Finance

What Is A Lead Sheet In Accounting

Published: October 12, 2023

Learn about lead sheets in accounting and how they are used in finance. Gain a deeper understanding of this financial document and its importance in managing and analyzing financial data.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Lead Sheet

- Purpose of a Lead Sheet

- Components of a Lead Sheet

- Format and Layout of a Lead Sheet

- Importance of Lead Sheets in Accounting

- Examples of Information Typically Included in Lead Sheets

- Preparation and Maintenance of Lead Sheets

- Benefits and Drawbacks of Using Lead Sheets

- Conclusion

Introduction

Welcome to the world of accounting, where financial information is meticulously organized, recorded, and analyzed. In this complex realm of numbers and transactions, accuracy and transparency are of utmost importance. One essential tool that accountants utilize is the lead sheet, a document that plays a crucial role in ensuring the integrity and accuracy of financial records.

A lead sheet is a structured document used in accounting to summarize key financial information for specific accounts or transactions. It serves as a central repository of data, providing a concise snapshot of the relevant details. This vital resource aids accountants in identifying and investigating discrepancies, facilitating the reconciliation process, and maintaining the overall accuracy of financial statements.

While lead sheets may vary in their format and content based on organizational requirements, their purpose remains consistent – to streamline and simplify the accounting process. By consolidating pertinent information in a single document, accountants can quickly and efficiently review and analyze financial data, making informed decisions with confidence.

