Home>Finance>How To Calculate Quick Ratio From Balance Sheet

Finance

How To Calculate Quick Ratio From Balance Sheet

Published: December 27, 2023

Learn how to calculate the quick ratio, an important financial metric, from the balance sheet. Enhance your understanding of finance with this guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is the Quick Ratio?

- Understanding the Balance Sheet

- Step 1: Gathering the Required Information

- Step 2: Calculation of Current Assets

- Step 3: Calculation of Current Liabilities

- Step 4: Calculation of Quick Assets

- Step 5: Calculation of Quick Ratio

- Interpreting the Quick Ratio

- Limitations of the Quick Ratio

- Conclusion

Introduction

When it comes to evaluating the financial health and stability of a company, one crucial metric that investors and analysts often consider is the quick ratio. The quick ratio, also known as the acid-test ratio, is a financial ratio that allows stakeholders to assess a company’s ability to cover its short-term obligations using its most liquid assets. Understanding how to calculate the quick ratio from a company’s balance sheet is essential for making informed investment decisions and analyzing a company’s financial performance.

The quick ratio provides insight into a company’s liquidity position by comparing its quick assets to its current liabilities. Quick assets are the assets that can be easily converted to cash within a short period, while current liabilities are the company’s obligations that are due within one year. By focusing on the quick assets, the quick ratio excludes inventory (which might take longer to convert to cash) from the calculation, providing a more conservative measure of the company’s ability to meet its short-term obligations.

This article will guide you through the process of calculating the quick ratio from a company’s balance sheet and help you interpret the results. Additionally, we will explore the limitations of the quick ratio and discuss its relevance in different industries and scenarios.

What is the Quick Ratio?

The quick ratio, also known as the acid-test ratio, is a financial ratio that measures a company’s ability to meet its short-term obligations using its most liquid assets. It provides a more conservative assessment of liquidity than the current ratio by excluding inventory from the calculation. The quick ratio focuses on assets that can be quickly converted to cash, such as cash itself, marketable securities, and accounts receivable.

Typically expressed as a ratio, the quick ratio is calculated by dividing the total quick assets by the total current liabilities. The formula for calculating the quick ratio is as follows:

Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

A high quick ratio indicates that a company has a strong ability to pay off its current liabilities without relying on selling inventory. This suggests a high level of liquidity and financial stability. On the other hand, a low quick ratio may be a cause for concern as it suggests that the company may struggle to meet its short-term obligations.

The quick ratio is particularly important for industries that face rapid changes in market conditions or have high levels of uncertainty. For example, service-based companies that rely on immediate cash flow to pay their expenses often tend to have higher quick ratios. Conversely, industries that have a large amount of inventory, such as manufacturing or retail, typically have lower quick ratios due to the time it takes to convert inventory into cash.

Overall, the quick ratio provides valuable insights into a company’s liquidity position and its ability to handle short-term financial obligations. However, it is important to consider the quick ratio in conjunction with other financial metrics and ratios to get a comprehensive view of a company’s financial health.

Understanding the Balance Sheet

The balance sheet is one of the fundamental financial statements that provides an overview of a company’s financial position at a specific point in time. It presents a snapshot of a company’s assets, liabilities, and shareholders’ equity. Understanding the components of a balance sheet is essential for calculating the quick ratio.

A balance sheet is divided into two main sections: the left side represents a company’s assets, while the right side represents its liabilities and shareholders’ equity. The balance sheet follows the basic accounting equation, which states that assets equal liabilities plus shareholders’ equity.

