Finance

How Does Group Life Insurance Work?

Published: November 20, 2023

Discover how group life insurance works and its financial benefits. Protect your loved ones with this comprehensive coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Life insurance is a crucial financial tool that provides financial support and security to individuals and their families in the event of death. It offers a lump sum payment, known as the death benefit, to the beneficiaries of the policyholder. While individual life insurance is commonly known, group life insurance is an alternative option that many people might not be familiar with.

Group life insurance, as the name suggests, is coverage provided to a group of individuals who share a common affiliation, such as employees of a company, members of a professional association, or participants in an organization. It is often offered by employers as part of an employee benefits package.

Unlike individual life insurance, where the policyholder applies for coverage and pays the premiums, group life insurance is typically arranged and paid for by the organization or employer. The coverage is extended to all eligible members of the group without requiring individual underwriting or a medical examination.

In this article, we will delve into how group life insurance works, including eligibility and enrollment, coverage and benefits, cost and premiums, claims and payouts, as well as the advantages and disadvantages of group life insurance.

What is Group Life Insurance?

Group life insurance is a type of life insurance coverage that is provided to a group of individuals who share a common affiliation. This affiliation can be based on employment, membership in a professional association, or participation in an organization.

The policyholder in group life insurance is usually an organization or employer, and they provide coverage to all eligible members of the group. This means that individuals within the group do not have to go through the process of applying for coverage or undergoing individual underwriting.

The purpose of group life insurance is to provide financial protection to the members of the group and their beneficiaries in the event of the policyholder’s death. It offers a death benefit, which is a lump sum payment that is paid out to the designated beneficiaries upon the death of the insured individual.

Group life insurance policies are typically term policies, which means they provide coverage for a specific period of time, such as one year, five years, or ten years. The coverage amount is predetermined based on the policyholder’s specifications and is usually a multiple of the insured individual’s annual salary or a fixed amount.

Group life insurance policies may also offer additional benefits such as accidental death and dismemberment coverage or a terminal illness benefit, which provides a portion of the death benefit in the event of a diagnosis of a terminal illness.

It’s important to note that group life insurance is typically a form of a basic life insurance coverage and may not offer the same level of customization or flexibility as individual life insurance policies. The coverage amount and terms are often standard for all members of the group, and there may be limitations on the ability to modify or customize the policy.

Overall, group life insurance provides a convenient and cost-effective way for organizations to offer life insurance coverage to their members. It ensures that individuals and their families have financial protection in the event of an unexpected tragedy, without the need for them to individually apply for coverage.

How Does Group Life Insurance Work?

Group life insurance functions in a similar way to individual life insurance but with a few key differences. Here’s a breakdown of how group life insurance works:

- Arrangement and Sponsorship: Group life insurance is typically arranged and sponsored by an organization or employer. They purchase the policy and become the policyholder on behalf of the group.

- Eligibility and Enrollment: All individuals who meet the eligibility criteria set by the organization or employer can enroll in the group life insurance plan. Common eligibility requirements include full-time employment, membership in a specific professional association, or active participation in an organization.

- Automatic Coverage: Unlike individual life insurance, group life insurance does not require individual underwriting or medical examinations. Eligible members of the group are automatically covered, regardless of their health conditions.

- Group Policy Terms: The organization or employer sets the terms of the group life insurance policy. This includes the coverage amount, which is often a multiple of the member’s salary, and the duration of the coverage, which is typically a renewable term. The organization may also include additional benefits such as accidental death and dismemberment coverage.

- Group Policyholder Pays Premiums: In most cases, the organization or employer pays the premiums for the group life insurance policy. The premiums are usually based on the total number of employees or members in the group and the coverage amount.

- Continuity of Coverage: As long as the member remains eligible and actively participates in the group, the coverage continues. If a member leaves the organization or terminates employment, they may have the option to convert their group life insurance policy into an individual policy or seek coverage through other means.

- Death Benefit Payout: In the unfortunate event of the insured member’s death, the beneficiaries designated by the member receive the death benefit. The amount is typically paid out as a lump sum and is generally tax-free to the recipients.

- Portability Options: Some group life insurance policies offer portability options, which allow the members to convert their group coverage into an individual policy if they leave the group. This ensures that individuals can maintain coverage even after leaving the sponsoring organization.

