Home>Finance>How Should Intangible Assets Be Disclosed On The Balance Sheet?

Finance

How Should Intangible Assets Be Disclosed On The Balance Sheet?

Modified: December 30, 2023

Discover the best practices for disclosing intangible assets on the balance sheet and improving your financial reporting. Enhance your finance skills and knowledge.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Intangible Assets

- Importance of Disclosing Intangible Assets

- Current Accounting Standards for Intangible Assets

- Challenges in Disclosing Intangible Assets on the Balance Sheet

- Proposed Methods for Disclosing Intangible Assets

- Case Studies on Intangible Asset Disclosures

- Conclusion

- References

Introduction

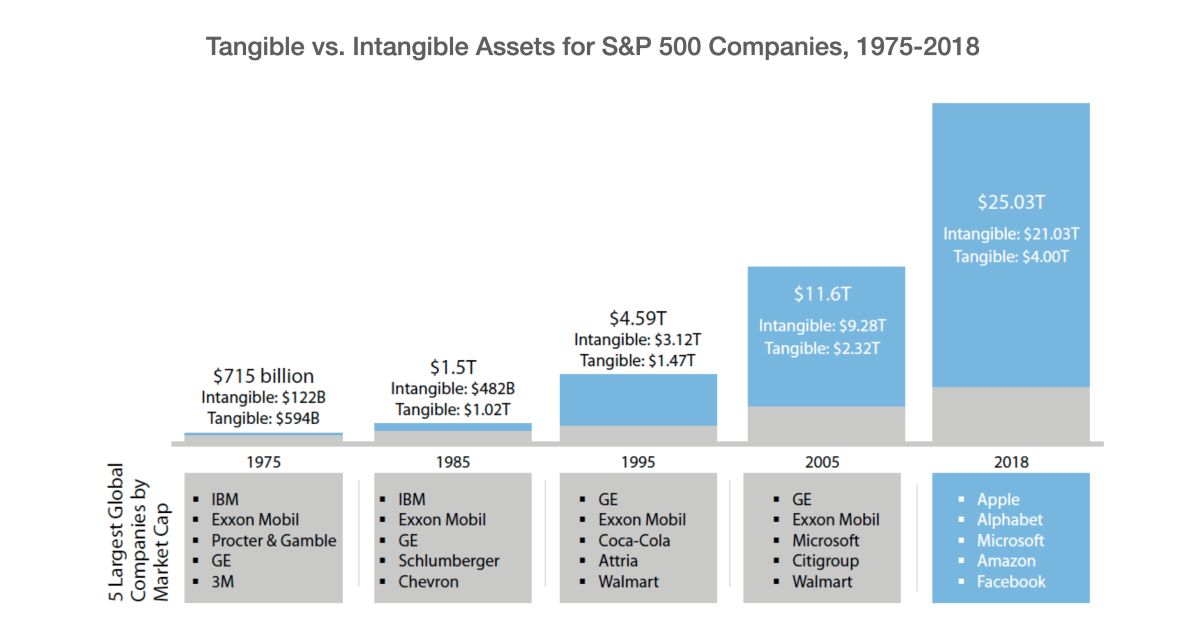

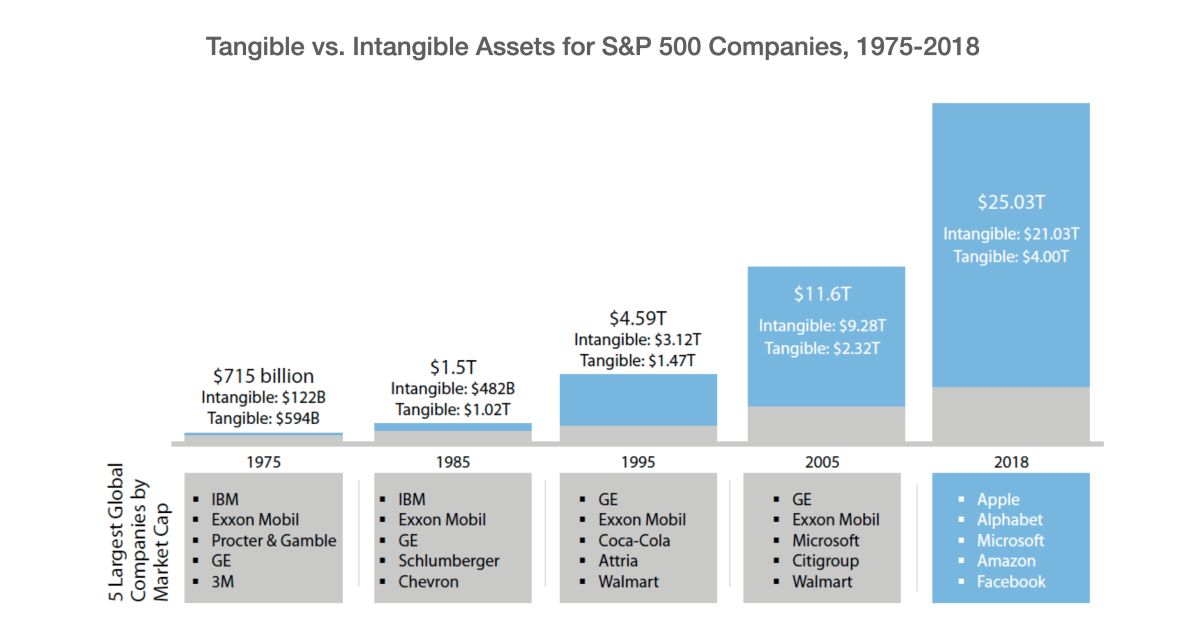

Welcome to the world of finance, where numbers and figures dominate the stage. Companies invest heavily in various assets to generate revenue and create value for their stakeholders. While tangible assets, such as buildings and machinery, have long been the focus of attention, the significance of intangible assets cannot be overlooked.

Intangible assets are non-physical resources that provide a competitive advantage to a company. Examples include patents, trademarks, copyrights, brand recognition, customer lists, and software. These assets play a pivotal role in today’s knowledge-based economy, where intellectual property and innovation drive success.

However, when it comes to presenting financial information, intangible assets pose a unique challenge. Unlike tangible assets, which can be easily quantified and listed on the balance sheet, intangible assets are often more difficult to measure and disclose. This can lead to discrepancies in financial reporting and a lack of transparency for investors and stakeholders.

