Home>Finance>How Is Treasury Stock Shown On The Balance Sheet?

Finance

How Is Treasury Stock Shown On The Balance Sheet?

Published: December 27, 2023

Learn how treasury stock is presented on the balance sheet and its significance in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Treasury stock is a term commonly used in finance and accounting that refers to shares of a company’s own stock that have been repurchased by the company. This stock is usually held by the company itself rather than being retired or canceled, and it is therefore considered as “outstanding” stock but not actively traded in the market. The treatment of treasury stock on the balance sheet is an important aspect of financial reporting, as it reflects the company’s financial position and provides insights into its capital structure.

The concept of treasury stock may seem counterintuitive at first, as companies typically issue shares of stock to raise capital from investors. However, there are various reasons why a company might decide to repurchase its own stock. It could be a strategic move to return excess cash to shareholders, to increase the company’s earnings per share, or to thwart a potential hostile takeover by reducing the number of shares available for trading.

In this article, we will explore the accounting treatment of treasury stock and how it is presented on the balance sheet. We will also discuss the importance of disclosing treasury stock information to investors and other stakeholders.

Definition of Treasury Stock

Treasury stock is a term used to describe shares of a company’s own stock that has been repurchased by the company. When a company buys back its own shares, those shares are no longer considered to be outstanding in the market. Instead, they are held by the company itself, which is why they are referred to as treasury stock.

Unlike shares that are retired or canceled, treasury stock remains part of the company’s total capital stock but is not available for trading or voting purposes. It is essentially considered “inactive” stock and is typically held by the company in its own treasury account.

It’s important to note that treasury stock is different from authorized, issued, and outstanding shares. Authorized shares are the maximum number of shares that a company is allowed to issue, while issued shares are the number of shares that have been actually issued by the company. Outstanding shares, on the other hand, are the issued shares that are currently held by investors in the market.

Treasury stock can be acquired in a number of ways, including open market purchases, direct repurchases from shareholders, or through stock buyback programs. The decision to repurchase shares of its own stock is typically made by a company’s management and board of directors, based on various factors such as the company’s financial position, strategic objectives, and market conditions.

The main purpose of acquiring treasury stock is to provide the company with more flexibility in managing its capital structure and utilizing its available cash. It can also be seen as a way to enhance shareholder value by reducing the number of shares outstanding, which may increase earnings per share and potentially boost the stock price.

Purpose of Treasury Stock

The repurchase of a company’s own stock, known as treasury stock, serves various purposes and can be driven by strategic, financial, and regulatory considerations. Let’s explore some of the main purposes behind companies acquiring treasury stock:

- Capital Structure Management: By repurchasing its own stock, a company can adjust its capital structure and optimize its financial position. This can be done by reducing the number of shares outstanding, which may increase earnings per share and enhance shareholder value. It can also allow the company to redistribute its excess cash to shareholders or reissue the treasury stock for other purposes, such as employee stock option plans.

- Market Manipulation and Defensive Measures: Acquiring treasury stock can be a defensive tactic to prevent hostile takeovers or counteract the influence of activist investors. By reducing the number of shares available for trading, the company can make it more difficult for external parties to gain control or influence over the company’s decision-making processes.

- Undervaluation and Investment Opportunity: Companies may repurchase their stock when they believe it is undervalued in the market. By buying back shares at a lower price, the company can potentially generate long-term value for shareholders when the stock price eventually appreciates. This can also signal to investors that the management has confidence in the company’s future prospects.

- Tax Efficiency: Repurchasing treasury stock can be a tax-efficient way for companies to distribute excess cash to shareholders. Instead of paying dividends, which may be subject to higher tax rates, the company can utilize its cash to buy back stock and increase the value of the remaining shares.

- Employee Stock Incentives: Treasury stock can be used to support employee stock incentive plans such as stock options or restricted stock units. By issuing treasury stock to employees, the company can align their interests with those of the shareholders and provide them with a sense of ownership and participation in the company’s success.

