Home>Finance>Loan Credit Default Swap Index (Markit LCDX) Definition

Finance

Loan Credit Default Swap Index (Markit LCDX) Definition

Published: December 19, 2023

Learn the definition of Loan Credit Default Swap Index (Markit LCDX) in the finance industry. Understand its significance and how it impacts the market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to the World of Loan Credit Default Swap Index (Markit LCDX)

When it comes to the world of finance, there are numerous terms and concepts that might seem puzzling to the average person. One such term is the Loan Credit Default Swap Index, also known as Markit LCDX. In this blog post, we will delve into the intricacies of this fascinating financial instrument and shed light on its definition and purpose. So, let’s jump right in!

Key Takeaways:

- The Loan Credit Default Swap Index, or Markit LCDX, is a financial derivative designed to spread the risk associated with defaults on corporate loans.

- Investors use Markit LCDX to gain exposure to the credit market without holding individual loans.

The Loan Credit Default Swap Index, or Markit LCDX, is a tool used in the world of finance to manage and mitigate credit risks. This financial derivative is created to help investors spread the risk associated with defaults on corporate loans. By using Markit LCDX, investors can gain exposure to the credit market without the need to hold individual loans themselves. This provides them with a diversified portfolio and reduces the impact of default on a single loan.

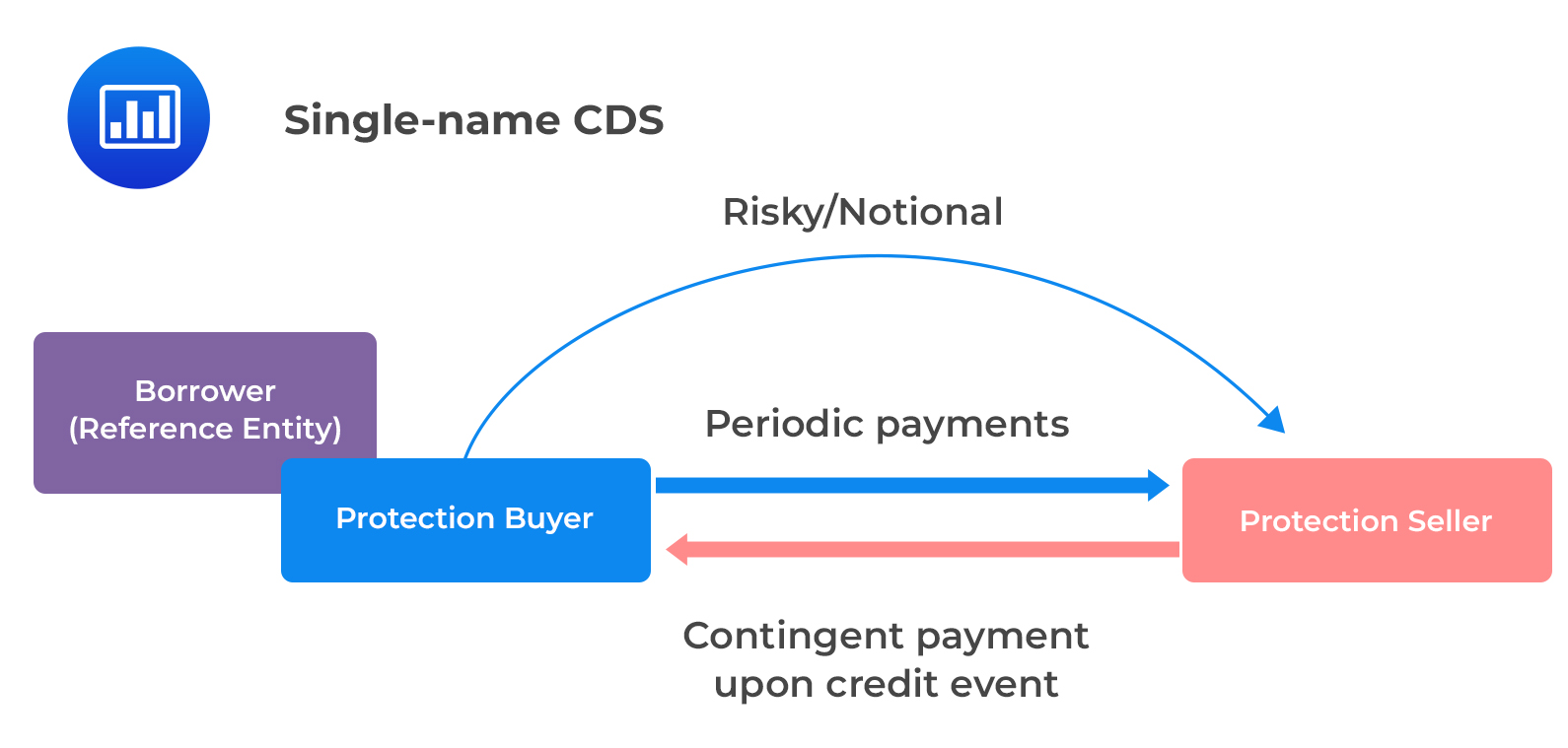

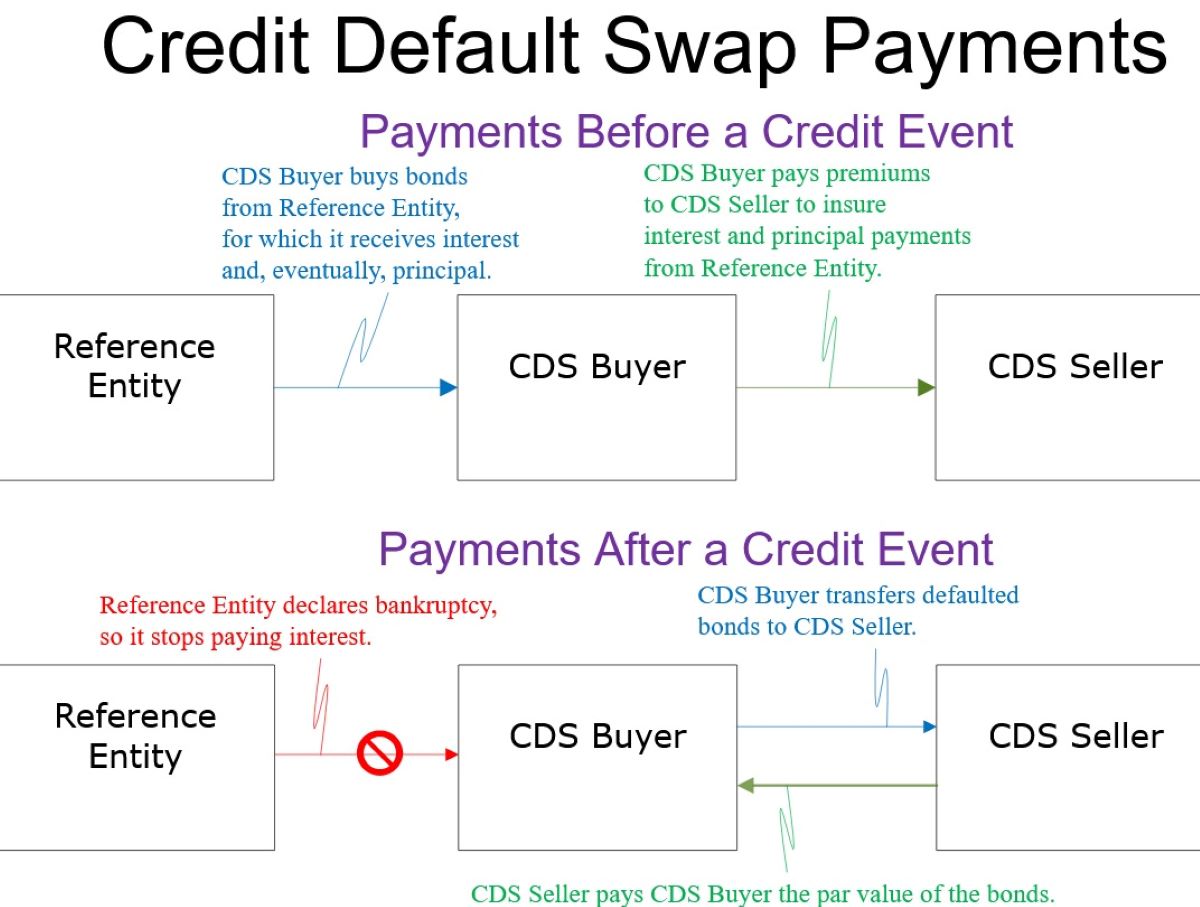

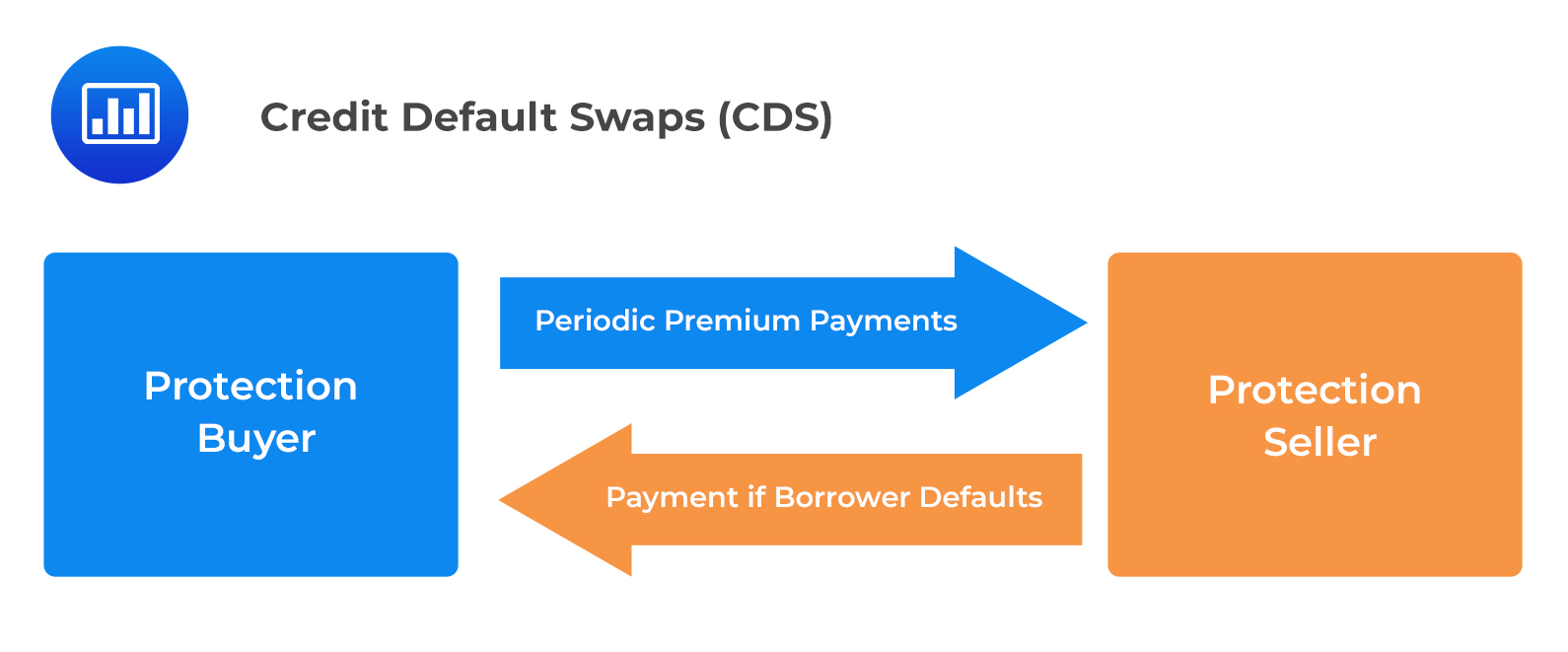

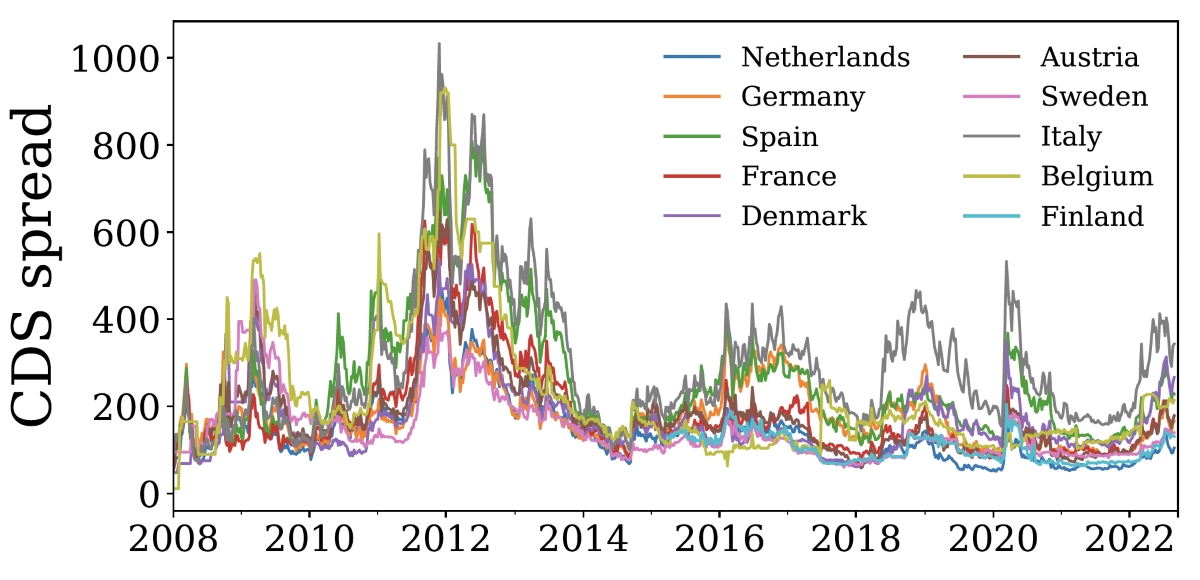

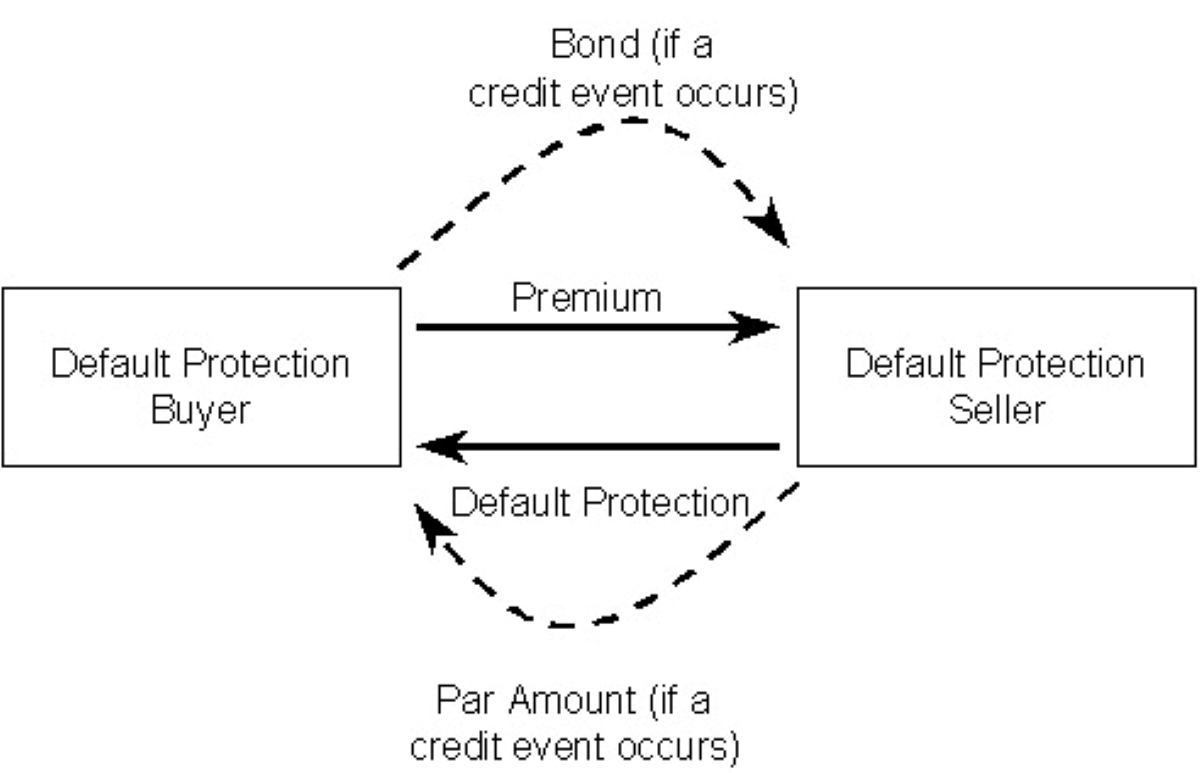

Now you may be wondering, how does Markit LCDX work? Well, this index functions through the use of credit default swaps (CDS). They are contracts in which one party