Therefore, it is crucial to establish clear guidelines for disclosing intangible assets on the balance sheet. This article aims to explore the definition of intangible assets, the importance of disclosing them, the current accounting standards, the challenges involved, and proposed methods for effective disclosure. Additionally, we will examine real-world case studies to provide practical insights.

By understanding the complexities associated with intangible assets and the significance of their disclosure, companies can enhance their financial reporting and provide a more accurate picture of their value to investors and stakeholders.

Definition of Intangible Assets

Intangible assets are assets that do not have a physical presence but possess value for a company. Unlike tangible assets, such as buildings and equipment, intangible assets cannot be touched or seen. Instead, they represent legal rights, intellectual property, and other intangible resources that contribute to a company’s competitive advantage and future earnings potential.

There are several categories of intangible assets, including:

- Intellectual Property: This category encompasses patents, trademarks, copyrights, and trade secrets. Intellectual property rights are legally protected and provide companies with exclusive ownership and control over their innovative creations, brands, and unique business processes.

- Brand Recognition: Brand recognition refers to the reputation and goodwill a company has built over time. It includes factors such as brand name, logo, customer loyalty, and market perception. Strong brand recognition can often result in higher customer trust, increased sales, and a competitive advantage over rivals.

- Customer Lists: Customer lists are valuable assets that represent the company’s existing customer base. These lists contain important information, such as customer contact details, purchasing history, and preferences. They enable companies to personalize marketing efforts, retain customers, and identify potential upsell or cross-sell opportunities.