It’s important to note that while treasury stock can have various benefits, there are also potential drawbacks and risks. Companies need to carefully evaluate their financial resources, market conditions, and regulatory requirements before engaging in treasury stock transactions to ensure they are acting in the best interests of their shareholders and maintaining transparency in their financial reporting.

Accounting Treatment of Treasury Stock

The accounting treatment of treasury stock involves recording the repurchase of shares on the company’s balance sheet and making appropriate adjustments to the equity section of the financial statements. Here are the key aspects of the accounting treatment of treasury stock:

- Cost Method: The most commonly used method for accounting for treasury stock is the cost method. Under this method, the treasury stock is recorded at its acquisition cost, which is the price paid to repurchase the shares. The cost of the treasury stock is debited to the treasury stock account, a contra-equity account that reduces the shareholders’ equity on the balance sheet.

- Reduction in Shareholders’ Equity: The repurchase of treasury stock reduces the total shareholders’ equity of the company. This reduction is reflected on the balance sheet as a deduction from the company’s total common stock and additional paid-in capital. Treasury stock is reported as a negative amount in the equity section of the balance sheet to indicate that it is a reduction in shareholders’ equity.

- Treatment of Dividends and Voting Rights: Treasury stock does not have voting rights and is not entitled to receive dividends or participate in shareholder meetings. Therefore, companies do not include treasury stock when determining the total number of shares for voting or dividend calculations.

- Disclosure in Financial Statements: The accounting treatment of treasury stock requires clear disclosure in the company’s financial statements. This includes providing information on the number of shares repurchased, the cost of the treasury stock, and any changes in the treasury stock account. These details are typically disclosed in the notes to the financial statements to ensure transparency for investors and other stakeholders.

It’s important for companies to adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) when accounting for treasury stock. Following the proper accounting treatment ensures accurate financial reporting and helps investors make informed decisions about the company’s financial health and performance.

It’s worth noting that the accounting treatment of treasury stock can vary depending on local regulatory requirements and specific company circumstances. Companies should consult with their accountants or financial advisors to ensure compliance with applicable accounting standards and regulations.

