Finance

How To Buy A Credit Default Swap

Modified: February 21, 2024

Looking to navigate the world of finance? Discover how to buy a credit default swap and protect your investments with expert guidance and insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Buying a credit default swap (CDS) can be a valuable tool for managing risk in the financial markets. Whether you are an individual investor or a financial institution, understanding how to navigate the world of credit default swaps is essential. This article will provide an overview of what credit default swaps are, how they work, and the steps involved in buying one.

A credit default swap is a financial contract between two parties, typically a buyer (the protection buyer) and a seller (the protection seller). The purpose of a CDS is to transfer credit risk from the buyer to the seller. In other words, the buyer is seeking protection against the possibility of a default by a specific borrower, such as a company or a government entity. If the borrower defaults, the seller of the CDS is obligated to pay the buyer the face value of the underlying debt instrument, such as a bond or a loan.

Credit default swaps can be used for various reasons. For investors, they offer a way to hedge against potential losses in their portfolios. For financial institutions, they can be used as a risk management tool to protect against default risks in their lending activities. However, it’s important to note that buying a credit default swap is not without its risks. It requires careful evaluation of the counterparty, thorough research, and understanding of the terms and conditions of the swap.

Understanding Credit Default Swaps

Before delving into the process of buying a credit default swap, it’s crucial to have a clear understanding of how these financial instruments work. A credit default swap is essentially an insurance contract that allows the buyer to transfer the risk of default on a specific debt obligation to the seller in exchange for regular premium payments.

At its core, a credit default swap is based on the concept of credit risk. Credit risk refers to the likelihood that a borrower will default on their debt obligations. By purchasing a credit default swap, the buyer is essentially protecting themselves against the possibility of a default by a specific borrower.

The value of a credit default swap is primarily determined by the creditworthiness of the underlying debt obligation. If the creditworthiness of the borrower deteriorates, the value of the CDS increases, as the likelihood of default rises. Conversely, if the creditworthiness improves, the value of the CDS decreases, as the risk of default decreases.

Credit default swaps are typically traded over-the-counter (OTC), meaning that they are not traded on a centralized exchange. The terms of each CDS contract are negotiated between the buyer and the seller, and can vary depending on the specific terms and conditions agreed upon.

It’s important to note that credit default swaps are derivative instruments, meaning that their value is derived from the underlying debt obligation. The buyer of a credit default swap does not need to own the underlying debt instrument, but simply has an insurable interest in it.

Overall, credit default swaps play a crucial role in the financial markets by allowing investors and financial institutions to transfer and manage credit risk. However, it’s essential to thoroughly understand the intricacies of credit default swaps and the risks involved before proceeding with a purchase.

Evaluating Risks and Benefits

When considering the purchase of a credit default swap, it is essential to carefully evaluate the risks and benefits associated with this financial instrument. While credit default swaps can provide protection against default risk, they also come with their own set of risks and considerations.

One of the primary benefits of a credit default swap is the ability to hedge against the risk of default on a specific debt obligation. This can be particularly valuable for investors who hold a significant amount of the underlying debt instrument in their portfolio. By purchasing a CDS, they can mitigate the potential losses in the event of a default.

Another benefit of credit default swaps is that they offer flexibility in terms of the borrower and the underlying debt instrument. Investors can choose the specific borrower and type of debt they wish to protect against, allowing for more targeted risk management strategies.

However, it’s crucial to assess and understand the risks associated with credit default swaps. One significant risk is counterparty risk, which refers to the risk of the protection seller defaulting on their obligations. If the protection seller fails to honor their payment obligations in the event of a default, the buyer may not receive the protection they sought.

Market liquidity is another important consideration. As credit default swaps are traded over-the-counter, the market can be less liquid compared to more standardized financial instruments. This can make it challenging to buy or sell a CDS at a desirable price, particularly in times of market stress.

Additionally, the pricing of credit default swaps can be complex and opaque. The determination of the premium payments and the underlying debt’s creditworthiness can involve sophisticated models and assumptions. It’s important to have a solid understanding of the pricing methodologies and underlying factors to assess the fair value of the CDS.

Overall, evaluating the risks and benefits of a credit default swap is crucial before making a purchase. Conducting thorough due diligence on the counterparty, understanding the market dynamics, and assessing the pricing factors are essential steps to mitigate potential risks and make informed decisions.