- Software and Technology: In the digital era, software and technology play a crucial role in a company’s operations. Software programs, applications, databases, and proprietary technology contribute to a company’s efficiency, productivity, and innovative capabilities.

- Contracts and Agreements: Contracts, licensing agreements, and lease agreements can also be considered intangible assets. These legal documents provide companies with contractual rights and obligations, allowing them to access resources, distribute products, or benefit from collaborations or partnerships.

Intangible assets, although intangible in nature, are often the driving force behind a company’s success. They can create barriers to entry for competitors, enhance market position, foster customer loyalty, and contribute to long-term sustainability and profitability.

Providing a clear definition of intangible assets is essential for financial reporting purposes. It allows for proper identification, measurement, and disclosure of these valuable resources on a company’s balance sheet.

Importance of Disclosing Intangible Assets

Disclosing intangible assets is of utmost importance in financial reporting as it provides crucial information to investors, stakeholders, and creditors. While tangible assets can be easily observed and assessed, the value of a company’s intangible assets is often more significant in today’s knowledge-driven economy. Here are several key reasons why disclosing intangible assets is essential:

- Enhanced Transparency: By disclosing intangible assets, companies provide stakeholders with a more comprehensive and transparent view of their value. This allows investors to make informed decisions based on a holistic understanding of a company’s assets and potential for future growth.

- Accurate Valuation: Intangible assets, such as patents or brand recognition, can be substantial contributors to a company’s overall value. Without disclosing these assets, the valuation of a company may be significantly underestimated, leading to mispricing and missed investment opportunities.

- Improved Risk Assessment: Intangible assets also have an impact on a company’s risk profile. For example, having a strong brand recognition can reduce the risk of losing customers to competitors, while patents can protect a company’s products from infringement. By disclosing these assets, stakeholders can better assess the risks associated with investing in a particular company.

- Increased Investor Confidence: Proper disclosure of intangible assets can instill confidence in investors by providing them with a comprehensive understanding of a company’s value proposition. This transparency can help attract potential investors and maintain strong relationships with existing ones.

- Compliance with Accounting Standards: Accounting standards, such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP), require companies to disclose their intangible assets. Failure to comply with these standards can result in penalties, legal issues, and reputational damage.

- Comparability and Benchmarking: Disclosing intangible assets allows for better comparability between companies operating in similar industries. Investors and analysts can use this information to benchmark performance, assess competitive advantages, and make more accurate investment decisions.

In today’s digital age, intangible assets are becoming increasingly valuable and influential in shaping the success of companies. Therefore, it is crucial for companies to recognize the importance of disclosing these assets to ensure transparent and accurate financial reporting.

Current Accounting Standards for Intangible Assets

Accounting standards establish guidelines for how companies should record, measure, and disclose their intangible assets. These standards ensure consistency and comparability in financial reporting across different companies and industries. The two most widely recognized accounting frameworks are the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP).

Under IFRS, intangible assets are recognized if it is probable that future economic benefits will flow to the entity and if the cost of the asset can be reliably measured. Intangible assets are initially measured at cost, which includes all directly attributable costs necessary to acquire or produce the asset. Subsequently, companies can choose to either revalue the asset or carry it at cost less accumulated amortization and impairment losses.

IFRS provides specific guidance for various types of intangible assets. For example:

- Research and Development (R&D) Costs: IFRS requires that research costs be expensed as incurred. Development costs, on the other hand, can be capitalized if certain criteria are met, including the technical feasibility of completing the intangible asset, the intention to complete it, the ability to use or sell it, and the likelihood of generating future economic benefits.

- Internally Generated Intangible Assets: In some cases, companies may internally generate intangible assets, such as software or brand recognition. IFRS specifies that internally generated intangible assets are not recognized as assets unless specific criteria are met, including the ability to identify the asset’s cost reliably and demonstrate the asset’s future economic benefits.

