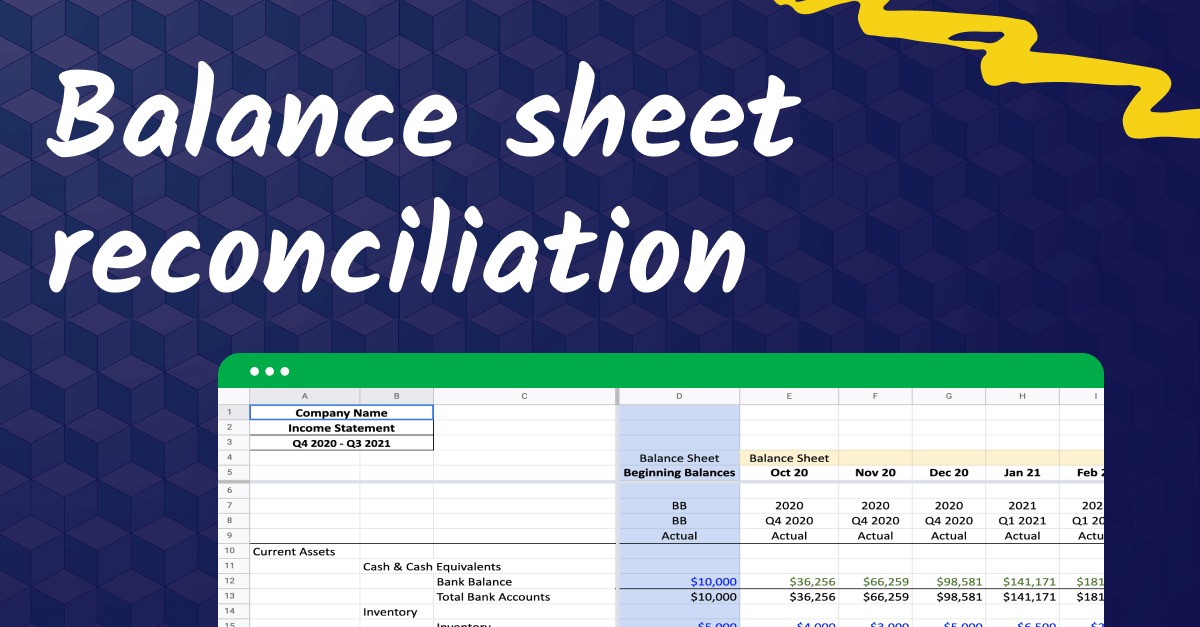

A classified balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It organizes and categorizes a company’s assets, liabilities, and equity into distinct groups, giving readers a clearer understanding of the company’s financial health.

The purpose of a classified balance sheet is to provide a structured presentation of a company’s financial information, making it easier for investors, creditors, and other stakeholders to analyze and evaluate the company’s financial performance. It allows them to assess the company’s liquidity, solvency, and overall financial stability.

In this article, we will explore the definition, purpose, components, and advantages of using a classified balance sheet. We will also discuss the limitations of this financial statement and its importance in financial analysis and decision-making.

By understanding the fundamentals of a classified balance sheet, you will be able to make more informed decisions when it comes to investing, lending, or partnering with a company. Let’s dive in and explore this essential financial tool.

Definition of a Classified Balance Sheet

A classified balance sheet is a financial statement that provides a detailed breakdown of a company’s assets, liabilities, and equity. It organizes these components into specific categories to provide a more comprehensive view of a company’s financial position. A classified balance sheet is often used by stakeholders such as investors, creditors, and analysts to assess a company’s financial stability and make informed decisions.

The key feature of a classified balance sheet is the classification of assets, liabilities, and equity into current and non-current categories. Current assets are those that are expected to be converted into cash or consumed within one year, while non-current assets have a longer-term nature. Similarly, current liabilities are obligations that are expected to be settled within one year, while non-current liabilities have longer repayment terms.

In addition to classifying assets and liabilities, equity is also presented on the balance sheet. Equity represents the residual interest in the assets of a company after deducting liabilities. It includes the contributed capital from shareholders and the accumulated retained earnings of the company.

By categorizing the components of a balance sheet, a classified balance sheet assists in providing a clear and organized view of a company’s financial position. This categorization allows stakeholders to quickly identify the liquidity of a company, its ability to meet short-term obligations, and its long-term financial stability.

Overall, a classified balance sheet serves as a vital tool in financial reporting and analysis, providing valuable insights into the financial health and stability of a company.

