Home>Finance>What Did Credit Default Swaps Have To Do With The 2008 Recession

Finance

What Did Credit Default Swaps Have To Do With The 2008 Recession

Published: March 4, 2024

Learn about the role of credit default swaps in the 2008 recession and their impact on the finance industry. Understand the connection between finance and the financial crisis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the complex world of finance, where seemingly abstract concepts can have tangible impacts on the global economy. In this article, we will delve into the enigmatic realm of credit default swaps (CDS) and their profound connection to the 2008 recession. Understanding credit default swaps is crucial for comprehending the intricate web of financial instruments that underpinned the crisis, and their role in precipitating one of the most significant economic downturns in modern history.

As we embark on this journey, it’s essential to recognize that the 2008 recession was not merely a series of isolated events but rather a confluence of interconnected factors. At the heart of this tumultuous period lay the housing market collapse, which reverberated throughout the entire financial system. Amidst this chaos, credit default swaps emerged as a pivotal player, amplifying the impact of the housing market collapse and sending shockwaves across the global financial landscape.

So, fasten your seatbelts as we navigate through the intricate world of credit default swaps, unraveling their significance in the 2008 recession and shedding light on the far-reaching implications they had on financial institutions and regulatory frameworks. By the end of this journey, you will not only grasp the intricacies of credit default swaps but also gain a deeper understanding of their role in shaping the modern financial landscape.

Understanding Credit Default Swaps

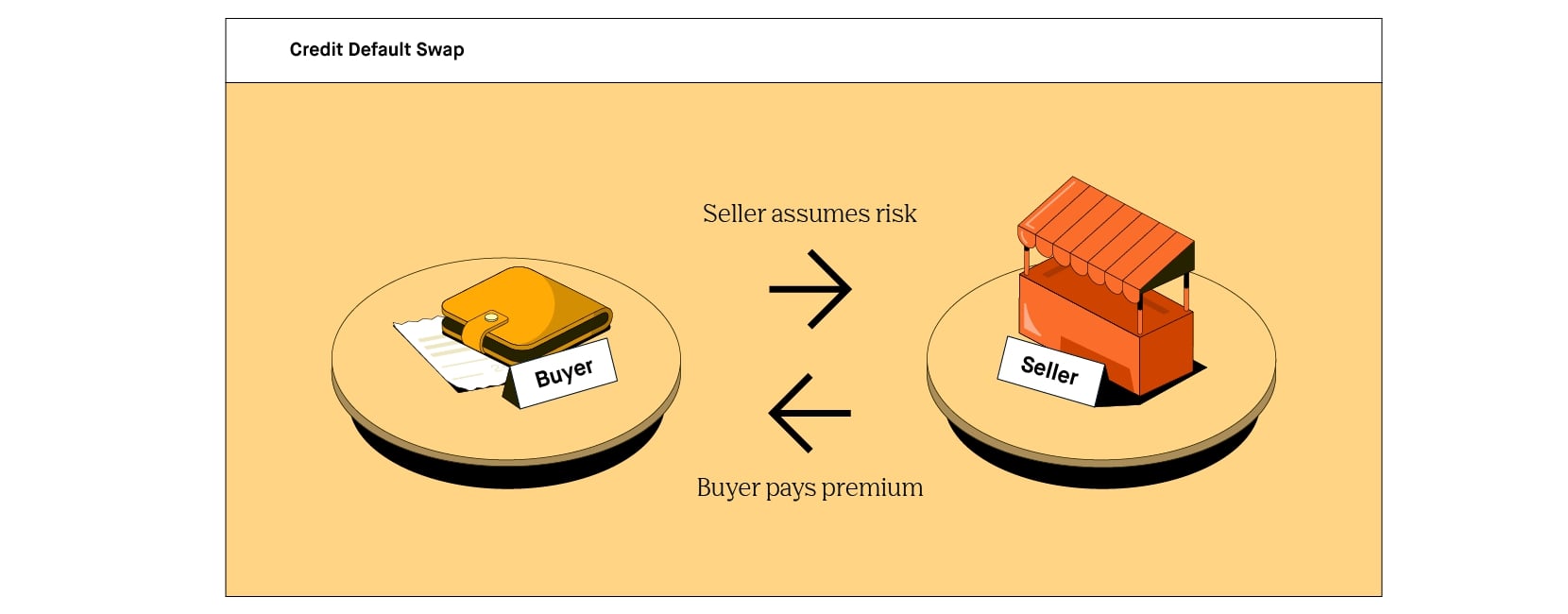

To comprehend the impact of credit default swaps on the 2008 recession, it’s imperative to grasp the essence of these financial instruments. At its core, a credit default swap is a derivative contract that allows an investor to “swap” or transfer the credit risk of a specific asset, such as a bond or loan, to another party in exchange for periodic payments. In essence, it functions as insurance against the default of a borrower or issuer.