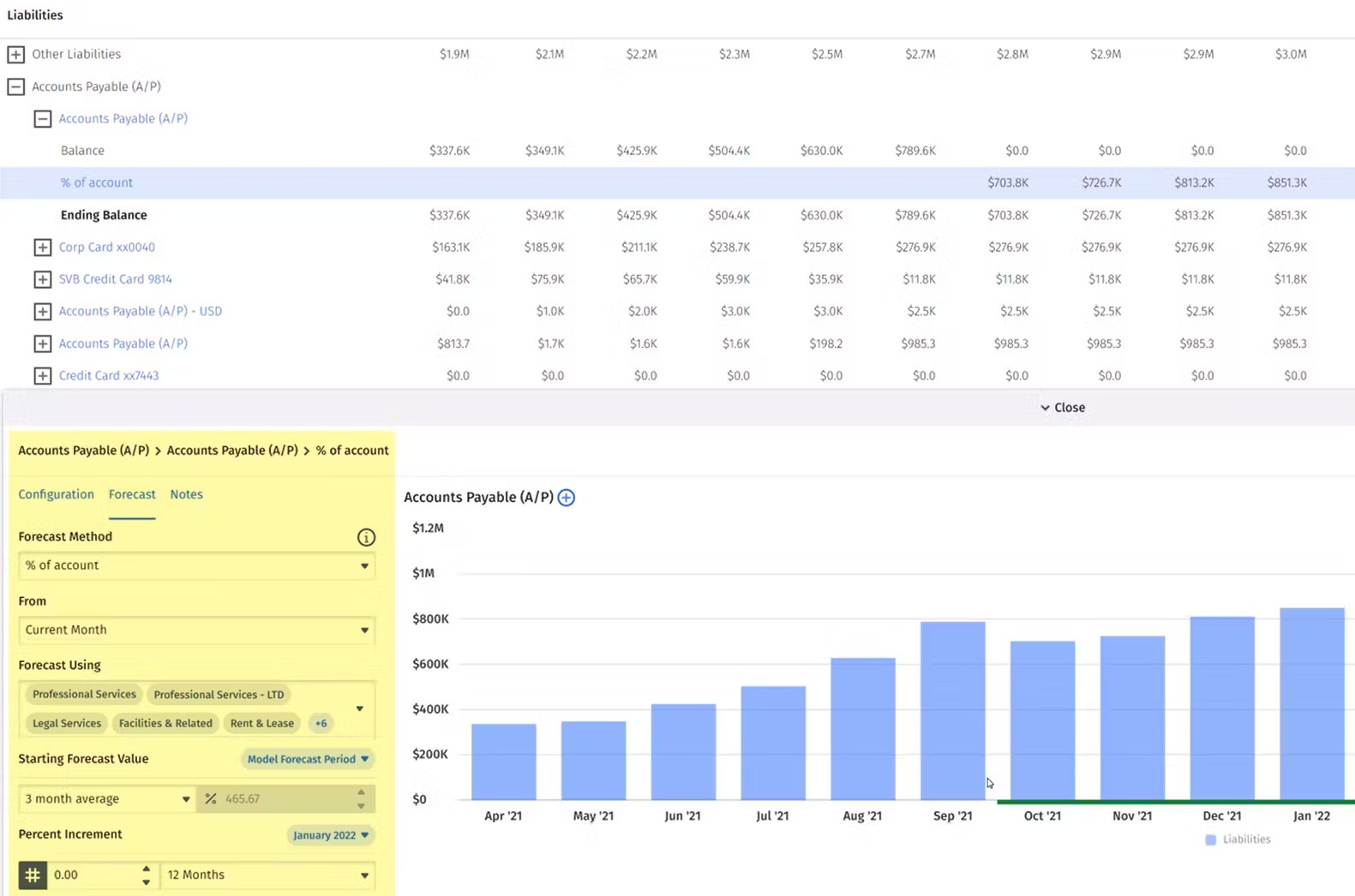

Presentation of Treasury Stock on the Balance Sheet

When it comes to presenting treasury stock on the balance sheet, it is important for companies to follow specific guidelines to accurately reflect their financial position. Here’s how treasury stock is typically presented on the balance sheet:

