Home>Finance>How To Find Futures Contracts For Specific Stocks

Finance

How To Find Futures Contracts For Specific Stocks

Published: December 24, 2023

Looking to trade futures contracts for specific stocks? Find out how to navigate the world of finance and get started with futures trading

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Futures Contracts

- Importance of Specific Stock Futures

- Methods of Finding Futures Contracts for Specific Stocks

- Checking with Brokerage Firms

- Utilizing Online Trading Platforms

- Visiting Stock Exchanges’ Websites

- Consulting Financial News Websites

- Using Financial Data Providers

- Conclusion

Introduction

In the world of finance, futures contracts play a crucial role in allowing investors to speculate on the future value of commodities, currencies, and financial instruments such as stocks. Futures contracts give traders the opportunity to buy or sell an asset at a predetermined price on a specific date in the future. While futures contracts are available for a wide range of assets, including commodities like oil and gold, they are also available for specific stocks.

Futures contracts for specific stocks are particularly important for investors who want to take a position in a particular company’s stock in the future. These contracts allow investors to hedge against market volatility, take advantage of price movements, or simply gain exposure to specific stocks without actually owning the shares outright. Finding futures contracts for specific stocks can be a bit challenging, but with the right approach, it can be relatively straightforward.

In this article, we will explore the methods and resources available to investors to find futures contracts for specific stocks. Whether you are a seasoned investor or just starting in the world of finance, understanding how to find these contracts is essential to your investment strategy. We will discuss how to check with brokerage firms, utilize online trading platforms, visit stock exchanges’ websites, consult financial news websites, and use financial data providers. By utilizing these methods, you will be able to access the contracts you need to achieve your financial goals.

Before we delve into the details of finding futures contracts for specific stocks, it’s important to have a solid understanding of what futures contracts are and why they are important in the world of finance. So, let’s take a moment to explore the concept of futures contracts and their significance.