Researching and Choosing a Counterparty

When buying a credit default swap, one of the most critical steps is researching and choosing a reliable counterparty. The counterparty is the entity or institution that will take on the risk of default and provide the protection outlined in the CDS contract. Here are some key factors to consider when conducting your research:

- Financial Stability: It is crucial to assess the financial stability and creditworthiness of the counterparty. You want to ensure that they have the capability to honor their payment obligations in the event of a default. Review their financial statements, credit ratings, and conduct thorough due diligence to understand their financial health.

- Reputation and Track Record: Look into the counterparty’s reputation and track record in the market. Consider their experience, history, and past performance in managing credit default swaps. A counterparty with a strong reputation and track record inspires confidence in their ability to fulfill their obligations.

- Regulatory Compliance: Verify that the counterparty operates in accordance with relevant regulations and complies with industry standards. This ensures that they are operating within a legal framework and adhering to best practices in the industry.

- Market Presence: Consider the counterparty’s market presence and market share. A well-established counterparty with a significant market presence indicates their expertise and credibility in the market. This can be beneficial in terms of liquidity and ease of transacting.

- Customer Support: Evaluate the quality of customer support and service provided by the counterparty. Prompt and efficient customer support can be crucial in addressing any concerns or inquiries during the lifespan of the CDS contract.

During your research, consider gathering information from various sources, such as financial news outlets, industry reports, and regulatory bodies. Additionally, seek recommendations and insights from trusted financial advisors or professionals who have experience in dealing with credit default swaps.

It’s important to note that when selecting a counterparty, you may have different options, including commercial banks, insurance companies, and specialized financial institutions. Each type of counterparty has its own strengths and weaknesses, so it’s essential to assess which one aligns best with your risk tolerance and specific requirements.

By conducting thorough research and due diligence, you can choose a counterparty that instills confidence and ensures the reliability of the credit default swap. This is a crucial step in mitigating counterparty risk and protecting your investment.

Negotiating Terms and Pricing

When buying a credit default swap, negotiating the terms and pricing is a critical step in ensuring that the contract meets your specific needs. Here are some key considerations and strategies to keep in mind during the negotiation process:

- Understand the Terms: Familiarize yourself with the terms and conditions of the credit default swap contract. This includes understanding the obligations of both the buyer and the seller, the triggers for payout, and any potential limitations or exclusions. Ensure that the terms align with your risk profile and objectives.

