Home>Finance>Where Is Accumulated Depreciation On Balance Sheet

Finance

Where Is Accumulated Depreciation On Balance Sheet

Modified: December 30, 2023

Learn about the placement of accumulated depreciation on a balance sheet in the field of finance. Gain insights on this important aspect.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on accumulated depreciation and its placement on the balance sheet. As a crucial component of financial reporting, accumulated depreciation plays a significant role in the financial statements of companies. Understanding its purpose and how it is accounted for is essential for investors, analysts, and anyone with an interest in evaluating a company’s financial health.

Accumulated depreciation is a term commonly encountered in the field of accounting, particularly in relation to fixed assets. It represents the cumulative amount of depreciation expense recognized over the useful life of an asset. Depreciation, in simple terms, refers to the gradual decrease in the value of an asset over time due to wear and tear, obsolescence, or other factors.

The purpose of accumulated depreciation is two-fold. Firstly, it serves as a means of accurately reflecting the diminishing value of fixed assets on the balance sheet. Secondly, it enables companies to allocate the cost of their fixed assets over their useful lives, matching the expense with the revenue generated by those assets. This aligns with the matching principle in accounting, which aims to accurately measure a company’s financial performance by matching revenues and expenses in the appropriate periods.

The accounting treatment of accumulated depreciation is fairly straightforward. Each period, a portion of the asset’s cost is allocated as depreciation expense, and this amount is added to the existing accumulated depreciation on the balance sheet. This results in a gradual increase in the accumulated depreciation balance over time, reflecting the overall wear and tear or loss in value of the asset.

Now that we have covered the basic concepts of accumulated depreciation, let us delve into how it is presented on the balance sheet. Understanding how accumulated depreciation is disclosed can provide valuable insights into a company’s financial position and can aid in making informed decisions.

Definition of Accumulated Depreciation

Accumulated depreciation is the cumulative depreciation expense recognized over the useful life of a fixed asset. It represents the reduction in the value of an asset over time due to factors such as wear and tear, obsolescence, or the passage of time.

