Finance

How To Find Total Liabilities On Balance Sheet

Published: December 27, 2023

Learn how to find total liabilities on a balance sheet and gain a deeper understanding of finance. Take control of your financial analysis today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Balance Sheet

- Understanding Liabilities on the Balance Sheet

- Different Types of Liabilities

- Examples of Current Liabilities

- Examples of Long-term Liabilities

- Finding Total Liabilities on the Balance Sheet

- Steps to Calculate Total Liabilities

- Importance of Analyzing Total Liabilities

- Key Takeaways

- Conclusion

Introduction

Welcome to our comprehensive guide on how to find total liabilities on the balance sheet. Understanding a company’s liabilities is essential for assessing its financial health and management’s ability to meet long-term obligations. The balance sheet is a crucial financial statement that provides insight into a company’s assets, liabilities, and shareholder equity. In this article, we will delve into the intricacies of liabilities on the balance sheet and guide you through the steps to calculate the total liabilities.

Liabilities represent the obligations a company owes to external parties or individuals. These can include debts, loans, payables, and other financial obligations that need to be fulfilled within a specific time frame. Analyzing the total liabilities provides investors, creditors, and other stakeholders with valuable information about a company’s ability to cover its financial obligations.

By understanding how to find total liabilities on the balance sheet, you can gain insights into a company’s financial structure, leverage, and overall financial health. This information is crucial when making investment decisions, assessing the risk associated with a particular company, or evaluating the financial stability of potential business partners.

Throughout this guide, we will explore different types of liabilities, including current liabilities and long-term liabilities, and provide examples of each. By the end of this article, you will have a clear understanding of how to locate and calculate the total liabilities on a balance sheet, as well as the significance of analyzing this crucial financial metric.

So, let’s dive in and explore the fascinating world of total liabilities on the balance sheet, and discover how it can help us make informed financial decisions.

