Home>Finance>How To Complete 941-X For Employee Retention Credit

Finance

How To Complete 941-X For Employee Retention Credit

Modified: February 21, 2024

Learn how to complete Form 941-X for the Employee Retention Credit and optimize your finances with our easy-to-follow guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Form 941-X?

- Overview of the Employee Retention Credit (ERC)

- Eligibility for the Employee Retention Credit

- Step 1: Gathering the Necessary Information

- Step 2: Completing Part 1 of Form 941-X

- Step 3: Completing Part 2 of Form 941-X

- Step 4: Completing Part 3 of Form 941-X

- Step 5: Calculating the Employee Retention Credit

- Step 6: Completing Part 4 of Form 941-X

- Step 7: Filing and Submitting Form 941-X

- Common Mistakes to Avoid

- Resources and Additional Information

- Conclusion

Introduction

Welcome to our comprehensive guide on how to complete Form 941-X for the Employee Retention Credit (ERC). As a business owner or employer, understanding and properly filing this form is crucial for claiming the ERC, a valuable tax credit designed to help businesses affected by the COVID-19 pandemic.

Form 941-X, also known as the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, is used to correct errors and make adjustments to the original Form 941. This includes claiming or adjusting the Employee Retention Credit.

The Employee Retention Credit was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020. It was later extended and expanded under the Consolidated Appropriations Act in 2021 and the American Rescue Plan Act in 2021. The ERC provides eligible employers with a refundable tax credit for wages paid to employees during periods of significant revenue decline or full or partial shutdowns due to the pandemic.

Completing Form 941-X may seem overwhelming at first, but with a clear understanding of the process and the necessary information, you can easily navigate through it and claim the Employee Retention Credit appropriately.

In this guide, we will walk you through each step of completing Form 941-X for the Employee Retention Credit. We will provide detailed instructions and explanations to ensure you have a solid understanding of the process.

It is important to note that while we strive to provide accurate and up-to-date information, tax laws and regulations can change. Therefore, it is always recommended to consult with a tax professional or the IRS for the most current guidelines and instructions specific to your situation.

Now, let’s dive into the process of completing Form 941-X for the Employee Retention Credit and help you maximize your tax savings.

What is Form 941-X?

Form 941-X, also known as the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, is a form used by employers to correct errors and make adjustments to their previously filed Form 941, which is the Employer’s Quarterly Federal Tax Return.

Form 941 is typically filed on a quarterly basis by employers to report the wages paid to employees, along with the amount of federal income tax withheld, Social Security tax, Medicare tax, and any other applicable taxes. However, if there are any errors or adjustments that need to be made to the original Form 941, employers can use Form 941-X to rectify those mistakes.

One of the important reasons employers may need to use Form 941-X is to claim or adjust the Employee Retention Credit (ERC). The ERC is a refundable tax credit available to eligible employers who experienced a significant decline in revenue or were subject to full or partial shutdowns due to the COVID-19 pandemic. Form 941-X allows employers to claim the ERC retroactively if they were previously unaware of its availability or did not initially claim it on their original Form 941.

It’s important to note that Form 941-X can only be used to correct errors or make adjustments for quarters in the current calendar year and the prior calendar year. Any corrections or adjustments for previous years must be made using Form 941-X for the corresponding year.

When completing Form 941-X, employers need to provide detailed explanations for each correction or adjustment being made. This includes identifying the specific line numbers from the original Form 941 that need to be revised and providing the correct amounts or information. Employers also need to provide a written explanation of the reasons for each correction or adjustment.

By properly completing Form 941-X, employers can ensure that any errors or adjustments to their previously filed Form 941 are corrected accurately and that they can claim the appropriate tax credits or refunds they are entitled to. This includes claiming the valuable Employee Retention Credit, which can provide significant financial relief to eligible employers during these challenging times.

In the next section, we will provide an overview of the Employee Retention Credit and the eligibility criteria for claiming this tax credit.

Overview of the Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) is a valuable tax credit that was introduced as part of the COVID-19 relief measures included in the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020. It was later extended and expanded under the Consolidated Appropriations Act in 2021 and the American Rescue Plan Act in 2021.

