Home>Finance>Where To Find Capital Structure Of Company On Financial Statements

Finance

Where To Find Capital Structure Of Company On Financial Statements

Modified: December 29, 2023

Looking for the capital structure of a company? Learn how to find it on financial statements and understand its significance in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Capital Structure

- Importance of Capital Structure Analysis

- Components of Capital Structure

- Debt-to-Equity Ratio

- Debt Ratio

- Equity Ratio

- Debt-to-Asset Ratio

- Capital Structure on the Balance Sheet

- Capital Structure on the Income Statement

- Capital Structure on the Statement of Cash Flows

- Limitations of Capital Structure Analysis

- Conclusion

Introduction

When analyzing a company’s financial health, understanding its capital structure is vital. The capital structure refers to the way a company finances its operations through a combination of debt and equity. It represents the proportion of different sources of financing used by the company and plays a crucial role in its overall financial stability and risk profile.

Capital structure analysis allows investors and stakeholders to evaluate how a company funds its operations and how it manages its financial obligations. It provides insights into the company’s solvency, liquidity, and ability to generate profits. By examining the capital structure, investors can make informed decisions about the company’s financial health and its capacity to weather economic downturns.

Understanding the components of the capital structure is essential in comprehending how a company raises funds and allocates them into different financial instruments. The capital structure typically consists of debt and equity, with each source having its unique characteristics and implications.

In this article, we will delve into the various components of capital structure and how they are reflected in a company’s financial statements. By exploring the key ratios and indicators used to analyze capital structure, we aim to provide a comprehensive understanding of where to find the capital structure of a company on its financial statements.

Understanding Capital Structure

Capital structure refers to the way a company finances its operations and activities by using a combination of debt and equity. It represents the mix of long-term debt, short-term debt, and equity that a company employs to support its operations, investments, and expansion.

Debt is borrowed money that a company must repay over a specified period, usually with interest. It can include loans, bonds, and other forms of debt issued by the company to raise funds. Equity, on the other hand, represents ownership in the company and is obtained through the sale of shares to investors.

The capital structure of a company is significant, as it affects its financial standing, risk level, and ability to raise capital. The mix of debt and equity has several implications for investors, creditors, and management.

Firstly, the capital structure determines the level of financial risk for the company. A higher proportion of debt in the capital structure indicates a higher risk, as the company has greater financial obligations to meet. In contrast, a higher proportion of equity provides a cushion against financial distress since equity holders bear the risk of losses.

Secondly, the capital structure affects the cost of capital for the company. The cost of debt is the interest rate paid to lenders, while the cost of equity is the return expected by shareholders. By balancing the mix of debt and equity, companies aim to minimize the average cost of capital and maximize shareholder value.

Lastly, the capital structure influences the company’s ability to raise funds in the future. A company with a strong capital structure and a good track record can attract investors and creditors more easily. Conversely, a weak capital structure characterized by excessive debt or a lack of equity may hinder the company’s ability to access funds for growth or investment opportunities.

Understanding the capital structure is essential for investors, as it allows them to evaluate the financial risks and returns associated with investing in a company. By analyzing the capital structure, investors can assess the company’s leverage, profitability, and financial stability, helping them make informed investment decisions.

Importance of Capital Structure Analysis

Capital structure analysis plays a crucial role in understanding the financial health and stability of a company. By examining the capital structure, investors and stakeholders can gain insights into how a company funds its operations and manages its financial obligations. Here are some key reasons why capital structure analysis is important:

1. Assessing Risk: Capital structure analysis helps in evaluating the risk associated with a company’s financing choices. Companies with a high proportion of debt in their capital structure may be more vulnerable to economic downturns or changes in interest rates. On the other hand, companies with a well-balanced mix of debt and equity may have a lower risk profile and better resilience in challenging times.

2. Evaluating Financial Stability: The capital structure provides insights into a company’s ability to meet its financial obligations. A company with a balanced capital structure, diversified financing sources, and manageable debt levels is generally considered financially stable. Conversely, a company with excessive debt or an unstable capital structure may face difficulties in repaying its debts and maintaining its financial stability.

3. Understanding Cost of Capital: The capital structure affects a company’s cost of capital, which refers to the average rate of return required by investors for investing in the company. By analyzing the capital structure, investors can assess the company’s ability to generate returns that exceed its cost of capital. This information is critical for evaluating the company’s profitability and potential for future growth.