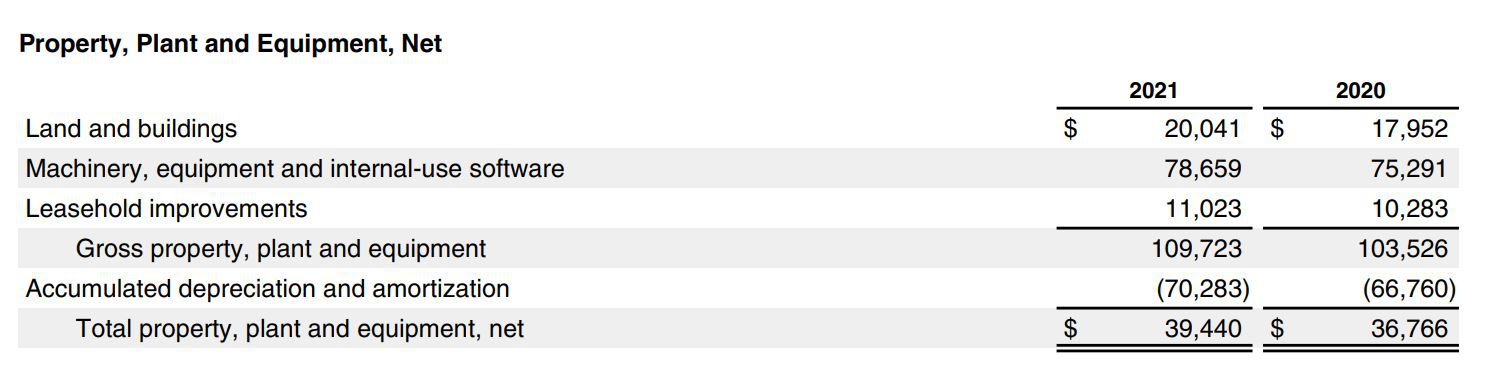

On the asset side, the balance sheet lists different categories of assets, including current assets, long-term investments, property, plant, and equipment, and intangible assets. Current assets are the most important for calculating the quick ratio, as they include the assets that a company can convert into cash within a short period, typically one year or less.

The liability side of the balance sheet includes current liabilities, long-term debt, and shareholders’ equity. Current liabilities are the obligations that a company is expected to settle within one year, such as accounts payable, short-term loans, and accrued expenses.

To calculate the quick ratio, we need specific information from the balance sheet, including the values of cash, marketable securities, accounts receivable, and current liabilities. These values can be found on the balance sheet and are essential for calculating the quick assets and the quick ratio.

Once you have a good understanding of the balance sheet and its components, you are ready to move on to the next step: gathering the required information for calculating the quick ratio.

