Finance

What Is A Good Free Cash Flow

Published: December 20, 2023

Learn what free cash flow is and how it can benefit your finances. Discover the importance of monitoring this key financial metric in managing your money effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where cash is king. When it comes to evaluating the financial health of a company, one crucial metric often used is free cash flow. Understanding what constitutes a good free cash flow is essential for investors and businesses alike. In this article, we will delve into the definition of free cash flow, explore its significance, discuss the factors that influence it, and provide examples of companies with strong free cash flows.

Free cash flow (FCF) represents the amount of cash a company has left over after deducting its expenses and capital expenditures. It is a measure of the company’s ability to generate cash from its core operations and is a key indicator of its financial stability and flexibility. Essentially, it shows how much cash a company has available to reinvest in the business, pay dividends, reduce debt, or pursue growth opportunities.

The importance of free cash flow cannot be overstated. It offers valuable insights into a company’s financial viability and its ability to withstand economic downturns. A positive free cash flow indicates that the company is generating more cash than it is spending, which is a positive sign for investors. It suggests that the company has enough liquidity to fund its operations, invest in growth initiatives, and reward shareholders through dividends or stock buybacks.

On the other hand, a negative or low free cash flow can be concerning. It may indicate that the company is struggling to generate enough cash to cover its expenses or invest in growth opportunities. This could lead to financial constraints, increased debt levels, or even bankruptcy in extreme cases.

