Finance

What Are Credit Default Swaps (CDS)?

Published: March 4, 2024

Learn about credit default swaps (CDS) and their role in finance. Understand how CDS work and their potential impact on the financial market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding Credit Default Swaps

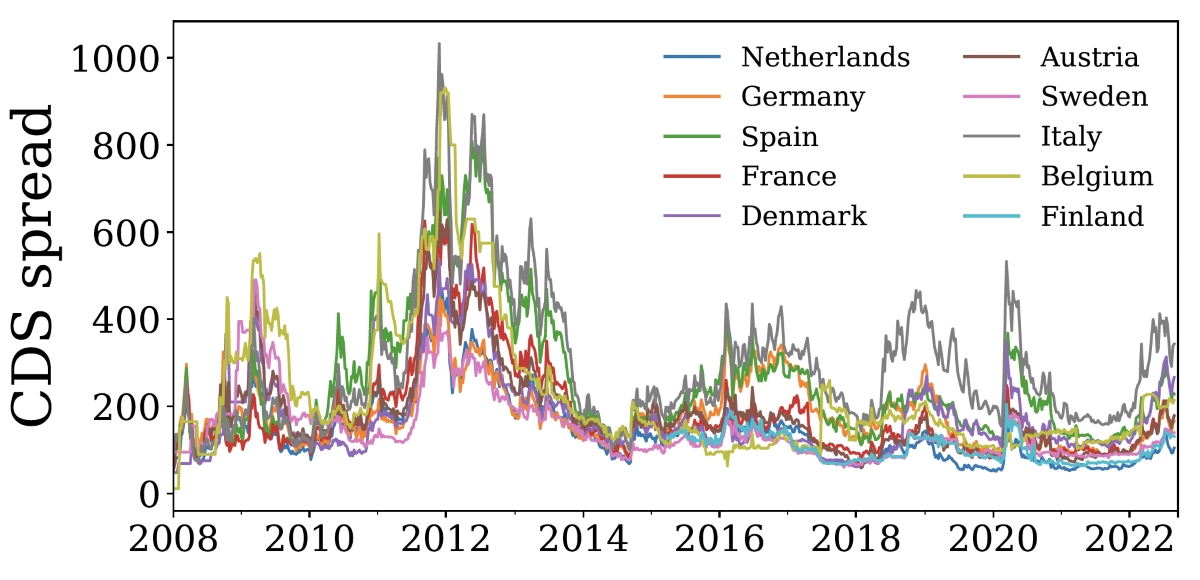

Credit default swaps (CDS) are financial derivatives that enable investors to mitigate the risk of default on bonds or loans. In essence, a credit default swap functions as insurance against the non-payment of debt. This financial instrument gained significant attention during the 2007-2008 financial crisis, as it was widely utilized and heavily criticized for its role in exacerbating the crisis.

CDS contracts are traded over-the-counter, meaning they are not transacted on formal exchanges, and their value is derived from the performance of underlying assets, such as corporate bonds or mortgage-backed securities. The concept of credit default swaps can be quite complex, but understanding their mechanics is essential for comprehending their impact on the financial markets and the broader economy.

This article aims to demystify credit default swaps by elucidating their workings, types, advantages, disadvantages, associated risks, and the regulatory framework governing them. By gaining insights into these aspects, readers can develop a nuanced understanding of credit default swaps and their implications for the financial landscape.