Overview of Balance Sheet

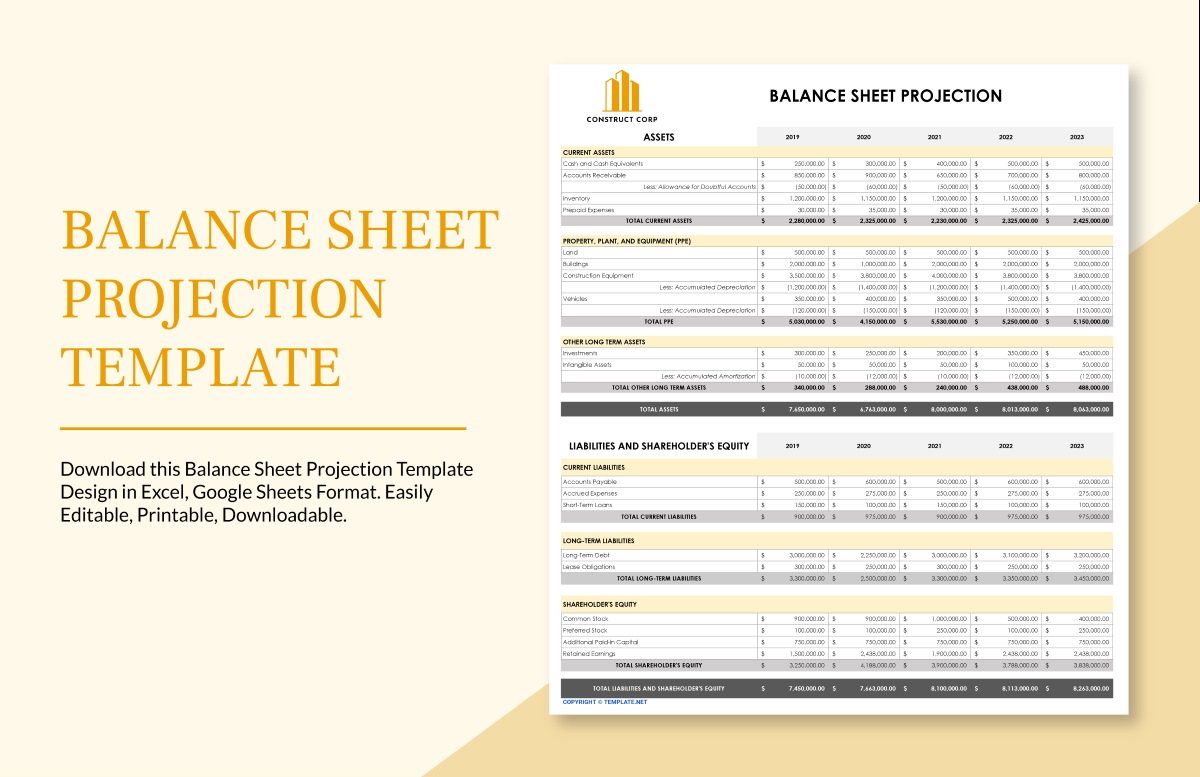

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is one of the three key financial statements, along with the income statement and cash flow statement. The balance sheet follows the fundamental accounting equation, which states that assets must equal liabilities plus shareholder equity.

The balance sheet is divided into three main sections: assets, liabilities, and shareholder equity. Assets represent everything that a company owns, including cash, investments, inventory, property, and equipment. Liabilities, as mentioned earlier, represent the company’s financial obligations. Shareholder equity represents the residual value of the company’s assets after deducting liabilities.

The balance sheet provides valuable information about a company’s financial health, liquidity, solvency, and leverage. Investors and creditors use it to gain insights into a company’s ability to meet its financial obligations and assess its overall financial stability.

It is important to note that the balance sheet is prepared based on the accounting principles and guidelines. It presents financial information in a systematic and standardized manner, allowing for easy comparison between companies and periods.

Now that we have a general understanding of the balance sheet, let’s focus specifically on the liabilities section and explore its various components.

Understanding Liabilities on the Balance Sheet

Liabilities on the balance sheet are financial obligations that a company owes to external parties or individuals. These obligations can be in the form of debts, loans, payables, or other financial commitments. Liabilities are categorized into two main types: current liabilities and long-term liabilities.

Current Liabilities: Current liabilities are debt obligations that are expected to be settled within one year or the operating cycle of the business, whichever is longer. They are typically short-term in nature and include items such as accounts payable, short-term loans, accrued expenses, and taxes payable. Current liabilities are important indicators of a company’s short-term financial health and its ability to meet its immediate financial obligations.

Long-term Liabilities: Long-term liabilities, also known as non-current liabilities, are obligations that extend beyond one year or the normal operating cycle of the business. They include items such as long-term loans, bonds payable, deferred tax liabilities, and lease obligations. Long-term liabilities provide insights into a company’s long-term financial stability and its ability to manage its debt load over an extended period.

Understanding the various types of liabilities is essential for evaluating a company’s financial position and assessing its ability to meet its financial obligations. By analyzing the balance sheet, investors and creditors can assess the level of risk associated with a company’s liabilities and make informed decisions.

Next, let’s take a closer look at some examples of current liabilities and long-term liabilities to further illustrate their significance on the balance sheet.

Different Types of Liabilities

Liabilities on the balance sheet can vary in nature and duration. It is important to differentiate between the different types of liabilities to gain a comprehensive understanding of a company’s financial obligations. Let’s explore some common types of liabilities:

- Accounts Payable: These are short-term obligations that arise from purchasing goods or services on credit. Accounts payable represent the amount a company owes to its suppliers and vendors and are typically settled within a short period.

- Short-term Loans: These are loans that are due for repayment within a year or the operating cycle of the business, whichever is longer. Short-term loans are often used to finance day-to-day operations or cover temporary cash flow gaps.

- Accrued Expenses: Accrued expenses are expenses that have been incurred but not yet paid. They include items such as salaries payable, interest payable, and taxes payable. Accrued expenses are recorded as liabilities and are usually settled in the near future.