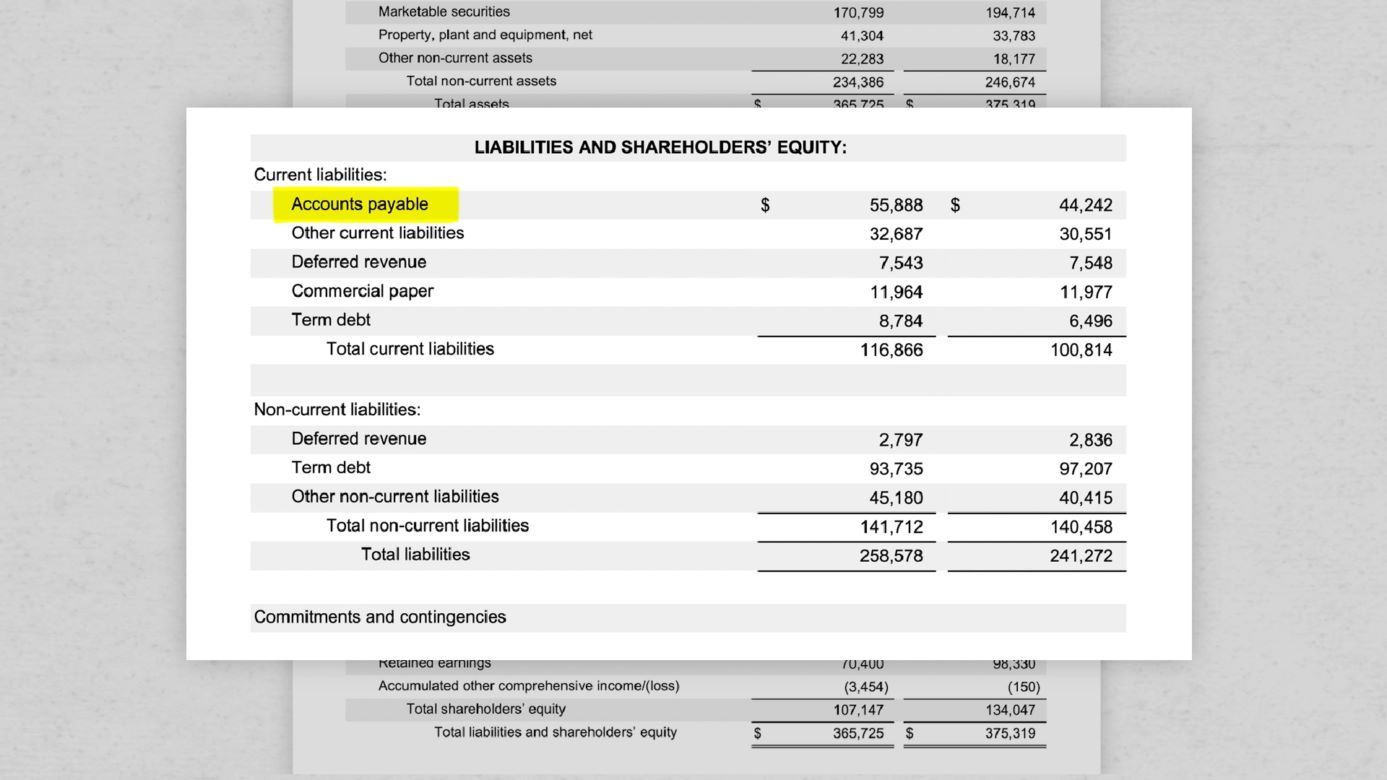

The main components of a lead sheet typically include the account name, account number, transaction details, supporting documentation references, and any relevant notes or comments. By organizing and documenting this information comprehensively, accountants can easily track and trace the flow of transactions, ensuring that everything balances and aligns with the underlying accounting principles and policies.

The format and layout of a lead sheet can vary depending on the specific accounting system or software being used. However, most lead sheets consist of columns or sections that capture essential information, such as the date, description, debit, credit, and running balances. This structured approach enables accountants to analyze transactions, identify trends, and promptly detect any irregularities or errors.

Lead sheets play a vital role in maintaining accurate financial records and providing a clear audit trail. Whether it’s for internal use or external audits, lead sheets serve as a valuable reference that helps accountants and auditors review and reconcile financial transactions effectively.

In the following sections, we will explore the purpose, components, format, importance, and examples of information typically included in lead sheets. We will also discuss the preparation and maintenance of lead sheets, as well as the benefits and drawbacks associated with using them in accounting practices. Through this comprehensive exploration, we aim to provide you with a deeper understanding of lead sheets and their role in ensuring financial integrity.

Definition of a Lead Sheet

A lead sheet is a document used in accounting that summarizes key financial information for specific accounts or transactions. It serves as a centralized reference tool, providing a concise overview of relevant details. The purpose of a lead sheet is to streamline the accounting process by consolidating essential information and facilitating easier analysis and review.

Lead sheets are commonly used in various accounting contexts, including general accounting, management accounting, and auditing. They can be tailored to meet the specific needs of an organization, department, or project, allowing for customization and flexibility.

At its core, a lead sheet serves as a roadmap for accountants and auditors, guiding them through the intricate web of financial transactions. It helps to ensure accuracy, transparency, and consistency in financial reporting.

The primary objective of a lead sheet is to provide a clear and concise summary of key financial information. This may include account balances, transaction details, supporting documentation references, and any necessary notes or comments. By organizing and documenting this information in a structured manner, accountants can easily navigate through the complexities of financial records.

Lead sheets can be created manually using spreadsheets or accounting software or generated automatically by an accounting system. Regardless of the method used, the end result is a document that captures essential data and serves as a reference point for accounting and auditing purposes.

It is worth noting that a lead sheet is not the same as a trial balance or a financial statement. While a trial balance summarizes the balances of all accounts, a lead sheet focuses on specific accounts or transactions. Similarly, a lead sheet is not a complete financial statement but rather a tool that aids in the preparation and analysis of financial statements.

Overall, a lead sheet is a powerful resource that helps accountants and auditors manage and review financial information efficiently. By providing a succinct summary of key details, it enhances the accuracy and integrity of financial records, leading to better decision-making and ensuring compliance with accounting standards and regulations.

Purpose of a Lead Sheet

The purpose of a lead sheet in accounting is to streamline the management and analysis of financial information. It serves as a centralized reference document that allows accountants and auditors to quickly and efficiently review and track specific accounts or transactions. The main objectives of a lead sheet include:

1. Consolidating Information:

A lead sheet gathers all the relevant financial details pertaining to a specific account or transaction into one document. It brings together information such as account balances, transaction dates, descriptions, and supporting documentation references. By consolidating this data, a lead sheet provides a comprehensive and convenient overview, eliminating the need to search through multiple records.