Understanding Futures Contracts

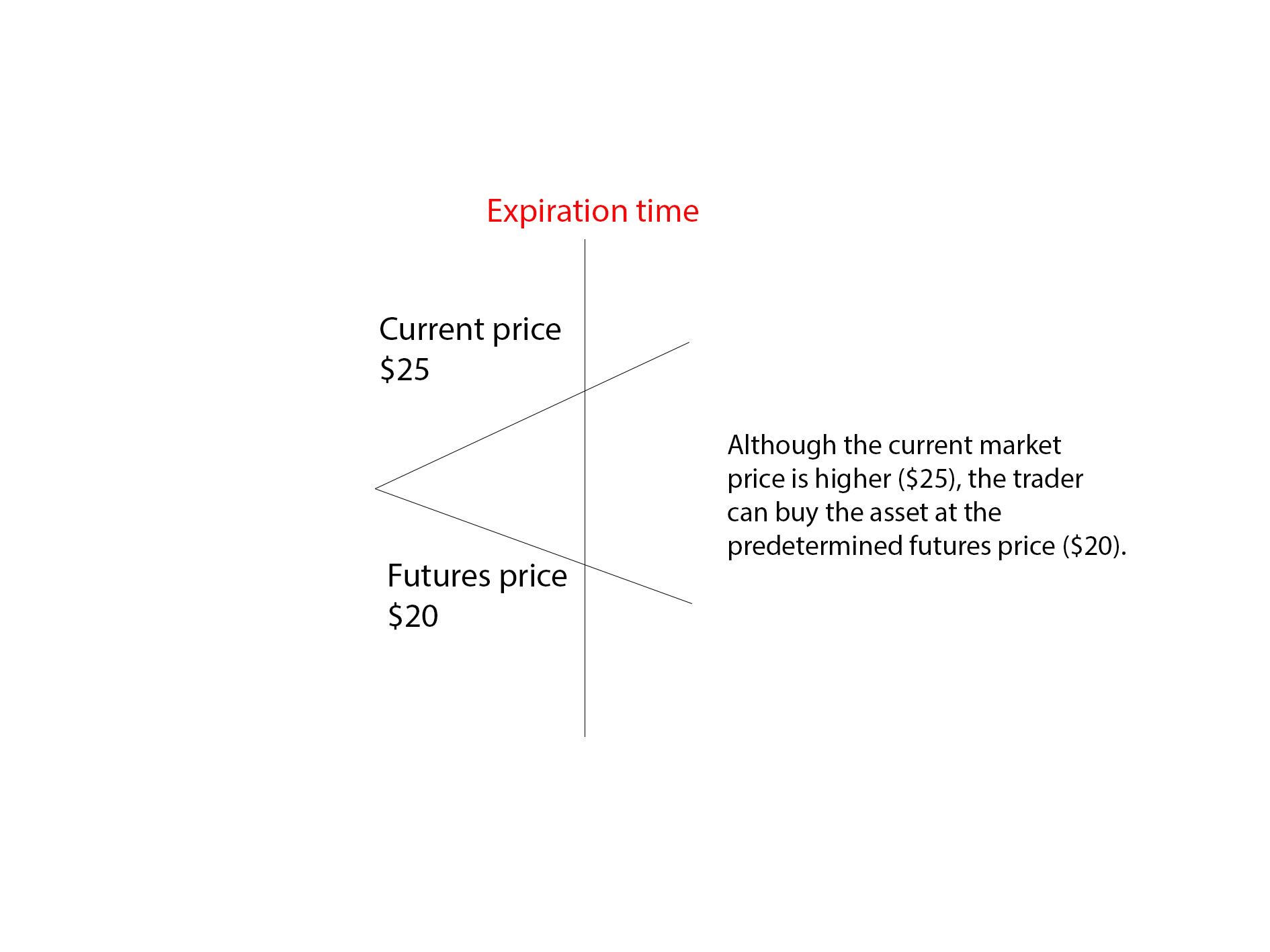

Futures contracts are financial agreements that obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined price on a specified future date. These contracts are standardized and traded on futures exchanges, providing investors a regulated marketplace to engage in futures trading. The asset underlying the contract can vary from commodities like oil, gold, and wheat, to financial instruments such as stock indexes and foreign currencies.

The key concept of futures contracts is that they are derivative instruments, meaning their value is derived from an underlying asset. This characteristic allows investors to speculate on the future price movement of the asset without actually owning it. Futures contracts are known for their leverage, as traders only need to deposit a fraction of the contract’s value, known as the margin, to control a significantly larger asset position. This amplifies potential returns, but also increases the risk associated with futures trading.

In the case of specific stock futures, the underlying asset is an individual company’s stock. Traders can buy or sell futures contracts that represent a specific number of shares in the company. These contracts are typically standardized in terms of the number of shares per contract and the expiration dates. The price at which the contract is executed is called the futures price, which is determined by the market forces of supply and demand.

For investors, futures contracts for specific stocks offer several advantages. Firstly, they can be used as a risk management tool to hedge against potential losses in stock holdings. By taking a short position in futures contracts, investors can offset potential declines in their stock portfolio. Conversely, taking a long position can help investors benefit from price increases in the underlying stock.

Additionally, specific stock futures allow investors to gain exposure to a company’s stock without actually owning the shares. This can be useful for investors who want to speculate on the performance of a company but do not want to deal with the complexities of owning the stock outright. Furthermore, futures contracts provide liquidity, as they are actively traded on exchanges, allowing investors to easily enter and exit positions.

Now that we have a clear understanding of futures contracts and their importance, let’s explore the different methods available to find futures contracts for specific stocks.

Importance of Specific Stock Futures

Specific stock futures play a significant role in the financial markets, offering investors various benefits and opportunities. Let’s explore the importance of these futures contracts in more detail.

1. Hedging: One of the primary reasons investors utilize specific stock futures is for hedging purposes. By taking an opposite position in futures contracts, investors can protect their stock holdings from potential losses caused by adverse market movements. This hedging strategy helps mitigate risk and provides a level of security in uncertain market conditions.