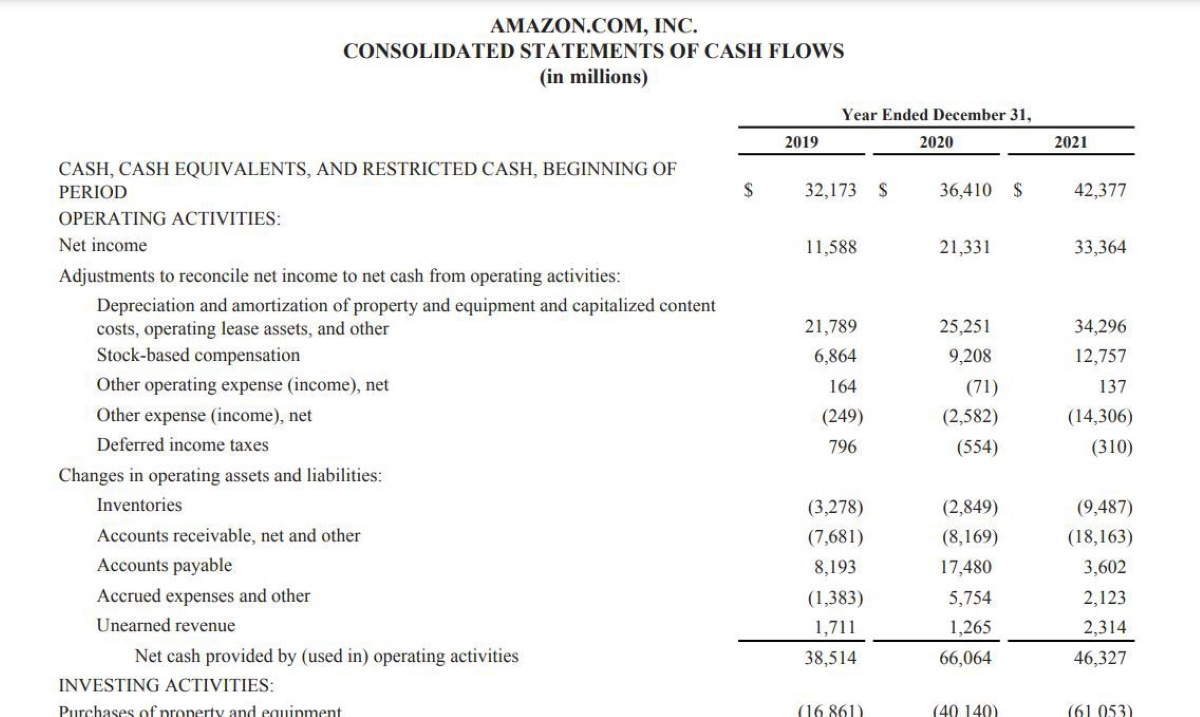

Depreciation is an accounting concept used to allocate the cost of an asset over its useful life. It is a non-cash expense, meaning it does not involve an outflow of cash. Instead, it is an estimation of the decrease in an asset’s value as it is used or becomes outdated. Accumulated depreciation, on the other hand, is the summation of all the depreciation expenses recognized since the asset’s acquisition.

The useful life of an asset refers to the length of time it is expected to generate economic benefits for the company. This can vary depending on the type of asset. For example, a building may have a useful life of several decades, while a piece of machinery may have a useful life of only a few years.

Accumulated depreciation is recorded as a contra-asset account on the balance sheet. It offsets the value of the corresponding fixed asset, resulting in a net value that represents the asset’s carrying value or book value.

It is essential to note that accumulated depreciation does not directly impact a company’s cash flow. Rather, it reflects the historical allocation of the asset’s cost over time.

By accumulating the depreciation expense, companies can maintain accurate and transparent financial statements. It allows for a more realistic representation of the true value of the fixed assets and helps in evaluating the overall financial health of the company.

Purpose of Accumulated Depreciation

The purpose of accumulated depreciation is twofold: to reflect the diminishing value of fixed assets and to allocate the cost of those assets over their useful lives.

Firstly, accumulated depreciation serves as a means of accurately reflecting the diminishing value of fixed assets on the balance sheet. As assets are used or become outdated, their value decreases over time. By recognizing depreciation expense and accumulating it over the asset’s useful life, companies can account for this decrease in value. Without accumulated depreciation, the true value of the asset may be overstated on the balance sheet, potentially misleading investors and stakeholders.

Secondly, accumulated depreciation enables companies to allocate the cost of their fixed assets over their useful lives. This aligns with the matching principle in accounting, which aims to match expenses with the revenue they generate. By spreading the cost of an asset over its useful life, companies can better match the expense with the corresponding revenue earned from utilizing the asset. This provides a more accurate depiction of the financial performance of the company in each reporting period.

Additionally, accumulated depreciation plays a crucial role in determining the net book value of an asset. The net book value is calculated by deducting the accumulated depreciation from the original cost of the asset. The net book value represents the carrying value of the asset on the balance sheet and provides valuable information about its current worth.

Another purpose of accumulated depreciation is to assist in decision-making. By understanding the depreciation charges over time, stakeholders can assess the rate of wear and tear on assets and plan for future replacements or repairs. It also provides insight into the company’s asset lifecycle and any potential maintenance costs that may arise.

Furthermore, accumulated depreciation is required for regulatory compliance. Financial reporting frameworks, such as Generally Accepted Accounting Principles (GAAP), mandate the recognition and disclosure of accumulated depreciation to ensure transparency and comparability among companies.

Overall, the purpose of accumulated depreciation is to accurately reflect the decrease in value of fixed assets over time and allocate the cost of those assets over their useful lives. It enables companies to match expenses with the revenue generated by the assets and provides valuable information for decision-making and financial analysis.

Accounting Treatment of Accumulated Depreciation

The accounting treatment of accumulated depreciation involves recognizing and accumulating depreciation expense over the useful life of a fixed asset. This process is essential in accurately reflecting the decrease in value of the asset over time.

Depreciation expense is typically calculated using various methods, such as straight-line depreciation, declining balance depreciation, or units-of-production depreciation. The chosen method depends on factors such as the nature of the asset and its expected pattern of use or obsolescence.