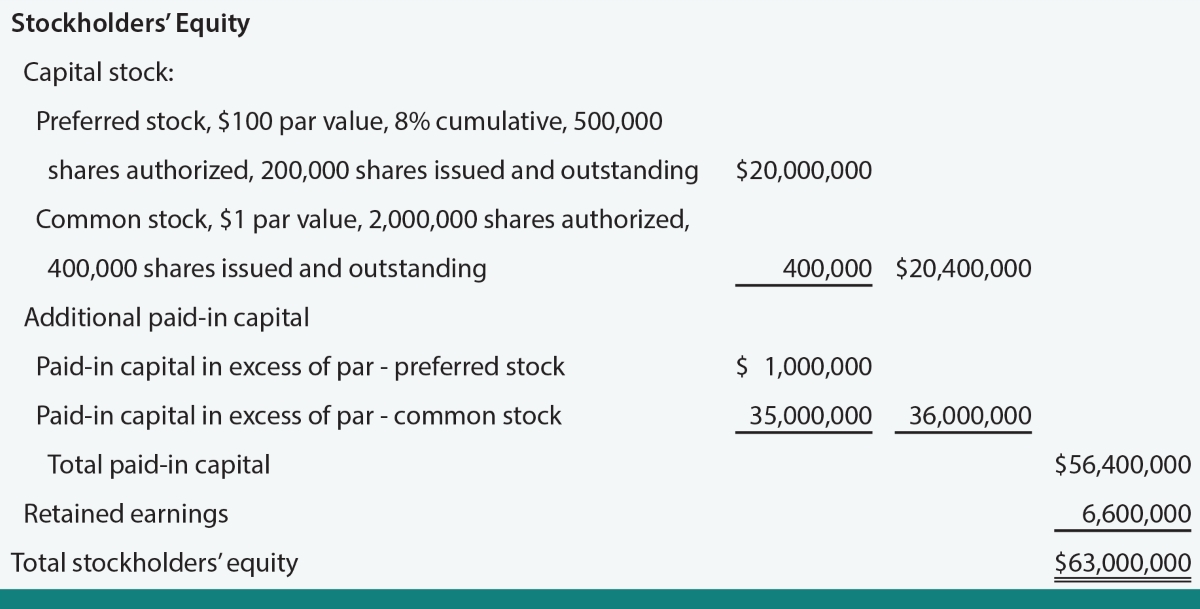

- Shareholders’ Equity Section: Treasury stock is reported as a negative amount within the shareholders’ equity section of the balance sheet. It is deducted from the common stock and additional paid-in capital accounts. This deduction reflects the reduction in shareholders’ equity due to the repurchase of shares.

- Separate Line Item: Treasury stock is commonly presented as a separate line item within the shareholders’ equity section. It is labeled as “Treasury Stock” or “Stock Repurchased” to clearly indicate that it represents shares that the company has bought back from the market.

- Carrying Value: The carrying value of treasury stock is typically stated as the cost of the shares repurchased. This is the amount at which the shares were originally bought back from the market or shareholders and is recorded as a negative number beneath the “Treasury Stock” line item.

- Net Equity Impact: The presentation of treasury stock on the balance sheet has a net impact on shareholders’ equity. The deduction of treasury stock from the common stock and additional paid-in capital accounts reduces the overall equity value, reflecting the decrease in outstanding shares due to the repurchase.

- Detailed Disclosure: Companies often provide additional disclosure in the footnotes to the financial statements regarding their treasury stock activities. This includes information about the number of shares repurchased, the average cost per share, and any changes in the treasury stock account balance over the reporting period.

By presenting treasury stock as a separate line item on the balance sheet, companies provide transparency and clarity to stakeholders regarding the repurchase of shares and its impact on the shareholders’ equity. This allows investors, creditors, and analysts to assess the company’s capital structure and make informed decisions about its financial health and performance.

It’s important for companies to adhere to applicable accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), when presenting treasury stock on the balance sheet. This ensures consistency and comparability in financial reporting across different companies and industries.