Purpose of a Classified Balance Sheet

A classified balance sheet serves several important purposes in the field of finance and accounting. It provides valuable information that helps stakeholders make informed decisions, assess a company’s financial position, and analyze its financial health. Here are some key purposes of a classified balance sheet:

- Clear Presentation of Financial Information: By categorizing assets, liabilities, and equity into distinct groups, a classified balance sheet provides a clear and organized presentation of a company’s financial information. This makes it easier for stakeholders to understand and interpret the financial position of the company.

- Assessment of Liquidity: One of the main purposes of a classified balance sheet is to assess a company’s liquidity. By segregating assets into current and non-current categories, stakeholders can quickly determine the availability of liquid assets that can be used to meet short-term obligations.

- Evaluation of Solvency: A classified balance sheet enables stakeholders to evaluate a company’s solvency, which refers to its ability to meet long-term obligations. By analyzing the composition of non-current assets and non-current liabilities, stakeholders can assess whether a company has sufficient resources to fulfill its long-term financial obligations.

- Identification of Working Capital: Working capital, which represents the difference between current assets and current liabilities, is a crucial measure of a company’s short-term financial health. A classified balance sheet helps stakeholders identify the amount of working capital a company has available to cover its day-to-day operations.

- Analysis of Financial Stability: By providing a comprehensive view of a company’s assets, liabilities, and equity, a classified balance sheet helps stakeholders analyze a company’s financial stability. They can assess the proportion of debt to equity, the quality of assets, and the overall risk profile of the company.

Overall, the purpose of a classified balance sheet is to provide stakeholders with a transparent and structured presentation of a company’s financial information. It enables them to make informed decisions, assess the financial health and stability of a company, and evaluate its ability to meet short-term and long-term obligations.

Components of a Classified Balance Sheet

A classified balance sheet consists of various components that provide a detailed breakdown of a company’s financial position. These components include assets, liabilities, and equity, each with its own subcategories. Let’s explore each component in more detail:

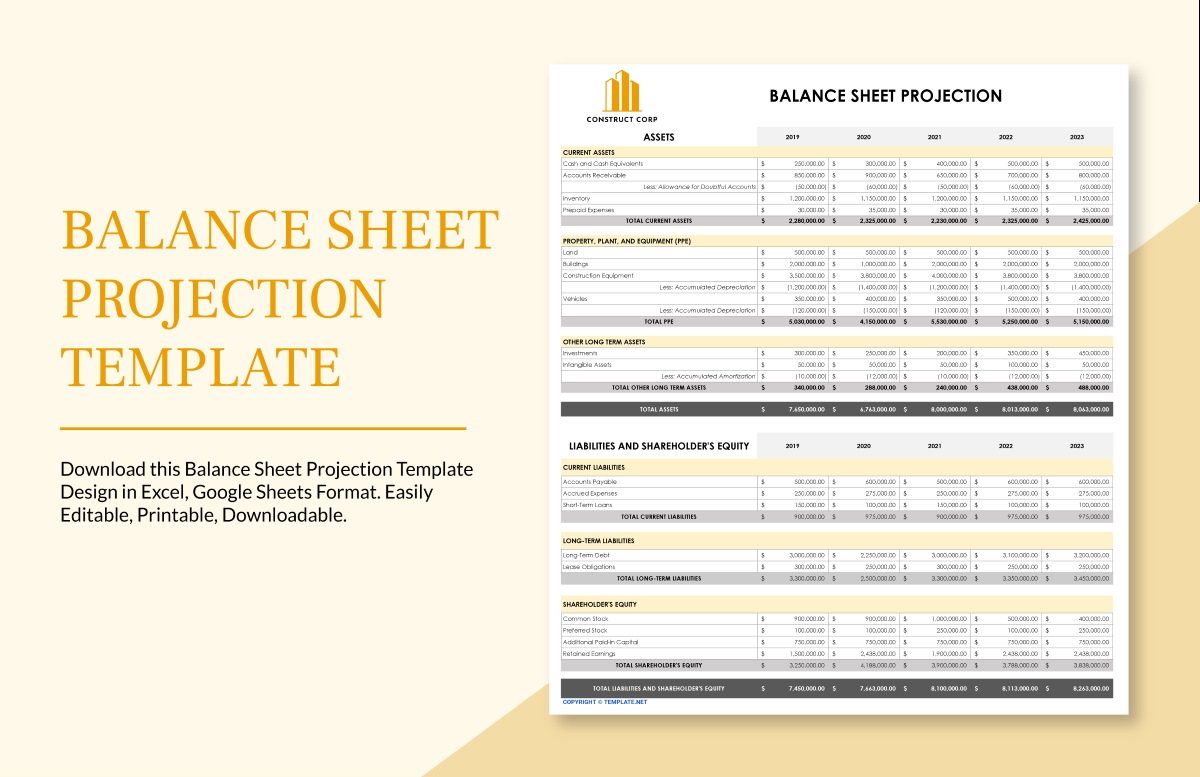

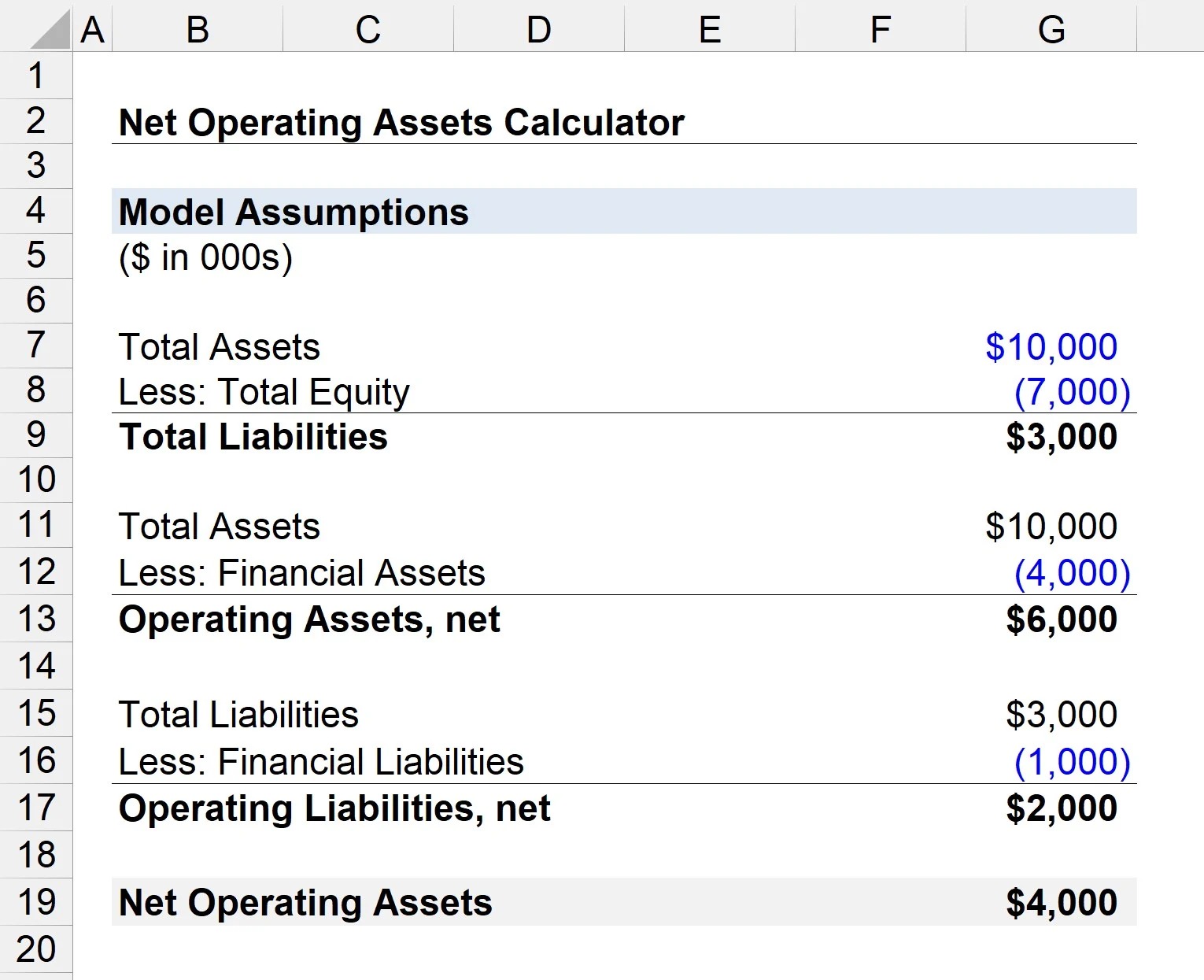

- Assets: Assets represent the resources owned or controlled by a company that have economic value. In a classified balance sheet, assets are typically divided into two main categories: current assets and non-current assets. Current assets include cash and cash equivalents, accounts receivable, inventory, and other assets that can be converted into cash within one year. Non-current assets, on the other hand, include property, plant, and equipment, intangible assets, long-term investments, and other assets with longer-term value.

