Home>Finance>How To Record Employee Retention Credit In Financial Statements

Finance

How To Record Employee Retention Credit In Financial Statements

Modified: March 2, 2024

Learn how to correctly record the Employee Retention Credit in your financial statements, ensuring accurate and compliant reporting. Enhance your finance processes with our expert guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on how to record the Employee Retention Credit in financial statements. As a business owner or financial professional, understanding how to properly account for this credit is crucial for accurate financial reporting. The Employee Retention Credit (ERC) is a valuable tax incentive available under the CARES Act and the Consolidated Appropriations Act for eligible employers who have been adversely impacted by the COVID-19 pandemic. It is designed to provide financial relief and encourage businesses to retain their employees.

While the ERC provides significant benefits to eligible employers, it is important to understand how to accurately document it in your financial statements. This entails recognizing the credit on your income statement, properly disclosing it in your footnotes, and incorporating it into your overall financial reporting. By correctly recording the ERC, you can ensure compliance with accounting standards and provide transparency to stakeholders.

In this article, we will guide you through the process of recording the Employee Retention Credit in your financial statements. We will explore how to account for the credit on your income statement, balance sheet, and cash flow statement. Additionally, we will discuss the importance of proper disclosures and notes to enhance the understanding of the credit’s impact on your financial position.

While the specific requirements for recording the Employee Retention Credit may vary depending on your organization’s accounting policies and practices, this guide will provide a general framework to help you navigate the process effectively.

Without further ado, let’s dive into the details of how to record the Employee Retention Credit in your financial statements.

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) is a tax incentive introduced as part of the CARES Act in response to the economic impact of the COVID-19 pandemic. It provides eligible employers with a refundable tax credit for retaining employees during the crisis. The credit was later extended and expanded by the Consolidated Appropriations Act.

The purpose of the ERC is to encourage businesses to keep their workforce employed, even in the face of economic uncertainty. By providing financial relief to eligible employers, the credit aims to mitigate the need for layoffs, furloughs, or pay cuts.

To qualify for the Employee Retention Credit, employers must meet certain criteria. One of the primary eligibility requirements is that the business experienced a significant decline in gross receipts or was subject to a full or partial suspension of operations due to a government order related to COVID-19.

The amount of the credit is calculated based on a percentage of qualified wages paid to employees during the eligible periods. For businesses with less than 100 full-time employees, all wages qualify for the credit, whether the employees are working or not. For businesses with more than 100 full-time employees, only wages paid to employees who are not providing services due to COVID-19-related reasons are eligible for the credit.

It is important to note that the Employee Retention Credit is refundable, meaning that if the credit exceeds the employer’s total tax liability, the excess will be refunded to the employer. This makes the credit particularly valuable for businesses facing financial challenges.

Overall, the Employee Retention Credit provides a significant opportunity for eligible employers to offset their payroll tax liabilities and improve their cash flow during these challenging times. By understanding the intricacies of this credit, businesses can take full advantage of the financial benefits it offers, helping to alleviate some of the economic burdens caused by the pandemic.

Understanding Financial Statements

Financial statements are essential tools for businesses to communicate their financial performance and position to external stakeholders such as investors, creditors, and regulators. These statements provide a snapshot of a company’s financial health and help analyze its overall financial performance. Understanding the components of financial statements is crucial for accurate and transparent reporting of the Employee Retention Credit.

The three main financial statements are the income statement, the balance sheet, and the cash flow statement. Each statement serves a specific purpose and provides valuable insights into different aspects of a company’s operations.

The income statement, also known as the profit and loss statement, shows a company’s revenues, expenses, and net income or loss over a specific period. It reflects the financial performance of a business by detailing its revenue streams, cost of goods sold, operating expenses, and other income or expenses. Reporting the Employee Retention Credit on the income statement involves recognizing the credit as a reduction in payroll expenses.

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and shareholders’ equity. The balance sheet is important for disclosing any liabilities or obligations related to the Employee Retention Credit, such as potential tax liabilities, deferred tax assets, or other related accounts.

The cash flow statement tracks the inflows and outflows of cash and cash equivalents over a period of time. It categorizes cash flows into operating activities, investing activities, and financing activities. While the Employee Retention Credit doesn’t directly impact the cash flow statement, it may indirectly affect cash flows by reducing payroll expenses and improving cash flow stability for eligible employers.

In addition to the main financial statements, businesses are also required to provide relevant disclosures and notes to the financial statements. These disclosures help provide additional context and details about various financial transactions and events. Including appropriate disclosures about the Employee Retention Credit in the footnotes is crucial to ensure transparency and compliance with accounting standards.

