Finance

How To Make Money With Credit Default Swaps

Published: March 4, 2024

Learn how to profit from credit default swaps and navigate the finance industry with our comprehensive guide. Discover expert strategies and tips for success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the intriguing world of finance, where opportunities abound for those seeking to expand their wealth through astute investments. In this article, we delve into the realm of credit default swaps (CDS) and explore the potential for making money within this complex yet lucrative financial instrument. Whether you're a seasoned investor or a novice seeking to broaden your financial knowledge, understanding the workings of credit default swaps can provide valuable insights into diversifying your investment portfolio.

Credit default swaps serve as a form of insurance against the default of a borrower, typically a corporation or government entity. This derivative instrument has garnered significant attention due to its role in the 2008 financial crisis, but it remains a powerful tool for investors seeking to capitalize on market movements and credit events.

Throughout this article, we will navigate the intricacies of credit default swaps, exploring how they function, the potential for profit, and the associated risks. By gaining a comprehensive understanding of this financial instrument, you will be better equipped to make informed decisions and potentially enhance your investment portfolio.

Join us on this enlightening journey as we unravel the mysteries of credit default swaps and uncover the strategies for leveraging them to generate wealth in the dynamic world of finance.

Understanding Credit Default Swaps

Before delving into the potential for making money with credit default swaps, it’s essential to grasp the fundamental concepts underlying this financial instrument. A credit default swap is a derivative contract that allows an investor to hedge against the risk of a borrower defaulting on their debt obligations. In essence, it functions as a form of insurance, providing protection to the buyer in the event of a credit event, such as a default or bankruptcy.