4. Evaluating Financial Flexibility: The capital structure of a company can impact its financial flexibility. A company with a strong capital structure and adequate equity may have more options for raising funds, such as issuing new shares or obtaining favorable loan terms. On the other hand, a company with a weak capital structure may face limitations in accessing capital, which can hinder its growth and expansion plans.

5. Comparative Analysis: Capital structure analysis allows for the comparison of companies within the same industry or sector. By comparing the capital structures of different companies, investors can identify patterns, trends, and best practices. This information can assist in making informed investment decisions based on the relative financial health and risk profiles of the companies.

Overall, capital structure analysis is essential for evaluating a company’s financial health, risk profile, and growth potential. It provides crucial insights into how a company finances its operations and manages its financial obligations, allowing investors to make informed decisions about investing in the company’s stock or bonds.

Components of Capital Structure

The capital structure of a company is composed of various components that represent the mix of financing sources used to support its operations. Understanding these components is crucial in analyzing how a company raises funds and allocates them within its financial structure. Here are the key components of capital structure:

1. Debt: Debt is a component of capital structure that represents borrowed funds that a company must repay over time, typically with interest. This can include bank loans, bonds, lines of credit, and other forms of debt issued by the company. Debt allows a company to access funds for investment or expansion, but it also creates financial obligations and interest expenses.

2. Equity: Equity represents ownership in a company and is obtained through the sale of shares to investors. It represents the residual interest in the company’s assets after deducting liabilities. Equity holders have ownership rights, including the right to vote on corporate matters and the right to receive a share of profits through dividends. Equity provides a cushion against financial distress and allows companies to raise capital without incurring debt.

3. Preferred Stock: Preferred stock is a form of equity that has characteristics of both debt and equity. It has a fixed dividend rate and priority over common stockholders in receiving dividends. Preferred stockholders do not usually have voting rights but have a higher claim on assets in the event of liquidation. Preferred stock is an alternative source of long-term financing for companies.

4. Retained Earnings: Retained earnings are the accumulated profits of a company that are reinvested back into the business instead of being paid out as dividends. It represents the portion of earnings that is retained for future growth, investment, or debt reduction. Retained earnings contribute to the company’s equity capital and are an important component of the capital structure.

5. Convertible Securities: Convertible securities, such as convertible bonds or preferred stock, allow investors to convert their holdings into common equity at a predefined conversion ratio. These securities provide the holder with the option to convert debt or preferred shares into equity based on certain conditions. Convertible securities combine the characteristics of debt and equity in the capital structure.

6. Short-Term Liabilities: Short-term liabilities, such as accounts payable, short-term loans, and accrued expenses, are also considered part of a company’s capital structure. While they are not long-term financing sources, they represent the company’s obligations that need to be settled within a year. These liabilities play a role in assessing the company’s liquidity and short-term financial health.

By understanding the components of capital structure, investors and analysts can gain insights into how a company finances its operations, manages its debt levels, and allocates ownership. The mix of these components determines the financial risk, flexibility, and stability of the company, making capital structure analysis an essential part of evaluating a company’s financial health and investment prospects.

Debt-to-Equity Ratio

The debt-to-equity ratio is a key financial ratio that measures the proportion of a company’s financing that comes from debt compared to equity. It provides insights into the company’s financial leverage and risk profile by analyzing the relationship between its long-term debt and shareholders’ equity.

The formula for calculating the debt-to-equity ratio is:

Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity

A higher debt-to-equity ratio indicates that a company relies more heavily on debt financing, which can increase financial risk and interest expenses. Conversely, a lower ratio suggests a higher proportion of equity financing, which may imply a better financial position and lower risk.

The debt-to-equity ratio is used by investors, creditors, and analysts to assess a company’s capital structure and financial health. Here are some key points to consider when analyzing the debt-to-equity ratio:

1. Industry Comparison: The debt-to-equity ratio should be viewed in the context of the industry in which the company operates. Different industries have varying levels of debt tolerance and capital structure preferences. It is important to compare the ratio with industry benchmarks for a more meaningful analysis.

2. Trends Over Time: Monitoring the trend in the debt-to-equity ratio helps to identify changes in a company’s capital structure over time. If the ratio consistently increases, it may indicate higher financial risk or a shift towards more debt financing. On the other hand, a decreasing ratio may suggest a reduction in debt or an increase in equity, improving the company’s financial position.

3. Comparison to Competitors: Comparing the debt-to-equity ratio with competitors provides insights into the company’s relative financial leverage and risk. A significantly higher ratio compared to peers could suggest higher risk exposure or inefficient capital management.

