Home>Finance>What Is The Primary Limitation Of The Balance Sheet?

Finance

What Is The Primary Limitation Of The Balance Sheet?

Modified: March 1, 2024

The primary limitation of the balance sheet in finance is its inability to capture intangible assets and liabilities, leading to an incomplete representation of a company's financial position.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to assessing the financial health and performance of a company, one of the most important financial statements is the balance sheet. It provides a snapshot of a company’s financial position at a specific point in time, allowing stakeholders to gauge its liquidity, solvency, and overall financial stability.

The balance sheet is a crucial tool for investors, lenders, and even internal stakeholders, as it helps them make informed decisions based on the company’s financial standing. It displays a company’s assets, liabilities, and shareholders’ equity, providing insights into how the company has financed its operations and the value of its net assets.

Understanding the balance sheet is essential in evaluating the financial health of a business. However, it is important to recognize that the balance sheet does have its limitations. While it provides valuable information, it does not paint a complete picture of a company’s financial state.

This article will delve into the primary limitation of the balance sheet and explain how it can impact the overall assessment of a company’s financial position. By understanding this limitation, stakeholders can make more informed decisions and gain a better perspective on a company’s financial health.

Definition of the Balance Sheet

Before diving into its limitations, it is important to establish a clear understanding of what exactly a balance sheet is. The balance sheet, also known as the statement of financial position, is a financial statement that provides a snapshot of a company’s financial standing at a specific moment in time.

At its core, the balance sheet follows a fundamental accounting equation: Assets = Liabilities + Shareholders’ Equity. This equation ensures that the balance sheet always remains in balance, hence the name. It reflects the principle that every financial transaction has a dual impact on the company’s financial position, with each transaction affecting both sides of the equation.

The balance sheet is divided into three main components: assets, liabilities, and shareholders’ equity. Assets represent what the company owns or controls, including cash, investments, property, inventory, and accounts receivable. Liabilities, on the other hand, are the company’s obligations or debts, such as loans, accounts payable, and accrued expenses. Shareholders’ equity represents the ownership interest in a company, derived from the initial investment and subsequent earnings or losses.

By presenting these components, the balance sheet provides stakeholders with a clear overview of what the company owns, what it owes, and the residual interest of its owners. It forms the foundation for other financial statements, such as the income statement and cash flow statement, and helps stakeholders assess a company’s financial position, performance, and ability to meet its short-term and long-term obligations.

Now that we have established the definition and purpose of the balance sheet, let us explore its primary limitation and how it can impact the assessment of a company’s financial position.

Purpose and Importance of the Balance Sheet

The balance sheet serves several crucial purposes and holds significant importance in the financial analysis of a company. Understanding its purpose and importance is key to interpreting the financial health and stability of an organization.

First and foremost, the balance sheet provides stakeholders with a comprehensive view of a company’s financial position at a specific point in time. It allows investors, creditors, management, and other interested parties to assess the company’s liquidity, solvency, and overall financial stability. By evaluating the asset and liability composition, stakeholders can make informed decisions about investing, lending, or partnering with the company.

Furthermore, the balance sheet enables stakeholders to analyze a company’s capital structure and financing decisions. It shows the mix between debt and equity, indicating the level of financial risk and leverage employed by the organization. This information is valuable for creditors in assessing the company’s ability to repay its debts and for investors in evaluating their potential returns and risks.

The balance sheet also plays a crucial role in monitoring a company’s performance and growth over time. By examining the changes in asset and liability values from one period to another, stakeholders can identify trends, such as increasing sales, rising debt levels, or changes in working capital. This analysis can help identify potential strengths, weaknesses, and areas of improvement within the company.

Moreover, the balance sheet aids in determining the value of a company’s net assets or shareholders’ equity. This is a vital consideration for shareholders and potential investors as it signifies the residual value that would be distributed among them in the event the company is liquidated.

Overall, the balance sheet provides transparency and accountability in financial reporting, ensuring that companies accurately represent their financial position to stakeholders. It serves as the foundation for financial analysis and decision-making, providing valuable insights into a company’s financial health, performance, and long-term viability.

