Finance

How To Find Current Ratio On Balance Sheet

Published: December 27, 2023

Discover how to calculate the current ratio on a balance sheet in finance. Learn the key formula and understand its importance for evaluating a company's liquidity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to this comprehensive guide on how to find the current ratio on a balance sheet. Whether you are a business owner, investor, or finance enthusiast, understanding the current ratio is crucial in evaluating a company’s financial health. The current ratio is a key liquidity metric that measures a company’s ability to cover its short-term liabilities using its current assets. By analyzing this ratio, you can gain valuable insights into the short-term financial health and stability of a company.

In this article, we will delve into the components of a balance sheet, explain how to calculate the current ratio, and provide a step-by-step guide to finding the current ratio on a balance sheet. Additionally, we will discuss the interpretation of the current ratio and its limitations in conducting a comprehensive financial analysis. By the end of this guide, you will have a solid grasp of the current ratio and its significance in assessing a company’s financial position.

Before we dive into the details, let’s briefly understand the importance of liquidity and the role it plays in business operations. Liquidity refers to a company’s ability to convert its assets into cash to meet its obligations. Without sufficient liquidity, businesses may struggle to pay suppliers, employees, and other short-term liabilities, which can lead to financial distress and even bankruptcy.

One way to measure liquidity is through the current ratio, which compares a company’s current assets to its current liabilities. Current assets include cash, accounts receivable, inventory, and other assets that are expected to be converted into cash within one year. Current liabilities, on the other hand, represent the obligations that are due within one year, such as accounts payable, short-term loans, and accrued expenses.

The current ratio is expressed as a numerical value, representing the number of times a company’s current assets can cover its current liabilities. It provides a quick snapshot of a company’s ability to meet its short-term obligations and is widely used by investors, lenders, and analysts to assess the financial health and liquidity position of a business.

Now that we have a basic understanding of the importance of liquidity and the role of the current ratio, let’s move on to exploring the components of a balance sheet and how the current ratio is calculated.

Understanding Current Ratio

The current ratio is an essential financial metric that measures a company’s ability to cover its short-term obligations with its current assets. It helps determine the liquidity position and the overall financial health of a company. By analyzing the current ratio, investors and analysts can gain insights into how effectively a company is managing its short-term finances.

The current ratio is calculated by dividing the total current assets of a company by its total current liabilities. Current assets are the assets that can easily be converted into cash within a year, such as cash and cash equivalents, accounts receivable, inventory, and short-term investments. On the other hand, current liabilities are the obligations that are due within a year, including accounts payable, accrued expenses, and short-term debt.

A high current ratio indicates that a company has a strong liquidity position and is more capable of meeting its short-term obligations. It suggests that the company has sufficient assets to cover its liabilities and can rely on its current assets to generate cash when needed. A ratio above 1 indicates that a company has more current assets than current liabilities, which is generally considered favorable.

On the other hand, a low current ratio may indicate that a company has liquidity challenges and may struggle to meet its short-term obligations. This could be a sign of financial distress or inefficiencies in managing working capital. It is important to note that an excessively high current ratio may also indicate that a company is not effectively utilizing its assets to generate profits.

It is essential to compare the current ratio of a company with its historical ratios and industry peers to gain a better understanding of its liquidity position. A company’s current ratio should be considered in the context of its specific industry and business model. For example, capital-intensive industries such as manufacturing may have a lower current ratio due to higher inventory levels, while service-based industries may have a higher current ratio due to lower inventory requirements.

Overall, the current ratio provides valuable information about a company’s liquidity and short-term financial strength. By analyzing this metric, investors and analysts can make more informed decisions regarding investment opportunities, creditworthiness, and overall financial stability.

Now that we have a solid understanding of the current ratio and its significance, let’s move on to exploring the components of a balance sheet and how to calculate the current ratio in the next section.