It’s important for members of a group life insurance plan to understand the terms and conditions of the policy and review their coverage periodically. They should also ensure that their beneficiaries are correctly designated to receive the death benefit in the event of their passing.

Overall, group life insurance provides a convenient and accessible way for organizations to offer life insurance coverage to their members. It offers financial protection and peace of mind to individuals and their families at a reasonable cost.

Eligibility and Enrollment

Eligibility and enrollment in a group life insurance plan are determined by the organization or employer sponsoring the policy. Here are some key aspects to consider:

Eligibility Criteria: The sponsoring organization sets the eligibility criteria for the group life insurance plan. Common criteria include full-time employment, a minimum length of service, or membership in a specific professional association or organization. It’s important to review the specific requirements to determine if you qualify for coverage.

Automatic Enrollment: In some cases, eligible members are automatically enrolled in the group life insurance plan without any action required on their part. This allows for seamless coverage and ensures that all eligible individuals are included in the policy.

Enrollment Periods: Organizations may have specific enrollment periods during which eligible individuals can join the group life insurance plan. These enrollment periods are typically offered during initial employment or during specific open enrollment periods throughout the year.

Proof of Insurability: Unlike individual life insurance, group life insurance generally does not require proof of insurability, such as medical examinations or underwriting. This means that individuals with pre-existing health conditions can still be covered under the group policy.

Dependent Coverage: Many group life insurance plans also offer coverage for dependents, such as spouses and children. The organization or employer may require additional premiums for dependent coverage or may include it as part of the overall plan.

Beneficiary Designation: It’s important to designate one or more beneficiaries who will receive the death benefit in the event of your passing. This can be done during the enrollment process or by completing a beneficiary designation form provided by the organization.

Changes in Enrollment: In some cases, opportunities for enrollment or changes in coverage may arise due to qualifying life events, such as marriage, the birth of a child, or a change in employment status. It’s crucial to understand the specific policies and procedures for making changes to your coverage.

If you are unsure about your eligibility or need assistance with the enrollment process, reach out to the human resources department or benefits coordinator in your organization. They can provide guidance and support to ensure that you understand the eligibility requirements and can take advantage of the group life insurance offered.

Remember to review the terms and conditions of the group life insurance plan carefully, including the coverage amount, duration, and any additional benefits or options that may be available. This will help you make informed decisions about your coverage and ensure that you have the appropriate protection for yourself and your loved ones.

Coverage and Benefits

Group life insurance provides coverage and benefits to the members of the group in the event of their death. Here are the key aspects to consider:

Coverage Amount: The coverage amount in a group life insurance plan is typically based on a multiple of the member’s salary. It can also be a fixed amount predetermined by the sponsoring organization. The purpose of this coverage is to provide financial support to the beneficiaries of the insured individual.

Term Coverage: Group life insurance policies are often term policies, meaning they offer coverage for a specific period of time, such as one year or five years. The coverage needs to be renewed periodically to maintain the protection. Some policies may also have conversion options to convert the term coverage into a permanent life insurance policy.

Additional Benefits: Group life insurance policies may include additional benefits beyond the basic death benefit. These benefits can vary depending on the policy and may include accidental death and dismemberment coverage, which provides an additional payout if death or dismemberment occurs due to an accident. Some policies may also offer a terminal illness benefit, which provides a portion of the death benefit if the insured individual is diagnosed with a terminal illness.

No Medical Underwriting: One of the key advantages of group life insurance is that it typically does not require individual medical underwriting. This means that individuals with pre-existing health conditions can still be covered under the group policy without needing to undergo a medical examination or providing detailed medical information.

Portability Options: Depending on the policy, group life insurance may offer portability options. These options allow members to convert their group coverage into individual coverage if they leave the group. This ensures that individuals can maintain life insurance protection even if they change employers or organizations.

Accelerated Death Benefits: Some group life insurance policies may offer accelerated death benefits, allowing individuals with terminal illnesses to access a portion of their death benefit while still alive. This can help cover medical expenses or other financial needs during a difficult time.

Spousal and Dependent Coverage: Many group life insurance plans offer the option to include coverage for spouses and dependent children. This provides additional financial protection for the entire family.