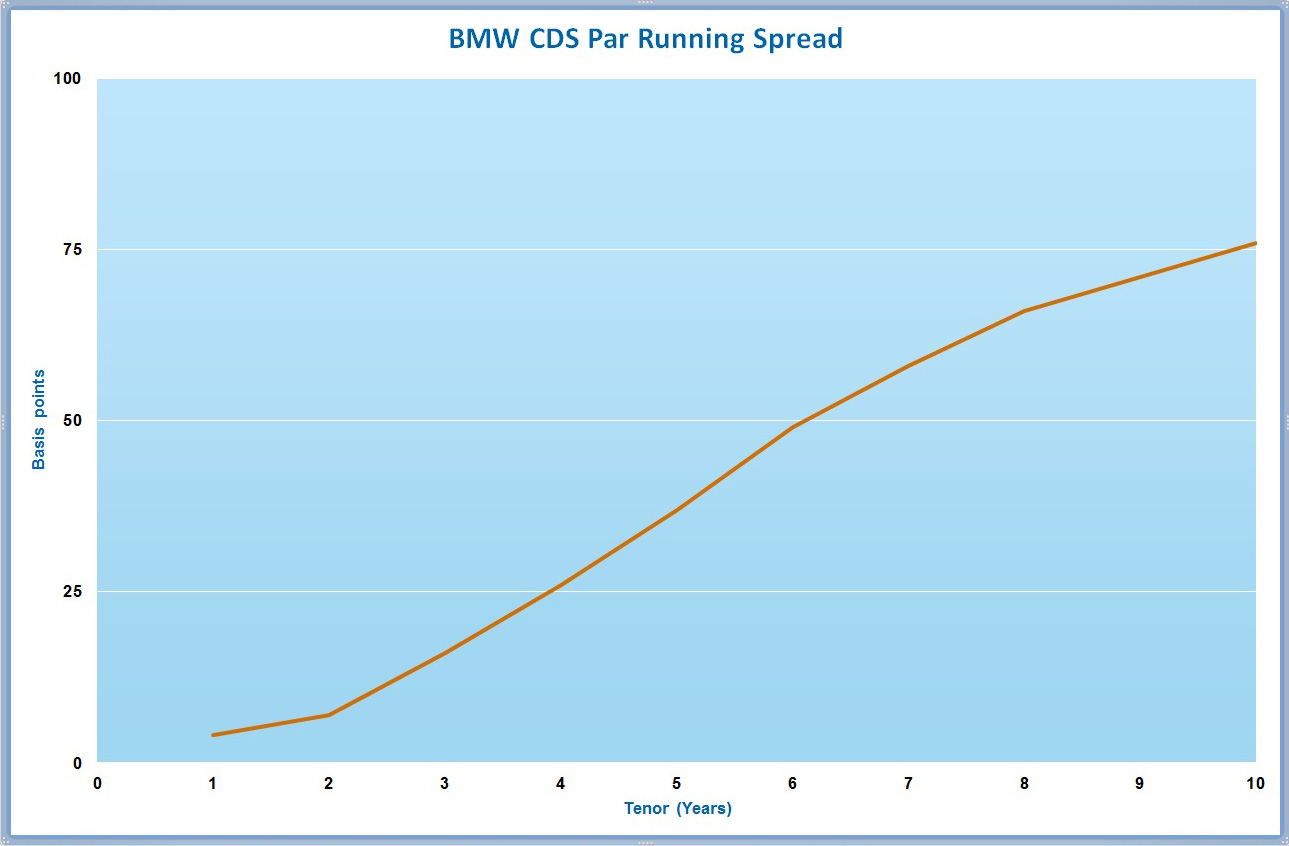

- Assess the Creditworthiness: Evaluate the creditworthiness of the underlying debt instrument and determine the appropriate premium rate. Factors such as the borrower’s credit rating, financial stability, and market conditions can influence the pricing of the credit default swap. Conduct thorough research and analysis to negotiate a fair and competitive premium rate.

- Consider Market Conditions: Take into account the prevailing market conditions and the overall demand for credit default swaps. During times of heightened market volatility or economic uncertainty, the pricing may be higher due to increased risk. Evaluate the market sentiment and assess if it aligns with your risk appetite.

- Seek Competitive Quotes: Approach multiple potential counterparties and request quotes for the credit default swap. This allows you to compare the terms and pricing offered by different parties. Consider negotiating with multiple counterparties to secure the most favorable terms and pricing.

- Negotiate and Clarify Terms: Engage in open and transparent communication with the counterparty to negotiate the terms of the credit default swap. Clearly articulate your requirements and objectives, and seek clarification on any ambiguities or uncertainties. Remember that negotiation is a collaborative process, and both parties should work towards mutual agreement.

Throughout the negotiation process, it is essential to maintain a balanced approach. While it is important to strive for favorable terms and pricing, it is equally important to ensure that the agreement remains feasible for the counterparty. Establishing a mutually beneficial and sustainable agreement sets the foundation for a successful credit default swap arrangement.

Consider engaging the services of legal and financial professionals with expertise in credit default swaps. Their knowledge and experience can provide valuable guidance during the negotiation process, ensuring that the terms and pricing are favorable and aligned with your investment objectives.

By carefully negotiating the terms and pricing of the credit default swap, you can secure an agreement that meets your risk management needs while ensuring fair and competitive pricing.

Finalizing the Purchase

After negotiating the terms and pricing of the credit default swap, the next step is to finalize the purchase. This involves completing the necessary documentation and executing the contract. Here are the key steps involved in finalizing the purchase:

- Review and Approval: Review the final terms and conditions of the credit default swap contract. Ensure that all the negotiated terms are accurately reflected. Seek legal advice if necessary to understand the legal implications of the contract. Once you are satisfied with the terms, provide your approval to proceed with the purchase.

- Documentation: Prepare or obtain the required documentation for the credit default swap. This may include the contract agreement, supporting legal documents, and any additional disclosures or notices as required by regulatory authorities. Ensure that all documents are properly filled out, signed, and dated by both parties.

- Counterparty Confirmation: Seek confirmation from the counterparty that they are ready to proceed with the purchase. This confirmation can be in the form of a signed contract or an official communication stating their commitment to the transaction.

- Payment of Premium: Arrange for the payment of the premium as outlined in the contract. This may involve wiring funds or issuing a check to the counterparty. Ensure that the payment is made within the specified timeframe to secure the agreed-upon terms.