4. Impact on Financial Stability: A high debt-to-equity ratio may make a company more vulnerable to economic downturns, interest rate fluctuations, or changes in credit conditions. It could indicate a higher probability of financial distress or difficulties in meeting debt obligations. Conversely, a low ratio reflects a higher level of financial stability and resilience.

5. Investor Perspective: Investors use the debt-to-equity ratio to evaluate the risk-return tradeoff. Higher leverage can lead to higher potential returns but also increases the risk of financial distress. Investors with a conservative risk appetite may prefer companies with lower debt-to-equity ratios.

Overall, the debt-to-equity ratio provides a snapshot of a company’s capital structure and its financing choices. It is an important metric for assessing financial leverage, risk exposure, and long-term solvency. By analyzing this ratio, investors can gain valuable insights into a company’s financial stability and make better-informed investment decisions.

Debt Ratio

The debt ratio is a financial ratio that measures the proportion of a company’s assets that are financed through debt. It provides insights into the company’s overall debt burden and its ability to meet its financial obligations. The debt ratio is calculated by dividing the total debt of the company by its total assets.

The formula for calculating the debt ratio is:

Debt Ratio = Total Debt / Total Assets

A higher debt ratio indicates that a larger portion of the company’s assets is financed through debt, indicating higher financial leverage and potentially higher financial risk. On the other hand, a lower debt ratio suggests a lower reliance on debt financing and a higher proportion of assets funded by equity.

When analyzing the debt ratio, it’s important to consider the following points:

1. Debt Capacity: The debt ratio helps assess a company’s debt capacity, revealing its ability to take on additional debt or repay existing debts using its assets. A higher debt ratio may indicate a company’s limited capacity to take on further debt and may have difficulty securing more financing.

2. Comparison to Industry Averages: Comparing the company’s debt ratio to the industry average helps to evaluate its relative level of debt. Industries differ in terms of debt tolerance and capital structure norms, so it’s important to benchmark the ratio against industry peers to gain a meaningful understanding.

3. Trends Over Time: Monitoring the trend in the debt ratio over time provides insights into the company’s changing capital structure and financing decisions. A decreasing ratio may indicate a reduction in debt or an increase in equity financing, while an increasing ratio may suggest a shift towards more debt financing or an accumulation of liabilities.

4. Risk Assessment: A higher debt ratio increases the company’s financial risk, as a larger portion of its assets is financed by debt. This implies higher interest expenses and a greater reliance on generating sufficient cash flow to cover debt obligations. An excessive debt ratio increases the risk of default or financial distress in the event of economic downturns or operational challenges.

5. Comparative Analysis: Analyzing the debt ratio of different companies within the same industry can provide insights into their different capital structures and risk profiles. Companies with lower debt ratios may be perceived as more financially stable and less risky, while those with higher debt ratios may be considered riskier investments.

It’s important to note that the optimal debt ratio may vary depending on factors like industry, company size, and growth prospects. While a higher debt ratio implies higher risk, it can also indicate a company’s willingness to leverage debt for growth opportunities. Investors should consider various factors and industry standards when interpreting the debt ratio in their investment analysis.

Equity Ratio

The equity ratio is a financial ratio that measures the proportion of a company’s assets that are financed through equity. It provides insights into the company’s reliance on shareholder investment to fund its operations and growth. The equity ratio is calculated by dividing the total equity of the company by its total assets.

The formula for calculating the equity ratio is:

Equity Ratio = Total Equity / Total Assets

A higher equity ratio indicates a larger proportion of the company’s assets is financed through equity. This implies a lower reliance on debt financing and a higher level of financial security and stability. Conversely, a lower equity ratio suggests a higher reliance on debt funding, which may increase financial risk and interest expenses.

Here are some important points to consider when analyzing the equity ratio:

1. Financial Stability: A higher equity ratio signifies a higher level of financial stability since a larger portion of the company’s assets is funded via shareholders’ investment. This provides a cushion against financial distress and adds confidence to creditors and investors about the company’s long-term solvency.

2. Ownership and Control: Equity represents ownership in the company and provides shareholders with voting rights and potential dividends. Analyzing the equity ratio helps evaluate the degree of control that shareholders have over the company’s decision-making processes. A higher equity ratio may indicate a more shareholder-oriented company.

3. Comparison to Industry Peers: Comparing the equity ratio to industry peers is essential since acceptable levels of equity financing vary by industry. Industries with high capital-intensive requirements, such as manufacturing or infrastructure, may have higher equity ratios compared to service-based industries where intellectual property may be the primary asset.