Understanding Credit Default Swaps

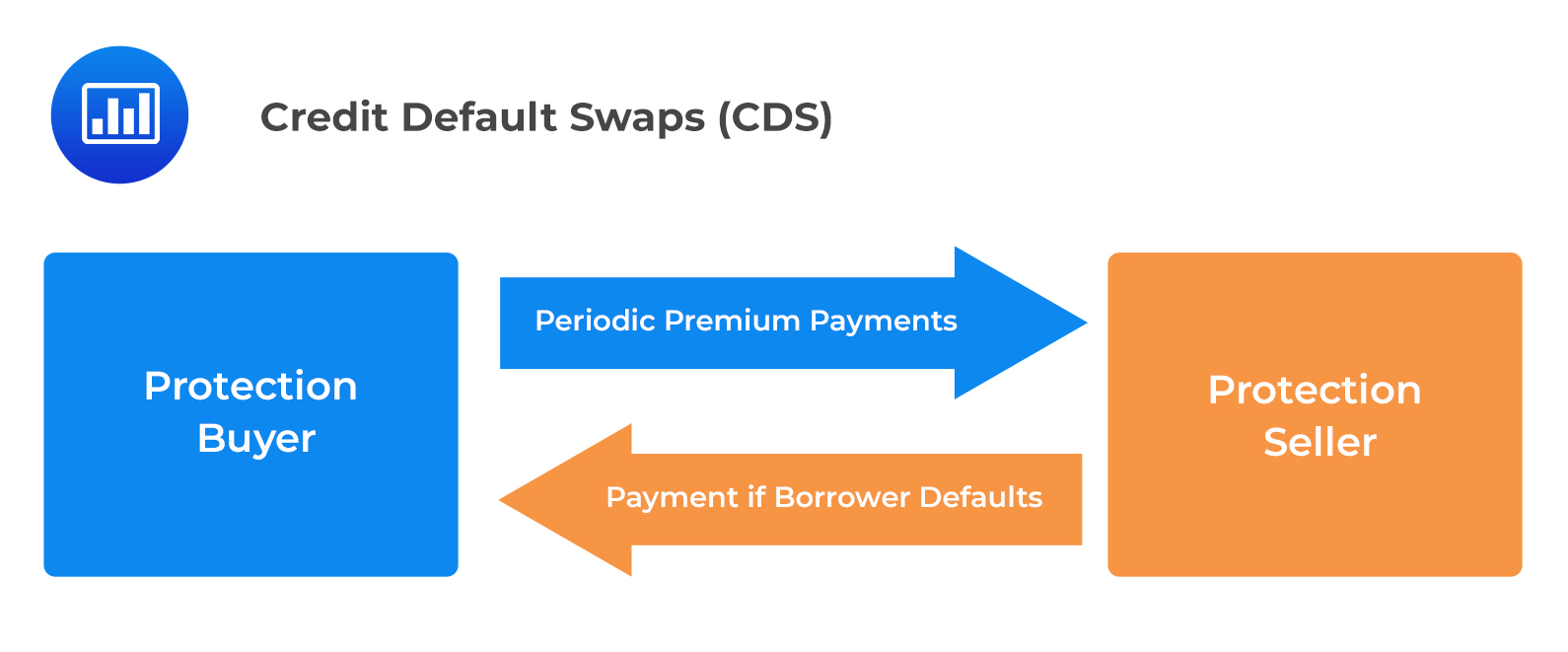

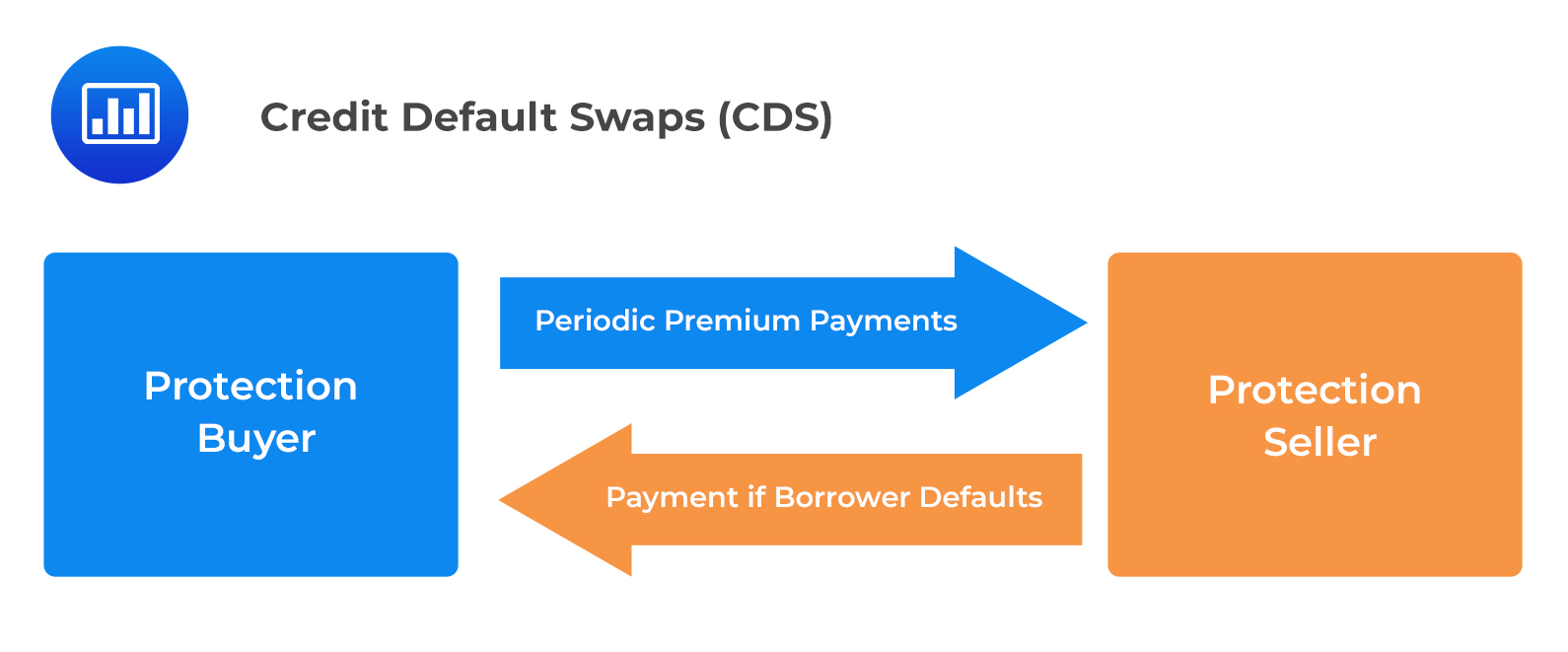

To comprehend credit default swaps (CDS), it’s crucial to grasp their fundamental nature and purpose. At its core, a credit default swap is a financial contract between two parties, where the buyer makes periodic payments to the seller in exchange for protection against potential credit defaults. In the event of a default on the underlying debt instrument, the seller compensates the buyer for the loss incurred.

One of the key distinctions of credit default swaps is that they are not limited to the original creditor of the debt. This means that entities not directly involved in a loan or bond transaction can also purchase CDS protection, thereby introducing a speculative element to these instruments. This speculative aspect, along with the absence of regulatory oversight in the early years of CDS trading, contributed to concerns about their potential for amplifying systemic risks within the financial system.

Furthermore, credit default swaps are often likened to insurance policies, as they offer a means of hedging against credit risk. However, unlike traditional insurance, CDS contracts can be bought and sold multiple times, allowing for the creation of complex chains of interconnected obligations among various market participants. This feature has been a subject of scrutiny, particularly in the context of systemic risk and the potential for contagion during times of financial distress.

By delving into the intricacies of credit default swaps, individuals can gain a deeper understanding of how these instruments function within the broader financial landscape. The subsequent sections of this article will further elucidate the mechanics, types, advantages, disadvantages, risks, and regulatory aspects of credit default swaps, offering a comprehensive overview of their impact on the financial markets and the economy as a whole.