The ERC is designed to provide financial support to eligible employers who have been significantly affected by the COVID-19 pandemic. It is a refundable tax credit, which means that if the amount of the credit exceeds the employer’s tax liability, the excess can be refunded to the employer.

The ERC is available to employers who meet specific criteria. Initially, the credit was only available to employers who experienced a full or partial suspension of their operations due to a government order or a significant decline in gross receipts. However, with subsequent legislative changes, the credit became available to a broader range of employers.

Under the current ERC guidelines, eligible employers can claim a credit for qualified wages paid to their employees. The credit is equal to a percentage of the qualified wages, up to a maximum amount per employee per calendar quarter.

Qualified wages are wages paid to employees during periods of significant operational disruptions due to government orders or a significant decline in gross receipts. The specific criteria for determining qualified wages depend on the time period in which the qualifying conditions are met.

For 2020, the ERC is calculated as 50% of qualified wages, up to a maximum of $10,000 per employee for the entire year. This means that the maximum credit per employee for 2020 is $5,000.

For 2021, the ERC was expanded and increased. Eligible employers can now claim a credit of 70% of qualified wages, up to a maximum of $10,000 per employee per calendar quarter. This means that the maximum credit per employee for each quarter in 2021 is $7,000.

The ERC is applied against the employer’s share of Social Security taxes. If the amount of the credit exceeds the employer’s share of Social Security taxes, the excess can be refundable, subject to certain limitations.

It’s important to note that employers cannot claim the ERC for the same wages used to calculate other COVID-19 relief measures, such as the Paycheck Protection Program (PPP) loan forgiveness or the Families First Coronavirus Response Act (FFCRA) payroll tax credits.

In the next section, we will discuss the eligibility criteria for claiming the Employee Retention Credit.

Eligibility for the Employee Retention Credit

To claim the Employee Retention Credit (ERC), employers must meet specific eligibility criteria outlined by the Internal Revenue Service (IRS). These criteria vary depending on the time period in which the qualifying conditions are met.

For the eligibility period in 2020, employers must fall into one of two categories:

- Full or Partial Suspension: The employer’s operations were fully or partially suspended by a government order due to the COVID-19 pandemic.

- Significant Decline in Gross Receipts: The employer experienced a significant decline in gross receipts for at least one calendar quarter compared to the same quarter in the previous year.

For the eligibility period in 2021, employers must meet the following criteria:

- Full or Partial Suspension: The employer’s operations were fully or partially suspended by a government order due to the COVID-19 pandemic. This includes orders related to a governmental shutdown, curfew, capacity limitations, or other restrictions that directly impacted the employer’s ability to conduct business.

- Significant Decline in Gross Receipts: The employer must have experienced a significant decline in gross receipts for a calendar quarter in 2021. A significant decline is defined as a 20% or more decrease in gross receipts compared to the same quarter in 2019.

It’s important to note that employers who receive a Paycheck Protection Program (PPP) loan can still be eligible for the ERC. However, the same wages cannot be used to qualify for both the PPP loan forgiveness and the ERC. Additionally, employers who received the Restaurant Revitalization Fund (RRF) or the Shuttered Venue Operators Grant (SVOG) cannot claim the ERC for wages paid with these funds.

The ERC is available to all types of employers, including for-profit businesses, tax-exempt organizations, and government entities. However, the specific eligibility criteria and calculations may differ for each entity type.

Employers should carefully review the guidelines and instructions provided by the IRS to determine their eligibility and calculate the amount of the credit they can claim. It is recommended to seek guidance from a tax professional to fully understand the eligibility requirements specific to their situation.

In the upcoming sections, we will outline the step-by-step process to complete Form 941-X and claim the Employee Retention Credit.

Step 1: Gathering the Necessary Information

Before starting the process of completing Form 941-X for the Employee Retention Credit (ERC), it’s essential to gather all the necessary information and documentation to ensure accuracy and efficiency.

Here are some key pieces of information you will need:

- Payroll Records: Gather your payroll records for the quarters in which you are claiming the ERC. This includes information on employee wages, hours worked, and any applicable tax withholdings.

- Employee Information: Ensure you have the correct and updated information for all employees, including their names, Social Security numbers, and employment dates.