It’s important to carefully review the coverage and benefits offered in your specific group life insurance policy. Understand the terms, limitations, and any exclusions that may apply. It’s also essential to keep your beneficiaries updated and ensure that the necessary paperwork and documentation are in place to facilitate a smooth claims process.

Remember that while group life insurance provides valuable coverage, it may have limitations compared to individual life insurance policies. It’s worth considering additional individual coverage to supplement your group policy, especially if you have specific financial obligations or goals.

Speak with your organization’s benefits coordinator or insurance provider to get a clear understanding of the coverage and benefits included in your group life insurance plan. They can answer any questions you may have and help you make informed decisions about your life insurance needs.

Cost and Premiums

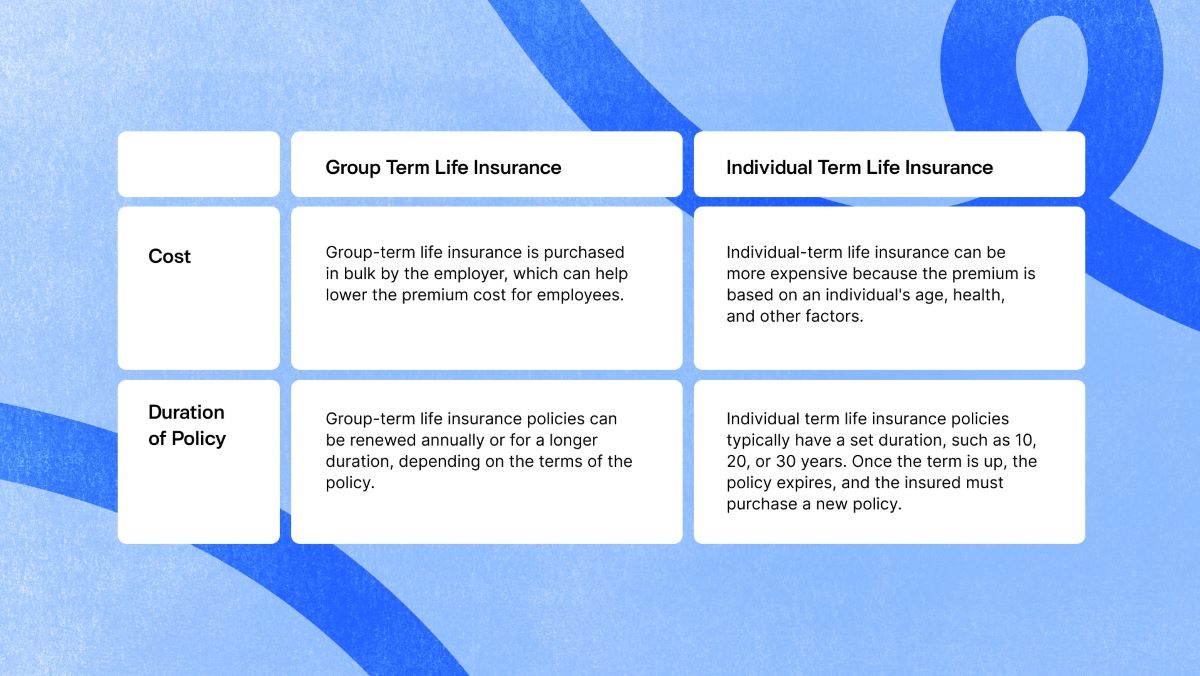

When it comes to group life insurance, the cost and premiums are important factors to consider. Here’s what you need to know:

Employer-Sponsored Coverage: In most cases, the cost of group life insurance is paid for by the employer or organization sponsoring the policy. The premiums are typically based on the number of employees or members in the group and the coverage amount per individual.

Standardized Premiums: Group life insurance policies often have standardized premiums, meaning that the premium rate is the same for all individuals within the group, regardless of age or health status. This can work in your favor if you have pre-existing health conditions and would otherwise face higher premiums in an individual life insurance policy.

Group Rating System: Some group life insurance policies use a rating system based on the overall risk profile of the group. In this case, factors such as the average age and health of the group members can influence the premium rates. Generally, larger groups tend to have lower premium rates due to the spreading of risk.

Supplemental Coverage: Depending on the policy, you may have the option to purchase additional coverage beyond the basic amount provided by the employer. This supplemental coverage often requires additional premiums, which may vary based on age and coverage amount.