4. Investor Confidence: Investors often seek companies with a reasonable equity ratio as it suggests a lower financial risk and a higher likelihood of generating stable returns. A healthy equity ratio demonstrates that the company has a substantial financial cushion to absorb potential losses and can navigate economic uncertainties more effectively.

5. Capital Structure Analysis: Analyzing the equity ratio alongside other capital structure ratios like debt-to-equity ratio provides a comprehensive understanding of the company’s financing mix. By examining both debt and equity ratios, investors can determine the company’s capital structure preferences and assess its risk-return tradeoff.

The significance of the equity ratio may vary depending on the company’s growth stage, industry dynamics, and specific circumstances. It’s essential to consider the nature of the business and its capital requirements when interpreting the equity ratio. Furthermore, it is valuable to assess the trend in the equity ratio over time to understand the company’s capital structure changes and their implications on financial stability.

Debt-to-Asset Ratio

The debt-to-asset ratio is a financial ratio that measures the proportion of a company’s assets that are financed through debt. It provides insights into the company’s overall debt burden and the level of risk associated with its financial structure. The debt-to-asset ratio is calculated by dividing the total debt of the company by its total assets.

The formula for calculating the debt-to-asset ratio is:

Debt-to-Asset Ratio = Total Debt / Total Assets

A higher debt-to-asset ratio indicates a higher proportion of a company’s assets are financed by debt. This suggests a higher level of leverage and financial risk, as the company has a significant amount of funding that needs to be serviced. On the other hand, a lower debt-to-asset ratio indicates a lower reliance on debt financing and a higher proportion of assets funded by equity.

Here are some key points to consider when analyzing the debt-to-asset ratio:

1. Financial Risk: The debt-to-asset ratio helps assess the financial risk associated with a company’s capital structure. A higher ratio implies a greater risk of financial distress, as a larger portion of the company’s assets is financed by debt. This increases the company’s vulnerability to economic downturns, interest rate fluctuations, or changes in credit conditions.

2. Industry Comparisons: Comparing the debt-to-asset ratio to industry peers is crucial, as acceptable levels of debt vary by industry. Industries with stable cash flows and low-risk profiles may have lower debt-to-asset ratios, while industries with higher capital requirements or cyclical nature may have higher ratios.

3. Investor Confidence: Investors consider the debt-to-asset ratio when assessing a company’s financial health and investment potential. A higher ratio can indicate higher financial risk, potentially making investors more cautious or demanding higher returns. Conversely, a lower ratio may provide a sense of financial stability and increase investor confidence.

4. Impact on Creditworthiness: The debt-to-asset ratio is an important metric considered by creditors when evaluating a company’s creditworthiness. A high ratio may negatively impact a company’s credit rating, making it more challenging to obtain financing or resulting in higher borrowing costs. Maintaining a reasonable debt-to-asset ratio is crucial for preserving good credit standing.

5. Trends Over Time: Analyzing the trend in the debt-to-asset ratio over time provides insights into a company’s capital structure changes and financial strategy. An increasing ratio may signify a higher reliance on debt financing or a decline in asset values, while a decreasing ratio may indicate efforts to reduce leverage or an increase in asset values.

The debt-to-asset ratio is an important indicator of a company’s financial risk and stability. However, it should be analyzed alongside other financial ratios and factors, such as the company’s profitability, cash flow, and growth prospects, to gain a comprehensive understanding of its overall financial health.

Capital Structure on the Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It reflects the capital structure by presenting the company’s assets, liabilities, and shareholders’ equity. Analyzing the balance sheet helps in understanding how a company finances its operations and the relative proportions of debt and equity in its capital structure.

Here are the key components of the balance sheet that reflect the capital structure:

1. Assets: The assets section of the balance sheet represents what the company owns, including tangible assets like property, equipment, and inventory, as well as intangible assets like patents or trademarks. The composition and value of these assets are critical in determining the overall financial stability and debt capacity of the company.

2. Liabilities: The liabilities section of the balance sheet represents the company’s financial obligations or debts to external parties. It includes both short-term liabilities, such as accounts payable and accrued expenses, and long-term liabilities, such as bonds, loans, or mortgages. The liabilities section reveals the extent of debt financing used by the company and its ability to meet its financial obligations.

3. Shareholders’ Equity: The shareholders’ equity section of the balance sheet reflects the residual interest in the company’s assets after deducting its liabilities. It includes common stock, preferred stock, additional paid-in capital, retained earnings, and other equity components. The shareholders’ equity represents the ownership stake and the portion of the company’s financing that comes from equity investors.