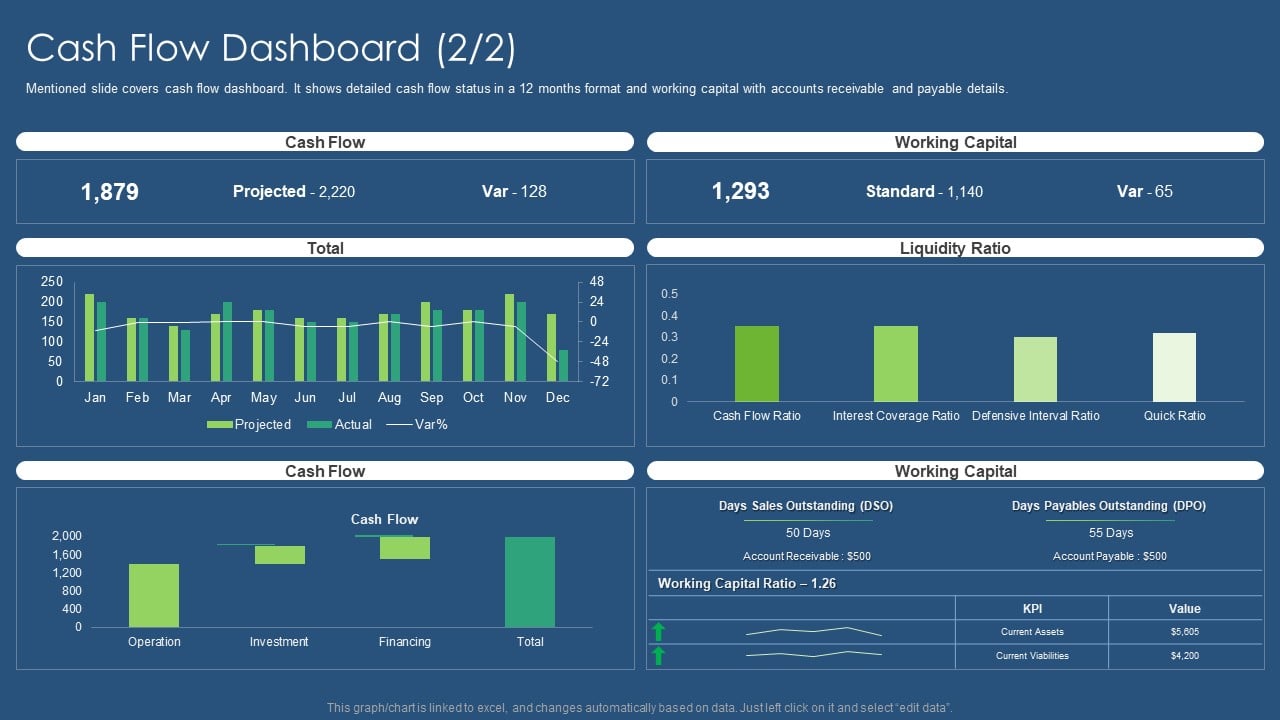

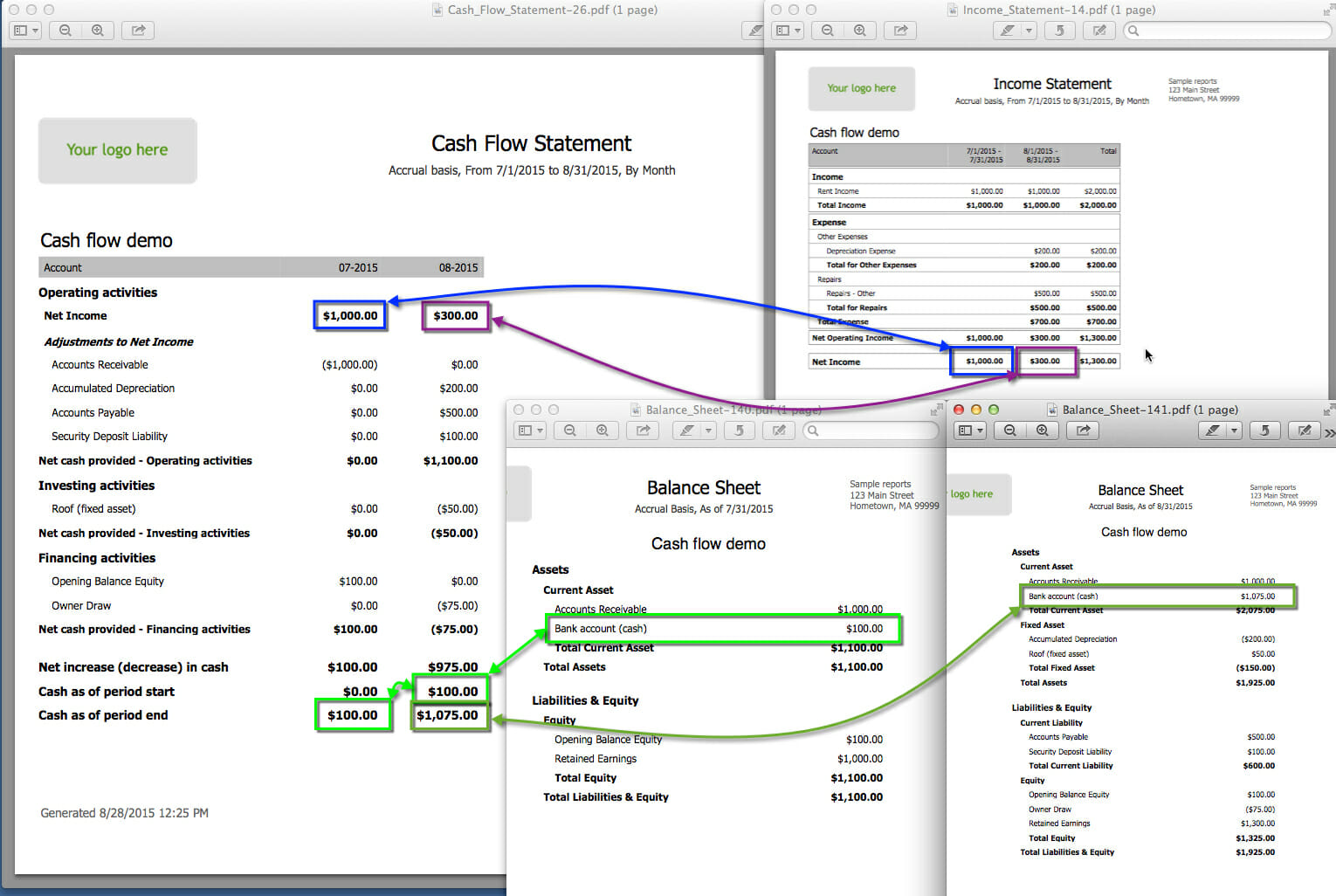

Determining the free cash flow of a company involves analyzing its financial statements, especially the cash flow statement. The cash flow statement provides a breakdown of the inflows and outflows of cash from the company’s operating, investing, and financing activities. By subtracting the capital expenditures from the net operating cash flow, you can calculate the free cash flow.