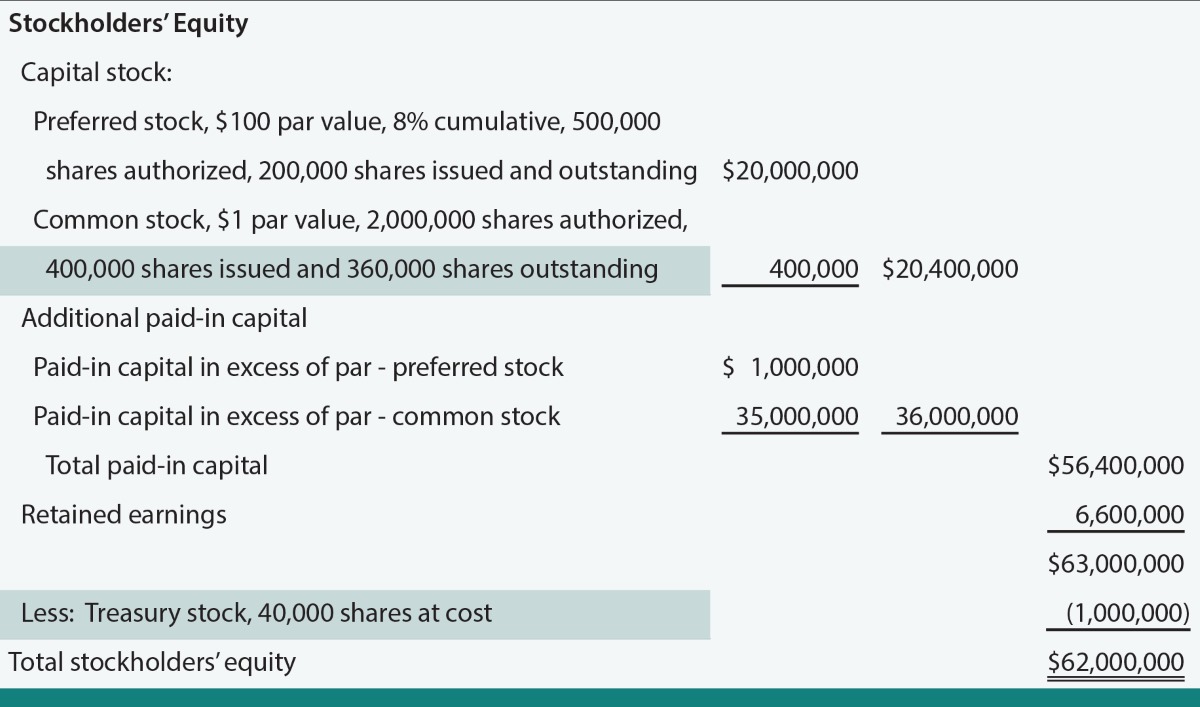

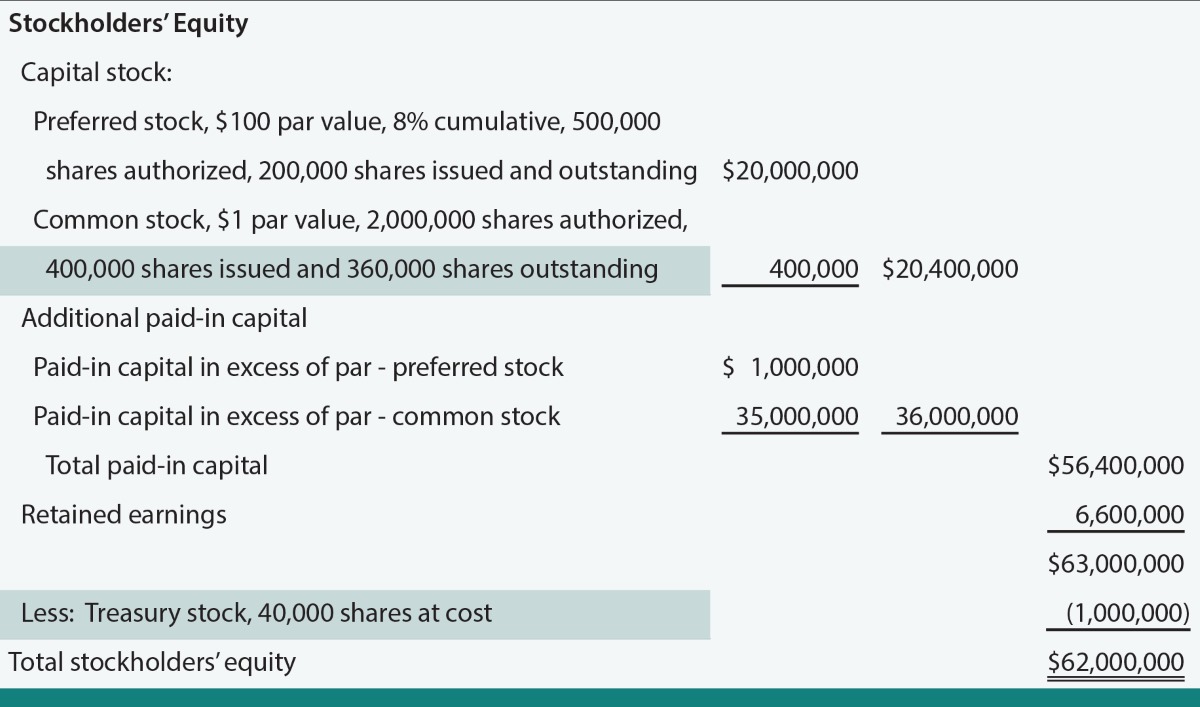

Example of How Treasury Stock is Shown on the Balance Sheet

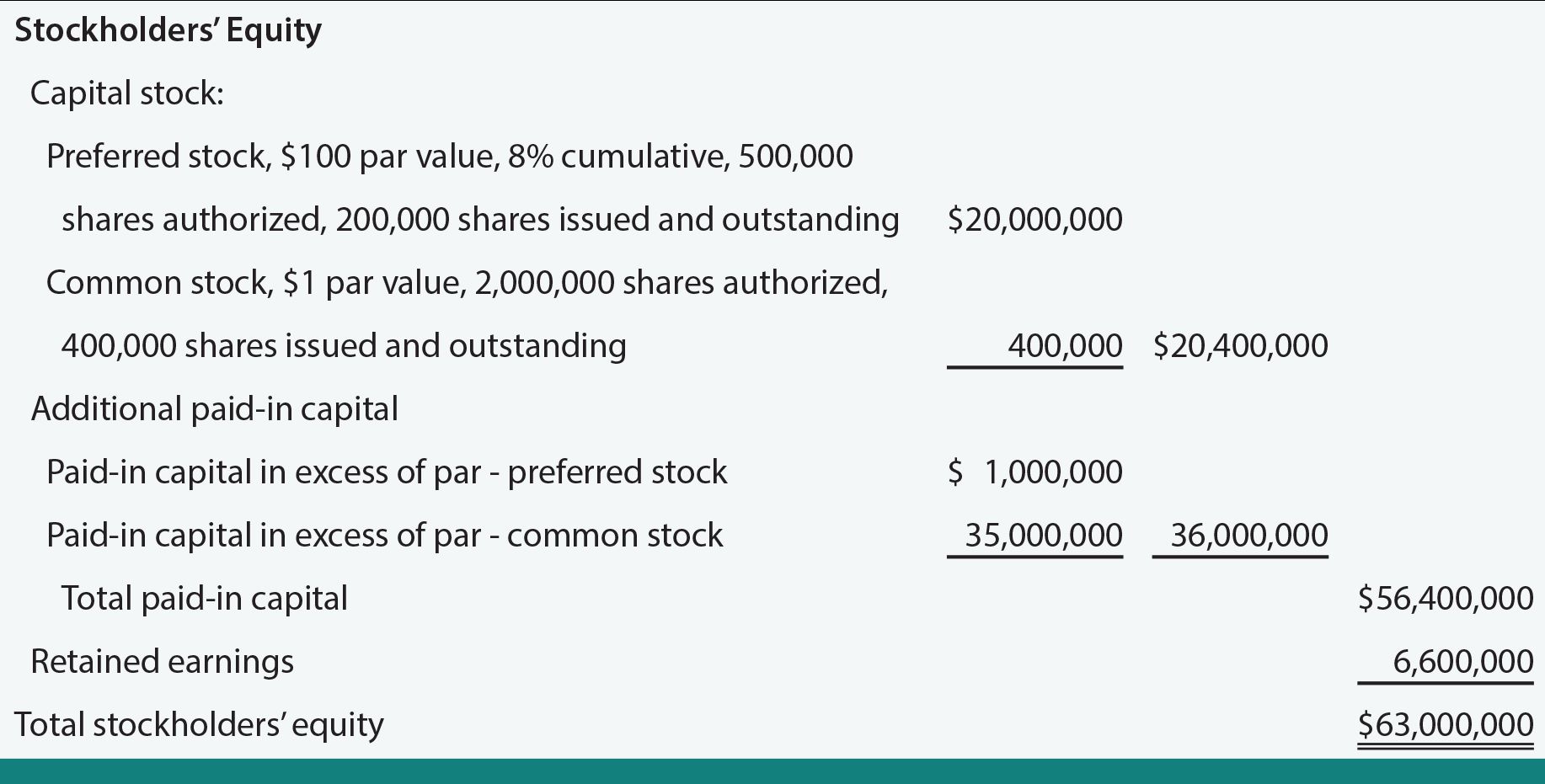

To illustrate how treasury stock is presented on the balance sheet, let’s consider a hypothetical example:

Company XYZ repurchases 10,000 shares of its own common stock at a cost of $20 per share. The company’s common stock was originally issued at $30 per share, and it has additional paid-in capital of $200,000.

