Home>Finance>In What Currency Are Credit Default Swaps Traded

Finance

In What Currency Are Credit Default Swaps Traded

Published: March 4, 2024

Credit default swaps are traded in various currencies. Learn about the different currency options for trading credit default swaps in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Currency of Credit Default Swaps

Credit default swaps (CDS) are financial derivatives that enable investors to protect themselves against the risk of a borrower defaulting on their debt obligations. These instruments played a significant role in the 2008 financial crisis, leading to increased scrutiny and regulation. Understanding the currency in which credit default swaps are traded is crucial for investors and market participants.

In this article, we will delve into the world of credit default swaps and explore the currency aspect of these financial instruments. We will examine the factors that influence the choice of currency for trading credit default swaps and its implications for market dynamics. By gaining insights into the currency of credit default swaps, readers will be better equipped to comprehend the complexities of this essential component of the global financial system.

The currency in which credit default swaps are traded is a pivotal aspect that impacts market liquidity, pricing, and risk management. As we navigate through this exploration, we will uncover the intricacies of CDS trading and shed light on the factors that drive the choice of currency for these financial instruments. Let's embark on this enlightening journey to unravel the mysteries surrounding the currency of credit default swaps.

Understanding Credit Default Swaps

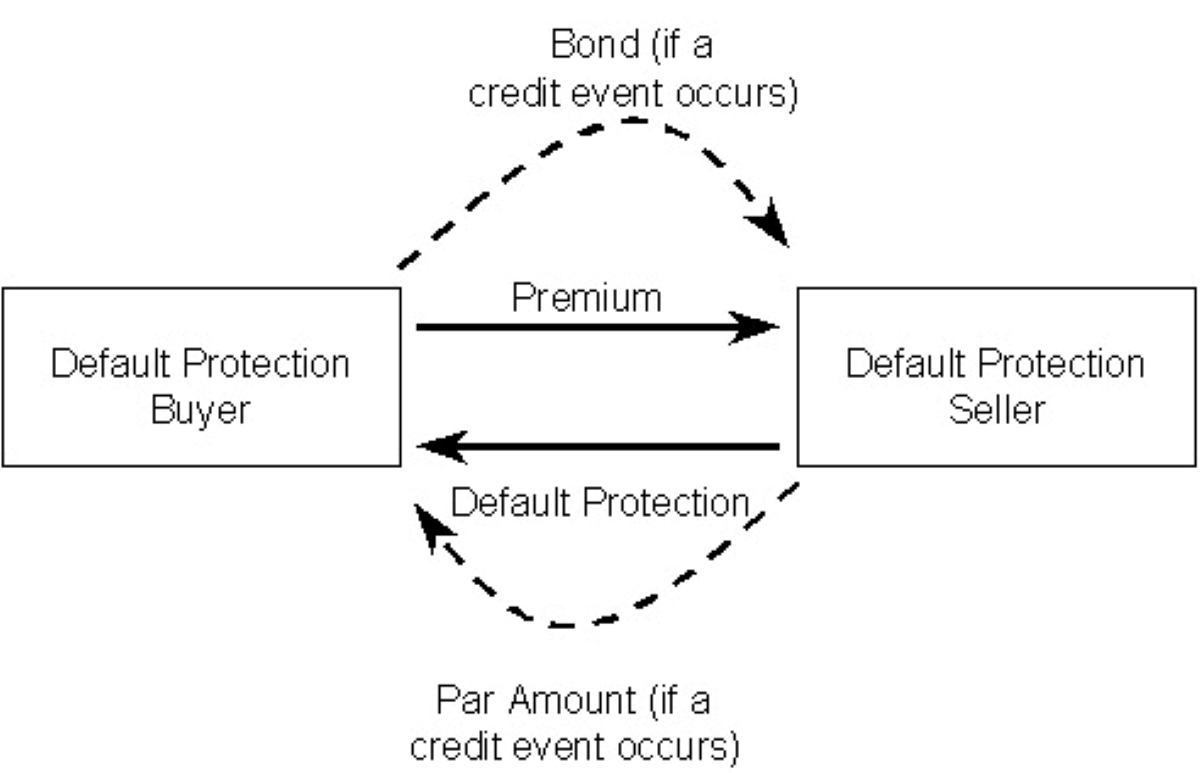

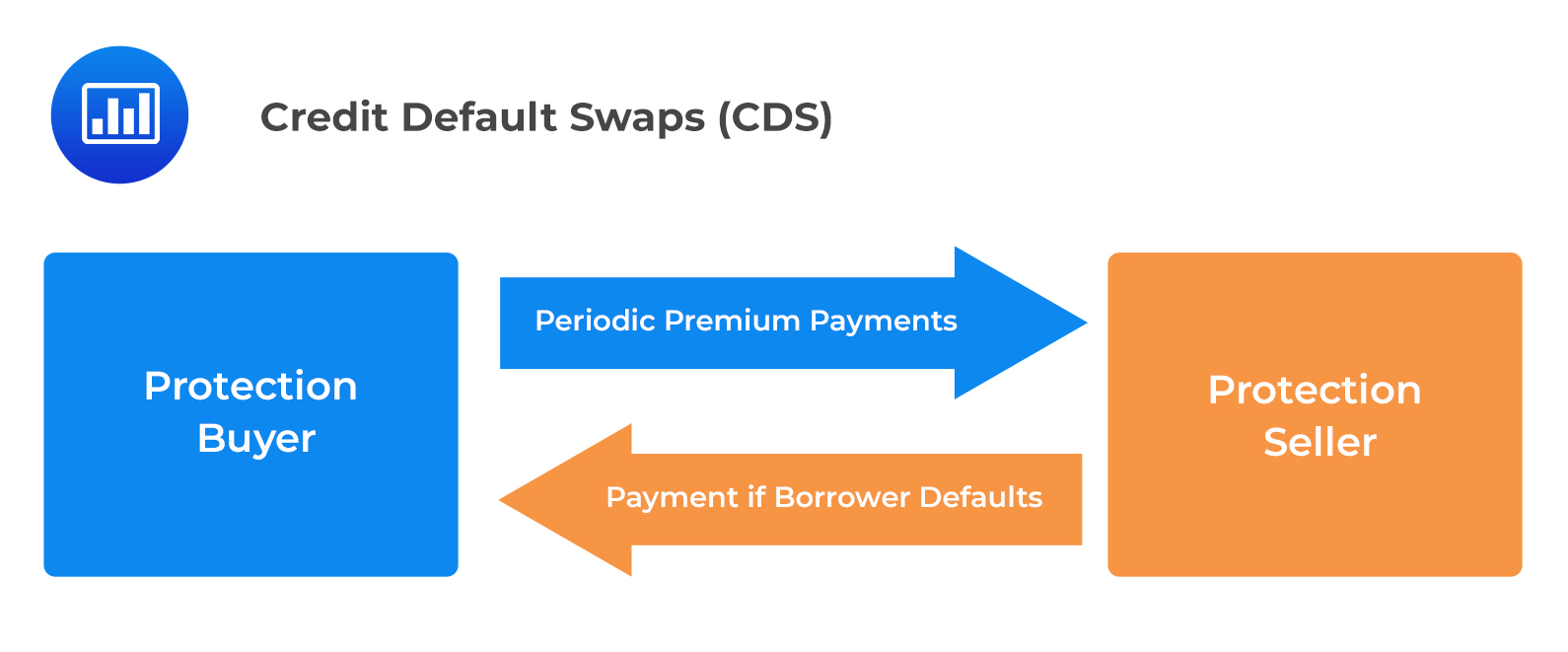

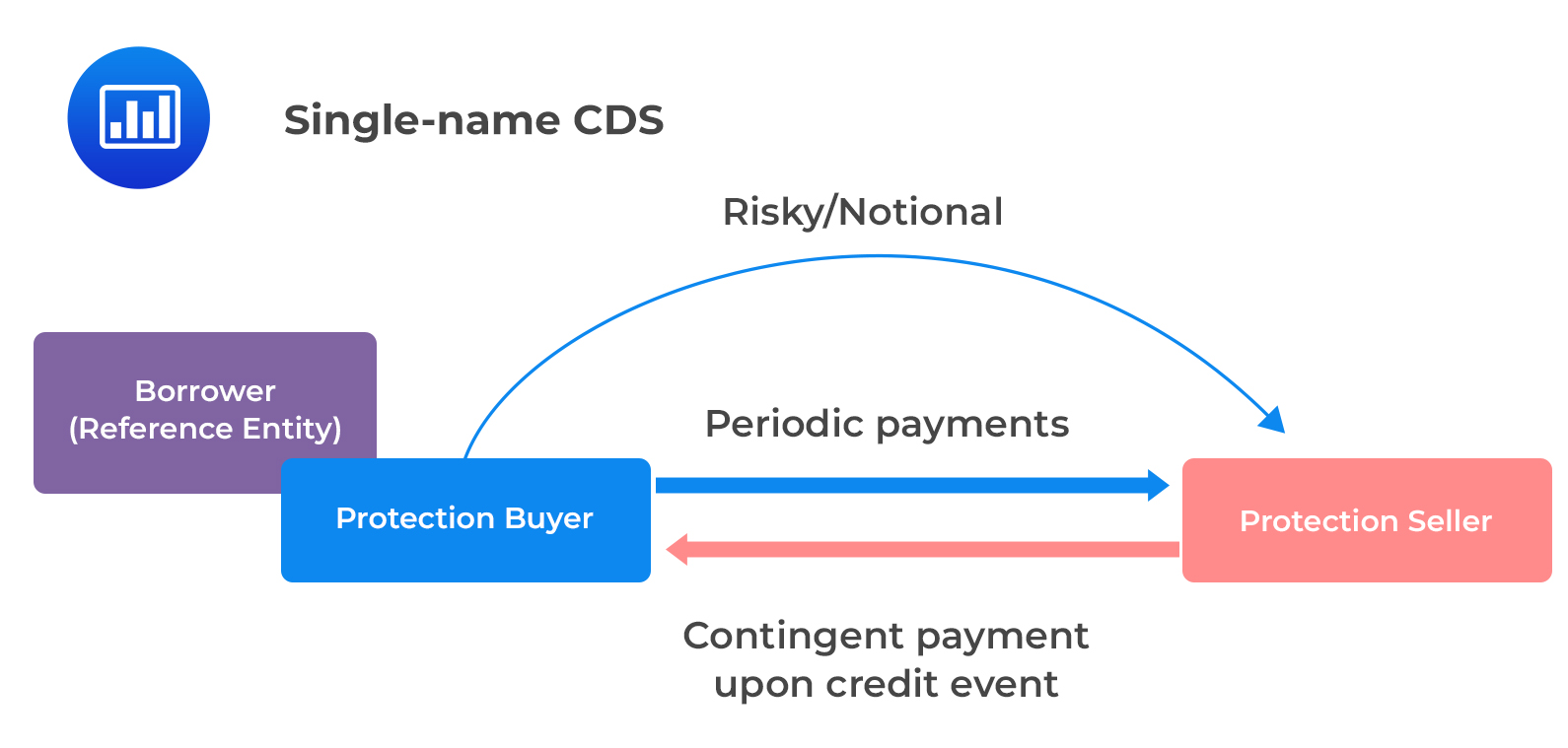

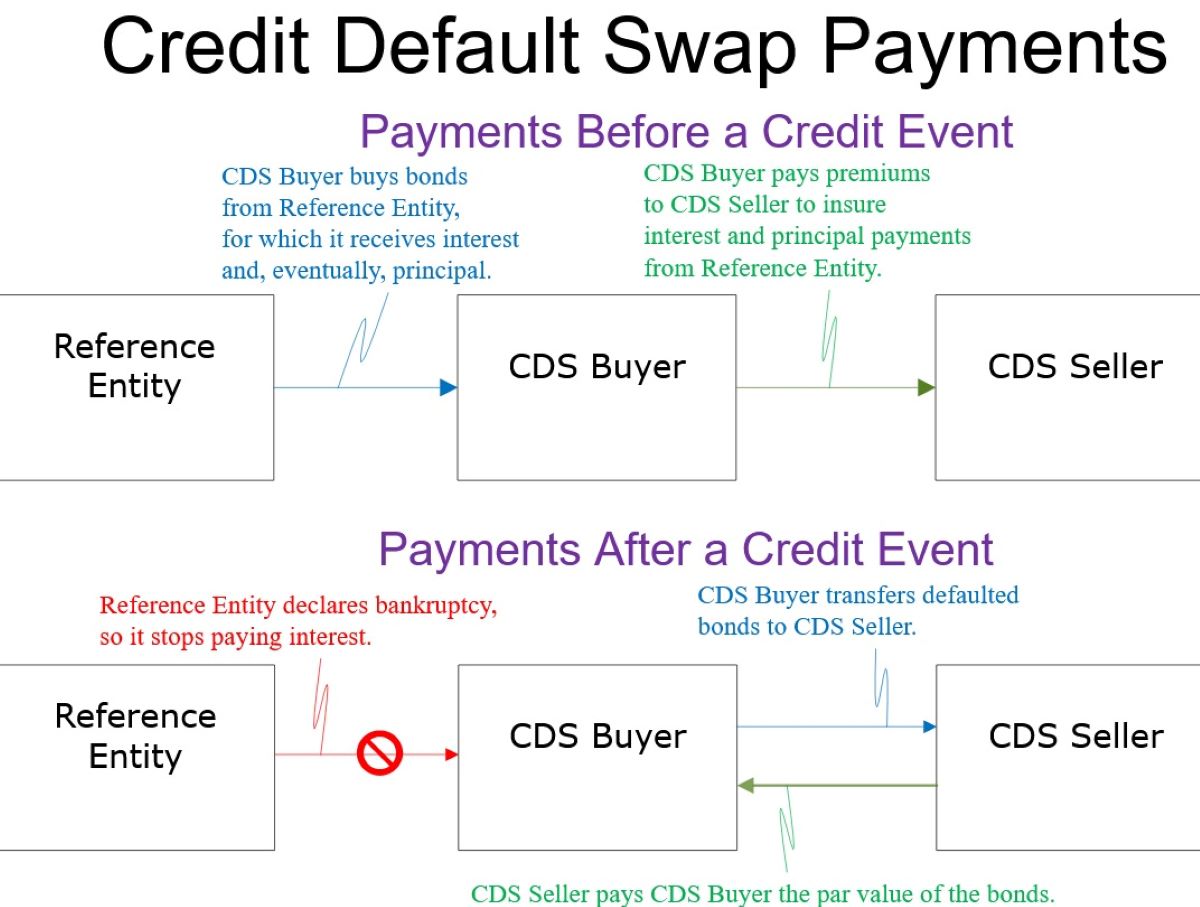

To comprehend the currency in which credit default swaps (CDS) are traded, it is essential to first grasp the fundamental nature of these financial instruments. A credit default swap is a derivative contract between two parties, where the protection buyer pays a periodic fee to the protection seller in exchange for protection against the default of a specific borrower or entity.

Essentially, a credit default swap functions as insurance against the default of a borrower. If the borrower fails to meet its debt obligations, the protection seller compensates the protection buyer for the loss incurred. This transfer of risk from the buyer to the seller forms the crux of credit default swaps.

Credit default swaps are widely used by investors and institutions to hedge against credit risk or to speculate on the creditworthiness of a particular entity. These instruments provide a way to manage exposure to credit events and can offer insights into market sentiment regarding the financial health of companies and sovereign entities.

It is important to note that credit default swaps are not limited to individual companies; they can also be based on baskets of entities or even sovereign debt. The versatility of credit default swaps has contributed to their widespread use in the global financial markets, making them a crucial tool for risk management and investment strategies.

