Home>Finance>What Is An Inefficient Market? Definition, Effects, And Example

Finance

What Is An Inefficient Market? Definition, Effects, And Example

Published: December 9, 2023

Learn about inefficient markets in finance - definition, effects, and example. Gain insights into how market inefficiencies impact financial outcomes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is an Inefficient Market? Definition, Effects, and Example

Welcome to our “FINANCE” category, where we provide you with informative articles on various aspects of the financial world. In today’s post, we will explore the concept of inefficient markets and how they can impact investors. If you’ve ever wondered why prices fluctuate dramatically or why some investors seem to consistently outperform the market, this article is for you.

Key Takeaways

- An inefficient market refers to a financial market where prices do not fully reflect all available information, leading to potential opportunities for profit.

- Inefficient markets may arise due to informational asymmetry, behavioral biases, or regulatory constraints.

Before diving into the intricacies of inefficient markets, let’s start with a definition. An inefficient market is a financial market in which prices of securities or assets do not accurately reflect all available information. In other words, the market participants’ behavior may not be completely rational, and thus, price movements may deviate from their intrinsic or fundamental values. This deviation creates opportunities for investors to capitalize on mispriced assets.

So, what are the effects of inefficient markets? Here are a few notable ones:

- Opportunity for Profit: Inefficient markets provide opportunities for investors who can identify mispriced assets. By purchasing undervalued assets or selling overvalued ones, these investors can potentially earn above-average returns.

- Volatility and Price Fluctuations: Inefficient markets are often characterized by greater price volatility and fluctuations. This can create both risks and opportunities for investors, depending on their ability to react to market inefficiencies.

- Market Inefficiencies May Persist: Inefficient markets can persist because correcting inefficiencies requires accurate information and proper analysis. As long as market participants have imperfect knowledge or biased decision-making, the market may remain inefficient.

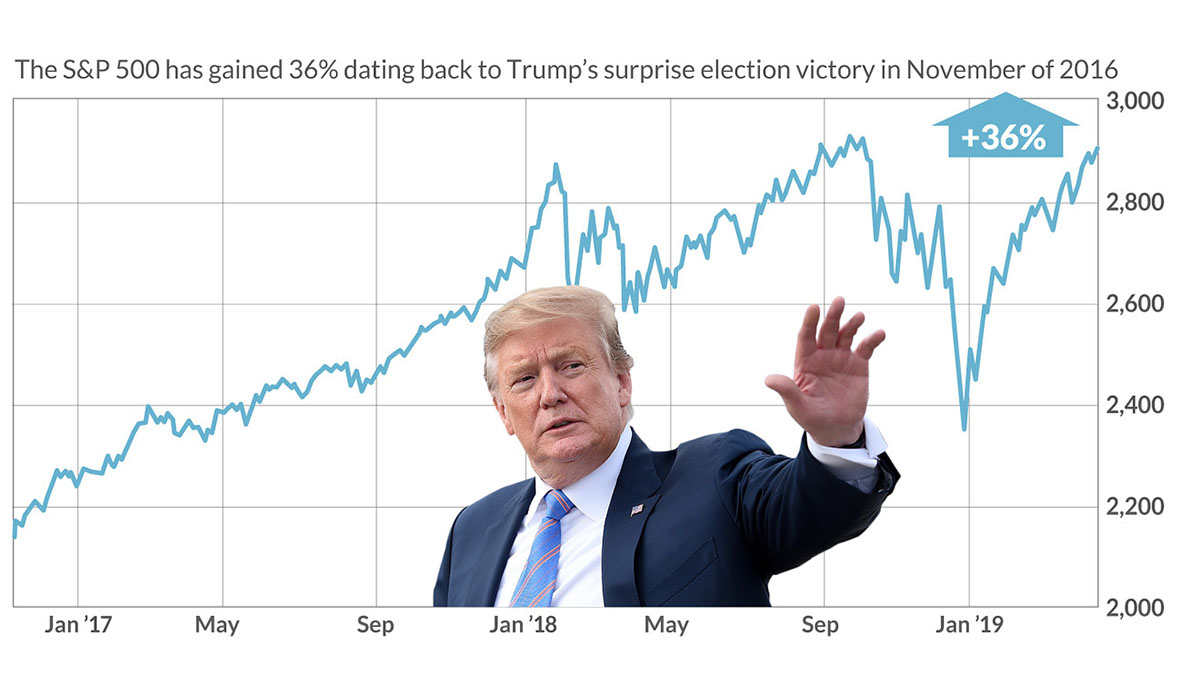

Let’s consider an example to illustrate the concept of an inefficient market. Imagine there is a small biotechnology company that has developed a groundbreaking drug with the potential to revolutionize the medical industry. However, due to limited public information and a lack of investor awareness, the company’s stock is trading at a significantly lower price than its true value. A savvy investor who conducts thorough research and recognizes the potential of the drug could take advantage of this market inefficiency and purchase the stock at a bargain. As more investors become aware of the drug’s potential, the stock price would gradually adjust to its fair value, making the market more efficient.

In summary, inefficient markets can present opportunities for investors to profit from mispriced assets. However, it is important to note that identifying market inefficiencies requires significant expertise, research, and analysis. Additionally, these opportunities may dwindle as more participants recognize and exploit the inefficiencies. Understanding the dynamics of market efficiency, and its potential limits, can help investors make informed decisions and navigate the financial landscape.