- Goodwill: Goodwill arises when a company acquires another entity and pays more than the fair value of the identifiable assets acquired. IFRS requires that goodwill be initially recognized at cost and subsequently tested for impairment annually. Impairment occurs when the asset’s carrying amount exceeds its recoverable amount, and in such cases, the asset is written down.

Similarly, under GAAP, intangible assets are recorded at their cost, which includes all directly attributable costs necessary to acquire or create the asset. GAAP requires that intangible assets with finite useful lives be amortized over their estimated useful lives. However, intangible assets with indefinite useful lives, such as trademarks, are not amortized but are subject to impairment tests at least annually.

Both IFRS and GAAP require companies to disclose relevant information about their intangible assets in the footnotes to the financial statements. This includes details such as the nature of the asset, its useful life or amortization period, any impairment losses, and any restrictions or contingencies associated with the asset.

It is important for companies to adhere to these accounting standards to ensure consistency and transparency in their financial reporting of intangible assets. Compliance with these guidelines helps stakeholders make informed decisions based on accurate and reliable information.

Challenges in Disclosing Intangible Assets on the Balance Sheet

Disclosing intangible assets on the balance sheet poses several challenges for companies. Unlike tangible assets, intangible assets are often more difficult to measure, value, and disclose. Here are some of the key challenges encountered:

- Subjectivity of Measurement: Intangible assets are inherently subjective in nature, making their measurement a challenge. Unlike tangible assets that have a clear financial value, the value of intangible assets is often based on estimates and assumptions. This subjectivity can lead to discrepancies in financial reporting, as different valuation techniques and models may yield different results.

- Lack of Market Prices: Unlike publicly traded stocks or physical assets, there is often no active market for intangible assets. This makes it challenging to determine their fair value. Companies may need to rely on external experts or internal valuation models to estimate the value of their intangible assets, introducing further complexity and variability into the process.

- Complexity of Identifying and Valuing Intangible Assets: Companies often have a wide range of intangible assets, each with its unique characteristics and value drivers. Identifying and accurately valuing these assets can be a complex task, requiring specialized knowledge and expertise. Additionally, some intangible assets, such as brand recognition or customer relationships, may be challenging to quantify and measure in monetary terms.

- Changing Nature of Intangible Assets: Intangible assets are dynamic and can evolve over time. New technologies, market trends, and changes in customer preferences can impact the value and relevance of certain intangible assets. Keeping up with these changes and accurately reflecting them in financial reporting can be a challenge for companies.

- Regulatory and Reporting Requirements: Different accounting standards and regulations may have varying requirements for the disclosure of intangible assets. Companies need to stay up-to-date with these requirements to ensure compliance and avoid potential penalties or legal issues.

- Confidentiality Concerns: Some companies may be reluctant to disclose certain valuable intangible assets due to concerns about revealing proprietary information or sensitive competitive advantages. Balancing the need for transparency with the protection of sensitive information poses a challenge in intangible asset disclosure.

Overall, the challenges in disclosing intangible assets on the balance sheet stem from their unique characteristics, subjective valuation methods, and the evolving nature of these assets. Companies must navigate these challenges to provide accurate, transparent, and meaningful information to investors and stakeholders regarding the value and impact of their intangible assets.

Proposed Methods for Disclosing Intangible Assets

To overcome the challenges associated with disclosing intangible assets on the balance sheet, several methods and best practices have been proposed. These methods aim to improve transparency, consistency, and comparability in financial reporting. Here are some of the key approaches:

- Valuation Techniques: Companies can utilize various valuation techniques to determine the fair value of their intangible assets. These techniques may include market-based approaches, income-based approaches, or cost-based approaches. Engaging external experts or specialized valuation firms can provide impartial and professional assessments.

- Segmented Reporting: Instead of aggregating intangible assets into a single line item on the balance sheet, companies can consider providing more detailed information on different categories of intangible assets. This allows stakeholders to better understand the components and value drivers of a company’s intangible assets.