As we delve deeper into the realm of credit default swaps, we will gain a deeper understanding of the intricate mechanisms that govern these financial instruments. By unraveling the complexities of CDS, we can better appreciate the significance of the currency in which they are traded and its implications for market dynamics.

Currency of Credit Default Swaps

The currency in which credit default swaps (CDS) are traded plays a crucial role in shaping the dynamics of the derivatives market. CDS can be denominated in various currencies, including but not limited to the US dollar (USD), euro (EUR), Japanese yen (JPY), British pound (GBP), and Swiss franc (CHF). The choice of currency for CDS trading is influenced by a multitude of factors, ranging from the location of the reference entity to the preferences of market participants.

Market liquidity and the concentration of market participants in specific regions can significantly impact the currency of CDS trading. For instance, CDS referencing entities based in the United States may predominantly be traded in USD, reflecting the local market dynamics and the preferences of market participants. Similarly, CDS referencing European entities may be denominated in EUR, aligning with the regional market dynamics and the preferences of investors and institutions.

Furthermore, the currency of CDS trading is influenced by the underlying currency of the debt obligations being hedged or speculated upon. If the reference entity issues debt in a specific currency, market participants may prefer to trade CDS denominated in the same currency to align with the underlying exposure. This alignment can reduce currency risk and streamline risk management strategies for market participants.

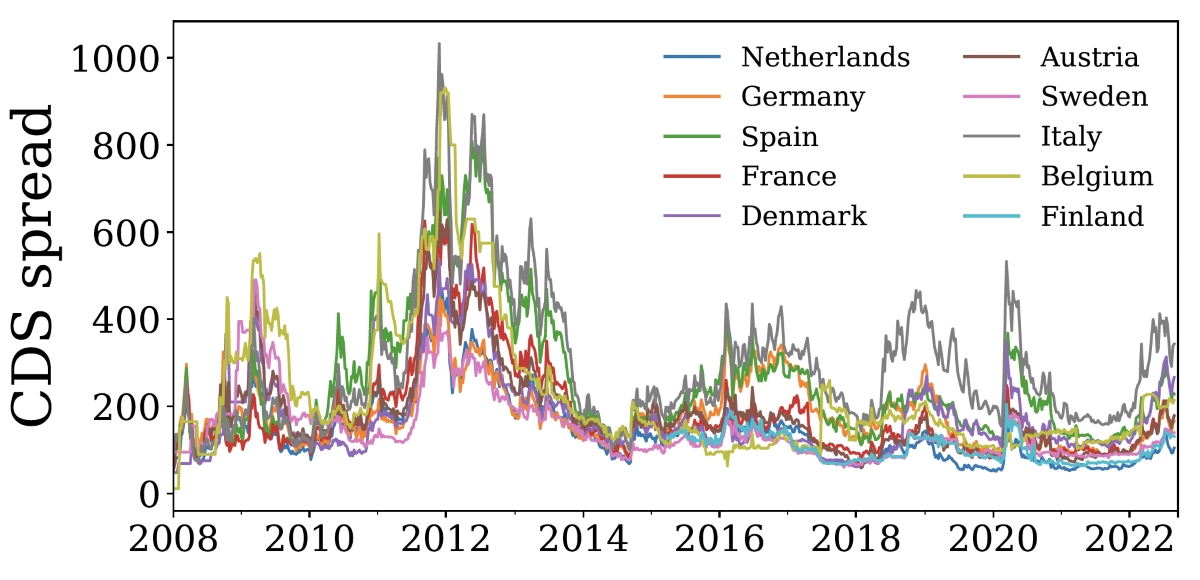

Another factor that shapes the currency of CDS trading is the presence of currency-specific risk factors and market dynamics. Exchange rate fluctuations, interest rate differentials, and geopolitical developments can all impact the pricing and trading of CDS in different currencies. Market participants keen on managing currency risk may opt for CDS denominated in the currency of their underlying exposure to mitigate the impact of currency fluctuations on their overall risk profile.