Several factors can influence a company’s free cash flow. These include its revenue growth, operating expenses, capital expenditure requirements, working capital management, and debt levels. A company with strong revenue growth, controlled expenses, efficient working capital management, and manageable debt will typically have a higher free cash flow.

Definition of Free Cash Flow

Free cash flow (FCF) is a financial metric that measures the cash generated by a company’s operations after deducting expenses and capital expenditures. It represents the amount of cash available for a company to reinvest in its business, pay dividends to shareholders, reduce debt, or pursue growth opportunities.

To fully understand the concept of free cash flow, let’s break down the components:

- Cash from Operations: This refers to the cash generated through a company’s core operations, such as sales of goods or services. It includes cash received from customers and cash paid to suppliers, employees, and other operating expenses.

- Capital Expenditures: These are investments made by a company in fixed assets, such as buildings, machinery, or equipment, to support its operations or future growth. Capital expenditures represent cash outflows.

The formula to calculate free cash flow is:

Free Cash Flow = Cash from Operations – Capital Expenditures

A positive free cash flow indicates that a company is generating more cash from its operations than it is spending on capital expenditures. This surplus cash can be used for various purposes, such as expanding the business, making acquisitions, paying down debt, or returning value to shareholders.

Conversely, a negative free cash flow suggests that a company is spending more on capital expenditures than it is generating from operations. This may indicate that the company is facing financial challenges and may have difficulty meeting its obligations or funding future growth initiatives.

Free cash flow is considered a fundamental measure of a company’s financial health and sustainability. It provides insights into the company’s ability to generate cash flow consistently and its capacity to handle unexpected expenses or economic downturns. Investors and analysts often use free cash flow to evaluate the value and potential of a company’s stock.

It is important to note that free cash flow is different from net income. Net income represents a company’s profitability after accounting for expenses and taxes, while free cash flow focuses on the actual cash generated and available for use.

By analyzing free cash flow, investors can gain a clearer understanding of a company’s financial strength and its ability to generate returns for its shareholders. It serves as a valuable tool for decision-making and assessing the long-term sustainability and growth prospects of a business.

Importance of Free Cash Flow

Free cash flow (FCF) is a critical metric for investors, analysts, and businesses. It provides key insights into a company’s financial health, operational efficiency, and growth potential. Understanding the importance of free cash flow is crucial for evaluating investment opportunities, making informed business decisions, and managing financial resources effectively.

Here are some reasons why free cash flow is important:

- Indicator of Financial Stability: Free cash flow offers a snapshot of a company’s ability to generate excess cash from its operations. A positive free cash flow indicates that the company is generating more cash than it needs for its day-to-day operations. This surplus cash can be used to invest in growth initiatives, pay down debt, or distribute to shareholders. It shows that the company has a solid financial foundation and is capable of withstanding economic downturns or unexpected expenses.

- Flexibility and Growth Opportunities: Companies with strong free cash flow have the flexibility to pursue growth opportunities. They can invest in research and development, expand their operations, make strategic acquisitions, or explore new markets. By having ample cash on hand, these companies can capitalize on emerging trends, innovate, and stay ahead of the competition. Free cash flow provides the financial resources necessary for growth and ensures a company’s long-term sustainability.

- Ability to Reward Shareholders: Free cash flow allows a company to reward its shareholders through dividends, share buybacks, or special distributions. When a company generates excess cash, it can choose to distribute these funds to shareholders as a return on their investment. This not only attracts investors but also enhances shareholder value and confidence in the company’s financial strength and stability. Potential investors often look for companies with a history of consistent and growing free cash flow as it signifies a company’s ability to generate returns.

- Debt Management: Free cash flow plays a crucial role in managing and reducing debt. Companies with significant free cash flow can allocate cash towards paying down debt, reducing interest expenses, and improving their creditworthiness. By reducing debt levels, companies can strengthen their balance sheets, improve financial ratios, and lower their overall risk profile. This, in turn, can lead to lower borrowing costs and improved access to capital in the future.

