Home>Finance>What Are The Differences Between Tangible And Intangible Assets On A Companys Balance Sheet?

Finance

What Are The Differences Between Tangible And Intangible Assets On A Companys Balance Sheet?

Modified: February 21, 2024

Discover the disparities between tangible and intangible assets in finance and how they impact a company's balance sheet. Enhance your understanding of asset classification.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Tangible Assets

- Examples of Tangible Assets

- Characteristics of Tangible Assets

- Definition of Intangible Assets

- Examples of Intangible Assets

- Characteristics of Intangible Assets

- Differences Between Tangible and Intangible Assets on a Company’s Balance Sheet

- Importance of Differentiating Tangible and Intangible Assets

- Conclusion

Introduction

When analyzing a company’s financial health and assessing its value, understanding the different types of assets on its balance sheet is crucial. Assets can be broadly categorized into two main types: tangible and intangible assets. Tangible assets are physical items that have a physical form and can be touched, while intangible assets are non-physical assets that lack physical substance. Both types of assets play a significant role in determining a company’s overall financial strength.

In this article, we will delve into the differences between tangible and intangible assets, exploring their definitions, characteristics, and examples. Furthermore, we will shed light on why it is important to differentiate between the two on a company’s balance sheet, as well as their implications for financial analysis and decision-making.

By grasping the dissimilarities between tangible and intangible assets, investors, analysts, and stakeholders can effectively evaluate a company’s asset base, derive insights into its financial stability, and make informed investment decisions.

Definition of Tangible Assets

Tangible assets are assets that have a physical form and can be touched or seen. These are assets that are used in the production or operation of a business and have a measurable value. Tangible assets are also known as physical assets and can range from buildings, land, machinery, vehicles, equipment, inventory, and cash.

The key characteristic of tangible assets is that they have a physical presence and can be physically observed, measured, and quantified. These assets provide value to a company by generating income or contributing to the production of goods and services. For example, a manufacturing company may have tangible assets such as factories, production equipment, and raw materials that are critical to its operations.

Furthermore, tangible assets are typically subject to depreciation, which is the gradual decrease in value over time due to wear and tear, obsolescence, or other factors. Depreciation allows companies to account for the reduction in value of their tangible assets over their useful life. This depreciation expense is recorded on the company’s income statement and can have a significant impact on its profitability.

It is worth mentioning that while tangible assets are physical in nature, their value can fluctuate based on market conditions and changes in demand. For example, land and property values can appreciate or depreciate depending on factors such as location, economic trends, and supply and demand dynamics.

Overall, tangible assets form a substantial portion of a company’s asset base and provide the necessary resources for its operations. Understanding the value, depreciation, and significance of these assets is crucial for accurate financial analysis and decision-making.

Examples of Tangible Assets

Tangible assets encompass a wide range of physical items that a company owns and utilizes in its business operations. Here are some common examples of tangible assets:

- Buildings and Real Estate: This includes office buildings, manufacturing facilities, warehouses, retail stores, and land owned by the company.

- Machinery and Equipment: These are the tools and machinery used in the production process, such as assembly lines, forklifts, vehicles, and computers.

- Inventory: This refers to the raw materials, work-in-progress goods, and finished products that a company holds for sale or in the process of production. It can include items like raw materials, finished goods, and supplies.

- Cash and Cash Equivalents: This represents the physical currency, bank account balances, and short-term investments that a company possesses.

- Furniture and Fixtures: These are the items used to furnish offices, such as desks, chairs, and shelves.

- Tools and Supplies: This includes any equipment, tools, or supplies necessary for carrying out specific tasks or functions within the company.

- Land and Natural Resources: This includes the value of land and any resources extracted from it, such as oil, gas, minerals, or timber.

These examples highlight the diverse range of tangible assets that a company may possess, each with its own unique value and significance in supporting the business’s operations and generating revenue.

Characteristics of Tangible Assets

Tangible assets possess several key characteristics that distinguish them from other types of assets. Understanding these characteristics is vital for accurate financial analysis and decision-making. Here are the main characteristics of tangible assets:

- Physical Existence: Tangible assets are physical items that can be touched, seen, and measured. Unlike intangible assets, they have a visible form and occupy physical space.