Components of a Balance Sheet

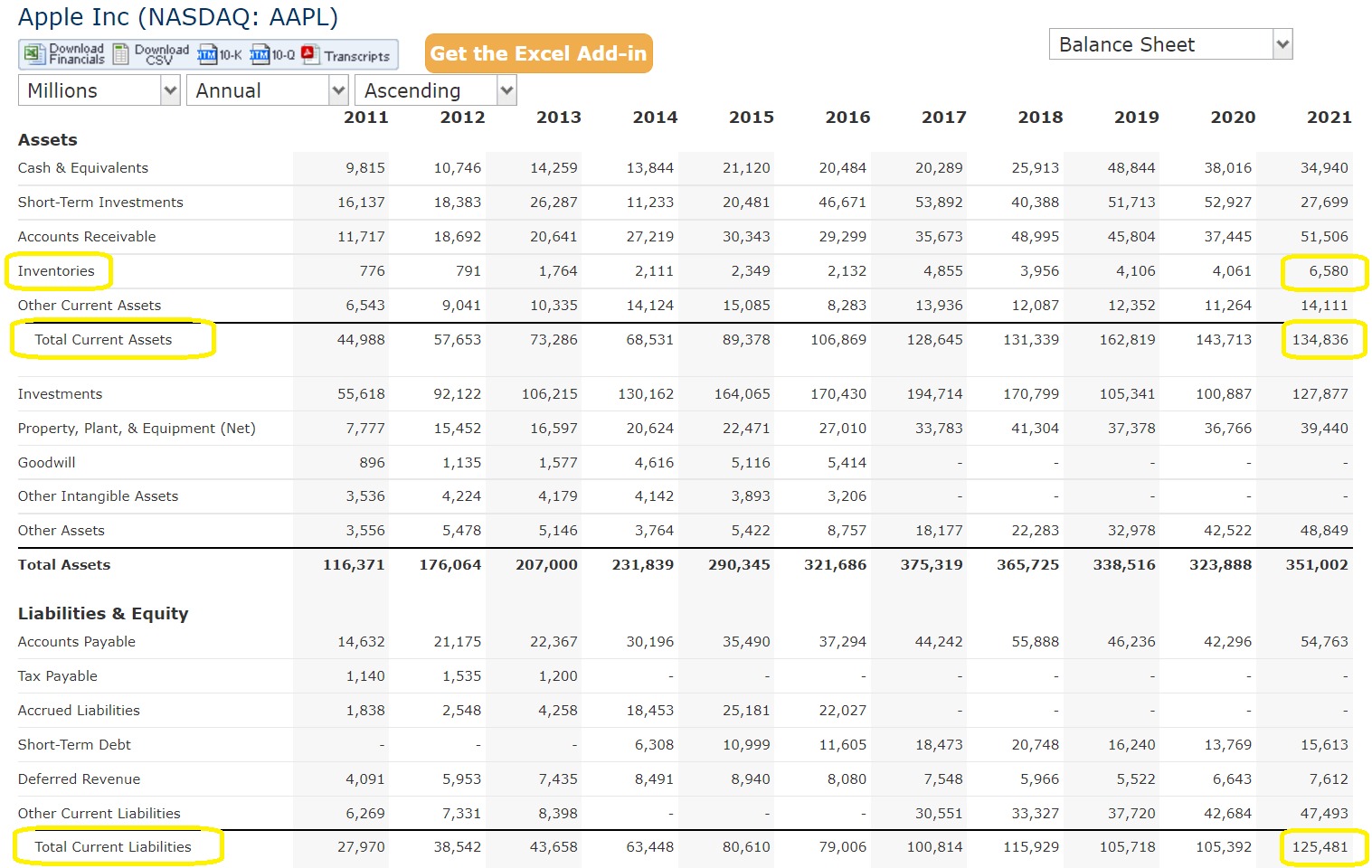

A balance sheet is one of the three main financial statements used by companies to present their financial position. It provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. Understanding the components of a balance sheet is essential in calculating the current ratio.

There are three main components of a balance sheet: assets, liabilities, and shareholders’ equity.

- Assets: Assets represent what a company owns and can be categorized into current and non-current assets. Current assets are those that are expected to be converted into cash within one year, such as cash and cash equivalents, accounts receivable, and inventory. Non-current assets, also known as long-term assets, are assets that are not easily liquidated, such as property, plant, and equipment, and intangible assets like patents and trademarks.