- Operational Efficiency: Examining a company’s free cash flow can reveal insights into its operational efficiency. If a company consistently generates positive free cash flow, it suggests that its operations are effective in converting sales into cash. It indicates that the company is able to manage its expenses, collect payments from customers, and control its capital expenditure requirements. Improved operational efficiency can enhance profitability and position the company for sustainable long-term growth.

Overall, free cash flow is a critical metric for assessing a company’s financial viability, growth potential, and ability to deliver value to shareholders. By analyzing and understanding free cash flow, investors and businesses can make informed decisions, mitigate risks, and position themselves for success in the ever-changing global marketplace.

Determining Free Cash Flow

Determining a company’s free cash flow (FCF) is essential for evaluating its financial performance and assessing its ability to generate cash from its operations. The process involves analyzing the company’s financial statements, particularly the cash flow statement, to calculate the free cash flow figure.

Here’s a step-by-step guide to determining free cash flow:

- Obtain the Cash Flow Statement: The cash flow statement provides a breakdown of the company’s cash inflows and outflows from its operating, investing, and financing activities. It is typically included in the company’s annual financial statements or quarterly reports.

- Identify the Operating Cash Flow (OCF): The operating cash flow represents the cash generated or used in the company’s core operations. It is calculated by starting with the net income and adjusting for non-cash items and changes in working capital. The operating cash flow figure is usually found in the cash flow statement.

- Identify the Capital Expenditures (CAPEX): Capital expenditures refer to the company’s investments in long-term assets, such as property, plant, and equipment, or research and development. It is important to identify and separate the capital expenditures from other cash outflows, such as operating expenses or debt payments.

- Calculate Free Cash Flow: Subtract the capital expenditures (CAPEX) from the operating cash flow (OCF) to calculate the free cash flow. The formula is as follows: FCF = OCF – CAPEX. The resulting figure represents the amount of cash available after accounting for operational expenses and capital investments.

After calculating the free cash flow, it is important to interpret the results in the context of the company’s industry, business model, and growth prospects. A positive free cash flow suggests that the company is generating cash surpluses, indicating financial strength and the potential to reinvest in the business or distribute to shareholders. Conversely, a negative free cash flow may raise concerns about the company’s ability to sustain operations or fund growth initiatives without additional external financing.

It is important to note that free cash flow can vary significantly between different industries and companies. Capital-intensive businesses, such as manufacturing or infrastructure companies, may have higher capital expenditure requirements, resulting in lower free cash flow compared to companies operating in less asset-heavy sectors.

Furthermore, it is essential to consider the timing and sustainability of the free cash flow. A company may have a positive free cash flow in one period but experience fluctuations due to factors such as seasonal sales patterns or one-time expenses. Analyzing the trend of free cash flow over multiple periods can provide a more accurate assessment of a company’s financial performance and cash generation capabilities.

Overall, determining free cash flow is a crucial step in evaluating a company’s financial health and its ability to generate cash. By understanding how to calculate and interpret free cash flow, investors and businesses can make more informed decisions and gain insights into a company’s cash flow dynamics and long-term prospects.

Factors Affecting Free Cash Flow

Several factors can have a significant impact on a company’s free cash flow (FCF). Understanding these factors is essential for assessing the financial health and sustainability of a business. Let’s explore the key elements that influence free cash flow:

- Revenue Growth: The growth rate of a company’s revenue directly affects its free cash flow. Higher revenue growth typically leads to increased cash inflows from sales. This, in turn, can positively impact free cash flow by providing more funds to cover expenses and invest in growth initiatives.

- Operating Expenses: The level of operating expenses, including costs related to raw materials, labor, marketing, and administrative functions, affects free cash flow. Managing and controlling expenses can help optimize cash generation and improve free cash flow. Companies that efficiently manage their costs are typically better positioned to generate positive free cash flow.