- Measurable and Quantifiable: Tangible assets have a measurable value, typically expressed in monetary terms. This allows for easy evaluation and inclusion in financial statements.

- Depreciation: Tangible assets generally experience depreciation over time. They may lose value due to factors such as wear and tear, obsolescence, or changes in market demand. Companies account for this depreciation by allocating a portion of the asset’s value as an expense on their income statements.

- Physical Wear and Tear: Tangible assets are subject to physical wear and tear through their use in business operations. Consequently, they may require maintenance, repairs, or even replacement over time.

- Value Fluctuation: The value of tangible assets can be influenced by various factors, such as changes in market conditions, supply and demand dynamics, and technological advancements. For example, the value of machinery may decrease if newer and more efficient technology becomes available.

- Collateral: Tangible assets can be used as collateral for obtaining loans or other forms of financing. Lenders often view tangible assets as a reliable form of security in case the borrower defaults on the loan.

These characteristics underscore the importance of properly managing and evaluating tangible assets within a company. By recognizing the physical nature, depreciation, and other unique features of tangible assets, businesses can make informed decisions regarding their acquisition, utilization, and potential disposal.

Definition of Intangible Assets

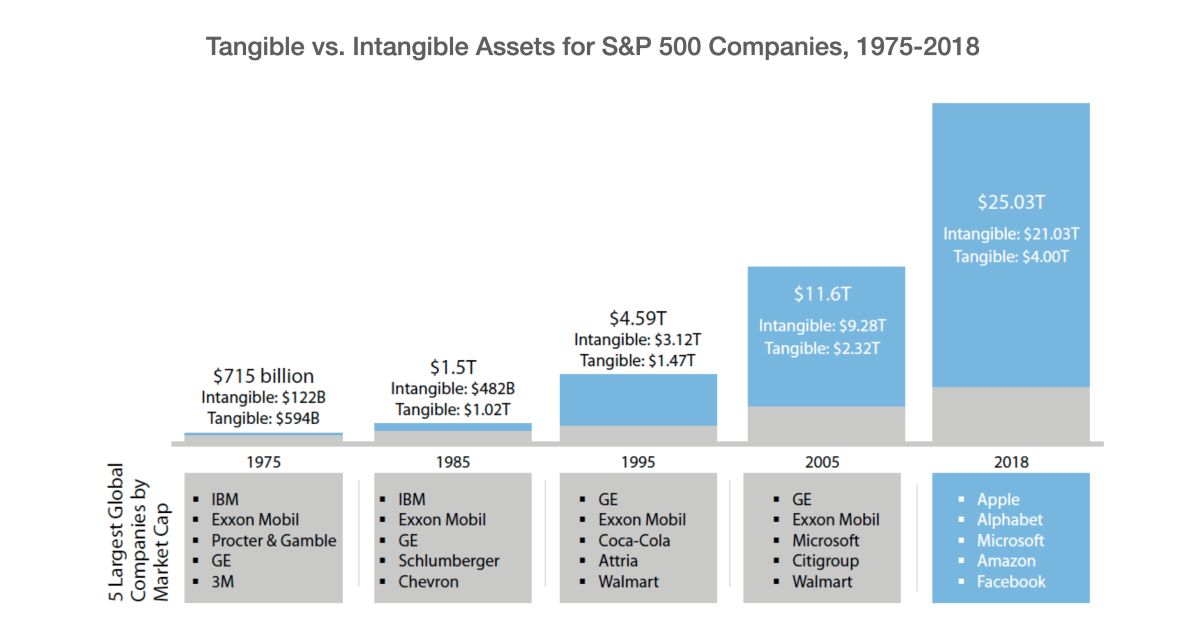

Unlike tangible assets, intangible assets do not have a physical form and cannot be touched or seen. Instead, they represent non-physical assets that hold value for a business. Intangible assets are valuable because they provide exclusive rights and advantages to a company, which can contribute to its competitive position and long-term success.

Intangible assets can take various forms, including intellectual property, brand recognition, customer relationships, patents, copyrights, trademarks, and proprietary technology. These assets are often the result of human creativity, innovation, and intellectual capital.