Step 1: Gathering the Required Information

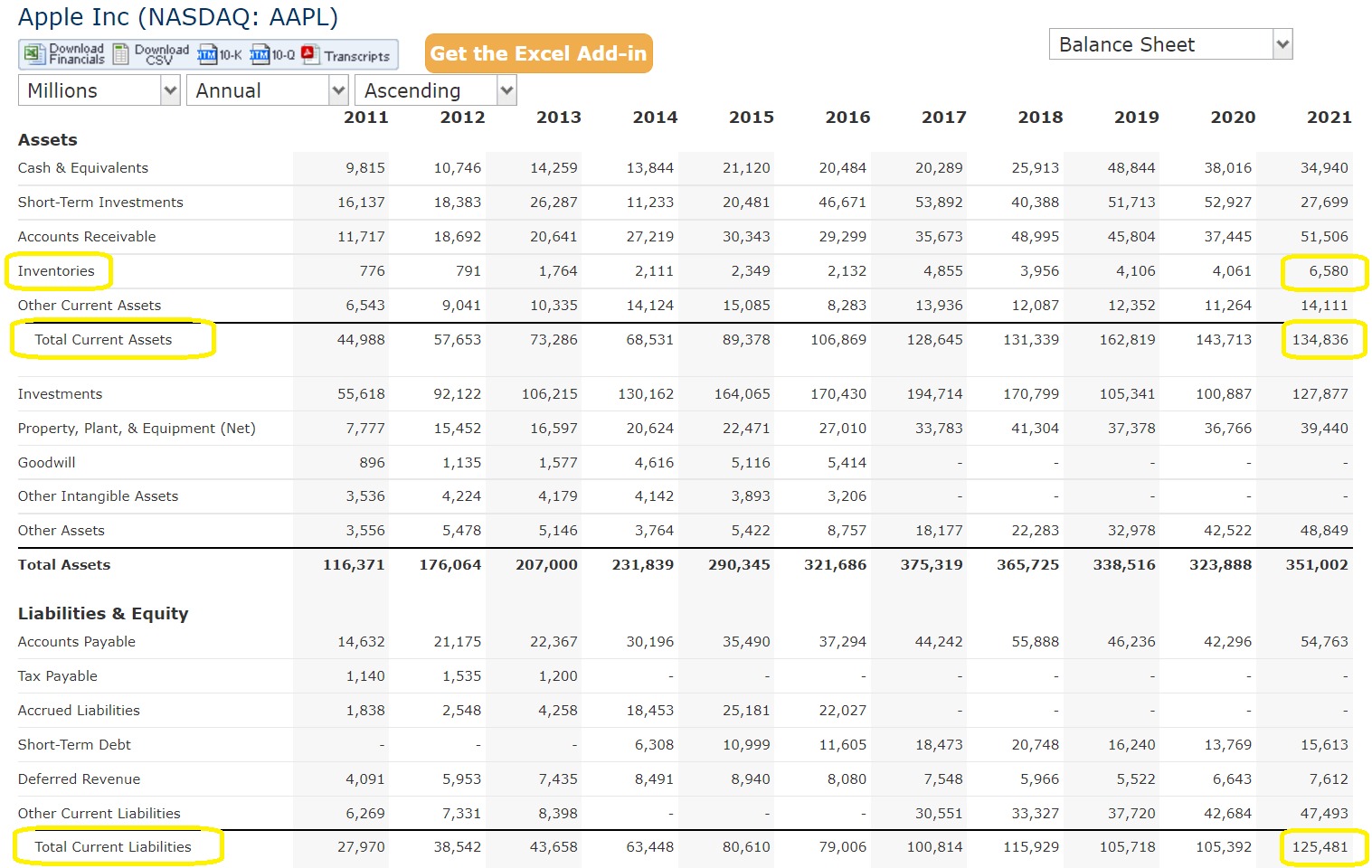

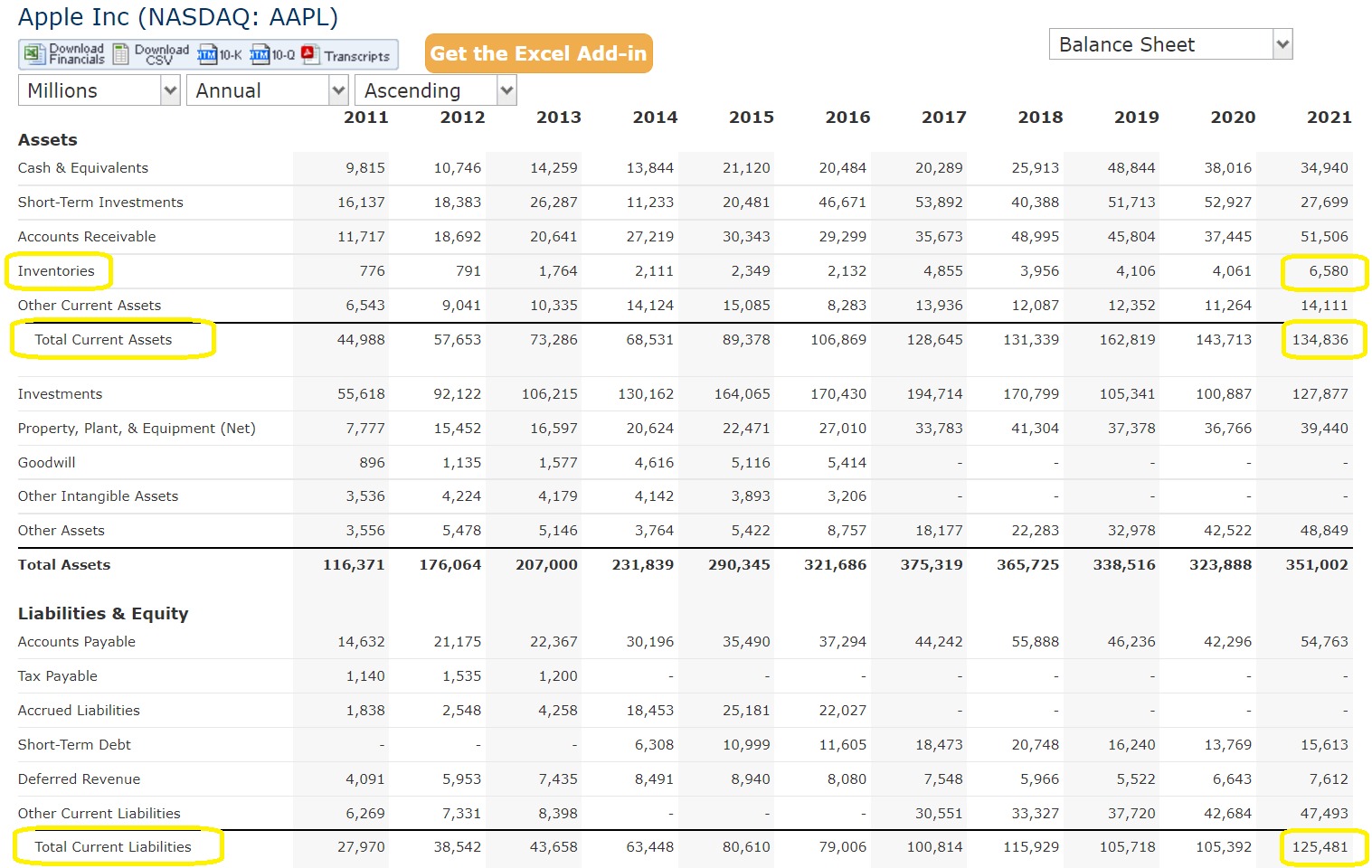

Before calculating the quick ratio, it is necessary to gather the required information from the company’s balance sheet. The key values needed are cash, marketable securities, accounts receivable, and current liabilities.

These values can typically be found under the relevant sections on the balance sheet. Cash represents the amount of money a company has on hand or in its bank accounts. Marketable securities encompass investments that are easily converted into cash, such as stocks or bonds. Accounts receivable refers to the money owed to the company by its customers for goods or services provided.

Current liabilities include any obligations that the company is expected to fulfill within a year, such as accounts payable, short-term loans, or accrued expenses. These liabilities must be categorized separately from long-term debt, which is not included in the calculation of the quick ratio.

Once you have located these values on the balance sheet, it is time to move on to the next step: calculating the current assets.

Note: If you are unable to find the required information on the balance sheet, it may be necessary to consult the company’s financial statements or annual report for more detailed information. In some cases, the balance sheet may be presented in consolidated form, combining the financial information of multiple subsidiaries or business units. In such instances, it is important to ensure that the relevant figures are appropriately extracted for accurate calculation of the quick ratio.

Step 2: Calculation of Current Assets

Calculating the current assets is the next step in determining the quick ratio. Current assets are the assets that a company expects to convert into cash within a short period, typically one year or less. These assets are crucial for determining a company’s liquidity and ability to meet its short-term obligations.

The components of current assets may vary among companies, but they generally include cash, marketable securities, and accounts receivable. To calculate the total current assets, simply add up the values of these components as reported on the balance sheet.

1. Cash: This includes the amount of money a company has on hand or in its bank accounts. Check the balance sheet for the value of cash, which is typically listed under the current assets section.

2. Marketable Securities: Marketable securities are investments that can be easily converted into cash, such as stocks, bonds, or Treasury bills. Look for the value of marketable securities on the balance sheet and include it in the calculation.