2. Facilitating Analysis:

Lead sheets are designed to enable efficient analysis and review of financial information. By organizing information in a structured format, accountants can easily identify any discrepancies or irregularities. For example, analyzing the transaction details on a lead sheet can help pinpoint errors such as duplicate entries, incorrect postings, or missing documentation. This makes lead sheets an invaluable tool for maintaining accurate financial records.

3. Supporting Reconciliation:

Reconciling accounts is a crucial aspect of accounting. A lead sheet plays a significant role in this process by providing a clear audit trail. Accountants can compare the transactions recorded in the lead sheet with the corresponding entries in other financial documents, such as bank statements or invoices. This reconciliation helps identify any inconsistencies or omissions, ensuring the accuracy and integrity of financial records.

4. Enhancing Decision-Making:

Lead sheets provide a snapshot of essential financial information, allowing accountants and financial managers to make informed decisions. By having all the relevant details readily available, they can assess the financial health of specific accounts, monitor trends, and identify areas for improvement. Lead sheets provide a valuable resource for evaluating performance, assessing risks, and making strategic decisions.

5. Simplifying Auditing:

During external audits or internal reviews, auditors often rely on lead sheets to analyze financial transactions and ensure compliance with accounting standards. The clear and concise format of lead sheets aids auditors in understanding and verifying the accuracy of recorded transactions. The presence of supporting documentation references on the lead sheet enables auditors to locate and examine the underlying evidence, ensuring transparency and facilitating a smooth audit process.

In summary, the purpose of a lead sheet is to streamline the accounting process by consolidating and organizing financial information for specific accounts or transactions. By providing a comprehensive overview, facilitating analysis, supporting reconciliation efforts, enhancing decision-making, and simplifying audits, lead sheets play a vital role in maintaining accurate and reliable financial records.

Components of a Lead Sheet

A lead sheet in accounting typically consists of several key components that help organize and present the necessary financial information. These components serve as the building blocks of a lead sheet and provide a structured format for better understanding and analysis. The main components of a lead sheet include:

1. Account Name and Number:

The lead sheet starts by specifying the account name and number. This information identifies the account to which the lead sheet pertains, ensuring clarity and accuracy in tracking financial transactions.

2. Transaction Details:

The transaction details section is where specific information about each transaction associated with the account is recorded. This includes the date of the transaction, a detailed description of the transaction, and any relevant supporting documentation references. It serves as a chronological record of the history and activity for the account.

3. Debit and Credit Columns:

The lead sheet incorporates columns to record the debit and credit amounts associated with each transaction. These columns allow for the proper classification and balancing of the financial information. The debit column captures the amounts that increase the account balance, while the credit column records the amounts that reduce the account balance.

4. Running Balances:

In addition to recording individual transaction amounts, a lead sheet may include a running balance column. This column calculates and displays the cumulative balance for the account after each transaction. It helps accountants keep track of the account’s balance and quickly identify any discrepancies or errors.

5. Notes and Comments:

Lead sheets often provide space for accountants to include any relevant notes or comments about specific transactions or account activities. This section allows for additional context or explanations to be documented, providing valuable insights for later analysis and review.

6. Supporting Documentation References:

One of the essential components of a lead sheet is the inclusion of references to supporting documentation. This may include invoice numbers, receipt numbers, or any other relevant documents that verify the transactions recorded. By referencing the supporting documentation, accountants and auditors can easily locate and review the underlying evidence when necessary.

The layout and organization of these components may vary depending on the specific accounting system or software used. However, the overall objective remains the same – to provide a clear and concise summary of key financial information for a specific account or transaction.

By combining these components, a lead sheet offers accountants and auditors a consolidated view of the relevant financial data. It allows for easier analysis, reconciliation, and decision-making, ultimately contributing to accurate financial reporting and ensuring compliance with accounting standards.

Format and Layout of a Lead Sheet

The format and layout of a lead sheet in accounting play a crucial role in presenting financial information in a clear and organized manner. A well-designed lead sheet ensures that the data is easily understood, accessible, and facilitates efficient analysis. While the exact format may vary depending on the accounting system or software being used, there are several common elements that contribute to an effective lead sheet:

1. Clear Headers and Labels:

A lead sheet begins with clear and descriptive headers, indicating the account name, number, and any other relevant information. Each section is labeled appropriately, allowing users to quickly identify the content and purpose of different sections within the lead sheet.