One key characteristic of intangible assets is that they are not easily measured or valued. Their worth lies in their ability to generate future economic benefits for the company. Unlike tangible assets, which can be assigned a specific monetary value, the value of intangible assets is often subjective and can vary based on market perception, brand reputation, and other factors.

It is important for companies to identify, recognize, and properly account for their intangible assets. These assets can represent significant value and may contribute significantly to a company’s overall worth and competitive advantage. For example, a strong brand name can differentiate a company from its competitors, attract customers, and command premium pricing.

Recognizing and valuing intangible assets is essential for accurately reflecting a company’s financial position and attractiveness to investors. Proper accounting treatment ensures that the value of intangible assets is appropriately reflected on the balance sheet and can be used for strategic decision-making, mergers and acquisitions, and financial reporting.

Examples of Intangible Assets

Intangible assets are valuable assets that lack physical substance. They represent intellectual property, brand recognition, and other intangible advantages that contribute to a company’s competitive edge. Here are some common examples of intangible assets:

- Intellectual Property: This includes patents, trademarks, and copyrights that protect a company’s inventions, designs, brand names, logos, and creative works from being used by others without permission.

- Brand Equity: Brand equity refers to the value and recognition associated with a company’s brand name and its reputation among consumers. Well-established and trusted brands can command customer loyalty and premium pricing.

- Customer Relationships: A strong and loyal customer base is an intangible asset that can provide recurring business and long-term revenue streams. Companies invest in building customer relationships to enhance customer satisfaction, retention, and advocacy.

- Contracts and Agreements: Exclusive contracts with suppliers, distributors, or partners can create a competitive advantage by ensuring a stable supply chain or securing unique distribution channels.

- Proprietary Technology: Intangible assets can include proprietary technology, such as software, algorithms, or trade secrets, that give a company a technological edge over its competitors.

- Goodwill: Goodwill represents the intangible value derived from factors such as reputation, customer loyalty, and employee morale. It arises when a company acquires another business for a price greater than its identifiable assets.

- Research and Development (R&D): Investments in R&D can lead to the creation of intangible assets such as intellectual property, know-how, and technological advancements that drive innovation within a company.

These examples illustrate the wide array of intangible assets that companies possess. While intangible assets may not have physical form, their value lies in their ability to generate revenue, enhance brand recognition, and provide a competitive advantage in the marketplace.

Characteristics of Intangible Assets

Intangible assets possess several distinct characteristics that differentiate them from tangible assets. Understanding these characteristics is crucial for assessing their value and impact on a company’s financial position. Here are the key characteristics of intangible assets:

- Non-Physical Nature: Intangible assets lack physical substance and cannot be touched or seen. They are intangible in nature and primarily exist in the form of legal rights, intellectual property, or brand recognition.

- Subjective Value: Unlike tangible assets, which typically have measurable monetary values, the value of intangible assets is often subjective and based on market perception. The value of a strong brand or customer loyalty, for example, can be difficult to quantify precisely.

- Unique and Non-Duplicable: Many intangible assets are unique to a specific company and cannot be easily replicated or duplicated by competitors. This provides a sustainable competitive advantage and increases the asset’s value.

- Legal Protection: Intangible assets can be protected by various legal mechanisms, such as patents, trademarks, and copyrights. This protection grants exclusive rights to the asset’s owner and prevents others from using or copying it without authorization.

- Longevity and Indefinite Life Span: Intangible assets often have an indefinite life span, meaning they can provide long-term benefits to a company. This can include ongoing revenue streams, brand recognition, or customer loyalty built over time.

- Strategic Importance: Intangible assets play a crucial role in a company’s strategic positioning and competitiveness. They contribute to market differentiation, customer perception, and the ability to command premium pricing.

- Disclosure Challenges: Intangible assets can pose challenges in terms of disclosure and valuation on financial statements. Since their value is subjective and often difficult to measure precisely, companies must make reasonable estimates while adhering to accounting standards.

These characteristics underscore the unique nature and importance of intangible assets in a company’s overall value and competitive advantage. Properly recognizing, managing, and leveraging intangible assets are essential for effective financial analysis, decision-making, and long-term business success.