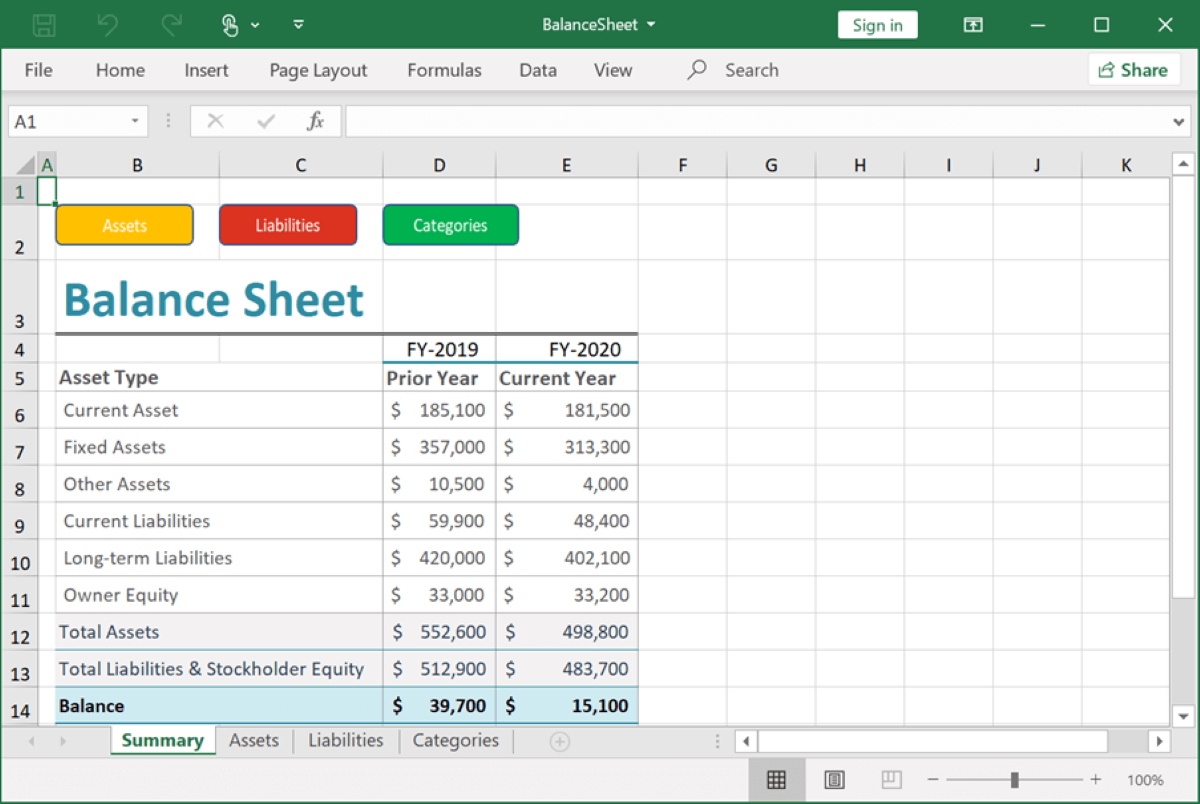

On the balance sheet, the presentation of treasury stock would look as follows:

- Common Stock: 1,000,000 shares x $30 = $30,000,000

- Additional Paid-in Capital: $200,000

- Treasury Stock: (10,000 shares x $20) = ($200,000)

In this example, the common stock and additional paid-in capital represent the initial equity raised by the company through the issuance of shares. The treasury stock is presented as a separate line item, indicating the shares repurchased by the company.

The value of the treasury stock is calculated by multiplying the number of repurchased shares (10,000) by the cost per share ($20), resulting in a negative value of ($200,000). This deduction from the shareholders’ equity section reflects the reduction in the overall equity due to the repurchase of shares.

It’s worth noting that the presentation of treasury stock on the balance sheet may vary depending on the specific accounting standards followed and the reporting requirements of the jurisdiction in question. However, the overall concept remains consistent: treasury stock is shown as a separate line item within the shareholders’ equity section, with a negative value representing the cost of the repurchased shares.