2. Speculation: Specific stock futures enable investors to speculate on the future price movements of individual companies’ stocks without actually owning the underlying shares. This speculative trading allows investors to potentially profit from both upward and downward price swings in the stock market. It provides an opportunity to capitalize on market volatility and make gains irrespective of the direction of the market.

3. Leverage: Specific stock futures offer significant leverage, allowing investors to control a large position with a relatively small amount of capital. This leverage amplifies potential returns for traders, which can be especially appealing for those who are confident in their market predictions. However, it’s important to note that leverage magnifies the potential for losses as well, so careful risk management is crucial.

4. Portfolio Diversification: Investing in specific stock futures allows investors to diversify their portfolios beyond traditional stock holdings. By including futures contracts in their investment strategy, investors can spread risk and potentially enhance overall portfolio performance. This diversification provides exposure to different sectors and companies, reducing the impact of any individual stock’s performance on the portfolio.

5. Liquidity and Easy Trading: Specific stock futures are actively traded on regulated exchanges, providing high liquidity. This means investors can easily buy or sell futures contracts at any time during trading hours, ensuring quick and efficient execution of trades. The ease of trading futures contracts allows investors to take advantage of market opportunities and manage their positions effectively.

Overall, specific stock futures offer a range of advantages for investors, including risk management, speculation, leverage, diversification, and liquidity. By understanding and utilizing these contracts, investors can enhance their investment strategies and navigate the ever-changing landscape of the stock market.

Methods of Finding Futures Contracts for Specific Stocks

Finding futures contracts for specific stocks can be essential for investors looking to gain exposure to particular companies or hedge against potential market risks. There are several methods that investors can use to find these contracts. Let’s explore the most common methods below:

- Checking with Brokerage Firms: A reliable method of finding futures contracts for specific stocks is to reach out to brokerage firms. Full-service brokerage firms often provide access to a wide range of futures contracts, including those for specific stocks. By contacting your brokerage firm or checking their website, you can inquire about the availability and details of the specific stock futures contracts you are interested in.

- Utilizing Online Trading Platforms: Online trading platforms are popular and convenient tools for accessing futures contracts. Many brokerage firms offer comprehensive online platforms that allow investors to trade specific stock futures easily. These platforms provide real-time market data, order execution capabilities, and often include advanced trading features. By utilizing these platforms, investors can research, trade, and monitor their specific stock futures positions all in one place.

- Visiting Stock Exchanges’ Websites: Stock exchanges such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE) list the futures contracts available for trading on their websites. These exchanges typically offer a wide range of futures contracts, including specific stock contracts. By visiting their websites, investors can search for the specific stock futures they are interested in and find detailed information about contract specifications, expiration dates, and trading hours.

- Consulting Financial News Websites: Financial news websites are valuable resources for investors seeking information on specific stock futures. These websites often cover market trends, economic news, and updates on various financial instruments, including futures contracts. By browsing through these websites or utilizing their search functions, investors can find news articles, analysis, and commentary specific to the particular stock futures they are interested in.

- Using Financial Data Providers: Financial data providers, such as Bloomberg, Thomson Reuters, or FactSet, offer comprehensive databases that include information on various futures contracts. These platforms provide data on contract specifications, pricing, historical performance, and other relevant information. Investors can utilize these platforms to conduct research on specific stock futures and make informed trading decisions.

By utilizing these methods, investors can efficiently find the futures contracts they need to accomplish their investment objectives. It’s important to note that availability and access to specific stock futures may vary depending on the investor’s brokerage, the stock exchange, and market conditions. Therefore, it’s always recommended to do thorough research and consult with professionals before engaging in futures trading.