- Capital Expenditure (CAPEX) Requirements: Capital expenditures refer to investments a company makes in assets such as property, plant, equipment, or technology. The level of capital expenditure required can impact free cash flow, as it represents cash outflows. Companies with higher capital expenditure requirements may experience reduced free cash flow as they allocate more funds to long-term asset investments.

- Working Capital Management: Efficient management of working capital, which includes cash, inventory, accounts receivable, and accounts payable, can significantly impact free cash flow. Optimizing the cash conversion cycle, managing inventory levels, accelerating accounts receivable collections, and negotiating favorable payment terms with suppliers can help improve free cash flow by reducing the cash tied up in working capital.

- Debt and Interest Expenses: The level of debt and associated interest expenses can affect free cash flow. Companies with higher debt levels usually have higher interest payments, reducing their available cash flow. Managing debt levels, refinancing at lower interest rates, or reducing interest expenses can improve free cash flow.

- Taxation: Tax obligations impact free cash flow as they represent cash outflows. Changes in tax rates, tax credits, incentives, and deductions can affect a company’s tax burden, subsequently influencing its free cash flow.

- Macroeconomic Factors: Economic conditions and external factors can impact free cash flow. Factors such as inflation, interest rates, exchange rates, and regulations can have both positive and negative effects on a company’s cash flow. Companies need to consider these factors and adjust their strategies accordingly to manage their cash flow effectively.

It is important to note that these factors do not act independently, but rather interact and influence each other. For example, revenue growth can impact operating expenses and working capital requirements. Similarly, managing debt levels can affect interest expenses and capital expenditure decisions.

Each industry and business model may have unique factors that affect free cash flow. Capital-intensive industries, such as manufacturing or infrastructure, tend to have higher capital expenditure requirements, which can lower free cash flow. Service-oriented companies, on the other hand, may have lower capital expenditure needs and higher margins, leading to higher free cash flow.

Considering the impact of these factors on free cash flow allows investors and businesses to gain a comprehensive understanding of a company’s cash generation capabilities, financial stability, and long-term sustainability.

