Home>Finance>How Do You Search Credit Default Swaps In Interactive Brokers

Finance

How Do You Search Credit Default Swaps In Interactive Brokers

Published: March 4, 2024

Looking to search credit default swaps in Interactive Brokers? Learn how to find and trade finance products with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

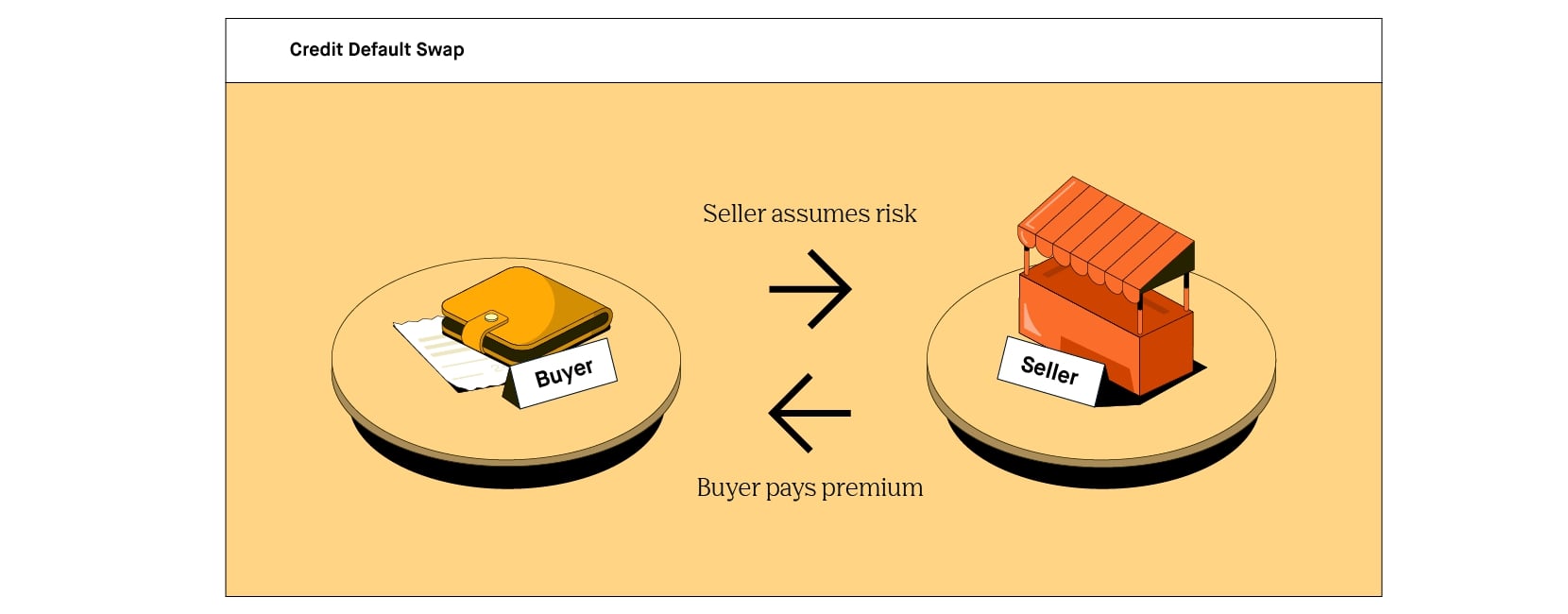

Credit default swaps (CDS) are financial instruments that have gained significant attention in the world of finance. They are essentially a form of insurance against the default of a borrower, typically a corporation or government. In essence, a CDS is a contract between two parties, where the buyer makes periodic payments to the seller in exchange for protection in the event of a credit event, such as a default or bankruptcy of the underlying borrower.

Understanding the intricacies of credit default swaps is crucial for investors and financial professionals alike. These instruments provide a means of hedging against credit risk and can also be utilized for speculative purposes. As such, having access to platforms that facilitate the trading and analysis of credit default swaps is paramount.