How Credit Default Swaps Work

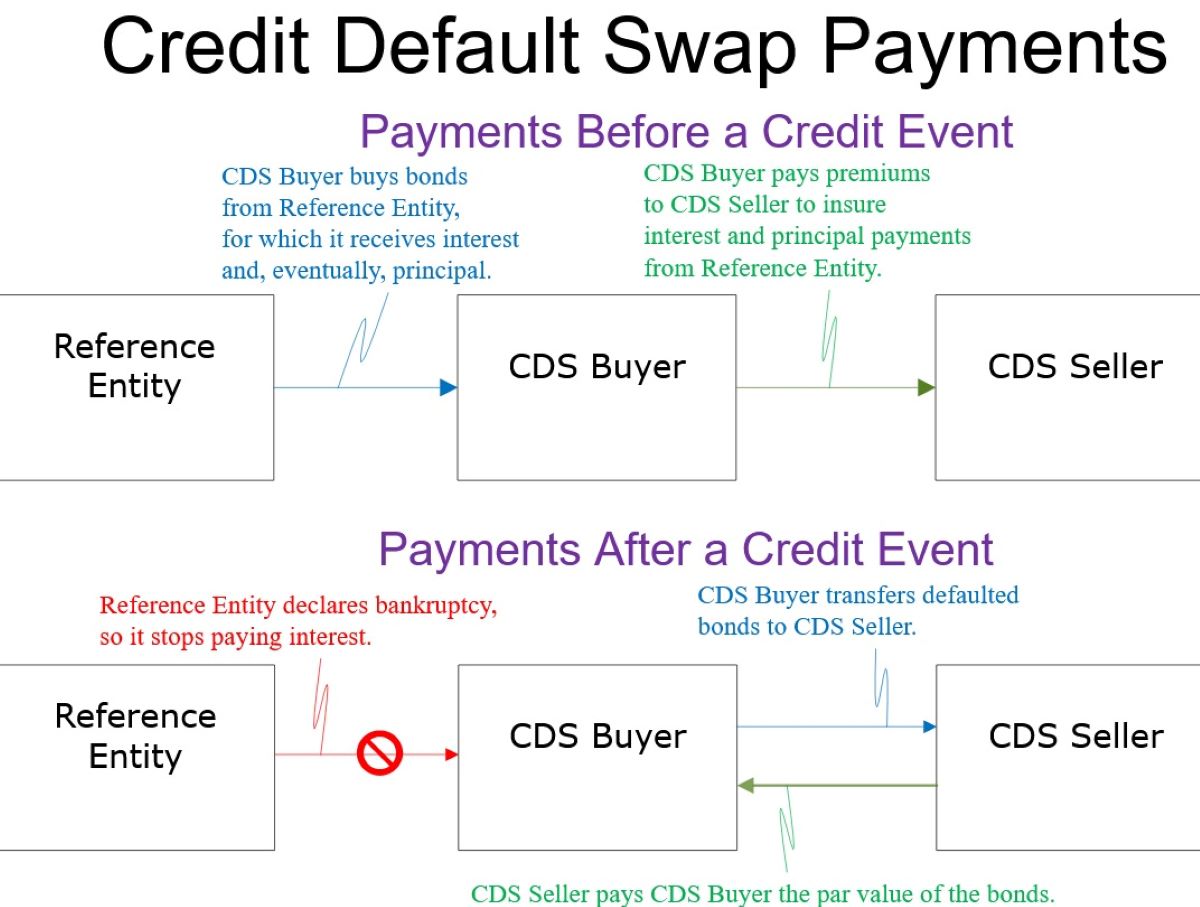

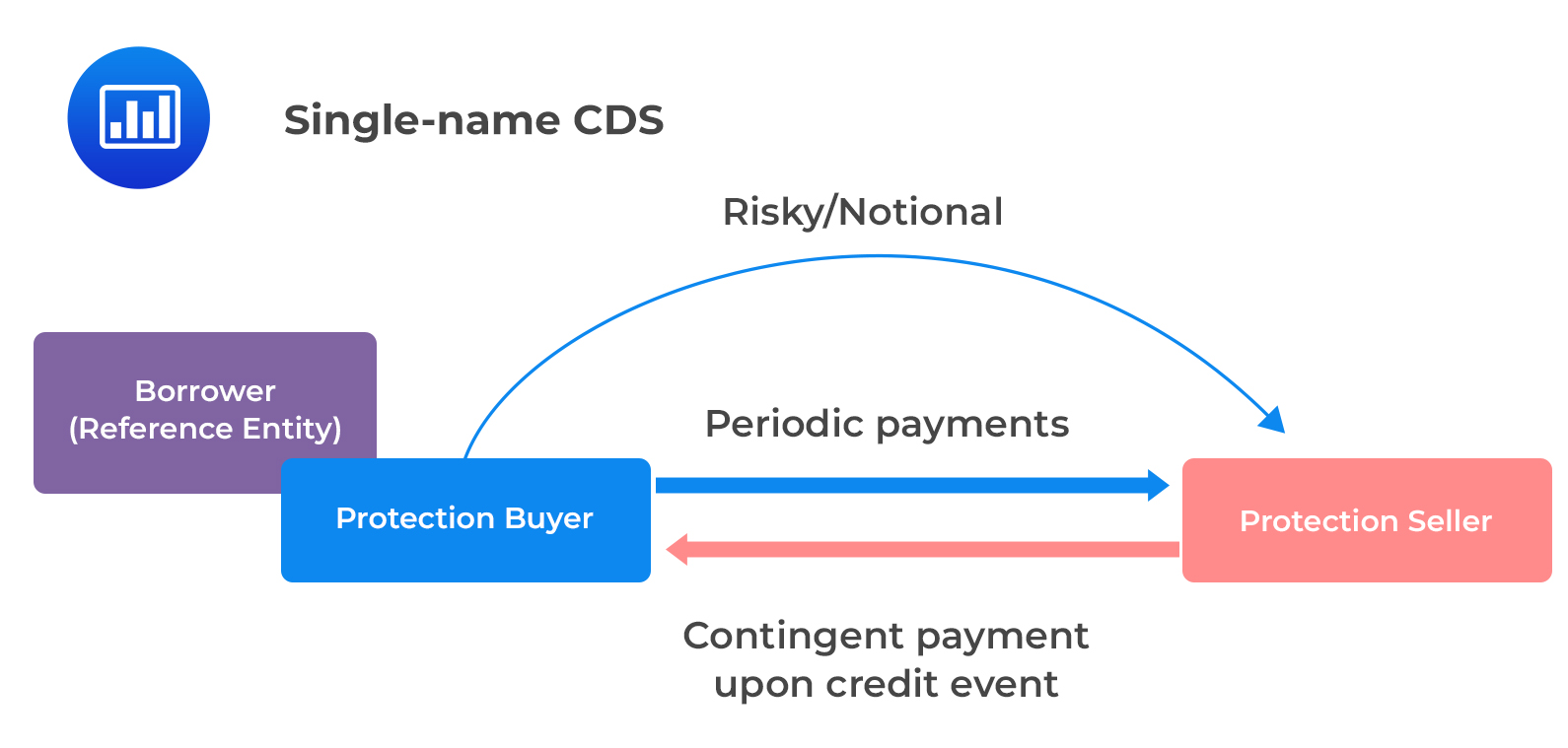

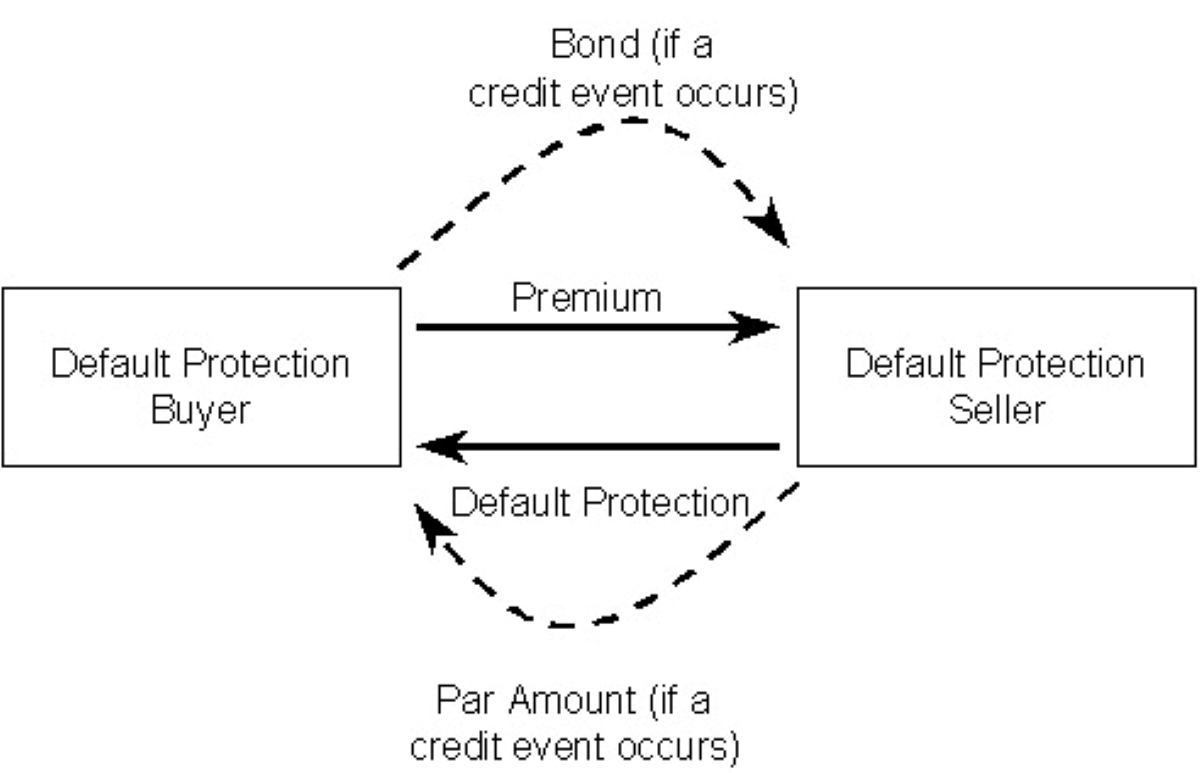

Credit default swaps operate on the basis of a bilateral agreement between two parties: the protection buyer and the protection seller. The buyer, seeking protection against the possibility of a credit event, makes regular payments, often referred to as premiums, to the seller over the term of the contract. In return, the seller agrees to compensate the buyer in the event of a default on the underlying debt instrument, such as a bond or loan.

It’s important to note that the protection buyer does not need to own the underlying debt instrument to purchase a credit default swap. This characteristic has led to the use of CDS for speculative purposes, as investors can effectively bet on the creditworthiness of a particular entity without holding its debt. This aspect of CDS has been a subject of debate, as it has the potential to influence the market’s perception of credit risk and the pricing of debt securities.