- Enhanced Disclosures: Providing more extensive disclosures in the footnotes to the financial statements can offer additional insights into the nature, significance, and valuation methodologies of intangible assets. Including information about the useful life or amortization period, impairment tests, and any restrictions or contingencies associated with the assets can improve transparency.

- Industry-Specific Guidelines: Developing industry-specific guidelines for the disclosure of intangible assets can help standardize reporting practices. These guidelines can take into account the unique characteristics and valuation methods specific to certain industries, enhancing comparability.

- Engagement with Investors: Companies can actively engage with investors and stakeholders to understand their needs and preferences regarding intangible asset disclosure. This dialogue can help tailor disclosure practices to meet the expectations of interested parties and align with industry best practices.

- Continuous Monitoring and Updates: Given the dynamic nature of intangible assets, companies should regularly review and update their disclosure practices to reflect any changes or significant events. This ensures that the information provided remains relevant and up-to-date for decision-making.

Implementing these proposed methods can enhance the disclosure of intangible assets on the balance sheet and provide stakeholders with meaningful and useful information. It is crucial for companies to assess their specific circumstances, resources, and industry requirements when determining the most appropriate approach for disclosing their intangible assets.

Case Studies on Intangible Asset Disclosures

Examining real-world case studies can provide valuable insights into how companies disclose their intangible assets on the balance sheet. Let’s explore two notable examples:

Case Study 1: Apple Inc.

Apple Inc., a global technology company, is known for its strong brand recognition and innovative products. In its financial reporting, Apple discloses its intangible assets, including patents, trademarks, and brand value. The company provides detailed information in its footnotes, outlining the nature of its intangible assets and the useful life or amortization period for each category.

Apple also discloses any impairment losses related to its intangible assets and explains the methodology used for impairment testing. This enables stakeholders to understand the financial impact of these assets on the company’s overall performance.

Furthermore, Apple provides an in-depth discussion of its research and development activities, emphasizing the importance of intangible assets generated from ongoing innovation. This helps investors gain insight into the company’s growth potential and its commitment to developing and protecting its intangible assets.