- Employer Identification Number (EIN): Your EIN is a unique identifier assigned to your business or organization. You will need this number to correctly identify your business on Form 941-X.

- Original Form 941: Have a copy of the original Form 941 that needs correction or adjustment. This will serve as a reference for identifying the errors and determining the necessary changes to be made.

- Quarterly Tax Returns: Gather any other quarterly tax returns or forms related to payroll and employment taxes that were previously filed. These documents may be helpful in identifying any discrepancies or errors that need to be corrected.

- Employee Retention Credit Documentation: Collect supporting documentation that demonstrates your eligibility for the ERC. This may include financial records, government orders impacting your operations, and any other relevant information specified in the IRS guidelines.

- Guidance and Instructions: Keep a copy of the IRS instructions for Form 941-X and any other relevant guidance specific to the Employee Retention Credit. These resources will provide you with detailed instructions on how to complete the form accurately and claim the appropriate credit amount.

- Consultation with a Tax Professional: Consider seeking guidance from a tax professional who is well-versed in tax laws and regulations. They can provide valuable insights and assistance in navigating the complexities of Form 941-X and ensure compliance with all applicable requirements.

Gathering all the necessary information and documentation ahead of time will streamline the process of completing Form 941-X. It will help you avoid delays, errors, and missing information when claiming the Employee Retention Credit and seeking the maximum tax benefits for your business.

Once you have gathered the required information, you can proceed to the next step: completing Part 1 of Form 941-X. We will provide detailed instructions for each part of the form in the following sections.

Step 2: Completing Part 1 of Form 941-X

Part 1 of Form 941-X focuses on providing basic information about your business, including your Employer Identification Number (EIN), business name, address, and the tax period for which you are making the correction or adjustment.

Here’s a breakdown of the key elements to complete in Part 1:

- Line 1: Enter your Employer Identification Number (EIN) in the designated box. Make sure to double-check the accuracy of the EIN to avoid any processing issues. If you don’t have an EIN, you will need to obtain one before completing Form 941-X.

- Line 2: State your business or organization’s legal name as it appears on your official tax documents. If your business operates under a trade name or “doing business as” (DBA), you can specify that as well.

- Line 3: Provide your business address, including street, city, state, and ZIP code. If your address has changed since the original filing of Form 941, make sure to enter the updated address accordingly.

- Line 4: Indicate the filing frequency for Form 941, which is typically quarterly. If you filed your original Form 941 on a different filing schedule, indicate that here.

- Line 5: Enter the tax period for which you are making the correction or adjustment on Form 941-X. Specify the quarter and year accurately to ensure proper alignment with the original Form 941.

- Line 6: If you operated under a different name or address during the period covered by the original Form 941, provide the previous name or address here.

- Line 7: Specify the tax adjustments you are making. This could include adjustments related to the Employee Retention Credit, tax credits, tax withholdings, and other corrections.

- Line 8: Indicate the reason for filing Form 941-X. Choose the appropriate reason code that aligns with the corrections or adjustments being made. Refer to the instructions provided by the IRS to determine the correct reason code.

Make sure to review all the information provided in Part 1 for accuracy and completeness. Any errors or omissions could potentially delay the processing of your Form 941-X. Once you have reviewed and verified the information, you can proceed to the next steps to complete the remaining parts of Form 941-X.

In the next section, we will discuss Part 2 of Form 941-X, which focuses on the detailed changes or corrections that need to be made to the original Form 941.

Step 3: Completing Part 2 of Form 941-X

Part 2 of Form 941-X is where you provide detailed information about the specific changes or corrections you are making to the original Form 941. This section is essential for accurately documenting the adjustments and ensuring the proper calculation of the Employee Retention Credit (ERC).

Here’s a breakdown of the key elements to complete in Part 2:

- Column 1: This column is used to report the original amounts that were reported on the original Form 941. Refer to your original Form 941 and enter the appropriate amounts for the specific lines being adjusted.

- Column 2: In this column, you will enter the changes or corrections being made to the original amounts reported in Column 1. Ensure that the changes align with the adjustments you are claiming for the Employee Retention Credit.

- Column 3: This column calculates the revised amounts by subtracting the amounts in Column 2 from the amounts in Column 1. The revised amounts reflect the corrections or adjustments being made.