When a credit event, such as a default or restructuring, occurs with respect to the underlying debt, the protection buyer can claim the face value of the instrument from the protection seller. The determination of whether a credit event has occurred is typically based on predefined criteria, which may include ratings downgrades or missed interest or principal payments.

Credit default swaps are customizable instruments, allowing parties to tailor the terms of the contract to their specific requirements. This flexibility has contributed to the widespread use of CDS for hedging against credit risk, as well as for speculative purposes. However, the complexity and lack of transparency associated with certain CDS transactions have raised concerns about their potential to impact market stability and the broader financial system.

By understanding the mechanics of credit default swaps, market participants and observers can gain insights into the dynamics of credit risk management and the interplay between financial instruments. The subsequent sections of this article will delve into the various types of credit default swaps, their advantages, disadvantages, associated risks, and the regulatory framework governing their use, offering a comprehensive perspective on these influential financial instruments.

Types of Credit Default Swaps

Credit default swaps encompass a range of variations tailored to specific needs and risk management strategies. The primary types of CDS include single-name credit default swaps and index credit default swaps.

Single-Name Credit Default Swaps: As the name suggests, single-name credit default swaps provide protection against the default of a specific entity or reference entity. These entities can include corporations, sovereign nations, or other issuers of debt securities. Single-name CDS are often utilized by investors seeking to hedge against the credit risk associated with a particular issuer’s debt, offering a targeted approach to managing credit exposure.

Index Credit Default Swaps: Index credit default swaps provide protection against the default of a basket of reference entities, typically comprising a specific sector, geographic region, or credit rating category. Index CDS offer a more diversified approach to hedging credit risk, allowing investors to mitigate the impact of widespread credit events within a defined market segment. These instruments are particularly valuable for portfolio managers looking to safeguard against systemic risks that could affect a broad range of assets.