3. Accounts Receivable: Accounts receivable represent the money owed to the company by its customers for goods or services provided. Locate the value of accounts receivable on the balance sheet and include it in the calculation.

Once you have gathered the values for cash, marketable securities, and accounts receivable, simply add them together to obtain the total current assets.

Total Current Assets = Cash + Marketable Securities + Accounts Receivable

Now that you have calculated the total current assets, you are ready to move on to the next step: determining the current liabilities.

Step 3: Calculation of Current Liabilities

In order to calculate the quick ratio accurately, it is essential to determine the current liabilities of the company. Current liabilities are the obligations that a company is expected to settle within a year or its operating cycle, whichever is longer. These include accounts payable, short-term loans, and accrued expenses.

To calculate the total current liabilities, you need to locate the values of these current liabilities on the company’s balance sheet and add them together. Common examples of current liabilities include:

1. Accounts Payable: This refers to the amount owed by the company to its suppliers or vendors for goods or services received. Look for the value of accounts payable on the balance sheet and include it in the calculation.

2. Short-Term Loans: These are loans or borrowings that the company needs to repay within one year. The balance or outstanding amount of these loans can be found on the balance sheet, typically under the current liabilities section.

3. Accrued Expenses: Accrued expenses are costs or expenses that the company has incurred but not yet paid for. These can include salaries, utilities, taxes, or interest. Check the balance sheet for any reported accrued expenses and include them in the calculation.

Once you have gathered the values for accounts payable, short-term loans, and accrued expenses, simply add them together to obtain the total current liabilities.

Total Current Liabilities = Accounts Payable + Short-Term Loans + Accrued Expenses

By accurately calculating the total current liabilities, you are now ready to move on to the next step: determining the quick assets.

Step 4: Calculation of Quick Assets

After determining the total current assets and total current liabilities, the next step in calculating the quick ratio is to determine the quick assets. Quick assets are the subset of current assets that can be readily converted into cash within a short period, typically one year or less. These assets are highly liquid and exclude inventory, which may take longer to convert to cash.