When completing Part 2, it’s crucial to accurately identify the specific lines and amounts that need to be corrected. This includes any wages, tax withholdings, or other relevant figures that impact the calculation of the ERC.

If you are correcting multiple lines or making complex adjustments, you might need to provide additional explanations in Part 4 of Form 941-X to provide further clarity for the IRS.

Once you have completed Part 2, review the information provided to ensure accuracy and consistency. Double-check the calculations to make sure the revised amounts in Column 3 are correctly calculated based on the changes in Column 2.

In the next section, we will discuss Part 3 of Form 941-X, which focuses on calculating the Employee Retention Credit and determining any overpayment or underpayment amounts.

Step 4: Completing Part 3 of Form 941-X

Part 3 of Form 941-X is where you calculate the Employee Retention Credit (ERC) and determine any overpayment or underpayment amounts resulting from the adjustments made in Part 2. This section of the form is crucial for accurately determining the amount of credit you are eligible to claim or any additional tax liabilities that may arise.

Here’s a breakdown of the key elements to complete in Part 3:

- Line 10: Enter the revised total tax liability amount for the quarter. This includes federal income tax withholding, Social Security tax, and Medicare tax.

- Line 11: Calculate the tentative total credit amount by multiplying the total qualified wages by the applicable credit percentage for the specific quarter. The credit percentage can vary depending on the eligibility period and legislative changes.

- Line 12: Enter any advance payments of the ERC that were previously received or claimed for the quarter. This includes any payments received through Form 7200 or any other means.

- Line 13: Calculate the allowable credit by subtracting Line 12 from Line 11. This represents the actual amount of ERC that you are eligible to claim for the quarter.

- Line 14: Enter the total tax liability amount for the quarter as indicated on Line 10.

- Line 15: Determine if you have an overpayment or underpayment by comparing the allowable credit on Line 13 to the total tax liability on Line 14. If Line 13 is greater, you have an overpayment. If Line 13 is less, you have an underpayment.

- Line 16: Enter the overpayment amount if there is one. This represents the excess credit that can be refunded to you.

- Line 17: Enter the underpayment amount if there is one. This represents any additional tax liability that needs to be paid.

- Line 18: Calculate the net amount by subtracting the underpayment on Line 17 from the overpayment on Line 16. This represents the overall impact of the adjustments on your tax liability.

When completing Part 3, it’s crucial to accurately calculate the ERC based on the qualified wages and applicable credit percentages. Take into consideration any legislative changes or eligibility criteria specific to the period in which the adjustments are being made.

Review all the calculations and amounts entered in Part 3 to ensure accuracy and consistency. Double-check the figures to ensure the proper calculation of the ERC, any overpayments, and any underpayments.

Completing Part 3 will provide you with a clear understanding of the overall impact of the adjustments on your tax liability and help you determine if you are entitled to a refund or if there are additional tax payments required.

In the next section, we will discuss Part 4 of Form 941-X, where you can provide additional explanations and details regarding the corrections or adjustments made.