As we navigate the intricate landscape of CDS trading, it becomes evident that the currency in which these derivatives are traded is not arbitrary; rather, it is intricately linked to market dynamics, risk management considerations, and the underlying debt obligations. By comprehending the factors that influence the currency of CDS trading, market participants can make informed decisions and navigate the derivatives market with a deeper understanding of its nuances.

Factors Affecting Currency of Credit Default Swaps

The currency in which credit default swaps (CDS) are denominated is influenced by a myriad of factors that shape the dynamics of the derivatives market. Understanding these factors is essential for market participants seeking to navigate the complexities of CDS trading and make informed decisions regarding currency exposure and risk management.

Location of Reference Entity: The geographical location of the reference entity, which is the entity whose credit risk the CDS is designed to hedge or speculate on, plays a significant role in determining the currency of CDS trading. Entities based in the United States may lead to CDS denominated in US dollars, while European entities may result in CDS denominated in euros, reflecting the regional market dynamics and preferences of market participants.

Underlying Debt Obligations: The currency of the underlying debt obligations being hedged or speculated upon influences the choice of currency for CDS trading. If the reference entity issues debt in a specific currency, market participants may opt for CDS denominated in the same currency to align with the underlying exposure, thereby reducing currency risk and streamlining risk management strategies.

Market Liquidity and Participant Preferences: The concentration of market participants and the liquidity of CDS in specific currencies can impact the choice of currency for trading. Market participants may prefer to trade CDS in currencies that align with their existing exposures or that offer deeper liquidity, reflecting their risk management preferences and market dynamics.

Currency-Specific Risk Factors: Exchange rate fluctuations, interest rate differentials, and geopolitical developments can influence the pricing and trading of CDS in different currencies. Market participants keen on managing currency risk may opt for CDS denominated in the currency of their underlying exposure to mitigate the impact of currency fluctuations on their overall risk profile.

Regulatory and Legal Considerations: Regulatory and legal factors, including the jurisdiction of the reference entity and the regulatory environment governing CDS trading, can influence the choice of currency for these derivatives. Compliance with regulatory requirements and legal frameworks may impact the currency in which CDS are traded, reflecting the regulatory landscape and market infrastructure.

By considering these factors, market participants can gain valuable insights into the intricate dynamics that underpin the currency of CDS trading. Navigating the derivatives market with a deep understanding of these factors enables informed decision-making and effective risk management strategies, contributing to the efficient functioning of the CDS market.

Conclusion

Exploring the currency of credit default swaps (CDS) unveils a complex interplay of market dynamics, risk management considerations, and regulatory influences. The choice of currency for CDS trading is not arbitrary; rather, it is intricately linked to a myriad of factors that shape the derivatives market and impact the decisions of market participants.

Understanding the currency of CDS trading is essential for investors, institutions, and financial professionals seeking to navigate the complexities of credit risk management and derivatives trading. By comprehending the factors that influence the currency of CDS, market participants can make informed decisions regarding currency exposure, risk mitigation, and investment strategies.

The location of the reference entity, the currency of underlying debt obligations, market liquidity, participant preferences, currency-specific risk factors, and regulatory considerations all contribute to the intricate tapestry of the currency of CDS trading. Market participants keen on managing credit risk and currency exposure must carefully evaluate these factors to make prudent decisions in the derivatives market.

As the global financial landscape continues to evolve, the currency of CDS trading remains a dynamic and influential aspect of the derivatives market. Market participants must adapt to changing market conditions, regulatory developments, and macroeconomic trends to effectively navigate the currency dynamics of CDS trading.

In conclusion, the currency of credit default swaps reflects the multifaceted nature of the derivatives market, encompassing a diverse array of factors that shape trading decisions and risk management strategies. By embracing a nuanced understanding of the currency of CDS, market participants can enhance their ability to manage credit risk, optimize investment portfolios, and contribute to the efficient functioning of the global financial system.