Now that we understand the purpose and importance of the balance sheet, let us delve into its components to gain a deeper understanding of its construction and the information it provides.

Components of the Balance Sheet

The balance sheet is divided into three main components: assets, liabilities, and shareholders’ equity. Each component provides valuable information about a company’s financial resources, obligations, and ownership interests.

1. Assets: Assets represent what the company owns or controls. This includes both current and non-current assets. Current assets are those that can be easily converted into cash within a year, such as cash and cash equivalents, accounts receivable, inventory, and short-term investments. Non-current assets, on the other hand, are long-term assets that provide value to the company over an extended period, such as property, plant, and equipment, long-term investments, and intangible assets.

2. Liabilities: Liabilities represent the company’s obligations or debts. Like assets, liabilities are also categorized as current and non-current. Current liabilities are expected to be settled within a year and include items such as accounts payable, short-term loans, and accrued expenses. Non-current liabilities, also known as long-term liabilities, have longer repayment terms and include items like long-term debt, deferred taxes, and pension obligations.

3. Shareholders’ equity: Shareholders’ equity, also known as owners’ equity or stockholders’ equity, represents the residual interest in the company after deducting liabilities from assets. It includes various components such as share capital, retained earnings, and additional paid-in capital. Shareholders’ equity reflects the amount of capital invested by shareholders, as well as earnings accumulated over time through profits or losses.

The relationship among these components is represented by the fundamental accounting equation: Assets = Liabilities + Shareholders’ Equity. This equation ensures that the balance sheet remains balanced, with the total value of assets equaling the sum of liabilities and shareholders’ equity.

By analyzing the components of the balance sheet, stakeholders can gain insights into a company’s liquidity, debt obligations, capital structure, and the value of shareholders’ investments. It provides a holistic view of the company’s financial resources, liabilities, and ownership, enabling stakeholders to assess its financial health and make informed decisions.

Now that we have explored the components of the balance sheet, it is important to recognize its primary limitation and understand how it can impact the overall assessment of a company’s financial position.