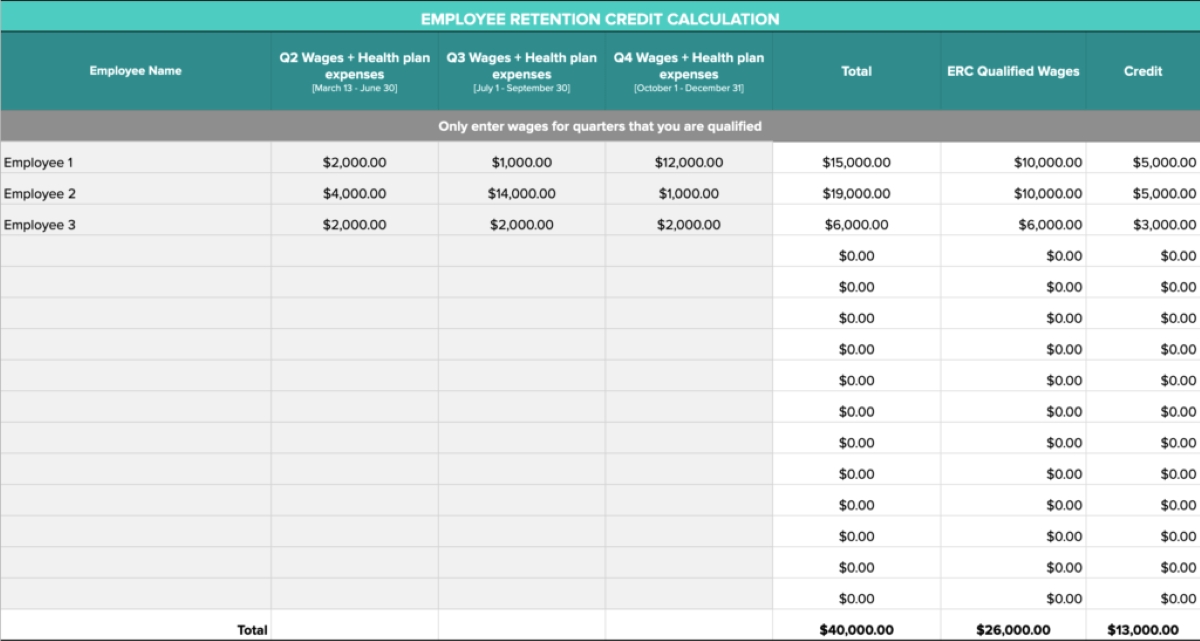

Step 5: Calculating the Employee Retention Credit

Calculating the Employee Retention Credit (ERC) is a crucial step in completing Form 941-X. This credit provides financial relief to eligible employers who have experienced significant disruptions due to the COVID-19 pandemic. The ERC is calculated based on qualified wages paid to employees during the specified eligibility periods.

To calculate the ERC, follow these steps:

- Determine the Eligibility Period: Identify the specific eligibility period for which you are claiming the credit. This could be a quarter in 2020 or any eligible quarter in 2021.

- Calculate Qualified Wages: Determine the total wages paid to employees during the eligibility period. Be sure to consider any wage limitations set by the ERC guidelines.

- Apply the Applicable Percentage: Depending on the eligibility period, apply the corresponding credit percentage to the qualified wages. For example, in 2020, the credit rate is 50% of qualified wages, while in 2021, it increased to 70%.

- Consider the Wage Limitations: Be aware of the wage limitations that may apply depending on the number of employees and the average annual gross receipts of your business.

- Calculate the Maximum Credit Amount: Multiply the qualified wages by the applicable credit rate to determine the maximum amount you can claim for the ERC for the specific eligibility period.

- Accounting for Other Relief Programs: Ensure that the same wages used to calculate the ERC are not being double-counted for other relief programs like the Paycheck Protection Program (PPP) loan forgiveness or the Families First Coronavirus Response Act (FFCRA) payroll tax credits.

It’s essential to review the guidelines and instructions provided by the IRS to determine the specific calculations and requirements for the ERC based on your business’s unique circumstances. Additionally, consulting with a tax professional can provide further guidance to ensure accurate calculations and maximize the credit amount you can claim.

By accurately calculating the ERC, you can determine the amount to be claimed on your Form 941-X and provide proper documentation to support your credit calculation. This will help ensure compliance with applicable regulations and maximize the financial benefits for your business.

In the next section, we will discuss completing Part 4 of Form 941-X, where you can provide additional explanations regarding the corrections or adjustments made.

Step 6: Completing Part 4 of Form 941-X

Part 4 of Form 941-X provides the opportunity to provide additional explanations or details regarding the corrections or adjustments made on Form 941. This section allows you to provide supporting documentation, clarify any complex adjustments, or provide context for the changes being made.

Here’s a breakdown of the key elements to complete in Part 4:

- Explanation of Adjustments: Use this space to provide a clear and concise explanation of the corrections or adjustments being made on Form 941-X. Explain the specific reasons for the changes and provide any necessary supporting documentation.

- Additional Support Attachments: If you have any additional documentation or evidence to support the adjustments made, you can attach them to Form 941-X. Ensure that any attachments are organized and clearly labeled to facilitate review by the IRS.

- Statement of Consent: If you are filing Form 941-X on behalf of another person or entity, including a corporation, partnership, or estate, you may need to provide a statement of consent. This statement allows the IRS to share information related to the form with the authorized representatives.