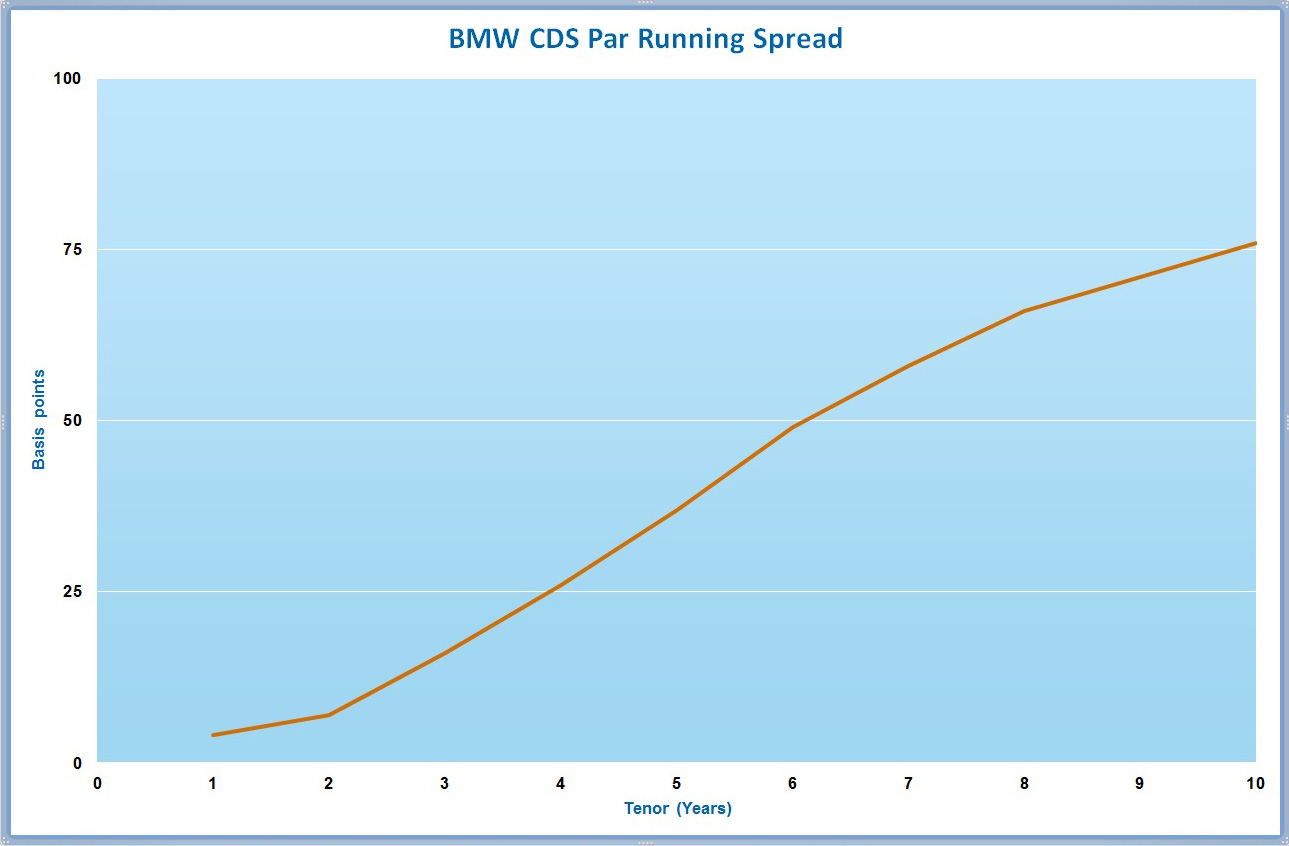

At its core, a credit default swap involves two parties: the protection buyer and the protection seller. The protection buyer pays a periodic fee, known as the premium, to the protection seller in exchange for protection against the default of a specific debt instrument or entity. In the event of a credit event, the protection seller is obligated to compensate the protection buyer for the loss incurred due to the default.

One of the key aspects of credit default swaps is their flexibility and the ability to trade them in the secondary market. This feature allows investors to speculate on the creditworthiness of various entities and capitalize on market movements. Moreover, credit default swaps are not limited to traditional bonds; they can be based on a diverse range of underlying assets, including corporate bonds, mortgage-backed securities, and sovereign debt.

It’s important to note that credit default swaps are not without controversy and have been the subject of intense scrutiny. Critics argue that the speculative nature of credit default swaps can exacerbate market volatility and pose systemic risks to the financial system. However, when used prudently, credit default swaps can offer investors a valuable tool for managing credit risk and potentially generating profits in a dynamic market environment.

By understanding the mechanics of credit default swaps, investors can gain insights into the intricate workings of the financial markets and explore the potential for leveraging this instrument to enhance their investment strategies.

Making Money with Credit Default Swaps

Now, let’s explore the intriguing realm of making money with credit default swaps. While the concept of profiting from the potential default of a borrower may seem counterintuitive, credit default swaps offer investors a unique opportunity to capitalize on market movements and credit events.

One of the primary ways to make money with credit default swaps is through speculative trading. By taking a view on the creditworthiness of a particular entity or debt instrument, investors can enter into credit default swap contracts with the anticipation of profiting from a credit event. For instance, if an investor believes that a specific corporation is at risk of defaulting on its debt, they can purchase credit default swaps as a form of insurance. If the company indeed defaults, the value of the credit default swaps would increase, allowing the investor to profit from the protection purchased.

Additionally, credit default swaps can serve as a hedging tool, enabling investors to mitigate the risk of their existing credit exposures. For example, institutional investors holding a portfolio of corporate bonds may use credit default swaps to protect against the default of specific issuers within their portfolio. This hedging strategy can help safeguard their overall investment portfolio from potential credit losses.

Furthermore, credit default swaps offer the potential for generating income through the sale of protection. Sellers of credit protection receive premiums from buyers in exchange for assuming the risk of a credit event. If the default does not occur, the protection seller retains the premiums as profit. However, it’s crucial for protection sellers to assess the credit risk diligently and manage their exposure prudently to avoid potential losses.

It’s important to approach the potential for making money with credit default swaps with a thorough understanding of the associated risks. While these financial instruments offer opportunities for profit, they also carry inherent complexities and uncertainties. Investors should conduct comprehensive research, assess credit risk prudently, and consider consulting with financial professionals to navigate the intricacies of credit default swaps effectively.

