Finance

When Does Employee Retention Credit Expire

Published: January 10, 2024

Learn about the expiration date of the Employee Retention Credit in the finance industry. Stay informed about important financial updates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Employee Retention Credit (ERC) has become an important financial resource for businesses during the challenging times brought about by the COVID-19 pandemic. This tax credit, introduced as part of the CARES Act in March 2020, aims to provide financial assistance to businesses that have experienced significant disruptions due to the pandemic, encouraging them to retain their employees.

The Employee Retention Credit offers eligible employers the opportunity to receive a refundable tax credit for a percentage of qualified wages paid to employees. The credit is designed to help businesses keep employees on payroll, even if work hours are reduced or operations are suspended altogether.

As businesses navigate the uncertainty of the ongoing pandemic and the economic recovery process, it’s essential to understand the timeline and potential expiration of the Employee Retention Credit. Awareness of the timelines and extensions can help businesses plan their financial strategies and maximize the benefits they can receive.

In this article, we will delve into the details of the Employee Retention Credit and its expiry dates. We’ll explore the initial expiration date of the credit, as well as the subsequent extensions that have been put in place to provide additional relief to eligible businesses.

Understanding the Employee Retention Credit

The Employee Retention Credit is a tax credit that was introduced in response to the economic challenges faced by businesses during the COVID-19 pandemic. It was established under the CARES Act in March 2020 and has since been extended to provide continued relief for eligible employers.

The purpose of the credit is to incentivize businesses to retain their employees, even in the face of financial hardship caused by the pandemic. It is intended to offset a portion of the employer’s payroll taxes and provide a direct financial benefit to businesses that meet the eligibility criteria.

The credit is calculated based on a percentage of qualified wages paid to employees during specific quarters. For wages paid between March 13, 2020, and December 31, 2020, the credit is equal to 50% of qualified wages, up to a maximum of $10,000 per employee. For wages paid after December 31, 2020, and before July 1, 2021, the credit is equal to 70% of qualified wages, up to a maximum of $10,000 per employee.

Qualified wages differ depending on the size of the business. For businesses with an average of more than 100 employees in 2019, qualified wages are those paid to employees who are not providing services due to a full or partial suspension of operations or a significant decline in gross receipts. For businesses with an average of 100 or fewer employees in 2019, qualified wages include all wages paid during the eligibility period, regardless of whether employees are providing services or not.

It’s important to note that the Employee Retention Credit is a refundable credit, meaning that if the credit exceeds the employer’s total payroll taxes, the excess can be refunded to the employer. This makes the credit a valuable financial resource for eligible businesses.

Initial Expiration and Extensions

When the Employee Retention Credit was initially introduced as part of the CARES Act, it was set to expire on December 31, 2020. However, recognizing the ongoing impact of the pandemic on businesses, the credit was extended through several legislative changes to provide continued relief.

The first extension came with the passing of the Consolidated Appropriations Act in December 2020. This legislation extended the Employee Retention Credit until June 30, 2021. This extension provided eligible employers with additional time to take advantage of the credit and help them navigate the ongoing economic challenges caused by the pandemic.

It’s important to note that the extension also brought some modifications to the credit. Effective January 1, 2021, the credit percentage increased from 50% to 70% of qualified wages. This change aimed to provide businesses with an even greater incentive to retain their employees and continue operating during these difficult times.

The extension granted under the Consolidated Appropriations Act gave businesses an additional six months to claim the credit for wages paid between January 1, 2021, and June 30, 2021.

Given the evolving nature of the pandemic and its impact on businesses, it is advisable to stay informed about any future extensions or changes to the Employee Retention Credit. Legislative acts and economic stimulus packages may continue to bring new opportunities for eligible businesses to access this valuable financial support.

The CARES Act Extension

The Employee Retention Credit (ERC) was initially introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was signed into law in March 2020. The primary intention behind the ERC was to provide financial relief to businesses struggling in the wake of the COVID-19 pandemic.

Under the original version of the CARES Act, the credit was set to expire on December 31, 2020. However, recognizing the ongoing challenges faced by businesses, Congress passed subsequent legislation that extended the availability of the ERC beyond its initial expiration date.

By extending the Employee Retention Credit, lawmakers aimed to provide continued support to eligible businesses and encourage them to retain their employees during this unprecedented time. The extension allowed businesses to access financial assistance and helped alleviate some of the economic burdens brought about by the pandemic.

During its original term, the Employee Retention Credit provided businesses with a refundable tax credit equal to 50% of qualified wages paid to employees between March 13, 2020, and December 31, 2020. Qualified wages included both salary and health benefits, up to a maximum of $10,000 per employee.

It’s important to note that the ERC was available to businesses of all sizes, regardless of their profitability or whether they received other forms of assistance, such as Paycheck Protection Program (PPP) loans.