When completing Part 4, it’s important to provide sufficient detail and clarity about the corrections or adjustments being made. Use plain language and avoid overly technical terms or jargon. Explain any calculations, methodologies used, or any applicable exemptions or qualifications.

If you are attaching supporting documentation, make sure to label each attachment clearly and reference them in the explanation provided. This will help the IRS understand the context and legitimacy of the adjustments being made.

Ensure that all explanations and attachments are accurate, complete, and relevant to the adjustments made on Form 941-X. Double-check all the information provided in Part 4 to minimize the chances of any discrepancies or misunderstandings during the review process.

In the final section, we will discuss the steps for filing and submitting Form 941-X to the appropriate IRS location.

Step 7: Filing and Submitting Form 941-X

Once you have completed all the necessary sections of Form 941-X, it’s time to file and submit the form to the appropriate IRS location. Filing and submitting Form 941-X correctly and in a timely manner is crucial to ensure that your corrections or adjustments are processed promptly by the IRS.

Follow these guidelines to file and submit Form 941-X:

- Review and Verify: Before submitting Form 941-X, review all the information provided to ensure accuracy and completeness. Double-check the calculations, supporting documentation, and any attachments to minimize any potential errors or omitted details.

- Make Copies: Make copies of the completed Form 941-X, along with any supporting documentation or attachments, for your records. This will serve as your reference in case of any future inquiries, audits, or disputes.

- Mail or Electronically File: Determine the appropriate method of filing based on your business structure and filing history. Most businesses can mail Form 941-X to the address provided in the instructions. However, some employers may have the option to file electronically using the IRS e-file system.

- Include Payment if Necessary: If the adjustments made on Form 941-X result in an underpayment or additional tax liability, include the payment with the filed form. Pay attention to any specific instructions provided by the IRS regarding payment methods or deadlines.

- Keep a Record: Once submitted, keep a record of the date of filing and any confirming documentation, such as certified mail receipts or electronic delivery confirmation. This will serve as evidence of the timely filing of Form 941-X.

- Monitor Status: After submitting Form 941-X, monitor the status of your submission. You can do this by tracking the filing through the IRS online system (if applicable) or by following up via mail or phone with the appropriate IRS contact.

It’s important to note that filing and processing times may vary, so be patient during the review and processing of your Form 941-X. If you have any concerns or questions, consider reaching out to the IRS helpline or consulting with a tax professional for guidance and support.

By following the necessary steps to file and submit Form 941-X correctly, you can ensure that your correction or adjustment is properly processed, providing you with the necessary accounting and financial resolution for the Employee Retention Credit.

With the completion of Step 7, you have successfully completed the process of filing Form 941-X for the Employee Retention Credit! By carefully following the instructions and guidelines provided in this guide, you have taken a crucial step towards maximizing the tax benefits and financial support available to your business during these challenging times.

Remember to keep a copy of your filed Form 941-X, any supporting documentation, and a record of the date of filing for your records. This will be essential for future reference, potential audits, or any inquiries from the IRS.

Should you have any further questions or need additional guidance, consult with a tax professional who can provide personalized advice tailored to your specific circumstances and ensure compliance with current tax laws and regulations.

Best of luck with your Form 941-X filing and the Employee Retention Credit!

Common Mistakes to Avoid

Filing Form 941-X for the Employee Retention Credit (ERC) requires careful attention to detail to ensure accurate reporting and maximize your tax benefits. Avoiding common mistakes can save you time, prevent delays, and ensure compliance with IRS regulations. Here are some common mistakes to watch out for when completing Form 941-X:

- Incorrect or Incomplete Information: Double-check all the information provided, including your employer identification number (EIN), business name, address, and tax period. Any errors or omissions can lead to processing delays or incorrect tax calculations.

- Inaccurate Calculations: Pay close attention to the calculations for the Employee Retention Credit, qualified wages, credit percentages, and any wage limitations. Errors in calculations can result in an incorrect credit amount or potential underpayment or overpayment.

- Lack of Supporting Documentation: Ensure that you have supporting documentation to substantiate your eligibility for the Employee Retention Credit. Keep detailed records of government orders, financial records, and any other relevant documentation for future reference and potential audits.