Checking with Brokerage Firms

One of the most straightforward methods of finding futures contracts for specific stocks is by checking with brokerage firms. Brokerage firms serve as intermediaries between investors and the financial markets, offering a range of services, including access to various futures contracts. Here’s how you can utilize this method to find specific stock futures:

First, identify the brokerage firms you have accounts with or are interested in working with. Full-service brokerage firms typically provide access to a wide range of futures contracts, including those for specific stocks. Some popular brokerage firms that offer futures trading services include TD Ameritrade, E*TRADE, and Interactive Brokers, among others.

Once you have identified the brokerage firms, reach out to them directly. You can contact their customer support or visit their website to gather information about the availability and details of specific stock futures contracts. Most brokerage firms have dedicated futures departments that can assist you in finding the contracts you are interested in.

When contacting the brokerage firm, provide them with the specific stock you are interested in and ask for details regarding the futures contract corresponding to that stock. They will be able to provide you with information such as the contract specifications, expiration dates, contract size, tick size, and margin requirements.

It’s important to keep in mind that different brokerage firms may offer varying selections of specific stock futures contracts. Some firms may have a more extensive list of available contracts, while others may have a more limited offering. Therefore, it’s advisable to check with multiple brokerage firms to compare the options and choose the one that best suits your needs.

In addition to checking directly with the brokerage firms, their websites can also be a valuable source of information. Brokerage firms typically provide online trading platforms where you can search for specific stock futures contracts, view real-time prices, and even place trades. These platforms often offer advanced charting tools, research resources, and educational materials to assist you in making informed trading decisions.

Overall, checking with brokerage firms is a reliable method for finding futures contracts for specific stocks. By leveraging their expertise and resources, you can gain access to a wide range of contracts and receive guidance on trading futures effectively. Remember to conduct thorough research, compare offerings, and consider factors such as fees, commission rates, and customer support when choosing a brokerage firm.

Utilizing Online Trading Platforms

Another effective method of finding futures contracts for specific stocks is by utilizing online trading platforms. Online trading platforms are convenient, user-friendly tools that provide access to a wide array of financial instruments, including specific stock futures. Here’s how you can utilize this method to find the contracts you’re interested in:

Start by identifying reputable online trading platforms that offer futures trading services. Many brokerage firms provide their own proprietary trading platforms, while others may utilize well-known platforms such as thinkorswim by TD Ameritrade, E*TRADE’s Power E*TRADE, or Interactive Brokers’ Trader Workstation. Research and explore different platforms to ensure they offer the specific stock futures you’re looking for.

Once you have selected an online trading platform, sign up for an account. This typically involves providing personal information, completing compliance requirements, and depositing funds into your trading account. The setup process may vary slightly depending on the platform, but it is usually straightforward and guided by the platform itself.

After setting up your account, log in to the online trading platform. Familiarize yourself with the platform’s interface and navigation tools. Online trading platforms often provide customizable market watch lists, where you can add specific stock futures to monitor their prices and track their performance in real-time.

Utilize the search or symbol lookup feature on the online trading platform to find the specific stock futures contracts you’re interested in. Enter the symbol or the company name of the stock and filter the results to display futures contracts. The platform should provide detailed information about the contract specifications, including contract size, contract month, expiration date, and trading hours.

Take advantage of the research tools and resources available on the online trading platform. Some platforms offer technical analysis charts, news feeds, and research reports that can help you make informed trading decisions. By analyzing market trends, news events, and historical price data, you can develop a better understanding of the specific stock futures you wish to trade.

Once you have identified the specific stock futures contract you want to trade, you can place an order directly through the online trading platform. Specify the quantity of contracts you want to buy or sell, choose the order type (e.g., market order or limit order), and review the order details before submitting it. The platform will execute the order based on the prevailing market conditions.

Utilizing online trading platforms provides several advantages, including accessibility, real-time market data, and a wide range of trading tools. These platforms enable you to research, monitor, and trade specific stock futures from anywhere with an internet connection. However, it’s important to remember that trading involves risks, and it’s advisable to familiarize yourself with the platform’s features and educate yourself about futures trading before executing any trades.