- Taxes Payable: Taxes payable represent the amount of taxes owed to government authorities, such as income taxes or sales taxes. These liabilities arise from taxable income generated by the company and are settled according to the respective tax regulations.

- Long-term Loans: Long-term loans are debt obligations that have a maturity period beyond one year. These loans often have fixed repayment schedules and include items such as mortgages, corporate bonds, and long-term bank loans.

- Lease Obligations: Lease obligations arise from leasing assets, such as property, equipment, or vehicles, for a specified period. These liabilities include lease payments that need to be made throughout the lease term.

These are just a few examples of the diverse range of liabilities that can appear on a company’s balance sheet. It is important to note that each company’s balance sheet may include different types of liabilities, depending on its industry, operations, and financial structure.

Now that we have explored different types of liabilities, let’s move on to the next section and discuss how to calculate the total liabilities on the balance sheet.

Examples of Current Liabilities

Current liabilities are short-term obligations that are expected to be settled within one year or the operating cycle of a business. They provide insight into a company’s immediate financial obligations and its ability to meet its short-term liabilities. Let’s explore some common examples of current liabilities:

- Accounts Payable: This represents the amount a company owes to its suppliers and vendors for goods or services purchased on credit. It is a common current liability found on the balance sheet.

- Short-term Loans: These are loans that need to be repaid within a short time frame, usually within a year. They are often obtained to meet working capital needs or fund temporary cash flow gaps.

- Accrued Expenses: Accrued expenses are liabilities that have been incurred but not yet paid. Examples include salaries payable, interest payable, and taxes payable. These obligations are recorded on the balance sheet and will be settled in the near future.

- Unearned Revenue: Unearned revenue refers to payments received in advance for goods or services that have not yet been delivered. It represents an obligation to provide the promised goods or services in the future.

- Income Taxes Payable: This represents taxes that a company owes to tax authorities based on taxable income. Income taxes payable are recorded as current liabilities until they are paid to the relevant tax authorities.

- Deferred Revenue: Deferred revenue is the opposite of unearned revenue. It represents advance payments received for goods or services that have not yet been provided. As the company fulfills its obligations, deferred revenue is recognized as revenue in the income statement.

These are just a few examples of current liabilities commonly found on the balance sheet. It is important to note that the specific current liabilities a company has can vary depending on its industry, operations, and financial activities.

Understanding a company’s current liabilities is crucial for evaluating its short-term financial health and liquidity. Analyzing the composition and trends of current liabilities can provide valuable insights into a company’s ability to meet its immediate financial obligations.

Now that you are familiar with examples of current liabilities, let’s proceed to the next section and explore examples of long-term liabilities.

Examples of Long-term Liabilities

Long-term liabilities are financial obligations that extend beyond one year or the normal operating cycle of a business. They provide insights into a company’s long-term financial stability and its ability to manage its debt load over an extended period. Let’s explore some common examples of long-term liabilities:

- Long-term Loans: These are loans that have a maturity period beyond one year. They often have fixed repayment schedules and include items such as mortgages, corporate bonds, and long-term bank loans.

- Bonds Payable: Bonds payable represent the debt issued by a company to raise capital. They typically have a maturity date beyond one year and are subject to interest payments to bondholders at fixed intervals.

- Lease Obligations: Lease obligations arise from leasing assets, such as property, equipment, or vehicles, for a specified period. Companies that lease assets have long-term lease obligations that need to be recorded in the balance sheet.

- Deferred Tax Liabilities: Deferred tax liabilities arise when a company’s taxable income is lower than its accounting income due to differences in tax regulations and accounting standards. These liabilities are recorded on the balance sheet and represent an obligation to pay additional taxes in the future.

- Pension Liabilities: Pension liabilities represent the future pension payments that a company is obligated to pay to its employees. These long-term obligations are recorded on the balance sheet and are often associated with defined benefit pension plans.