By clearly presenting treasury stock on the balance sheet, companies provide transparency to stakeholders regarding their capital structure and the impact of stock repurchases on shareholders’ equity. This information enables investors, creditors, and analysts to better assess the financial health and performance of the company.

Importance of Disclosing Treasury Stock

Disclosing treasury stock information is of significant importance as it provides transparency and insights into a company’s capital structure and stock repurchase activities. Here are some reasons why disclosing treasury stock is essential:

- Accuracy of Financial Statements: In keeping with accounting principles and regulations, disclosing treasury stock ensures the accuracy and completeness of a company’s financial statements. By including treasury stock as a separate line item, stakeholders can clearly see the reduction in shareholders’ equity resulting from stock repurchases, allowing for more accurate analysis of the company’s financial health.

- Investor Decision-Making: Investors rely on accurate and comprehensive information to make informed investment decisions. When a company discloses treasury stock, it provides investors with a clear picture of the company’s capital structure and any potential impact on key financial metrics, such as earnings per share (EPS). This information helps investors assess the company’s performance and evaluate its long-term growth prospects.

- Protection of Shareholders’ Interests: Disclosing treasury stock is crucial for protecting the interests of shareholders. When a company repurchases its own stock, it may affect ownership rights, voting power, and entitlement to dividends. Transparent disclosure ensures that shareholders are aware of the company’s actions and can assess the potential impact of stock repurchases on their investment.

- Corporate Governance and Accountability: By disclosing treasury stock, a company demonstrates its commitment to transparency and accountability. This fosters trust among stakeholders, including shareholders, employees, lenders, and regulatory authorities. It also indicates the company’s adherence to sound corporate governance practices, which are highly valued in today’s business environment.

- Use in Financial Analysis: Disclosed treasury stock information can be utilized for financial analysis purposes. Analysts can examine the trends of stock repurchases over time and assess their impact on various financial ratios and metrics, such as return on equity (ROE) and price-earnings (P/E) ratio. This analysis helps in evaluating the efficiency and effectiveness of a company’s share repurchase strategy.

It is worth noting that the disclosure of treasury stock may be required by accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Companies should comply with these standards and provide comprehensive and accurate disclosure in their financial statements and related footnotes.

Overall, the disclosure of treasury stock is crucial for maintaining transparency, protecting shareholder interests, and facilitating informed decision-making by investors and other stakeholders. By providing clear and complete information, companies demonstrate their commitment to sound financial reporting practices and foster trust among the investing community.

Conclusion

Treasury stock plays a significant role in a company’s financial reporting and capital structure. Understanding the definition, purpose, accounting treatment, and presentation of treasury stock is essential for investors, analysts, and other stakeholders. By accurately disclosing treasury stock information, companies can provide transparency and insights into their stock repurchases, enabling stakeholders to make informed decisions.

Treasury stock is a term used to describe shares of a company’s own stock that have been repurchased by the company and are held by the company itself. The repurchase of treasury stock can serve various purposes, such as capital structure management, market manipulation, undervaluation opportunities, tax efficiency, and support for employee stock incentives.

In terms of accounting treatment, treasury stock is typically recorded at cost and deducted from the shareholders’ equity section of the balance sheet. It is presented as a separate line item, indicating the repurchased shares and their negative value. Disclosing treasury stock information ensures accurate financial reporting, helps investors assess the financial health of the company, and protects shareholders’ interests.

Disclosing treasury stock is important for the accuracy of financial statements, investor decision-making, protection of shareholders’ interests, corporate governance, and financial analysis. By providing transparency and comprehensive disclosure, companies demonstrate their commitment to accountability and promote trust among stakeholders.

In conclusion, treasury stock is a key aspect of a company’s financial landscape and understanding its treatment and presentation on the balance sheet is crucial for financial analysis and investor confidence. Companies should adhere to accounting standards, disclose treasury stock information accurately, and ensure transparency in their reporting practices to maintain credibility and facilitate informed decision-making.