- Failure to Adequately Explain Adjustments: In Part 4 of Form 941-X, provide clear and detailed explanations of the corrections or adjustments being made. Without proper explanations, the IRS may have difficulty understanding the nature and legitimacy of the adjustments.

- Confusion with Other Relief Programs: Avoid double-dipping and ensure that the same wages used for the Employee Retention Credit are not being claimed for other relief programs such as Paycheck Protection Program (PPP) loan forgiveness or Families First Coronavirus Response Act (FFCRA) payroll tax credits.

- Ignorance of Updated Guidelines: Stay informed about changes in ERC regulations and guidelines. The eligibility criteria, credit percentages, and wage limitations have evolved over time. Ensure that you are using the most up-to-date guidance to avoid incorrect reporting or miscalculations.

- Missing Filing Deadline: Be mindful of the filing deadlines for Form 941-X. Late filings can result in penalties and interest. Review the IRS instructions to determine the specific deadline that applies to your situation.

Avoiding these common mistakes will help you navigate the Form 941-X filing process more smoothly and ensure the accurate calculation and reporting of the Employee Retention Credit. It’s advisable to consult with a tax professional or utilize tax software tailored for payroll taxes to minimize the chances of errors and omissions.

By remaining diligent and attentive to detail, you can increase your chances of a successful filing, maximize your tax benefits, and effectively utilize the Employee Retention Credit to support your business during these challenging times.

Resources and Additional Information

Filing Form 941-X for the Employee Retention Credit (ERC) can be complex, and it’s essential to stay informed of current guidelines and regulations. Here are some resources and additional information that can assist you in understanding and navigating the process:

- IRS Website: The official website of the Internal Revenue Service (IRS) is a valuable resource for accessing forms, instructions, publications, and updates related to the Employee Retention Credit. Visit irs.gov for the latest information.

- IRS Form 941-X Instructions: The instructions provided by the IRS for Form 941-X offer detailed guidance on completing the form, eligibility criteria, calculating the ERC, and other important considerations. Read the instructions thoroughly to ensure accurate filing.

- Tax Professional: Consulting with a tax professional who specializes in payroll taxes and small business accounting can provide personalized guidance tailored to your specific circumstances. They can provide advice, help maximize your tax benefits, and ensure compliance with tax laws and regulations.