To calculate the quick assets, you need to subtract the value of inventory from the total current assets. Inventory includes raw materials, work-in-progress, and finished goods that a company holds for sale or production. It is important to exclude inventory from the calculation because it may not be converted into cash quickly enough to meet short-term obligations. The formula to calculate quick assets is as follows:

Quick Assets = Total Current Assets – Inventory

By subtracting the inventory value from the total current assets, you obtain the quick assets that can be readily converted into cash. Make sure to gather the values for total current assets and inventory from the company’s balance sheet for accurate calculation.

Generally, the value of inventory is reported separately on the balance sheet. However, if it is not explicitly stated, you may need to refer to the footnotes or consult the company’s annual report for further details. Once you have obtained the value of inventory, subtract it from the total current assets to determine the quick assets.

Understanding the calculation of quick assets is crucial in assessing a company’s liquidity and its ability to meet short-term obligations. With the calculation of quick assets complete, you are now ready for the final step of determining the quick ratio.

Step 5: Calculation of Quick Ratio

Now that you have calculated the total current assets and determined the quick assets, you are ready to calculate the quick ratio. The quick ratio, also known as the acid-test ratio, compares a company’s quick assets to its current liabilities, providing a measure of its ability to cover short-term obligations without relying on the sale of inventory.

The formula for calculating the quick ratio is as follows:

Quick Ratio = Quick Assets / Current Liabilities

To calculate the quick ratio, divide the value of quick assets (obtained in the previous step) by the total current liabilities. The result will give you the quick ratio, expressed as a decimal or a ratio.

A quick ratio greater than 1 indicates that a company has sufficient quick assets to cover its current liabilities, suggesting a strong liquidity position. A quick ratio of exactly 1 means that a company’s quick assets are equal to its current liabilities, while a quick ratio less than 1 indicates a potential inability to meet short-term obligations without relying on the sale of inventory or additional funding.

Interpreting the quick ratio should take into consideration the nature of the industry and the company’s specific circumstances. Different industries may have different liquidity requirements, and what might be considered a healthy quick ratio in one industry could be deemed low in another.

It is important to note that the quick ratio is just one metric in assessing a company’s financial health, and it should be used in conjunction with other financial ratios and metrics for a comprehensive analysis.

By calculating the quick ratio, you gain insights into a company’s liquidity position and its ability to meet short-term obligations. Understanding the quick ratio allows you to make informed decisions and gauge the financial strength of a company.

Interpreting the Quick Ratio

The quick ratio is a critical metric for assessing a company’s liquidity and its ability to cover short-term obligations using its most liquid assets. Interpreting the quick ratio involves considering the result in the context of the company’s industry norms, historical trends, and specific circumstances.

A quick ratio greater than 1 indicates that a company has sufficient quick assets to cover its current liabilities, suggesting a strong liquidity position. This means that the company can meet its obligations without relying heavily on the sale of inventory or obtaining additional funding. A quick ratio of exactly 1 means that a company’s quick assets are equal to its current liabilities, indicating that it can just meet its short-term obligations. Though this ratio is acceptable, having some buffer above 1 is generally preferred for financial stability.

On the other hand, a quick ratio less than 1 suggests a potential inability to cover short-term obligations without relying on inventory conversion or additional funding. This may raise concerns about the company’s liquidity and its ability to manage cash flow effectively.

It’s important to note that interpreting the quick ratio should consider industry standards and the specific characteristics of the company under analysis. Industries with low liquidity needs, such as utilities or essential service providers, may have higher quick ratios compared to industries with high inventory turnover, such as retail or manufacturing. Comparing a company’s quick ratio to its industry peers can provide insights into its relative liquidity position and whether it is lagging or leading in terms of financial health.

Interpreting the quick ratio also requires assessing historical trends and changes over time. Significant fluctuations in the quick ratio compared to previous periods may indicate changes in the company’s liquidity position. It is crucial to analyze the reasons behind these changes, such as changes in sales patterns, inventory management practices, or adjustments in capital structure.

Additionally, understanding the company’s specific circumstances, including its business model, customer payment terms, and reliance on credit, is essential in interpreting the quick ratio accurately. For example, a company that has long customer payment cycles or relies heavily on credit sales may have a higher accounts receivable balance, which can impact the quick ratio. Examining the company’s collection practices and credit policies can help provide a more comprehensive assessment.