- Liabilities: Liabilities are the obligations of a company to pay back debts or settle other financial obligations. Similar to assets, liabilities are classified into current liabilities and non-current liabilities. Current liabilities include accounts payable, short-term loans, accrued expenses, and other obligations that are due within one year. Non-current liabilities, also known as long-term liabilities, consist of long-term loans, bonds payable, deferred tax liabilities, and other obligations with longer repayment terms.

- Equity: Equity represents the residual interest in the assets of a company after deducting liabilities. It reflects the ownership interest of shareholders and the accumulated earnings of the company. Equity is divided into several categories, including contributed capital (common stock and preferred stock), additional paid-in capital, retained earnings, and other equity components such as treasury stock.

By categorizing the assets, liabilities, and equity into subcategories, a classified balance sheet provides a detailed picture of a company’s financial position. It allows stakeholders to assess the liquidity of a company, evaluate its long-term financial stability, and understand the ownership structure and accumulated earnings.

It’s worth noting that the specific categories and subcategories within each component may vary depending on the accounting standards and reporting requirements of the jurisdiction in which the company operates. Nevertheless, the overall purpose of a classified balance sheet remains the same – to provide a structured presentation of a company’s financial position.

Assets

Assets are a fundamental component of a classified balance sheet. They represent the resources owned or controlled by a company that have economic value. Assets are categorized into two main groups: current assets and non-current assets. Let’s delve into each category:

- Current Assets: Current assets are resources that are expected to be converted into cash or consumed within one year or the operating cycle of the business, whichever is longer. Common examples of current assets include:

- Cash and Cash Equivalents: This category includes physical cash, as well as highly liquid assets that can be easily converted into cash, such as bank accounts, money market funds, and short-term investments.

- Accounts Receivable: These represent the amounts owed to the company by its customers in exchange for goods or services provided on credit. Accounts receivable are typically reported at their net realizable value, which deducts allowances for doubtful accounts.

- Inventory: Inventory comprises the goods held by a company for sale or for use in its production process. It includes raw materials, work-in-progress, and finished goods. Inventory is reported at the lower of cost or net realizable value.

- Prepaid Expenses: Prepaid expenses are payments made in advance for goods or services that will be consumed in the future. Examples include prepaid insurance, prepaid rent, and prepaid subscriptions.

- Short-Term Investments: These are investments in financial instruments that have a maturity period of less than one year. Examples include Treasury bills, certificates of deposit, and money market funds.

- Non-Current Assets: Non-current assets are resources that are expected to provide economic benefits to the company for more than one year. Common examples of non-current assets include:

- Property, Plant, and Equipment (PP&E): PP&E includes tangible assets such as land, buildings, machinery, and vehicles that are used in the company’s operations. These assets are recorded at their historical cost less accumulated depreciation.

- Intangible Assets: Intangible assets are non-physical assets that provide value to the company. This includes patents, trademarks, copyrights, and goodwill. Intangible assets are usually recorded at their acquisition cost less accumulated amortization or impairment.

- Long-Term Investments: Long-term investments refer to investments in other companies or financial instruments that are held for more than one year. Examples include stocks, bonds, and long-term loans to other entities.

- Deferred Charges: Deferred charges represent costs incurred that are expected to provide benefits to the company over several periods. These may include long-term prepaid expenses, deferred research and development costs, and deferred financing costs.

The classification of assets into current and non-current categories helps stakeholders evaluate a company’s liquidity, operational efficiency, and long-term investment strategies. It allows for a more accurate assessment of the availability and utilization of a company’s resources, aiding in financial analysis and decision-making.

Liabilities

Liabilities are a crucial component of a classified balance sheet, representing the obligations or debts owed by a company to external parties. Similar to assets, liabilities are classified into two main groups: current liabilities and non-current liabilities. Let’s explore each category in more detail:

- Current Liabilities: Current liabilities are obligations that are expected to be settled within one year or the operating cycle of the business, whichever is longer. Common examples of current liabilities include:

- Accounts Payable: Accounts payable represents the amount owed by the company to its suppliers for goods or services received on credit. It is a short-term liability that is typically paid off within a short period of time.

- Short-Term Loans: These are loans that are due to be repaid within one year. Short-term loans can include lines of credit, bank overdrafts, and other forms of borrowing with a short repayment period.