One such platform is Interactive Brokers, a renowned brokerage firm that offers a wide array of financial products and services. Interactive Brokers provides a comprehensive suite of tools for investors to research, analyze, and trade various financial instruments, including credit default swaps.

In this article, we will delve into the world of credit default swaps, understanding their significance in the financial markets, and exploring how one can access and search for credit default swaps within the Interactive Brokers platform. Whether you are a seasoned investor or a novice exploring the complexities of financial derivatives, gaining insights into the functionality of credit default swaps within Interactive Brokers can be immensely valuable. Let's embark on this journey to unravel the intricacies of credit default swaps and navigate the process of searching for these instruments within the Interactive Brokers ecosystem.

Understanding Credit Default Swaps

Credit default swaps (CDS) are derivative contracts that enable investors to mitigate the risk of credit default associated with a particular entity or instrument. These financial instruments are essentially a form of insurance against the default of a borrower, providing protection to the buyer in the event of a credit event.

When a party purchases a credit default swap, they are essentially seeking protection against the possibility of a borrower failing to meet their debt obligations. In exchange for this protection, the buyer makes periodic payments, often referred to as the “premium,” to the seller of the CDS. If a credit event occurs, such as a default, the seller is obligated to compensate the buyer for the loss incurred due to the default of the underlying borrower.

It’s important to note that the buyer of a CDS does not need to own the underlying debt instrument of the referenced entity. This characteristic of credit default swaps makes them a popular tool for speculating on the creditworthiness of various entities without directly holding their debt securities.

Furthermore, credit default swaps are customizable and can be tailored to specific credit risks, offering flexibility in their application. They can be linked to various types of debt instruments, such as corporate bonds, municipal bonds, or asset-backed securities, allowing investors to hedge against the credit risk associated with a diverse range of assets.

While credit default swaps provide an effective means of hedging against credit risk, they have also been subject to criticism and scrutiny, particularly in the aftermath of the 2008 financial crisis. The widespread use of CDS, often in complex and opaque ways, contributed to the amplification of systemic risks within the financial system during that period.

Despite the controversies surrounding credit default swaps, they remain an integral part of the global financial markets, offering investors and institutions a mechanism to manage and transfer credit risk. As we navigate the complexities of credit default swaps, it becomes essential to explore how these instruments can be accessed and searched for within the Interactive Brokers platform, a renowned hub for financial trading and analysis.

Accessing Credit Default Swaps in Interactive Brokers

Interactive Brokers, a leading brokerage firm, offers a robust platform that enables users to access and trade a wide range of financial instruments, including credit default swaps. To begin engaging with credit default swaps on the Interactive Brokers platform, users must have a comprehensive understanding of the available tools and functionalities provided by the brokerage.

One of the primary prerequisites for accessing credit default swaps through Interactive Brokers is to ensure that the user’s account is approved for trading in these derivative products. This may involve meeting specific eligibility criteria and obtaining the necessary permissions within the account settings. Interactive Brokers prioritizes risk management and regulatory compliance, thus necessitating a clear understanding of the requirements for engaging in credit default swap trading.

Upon fulfilling the necessary account permissions, users can leverage the platform’s advanced trading interface to explore and analyze credit default swaps. Interactive Brokers provides a suite of research and analysis tools that empower users to delve into the intricacies of credit default swaps, assess market conditions, and make informed trading decisions.

Furthermore, Interactive Brokers offers access to real-time market data and pricing information for credit default swaps, enabling users to stay updated on the latest developments in the credit derivatives market. This real-time data is invaluable for conducting thorough research and identifying potential trading opportunities within the realm of credit default swaps.

Moreover, Interactive Brokers’ platform incorporates risk management tools that are essential for navigating the complexities of credit default swaps. These tools enable users to evaluate and manage the inherent risks associated with trading credit derivatives, thereby fostering a prudent and informed approach to engaging with these financial instruments.