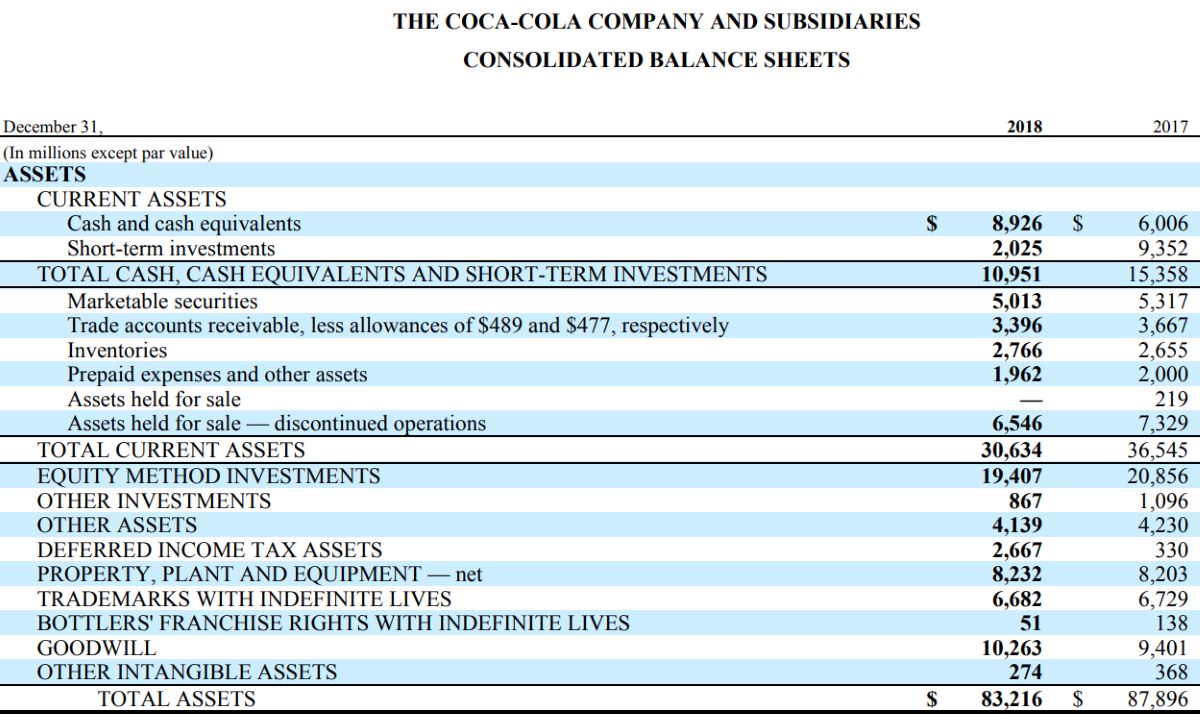

Case Study 2: Coca-Cola Company

The Coca-Cola Company, a leading beverage manufacturer, relies heavily on its strong brand recognition and customer loyalty. In its financial statements, Coca-Cola discloses details about its brand value as an intangible asset.

Coca-Cola provides information about the methodology used to determine the fair value of its brand, including the resources and assumptions involved in the valuation process. This transparency allows stakeholders to assess the significance of the brand value and its impact on the company’s financial position.

The company also discloses any impairment losses related to its brand value, ensuring transparency about potential risks and challenges affecting the value of this intangible asset.

These case studies highlight the importance of disclosing intangible assets and provide examples of how companies approach the disclosure process. By providing comprehensive and transparent information, companies can enable stakeholders to have a better understanding of the value, risks, and opportunities associated with these intangible assets.

Conclusion

Disclosing intangible assets on the balance sheet is a critical aspect of financial reporting in today’s knowledge-driven economy. While intangible assets may lack a physical presence, they hold substantial value for companies and can significantly impact their competitive advantage, financial performance, and long-term sustainability.

Throughout this article, we have explored the definition of intangible assets, the importance of disclosing them, the current accounting standards, the challenges involved, proposed methods for disclosure, and real-world case studies.

Intangible assets, such as intellectual property, brand recognition, customer lists, and software, contribute to a company’s value proposition and should be accurately measured, valued, and disclosed. They enhance transparency, provide a more comprehensive view of a company’s value, improve risk assessment, and instill confidence in investors and stakeholders.

While challenges in disclosing intangible assets exist, such as subjective measurement, lack of market prices, and evolving nature, companies can overcome these challenges through the utilization of valuation techniques, segmented reporting, enhanced disclosures, industry-specific guidelines, engagement with investors, and continuous monitoring and updates.

Real-world case studies, such as Apple Inc. and The Coca-Cola Company, illustrate how companies disclose their intangible assets and provide valuable insights into best practices and approaches.

In conclusion, the disclosure of intangible assets on the balance sheet is vital for accurate and transparent financial reporting. By adhering to accounting standards, implementing effective disclosure methods, and providing comprehensive information, companies can enhance investor confidence, facilitate better decision-making, and demonstrate the true value of their intangible assets.

References

1. International Financial Reporting Standards (IFRS). (n.d.). International Accounting Standards Board. Retrieved from https://www.ifrs.org/.

2. Generally Accepted Accounting Principles (GAAP). (n.d.). Financial Accounting Standards Board. Retrieved from https://www.fasb.org/jsp/FASB/Page/SectionPage&cid=1218220137522.

3. Apple Inc. Annual Report. (2021). Retrieved from https://www.apple.com/investor/annual-reports/.

4. The Coca-Cola Company. Annual Report. (2021). Retrieved from https://www.coca-colacompany.com/investors/annual-report.

5. Financial Accounting Standards Board (FASB). (2021). Statement of Financial Accounting Standards No. 142: Goodwill and Other Intangible Assets. Retrieved from https://www.fasb.org/cs/ContentServer.

Please note that the references provided are for informational purposes and further research. It is essential to consult official accounting standards and the specific financial reports of companies for more detailed and up-to-date information.