- Accrued Expenses: Accrued expenses are costs that have been incurred but have not yet been paid by the company. Examples include accrued wages, accrued taxes, and accrued interest on outstanding loans.

- Income Taxes Payable: This represents the amount of income tax owed by the company to the government for the current period. It includes both current and deferred income tax liabilities.

- Dividends Payable: Dividends payable are the amount of dividends declared by the company’s board of directors but not yet paid out to shareholders.

- Non-Current Liabilities: Non-current liabilities are obligations that are due beyond one year or the normal operating cycle of the business. Common examples of non-current liabilities include:

- Long-Term Loans: Long-term loans are debts that are due to be repaid over a longer period, typically beyond one year. They can include mortgages, bonds, and other forms of long-term borrowing.

- Bonds Payable: Bonds payable represent the outstanding debt securities issued by the company to raise capital. They usually have a maturity period of more than one year and carry a fixed interest rate.

- Pension Obligations: This represents the company’s obligations towards its employees’ retirement benefits and pensions. It includes both the current service cost and the projected benefit obligation.

- Lease Obligations: Lease obligations represent the long-term rental agreements entered into by the company for buildings, equipment, or other assets. These liabilities are recognized in accordance with accounting standards such as ASC 842 or IFRS 16.

- Deferred Tax Liabilities: Deferred tax liabilities arise from temporary differences between accounting and tax recognition of certain items. They represent the future tax obligations that the company will have to pay.

The classification of liabilities into current and non-current categories helps stakeholders assess a company’s short-term and long-term solvency. It enables them to evaluate the company’s ability to meet its immediate financial obligations and its long-term repayment capacity. By analyzing the composition of liabilities, stakeholders can also assess the overall financial risk associated with a company’s debt structure.