By leveraging the unique characteristics of credit default swaps, investors can explore innovative strategies to enhance their investment portfolios and potentially capitalize on market dynamics and credit events.

Risks and Considerations

While credit default swaps present opportunities for profit, it’s crucial to recognize the inherent risks and considerations associated with these financial instruments. Understanding the potential downsides and complexities is paramount for investors seeking to navigate the world of credit default swaps.

One of the primary risks of credit default swaps is the potential for significant losses. If the credit event does not occur as anticipated, buyers of protection may incur substantial losses, as the value of the credit default swaps would diminish. This underscores the speculative nature of these instruments and the importance of conducting thorough credit analysis before entering into credit default swap contracts.

Moreover, the lack of transparency in the credit default swap market can pose challenges for investors. Unlike traditional securities markets, credit default swaps are traded over-the-counter (OTC), leading to limited visibility into pricing and counterparty risk. This opacity can amplify the complexities of assessing the true value and risks associated with credit default swaps, requiring investors to exercise caution and due diligence.

Counterparty risk is another critical consideration when dealing with credit default swaps. In the event of a credit event, the protection seller may fail to fulfill their obligations, leading to potential losses for the protection buyer. This underscores the importance of evaluating the creditworthiness and reliability of counterparties when engaging in credit default swap transactions.

Furthermore, the systemic implications of credit default swaps cannot be overlooked. The interconnectedness of market participants and the potential for contagion effects in the event of widespread credit events underscore the systemic risks associated with these instruments. While credit default swaps offer opportunities for profit, they also have the potential to amplify market volatility and contribute to systemic risk if not managed prudently.

Given these complexities and risks, it’s essential for investors to approach credit default swaps with a comprehensive understanding of credit risk, market dynamics, and regulatory considerations. Engaging with experienced financial professionals and conducting thorough due diligence can help investors navigate the complexities of credit default swaps and make informed decisions aligned with their investment objectives.

By acknowledging the risks and considerations inherent in credit default swaps, investors can approach these instruments with a balanced perspective, leveraging their potential for profit while prudently managing the associated complexities and uncertainties.

Conclusion

As we conclude our exploration of credit default swaps, it’s evident that these financial instruments offer a unique avenue for investors to manage credit risk and potentially generate profits. While credit default swaps have garnered attention for their role in the 2008 financial crisis, they remain a valuable tool for hedging against credit events and speculating on the creditworthiness of entities.

Understanding the mechanics of credit default swaps is essential for investors seeking to leverage these instruments effectively. Whether it’s through speculative trading, hedging existing credit exposures, or selling protection, credit default swaps provide diverse opportunities for investors to navigate the dynamic landscape of credit risk and market movements.

However, it’s paramount for investors to approach credit default swaps with a comprehensive understanding of the associated risks and considerations. The speculative nature, lack of transparency, counterparty risk, and systemic implications underscore the complexities and uncertainties inherent in these instruments. Prudent risk management, thorough due diligence, and engaging with experienced financial professionals are essential for navigating the intricacies of credit default swaps effectively.

Ultimately, credit default swaps can serve as a valuable addition to an investor’s toolkit, offering innovative strategies for managing credit risk and potentially enhancing investment portfolios. By gaining insights into the workings of credit default swaps and approaching them with a balanced perspective, investors can explore the potential for generating returns while prudently managing the associated complexities and uncertainties.

As the financial landscape continues to evolve, credit default swaps remain a dynamic and influential component of the global financial markets. By embracing a nuanced understanding of these instruments and adopting prudent risk management practices, investors can harness the potential of credit default swaps to navigate the complexities of credit risk and capitalize on market opportunities.

Join us in embracing the multifaceted world of credit default swaps, where astute insights, comprehensive understanding, and prudent risk management converge to unlock the potential for managing credit risk and pursuing investment success in the dynamic realm of finance.