Tax Considerations: In many countries, the premiums paid for group life insurance are often tax-deductible for the employer. However, for the employee, the premiums are typically considered a taxable benefit. It’s important to consult with a tax professional or review the local tax regulations to understand the specific tax implications of group life insurance premiums in your situation.

Cost vs. Individual Coverage: Group life insurance can be more cost-effective than purchasing an individual life insurance policy. This is because the risk is spread across a larger pool of insured individuals, resulting in lower premium rates. However, group policies may have limitations in terms of coverage amount and terms compared to individual policies.

Premium Payment: Premiums for group life insurance are usually deducted from your paycheck or paid directly by the employer. It’s important to review your pay stub or benefits documentation to ensure that the premiums are being deducted accurately and consistently.

Remember that the cost of group life insurance can vary depending on several factors, including the size of the group, the coverage amount, and any additional benefits included in the policy. It’s important to review the terms of your group life insurance plan and compare it to individual policies to ensure you have the appropriate coverage to meet your specific needs.

Consider speaking with a financial advisor or insurance professional to understand the cost implications of group life insurance and to determine if supplemental individual coverage is necessary to achieve your financial goals and provide adequate protection for yourself and your loved ones.

Claims and Payouts

When a member of a group life insurance policy passes away, the process of filing a claim and receiving the death benefit is initiated. Here’s what you need to know about claims and payouts:

Notification Process: The first step in filing a claim is to notify the insurance provider about the death of the insured individual. The beneficiary or an authorized representative of the beneficiary should contact the human resources department or benefits coordinator within the sponsoring organization to initiate the claim process.

Documentation Requirements: The insurance provider will require certain documentation to process the claim. This typically includes a completed claim form, a certified copy of the death certificate, and any additional documents specified by the insurance provider. It’s important to gather and submit all required documents promptly to avoid delays in the claims process.

Beneficiary Designation: The death benefit is paid to the beneficiaries designated by the insured individual. It’s crucial to review and update beneficiary designations as necessary to ensure that the death benefit is distributed according to the insured individual’s wishes.

Claim Evaluation: The insurance provider will evaluate the claim based on the terms and conditions of the group life insurance policy. They will review the submitted documentation and assess whether the claim meets all the requirements for payout.

Payout Options: The death benefit in group life insurance policies is typically paid out as a lump sum to the designated beneficiaries. Depending on the policy and insurance provider, beneficiaries may have the option to choose other payout options, such as receiving the benefit in installments or selecting an annuity option.

Tax Implications: In many countries, the death benefit received from a group life insurance policy is generally tax-free for the beneficiaries. However, it’s important to consult with a tax professional or review local tax regulations to understand the specific tax implications of the death benefit in your situation.

Processing Time: The time it takes to process and pay out a claim can vary depending on the insurance provider and the complexity of the case. However, many insurance providers strive to process claims efficiently and aim to provide the payout to beneficiaries as soon as possible.

Disputes and Appeals: If there are any disputes or issues regarding the claim or payout, beneficiaries have the right to file an appeal or lodge a complaint with the insurance provider. It’s advisable to review the policy terms regarding the claims process and any dispute resolution procedures that may be in place.

During the challenging time of dealing with the loss of a loved one, it’s important to seek support from the appropriate channels, such as the human resources department or a designated representative within the sponsoring organization. They can guide you through the claims process and provide assistance in completing the necessary paperwork.

Remember to maintain open communication with the insurance provider and provide all requested information promptly. This will help facilitate a smooth claims process and ensure that the designated beneficiaries receive the death benefit in a timely manner.

Advantages of Group Life Insurance

Group life insurance offers several advantages to both the members of the group and the sponsoring organization. Here are some key benefits:

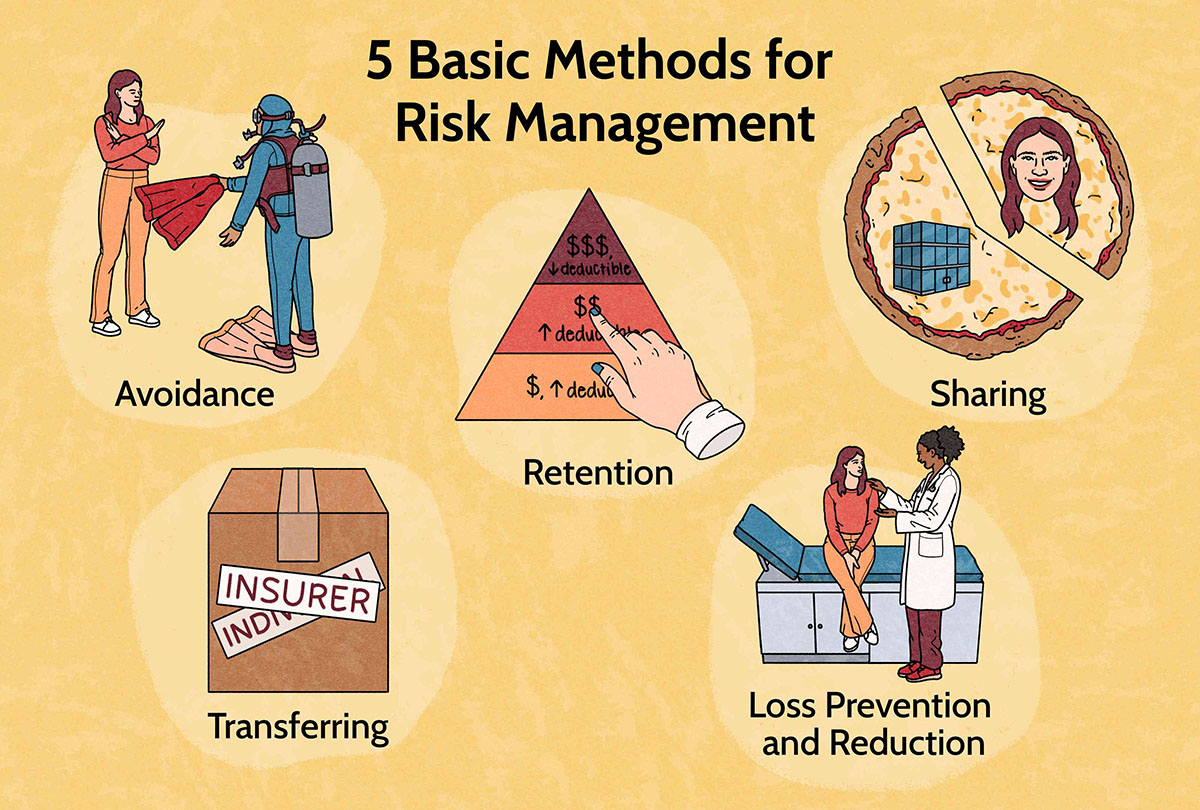

Accessibility: Group life insurance provides accessible coverage to a large group of people. Eligible members are automatically enrolled without the need for individual underwriting or medical examinations. This makes it easier for individuals with pre-existing health conditions to obtain life insurance coverage.

Cost Savings: Group life insurance policies often have lower premium rates compared to individual policies. This is because the risk is spread across a larger pool of insured individuals, resulting in cost savings for both the members and the sponsoring organization.

No Administrative Hassle: The organization or employer takes care of the administrative tasks associated with the group life insurance policy, such as policy selection, premium payments, and claims processing. This relieves the members of the group from the administrative burden typically associated with individual life insurance policies.

Convenience: Group life insurance coverage is provided as part of a benefits package, making it a convenient option for employees or members of an organization. It offers a simplified and efficient way to obtain life insurance coverage without the need for individual applications or negotiations.

No Waiting Periods: In group life insurance, there are typically no waiting periods for coverage to take effect. Once eligible, members are immediately covered under the policy, providing them with immediate financial protection for themselves and their beneficiaries.

Supplemental Coverage Options: Some group life insurance policies offer the option to purchase supplemental coverage beyond the basic amount provided by the employer. This allows individuals to customize their coverage to suit their specific needs and financial goals.

Portability: Many group life insurance policies offer portability options, allowing members to convert their group coverage into individual coverage if they leave the group. This ensures continuity of coverage even if they change employers or organizations.

Inclusion of Dependent Coverage: Group life insurance often includes the option to extend coverage to spouses and dependent children. This provides additional financial protection for the entire family without the need for separate policies.

Employee Retention and Recruitment: Offering group life insurance as part of an employee benefits package can enhance employee retention and attract new talents. It demonstrates the organization’s commitment to the well-being of its members and enhances the overall employee value proposition.