Understanding how the Employee Retention Credit impacts these financial statements is essential for accurate and transparent financial reporting. By effectively recording and disclosing the credit in the appropriate financial statements, businesses can provide a clearer picture of their financial performance and position to stakeholders and ensure compliance with accounting guidelines.

Recording the Employee Retention Credit in Financial Statements

Recording the Employee Retention Credit in financial statements involves properly accounting for the credit’s impact on the income statement, balance sheet, and cash flow statement. It is important to accurately reflect the credit in these statements to provide a clear representation of the financial effects of the credit.

Let’s explore how the Employee Retention Credit is recorded in each of these financial statements:

Income Statement

The income statement reflects a company’s revenues, expenses, and net income or loss. To record the Employee Retention Credit, the credit amount should be recognized as a reduction in payroll expenses in the income statement. This reduces the total expense and increases the net income or reduces the net loss for the period.

For example, if a company had $100,000 in qualified wages and a corresponding Employee Retention Credit of $50,000, the payroll expense would be reduced by $50,000, resulting in a lower total expense and potentially higher net income or reduced net loss.

Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. When recording the Employee Retention Credit in the balance sheet, it is important to consider any tax-related implications.

If the credit is expected to result in a reduction in a tax liability, it should be recorded as a receivable in the current assets section of the balance sheet. This reflects the expected cash inflow from the credit in the future.

Conversely, if the credit is recognized as a reduction in a tax expense already paid, it should be recorded as a reduction in the corresponding tax liability under current liabilities. This reflects the decrease in the company’s obligation to pay taxes.

Cash Flow Statement

The cash flow statement provides information about a company’s cash inflows and outflows during a specific period. While the Employee Retention Credit itself doesn’t typically directly impact the cash flow statement, it can indirectly affect cash flows by reducing payroll expenses.

By reducing payroll expenses, the Employee Retention Credit can improve cash flow stability for eligible employers. This can be reflected in the operating activities section of the cash flow statement, where the reduction in expenses due to the credit can be shown as a positive impact on cash flow.

Disclosures and Notes to Financial Statements

In addition to properly recording the Employee Retention Credit in the financial statements, businesses are also required to provide relevant disclosures and notes to enhance the understanding of the credit’s impact.

These disclosures should include information about the eligibility criteria, calculation methodology, and any potential limitations or uncertainties surrounding the credit. The purpose is to provide transparency and ensure compliance with accounting standards.

By effectively recording the Employee Retention Credit in the appropriate financial statements and providing necessary disclosures, businesses can accurately reflect the financial impact of the credit and provide stakeholders with a clear understanding of its effects on the company’s financial position.

Income Statement

The income statement, also known as the profit and loss statement, is a financial statement that shows a company’s revenues, expenses, and net income or loss over a specific period. When recording the Employee Retention Credit in the income statement, it is important to properly recognize the credit as a reduction in payroll expenses.

To accurately reflect the impact of the Employee Retention Credit on the income statement, follow these steps:

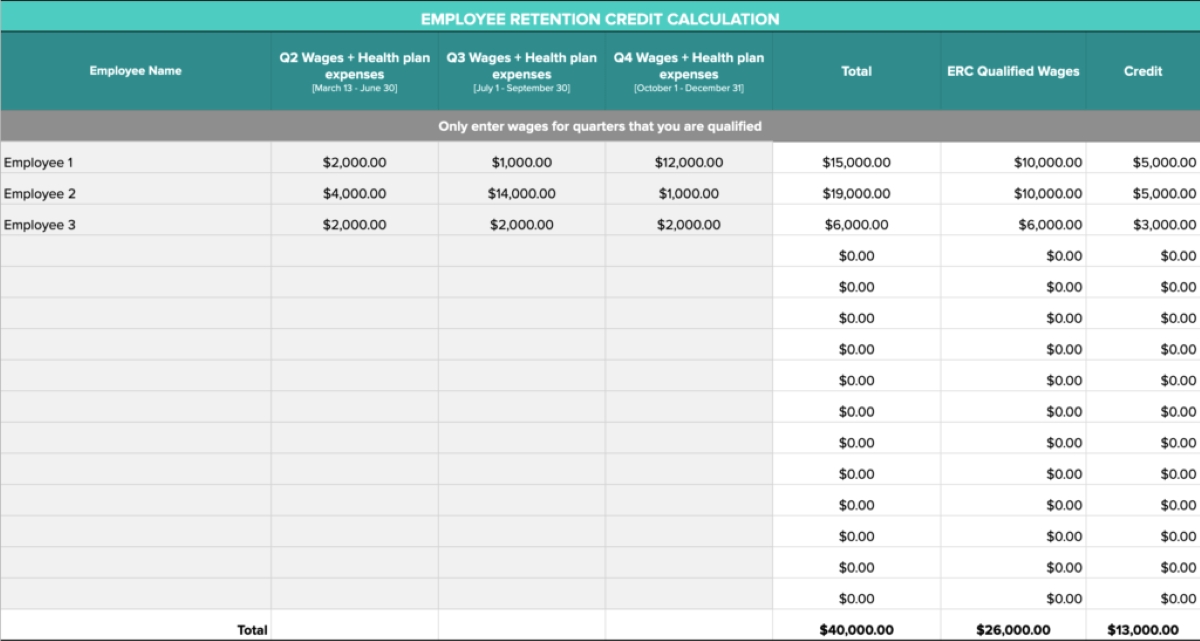

- Identify qualified wages: Determine the portion of wages that qualifies for the Employee Retention Credit. The credit is generally calculated based on wages paid to eligible employees during specific periods. Take into account any limitations or restrictions on eligible wages based on the number of full-time employees.

- Calculate the credit amount: The Employee Retention Credit is generally a percentage of qualified wages, subject to certain limitations. Calculate the credit amount based on the applicable percentage determined by the specific legislation in force.

- Recognize the credit as a reduction in expenses: Once the credit amount is determined, record it as a reduction in payroll expenses in the income statement. This reduces the total expense amount for the period and can potentially increase the net income or reduce the net loss.

For example, suppose a business had $200,000 in qualified wages and a corresponding Employee Retention Credit of $50,000. In this case, the payroll expenses would be reduced by the credit amount, resulting in a lower total expense. If the total expenses (excluding the credit) were $300,000, the new total expense would be $250,000 after subtracting the credit. As a result, the net income for the period would increase by $50,000.

It is important to properly document the Employee Retention Credit in the income statement to provide an accurate representation of the company’s financial performance. This ensures transparency and compliance with accounting standards.

Additionally, it is essential to provide appropriate disclosures in the footnotes of the financial statements to explain the nature and impact of the Employee Retention Credit on the income statement. These disclosures should include information about the credit calculation, eligibility criteria, and any potential limitations or uncertainties associated with the credit.

By accurately recording the Employee Retention Credit in the income statement and providing relevant disclosures, businesses can provide stakeholders with a clear understanding of the credit’s impact on the company’s financial performance during the specified period.

Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. When recording the Employee Retention Credit in the balance sheet, it is important to consider any tax-related implications and reflect the impact on the company’s obligations and assets.

To accurately account for the Employee Retention Credit in the balance sheet, follow these steps:

- Identify the tax liability or tax expense: Determine the tax liability or tax expense related to the period in question. This will depend on the specific tax laws and regulations applicable to your business.

- Recognize the credit as a receivable (or reduction in liability): If the Employee Retention Credit is expected to result in a reduction in a tax liability, record it as a receivable in the current assets section of the balance sheet. This reflects the expected cash inflow from the credit in the future.

- Disclose tax-related liabilities or obligations: If the credit is recognized as a reduction in a tax expense already paid, it should be recorded as a reduction in the corresponding tax liability under current liabilities. This reflects the decrease in the company’s obligation to pay taxes.

For example, if a company expects to receive a credit of $50,000 based on the Employee Retention Credit, it should be recorded as a receivable in the current assets section of the balance sheet. This indicates that the company expects to receive this amount as a refund in the future, improving its financial position.

It is important to provide appropriate disclosures in the footnotes of the financial statements to explain the nature and impact of the Employee Retention Credit on the balance sheet. These disclosures should include information about any tax-related receivables, liabilities, or obligations associated with the credit.

By accurately recording the Employee Retention Credit in the balance sheet and providing necessary disclosures, businesses can provide stakeholders with a clear understanding of the credit’s impact on the company’s financial position at a specific point in time.

It is recommended to consult with a qualified tax professional or accountant to ensure compliance with specific tax regulations and accounting guidelines when recording the Employee Retention Credit in the balance sheet.

Cash Flow Statement

The cash flow statement is a financial statement that provides information about a company’s cash inflows and outflows during a specific period. While the Employee Retention Credit itself doesn’t typically directly impact the cash flow statement, it can indirectly affect cash flows by reducing payroll expenses and improving cash flow stability for eligible employers.

When analyzing the impact of the Employee Retention Credit on the cash flow statement, consider the following points:

- Operating Activities: The reduction in payroll expenses due to the Employee Retention Credit can be reflected in the operating activities section of the cash flow statement. This reduction in expenses improves the cash flow stability for eligible employers, as less cash is flowing out of the business for wages and related payroll costs.

- Investing and Financing Activities: The Employee Retention Credit itself does not directly impact investing and financing activities, as it relates more to operational expenses. However, any additional cash flow stability provided by the credit may indirectly impact investment decisions or financing activities by improving the company’s overall financial position.