It is important to note that the quick ratio is just one piece of the puzzle when assessing a company’s financial health. It should be used in conjunction with other financial ratios and metrics, such as the current ratio, working capital, and cash flow analysis, to get a holistic understanding of the company’s liquidity and overall financial position.

By interpreting the quick ratio within the appropriate context, investors, analysts, and stakeholders can gain valuable insights into a company’s liquidity and make informed decisions regarding its financial stability and ability to handle short-term financial obligations.

Limitations of the Quick Ratio

While the quick ratio is a valuable metric for assessing a company’s liquidity and short-term financial health, it is important to be aware of its limitations. Understanding these limitations will help in interpreting the quick ratio more effectively and making informed decisions based on a broader analysis.

1. Exclusion of Inventory: One of the main limitations of the quick ratio is that it excludes inventory from the calculation. While excluding inventory provides a conservative measure of liquidity, it may not accurately reflect the company’s ability to convert inventory into cash when needed. Industries that heavily rely on inventory, such as manufacturing or retail, may have higher levels of inventory that cannot be easily converted into cash in the short term.

2. Industry Variations: The quick ratio should be interpreted in the context of the specific industry in which the company operates. Different industries have varying liquidity requirements and inventory turnover rates. What may be considered a low quick ratio in one industry could be normal or high in another. Thus, it is crucial to compare the quick ratio of a company against its industry peers to gain a meaningful understanding of its liquidity position.

3. Timing and Seasonality: The quick ratio provides a snapshot of a company’s liquidity at a specific point in time. However, businesses often experience fluctuations in cash flow and liquidity throughout the year. Seasonal or cyclical businesses may have varying quick ratios at different times of the year, making it important to consider the timing and seasonality when interpreting the metric.

4. Ignoring Potential Cash Sources: The quick ratio focuses solely on liquid assets like cash, marketable securities, and accounts receivable. It does not consider other potential sources of cash, such as lines of credit, unused borrowing capacity, or future sales revenue. Therefore, a company with access to additional credit facilities or a strong sales pipeline may have the ability to cover short-term obligations, even with a lower quick ratio.

5. Limited Profitability Insight: While the quick ratio helps assess a company’s short-term liquidity position, it does not provide insights into the company’s profitability or long-term financial viability. It is important to evaluate the quick ratio in conjunction with other financial ratios and metrics, such as profitability ratios (e.g., return on investment) and solvency ratios (e.g., debt-to-equity ratio), to gain a comprehensive understanding of a company’s overall financial health.

6. Lack of Consideration for Cash Flow Dynamics: The quick ratio does not take into account the timing of cash flows. A company may have a strong quick ratio, but if its accounts receivable collection slows down or it faces delays in payments from customers, its liquidity may be severely impacted. Assessing the company’s cash flow dynamics, including cash conversion cycles and working capital management, is essential in understanding its true liquidity position.

While the quick ratio provides valuable insights into a company’s short-term liquidity, it is crucial to consider its limitations and incorporate it into a broader financial analysis. By examining the quick ratio alongside other financial metrics, industry benchmarks, and a deep understanding of the company’s operations, stakeholders can gain a more comprehensive perspective on its liquidity and financial health.

Conclusion

The quick ratio is an essential financial ratio for evaluating a company’s liquidity and ability to meet short-term obligations using its most liquid assets. By excluding inventory, the quick ratio provides a more conservative measure of liquidity, focusing on quick assets like cash, marketable securities, and accounts receivable.

Calculating the quick ratio involves gathering the necessary information from the balance sheet, including total current assets and current liabilities, and performing the calculation. Interpreting the quick ratio requires considering industry norms, historical trends, and specific company circumstances to understand its implications accurately.

However, it is important to recognize the limitations of the quick ratio. Excluding inventory may not fully capture a company’s ability to convert assets into cash when needed. Industry variations, timing and seasonality, potential cash sources, limited profitability insight, and the lack of consideration for cash flow dynamics are all factors to consider when interpreting the quick ratio.

To gain a comprehensive understanding of a company’s financial health, it is recommended to evaluate the quick ratio alongside other financial ratios and metrics, such as the current ratio, profitability ratios, and cash flow analysis. Combining these metrics provides a more holistic view of a company’s liquidity, profitability, solvency, and overall financial performance.

Ultimately, the quick ratio serves as a valuable tool to assess a company’s ability to manage short-term obligations and weather financial challenges. By incorporating the quick ratio into a thorough financial analysis, stakeholders can make informed decisions about investing, lending, or doing business with a company based on its liquidity position and financial stability.