2. Consistent Column Layout:

A lead sheet typically consists of columns that organize financial data in a structured manner. Common columns include the transaction date, description, debit amount, credit amount, and running balance. Consistency in column layout helps accountants easily compare and analyze data across different entries and enhances the readability of the lead sheet.

3. Formatting for Readability:

The lead sheet should be formatted for optimal readability, with consistent font styles, sizes, and spacing. The use of bold or italicized text can help highlight important information or headers. Adequate spacing between sections and rows improves visual clarity and prevents confusion when reviewing the lead sheet.

4. Logical Ordering of Entries:

Entries in a lead sheet should follow a logical order, such as starting with the most recent transactions and progressing towards previous ones. This organization allows for easier analysis and tracking of financial activities within the account.

5. Subtotals and Totals:

In some cases, lead sheets may include subtotals and totals for specific sections or for the overall account balance. These calculations provide a summary of the financial information captured in the lead sheet, assisting accountants in quickly assessing the account’s overall financial position.

6. Supporting Documentation References:

A well-designed lead sheet incorporates references to supporting documentation, such as invoice numbers or receipts, alongside each transaction entry. This allows accountants and auditors to easily locate and cross-reference the relevant documents when needed, ensuring transparency and accuracy in financial reporting.

Accounting software often provides pre-designed templates for lead sheets, ensuring consistency and ease of use. However, manual lead sheets can be created using spreadsheet programs, such as Microsoft Excel, where the formatting options and formulas can be customized to fit specific needs.

Ultimately, the format and layout of a lead sheet should prioritize clarity, organization, and accessibility. It should be designed to facilitate efficient analysis, reconciliation, and review of financial information, supporting accurate financial reporting and decision-making.

Importance of Lead Sheets in Accounting

Lead sheets play a critical role in the field of accounting, facilitating efficient and accurate management of financial information. They offer several important benefits that contribute to the overall integrity and reliability of financial records. Below are key reasons why lead sheets are important in accounting:

1. Organization and Consolidation:

Lead sheets serve as a central repository for relevant financial data. By consolidating information related to specific accounts or transactions, accountants can easily track and review financial activities. This organization and consolidation save time and effort, preventing the need to search through multiple documents to locate and analyze the necessary information.

2. Accuracy and Transparency:

Lead sheets are designed to ensure the accuracy and transparency of financial records. Accountants can use them to cross-reference transactions with supporting documentation, ensuring that the recorded information aligns with the actual transactions. Any discrepancies or errors can be quickly identified and addressed, leading to more reliable financial reporting.

3. Reconciliation and Verification:

Reconciling accounts is a critical process in accounting. Lead sheets provide a clear audit trail, allowing accountants to compare the transactions recorded in the lead sheet with other supporting documents, such as bank statements or invoices. This reconciliation helps identify any discrepancies or omissions, ensuring the accuracy and completeness of financial records.

4. Analysis and Decision-Making:

Lead sheets provide valuable insights for analysis and decision-making. By summarizing key financial information, accountants can monitor trends, identify patterns, and assess the financial health of specific accounts or transactions. This analysis aids in making informed decisions, managing risks, and identifying areas for improvement.

5. Audit Compliance:

Lead sheets are essential during audits, both internal and external. They provide auditors with a clear and organized overview of financial transactions, making the process more efficient. The inclusion of supporting documentation references ensures transparency and facilitates the verification of recorded transactions, leading to smoother and more accurate audits.

6. Documentation and Legal Compliance:

Lead sheets serve as evidence of financial transactions and can be used to demonstrate compliance with legal and regulatory requirements. In the event of an audit or legal inquiry, an organized and comprehensive lead sheet can provide the necessary documentation to support the accuracy and validity of reported financial information.

In summary, lead sheets are invaluable tools in accounting due to their role in organizing and consolidating financial data, ensuring accuracy and transparency, facilitating reconciliation and verification, aiding in analysis and decision-making, supporting audit compliance, and providing necessary documentation for legal compliance. By using lead sheets effectively, accountants can enhance the overall integrity and reliability of financial records, contributing to the success and growth of an organization.