Additionally, credit default swaps can be categorized based on their settlement terms, with the two primary types being physical settlement and cash settlement. In a physical settlement, the protection seller delivers the underlying debt instrument to the protection buyer in the event of a credit event. On the other hand, cash settlement involves the transfer of cash between the parties based on the notional value of the underlying debt and the recovery rate determined at the time of the credit event.

Understanding the various types of credit default swaps is essential for market participants and risk managers, as it enables them to select the most suitable instruments for their specific hedging or investment objectives. The subsequent sections of this article will delve into the advantages, disadvantages, risks, and regulatory aspects of credit default swaps, providing a comprehensive understanding of these influential financial instruments.

Advantages and Disadvantages of Credit Default Swaps

Credit default swaps offer several advantages that make them valuable tools for managing credit risk and investment portfolios. However, these instruments also present certain disadvantages and risks that warrant careful consideration by market participants and regulators.

Advantages:

- Risk Mitigation: One of the primary advantages of credit default swaps is their utility in hedging against credit risk. Investors and institutions can use CDS contracts to protect their portfolios from potential losses due to the default of underlying debt instruments, thereby enhancing risk management capabilities.

- Portfolio Diversification: Credit default swaps enable investors to diversify their exposure to credit risk across a range of entities or market segments. This diversification can help mitigate the impact of credit events on a portfolio and reduce the concentration of risk associated with specific issuers.

- Liquidity and Flexibility: CDS contracts offer liquidity and flexibility, allowing market participants to adjust their credit risk exposures and investment strategies more efficiently. The ability to buy and sell CDS positions provides a level of agility in managing credit risk and adapting to changing market conditions.

Disadvantages:

- Counterparty Risk: One of the foremost concerns associated with credit default swaps is the exposure to counterparty risk. In the event of a protection seller’s default, the protection buyer may face challenges in realizing the protection provided by the CDS contract, potentially leading to significant losses.

- Systemic Risk: The interconnected nature of credit default swaps and their potential to amplify risks within the financial system has raised concerns about systemic risk. The widespread use of CDS and the complex web of obligations among market participants have the potential to exacerbate financial instability during periods of stress.

- Regulatory Challenges: The regulatory oversight of credit default swaps has been a subject of ongoing debate and scrutiny. The complexity of these instruments, along with the lack of transparency in certain CDS transactions, has posed challenges for regulators in effectively monitoring and managing associated risks.

By weighing the advantages and disadvantages of credit default swaps, market participants can make informed decisions regarding the use of these instruments for risk management and investment purposes. The subsequent sections of this article will delve into the risks associated with credit default swaps, as well as the regulatory framework governing their use, offering a comprehensive perspective on these influential financial instruments.

Risks Associated with Credit Default Swaps

Credit default swaps (CDS) entail various risks that warrant careful consideration by market participants and regulators. Understanding and effectively managing these risks are essential for maintaining the stability of financial markets and safeguarding against systemic vulnerabilities.

Counterparty Risk: One of the primary risks associated with credit default swaps is counterparty risk. In a CDS contract, both the protection buyer and the protection seller are exposed to the risk of default by the other party. If the protection seller fails to honor their obligations in the event of a credit event, the protection buyer may face challenges in realizing the protection provided by the contract, leading to potential financial losses.

Market Risk: Credit default swaps are susceptible to market risk, particularly in relation to changes in the creditworthiness of the underlying reference entities. Fluctuations in credit spreads, credit ratings, and overall market conditions can impact the valuation and performance of CDS contracts, potentially exposing investors to losses or diminished hedging effectiveness.

Liquidity Risk: The liquidity of credit default swaps can pose significant risks, especially during periods of market stress or heightened uncertainty. Limited liquidity in the CDS market may hinder investors’ ability to enter into or exit CDS positions, potentially amplifying the impact of credit events and impairing risk management strategies.

Systemic Risk: The interconnected nature of credit default swaps and their potential to amplify risks within the financial system has raised concerns about systemic risk. The widespread use of CDS and the complex web of obligations among market participants have the potential to exacerbate financial instability during periods of stress, potentially leading to contagion effects and broader market disruptions.