The CARES Act extension of the Employee Retention Credit played a crucial role in providing financial stability and relief to countless businesses, allowing them to retain their workforce despite facing significant economic challenges. It enabled businesses to access funds that could be used to cover operational costs and preserve jobs, ultimately contributing to the overall recovery of the economy.

While the CARES Act provided an initial extension of the ERC, it’s worth noting that subsequent legislation further extended the availability of the credit, as we will explore in the next section.

The Consolidated Appropriations Act Extension: Relief for 2021

In December 2020, the Consolidated Appropriations Act was passed, which brought further relief and extensions to the Employee Retention Credit (ERC). This legislation recognized the ongoing impact of the COVID-19 pandemic on businesses and aimed to provide continued support to eligible employers.

One of the significant changes introduced by the Consolidated Appropriations Act was the extension of the ERC until June 30, 2021. This extension gave eligible businesses an additional six months to claim the credit for qualified wages paid between January 1, 2021, and June 30, 2021.

Furthermore, the extension also modified the calculation of the credit. Effective January 1, 2021, the credit percentage increased from 50% to 70% of qualified wages. This enhancement allowed eligible businesses to receive a higher credit amount, further incentivizing them to retain and compensate their employees.

Under the modified rules, businesses were allowed to claim the credit for up to $10,000 of qualified wages per employee per quarter for wages paid between January 1, 2021, and June 30, 2021. This meant that eligible employers could potentially receive a maximum credit of $7,000 per employee per quarter.

In addition, the employee eligibility criteria were expanded under the Consolidated Appropriations Act. Previously, qualified wages only included those paid to employees who were not providing services due to a full or partial suspension of operations or a significant decline in gross receipts. However, the new legislation allowed businesses with an average of 100 or fewer employees in 2019 to claim the credit for all wages paid, whether employees were providing services or not.

The extension provided by the Consolidated Appropriations Act and the modifications to the ERC criteria aimed to provide additional relief and support to eligible businesses during the first half of 2021. These changes recognized the evolving nature of the pandemic and the continued need for financial assistance in the face of ongoing challenges.

As businesses continue to navigate these uncertain times, it is crucial to stay informed about any future updates or extensions to the Employee Retention Credit. Monitoring legislative changes can help businesses take advantage of this valuable financial resource and make informed decisions regarding their workforce and financial strategies.

Eligibility Criteria for the Employee Retention Credit

To qualify for the Employee Retention Credit (ERC), businesses must meet certain eligibility criteria. These criteria are designed to ensure that the credit is targeted towards businesses that have been significantly impacted by the COVID-19 pandemic. Here are the key requirements:

- Business operations: Eligible businesses must have experienced either a full or partial suspension of operations due to a government order related to COVID-19, or they must have experienced a significant decline in gross receipts. A significant decline is defined as a 50% or more reduction in gross receipts compared to the same quarter in the prior year.

- Time period: For wages paid between March 13, 2020, and December 31, 2020, eligible businesses must have experienced either a full or partial suspension of operations or a significant decline in gross receipts. For wages paid after December 31, 2020, and before July 1, 2021, the criteria remain the same, but the time period is extended.

- Business size: The eligibility criteria differ based on the business size. For businesses with an average of more than 100 employees in 2019, qualified wages are those paid to employees who are not providing services due to a full or partial suspension of operations or a significant decline in gross receipts. For businesses with an average of 100 or fewer employees in 2019, qualified wages include all wages paid during the eligibility period, regardless of whether employees are providing services or not.

- Governmental entities and small businesses: Governmental entities are not eligible for the ERC. Additionally, certain small businesses, such as self-employed individuals and businesses that receive Paycheck Protection Program (PPP) loans, may not be eligible for the credit, depending on factors like loan forgiveness and ownership structure.

It’s important for businesses to carefully review the eligibility criteria and consult with tax professionals or advisors to ensure that they meet all the requirements. Meeting the eligibility criteria is essential to successfully claim the Employee Retention Credit and access the financial relief provided by the credit.

As the ERC has undergone extensions and changes over time, it is advisable to stay updated on any new developments or modifications to the eligibility criteria. This will help businesses determine their eligibility for the credit and make appropriate financial decisions to mitigate the effects of the pandemic.

How to Claim the Employee Retention Credit

Claiming the Employee Retention Credit (ERC) involves following a set of steps to ensure that businesses can access the financial relief provided by the credit. Here’s a guide on how to claim the ERC:

- Determine eligibility: Before proceeding with the claim, businesses must thoroughly review the eligibility criteria to determine if they meet the requirements. This includes assessing factors such as business operations, time periods, and size.

- Calculate the credit: Once eligibility is established, businesses need to calculate the amount of the credit they are entitled to. This involves determining qualified wages and the applicable percentage based on the time period in which the wages were paid.