Examples of Information Typically Included in Lead Sheets

Lead sheets in accounting capture and summarize essential financial information for specific accounts or transactions. The specific details included in a lead sheet may vary depending on the organization’s needs and accounting practices. However, some common examples of information typically included in lead sheets are:

1. Account Name and Number:

The lead sheet begins with the account name and its corresponding account number. This information ensures clarity and identification of the specific account being referenced in the lead sheet.

2. Transaction Date:

Each transaction recorded in the lead sheet includes the date on which the transaction occurred. This helps accountants track the chronology of financial activities and identify any time-based trends or patterns.

3. Transaction Description:

A brief description of the transaction is provided to explain the nature of the financial activity. This description may include details such as the purpose of the transaction, the parties involved, and any relevant notes or comments.

4. Debit and Credit Amounts:

The lead sheet includes columns for recording the debit and credit amounts associated with each transaction. The debit amount indicates the money or value entering the account, while the credit amount represents the money or value leaving the account.

5. Running Balance:

A running balance column is often included in the lead sheet, which maintains a cumulative total of the account balance after each transaction. This running balance allows for easy tracking and verification of the account’s financial status.

6. Supporting Documentation References:

For each transaction, references to supporting documentation are provided. This may include invoice numbers, receipt numbers, or other relevant document references that verify the authenticity and accuracy of the transaction. These references help in locating and cross-referencing the underlying evidence if needed.

7. Notes and Comments:

Lead sheets may have a section for accountants to add notes or comments regarding specific transactions or account activities. This section allows for additional context, explanations, or any exceptional circumstances that need to be highlighted for future reference or analysis.

These are just a few examples of the information typically included in lead sheets. However, lead sheets can be customized to meet the specific requirements and preferences of an organization, allowing for the inclusion of additional information relevant to their accounting practices.

By capturing and organizing this information, lead sheets provide a consolidated view of financial activity for specific accounts or transactions. This enhances the efficiency of analysis, supports proper documentation, facilitates accurate financial reporting, and ensures compliance with accounting standards and regulations.

Preparation and Maintenance of Lead Sheets

The preparation and maintenance of lead sheets in accounting are essential tasks to ensure accurate and reliable financial records. By following specific procedures and best practices, accountants can create and maintain lead sheets effectively. The key steps involved in the preparation and maintenance of lead sheets are as follows:

1. Identify the Accounts:

Start by identifying the specific accounts that require lead sheets. These may include key revenue accounts, expense accounts, or any accounts of particular significance to the organization.

2. Determine the Required Information:

Define the necessary information to include in the lead sheet for each account. This could involve transaction details such as dates, descriptions, debit and credit amounts, running balances, and supporting documentation references.

3. Choose the Format:

Select the format and layout for the lead sheet. This may involve using accounting software with built-in templates or creating manual lead sheets using spreadsheet programs. Ensure that the chosen format is clear, organized, and easily understandable for users.

4. Capture and Record Transactions:

Record transactions accurately and promptly in the lead sheet. Enter the transaction details, including the date, description, debit and credit amounts, and any relevant supporting documentation references. Be diligent in capturing all transactions related to the respective accounts.

5. Regularly Update and Review:

Maintain the lead sheets by regularly updating them with new transactions and reviewing for accuracy. It is essential to promptly record new transactions and ensure the data is accurate to maintain the integrity of the lead sheet.

6. Reconcile with Supporting Documents:

Periodically reconcile the lead sheet entries with the supporting documentation, such as bank statements, invoices, or receipts. This verification process ensures that the recorded transactions align with the actual evidence and helps identify any discrepancies or errors.

7. Document Notes and Comments:

Include notes and comments in the lead sheet to provide additional context or explanations regarding specific transactions or account activities. These notes can assist in future analysis or provide supporting information during audits.

8. Backup and Secure Lead Sheets:

Regularly back up the lead sheets to prevent data loss or corruption. Store the lead sheets in a secure location or utilize secure cloud-based storage to protect the sensitive financial information captured in the sheets.