Regulatory Risk: The regulatory environment surrounding credit default swaps introduces regulatory risks, as changes in the regulatory framework or the implementation of new rules can impact the trading, pricing, and risk management of CDS contracts. Regulatory developments may also influence market participants’ strategies and the overall dynamics of the CDS market.

By recognizing and addressing these risks, market participants can adopt informed risk management practices and contribute to the resilience and stability of the financial system. The subsequent section of this article will explore the regulatory framework governing credit default swaps, shedding light on the measures aimed at mitigating associated risks and promoting the prudent use of these financial instruments.

Regulation of Credit Default Swaps

The regulation of credit default swaps (CDS) has been a focal point for policymakers and regulatory authorities, particularly in the aftermath of the 2007-2008 financial crisis. The complex and interconnected nature of CDS transactions, along with their potential to impact systemic stability, has prompted efforts to enhance oversight and mitigate associated risks.

Regulatory Framework: In the United States, the regulation of credit default swaps is overseen by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in response to the financial crisis, introduced comprehensive regulatory reforms for over-the-counter derivatives, including credit default swaps. These reforms aimed to increase transparency, mitigate systemic risk, and enhance the oversight of CDS transactions.

Central Clearing and Reporting: One of the key regulatory measures introduced for credit default swaps is the requirement for central clearing and reporting of CDS transactions. Central clearing facilitates the mitigation of counterparty risk by interposing a central counterparty (CCP) between the protection buyer and the protection seller. Additionally, the reporting of CDS trades to registered trade repositories enhances transparency and enables regulators to monitor market activity and assess systemic risks effectively.

Capital and Margin Requirements: Regulatory authorities have implemented capital and margin requirements for entities engaged in credit default swaps, aiming to bolster the resilience of market participants and mitigate the potential for destabilizing losses. By mandating the maintenance of adequate capital and the posting of initial and variation margin, regulators seek to enhance the financial soundness of CDS market participants and reduce the likelihood of default-related disruptions.

Trade Execution and Transparency: Regulatory initiatives have focused on promoting the trading of credit default swaps on regulated platforms, such as swap execution facilities (SEFs) and designated contract markets (DCMs). These measures aim to enhance market transparency, improve price discovery, and facilitate a more orderly and efficient trading environment for CDS contracts.

By implementing these regulatory measures, authorities seek to address the inherent risks associated with credit default swaps and foster a more resilient and transparent derivatives market. The effective oversight and regulation of CDS transactions are essential for promoting financial stability and mitigating systemic vulnerabilities, contributing to the overall integrity of the global financial system.

Conclusion

Credit default swaps (CDS) occupy a significant role in the realm of financial instruments, offering a means of hedging against credit risk and managing investment portfolios. However, the utilization of CDS also presents inherent complexities and risks that necessitate careful consideration by market participants and regulatory authorities.

Understanding the mechanics, types, advantages, disadvantages, associated risks, and regulatory framework of credit default swaps is essential for developing a comprehensive perspective on these influential financial instruments. The multifaceted nature of CDS transactions underscores the importance of informed decision-making and prudent risk management practices within the financial industry.

By recognizing the advantages of credit default swaps, such as their risk mitigation capabilities, portfolio diversification potential, and liquidity advantages, market participants can harness these instruments to enhance their risk management strategies and investment approaches. However, it is crucial to remain cognizant of the associated disadvantages, including counterparty risk, systemic implications, and regulatory challenges, to effectively navigate the complexities of CDS transactions.

Furthermore, the regulatory oversight of credit default swaps plays a pivotal role in promoting market integrity, transparency, and stability. Regulatory measures, such as central clearing and reporting requirements, capital and margin mandates, and initiatives to enhance trade execution and transparency, are instrumental in mitigating risks and bolstering the resilience of the CDS market.

Ultimately, the prudent use of credit default swaps hinges on a comprehensive understanding of their intricacies and implications. By fostering transparency, sound risk management practices, and effective regulatory oversight, market participants and authorities can contribute to the integrity and stability of the global financial system, ensuring that credit default swaps serve as valuable tools for risk management and investment, while mitigating potential systemic vulnerabilities.