Once the appropriate depreciation expense is determined, it is recorded on the income statement as an operating expense. This expense reduces the company’s net income and reflects the cost of utilizing the asset during the reporting period.

Simultaneously, the same amount of depreciation expense is added to the accumulated depreciation account on the balance sheet. Accumulated depreciation is a contra-asset account, meaning it offsets the value of the fixed asset to arrive at its net book value or carrying value.

For example, let’s say a company purchased a machine for $100,000 with an expected useful life of five years and no salvage value. The straight-line depreciation method is chosen, which evenly allocates the cost over the five years. Each year, the company would recognize $20,000 in depreciation expense. This $20,000 is recorded as an expense on the income statement and added to the accumulated depreciation account on the balance sheet.

As time passes, the accumulated depreciation balance increases, reflecting the total depreciation expense recognized over the asset’s useful life. The original cost of the machine remains unchanged on the balance sheet, while the net book value gradually decreases.

It is important to note that accumulated depreciation is not a cash account. It represents the accumulated expense over time and does not involve any actual cash outflows. Therefore, it is considered a non-cash item in the company’s financial statements.

When the fixed asset is no longer in use or is disposed of, the accumulated depreciation is deducted from the original cost of the asset. This results in the removal of both the asset and its associated accumulated depreciation from the balance sheet, ensuring that they are no longer included in the company’s financial position.

In summary, the accounting treatment of accumulated depreciation involves recognizing depreciation expense on the income statement and accumulating it in the accumulated depreciation account on the balance sheet. This process accurately reflects the decrease in value of fixed assets over time and helps in determining the net book value of the asset.