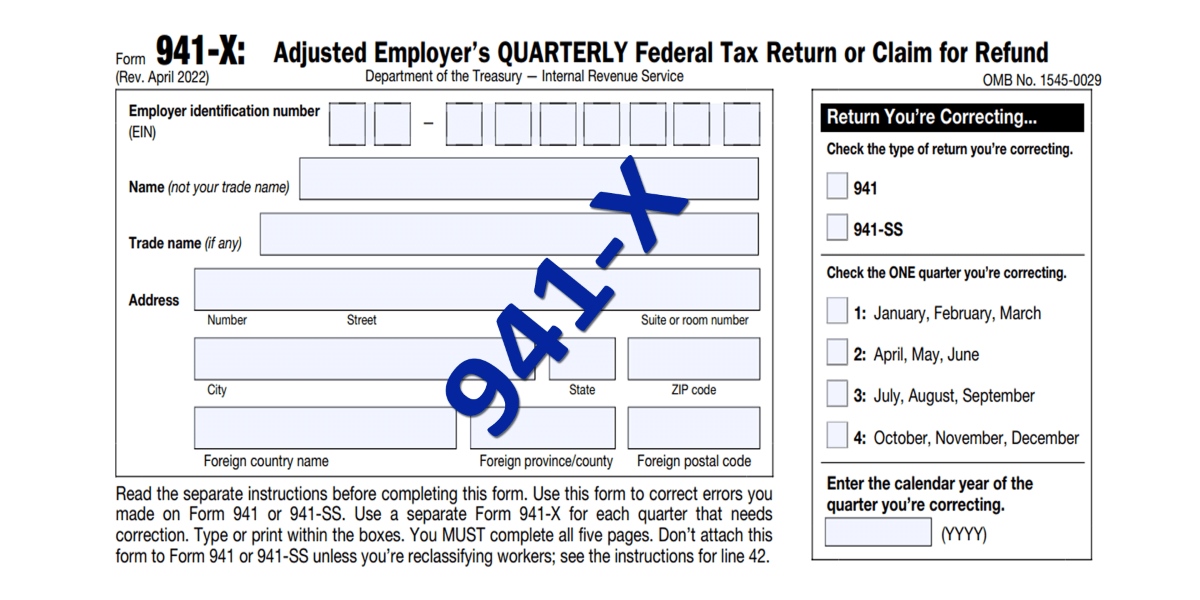

- File for the credit: To claim the ERC, businesses must file the appropriate forms with the Internal Revenue Service (IRS). For example, eligible businesses may need to complete Form 941, Employer’s Quarterly Federal Tax Return, to report and claim the credit.

- Retention of records: It is crucial to maintain accurate and detailed records to support the claim for the ERC. Documentation should include information on wages paid to employees, periods of suspension of operations, and any other relevant information that may be required for verification purposes.

- Consult with tax professionals: Given the intricacies of claiming the ERC, it is recommended that businesses consult with tax professionals or advisors who specialize in tax credits. These professionals can provide guidance on the specific requirements and help businesses navigate the claim process successfully.

It’s important to note that claiming the ERC may require additional documentation and compliance with IRS guidelines. Familiarizing oneself with the IRS guidance and regulations related to the credit is essential to ensure accurate and timely filing.

As the ERC undergoes extensions and modifications, businesses should stay informed about any updates or changes in the claim process. Ongoing monitoring of IRS guidance and consulting with tax professionals can provide businesses with the necessary support to claim the ERC and take full advantage of the financial relief it offers.

Conclusion

The Employee Retention Credit (ERC) has provided vital financial assistance to businesses during the unprecedented challenges of the COVID-19 pandemic. The credit, initially introduced as part of the CARES Act, has undergone extensions and modifications to continue offering relief to eligible employers.

Understanding the timeline and expiration dates of the ERC is crucial for businesses to effectively plan their financial strategies. The initial expiration date of the credit was extended through the passing of the Consolidated Appropriations Act, providing further relief until June 30, 2021.

To qualify for the ERC, businesses need to meet specific eligibility criteria, such as experiencing a full or partial suspension of operations or a significant decline in gross receipts. The size of the business also influences the criteria for qualified wages.

Claiming the ERC involves following a series of steps, including determining eligibility, calculating the credit amount, filing the necessary forms with the IRS, and retaining relevant records. Consulting with tax professionals can provide valuable guidance through the claim process.

As the ERC continues to evolve, it’s essential for businesses to stay informed about any updates or changes to the credit. Being aware of legislative acts and IRS guidance will allow businesses to maximize their access to this valuable financial resource.

Overall, the Employee Retention Credit has played a crucial role in helping businesses retain their employees and navigate the economic challenges brought about by the pandemic. By understanding the intricacies of the credit and taking advantage of its availability, businesses can secure much-needed financial support and contribute to their resilience and recovery.