Imagine a scenario where a financial institution holds a portfolio of mortgage-backed securities and seeks to mitigate the risk of default. They can enter into a credit default swap with another party, often a specialized financial entity such as a hedge fund or investment bank. In this agreement, the institution agrees to make regular payments to the counterparty, known as the “protection buyer,” in exchange for protection against potential defaults on the underlying assets.

One of the defining features of credit default swaps is that they enable investors to speculate on the creditworthiness of a particular entity without owning the underlying asset. This aspect contributed to the proliferation of complex and opaque financial dealings, as investors could take large positions on the credit quality of various entities without the transparency associated with traditional securities.

Furthermore, the widespread use of credit default swaps introduced a level of interconnectedness and systemic risk that was not fully understood or adequately regulated. As these instruments were traded over-the-counter (OTC) rather than on organized exchanges, the opacity and lack of standardized valuation methods added layers of complexity to the financial system, making it challenging to assess the true extent of exposure and potential contagion effects.

As we unravel the intricacies of credit default swaps, it becomes evident that these financial instruments played a pivotal role in amplifying the risks within the financial system, ultimately contributing to the severity of the 2008 recession. Their intricate nature and far-reaching implications underscore the need for a comprehensive understanding of these instruments and their impact on the broader economy.

The Role of Credit Default Swaps in the 2008 Recession

As the housing market bubble reached its zenith, the intricate web of credit default swaps became increasingly entangled in the impending crisis. The widespread use of these financial instruments exacerbated the fallout from the subprime mortgage collapse, amplifying the systemic risks that ultimately led to the 2008 recession.

One of the critical roles played by credit default swaps in the recession was their contribution to the proliferation of toxic assets within the financial system. Mortgage-backed securities, which were comprised of subprime mortgages bundled together and sold to investors, formed the underlying assets for many credit default swaps. As the housing market deteriorated and mortgage defaults surged, the value of these securities plummeted, triggering a wave of credit default swap payouts.

Moreover, the interconnected nature of credit default swaps magnified the impact of individual defaults, leading to a domino effect that reverberated through the financial sector. When one institution faced significant losses due to defaults on mortgage-backed securities, its counterparties, often interconnected through a complex web of credit default swaps, were also at risk. This interconnectedness amplified the contagion effect, spreading the financial distress across institutions and markets.

Furthermore, the lack of transparency and standardized valuation methods for credit default swaps obscured the true extent of risk exposure within the financial system. This opacity hindered the accurate assessment of counterparty risk and made it challenging for market participants and regulators to gauge the potential fallout from a widespread default scenario.

Ultimately, the role of credit default swaps in the 2008 recession can be characterized as a catalyst for amplifying systemic risks and exacerbating the fallout from the housing market collapse. The intricate interplay between these financial instruments and the underlying assets they sought to hedge underscored the complexity and interconnectedness that defined the crisis, highlighting the imperative of understanding the role of credit default swaps in shaping the events that unfolded in 2008.

Impact of Credit Default Swaps on Financial Institutions

The impact of credit default swaps on financial institutions during the 2008 recession was profound and far-reaching, reshaping the landscape of risk management and regulatory oversight within the industry. These complex financial instruments not only amplified the systemic risks but also directly impacted the stability and solvency of numerous institutions, contributing to the widespread turmoil that characterized the crisis.

One of the primary repercussions of credit default swaps on financial institutions stemmed from their role in magnifying the exposure to mortgage-backed securities and other toxic assets. As the housing market collapsed and defaults surged, institutions holding these assets found themselves facing substantial liabilities from credit default swap contracts. The resulting financial strain and uncertainty surrounding the valuation of these instruments eroded investor confidence and strained the balance sheets of numerous institutions, ultimately leading to a wave of bankruptcies, mergers, and government interventions.

Furthermore, the interconnected nature of credit default swaps intensified the contagion effect, spreading financial distress across institutions and markets. As defaults on underlying assets triggered payouts on credit default swaps, the interconnected web of counterparties faced heightened counterparty risk, leading to a loss of confidence in the stability of the financial system. This loss of confidence further exacerbated liquidity concerns and hindered the ability of institutions to access funding, exacerbating the severity of the crisis.