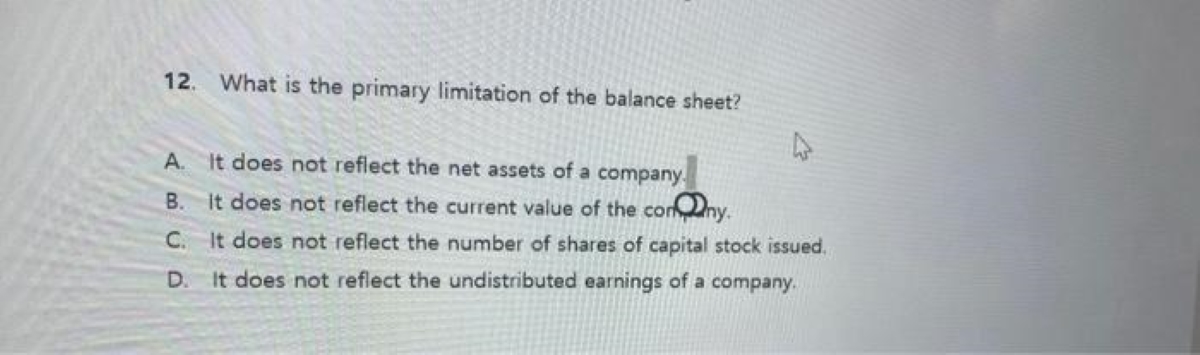

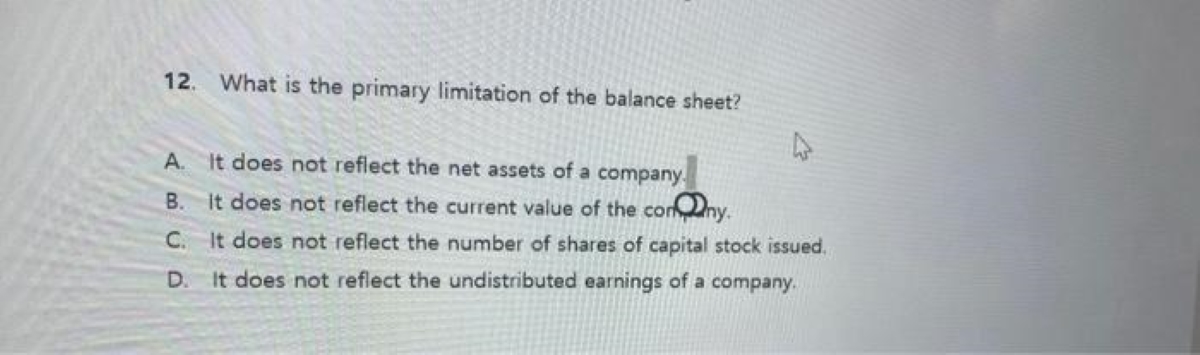

Primary Limitation of the Balance Sheet

While the balance sheet is a valuable tool for assessing a company’s financial position, it does have a primary limitation. This limitation lies in the fact that the balance sheet only provides a snapshot of the company’s financial position at a specific point in time.

Unlike the income statement, which captures a company’s financial performance over a period of time, the balance sheet does not portray the dynamic nature of a company’s operations. It does not reflect the changes in assets and liabilities that occur between balance sheet reporting dates.

This limitation means that the balance sheet may not accurately represent a company’s current financial position if significant changes have occurred since the reporting date. For example, if a company recently acquired new assets or incurred substantial liabilities after the balance sheet date, these changes would not be reflected in the current balance sheet.

An additional aspect to consider is that the balance sheet does not provide insights into the future prospects of a company. It does not capture potential changes that could have an impact on the company’s financial position, such as upcoming investments, changes in market conditions, or shifts in customer preferences.

Moreover, the balance sheet does not reflect the value of intangible assets, such as brand reputation, intellectual property, or human capital, which can be crucial drivers of a company’s success and future earnings potential.

Furthermore, the balance sheet relies heavily on historical cost accounting, which may not reflect the current market value of assets. For instance, the balance sheet may show the value of property and equipment at their original cost, even if their market value has significantly changed over time. This can distort the true economic value of a company’s assets.

It is important to acknowledge these limitations and use the balance sheet in conjunction with other financial statements and analysis techniques to obtain a more comprehensive understanding of a company’s financial position. Techniques such as cash flow analysis, ratio analysis, and trend analysis can provide additional insights to complement the information presented in the balance sheet.

In summary, the primary limitation of the balance sheet is that it provides a static snapshot of a company’s financial position at a specific point in time, which may not reflect the current or future state of the business. However, when used in conjunction with other financial analysis tools, the balance sheet remains a valuable resource for assessing a company’s financial health.

Conclusion

The balance sheet is a fundamental financial statement that provides stakeholders with valuable insights into a company’s financial position, capital structure, and ownership interests. It plays a crucial role in assessing liquidity, solvency, and overall financial stability. However, it is important to recognize the primary limitation of the balance sheet.

The limitation lies in the fact that the balance sheet only provides a snapshot of the company’s financial position at a specific point in time. It does not capture the dynamic nature of a company’s operations or factors that could impact its future financial position and prospects. Additionally, it may not accurately reflect the market value of assets or intangible assets that contribute to a company’s value.

Despite this limitation, the balance sheet remains a valuable tool, especially when used in conjunction with other financial statements and analysis techniques. By analyzing trends, ratios, and cash flow data, stakeholders can gain a more comprehensive understanding of a company’s financial health and performance.

It is essential for stakeholders to interpret the balance sheet in conjunction with other financial information, take into account any changes that occurred after the reporting date, and consider the potential impact of future events. This holistic approach will enable stakeholders to make well-informed decisions and assessments of a company’s financial position.

In conclusion, while the balance sheet has its limitations, it remains an integral part of financial analysis and provides a foundation for assessing a company’s financial health. By understanding its purpose, components, and limitations, stakeholders can make more informed decisions and gain a better understanding of a company’s financial position.