By following these steps, accountants can ensure the accurate preparation and maintenance of lead sheets. Regularly updating, reconciling, and reviewing the lead sheets enhances their value as reliable and accessible resources for financial analysis, reporting, and auditing purposes.

Benefits and Drawbacks of Using Lead Sheets

Lead sheets are valuable tools in accounting, offering numerous benefits that contribute to efficient financial management and accurate reporting. However, like any tool, they also come with certain drawbacks. Let’s explore the benefits and drawbacks of using lead sheets:

Benefits:

1. Organization and Consolidation:

Lead sheets streamline financial information by consolidating it into one document. This organization allows accountants to easily track and review specific accounts or transactions, saving time and effort.

2. Accuracy and Transparency:

Lead sheets enhance the accuracy and transparency of financial records by providing a clear audit trail. Accountants can cross-reference transactions with supporting documentation, ensuring accuracy and identifying any discrepancies.

3. Reconciliation and Verification:

Lead sheets facilitate the reconciliation and verification of financial information. Accountants can compare entries in the lead sheet with other financial documents, such as bank statements or invoices, to ensure consistency and accuracy.

4. Analysis and Decision-Making:

Lead sheets provide valuable insights for analysis and decision-making. By summarizing key financial data, accountants can monitor trends, assess financial health, and make informed decisions based on reliable information.

5. Audit Compliance:

Lead sheets simplify audits by providing auditors with an organized and comprehensive overview of financial transactions. The inclusion of supporting documentation references ensures transparency and facilitates verification during the audit process.

Drawbacks:

1. Manual Data Entry:

Creating and maintaining lead sheets require manual data entry, which can be time-consuming and prone to human error. It is essential to ensure that the data entered is accurate and consistently updated to maintain the integrity of the lead sheet.

2. Limited Scope:

Lead sheets focus on specific accounts or transactions, which means they may not capture the entirety of an organization’s financial activities. Accountants must ensure that relevant accounts are included in the lead sheets to avoid missing critical information.

3. Dependency on Supporting Documentation:

Lead sheets rely on accurate and readily available supporting documentation. Inaccurate or missing documentation can affect the reliability and validity of the recorded transactions in the lead sheet.

4. Formatting and Layout Constraints:

Lead sheets often have predetermined formats and layouts, which may restrict customization options. Accountants may need to work within these constraints, which can limit flexibility or require additional manual adjustments.

5. Additional Maintenance:

Maintaining lead sheets requires regular updates, reviews, and reconciliations. This additional maintenance work can be time-consuming, especially in organizations with high transaction volumes.

Despite these drawbacks, the benefits of using lead sheets, such as improved organization, accuracy, and analysis, far outweigh the potential challenges. By understanding and addressing the drawbacks, accountants can effectively leverage lead sheets to streamline financial processes and ensure reliable financial reporting.

Conclusion

In the world of accounting, lead sheets prove to be indispensable tools that enhance efficiency, accuracy, and transparency in financial management. These structured documents provide a consolidated view of key financial information for specific accounts or transactions, streamlining the accounting process and aiding in decision-making.

Through their organization and consolidation of financial data, lead sheets offer numerous benefits. They facilitate the accurate recording and tracking of transactions, ensure transparency and compliance with accounting standards, simplify the reconciliation process, and provide valuable insights for data analysis and decision-making. Lead sheets also serve as essential resources during audits, enabling auditors to review financial transactions easily and verify the accuracy of records.

However, it is essential to be aware of the potential drawbacks of using lead sheets, such as the requirement for manual data entry, limited scope, dependency on supporting documentation, formatting constraints, and additional maintenance. Accountants must address these challenges by ensuring accurate data entry, including all relevant accounts, maintaining proper documentation, and staying mindful of formatting and layout limitations.

In conclusion, lead sheets are invaluable tools in accounting practices, contributing to accurate financial reporting, informed decision-making, and compliance with accounting standards. By properly preparing, maintaining, and leveraging lead sheets, accountants can streamline processes, organize financial information, and enhance the integrity and reliability of financial records. With their ability to consolidate data, provide transparency, and support analysis, lead sheets ultimately play a critical role in effectively managing and analyzing financial information in the world of accounting.