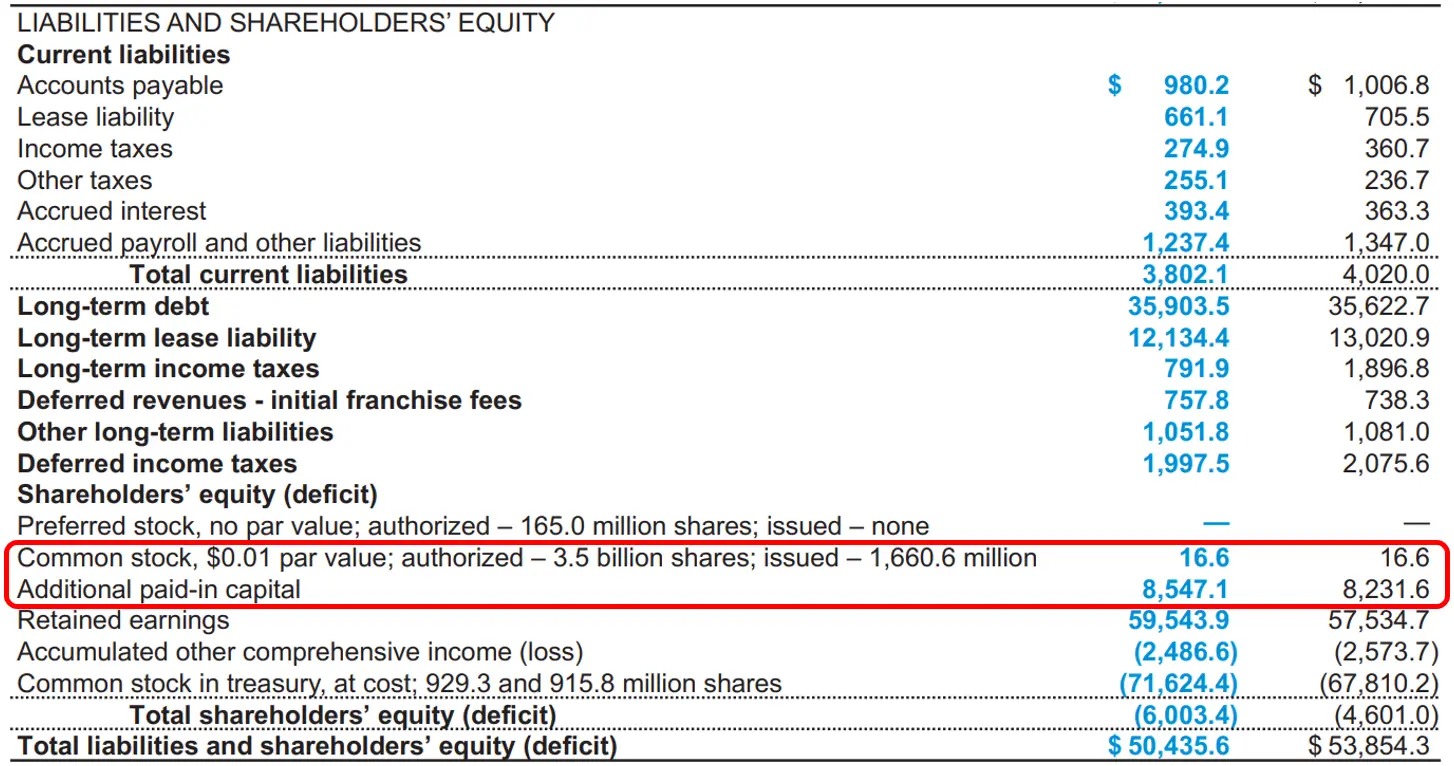

Presentation of Accumulated Depreciation on Balance Sheet

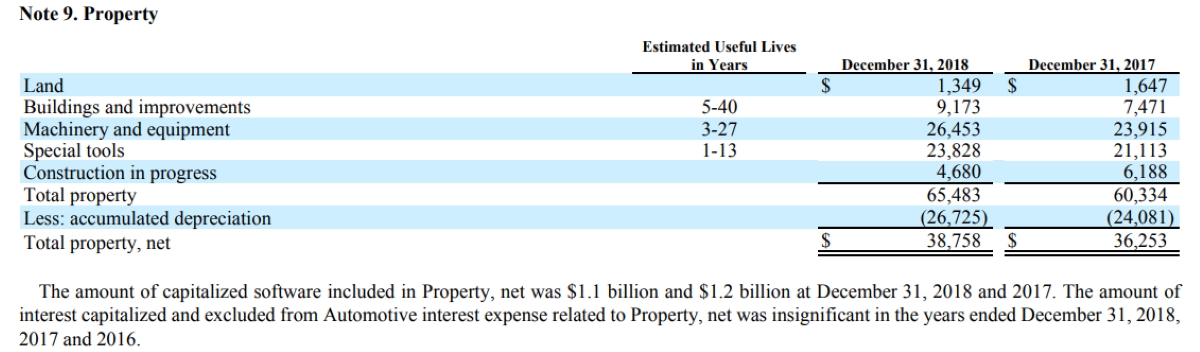

Accumulated depreciation is presented on the balance sheet as a contra-asset account. It is listed directly below the corresponding fixed asset it pertains to. The purpose of this presentation is to offset and reduce the value of the fixed asset to reflect its net book value or carrying value.

The accumulated depreciation account is labeled as a negative number and is typically displayed within parentheses or with a minus sign (-) to indicate its contra-asset nature. This presentation makes it clear that accumulated depreciation is subtracted from the original cost of the fixed asset when determining its net book value.

For example, let’s consider a company’s balance sheet with a building that was purchased for $1,000,000 and has accumulated depreciation of $200,000. The presentation would look as follows:

- Building: $1,000,000

- Less: Accumulated Depreciation (200,000)

- Net Book Value: $800,000

In this example, the building’s original cost is listed, followed by the presentation of accumulated depreciation as a deduction. The net book value of the building is then calculated by subtracting the accumulated depreciation from the original cost.

The presentation of accumulated depreciation on the balance sheet provides essential information about the historical allocation of the asset’s cost over time. It allows stakeholders to understand how much of the asset’s value has been consumed or lost due to factors such as wear and tear or obsolescence.

Importantly, the balance sheet should also disclose the specific details of the fixed assets and their accumulated depreciation. This may include information such as the description of the asset, its original cost, the method of depreciation used, the useful life, and the remaining useful life.

Additionally, it is common for companies to provide a separate line item on the balance sheet for the total accumulated depreciation of all fixed assets. This total represents the aggregate amount of cumulative depreciation recognized across all of the company’s fixed assets.