Equity

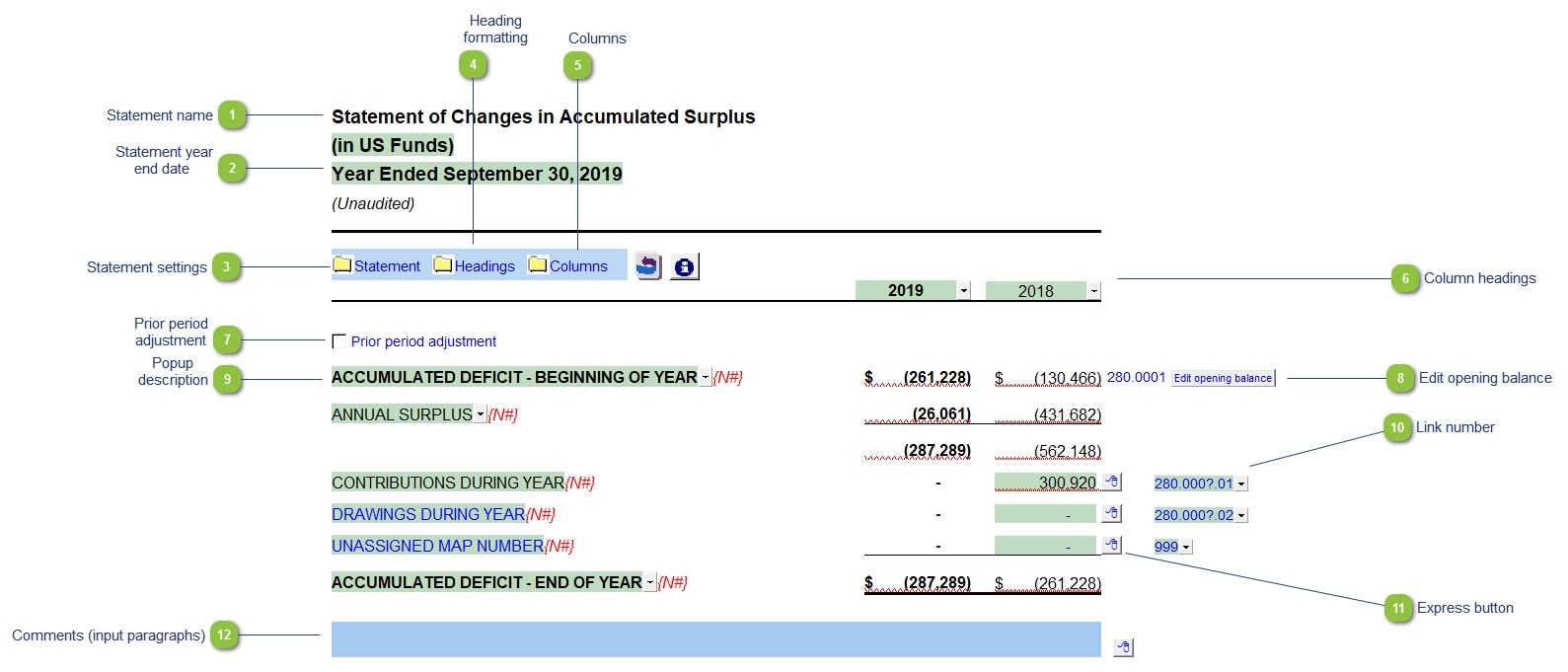

Equity is a significant component of a classified balance sheet, representing the residual interest in the assets of a company after deducting liabilities. It reflects the ownership interest of shareholders and the accumulated earnings of the company. Equity is typically categorized into several subcomponents, providing a comprehensive view of the company’s financial structure. Let’s explore each category:

- Contributed Capital: Contributed capital represents the amount of capital invested by shareholders in the company. It includes common stock, preferred stock, additional paid-in capital, and any other forms of capital contributed by shareholders.

- Retained Earnings: Retained earnings refer to the accumulated earnings of the company that have been retained for future business operations. It includes the net income of the company that has not been distributed to shareholders as dividends.

- Other Comprehensive Income: Other comprehensive income includes gains and losses that are not recognized in the income statement but directly affect shareholders’ equity. Examples include unrealized gains or losses on available-for-sale securities, foreign currency translation adjustments, and changes in pension obligations.

- Treasury Stock: Treasury stock represents shares of the company’s own stock that have been repurchased and are held by the company. It is recorded as a deduction from equity to reflect the reduction in the ownership interest of shareholders.

- Non-controlling Interest: Non-controlling interest, also known as minority interest, represents the portion of equity in a subsidiary that is not attributable to the parent company. It reflects the ownership interest held by minority shareholders in the subsidiary.

Equity provides insight into the ownership structure of a company and the accumulated profits or losses over time. It represents the residual claim on the company’s assets after deducting liabilities. The fluctuation in equity reflects the profitability, dividend payment, share issuances, share buybacks, and other transactions affecting shareholders’ ownership interests.

Stakeholders analyze equity to assess the financial health of the company, its ability to generate profits, and the return on investment for shareholders. It is also used to calculate important financial ratios, such as return on equity (ROE) and earnings per share (EPS), which measure the company’s profitability and shareholder value.

It’s worth noting that the composition and structure of equity can vary depending on factors such as the type of business entity, the stage of the company’s lifecycle, and the specific accounting standards followed by the company.

Current vs. Non-current Classification

One of the key distinctions made in a classified balance sheet is the classification of assets and liabilities into current and non-current categories. This categorization helps stakeholders in assessing the timing of cash flows and the liquidity of a company. Let’s explore the differences between current and non-current classification:

Current Assets: Current assets are those that are expected to be converted into cash or consumed within one year or the normal operating cycle of the business, whichever is longer. These assets are readily available for use in the company’s day-to-day operations. Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments. The classification of assets as current is crucial in evaluating a company’s ability to meet short-term obligations and manage its working capital efficiently.

Non-current Assets: Non-current assets are those that have a longer-term nature and are not expected to be converted into cash or consumed within one year. These assets provide economic benefits to the company over an extended period. Examples of non-current assets include property, plant, and equipment (PP&E), intangible assets, long-term investments, and deferred charges. The classification of assets as non-current helps stakeholders assess a company’s long-term investment strategies, its ability to generate future cash flows, and the value of its long-term assets.

Current Liabilities: Current liabilities are obligations that are due to be settled within one year or the normal operating cycle of the business, whichever is longer. These obligations require the company to disburse cash or other assets within the short term. Examples of current liabilities include accounts payable, short-term loans, accrued expenses, and income taxes payable. The classification of liabilities as current allows stakeholders to evaluate the company’s short-term solvency, its ability to meet immediate financial obligations, and its working capital management.

Non-current Liabilities: Non-current liabilities are obligations that are due beyond one year or the normal operating cycle of the business. These liabilities require future payment of cash or other assets over the long term. Examples of non-current liabilities include long-term loans, bonds payable, pension obligations, and lease obligations. The classification of liabilities as non-current helps stakeholders assess a company’s long-term financial commitments, its ability to manage long-term debt, and its overall financial stability.