- Deferred Compensation: Deferred compensation refers to liabilities arising from compensation arrangements in which an employee receives part of their compensation at a later date, such as stock options, retirement benefits, or long-term incentive plans.

These are just a few examples of long-term liabilities that can be found on a company’s balance sheet. The specific long-term liabilities will vary depending on the industry, operations, and financial policies of the company.

Long-term liabilities play a significant role in evaluating a company’s financial stability and its ability to manage its long-term debt obligations. Analyzing the composition and trends of long-term liabilities can provide insights into a company’s leverage, financial risk, and capacity to meet long-term financial commitments.

Now that we have explored examples of both current and long-term liabilities, let’s proceed to the next section and discuss how to find the total liabilities on the balance sheet.

Finding Total Liabilities on the Balance Sheet

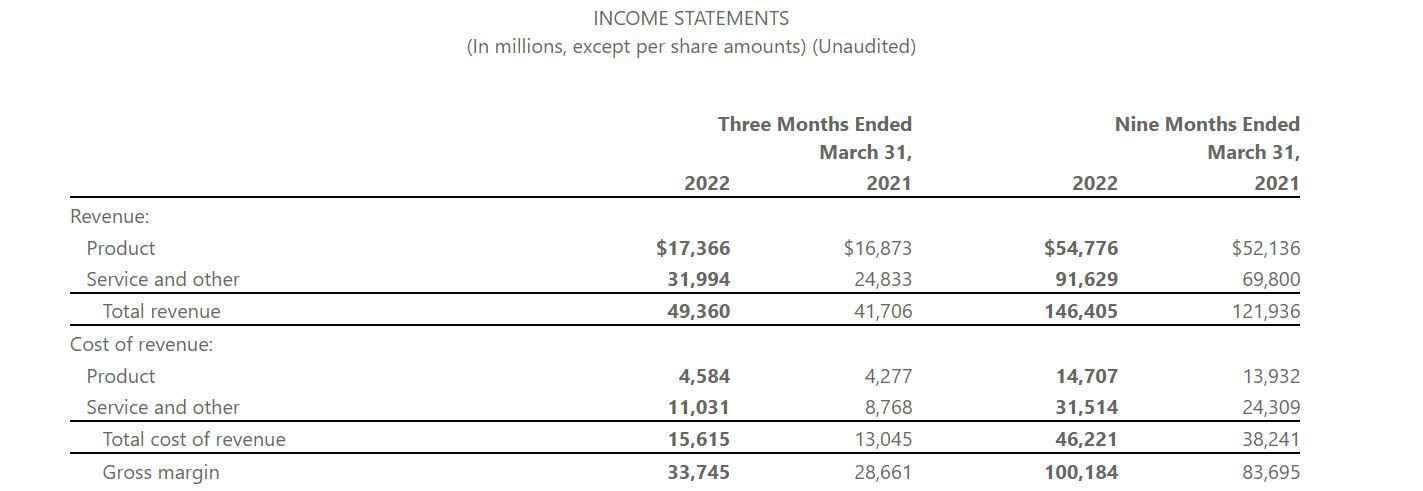

Calculating the total liabilities on the balance sheet is a crucial step in assessing a company’s financial health and understanding its overall indebtedness. To find the total liabilities, you need to locate the liabilities section on the balance sheet and sum up all the individual liabilities. Here’s how you can do it:

- Obtain a copy of the company’s balance sheet: This financial statement can typically be found in the annual report, SEC filings, or on the company’s website.

- Locate the liabilities section: On the balance sheet, the liabilities section is usually positioned below the assets section and above the shareholder equity section.

- Identify the current liabilities: Scan through the liabilities section and identify the line items that represent current liabilities, such as accounts payable, short-term loans, accrued expenses, and taxes payable.

- Sum up the current liabilities: Add up all the current liabilities to calculate the total current liabilities.