Overall, the presentation of accumulated depreciation on the balance sheet highlights its importance in accurately reflecting the value of fixed assets. It provides transparency and allows stakeholders to assess the net book value of the assets, which is crucial for evaluating the financial position and performance of a company.

Importance of Understanding Accumulated Depreciation

Understanding accumulated depreciation is crucial for various stakeholders, including investors, creditors, and analysts. It provides valuable insights into a company’s financial position, asset management, and overall financial health. Here are some key reasons why understanding accumulated depreciation is important:

1. Accurate Financial Statements: Accumulated depreciation ensures that a company’s financial statements accurately reflect the diminishing value of fixed assets over time. It helps in presenting a more realistic picture of the company’s financial position by reducing the carrying value of assets to their net book value.

2. Evaluation of Asset Quality: Accumulated depreciation allows stakeholders to assess the quality and age of a company’s fixed assets. Higher accumulated depreciation may indicate older assets that may require maintenance, repair, or replacement, potentially affecting future cash flow and profitability.

3. Ratio Analysis: Understanding accumulated depreciation is vital for conducting ratio analysis. Ratios such as return on assets (ROA) and asset turnover ratios rely on accurate values of net book assets, which are determined by deducting accumulated depreciation from the original cost of fixed assets.

4. Investment Decision-Making: Investors consider accumulated depreciation as a factor in their investment decisions. Higher accumulated depreciation may indicate higher depreciation charges and lower net book values, possibly affecting the asset’s future value and potential return on investment.

5. Maintenance and Replacement Planning: Accumulated depreciation helps companies plan for future maintenance and replacements of fixed assets. By understanding the historical allocation of the asset’s cost, companies can better estimate the useful life remaining for an asset and allocate funds accordingly.

6. Compliance with Accounting Standards: Accumulated depreciation is a requirement under accounting standards, such as Generally Accepted Accounting Principles (GAAP). Understanding its treatment and disclosure ensures compliance with these standards and promotes transparency in financial reporting.

7. Lending Decisions: Lenders and creditors consider accumulated depreciation when evaluating a company’s creditworthiness. Higher accumulated depreciation may indicate older assets or potential liquidity issues, affecting the company’s ability to service debt obligations.

8. Tax Implications: Understanding accumulated depreciation is essential for tax planning purposes. Depreciation expense is deductible for tax purposes, and accurate tracking of accumulated depreciation helps in determining taxable income and minimizing tax liabilities.

Overall, understanding accumulated depreciation is vital for financial analysis, decision-making, and compliance purposes. It provides insights into asset quality, financial position, and potential maintenance or replacement needs. By accurately reflecting the decrease in value of fixed assets, accumulated depreciation helps stakeholders make informed judgments and assess the financial health of a company.

Conclusion

In conclusion, accumulated depreciation is an essential concept in accounting that represents the cumulative depreciation expense recognized over the useful life of a fixed asset. It serves two main purposes: reflecting the diminishing value of an asset and allocating its cost over time.

The accounting treatment of accumulated depreciation involves recognizing depreciation expense on the income statement and accumulating it in the accumulated depreciation account on the balance sheet. This process ensures that the financial statements accurately reflect the decrease in value of fixed assets and enables the calculation of their net book value.

The presentation of accumulated depreciation on the balance sheet is as a contra-asset account, directly below the corresponding fixed asset. This presentation allows stakeholders to easily identify the accumulated depreciation and understand its impact on the net book value of the asset.

Understanding accumulated depreciation is important for various reasons. It ensures accurate financial reporting by reflecting the true value of assets over time. It helps in evaluating asset quality, planning for maintenance or replacements, and making investment decisions. It also assists in compliance with accounting standards and tax planning.

By grasping the concept of accumulated depreciation, investors, creditors, and analysts can gain valuable insights into a company’s financial position, asset management, and overall financial health. It allows for informed decision-making and provides a comprehensive understanding of the value and depreciation of fixed assets.

In conclusion, accumulated depreciation is a critical aspect of financial reporting that plays a significant role in accurately representing the value of fixed assets. Its proper understanding and interpretation are essential for stakeholders to assess a company’s financial health and make informed decisions regarding investments, lending, and strategic planning.