The current vs. non-current classification in a balance sheet is significant as it provides insights into a company’s liquidity, short-term and long-term financial obligations, and the timing of cash flows. It helps stakeholders assess the company’s ability to manage its working capital effectively, meet its short-term and long-term obligations, and plan for its future financial needs.

Advantages of Using a Classified Balance Sheet

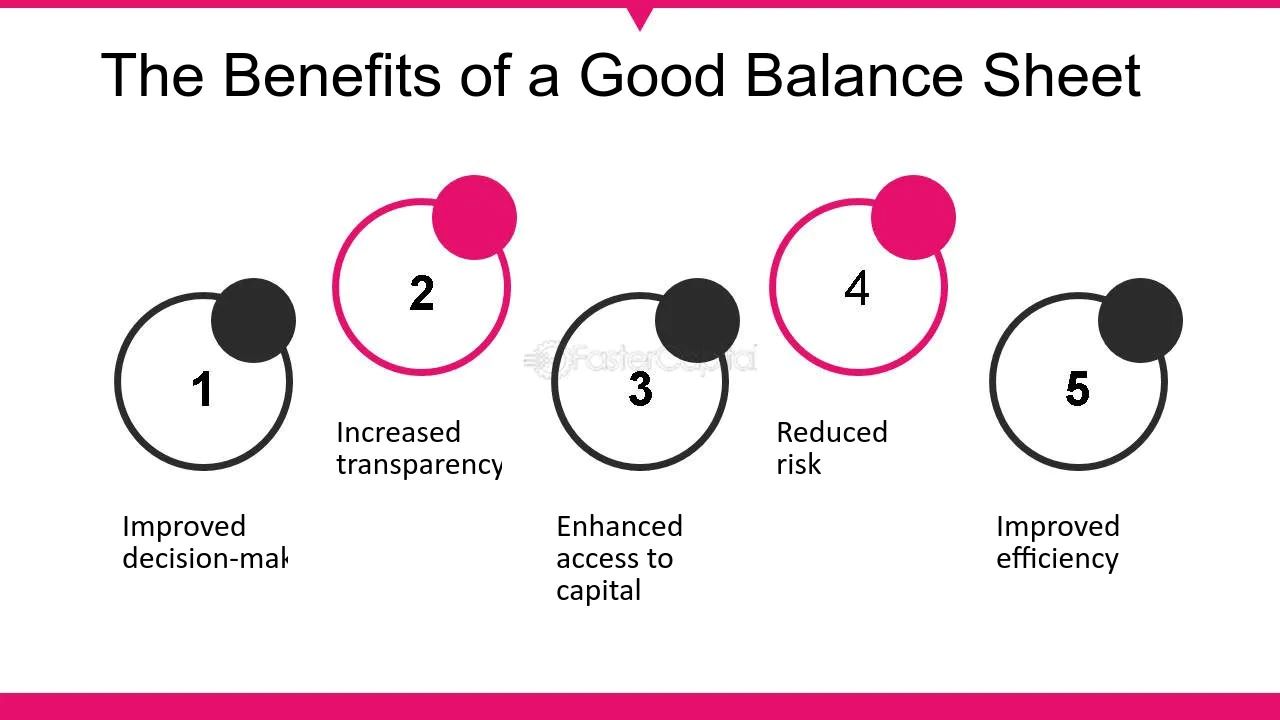

A classified balance sheet offers several advantages compared to an unclassified balance sheet. It provides a more detailed and organized view of a company’s financial position, allowing stakeholders to make better-informed decisions. Here are some key advantages of using a classified balance sheet:

- Enhanced Financial Analysis: The classification of assets, liabilities, and equity into current and non-current categories allows for a more comprehensive financial analysis. It helps stakeholders evaluate a company’s liquidity, solvency, and working capital management. By understanding the composition of current and non-current items, investors and creditors can assess a company’s short-term and long-term financial health.

- Improved Decision-making: The clear presentation of financial information in a classified balance sheet helps stakeholders make informed decisions. Investors can assess a company’s financial stability and profitability, aiding in investment decisions. Creditors can evaluate a company’s ability to repay its debts, supporting lending decisions. Entrepreneurs can analyze their own business’s financial position and make strategic decisions based on the data presented in the classified balance sheet.

- Effective Risk Assessment: The categorization of assets and liabilities enables stakeholders to assess a company’s risk exposure. Current liabilities provide insights into short-term obligations and the company’s ability to meet its immediate cash flow requirements. Non-current liabilities reveal long-term debt and future financial obligations. By understanding a company’s financial risk profile, stakeholders can evaluate the company’s ability to withstand economic downturns and external financial pressures.