Visiting Stock Exchanges’ Websites

Visiting stock exchanges’ websites is another effective method for finding futures contracts for specific stocks. Stock exchanges are regulated marketplaces where futures contracts are traded, and their websites often provide comprehensive information on the available contracts. Here’s how you can utilize this method to find the contracts you’re interested in:

Start by identifying the stock exchanges where specific stock futures are listed. Some well-known exchanges that offer futures contracts include the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the Intercontinental Exchange (ICE). Each exchange may have different listings, so it’s essential to identify the relevant exchange for the specific stock you are interested in.

Visit the website of the stock exchange you have identified. The website will typically have a section dedicated to futures contracts, where you can find information on the available contracts, contract specifications, and contract sizes. Additionally, you can search for the specific stock futures you’re interested in using the search or symbol lookup function on the website.

Review the details provided for the specific stock futures contracts. This includes information such as the contract ticker symbol, contract size, contract month, expiration date, and trading hours. Stock exchange websites often provide historical data, settlement prices, and other resources that can help you understand the contract’s performance and make informed trading decisions.

Some stock exchanges provide downloadable contract specifications documents that contain detailed information about the specific stock futures contracts. These documents may provide insights into margin requirements, order types, position limits, and other important trading considerations. Make sure to review these documents to have a comprehensive understanding of the contract.

Stock exchange websites often offer additional resources such as educational materials, market insights, and news updates. These resources can be valuable in understanding the dynamics of specific stock futures trading, market trends, and factors that may impact the underlying stock’s performance.

Once you have found the specific stock futures contract you want to trade, note the exchange where it is listed and the contract specifications. You can then use this information to trade the futures contract through your preferred brokerage or online trading platform that offers access to that specific exchange.

Visiting stock exchanges’ websites directly allows you to access accurate and up-to-date information on specific stock futures contracts. It provides transparency and ensures that you are well-informed about the contracts you are interested in trading. However, it’s important to note that trading futures involves risk, and it’s advisable to consult with a qualified financial professional or conduct thorough research before engaging in any trading activities.

Consulting Financial News Websites

Consulting financial news websites is a valuable method for finding futures contracts for specific stocks. These websites offer a wealth of information, including market news, analysis, and updates on various financial instruments, including futures contracts. Here’s how you can utilize this method to find the contracts you’re interested in:

Start by identifying reputable financial news websites that cover market trends and provide updates on futures contracts. Some popular financial news websites include Bloomberg, CNBC, Reuters, and MarketWatch. These websites often have dedicated sections for futures markets, where you can find information on specific stock futures contracts.

Visit the financial news website of your choice. Utilize their search function to search for the specific stock futures contract you’re interested in. Enter the company’s name or the contract’s symbol in the search bar, and the website will display articles, news, and analysis related to that specific stock futures contract.

Read the articles and news updates relevant to the specific stock futures you’re interested in. Financial news websites often provide insights into market trends, economic indicators, and factors that may impact the underlying stock’s performance. By staying informed about market developments, you can make more informed trading decisions.

Financial news websites may also provide information on the contract’s specifications, trading volumes, and historical performance. Look for articles or sections dedicated to futures trading, as they often cover specific stock futures contracts in detail.

Take note of any expert opinions or analysis provided by reputable financial experts or market commentators. These insights can help you evaluate the potential opportunities and risks associated with specific stock futures contracts. However, it’s important to consider multiple sources of information and conduct your own analysis before making any trading decisions.

Additionally, financial news websites often have user-friendly interfaces that display real-time prices and charts for futures contracts. These tools can assist you in monitoring the performance of specific stock futures and identifying potential trading opportunities.

While financial news websites provide a wealth of information, it’s important to approach the analysis with a critical mindset. Understand that news, opinions, and analysis are subjective and may have biases. Therefore, it’s crucial to cross-reference information from multiple sources and consult with a qualified financial professional to obtain a well-rounded view of the specific stock futures you’re interested in trading.