By examining the balance sheet, investors and analysts can gain insights into the company’s capital structure, financial health, and risk exposure. A few key points to consider when analyzing the capital structure on the balance sheet:

1. Debt-to-Equity Ratio: The debt-to-equity ratio can be calculated using the data from the liabilities and shareholders’ equity sections of the balance sheet. This ratio helps evaluate the company’s leverage and risk profile by comparing the proportion of debt financing to equity financing.

2. Asset Composition: The composition of assets on the balance sheet provides information about the company’s capital-intensive investments, liquidity levels, and potential collateral for debt financing. For example, a high proportion of fixed assets may indicate a higher reliance on long-term financing.

3. Working Capital: Working capital, calculated as current assets minus current liabilities, provides insights into the company’s short-term liquidity. It indicates the company’s ability to cover short-term obligations without relying on long-term debt or equity financing.

4. Retained Earnings: The retained earnings account in the shareholders’ equity section reflects the portion of earnings that the company has retained over time. Positive retained earnings indicate profitability and an ability to generate internal funding for growth and debt reduction.

Overall, the balance sheet serves as a crucial source of information to understand the capital structure of a company. It provides an overview of a company’s assets, liabilities, and equity, offering valuable insights into how the company finances its operations and manages its financial obligations.

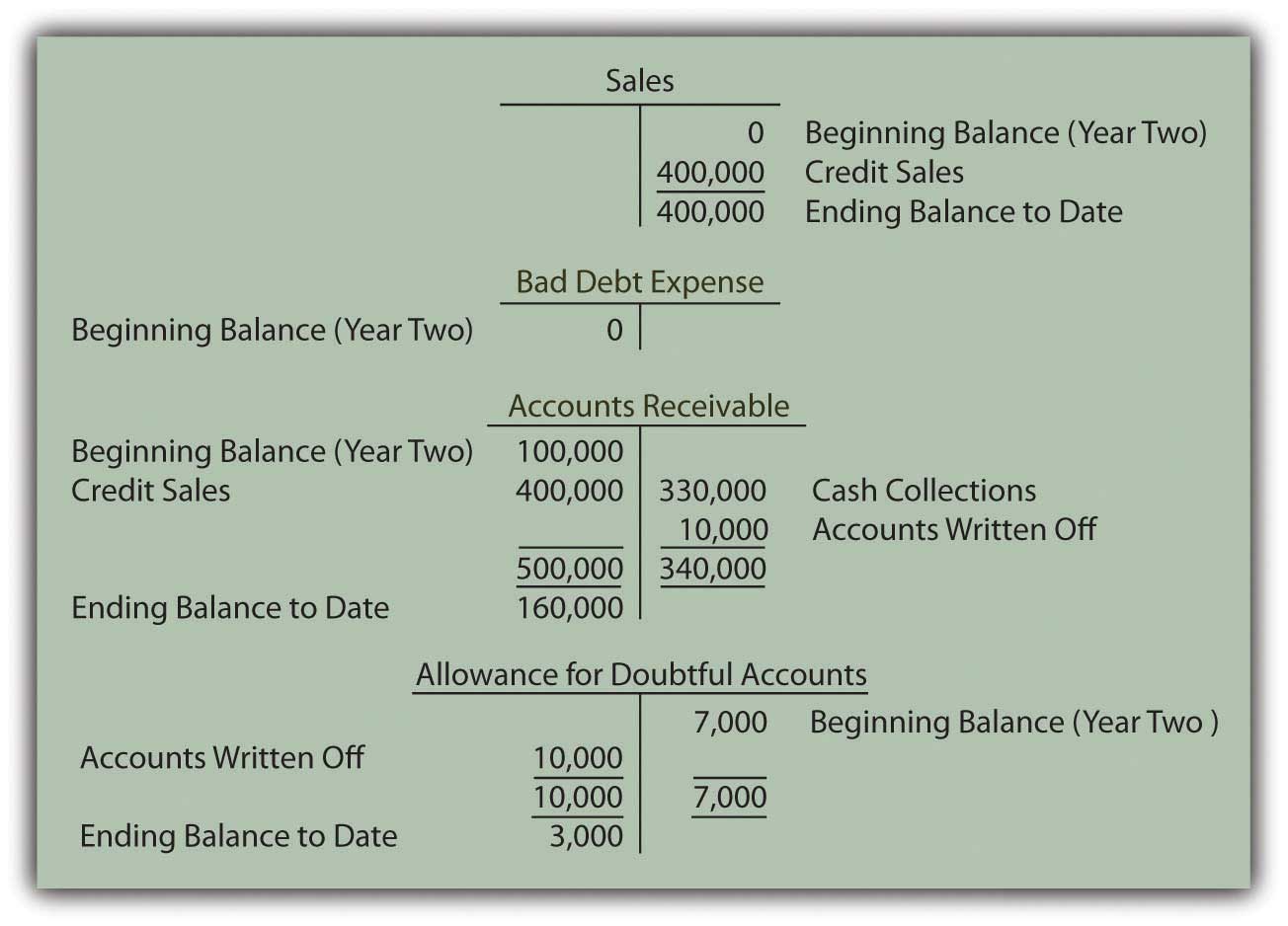

Capital Structure on the Income Statement

The income statement, also known as the statement of operations or profit and loss statement, provides an overview of a company’s financial performance over a specific period. While the income statement primarily focuses on revenues, expenses, and profitability, it also offers insights into how a company’s capital structure impacts its financial results.

Here are some key aspects of the income statement that reflect the capital structure:

1. Revenue: Revenue represents the total income generated by the company through its operational activities. It reflects the company’s ability to generate sales and revenue streams, which play a crucial role in supporting its capital structure by facilitating the repayment of debt or the generation of shareholder returns.

2. Expenses: Expenses encompass the costs incurred by the company in its day-to-day operations. This includes items such as cost of goods sold, marketing expenses, administrative costs, and interest expenses associated with debt financing. The level of expenses influences the profitability and debt-servicing capabilities of the company.