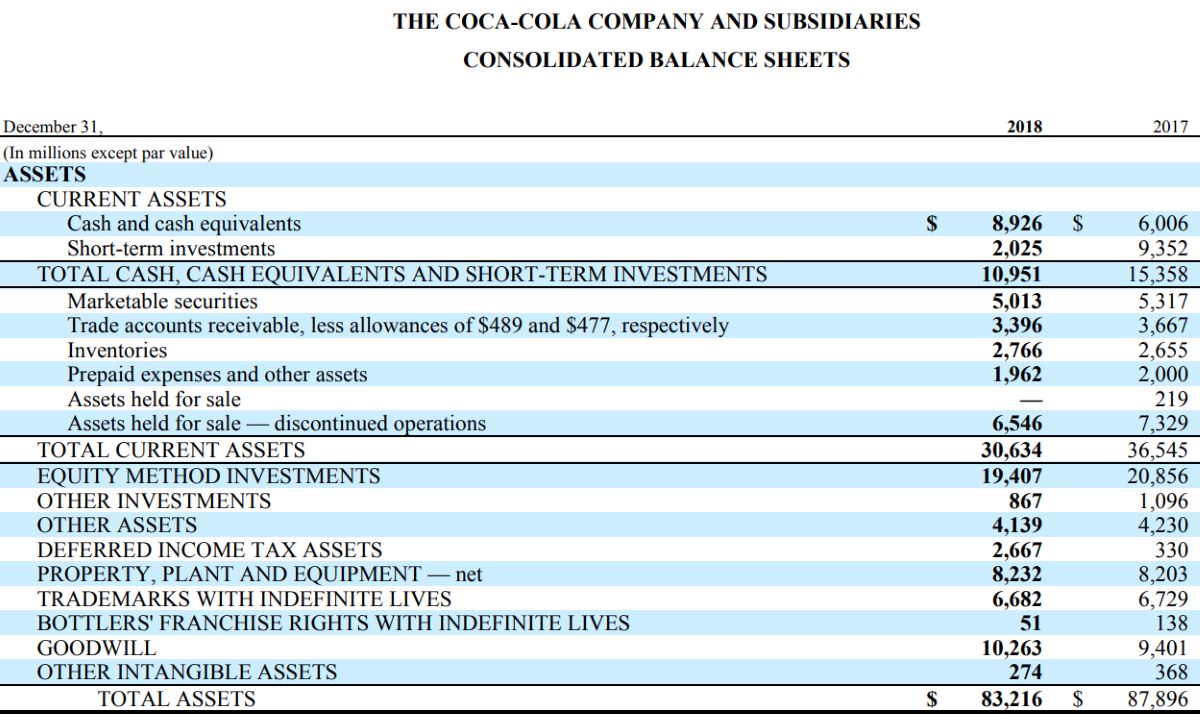

Differences Between Tangible and Intangible Assets on a Company’s Balance Sheet

On a company’s balance sheet, tangible and intangible assets are recorded separately due to their inherent differences. These differences can impact how these assets are valued, accounted for, and contribute to a company’s financial position. Here are the key disparities between tangible and intangible assets on a company’s balance sheet:

- Nature and Physical Form: Tangible assets have a physical presence and can be seen and touched. In contrast, intangible assets lack physical substance and are represented by legal rights, intellectual property, or brand equity.

- Measureability: Tangible assets, being physical items, have a measurable and quantifiable value. This allows for easier valuation and inclusion on the balance sheet. Intangible assets, on the other hand, can be difficult to measure and their value is often subjective and based on market perception.

- Depreciation: Tangible assets are subject to depreciation, gradually losing value over time due to wear and tear, obsolescence, or market factors. This depreciation is accounted for on the balance sheet as an expense, which reduces their recorded value. Intangible assets, however, do not undergo depreciation but may require periodic impairment testing to ensure their value is appropriately reflected.

- Legal Protection: Tangible assets typically do not have legal protection, apart from any regulatory requirements or physical security measures. In contrast, many intangible assets, such as patents, trademarks, or copyrights, have legal protection and exclusive rights granted to the company.