- Identify the long-term liabilities: Look for line items that represent long-term liabilities, including long-term loans, bonds payable, lease obligations, and deferred tax liabilities.

- Sum up the long-term liabilities: Add up all the long-term liabilities to calculate the total long-term liabilities.

- Calculate the total liabilities: Add the total current liabilities and the total long-term liabilities together to find the total liabilities on the balance sheet.

Once you have calculated the total liabilities, you can further analyze this figure in relation to other financial metrics to gain a better understanding of a company’s financial position. It is important to note that the total liabilities figure should be considered in conjunction with other financial information, such as assets, equity, and cash flow, to form a comprehensive assessment.

Now that we have discussed how to find the total liabilities on the balance sheet, let’s explore the importance of analyzing this financial metric.

Steps to Calculate Total Liabilities

Calculating the total liabilities on a company’s balance sheet involves a straightforward process. By following these steps, you can determine the total liabilities and gain a comprehensive understanding of a company’s financial obligations:

- Acquire the company’s balance sheet: Obtain the most recent balance sheet either from the company’s annual report, financial statements, or other reliable sources.

- Locate the liabilities section: Identify the section of the balance sheet that lists the company’s liabilities. This section is typically positioned below the assets section and above the shareholder equity section.

- Identify current liabilities: Within the liabilities section, identify line items that represent current liabilities. Examples of current liabilities include accounts payable, short-term loans, accrued expenses, and taxes payable.

- Sum up current liabilities: Add together all the individual current liabilities to calculate the total current liabilities. This figure represents the company’s short-term financial obligations.

- Identify long-term liabilities: Look for line items in the liabilities section that represent long-term obligations. Examples include long-term loans, bonds payable, lease obligations, and deferred tax liabilities.

- Sum up long-term liabilities: Add together all the individual long-term liabilities to calculate the total long-term liabilities. This figure represents the company’s long-term financial obligations.

- Calculate total liabilities: Add the total current liabilities and total long-term liabilities together to obtain the total liabilities on the balance sheet. This figure represents the company’s overall financial obligations.

Calculating the total liabilities provides essential insight into a company’s financial health, leverage, and ability to meet its financial obligations. It assists investors, creditors, and stakeholders in evaluating the company’s financial stability and assessing the level of risk associated with its liabilities.

Keep in mind that understanding the context of total liabilities is crucial. Comparing the total liabilities with other financial metrics, such as assets, equity, and cash flow, provides a more comprehensive assessment of a company’s financial position and can help uncover valuable insights into its financial health.

Now that you are familiar with the steps involved in calculating total liabilities, let’s explore the importance of analyzing this financial metric.

Importance of Analyzing Total Liabilities

Analyzing the total liabilities on a company’s balance sheet is crucial for understanding its financial health, evaluating its risk profile, and making informed investment or partnership decisions. Here are some key reasons why analyzing total liabilities is important:

Assessing Financial Stability:

By analyzing total liabilities, stakeholders can evaluate a company’s short-term and long-term financial stability. This helps in assessing its ability to meet its financial obligations on time. A higher proportion of liabilities in relation to assets or equity may indicate higher financial risk, especially if there is a significant level of short-term or high-interest debt.

Evaluating Leverage:

Total liabilities offer insights into a company’s leverage or debt levels. High levels of debt can increase a company’s financial risk, interest expenses, and potential limitations on future growth. Adequate analysis of total liabilities allows comparisons between companies in the same industry and helps identify those with more favorable leverage positions.

Understanding Debt Payment Obligations:

Analyzing total liabilities helps identify the timing and magnitude of debt payment obligations. It provides information about the maturity dates and repayment terms of long-term debt, giving stakeholders insights into the company’s ability to generate sufficient cash flow to meet these obligations.

Assessing Liquidity and Solvency:

By considering the proportion of liabilities that are due in the short term, stakeholders can evaluate a company’s liquidity and solvency. If a large portion of liabilities is due in the near future and the company lacks sufficient liquid assets or cash flow to cover these obligations, it may face challenges in meeting its short-term financial commitments.