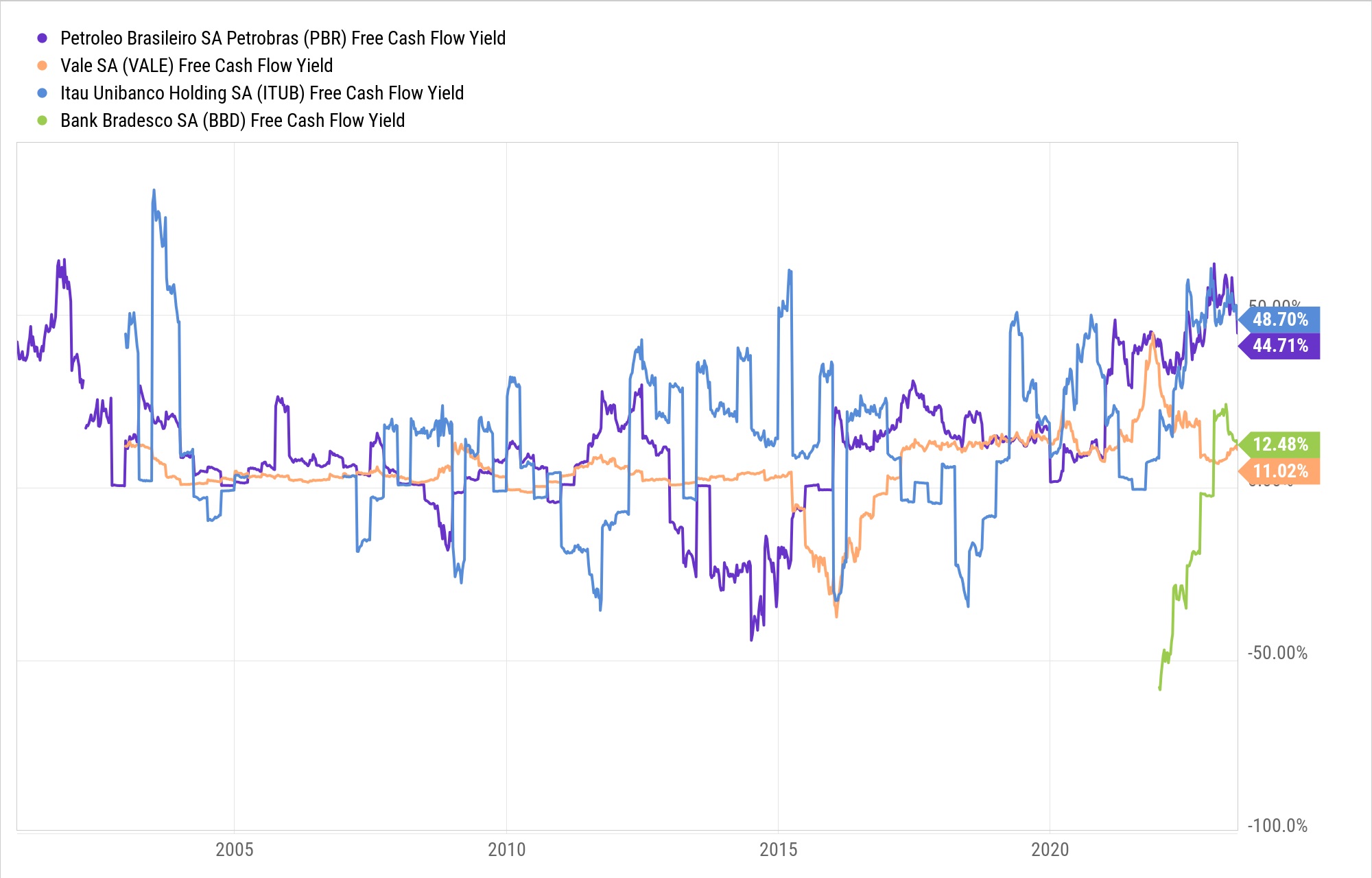

Examples of Good Free Cash Flow

Several companies have demonstrated strong free cash flow (FCF) generation, showcasing their ability to generate excess cash from their operations. Let’s explore a few examples of companies with good free cash flow:

- Apple Inc.: As one of the world’s largest technology companies, Apple has consistently generated robust free cash flow. The company’s strong product sales and high profit margins have enabled it to accumulate significant cash reserves. Apple’s ability to effectively manage its operating expenses, efficiently convert sales into cash, and minimize capital expenditure requirements has contributed to its impressive free cash flow.

- Microsoft Corporation: Microsoft is renowned for its software products and services and has consistently reported strong free cash flow. The company’s recurring revenue streams, including its Office suite and cloud-based services, have fueled its cash generation. Microsoft’s effective cost management, substantial cash flow from its Windows operating system, and strategic investments in cloud infrastructure have contributed to its impressive free cash flow figures.

- Johnson & Johnson: As a leading global healthcare company, Johnson & Johnson has consistently demonstrated strong free cash flow. The company’s diverse portfolio of pharmaceuticals, medical devices, and consumer healthcare products has provided a stable revenue stream. Johnson & Johnson’s disciplined approach to managing operating expenses, solid working capital management, and focus on innovation and expansion have contributed to its healthy free cash flow.

- Procter & Gamble: Procter & Gamble is a multinational consumer goods company known for its strong brands and global presence. The company has consistently generated solid free cash flow due to its robust sales across various product categories. Procter & Gamble’s efficient manufacturing and supply chain operations, effective cost management, and focus on brand innovation have helped drive its positive free cash flow.

- Visa Inc.: Visa, a global payment technology company, has consistently reported strong free cash flow. The company’s extensive network and transaction processing capabilities have led to substantial cash inflows. Visa’s ability to manage operating expenses, increase transaction volumes, and drive digital payment adoption has contributed to its impressive free cash flow generation.

These are just a few examples of companies with good free cash flow. It is important to note that free cash flow can vary across industries and business models. Capital-intensive industries, such as manufacturing or infrastructure, may have lower free cash flow due to higher capital expenditure requirements. Service-oriented companies, on the other hand, may have higher free cash flow due to lower capital expenditure needs and higher profit margins.

When evaluating free cash flow, it is crucial to consider the company’s growth prospects, market conditions, and industry dynamics. A sustained pattern of positive free cash flow, coupled with effective management of expenses, capital investments, and working capital, can be indicative of a company’s financial strength and the potential to create long-term shareholder value.