3. Interest Expense: Interest expense is a specific expense category on the income statement that reflects the cost of borrowing funds to finance the company’s operations. It represents the financial cost of debt financing, and a higher interest expense may indicate a higher level of debt in the company’s capital structure.

4. Taxes: Taxes levied on the company’s income are another factor that affects its profitability and cash flows. The income tax expense on the income statement reflects the company’s tax liabilities based on its taxable income. The capital structure can impact the tax burden, particularly if a company takes advantage of debt-related tax deductions or tax credits associated with equity financing.

By analyzing the income statement, investors and analysts can gain insights into how the company’s capital structure influences its financial performance. Consider the following points when examining the capital structure on the income statement:

1. Interest Coverage Ratio: The interest expense on the income statement can be used to calculate the interest coverage ratio. This ratio provides an indication of the company’s ability to meet its interest payments using its operating income. It helps assess the company’s capacity to service its debt obligations.

2. Profitability Analysis: Analyzing the company’s net income and profit margins on the income statement can help evaluate the impact of the capital structure on profitability. A higher interest expense due to greater debt levels may weigh down net income and overall profitability.

3. Operating Cash Flow: The income statement includes information that indirectly impacts cash flows, such as depreciation and amortization expense. By considering these items in conjunction with the capital structure, investors can assess the company’s operating cash flow generation capacity and its ability to fund its debt obligations or invest in growth opportunities.

4. Investor Perspective: Investors analyze the income statement to assess the overall profitability and return potential of a company. The capital structure influences both the risk and return expectations of investors, and understanding its impact on the income statement helps investors make informed investment decisions.

Overall, the income statement provides valuable insights into how the capital structure impacts a company’s financial performance. By examining revenue, expenses, interest expense, and profitability measures, investors can gain a deeper understanding of the relationship between the capital structure and the company’s operational and financial results.