Identifying Financial Risk:

Analyzing total liabilities helps identify potential financial risks that a company may face. Excessive levels of liabilities, especially when compared to assets or equity, may indicate a higher risk of default or bankruptcy. It is important to consider the overall financial health, cash flow, and earnings potential of the company in conjunction with total liabilities to assess its financial risk accurately.

By thoroughly analyzing total liabilities on the balance sheet, investors, creditors, and other stakeholders can make well-informed decisions regarding investment, lending, or partnership opportunities. It provides a comprehensive view of a company’s financial obligations and helps evaluate its overall financial stability and risk profile.

Now that we have explored the importance of analyzing total liabilities, let’s summarize the key takeaways from this article.

Key Takeaways

- Analyzing total liabilities on a company’s balance sheet is essential for evaluating its financial health, risk profile, and ability to meet its obligations.

- Liabilities can be categorized into current liabilities, which are short-term obligations, and long-term liabilities, which extend beyond one year.

- Examples of current liabilities include accounts payable, short-term loans, accrued expenses, and taxes payable.

- Examples of long-term liabilities include long-term loans, bonds payable, lease obligations, and deferred tax liabilities.

- To calculate total liabilities, locate the liabilities section on the balance sheet, sum up all current liabilities, sum up all long-term liabilities, and add the two figures together.

- Analyzing total liabilities helps assess a company’s financial stability, leverage, liquidity, solvency, and overall risk profile.

- In conjunction with other financial metrics, such as assets, equity, and cash flow, total liabilities provide a comprehensive understanding of a company’s financial position.

- Comparing total liabilities with industry benchmarks and historical data can give insights into a company’s financial health and performance trends.

- Understanding total liabilities is crucial for making informed investment, lending, or partnership decisions.

- It is important to consider the context and overall financial picture of a company when analyzing total liabilities, as certain industries may naturally have higher levels of liabilities.

By thoroughly analyzing the total liabilities on a company’s balance sheet, stakeholders can have a clearer understanding of the company’s financial obligations, risk exposure, and financial stability. This information is instrumental in making sound financial decisions and assessing the long-term viability of a company.

Now that you have a solid understanding of how to find total liabilities on the balance sheet and its importance, you can confidently analyze a company’s financial position and make informed financial decisions.

Remember, total liabilities are just one piece of the financial puzzle, and it is crucial to consider other financial metrics and the overall business environment when evaluating a company’s financial health.

Conclusion

Understanding and analyzing the total liabilities on a company’s balance sheet is imperative for assessing its financial health and overall risk profile. By identifying and calculating the company’s current liabilities and long-term liabilities, stakeholders can gain valuable insights into its ability to meet its financial obligations, manage its debt, and ensure long-term financial stability.

Throughout this comprehensive guide, we explored the various types of liabilities found on the balance sheet, including current liabilities and long-term liabilities. We discussed examples of each type and highlighted their significance in evaluating a company’s financial position.

We also discussed the steps involved in calculating the total liabilities, emphasizing the importance of considering both current and long-term obligations to obtain an accurate picture of a company’s overall financial obligations.

Moreover, we underscored the importance of thoroughly analyzing total liabilities as a means to assess financial stability, leverage, liquidity, and solvency. By understanding a company’s risk profile, stakeholders can make informed decisions regarding investments, partnerships, and lending opportunities.

Remember that total liabilities should be evaluated in conjunction with other financial metrics, such as assets, equity, and cash flow, to obtain a comprehensive view of a company’s financial health.

By following the steps outlined in this guide and considering the insights provided, stakeholders can confidently assess a company’s financial position, weigh the associated risks, and make sound financial decisions.

We hope this guide has provided a clear understanding of how to find total liabilities on the balance sheet and why it is essential to analyze this financial metric. Armed with this knowledge, you can navigate the financial landscape with confidence and make informed choices that align with your investment or partnership goals.