- Liabilities: Liabilities represent what a company owes to external parties and can be categorized as current and non-current liabilities. Current liabilities are obligations that need to be settled within a year, including accounts payable, short-term loans, and accrued expenses. Non-current liabilities, or long-term liabilities, are obligations that are due after the next year, such as long-term debt and deferred tax liabilities.

- Shareholders’ Equity: Shareholders’ equity represents the residual interest in the company’s assets after deducting its liabilities. It is the amount of investment made by the company’s shareholders and includes common stock, additional paid-in capital, retained earnings, and accumulated other comprehensive income.

The balance sheet follows the fundamental accounting equation, which states that assets must equal liabilities plus shareholders’ equity. This equation ensures that a company’s resources are balanced with its obligations and ownership interests.

By analyzing the components of a balance sheet, investors and analysts can assess a company’s financial stability, solvency, and liquidity. The balance sheet provides a clear picture of a company’s assets and liabilities, enabling stakeholders to evaluate its ability to meet short-term and long-term obligations.

Next, we will discuss how to calculate the current ratio by utilizing the information presented in the balance sheet. Understanding how the current ratio is derived is crucial in evaluating a company’s liquidity position.

Calculating Current Ratio

The current ratio is a simple yet powerful financial ratio that measures a company’s ability to meet its short-term obligations. By calculating the current ratio, investors and analysts can gain insights into the liquidity position and financial health of a company. The current ratio is derived by comparing a company’s current assets to its current liabilities.

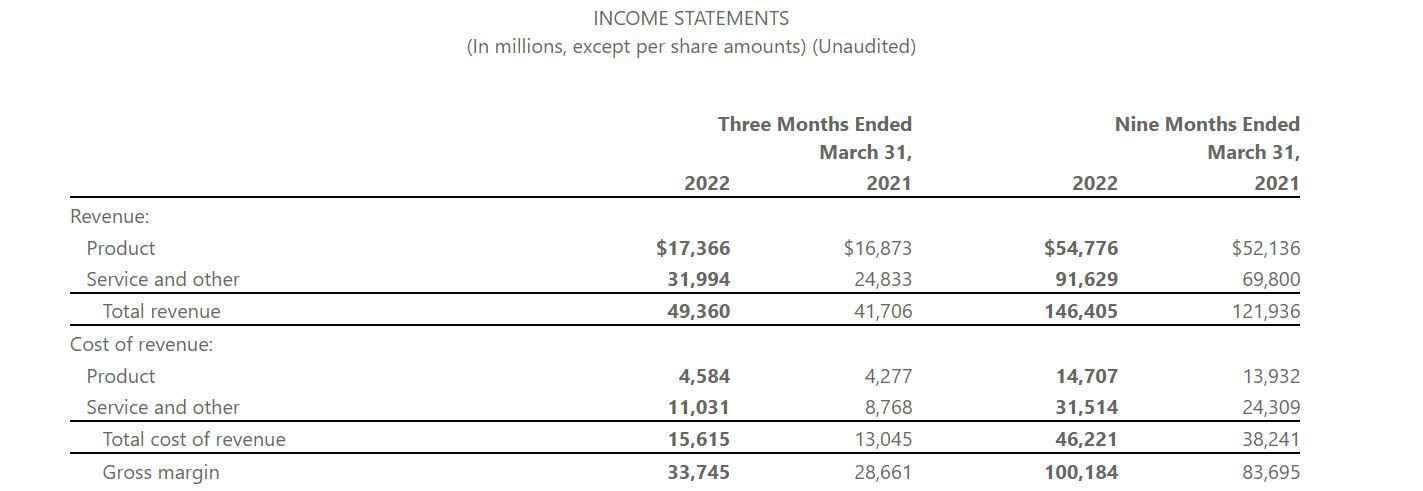

To calculate the current ratio, you need to gather the necessary financial information from a company’s balance sheet. Specifically, you will need the total current assets and the total current liabilities.

The formula for calculating the current ratio is as follows:

Current Ratio = Total Current Assets / Total Current Liabilities

For example, if a company has $500,000 in total current assets and $250,000 in total current liabilities, the current ratio would be:

Current Ratio = $500,000 / $250,000 = 2

This means that the company has two times more current assets than current liabilities, indicating a favorable liquidity position.