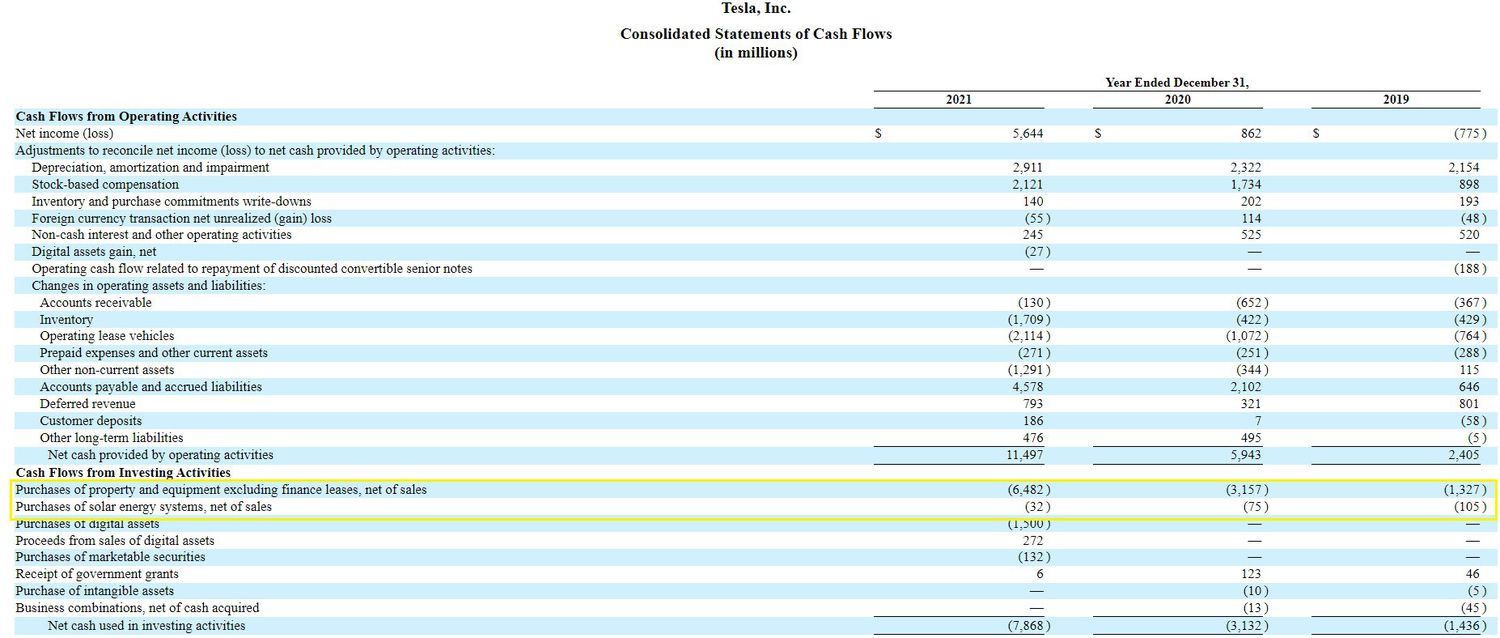

Capital Structure on the Statement of Cash Flows

The statement of cash flows provides a summary of a company’s cash inflows and outflows, categorized into operating, investing, and financing activities. While the primary purpose of the statement of cash flows is to analyze a company’s cash position, it also offers insights into how a company’s capital structure impacts its cash flow generation and financing activities.

Here are key aspects of the statement of cash flows that reflect the capital structure:

1. Operating Activities: The operating activities section of the statement of cash flows represents the cash flows generated or used by the company’s core operations. This includes cash from sales, payments to suppliers, employee salaries, and other operating expenses. The cash flows from operating activities may be influenced by the company’s capital structure, as debt-related interest payments or debt repayment affect cash flows.

2. Investing Activities: The investing activities section reflects the company’s cash flows related to investments in long-term assets, such as property, plant, and equipment, as well as acquisitions or divestitures of subsidiary companies. The capital structure plays a role in financing these investment activities. For example, debt financing may be used to fund acquisitions, or equity financing may provide the necessary funds for capital expenditures.

3. Financing Activities: The financing activities section highlights the cash flows related to the company’s financing decisions, including borrowing or repayment of debt, issuance or repurchase of equity securities, and payment of dividends. The capital structure directly influences the financing activities as debt financing generates cash inflows, while equity financing or payment of dividends leads to cash outflows.

By analyzing the statement of cash flows, one can gain insights into how the company’s capital structure impacts its cash flow generation and financing decisions. Consider the following points when examining the capital structure on the statement of cash flows:

1. Cash Flow from Financing Activities: By reviewing the cash flow from financing activities, investors can assess the extent to which the company relies on debt or equity financing. Large cash flows from debt financing may indicate a higher debt component in the capital structure, while significant equity financing could suggest a more equity-driven capital structure.

2. Cash Flow from Interest and Dividend Payments: The statement of cash flows provides information about the cash flows from interest payments on debt and dividend payments to equity shareholders. This allows investors to evaluate the impact of the company’s capital structure on its ability to generate cash flows to service its financial obligations and distribute returns to shareholders.

3. Free Cash Flow: Free cash flow, calculated using information from the statement of cash flows and the balance sheet, is an important metric that reflects the amount of cash generated by the company from operations after accounting for capital expenditures. Analyzing free cash flow in relation to the capital structure helps assess the company’s ability to generate excess cash flow to fund growth, reduce debt, or distribute dividends.