- Better Transparency and Comparability: A classified balance sheet provides transparency by presenting financial information in a structured and organized manner. This classification improves the comparability of financial data between different periods and among companies operating in the same industry. Stakeholders can easily identify changes in the composition of assets, liabilities, and equity, facilitating meaningful analysis and benchmarking.

- Facilitates Financial Reporting: Financial reporting requirements often mandate the use of a classified balance sheet. By adhering to these standards, companies ensure compliance and provide stakeholders with the necessary information to evaluate the financial position. The classification of items simplifies the reporting process and ensures consistency across different financial statements, thereby improving overall financial reporting efficiency.

The advantages of using a classified balance sheet make it an essential tool for financial analysis, decision-making, risk assessment, and financial reporting. It provides stakeholders with a clearer and more organized presentation of a company’s financial position, enabling them to make more informed judgments and strategic moves.

Limitations of a Classified Balance Sheet

While a classified balance sheet provides valuable insights into a company’s financial position, it also has certain limitations that stakeholders should be aware of. Understanding these limitations is essential for a comprehensive analysis of a company’s financial health. Here are some of the key limitations:

- Valuation Challenges: The values assigned to assets and liabilities on a balance sheet may not always reflect their true market or fair value. Valuation methods, such as historical cost or amortized cost, may fail to capture the current market value of assets. Additionally, intangible assets, such as intellectual property or brand value, may not be accurately reflected on the balance sheet.

- Complexity of Financial Transactions: As companies engage in various complex financial transactions, such as derivatives, hedging activities, or off-balance-sheet arrangements, these activities may not be fully disclosed or adequately reflected on the balance sheet. Consequently, stakeholders may not have a complete picture of the company’s risk exposure or financial commitments.

- Subjectivity in Accounting Estimates: The classification and measurement of items on a classified balance sheet often involve subjective judgments and accounting estimates. These estimates may vary across companies or even within the same company over different reporting periods. As a result, different interpretations and judgments can lead to inconsistencies in the classification of assets, liabilities, and equity.

- Omission of Non-measurable Assets: Not all assets, such as intellectual property, employee knowledge, or brand reputation, are easily quantifiable and may not be included on the balance sheet. These intangible assets can have significant value and contribute to the company’s overall financial performance and competitive advantage but may not be fully captured in the balance sheet.

- Limitations in Financial Forecasting: While a classified balance sheet provides a snapshot of a company’s financial position at a specific point in time, it may not provide sufficient information for accurate financial forecasting. Changes in market conditions, the economy, or industry dynamics can significantly impact a company’s future financial performance and may not be adequately reflected in the balance sheet.

Despite these limitations, stakeholders can overcome them by combining the information from the classified balance sheet with other financial statements and non-financial metrics. Supplementary disclosures, such as footnotes or management discussions, can also provide additional insights into the company’s financial position and help address some of the limitations of a classified balance sheet.

It is crucial for stakeholders to consider the limitations of a classified balance sheet and apply additional analysis and judgment to gain a more holistic understanding of a company’s financial position.

Conclusion

A classified balance sheet is a vital financial statement that organizes and categorizes a company’s assets, liabilities, and equity into distinct groups. It provides stakeholders with a clearer and more organized view of a company’s financial position, aiding in financial analysis, decision-making, and risk assessment.

Throughout this article, we explored the definition, purpose, components, advantages, and limitations of a classified balance sheet. We learned that the classification of assets and liabilities into current and non-current categories enables stakeholders to evaluate a company’s liquidity, solvency, working capital management, and long-term financial commitments.

The advantages of using a classified balance sheet include enhanced financial analysis, improved decision-making, effective risk assessment, better transparency, and facilitation of financial reporting. However, it is important to recognize the limitations of a classified balance sheet, such as valuation challenges, complexity of financial transactions, subjectivity in accounting estimates, omission of non-measurable assets, and limitations in financial forecasting.

To gain a comprehensive understanding of a company’s financial health, stakeholders should consider the balance sheet in conjunction with other financial statements, non-financial metrics, and supplementary disclosures. This holistic approach allows for a more informed assessment of a company’s overall performance, strategy, and future prospects.

In summary, a classified balance sheet serves as a valuable tool in evaluating a company’s financial position. It provides stakeholders with crucial information for making informed decisions, assessing financial stability, and understanding a company’s short-term and long-term financial obligations. By utilizing the insights gained from a classified balance sheet, stakeholders can navigate the financial landscape with greater confidence and make sound financial judgments.