It is important to note that the current ratio is just one of many financial ratios used to analyze a company’s financial health. It provides a snapshot view of a company’s liquidity, but it does not provide a complete picture of its financial condition. Therefore, it is crucial to interpret the current ratio in conjunction with other financial metrics and industry benchmarks.

Now that we understand how to calculate the current ratio, let’s move on to the next section, where we will provide a step-by-step guide to finding the current ratio on a balance sheet.

Step-by-Step Guide to Finding Current Ratio on a Balance Sheet

Understanding the current ratio is essential in evaluating a company’s liquidity and financial health. To calculate the current ratio, you need to follow a step-by-step process that involves gathering the relevant information from a company’s balance sheet and performing the calculation. Here is a guide to finding the current ratio:

- Obtain the balance sheet: Start by obtaining the most recent balance sheet of the company you are analyzing. The balance sheet can usually be found in the company’s financial statements or annual reports.

- Identify the current assets: Locate the current assets section of the balance sheet. This section will list the assets that are expected to be converted into cash within one year. Common current assets include cash, accounts receivable, inventory, and short-term investments.

- Sum up the current assets: Add up the total value of current assets listed on the balance sheet. This will give you the total current assets figure.

- Identify the current liabilities: Locate the current liabilities section of the balance sheet. This section will list the liabilities that are due within one year. Typical current liabilities include accounts payable, accrued expenses, and short-term debt.

- Sum up the current liabilities: Add up the total value of current liabilities listed on the balance sheet. This will give you the total current liabilities figure.

- Calculate the current ratio: Divide the total current assets by the total current liabilities. The resulting number is the current ratio.

- Interpret the current ratio: Evaluate the current ratio to assess the liquidity position of the company. A ratio above 1 indicates that the company has more current assets than current liabilities, suggesting a stronger liquidity position. Conversely, a ratio below 1 may indicate potential liquidity challenges.

Remember that the current ratio is just one measure of a company’s financial health. It should be interpreted in conjunction with other financial ratios, industry benchmarks, and qualitative factors to form a comprehensive analysis of a company’s liquidity and financial position.

Now that you know how to find the current ratio on a balance sheet, let’s delve into the interpretation of the current ratio in the next section.

Interpretation of Current Ratio

The current ratio is a vital financial ratio used to assess the liquidity and short-term financial health of a company. Interpreting the current ratio involves analyzing the ratio value in relation to historical ratios, industry benchmarks, and other relevant factors. Here is a guide to interpreting the current ratio:

1. Ratio Value: The numerical value of the current ratio indicates the number of times a company’s current assets can cover its current liabilities. A ratio above 1 suggests that the company has more current assets than current liabilities, indicating a stronger liquidity position. Conversely, a ratio below 1 may suggest potential liquidity challenges and the need for further investigation into the company’s ability to meet short-term obligations.

2. Comparison to Historical Ratios: Compare the current ratio to the company’s historical ratios to identify any trends. If the current ratio is consistent or improving over time, it may indicate an improving liquidity position. On the other hand, a declining trend in the current ratio could be a cause for concern and may require further analysis.

3. Industry Comparison: Compare the current ratio to industry benchmarks to assess the company’s liquidity position relative to its peers. Industries have varying levels of liquidity requirements, so it is crucial to consider the specific industry and business model when interpreting the current ratio.

4. Working Capital Management: Analyze the company’s working capital management practices. A high current ratio may indicate that the company is holding excessive levels of current assets, which may not be effectively utilized to generate profits. Conversely, a low current ratio may indicate efficient working capital management, as the company is effectively utilizing its assets to generate income.

5. Operating Cycle: Consider the length of the company’s operating cycle, which is the time it takes to convert inventory into cash. If the company has a longer operating cycle, it may require higher levels of working capital and, therefore, a higher current ratio to meet its short-term obligations.

6. External Factors: Take into account external factors that may impact the current ratio, such as economic conditions, industry trends, and changes in the company’s business model. These factors can influence the company’s ability to generate cash and manage its short-term obligations.

It is important to note that the interpretation of the current ratio should be performed in conjunction with other financial ratios and qualitative factors. Analyzing a company’s cash flow statement, profitability, debt levels, and overall financial strategy provides a more comprehensive assessment of its financial health.