4. Cash Flow Adequacy: Reviewing the statement of cash flows can help determine whether the company’s cash flows are adequate to cover its operating, investing, and financing activities. An imbalance between cash inflows and outflows may indicate potential cash flow challenges arising from the company’s capital structure and its impact on cash flows.

Overall, the statement of cash flows offers valuable insights into how a company’s capital structure impacts its cash flow generation and financing activities. By examining the operating, investing, and financing activities sections, investors can assess the company’s cash flow adequacy, debt servicing capacity, and ability to fund growth initiatives or distribute returns to shareholders.

Limitations of Capital Structure Analysis

While capital structure analysis provides valuable insights into a company’s financial health and risk profile, it is important to recognize its limitations. Here are some key limitations to consider:

1. Industry Variations: Different industries have varying levels of debt tolerance and capital structure preferences. Comparing the capital structure of companies across industries may not provide an accurate basis for evaluation. It is crucial to consider industry norms and standards when analyzing a company’s capital structure.

2. Timing and Context: Capital structure analysis represents a snapshot of the company’s financial health at a specific point in time. Changes in the financial markets, economic conditions, or the company’s business strategy can significantly impact its capital structure. It is important to analyze the capital structure in the context of the company’s financial history and broader market dynamics.

3. Debt Classification: Debt classification can vary based on the accounting standards followed by the company. Different categorizations of debt, such as current or long-term, can impact the reported capital structure ratios. It is crucial to understand the specific debt classification methods used by the company and adjust the analysis accordingly.

4. Off-Balance Sheet Items: Capital structure analysis may not capture off-balance sheet items, such as lease obligations, contingent liabilities, or derivative contracts. These items can have significant financial implications and impact the overall risk profile of the company. Investors should consider additional disclosures and supplementary information to gain a comprehensive view of the company’s obligations and risks.

5. Limited Financial Statements: Capital structure analysis relies on the financial information disclosed in the company’s financial statements. However, financial statements have limitations, such as potential errors, management biases, or incomplete disclosures. It is important to exercise caution and cross-verify the financial data with other reliable sources.

6. External Factors: Capital structure analysis does not consider external factors, such as changes in industry dynamics, technological advancements, or regulatory changes, which can impact the company’s future prospects. Investors should look beyond the capital structure analysis and consider a broader range of factors to make informed investment decisions.

7. Future Financial Performance: While capital structure analysis provides insights into a company’s financial position and risk profile, it may not accurately predict future financial performance. External factors, competitive pressures, or management decisions can significantly impact the company’s financial results and ultimately its capital structure.

It is important to recognize these limitations and consider capital structure analysis as one component of a comprehensive evaluation of a company’s financial health and investment potential. By incorporating other financial metrics, industry analysis, and qualitative factors, investors can gain a well-rounded understanding of the company’s overall financial position and risk profile.

Conclusion

Understanding the capital structure of a company is essential for investors, creditors, and stakeholders as it provides insights into how a company finances its operations and manages its financial obligations. By analyzing the components of capital structure and the various financial ratios associated with it, one can gain a comprehensive understanding of a company’s financial health, risk profile, and growth potential.

The debt-to-equity ratio helps assess the level of financial risk by examining the proportion of debt and equity financing. A higher ratio indicates greater reliance on debt and potential higher interest expenses, while a lower ratio suggests a more stable financial position.

The equity ratio provides insights into the extent to which a company relies on equity financing. A higher ratio indicates a healthier capital structure and a lower financial risk, while a lower ratio suggests a higher reliance on debt financing.

The debt ratio measures the proportion of a company’s assets that are financed through debt. It indicates the overall level of debt in the company’s capital structure and provides insights into its debt capacity and risk profile.

The debt-to-asset ratio evaluates the amount of a company’s assets that are supported by debt financing. It sheds light on the overall financial risk associated with the company’s capital structure.

The balance sheet, income statement, and statement of cash flows provide valuable information about a company’s capital structure and its impact on the company’s financial position, profitability, and cash flows.

While capital structure analysis is valuable, it has limitations. Factors such as industry variations, timing and context, debt classification, off-balance sheet items, limited financial statements, external factors, and the inability to predict future financial performance should all be considered.

In conclusion, capital structure analysis is a critical component of evaluating a company’s financial health and risk profile. By considering the different components of capital structure, analyzing financial ratios, and understanding the limitations, investors and stakeholders can make informed decisions about investing in a company and assessing its long-term viability.