agrees to compensate the other party if a specific loan or bond defaults. The value of Markit LCDX is based on a basket of CDS contracts that cover a range of corporate loans.

Here are a few key characteristics of the Loan Credit Default Swap Index:

- Industry-Specific: Markit LCDX covers specific industries, such as energy, transportation, technology, etc. This allows investors to focus on particular sectors of the economy.

- Diversification: As mentioned earlier, Markit LCDX offers investors the advantage of diversification. By holding a basket of CDS contracts, the impact of a default on a single loan is minimized. This reduces the overall risk and enhances the reliability of the investment.

- Index Calculation: The value of Markit LCDX is determined by market factors such as credit spreads, which reflect the perceived risk of default. As market conditions change, so does the price of the index.

Investing in Markit LCDX can provide both advantages and risks. On one hand, it allows investors to gain exposure to the credit market without the need for individual loans, providing diversification. On the other hand, it is still subject to market fluctuations and the risk of defaults. Therefore, it is crucial for investors to conduct thorough research and seek advice from financial professionals before making any investment decisions.

In conclusion, the Loan Credit Default Swap Index, also known as Markit LCDX, is a valuable financial tool used for spreading risk and gaining exposure to the credit market. By diversifying investments and utilizing credit default swaps, investors can navigate the complex world of corporate loans and manage risks more effectively. However, as with any investment, caution and careful consideration are essential. So, whether you’re a seasoned investor or just starting out, make sure to explore all aspects of Markit LCDX before making any financial decisions.