By providing a comprehensive suite of trading tools, research resources, and market data, Interactive Brokers equips users with the means to access and engage with credit default swaps in a manner that aligns with their investment objectives and risk tolerance. As we delve deeper into the process of searching for credit default swaps within the Interactive Brokers platform, it becomes evident that the brokerage’s offerings are tailored to cater to the diverse needs of investors and traders in the realm of credit derivatives.

Searching for Credit Default Swaps

Within the Interactive Brokers platform, the process of searching for credit default swaps involves leveraging the comprehensive tools and resources available to users. The platform’s intuitive interface and robust search functionalities enable investors to navigate the credit derivatives market with precision and efficiency.

Interactive Brokers provides a dedicated section within its platform for users to search and explore credit default swaps. This section encompasses a range of search parameters and filters that empower users to refine their quest for specific credit default swap instruments based on their unique preferences and investment criteria.

One of the key search criteria for credit default swaps within the Interactive Brokers platform is the identification of the underlying reference entities or instruments. Users can specify the entities or securities to which the credit default swaps are linked, allowing for targeted searches that align with their investment strategies and risk assessment.

Moreover, Interactive Brokers’ search functionality for credit default swaps encompasses parameters related to maturity dates, notional amounts, credit ratings, and other pertinent attributes of these derivative contracts. This granular level of search criteria enables users to tailor their exploration of credit default swaps based on specific contract details and market dynamics.

Additionally, the platform offers advanced search filters that facilitate the screening of credit default swaps based on liquidity, pricing, and market depth. This empowers users to identify credit default swaps that align with their trading objectives and liquidity preferences, thereby streamlining the process of discovering viable trading opportunities within the credit derivatives market.

Furthermore, Interactive Brokers’ platform integrates real-time market data and analytics, allowing users to conduct in-depth analysis and comparison of various credit default swap offerings. This real-time data empowers users to make well-informed decisions when searching for credit default swaps, leveraging insights into market trends, pricing dynamics, and liquidity conditions.

By harnessing the search capabilities within the Interactive Brokers platform, users can navigate the intricate landscape of credit default swaps with precision and agility. The platform’s comprehensive search functionality, coupled with real-time market data, equips investors and traders with the tools needed to identify, evaluate, and engage with credit default swaps in a manner that aligns with their investment objectives and risk appetite.

Conclusion

In conclusion, credit default swaps represent a pivotal component of the financial markets, offering investors and institutions a mechanism to hedge against credit risk and speculate on the creditworthiness of various entities. Understanding the intricacies of credit default swaps is essential for navigating the complexities of the derivatives market, and accessing these instruments within a reputable platform such as Interactive Brokers can enhance the efficiency and precision of trading activities.

Interactive Brokers’ robust platform provides users with the tools and resources necessary to access, analyze, and trade credit default swaps in a manner aligned with their investment goals and risk tolerance. By leveraging the platform’s advanced search functionalities, users can pinpoint specific credit default swap instruments based on underlying reference entities, maturity dates, notional amounts, credit ratings, and other pertinent attributes, thereby tailoring their exploration to suit their unique investment strategies.

Furthermore, the integration of real-time market data, pricing information, and risk management tools within the Interactive Brokers platform empowers users to make well-informed decisions when engaging with credit default swaps. The availability of comprehensive research and analysis tools enables investors to stay abreast of market developments and identify potential trading opportunities within the realm of credit derivatives.

As the financial landscape continues to evolve, the significance of credit default swaps in managing and transferring credit risk cannot be understated. Interactive Brokers’ commitment to providing a sophisticated and user-friendly platform for accessing credit default swaps underscores the brokerage’s dedication to empowering investors with the means to navigate the complexities of the derivatives market with confidence and agility.

Whether users are seeking to hedge against credit risk, speculate on the creditworthiness of specific entities, or diversify their investment portfolios, the availability of credit default swaps within the Interactive Brokers platform equips them with a versatile tool for addressing their financial objectives. By embracing the functionalities and resources offered by Interactive Brokers, investors and traders can embark on a journey to explore and engage with credit default swaps in a manner that aligns with their investment strategies and risk preferences, thereby harnessing the potential of these derivative instruments within the dynamic landscape of the financial markets.