By consulting financial news websites, you gain access to valuable insights, analysis, and news updates related to specific stock futures contracts. Staying informed about market developments can help you make better-informed trading decisions and capitalize on potential opportunities in the futures market.

Using Financial Data Providers

Using financial data providers is an effective method for finding futures contracts for specific stocks. These providers offer comprehensive databases and tools that allow investors to access detailed information on various financial instruments, including futures contracts. Here’s how you can utilize this method to find the contracts you’re interested in:

Start by identifying reputable financial data providers that offer data on futures contracts. Some popular providers include Bloomberg, Thomson Reuters, FactSet, and Morningstar Direct. These platforms provide access to real-time and historical market data, including information on specific stock futures contracts.

Subscribe to the financial data provider of your choice. Depending on the provider, you may need to create an account and subscribe to the relevant futures data package. These subscriptions generally come with a cost, so consider your budget and the level of data depth required for your trading needs.

Once you have subscribed to the financial data provider, explore the platform and familiarize yourself with its features. These platforms offer search functions or symbol lookup tools that allow you to search for specific stock futures contracts. Enter the symbol or the company name of the stock, and the platform will provide information on the available futures contracts related to that stock.

Review the data provided for the specific stock futures contracts. Financial data providers offer a range of information, including contract specifications, historical prices, trading volumes, and open interest. Additionally, they may provide analytics tools, charts, and reports on futures contracts to help you analyze the contract’s performance and historical trends.

Utilize the data provider’s charting tools, which often include technical indicators and customizable features. These tools can assist you in analyzing price movements, identifying patterns, and making informed trading decisions. With access to valuable data and tools, you can evaluate the potential risks and opportunities associated with specific stock futures contracts.

Financial data providers also offer news feeds and research reports that cover futures markets, including specific stock futures contracts. These resources can provide insights into market trends, news events, and expert opinions, ensuring that you are well-informed when trading specific stock futures.

Keep in mind that financial data providers offer a vast amount of data and tools, and it can be overwhelming for new users. Take the time to learn how to navigate the platform, explore its features, and understand the data provided. If you need assistance, most providers offer customer support or educational resources to help you make the most of their platform.

By using financial data providers, you gain access to comprehensive data, research tools, and analytics that are crucial for understanding and trading specific stock futures contracts. However, it’s essential to combine the information from financial data providers with other sources, conduct thorough research, and consult with a qualified financial professional to make well-informed trading decisions.

Conclusion

Finding futures contracts for specific stocks is an essential aspect of investing and trading in the financial markets. These contracts allow investors to gain exposure to particular companies, hedge against market risks, and speculate on future price movements. By utilizing the methods outlined in this article, investors can efficiently find the futures contracts they need to achieve their investment objectives.

Checking with brokerage firms and utilizing online trading platforms provide direct access to a wide range of futures contracts for specific stocks. Brokerage firms offer expertise and personalized assistance, while online trading platforms offer convenience and real-time market data. Visiting stock exchanges’ websites and consulting financial news websites provide comprehensive information and insights into specific stock futures contracts. Using financial data providers offers access to extensive databases and analytical tools to analyze and monitor futures contracts.

It’s important to emphasize the significance of conducting thorough research, understanding the risks associated with futures trading, and consulting with financial professionals before engaging in any trading activities. Trading futures involves leverage and speculation, which can result in substantial gains but also substantial losses. It’s crucial to have a well-defined strategy, risk management plan, and an understanding of the market dynamics before entering into specific stock futures trading.

By leveraging the methods discussed in this article and staying informed about market trends and developments, investors can effectively find futures contracts for specific stocks. Whether you are seeking to hedge against market risks, diversify your portfolio, or capitalize on price movements, these contracts can provide opportunities to achieve your financial goals.

Remember, successful trading requires discipline, continuous learning, and adaptability to the ever-changing financial landscape. Stay informed, assess the risks, and make well-informed decisions to maximize your chances of success in trading specific stock futures.