- Record Keeping: Maintain proper records of all documentation and communication related to the credit default swap. This includes keeping copies of the contract, payment receipts, and any correspondence exchanged with the counterparty. Good record-keeping is essential for future reference and potential disputes.

Throughout the finalization process, ensure open lines of communication with the counterparty. Address any concerns or questions promptly, and seek clarification on any ambiguities in the documentation. Maintaining a collaborative and transparent approach will help streamline the process and ensure a smooth finalization of the purchase.

It’s worth noting that credit default swaps may require periodic monitoring and periodic premium payments. Stay informed about the obligations outlined in the contract, such as reporting requirements and payment schedules. Regularly review the performance and creditworthiness of the underlying debt instrument to evaluate the ongoing need for the credit default swap.

By following these steps and ensuring meticulous attention to detail, you can successfully finalize the purchase of a credit default swap and establish a clear and enforceable agreement with the counterparty.

Managing and Monitoring the Credit Default Swap

Once you have finalized the purchase of a credit default swap, it is crucial to actively manage and monitor the contract to ensure its effectiveness and mitigate potential risks. Here are key steps for managing and monitoring a credit default swap:

- Stay Informed: Keep yourself informed about the performance and creditworthiness of the underlying debt instrument. This may include monitoring financial news, industry reports, and credit ratings of the borrower. Stay updated on any material changes that may impact the likelihood of default.

- Regular Reporting: Adhere to any reporting requirements specified in the credit default swap contract. This may involve providing periodic updates on the status of the underlying debt instrument, financial information, or other relevant details. Timely and accurate reporting is essential for the effective management of the contract.

- Ongoing Analysis: Continuously analyze the market conditions and assess the overall risk environment. Evaluate any developments or events that may impact the creditworthiness of the borrower or the broader industry. This includes monitoring macroeconomic factors, regulatory changes, and market trends.

- Maintain Communication: Maintain regular communication with the counterparty of the credit default swap. This may include periodic check-ins, discussions on market conditions, and updates on the status of the contract. Effective communication ensures a collaborative relationship and enables prompt action if any issues arise.

- Review and Adjust: Periodically review the terms and conditions of the credit default swap to assess their continued suitability. Consider the changing risk landscape and evaluate if any adjustments to the contract are necessary. This may involve renegotiating terms or seeking additional protection if deemed appropriate.

Additionally, it is essential to continue monitoring the financial stability and creditworthiness of the counterparty. Keep up with news and industry information regarding the counterparty to ensure they are still capable of fulfilling their obligations as the seller of the credit default swap.

If you encounter any issues or concerns throughout the lifespan of the credit default swap, don’t hesitate to engage with legal and financial professionals for guidance. They can provide valuable insights and help navigate any challenges that may arise.

Overall, proactive management and monitoring of the credit default swap contract are crucial to ensure that the protection you sought remains effective. By staying informed, fulfilling reporting requirements, and maintaining open communication, you can effectively manage the credit default swap and make informed decisions regarding its ongoing suitability.

Conclusion

Buying a credit default swap is a sophisticated financial undertaking that requires a comprehensive understanding of the instrument and careful evaluation of the associated risks and benefits. This article has provided an overview of the key considerations involved in purchasing a credit default swap.

Credit default swaps offer a way to manage credit risk by transferring the risk of default on a specific debt obligation to a counterparty. They can provide valuable protection for investors and financial institutions, but it is essential to conduct thorough research and due diligence when selecting a counterparty.

Understanding the terms and pricing of the credit default swap is crucial in negotiating a fair and competitive agreement. By seeking competitive quotes, assessing market conditions, and considering the creditworthiness of the underlying debt instrument, you can ensure favorable terms for your specific risk management needs.

Finalizing the purchase involves reviewing and approving the contract, completing the necessary documentation, and making the premium payment. Throughout the process, maintaining open communication with the counterparty is vital for a smooth transaction.

Once the credit default swap is in place, active management and monitoring are essential. Staying informed about the creditworthiness of the borrower, adhering to reporting requirements, and regularly analyzing market conditions will help ensure the effectiveness of the contract.

In conclusion, buying a credit default swap requires careful consideration of risks and benefits, diligent research, and diligent monitoring. By understanding the complexities of credit default swaps and implementing a comprehensive approach to their management, you can effectively mitigate credit risk and protect your financial interests.