It is important to note that the specific cash flow impact of the Employee Retention Credit will depend on the unique circumstances of each business. Factors such as the credit amount, timing of payments, and other cash flow inflows and outflows need to be evaluated on a case-by-case basis.

While the cash flow statement does not directly capture the credit itself, it plays a crucial role in providing a holistic view of a company’s cash position and how cash is generated, used, and invested within the business.

When presenting the cash flow statement, it is essential to provide appropriate disclosures in the footnotes of the financial statements. These disclosures should explain any cash flow implications related to the Employee Retention Credit and its impact on the overall cash flow stability of the business.

By understanding the indirect effects of the Employee Retention Credit on cash flows and ensuring proper disclosures, businesses can communicate the credit’s impact on their cash flow statement to stakeholders and provide a comprehensive picture of their financial position.

Disclosures and Notes to Financial Statements

Disclosures and notes to the financial statements are an integral part of financial reporting and provide additional context and details about various financial transactions and events. Including appropriate disclosures about the Employee Retention Credit is crucial to ensure transparency and compliance with accounting standards.

When preparing the disclosures and notes related to the Employee Retention Credit, consider the following:

- Eligibility criteria: Clearly explain the eligibility criteria that the business met to qualify for the Employee Retention Credit. This may include the requirements related to significant decline in gross receipts or full or partial suspension of operations due to COVID-19.

- Calculation methodology: Provide detailed information about how the credit amount was calculated. Explain the percentage of qualified wages used, any limitations or restrictions, and any other relevant factors considered in the calculation process.

- Timing: Disclose the periods to which the Employee Retention Credit pertains. Specify the start and end dates of the periods during which the credit was earned and any adjustments made in subsequent reporting periods.

- Impact on financial statements: Describe the impact of the Employee Retention Credit on the income statement, balance sheet, and cash flow statement. Provide a clear explanation of how the credit is reflected in each of these financial statements.

- Tax considerations: Disclose any tax-related implications associated with the credit, such as changes in deferred tax assets or liabilities, potential tax carrybacks or carryforwards, or any other tax-related accounts affected by the credit.

- Risks and uncertainties: Address any potential risks or uncertainties related to the Employee Retention Credit. This may include uncertainties regarding the eligibility criteria, changes in legislation, or audit implications.

By including comprehensive and transparent disclosures and notes, businesses provide stakeholders with a deeper understanding of the Employee Retention Credit’s impact on the financial statements. These disclosures help ensure compliance with accounting standards and foster trust and confidence among investors, creditors, and regulators.

It is important to consult with accounting professionals or experts to tailor the disclosures and notes to the specific circumstances of your business. They can provide guidance on the relevant accounting principles and disclosure requirements applicable to your situation.

Remember, accurate and meaningful disclosures and notes provide stakeholders with the necessary information to evaluate the financial position and performance of your business, including the effects of the Employee Retention Credit.

Conclusion

Properly recording and reporting the Employee Retention Credit in financial statements is crucial for businesses to accurately reflect the credit’s impact and comply with accounting standards. By following the guidelines outlined in this comprehensive guide, you can ensure that your financial statements provide a transparent and accurate representation of the credit’s effect on your company’s financial position and performance.

The Employee Retention Credit, introduced in response to the economic challenges brought about by the COVID-19 pandemic, serves as a valuable tax incentive for eligible employers. Understanding the criteria for eligibility, calculating the credit amount, and properly recording it in the financial statements are essential steps for effective financial reporting.

Throughout this guide, we have discussed how to record the credit in the income statement, reflecting it as a reduction in payroll expenses, as well as its implications for the balance sheet and cash flow statement. We’ve also emphasized the importance of including accurate disclosures and notes to provide additional details and context about the credit’s impact.

By taking the time to understand and implement proper accounting practices, businesses can provide stakeholders with a clear understanding of the Employee Retention Credit and its impact on financial statements. Transparent financial reporting builds trust and confidence among investors, lenders, and other external parties who rely on these statements to make informed decisions.

It is important to note that the specific requirements and guidelines for recording the Employee Retention Credit may vary based on your organization’s accounting policies and the applicable tax regulations. Therefore, it is recommended to consult with accounting professionals or experts to ensure compliance and accuracy in your financial reporting.

In conclusion, maintaining thorough and accurate financial records regarding the Employee Retention Credit not only helps businesses manage their tax obligations but also enhances their financial transparency and accountability. By following the proper procedures and guidelines discussed in this guide, businesses can effectively document the credit in their financial statements, providing stakeholders with a comprehensive understanding of its impact on the company’s financial performance and position.