- Valuation Challenges: Tangible assets, with their physical presence, generally have a more straightforward valuation process. The value of intangible assets, however, is often subjective and can be challenging to quantify accurately. Their valuation may depend on factors like market conditions, brand reputation, and the future economic benefits they are expected to generate.

- Marketability and Liquidity: Tangible assets, such as real estate or machinery, can often be sold or used as collateral, providing a level of marketability and liquidity. Intangible assets, despite their significant value, may lack direct marketability and can be more challenging to convert into cash quickly.

Understanding these differences is essential for analyzing a company’s balance sheet and accurately assessing its asset base. It highlights the varying characteristics, risks, and valuation challenges associated with tangible and intangible assets, which ultimately affect a company’s financial health and investment attractiveness.

Importance of Differentiating Tangible and Intangible Assets

Differentiating between tangible and intangible assets is crucial for several reasons. Understanding these distinctions is essential for financial analysis, decision-making, and accurately assessing a company’s value and financial health. Here are the key reasons why differentiating between tangible and intangible assets is important:

- Financial Reporting and Analysis: Properly differentiating between tangible and intangible assets allows for accurate financial reporting. Separating these assets on the balance sheet provides transparency and enables stakeholders to analyze the composition and value of the company’s asset base.

- Valuation and Investment Decisions: Tangible and intangible assets have different valuation methodologies. Understanding these differences helps investors and analysts assess a company’s value accurately. It allows for a comprehensive evaluation of a company’s financial position and aids in making informed investment decisions.

- Risk Assessment: Recognizing and understanding the mix of tangible and intangible assets in a company’s portfolio helps identify and assess risks. The depreciation and physical wear and tear associated with tangible assets may introduce operational and maintenance risks. Intangible assets, on the other hand, are exposed to risks such as obsolescence or changes in market perception and demand.

- Competitive Advantage: Differentiating tangible and intangible assets is crucial for identifying a company’s sources of competitive advantage. Understanding which intangible assets, such as brand equity or intellectual property, contribute to a company’s competitive edge helps guide strategic decisions and resource allocation.

- Investor Perception: Investors often assess a company based on the quality and composition of its asset base. By understanding the mix of tangible and intangible assets, investors can gauge a company’s potential for long-term growth, ability to adapt to changing market conditions, and underlying value proposition.

- Strategic Decision-Making: Differentiating between tangible and intangible assets facilitates strategic decision-making. It allows companies to prioritize investments in areas that enhance their competitive advantage, such as R&D for intangible asset creation or capital expenditure for tangible asset expansion.

By differentiating tangible and intangible assets, stakeholders can gain valuable insights into a company’s composition, value drivers, and competitive position. This understanding is critical for financial analysis, decision-making, and managing risks and opportunities effectively.

Conclusion

Understanding the differences between tangible and intangible assets is essential for analyzing a company’s financial health, assessing its value, and making informed investment decisions. Tangible assets, with their physical presence, can be measured, quantified, and subject to depreciation. Examples include buildings, equipment, and inventory. Intangible assets, on the other hand, lack physical substance but hold significant value for a company. Examples include intellectual property, brand equity, and customer relationships.

While tangible assets contribute to a company’s operational infrastructure, intangible assets drive competitive advantage, brand recognition, and future revenue potential. Properly differentiating between these asset types is critical for accurate financial reporting, risk assessment, and strategic decision-making. Tangible assets may have a more straightforward valuation process and provide collateral or market liquidity, while intangible assets rely on market perception and legal protection.

The ability to identify, measure, and accurately report on tangible and intangible assets on a company’s balance sheet is essential. It provides transparency, aids in financial analysis, and helps stakeholders evaluate a company’s value and competitive position. Recognizing these assets’ distinct characteristics and understanding their implications enables investors to assess risks, determine a company’s long-term growth potential, and make informed investment decisions.

In conclusion, tangible and intangible assets each play a vital role in a company’s financial position and overall value. By differentiating between these asset types and comprehending their unique characteristics, businesses can effectively manage their assets, enhance their competitive advantage, and maximize their long-term success.