The impact of credit default swaps also prompted a reevaluation of risk management practices and regulatory frameworks within the financial industry. The opacity and lack of transparency associated with these instruments underscored the need for enhanced risk assessment and improved oversight of derivative markets. Regulators and policymakers recognized the imperative of implementing measures to enhance transparency, standardize valuation methods, and mitigate the systemic risks posed by credit default swaps, leading to a paradigm shift in regulatory approaches and risk management practices.

In summary, the impact of credit default swaps on financial institutions during the 2008 recession was multifaceted, encompassing direct financial strain, heightened counterparty risk, and a reconfiguration of risk management and regulatory paradigms. The repercussions of these complex financial instruments reverberated throughout the industry, reshaping the dynamics of risk and regulation and underscoring the imperative of understanding their role in shaping the events of the crisis.

Regulatory Response to Credit Default Swaps

The profound impact of credit default swaps on the 2008 recession prompted a comprehensive reevaluation of regulatory frameworks and oversight mechanisms governing these complex financial instruments. In the aftermath of the crisis, regulators and policymakers recognized the imperative of enhancing transparency, mitigating systemic risks, and bolstering the resilience of the financial system in the face of opaque and interconnected derivative markets.

One of the pivotal regulatory responses to the challenges posed by credit default swaps was the implementation of measures aimed at enhancing transparency and standardizing valuation methods. Regulators sought to address the opacity surrounding these instruments by requiring greater disclosure of CDS positions and transactions, thereby enabling market participants and regulators to gain a clearer understanding of the extent of exposure and counterparty risk within the system. Additionally, efforts were made to standardize the valuation and reporting of credit default swaps to facilitate more accurate risk assessment and pricing.

Furthermore, regulatory reforms focused on mitigating the systemic risks associated with credit default swaps and enhancing the stability of the financial system. Initiatives such as central clearing counterparties (CCPs) and trade repositories were established to centralize the clearing and reporting of credit default swap transactions, thereby reducing counterparty risk and enhancing market transparency. By centralizing the processing of these transactions, regulators aimed to mitigate the interconnectedness and contagion effects that had contributed to the severity of the 2008 recession.

Another critical aspect of the regulatory response to credit default swaps involved the enhancement of risk management practices and capital requirements for institutions engaging in derivative transactions. Regulators implemented measures to strengthen risk management standards, improve capital adequacy requirements, and enhance stress testing protocols to ensure that financial institutions adequately accounted for the risks associated with credit default swaps and other derivatives in their operations.

Overall, the regulatory response to credit default swaps in the wake of the 2008 recession reflected a concerted effort to address the challenges posed by these complex financial instruments. The reforms aimed to enhance transparency, mitigate systemic risks, and fortify the resilience of the financial system, underscoring the imperative of regulatory vigilance in the face of evolving financial complexities.

Conclusion

The intricate web of credit default swaps played a pivotal role in shaping the events that culminated in the 2008 recession, leaving an indelible mark on the financial landscape and prompting a paradigm shift in regulatory and risk management practices. These complex financial instruments, designed to hedge against credit risk, ultimately amplified the systemic risks and contagion effects that reverberated throughout the global financial system.

As we reflect on the impact of credit default swaps, it becomes evident that their interconnected nature and lack of transparency contributed to the severity of the crisis, exacerbating the fallout from the housing market collapse and reshaping the dynamics of risk within the financial industry. The widespread use of these instruments magnified the exposure to toxic assets, heightened counterparty risk, and strained the stability of financial institutions, ultimately precipitating a wave of bankruptcies, mergers, and government interventions.

However, the aftermath of the 2008 recession also catalyzed a comprehensive regulatory response aimed at addressing the challenges posed by credit default swaps. Regulators and policymakers recognized the imperative of enhancing transparency, mitigating systemic risks, and fortifying the resilience of the financial system in the face of evolving complexities. The implementation of measures to centralize clearing and reporting, standardize valuation methods, and strengthen risk management practices underscored the commitment to mitigating the risks associated with these complex financial instruments.

As we navigate the complex terrain of finance, the lessons gleaned from the role of credit default swaps in the 2008 recession serve as a poignant reminder of the imperative of understanding the intricate interplay between financial instruments, market dynamics, and regulatory frameworks. The legacy of the crisis underscores the importance of vigilance, transparency, and robust risk management practices in safeguarding the stability and integrity of the financial system.

In conclusion, the impact of credit default swaps on the 2008 recession transcends the realm of finance, serving as a testament to the interconnectedness and complexities that define the modern financial landscape. As we chart a course forward, the lessons learned from the crisis underscore the imperative of continuous vigilance, transparency, and resilience in navigating the dynamic and intricate world of finance.