Now that we have covered the interpretation of the current ratio, let’s discuss the limitations of using the current ratio as a standalone financial analysis tool in the next section.

Limitations of Current Ratio Analysis

While the current ratio is a useful financial metric for assessing a company’s liquidity position, it is important to recognize its limitations and consider other factors when conducting a comprehensive financial analysis. Here are some of the limitations of relying solely on the current ratio:

1. Timing of Current Liabilities: The current ratio considers all current liabilities as due within one year, regardless of the actual timing of payment. Some current liabilities may have longer payment terms or are payable on demand. Therefore, the current ratio may not provide an accurate representation of a company’s immediate liquidity needs.

2. Quality of Assets: The current ratio does not differentiate between different types of current assets. Certain current assets, such as slow-moving inventory or accounts receivable with a high risk of default, may not be easily converted into cash. Thus, an overemphasis on the current ratio may overlook potential liquidity issues related to the quality of assets.

3. Seasonal Variations: Many businesses experience seasonal fluctuations in their working capital needs. For example, a retailer may have higher inventory levels during the holiday season. In such cases, the current ratio may not accurately reflect the company’s overall liquidity position during different periods of the year.

4. Industry Differences: Industries have varying liquidity requirements and working capital cycles. Comparing the current ratio of a company across industries without considering industry norms may lead to incorrect interpretations. It is crucial to benchmark the current ratio against industry-specific standards for a more accurate assessment.

5. Debt Structure: The current ratio does not consider the composition of a company’s current liabilities. Short-term debt and long-term debt due within one year are treated the same in the current ratio calculation. However, a high proportion of short-term debt relative to the company’s ability to generate cash may indicate a higher risk of financial distress.

6. Exclusion of Non-Current Items: The current ratio focuses solely on the company’s short-term liquidity position. It does not consider non-current assets and liabilities, which may have a significant impact on a company’s overall financial health and long-term solvency.

7. Changing Business Models: The current ratio may not capture the impact of changes in a company’s business model or strategic decisions. For example, a company transitioning from a product-based model to a subscription-based model may experience temporary shifts in liquidity due to changes in revenue recognition and customer acquisition costs.

To overcome these limitations, it is important to complement the analysis of the current ratio with other financial ratios, such as the quick ratio, cash conversion cycle, and profitability ratios. Additionally, conducting a thorough qualitative analysis by examining market dynamics, competitive positioning, and management strategy provides a more holistic view of a company’s financial health.

Now that we have explored the limitations of the current ratio, let’s summarize our findings in the concluding section.

Conclusion

The current ratio is a fundamental financial metric that allows investors, analysts, and business owners to assess a company’s liquidity and short-term financial health. By comparing a company’s current assets to its current liabilities, the current ratio provides valuable insights into the company’s ability to meet its short-term obligations.

Throughout this guide, we have covered the key aspects of the current ratio analysis, including its calculation, interpretation, and limitations. We discussed how to find the current ratio on a balance sheet by identifying the current assets and current liabilities, and performing a simple division calculation.

Interpreting the current ratio requires considering various factors such as industry benchmarks, historical trends, working capital management practices, and the company’s specific circumstances. It is important to recognize the limitations of the current ratio and utilize it as part of a comprehensive financial analysis, complemented by other financial ratios and qualitative factors.

While the current ratio provides valuable insights into a company’s liquidity, it should not be used in isolation. Other financial metrics, such as the quick ratio, cash flow analysis, and profitability ratios, provide a holistic view of a company’s financial health. Qualitative factors such as industry dynamics, competitive positioning, and management strategies further aid in evaluating a company’s overall financial strength and potential for future success.

By combining these tools and considerations, stakeholders can make more informed decisions when analyzing investments, evaluating creditworthiness, or managing a company’s financial operations. Understanding the current ratio and its role in financial analysis is an essential skill for anyone involved in the world of finance.

We hope this guide has provided you with a comprehensive understanding of how to find the current ratio on a balance sheet, interpret its value, and consider its limitations. Remember, financial analysis requires a holistic approach, taking into account both quantitative and qualitative factors, to gain a comprehensive understanding of a company’s financial position.