Peace of Mind: Knowing that they have life insurance coverage provides peace of mind for individuals and their beneficiaries. It ensures that financial protection will be available in the event of an unexpected tragedy, providing a sense of security and stability.

Group life insurance offers numerous advantages, including accessibility, cost savings, convenience, and peace of mind. It’s important for members to understand the terms and coverage of their group policy and consider supplementing it with individual coverage if necessary to meet their specific needs and financial goals.

Disadvantages of Group Life Insurance

While group life insurance offers many benefits, it also has some disadvantages that individuals should consider. Here are the key drawbacks to be aware of:

Limited Customization: Group life insurance policies are typically designed to provide standardized coverage to a large group of individuals. As a result, there is limited flexibility in customizing the coverage amount and terms to individual needs. This may not fully meet the specific requirements of certain members.

Coverage Limitations and Exclusions: Group life insurance policies often have limitations and exclusions in the coverage. This can include restrictions on coverage for certain types of deaths, such as suicides within a certain time frame. It’s important to review the policy details to understand the specific limitations and ensure they align with your needs.

Lack of Portability: While some group life insurance policies offer portability options, not all plans provide this feature. If you leave the group or organization sponsoring the policy, you may lose the coverage and potentially face challenges in obtaining suitable replacement coverage.

Dependence on Employer: Group life insurance coverage is often tied to employment. If you change jobs or lose your employment, you may lose access to the group policy. This can leave you without adequate life insurance coverage until you secure a new job or obtain individual coverage.

Coverage Ceases when Leaving the Group: When you leave the sponsoring organization, your coverage under the group life insurance policy typically ends. This gap in coverage can leave you vulnerable during the transition period, especially if you have dependents or financial obligations.

Less Privacy: With group life insurance, the insurance provider may have access to personal and financial information about you as part of the enrollment process. This can potentially compromise your privacy compared to individual life insurance policies where information is shared directly between you and the provider.

Employer Control over Benefits: Employers have control over the group life insurance policy and can make changes or even terminate the coverage at any time. This lack of personal control may limit your ability to make decisions about your coverage or seek alternative options.

Limited Beneficiary Options: Group life insurance policies often have restrictions on the choice of beneficiaries. The default option is typically limited to immediate family members, such as spouses and children. This may not accommodate individuals who wish to designate beneficiaries outside of these predefined options.

Tax Considerations: While group life insurance premiums are often tax-deductible for the employer, the premium amounts are typically considered taxable income for the employee. This means that the premiums can have a potential impact on your overall tax liability.

It’s important to consider these disadvantages alongside the benefits of group life insurance. Assess your individual needs and circumstances to determine whether the limitations of group coverage outweigh the advantages, and whether supplementing it with individual life insurance is necessary to meet your specific goals.

Consulting with a financial advisor or an insurance professional can provide valuable guidance in evaluating your options and ensuring that you have the appropriate life insurance coverage in place.

Conclusion

Group life insurance offers a convenient and accessible way for organizations to provide life insurance coverage to their members. It offers several advantages, including accessibility, cost savings, and the convenience of automatic enrollment without the need for individual underwriting. Group life insurance provides valuable financial protection and peace of mind to both the insured individuals and their beneficiaries in the event of an unexpected tragedy.

However, it is important to consider the limitations and disadvantages of group life insurance. The coverage may have restrictions on customization, limited portability, and dependence on employment. There may also be limitations on coverage and exclusions to consider. Additionally, group life insurance policies may not fully address the specific needs and goals of individuals, therefore it’s worth considering supplemental individual coverage.

Ultimately, the decision to rely solely on group life insurance or to supplement it with individual coverage depends on individual circumstances and priorities. It is essential to carefully review the terms and coverage of the group policy, and evaluate whether it aligns with your specific needs, financial goals, and plans for the future.

Consulting with a financial advisor or an insurance professional can provide valuable insights and guidance in determining the best course of action. They can help you navigate the complexities of life insurance options, evaluate your individual circumstances, and select the most suitable coverage to protect yourself and your loved ones.

Whether you choose group life insurance, individual coverage, or a combination of both, the key is to ensure that you have adequate financial protection in place to protect your family and provide peace of mind. Life insurance is an essential tool in safeguarding your loved ones’ future and ensuring their financial stability during difficult times.