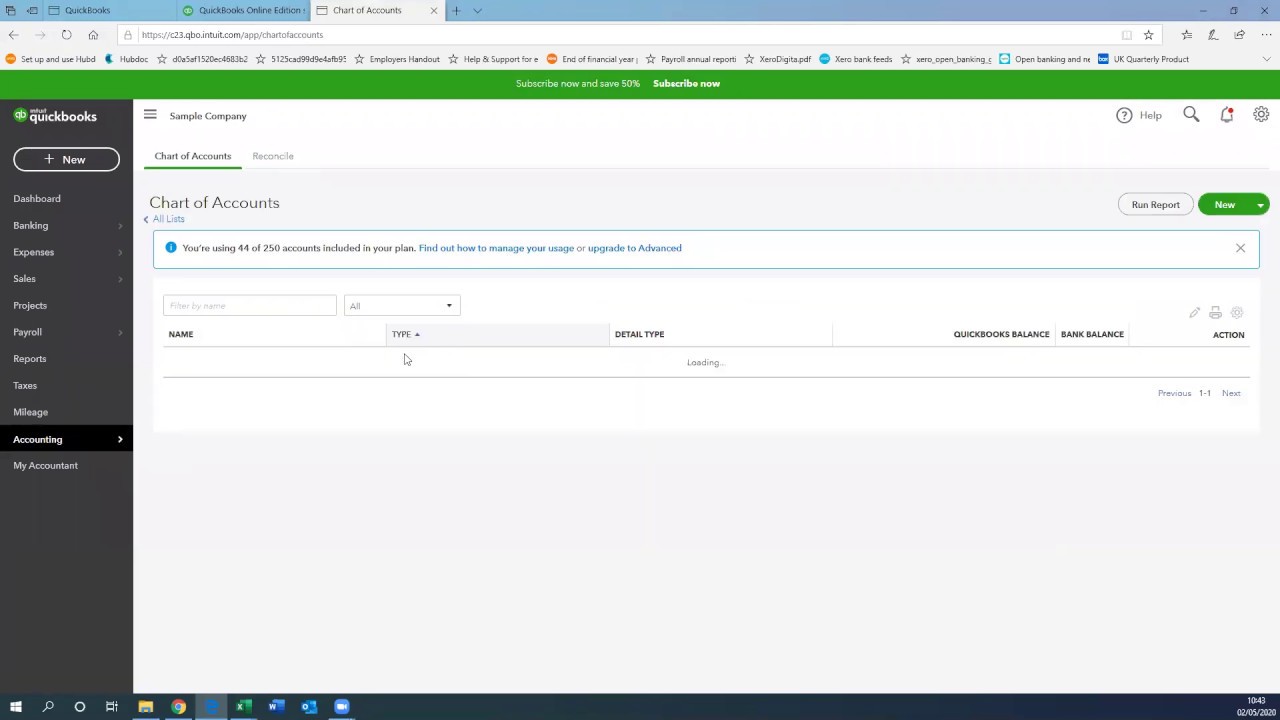

- Online Tax Software: Consider using online tax software specifically designed for payroll taxes. These tools can guide you through the process, help with calculations, and provide error checking to minimize mistakes. Popular options include TurboTax, H&R Block, and TaxSlayer.

- IRS Helpline: If you have specific questions or need clarification on ERC eligibility, calculations, or form filing, contact the IRS helpline at 1-800-829-4933. Note that wait times may be longer during peak periods.

- Local Small Business Associations: Reach out to your local small business associations or chambers of commerce for resources and guidance. These organizations often provide workshops, webinars, and other educational materials to help business owners navigate tax-related issues.

- IRS News and Updates: Stay informed about any updates or changes to the ERC through IRS news releases, newsletters, and tax alerts. This ensures that you are aware of any new guidance or legislative changes that may impact your eligibility or claiming process.

Remember, it’s crucial to stay up-to-date with the latest information provided by the IRS and consult reputable sources. The resources mentioned above can help you navigate through the complexities of Form 941-X and maximize the benefits of the Employee Retention Credit.

By utilizing these resources and seeking guidance when needed, you can ensure the accurate completion of Form 941-X, claim the appropriate tax credits, and effectively utilize the available support for your business in these challenging times.

Conclusion

Completing Form 941-X for the Employee Retention Credit (ERC) may seem daunting at first, but with the right understanding and attention to detail, you can successfully navigate through the process. This guide has provided you with a comprehensive overview of the steps involved in completing Form 941-X and claiming the ERC.

Remember to gather all the necessary information and documentation, review the eligibility criteria, and accurately calculate the ERC based on the qualified wages and applicable credit percentages. Avoid common mistakes, such as providing incomplete information or inaccurate calculations, and include thorough explanations of the adjustments being made on Form 941-X.

Utilize the resources and additional information provided, such as the IRS website and instructions, consultation with a tax professional, and online tax software, to ensure compliance with regulations and maximize your tax benefits.

Filing and submitting Form 941-X in a timely manner, along with any required payments, is crucial to facilitate the processing of your corrections or adjustments. Keep copies of all filed documents and supporting documentation for your records.

By properly completing Form 941-X and claiming the Employee Retention Credit, you can potentially receive valuable financial support for your business during these challenging times. The ERC is designed to help eligible employers recover some of the costs incurred due to the COVID-19 pandemic and maintain their workforce.

However, it’s important to stay informed about changes in regulations and guidelines as they may continue to evolve. Regularly check the IRS website, stay in touch with reputable sources, and consult with a tax professional to ensure you are aware of the latest updates regarding the ERC and any other relevant tax provisions.

Remember, the information provided in this guide is meant to serve as a general overview. It is crucial to seek professional advice tailored to your specific circumstances to ensure accurate compliance with tax laws and regulations.

By successfully completing Form 941-X for the Employee Retention Credit, you are taking a proactive step in maximizing your tax benefits and securing financial relief for your business. We hope this guide has provided valuable insights and guidance to support you throughout the process.

Thank you for your commitment to understanding and navigating the complexities of the Employee Retention Credit. We wish you success in claiming the credit and continued resilience in these challenging times.