Evaluating Good Free Cash Flow

When assessing a company’s free cash flow (FCF), it is important to evaluate not only the absolute value of the free cash flow but also the sustainability and quality of the cash generation. Here are key factors to consider when evaluating good free cash flow:

- Consistency: A company with consistently positive free cash flow is generally more reliable and better positioned to weather economic downturns. Analyze the historical trend of the company’s free cash flow over multiple periods to identify any significant fluctuations or deviations.

- Growth Potential: While consistent positive free cash flow is important, assessing a company’s growth potential is equally crucial. Look for companies that have the ability to grow their revenue and cash flow over time. Consider the industry dynamics, market share, competitive advantages, and the company’s growth strategy to determine its ability to generate sustained free cash flow growth.

- Return on Investment: Evaluate how a company utilizes its free cash flow to generate returns for shareholders. Look for companies that reinvest free cash flow wisely in initiatives with a high return on investment. This could include research and development, capital expenditure projects, strategic acquisitions, or share buybacks/dividends. Ensuring that the company is efficiently deploying cash to create value is essential.

- Debt Management: Examine the company’s debt levels and how it manages its debt. A healthy free cash flow should allow for debt reduction and interest payments without compromising growth opportunities. Excessive debt levels or high interest expenses can limit a company’s financial flexibility and pose risks to free cash flow generation.

- Efficient Operations: Consider how effectively the company manages its operating expenses and working capital. Efficient operating expense management can enhance free cash flow by minimizing costs. Additionally, optimizing working capital, such as reducing inventory levels or improving accounts receivable collections, can improve cash flow efficiency.

- Industry Comparison: Compare the company’s free cash flow performance to its industry peers to assess its relative strength. Different industries may have varying capital requirements, growth rates, and business models that impact free cash flow. Understanding industry norms and benchmarks can provide valuable insights into a company’s performance.

- Long-Term Sustainability: Evaluate the company’s competitive position, long-term prospects, and ability to adapt to changing market conditions. A company with a strong competitive advantage, innovative mindset, and a solid business strategy is more likely to sustain its free cash flow generation over the long run.

It is important to remember that evaluating free cash flow should be done in conjunction with other financial metrics and factors specific to the company and its industry. Each company’s situation and goals may vary, so it is crucial to consider the broader context when assessing the quality of free cash flow.

In summary, when evaluating good free cash flow, look for consistency, growth potential, efficient deployment of cash, prudent debt management, operational efficiency, industry comparisons, and long-term sustainability. Taking a holistic approach to analyzing free cash flow enables investors and analysts to gain a deeper understanding of a company’s financial strength and its ability to generate sustainable cash flow in the future.

Conclusion

Free cash flow (FCF) is a vital financial metric that provides insights into a company’s ability to generate cash after accounting for expenses and capital expenditures. Understanding what constitutes a good free cash flow is essential for investors and businesses alike.

In this article, we explored the definition of free cash flow and its significance. We learned that a positive free cash flow indicates a company’s financial stability and flexibility, while a negative or low free cash flow may raise concerns about its financial health.

Determining free cash flow involves analyzing a company’s financial statements, specifically the cash flow statement, to calculate the surplus cash available. Factors that influence free cash flow include revenue growth, operating expenses, capital expenditure requirements, working capital management, debt levels, and macroeconomic conditions.

We also examined examples of companies with good free cash flow, such as Apple, Microsoft, Johnson & Johnson, Procter & Gamble, and Visa. These companies have showcased strong free cash flow generation through their successful operations, cost management, innovation, and industry positioning.

Evaluating good free cash flow requires considering factors such as consistency, growth potential, return on investment, debt management, efficient operations, industry comparisons, and long-term sustainability. Understanding the quality of a company’s cash generation is crucial for making informed investment decisions and evaluating its overall financial health.

In conclusion, free cash flow provides valuable insights into a company’s financial viability, growth potential, and ability to deliver value to shareholders. By analyzing and understanding free cash flow, investors and businesses can make informed decisions, mitigate risks, and position themselves for long-term success.